Table of Contents

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author holds positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. This is a disclosure, not a recommendation to buy or sell stocks.

Table of contents

1. Portfolio update

2. Update on my key holdings

3. My plans going forwardPortfolio update

There was a slight increase in the value of the portfolio in October, much thanks to continued price gains in AeroEdge.

AeroEdge's success is due much to its ongoing shift from being a one-product company to three. But Japanese stocks have been strong in general. The Nikkei 225 has been on a tear this year, up +31%. The election of Takaichi as President of the leading political party, LDP, should probably prolong the ongoing bull market. Because she's likely to push for greater fiscal deficits, keeping the Yen weaker for longer and maintaining export-driven earnings growth for another year or two.

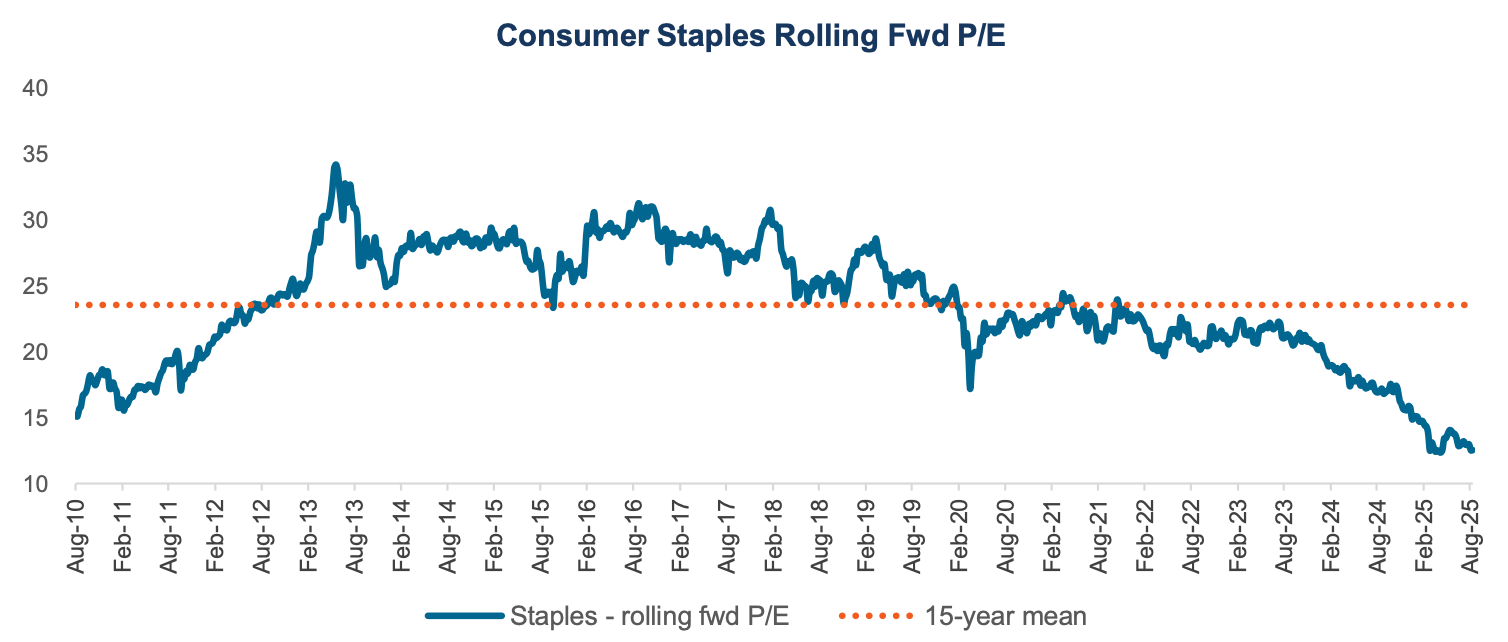

Another market that's become highly priced is that of Australia. I recently went through a long list of high-quality companies in Australia. While I wasn't looking for investment ideas, I couldn't help noticing the multiples at which some of these companies were trading. When I wrote about Codan back in 2022, for example, I predicted a forward P/E of 8x. Today, Codan has become a defense stock darling, bid up to the lofty level of 64x P/E. Even boring bank stocks like the Commonwealth Bank of Australia now trade at 28x P/E. This won't last forever.

There's greater value in Southeast Asia, in my personal view. These markets include the Philippines, Thailand and Indonesia. There's not much news on that front, except that foreign investors remain disinterested.

Yesterday, I listened in on Pangolin Asia Fund's investor call, where they made the case for Indonesian equities. As communicated in their September letter, the equity allocation of domestic institutions in Indonesia has declined from 30% pre-COVID down to just 13% today. This has represented incredible selling pressure that's only now starting to ease.

In said letter, Pangolin noted that investment managers employed by state institutions have effectively been barred from selling shares at a loss. So in a falling market, they've been acting like deer in a headlight, careful of buying too soon. Until now. Pangolin noted that US$50 billion social security fund JAMSOSTEK is planning to raise its equity allocation from 12-13% today to 20% by 2028. Sounds bullish to me?

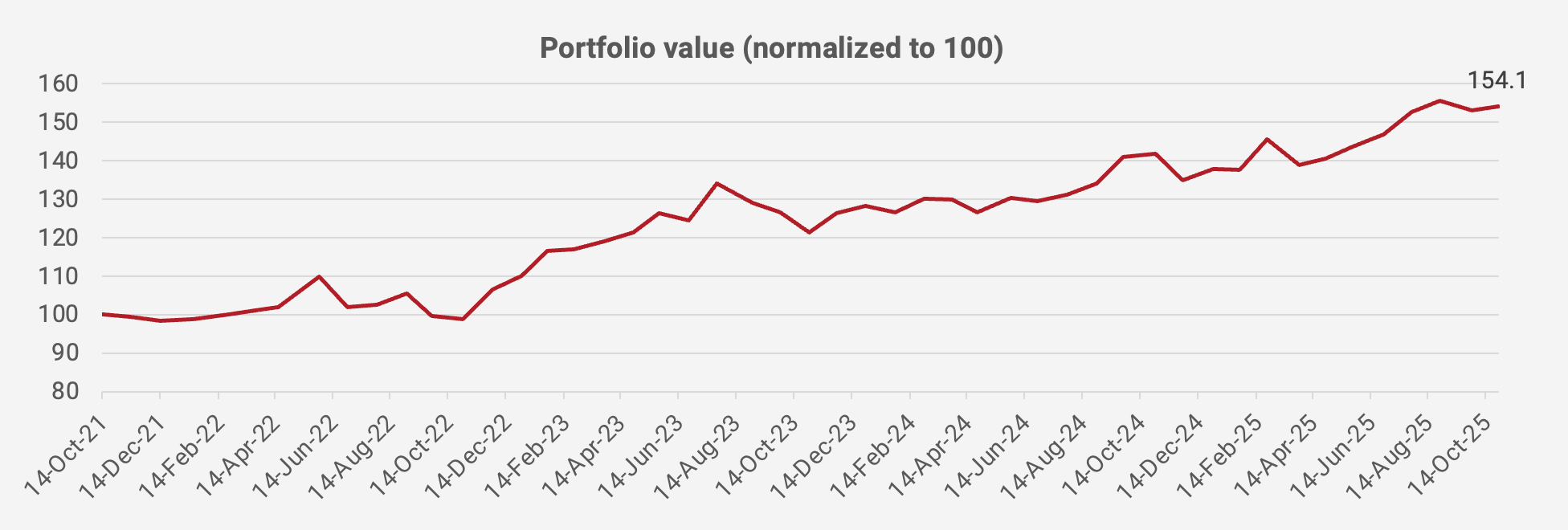

When it comes to my own portfolio, its value rose by +0.7% month-on-month in US Dollar terms. Since the portfolio’s inception in October 2021, the value has increased by +54.1%, equivalent to a +11.3% compound annual growth rate:

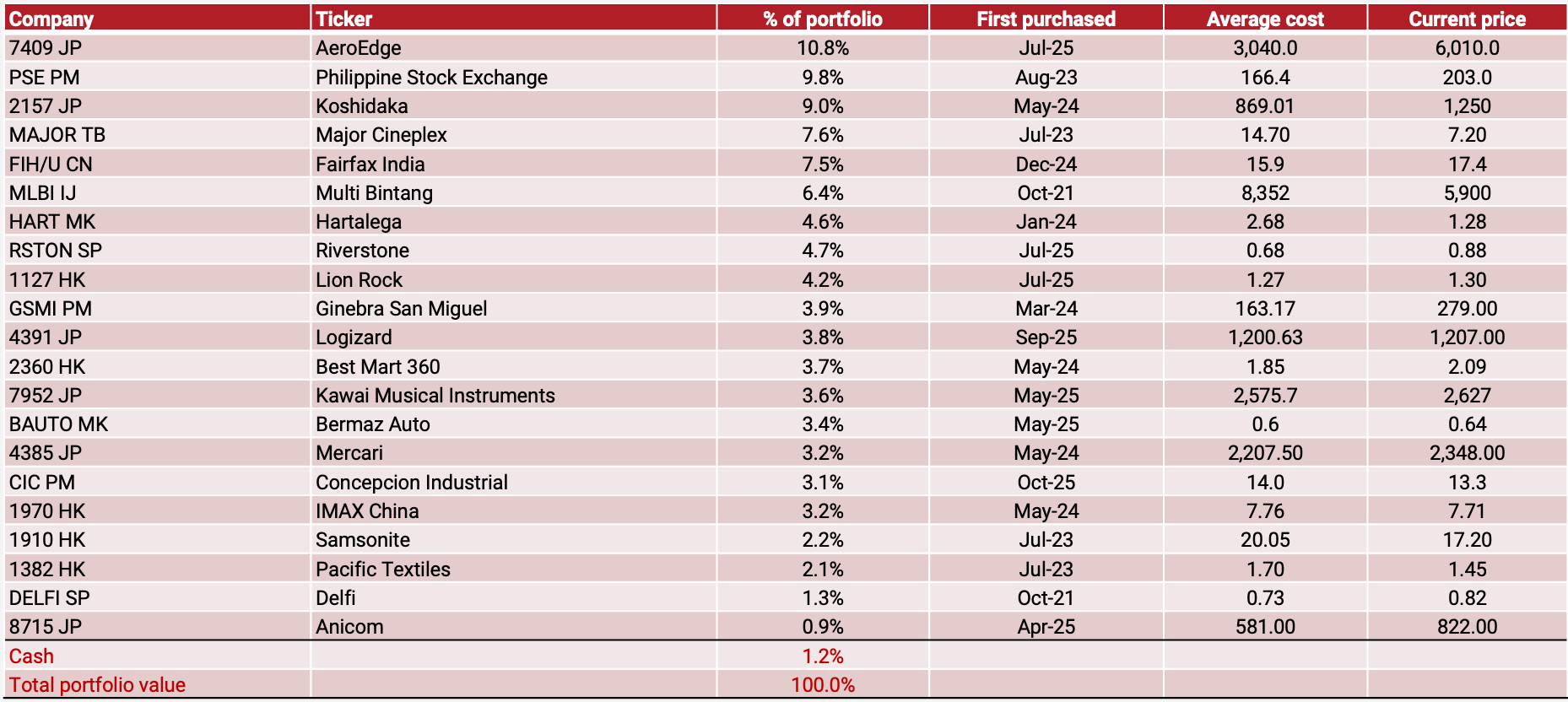

Here's what the latest portfolio looks like, snapshot taken on 27 October 2025:

During October, I spent countless hours moving my publication to its new home on the Ghost newsletter platform. So if I've been slow at replying, you know why. The website's initial design had glitches, but they've been fixed, and I think it's almost perfect now. You can check it out here: asiancenturystocks.com. I want to thank you for your patience during this transition.

Due to the work with the website, I only published one deep-dive in October: on Hong Kong-based luxury wristwatch retailer Oriental Watch. The stock has been discussed on Smartkarma for many years. Personally, I've been waiting for a turn in the wristwatch market. Alternative data provider Watchcharts.com has indices where you can track second-hand prices of Rolex watches and the like. I noted recently that watch prices had bottomed out in April this year. But digging deeper into the data, I realized that the Mainland China watch market remains weak. My conclusion is that the demand for wristwatches this year has primarily come from US buyers who are concerned about the coming tariffs on Swiss watch imports. Another conclusion is that Mainland Chinese buyers have gone to Japan in droves to take advantage of the weak Japanese Yen, especially when it comes to Grand Seiko watches. So the fundamentals for Oriental Watch don't seem to have fully turned yet, and I personally remain on the sidelines. But I will continue following the data with great interest. Oriental Watch itself remains inexpensive at just 8.3x P/E with a 12% dividend yield.

I did, however, buy shares in two other stocks I've recently written about:

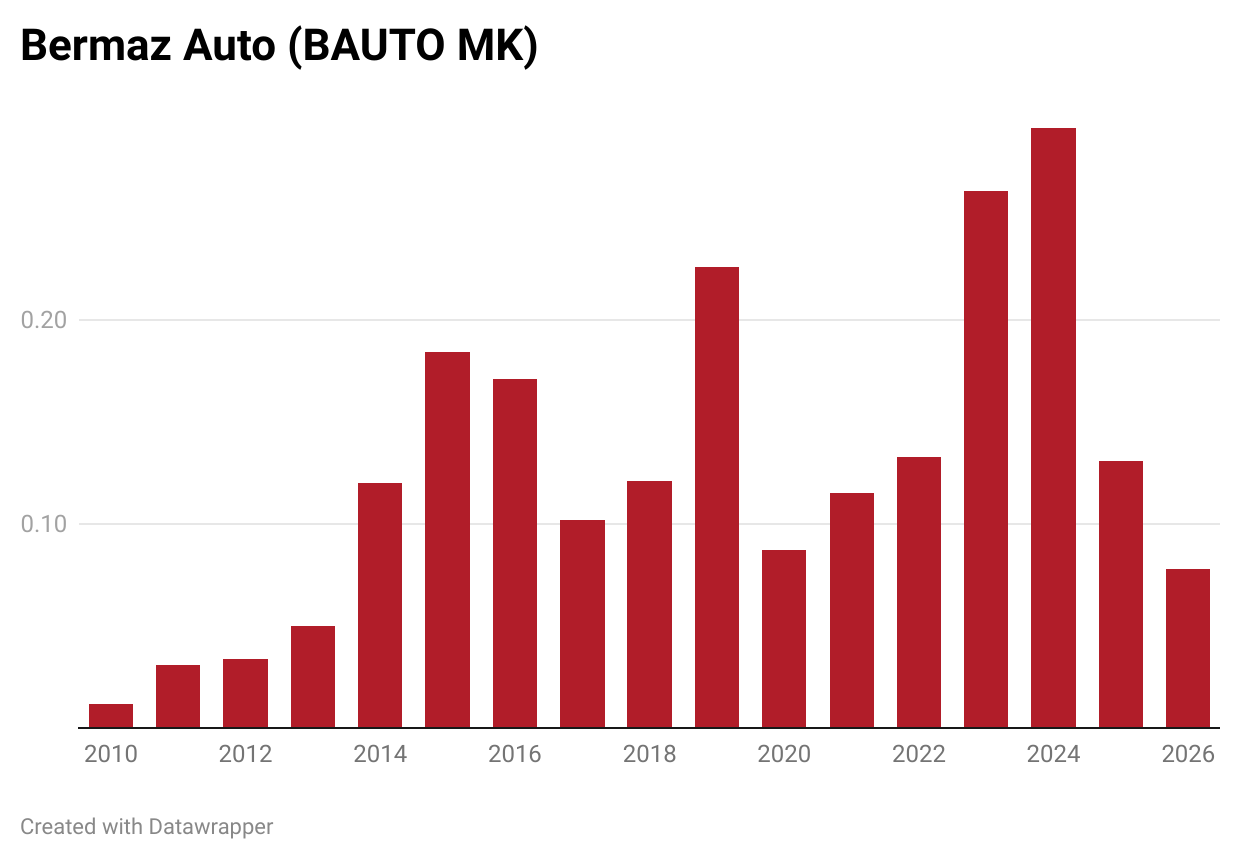

- I bought a small position in the Mazda dealer Bermaz Auto. I think it's going to benefit from Malaysian tariffs on Chinese EV imports. The tariff rate will increase from zero to 30% on 1 January 2026 and then another sales tax of 10% on 1 January 2028. The main reason why Bermaz Auto's earnings have declined is competition from BYD and other Chinese electric vehicle brands. Higher import tariffs should shift some of that demand back to Mazda. I personally doubt that we'll all move to electric vehicles, given that they have a limited range. I'd personally prefer a hybrid Toyota or Mazda, and I'm sure the brand will survive with continued low single-digit market share. On the positive side, Bermaz Auto's CEO and Chairman are both buying shares themselves, on top of the company's recent share buybacks. The stock trades at a headline P/E of 9.0x. But I expect earnings to come up significantly with the new Mazda model refreshes and the higher import tariffs. So it made rational sense to put on a position, in my personal view.

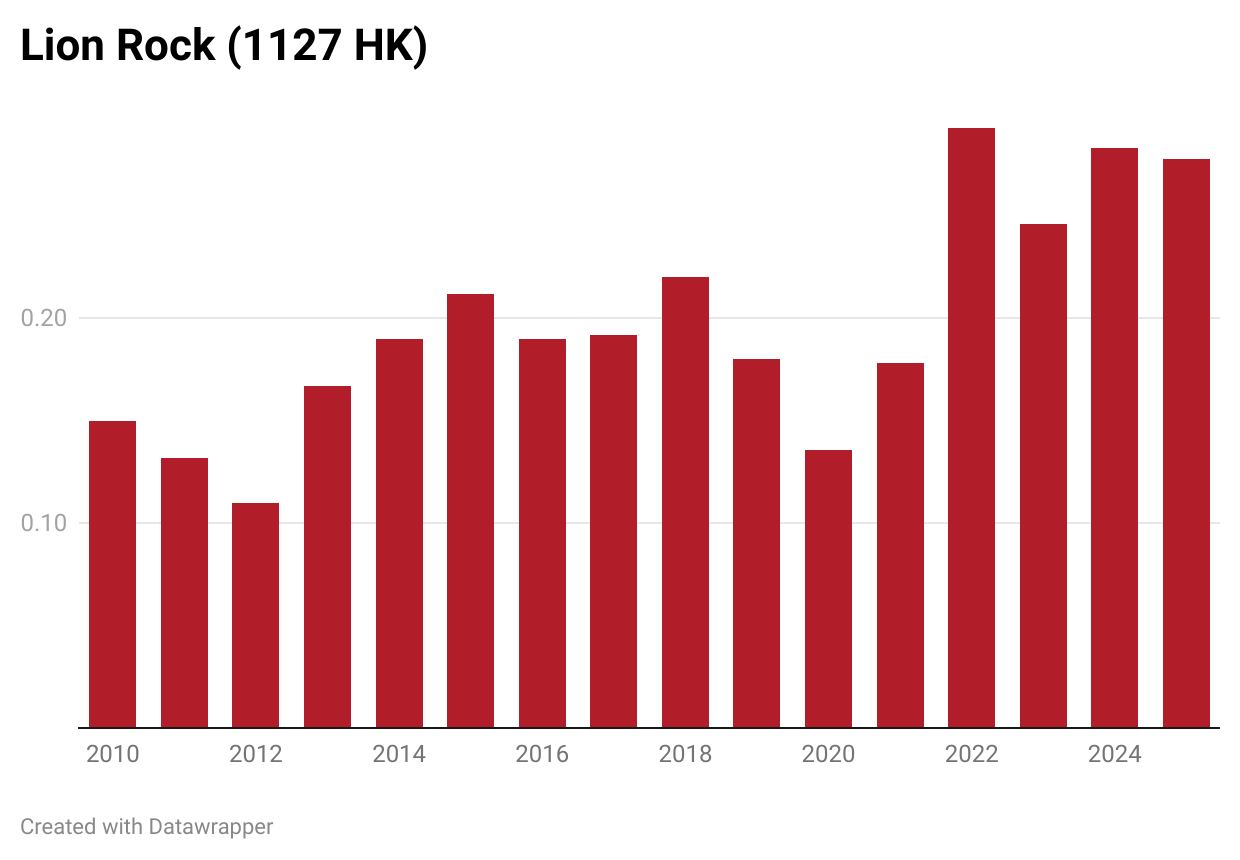

- I also bought shares in Hong Kong-based printing company Lion Rock. The company doesn't have any exciting catalysts ahead of it. But I found it encouraging to see that founder CK Lau bought 2.2 million shares in early October. I consider CK Lau to be a safe pair of hands, making up for the fact that the book printing industry is ruthlessly competitive. As long as he's in charge, I think Lion Rock will do just fine. It now trades at about 5x P/E with a 10% dividend yield. And I'm hoping that the large net cash position of 30% of the market cap will be put to use at some point in the future, hopefully through value-accretive M&A.

The portfolio’s cash balance is now 1.2%, held in Japanese Yen, Singapore Dollar, Hong Kong Dollars and US Dollar.

Update on my key holdings

Let’s move on to updates on the individual stocks in my portfolio.

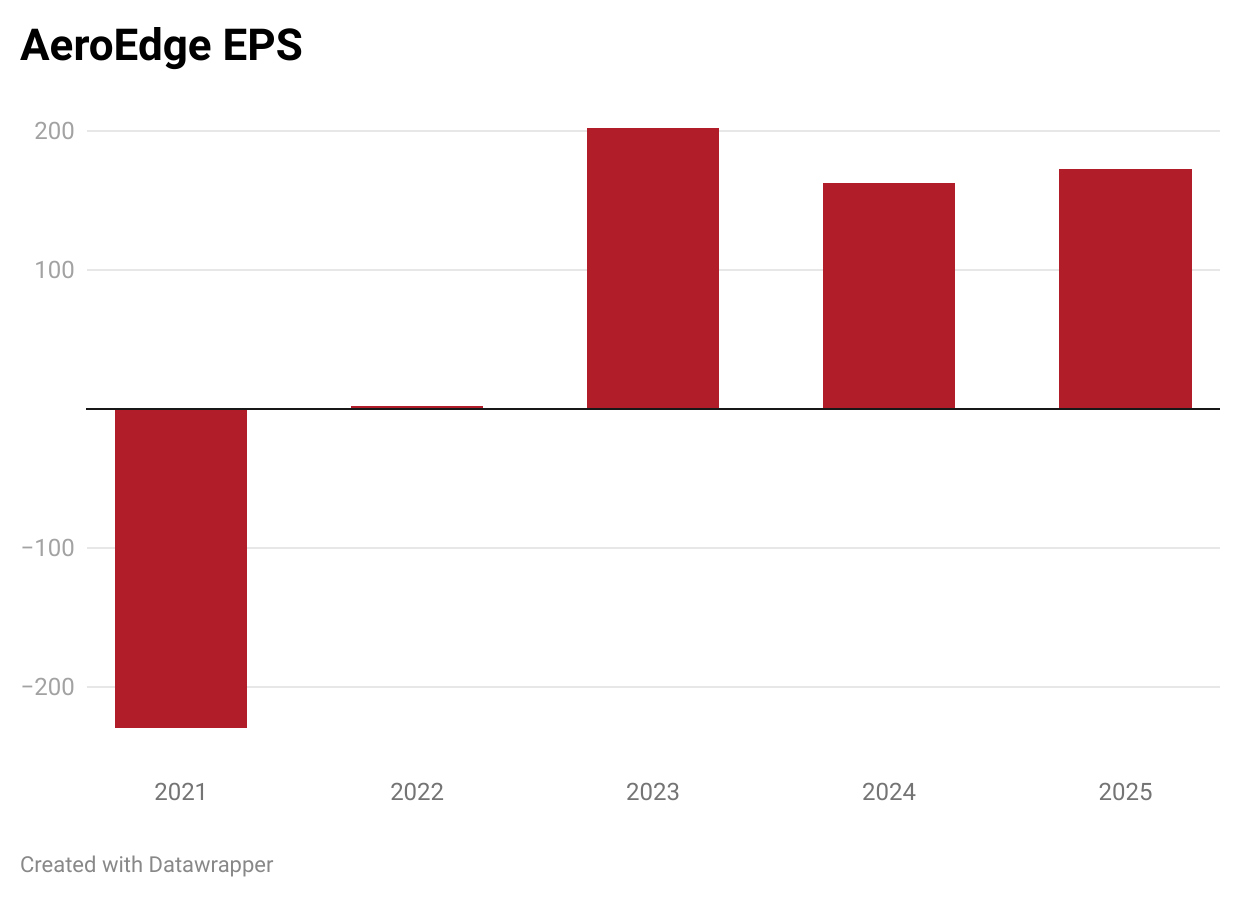

AeroEdge's (7409 JP — US$146 million) (10.8%) share price is flying high, up another +24% vs last month.

The last run-up seems to have been driven by the news that AeroEdge would split its shares 3-for-1. So the share count will triple, effective on 1 January 2026. I don't understand the enthusiasm for the share split, and it seems to suggest that weak hands have begun accumulating shares in the company.

AeroEdge issued 3,733 shares to three directors on the board and a few executives, as part of the company's incentive scheme. They will be restricted from selling their shares within the first three months of ownership.

A more important piece of news is that AeroEdge has now broken ground on a new casting plant and lab close to its existing "EdgeFactory" in Ashikaga City. The new plant will be used for producing the Titanium Aluminide alloy feedstock that AeroEdge will then use to build low-pressure turbine blades. AeroEdge had already announced back in August 2025 that it would enter the materials business. AeroEdge will invest JPY 2.6 billion in the new plant, and it's going to be finished by April 2027.

On my numbers, AeroEdge now trades at 23.5x P/E on FY2027 numbers. I might be underestimating future earnings a bit, given that they've now entered the materials business. We'll just have to wait and see. I personally don't think the shares are undervalued anymore, but true growth companies tend to trade at high multiples, so I'm not surprised to see the run-up in the share price.

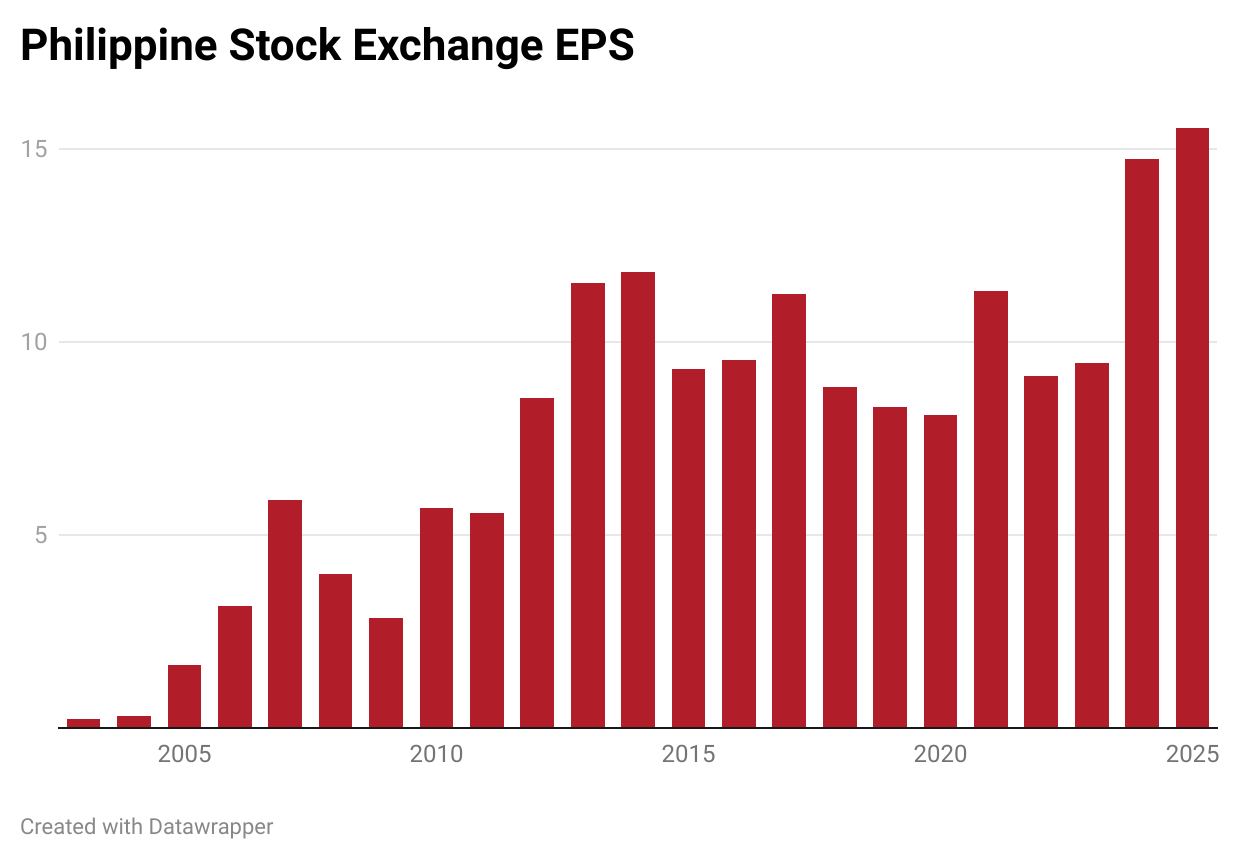

When it comes to the Philippine Stock Exchange (PSE PM — US$285 million) (9.8% position), Maynilad Water Services started its book-building process for its blockbuster IPO. It's reduced the size of the capital raise to PHP 34 billion (US$585 million). The shares are expected to be priced on 7 November 2025.

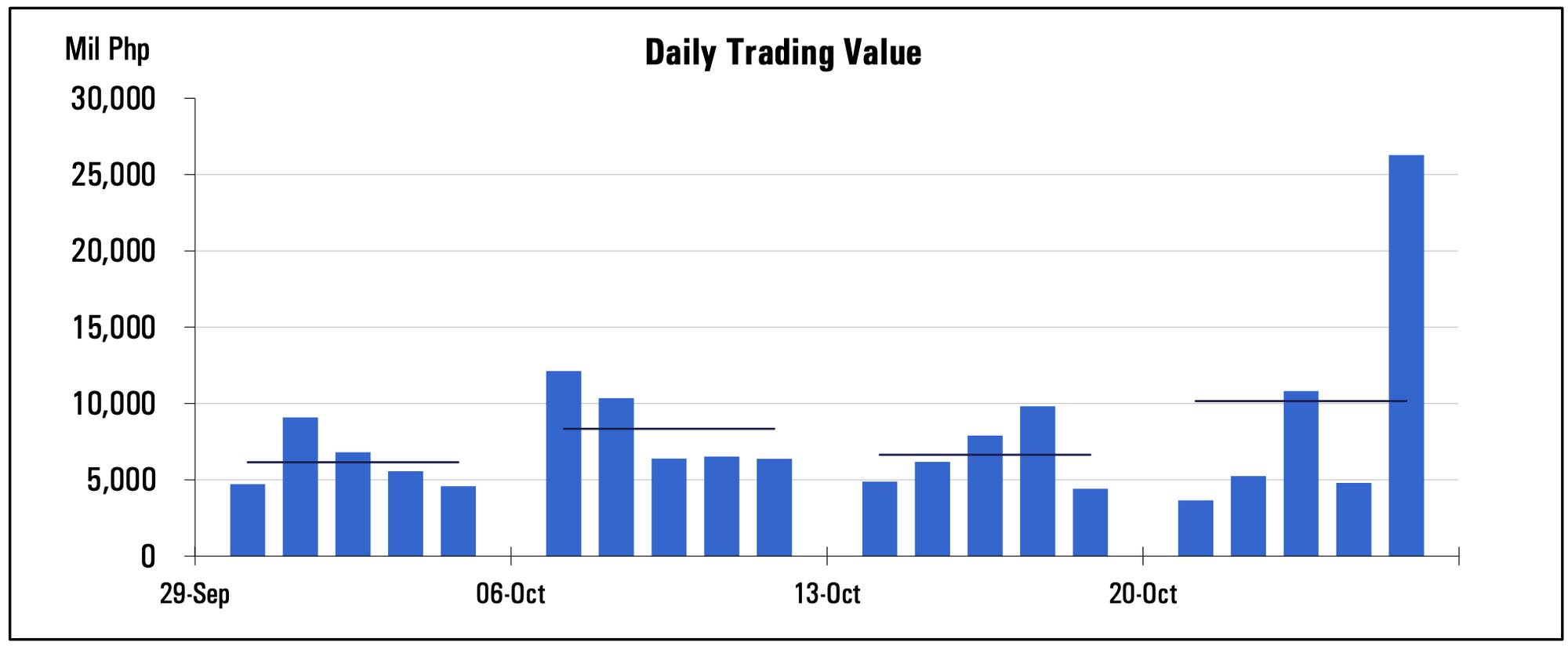

PSE's trading volumes picked up in October. In the past four weeks, they've ranged from PHP 6 billion to PHP 10 billion on average, slightly higher than the pre-CMEPA baseline of PHP 6 billion. So I'm hopeful that the lower stock transaction taxes from 1 July 2025 (60 bps to 10bps) are finally having an impact on PSE's trading volumes.

On the other hand, the PSEi benchmark index actually fell during the last week of October, suggesting that the high volumes were due to panic selling by foreigners rather than true bullishness about the market.

The exchange operator now trades at a forward P/E of 19.1x and a trailing P/E of 13.1x. But with significant operating leverage, I don't consider near-term earnings to be particularly meaningful. If trading volumes end up at PHP 10 billion per day, I think we could be getting closer to an EPS of PHP 17/share.

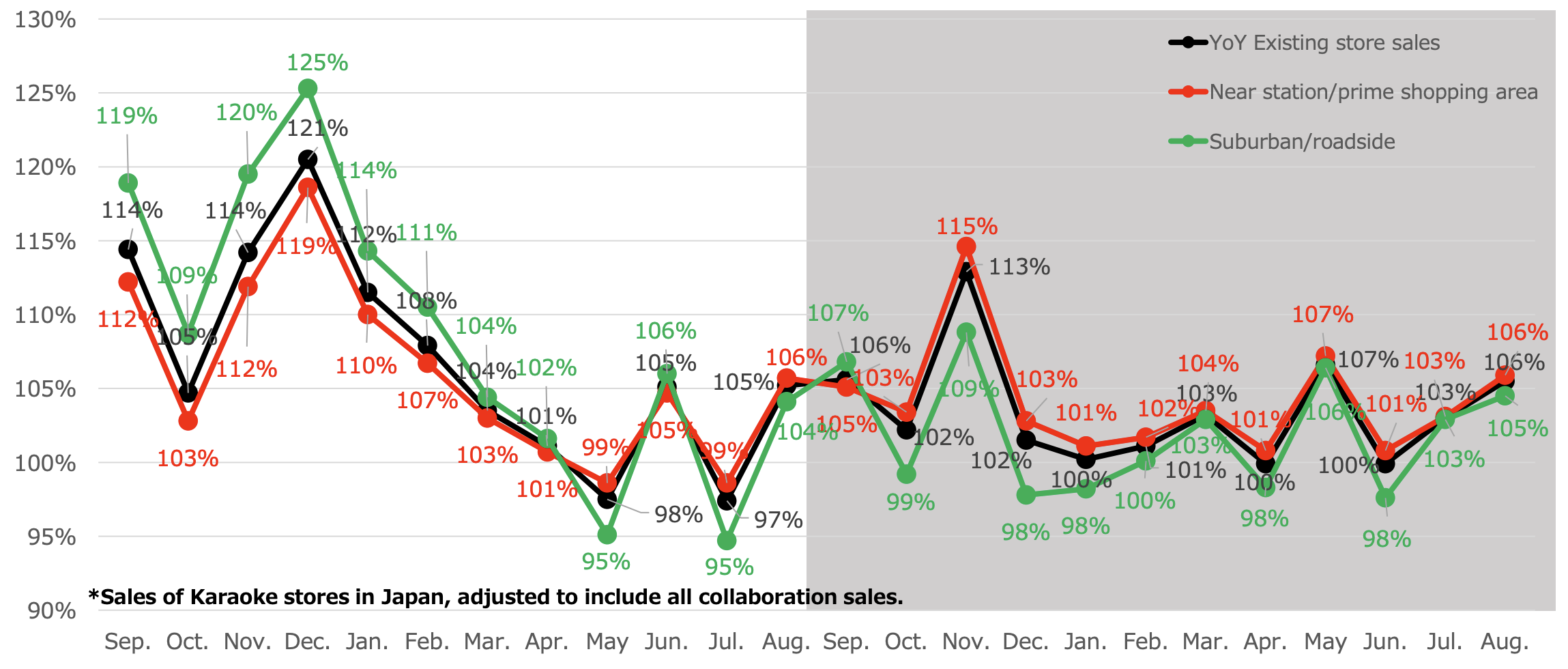

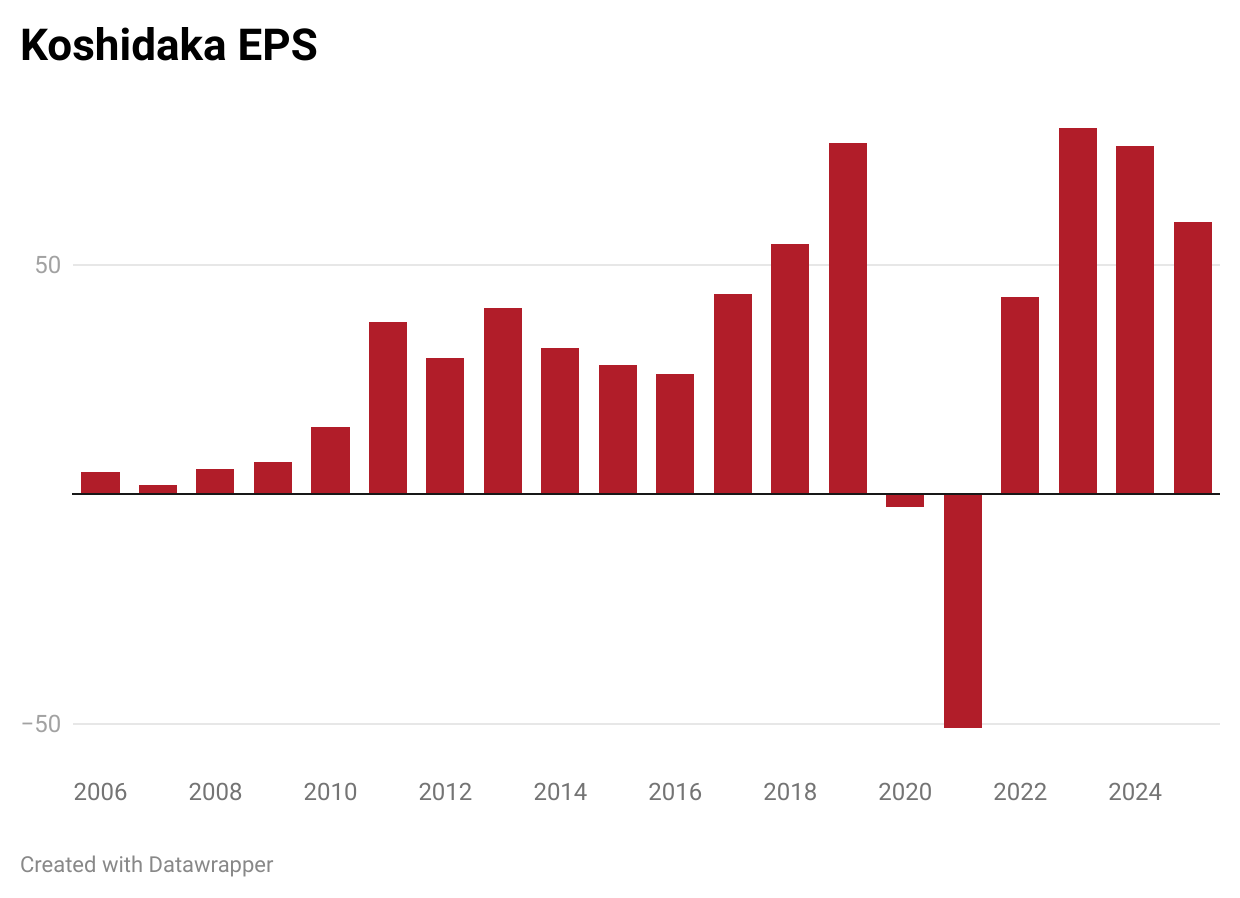

Japanese karaoke bar operator Koshidaka (2157 JP — US$628 million) (9.0% position) reported its full-year FY2025 result ending August 2025 (investor presentation, financial statements):

- Revenues rose by +9.7% year-on-year, thanks to the opening of new stores and steady same-store sales, including in the Kinki region, where Koshidaka is expanding rapidly

- Its operating profit grew by +12.1% year-on-year

- Koshidaka's net profit declined by -22.6% due to impairment losses of JPY 3.4 billion for certain unprofitable stores. There was also a JPY 405 million decline in non-cash cancelation income and shifts in FX gains.

Overall, I think Koshidaka is executing well, with same-store sales oscillating between 0-7% during most of 2025. The post-COVID surge in visitors is obviously over, but I think we can look forward to safe and steady growth.

The store count keeps rising by about +6% year-on-year. In addition, with new stores being larger in size, the number of total rooms actually grew +9% year-on-year. Most of Koshidaka's newly built stores are close to railway stations where foot traffic tends to be high.

Overseas, Koshidaka opened two stores in Malaysia and one in Thailand. In September 2025 (after the financial year-end), it also opened another two stores in Malaysia. Koshidaka is also preparing for the first new stores in the United States and the Philippines, a country where singing karaoke is part of the culture.

The long-term targets remain the same: JPY 100 billion in revenues and JPY 15 billion in operating profit by FY2027. It hopes to achieve this by rolling out Private Entertainment Rooms, offering services that are much broader than typical karaoke outlets, including billiards, darts, etc.

In other news, Koshidaka reported that two of its outside directors, Tomohiko Nishi and Kenji Kobayashi, have resigned. Instead, Koshidaka has now appointed Kanako Murakami and Kaori Ota to the board. Both of them are lawyers with backgrounds in corporate law, including in international M&A. I wonder if these appointments reflect a shift in Koshidaka's focus towards overseas markets.

Finally, in October 2025, Koshidaka agreed to sell Atsugi Vista Hotel in Kanawagawa at a profit, with extraordinary gains of JPY 0.9 billion. These will be reflected in FY2026 earnings.

The updated earnings forecast undershot expectations, causing the share price to drop in October. Koshidaka's new guidance is for revenues to grow +19% year-on-year, partly thanks to its recent acquisition of Joysound. Koshidaka now expects an earnings per share between JPY 91 and JPY 115, putting the P/E ratio between 10.5x and 13.3x. Along with a dividend of JPY 26, equivalent to a yield of 2.1%.

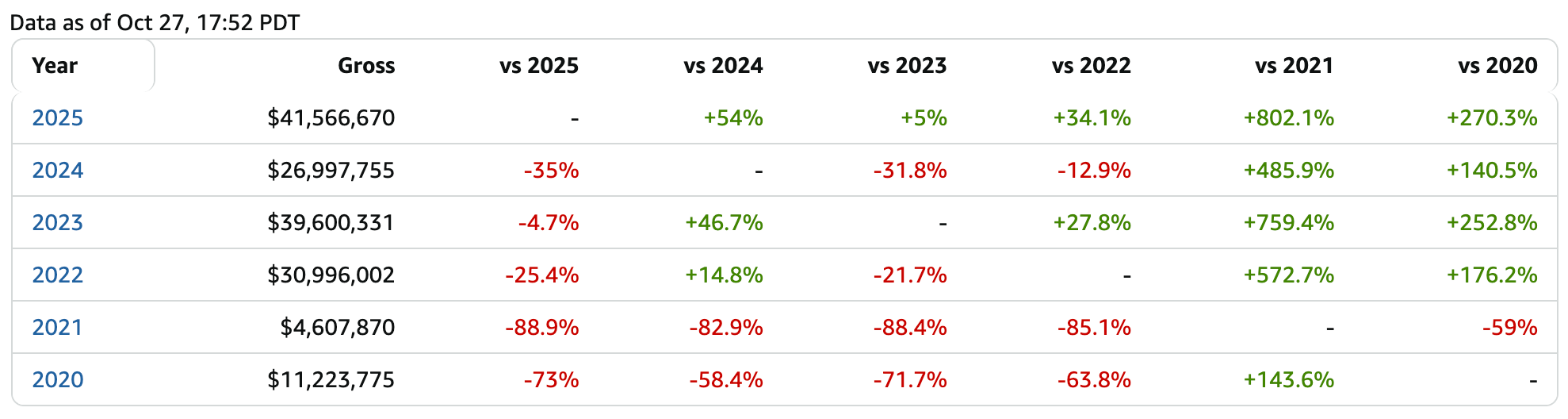

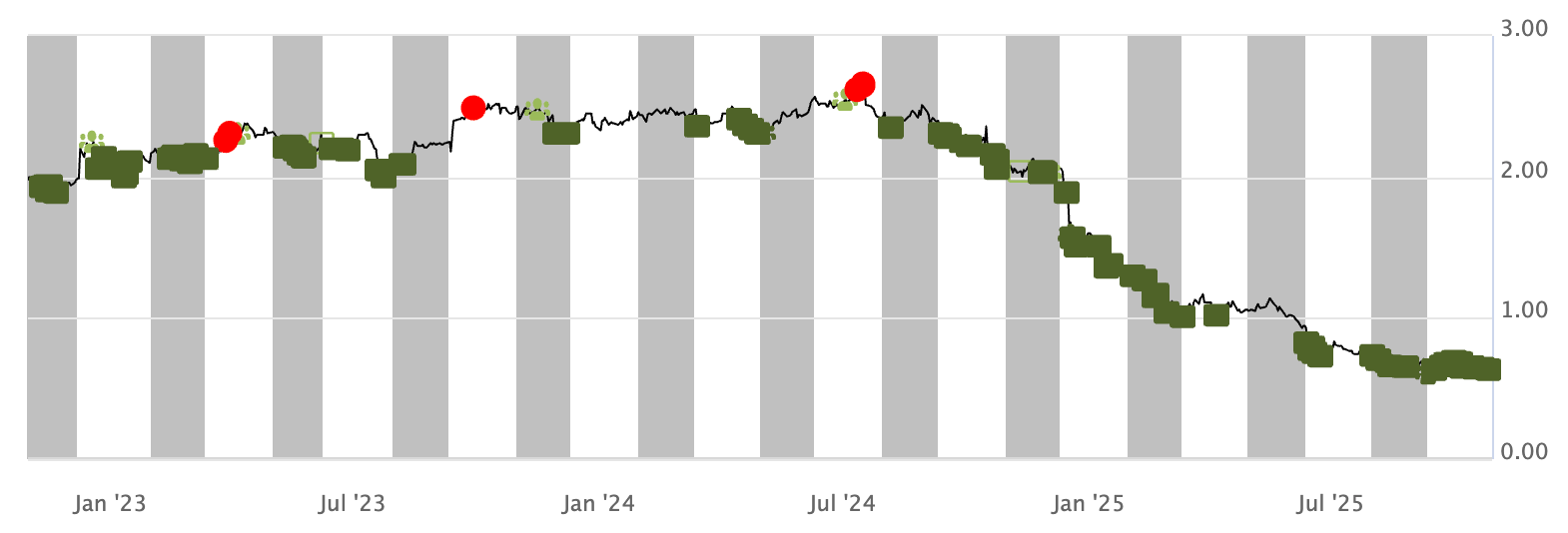

It's embarrassing to have owned Thai cinema operator Major Cineplex’s (MAJOR TB — US$169 million) (7.6 % position) through this continued decline in its share price. I believed that the stronger box office coming out of COVID-19 and the Hollywood writers' strike would cause Major's earnings to recover. But so far, they haven't.

Major Cineplex did announce progress in its new joint venture with seaweed snack manufacturer Taokaenoi. The capital for the Taokaenoi JV is THB 100 million, and the board has already been appointed. You can find more information about it here.

Major Cineplex also experimented with VR converted films together with K-pop groups ENHYPEN and TXT over at Paragon Cineplex in central Bangkok.

The insider buying has continued as the shares went lower in October. Founder and CEO Vicha Poolvaraluk purchased another 200,000 shares on 2 October and then another 40,000 on 16 October.

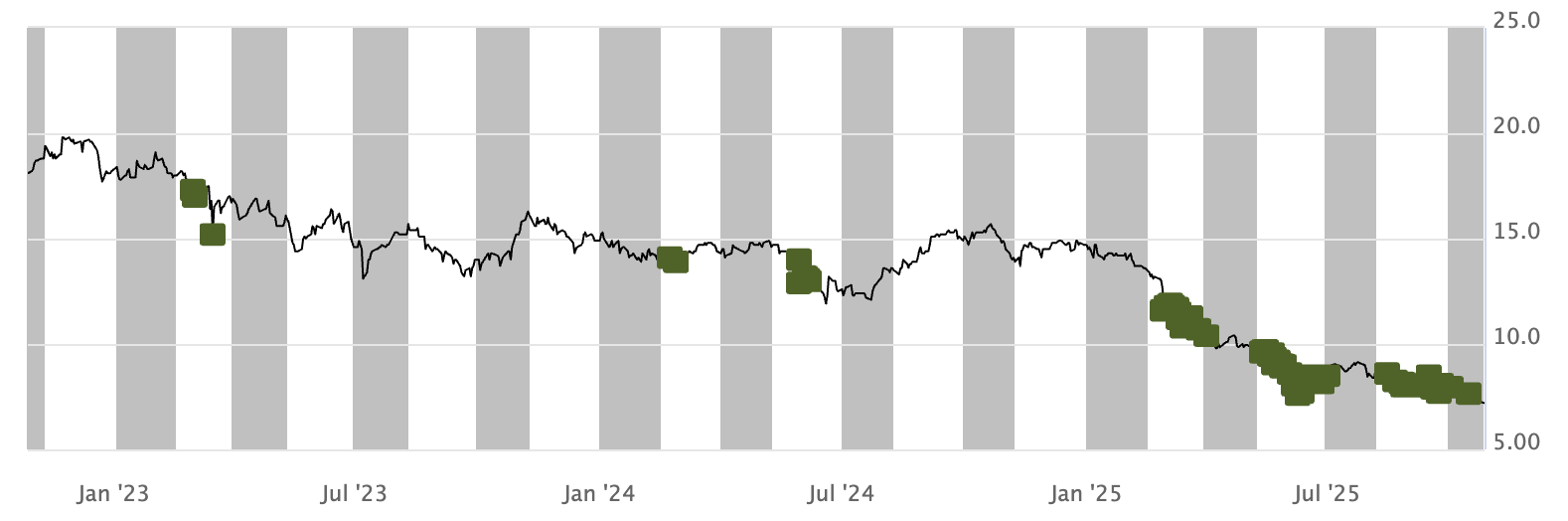

Here are the latest numbers for Thailand's box office revenues up until 27 October 2025. As you can tell, there's been a strong rebound in 2025, suggesting that we could end the year stronger than in 2023. In that year, Major Cineplex reported an adjusted earnings per share of THB 0.87.

However, note that Thai Box Office Mojo numbers are only for Bangkok and Chiang Mai, and only include the larger movie franchises. So the actual growth numbers may end up being different from what's been reported by them.

Major Cineplex now trades at THB 7.2 per share. Consensus estimates now have Major Cineplex trading at 9.6x P/E with a 4.9% dividend yield. The share buybacks have not yet resumed, but I'm hopeful that they eventually will.

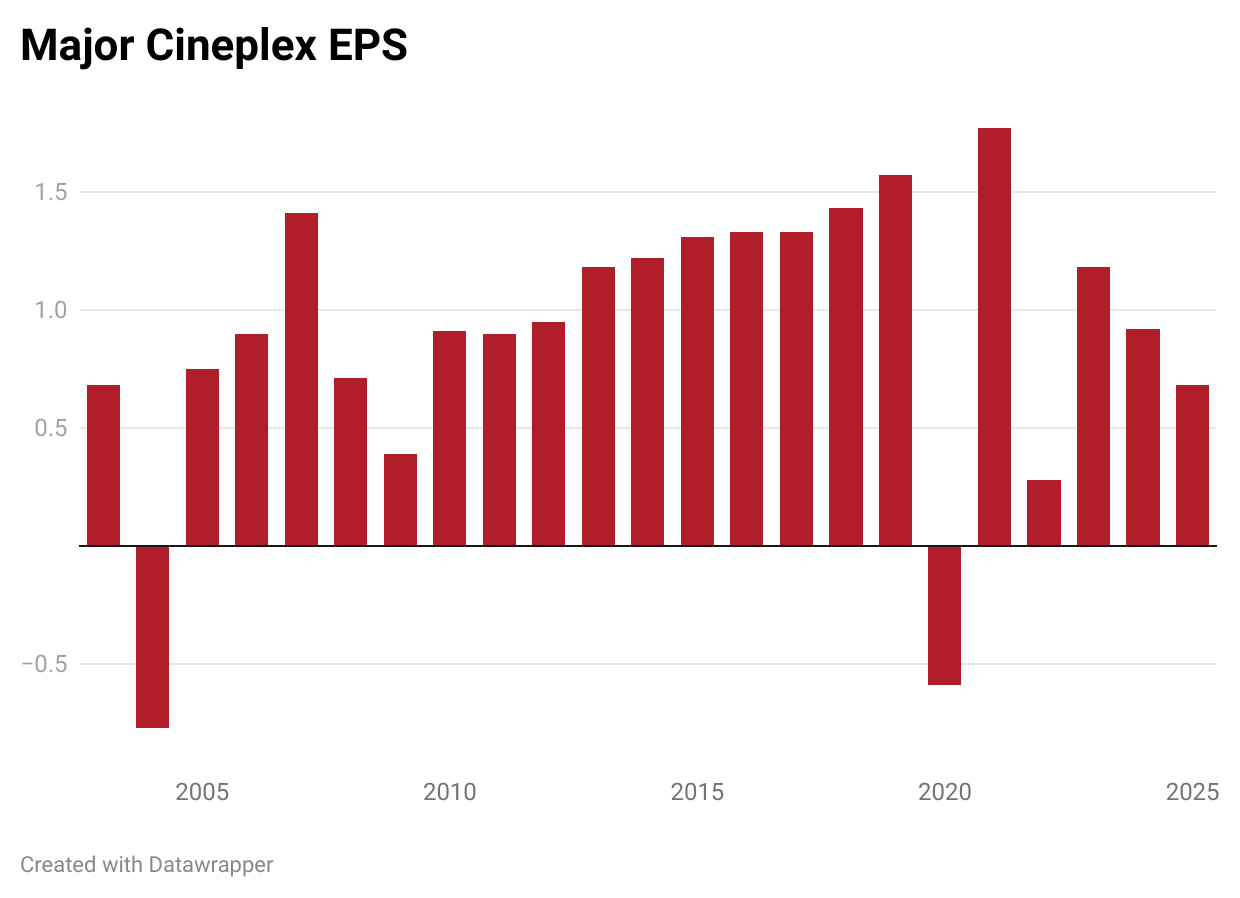

Not much news regarding investment holding company Fairfax India’s (FIH/U CN — US$2.3 billion) (7.5% position).

With the expansion of Terminal 2 set to start early next year, Bangalore International Airport (BIAL) is planning to issue INR 46 billion (US$522 million) in 15-year bonds with a coupon of 8.15%. While that may sound high, the bonds will be denominated in Indian Rupees – a currency with persistent inflation pressures.

Perhaps more importantly, the Airports Authority of India is planning to submit a pre-feasibility report for a second international airport in Bengaluru in late October. There are two possible sites: one near Kanakapura Road in the South and one near Chikkasoluru in the West. It's unclear whether BIAL will operate this new airport, so it is a competitive threat. But in any case, BIAL will retain its monopoly until at least the mid-2030s.

Fairfax India is going to report its 3Q2025 results on 30 October 2025, so I'll provide an update for you then. Its NAV per share remains at US$21.4. So with the current share price at US$17.2, the discount to NAV is currently about 20%. Once BIAL receives approval for a listing, I believe that the NAV could end up in the low 30s.

Indonesian beer producer Multi Bintang's (MLBI IJ — US$756 million) (6.4%) parent company Heineken reported weak global beer volumes of -4.3% year-on-year. Beer volumes in Asia, specifically Vietnam and China, were strong. But unfortunately, Heineken did not provide any comments on Indonesia this time around.

Multi Bintang was named a silver medalist in the MEA Marketer of the Year Award, within the sub-category "Experiential Marketing". Multi Bintang used the advertising agencies Acteeve and Leo Indonesia for the campaigns that led to it winning the prize.

The stock now trades at a forward P/E multiple of around 10.7x, along with an 8.9% dividend yield. The company is expected to report 3Q2025 earnings on 29 October 2025. I don't expect blowout earnings, given that the number of visitors to Bali has remained flat over the past year, and with the economy remaining weak. But eventually, growth is probably going to resume.

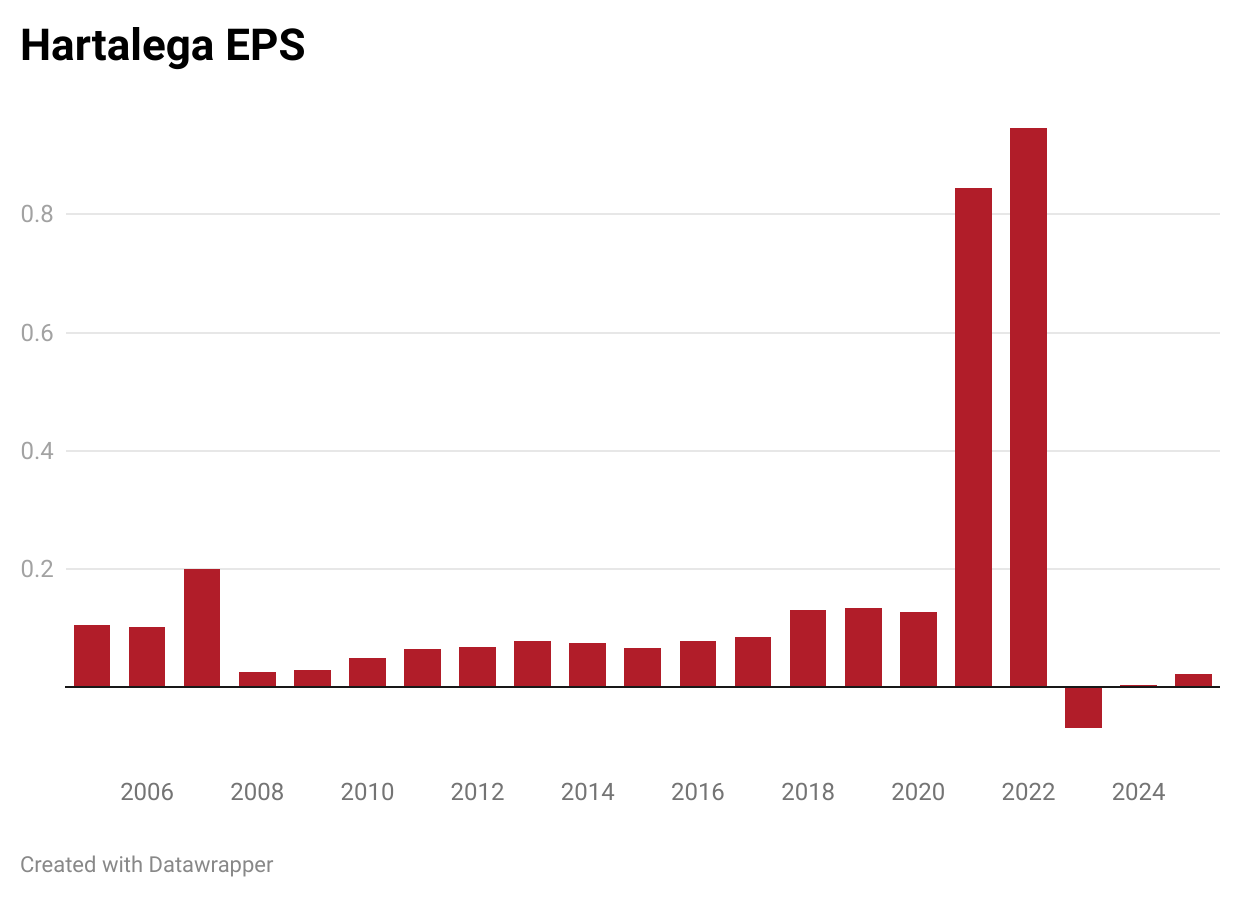

The fundamentals of Malaysian glove maker Hartalega (HART MK — US$1.0 billion) (4.6% position) have improved recently, but brokers remain bearish.

Philip Capital highlighted that Hartalega's utilization rate rose from 67% in 1Q2025 to 70% in 2Q2025. It also noted that average selling prices have remained flat, and that the Ringgit weakened against the US Dollar. So despite higher volumes, margins have remained under pressure. The additional tax assessment of MYR 101 million will be reviewed on 30 October 2025. In a worst-case scenario, Hartalega might lose 10% of its current net cash balance due to these newly required tax payments.

CGS International thinks the sector's return on equity will remain below 5.5% through calendar year 2027 due to competition. While US tariffs will cut Chinese supply in that market, CGS thinks that capacity is expanding outside of China, too. In summary, CGS thinks that Malaysian glove makers won't return to US$3 per 1,000 in profits until at least 2028. The broker is particularly bearish about Hartalega, which it sees as being the most expensive, with the lowest ROE and the highest cost structure.

In other news, it looks like new director Ms Lim Kit Yng declared ownership of 300,000 Hartalega shares on 2 October 2025 via her spouse. I can't figure out whether this represents new buying or a disclosure of an existing position. For the record, Ms Lim is the country head of CLSA in Malaysia, so she comes from a banking background. I consider her to be a valuable addition to the board.

Hartalega’s Price/Book ratio is now 1.0x, with a pre-COVID return on equity just below 20%. The bearishness that we're seeing in the sector is music to my ears, given that I'm contrarian in nature. Many years ago, Hartalega used to be touted as the sector's lowest-cost producer. I think CGS is simply wrong: just because Hartalega uses modern machinery,it doesn't mean that it has lost competitiveness. There is a market for high-quality disposable gloves.

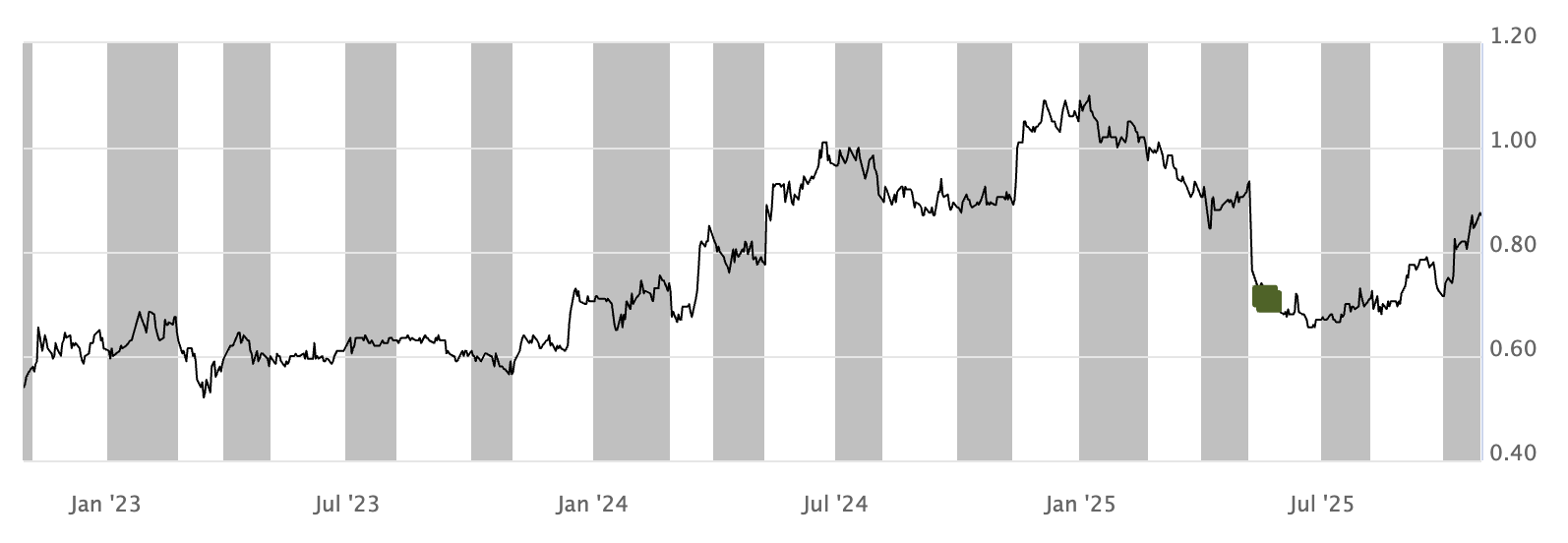

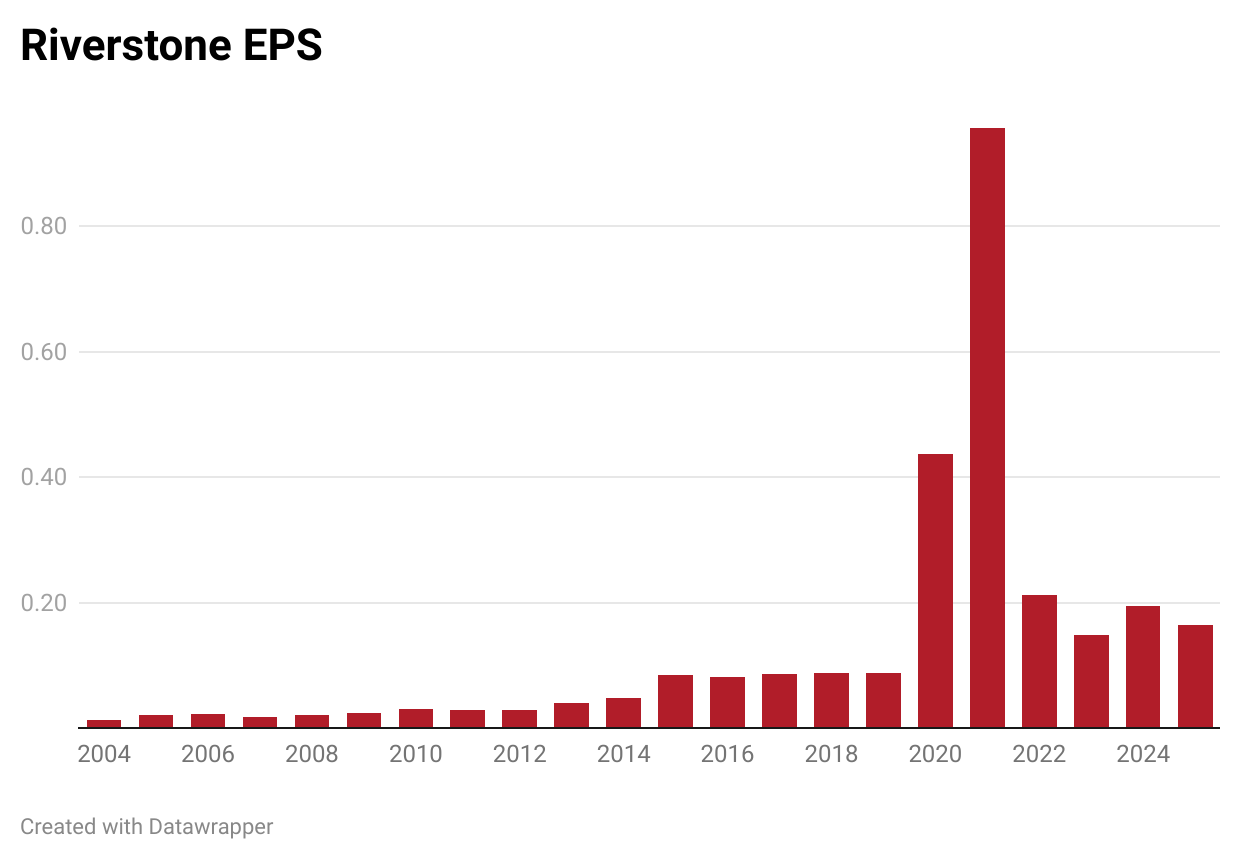

Not much news on Riverstone (RSTON SP — US$1.0 billion) (4.7%) either. The last insider transaction was CEO TS Wong buying 1.5 million shares in May 2025 after the share price got hit from the strong Malaysian Ringgit.

In October, broker UOB Kay Hian raised its target price for the stock to SG$0.98 cents on the basis of Riverstone becoming an AI stock. I had previously joked that Riverstone could eventually be seen as an AI play, given that its gloves are sold to semiconductor fabs and hard-disk drive manufacturers. And indeed, Riverstone is now expecting 10% QoQ volume growth in 3QFY2025 thanks to stronger demand from these two sectors. On the cost side, it also helps that nitrile prices have come off a bit.

Riverstone paid out its MYR 2.5 sen interim dividend on 3 October. In the past 12 months, the company has paid out MYR 22 sen in dividends per share, equivalent to SG$7 cents and a 7.5% dividend yield against today's share price of MYR 0.88.

Hong Kong book printer Lion Rock (1127 HK — US$130 million) (4.2% position) is a new position for me.

While book printing is a commodity service and subject to competition, I feel very comfortable with CK Lau in charge. He's proven to be a safe pair of hands, despite the turbulence that's occurred every few years.

The biggest event over the past month is that CK Lau accumulated another 2.2 million shares on 3 October 2025 at an average price of HK$1.29. I believe that this signals confidence about the future.

The stock now trades at a trailing P/E of 4.7x with a dividend yield of about 10%. There's no clear catalyst, as far as I can tell. But I'm hoping that CK Lau will eventually find another value-accretive acquisition. The net cash/market cap ratio is currently around 30%.

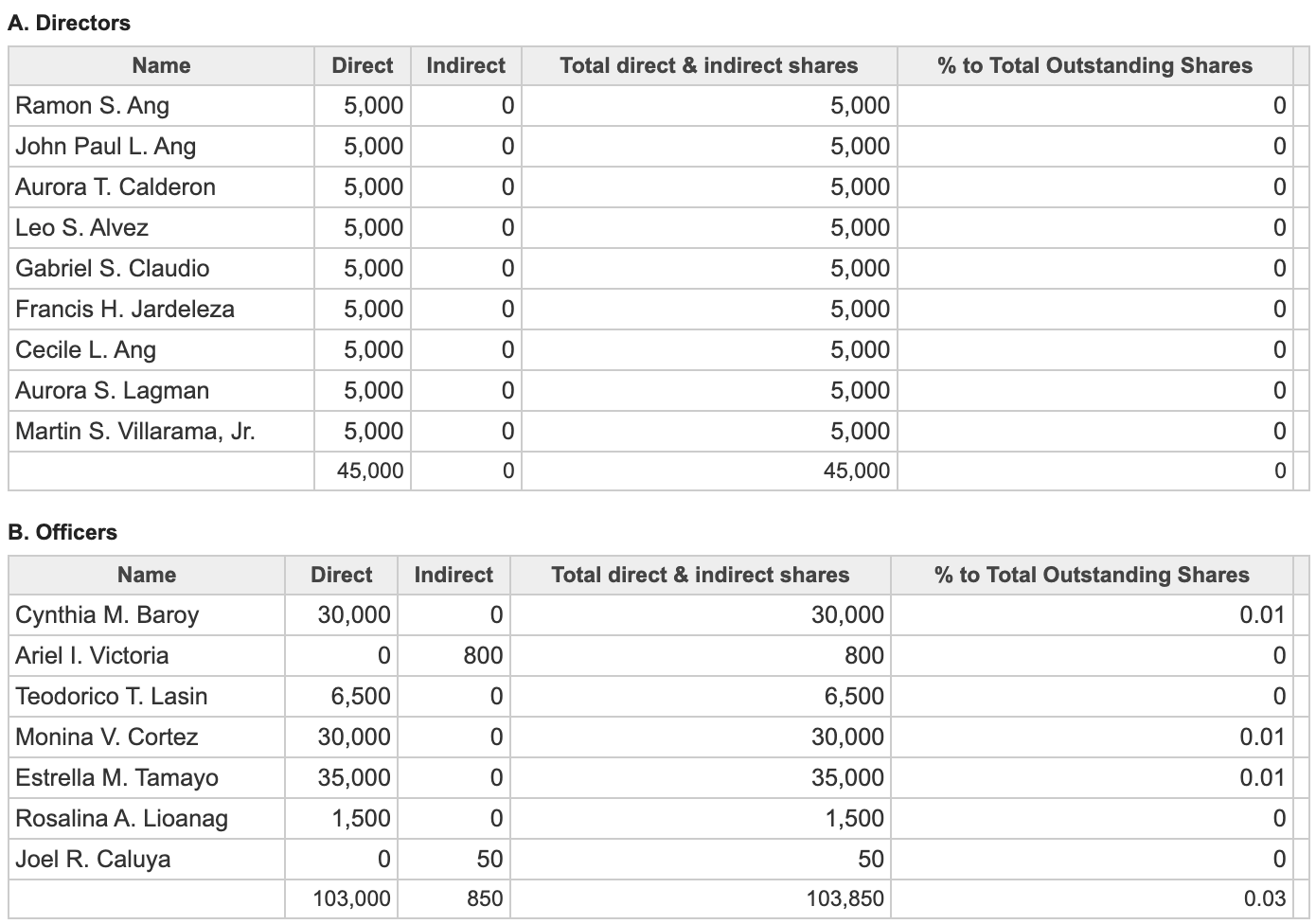

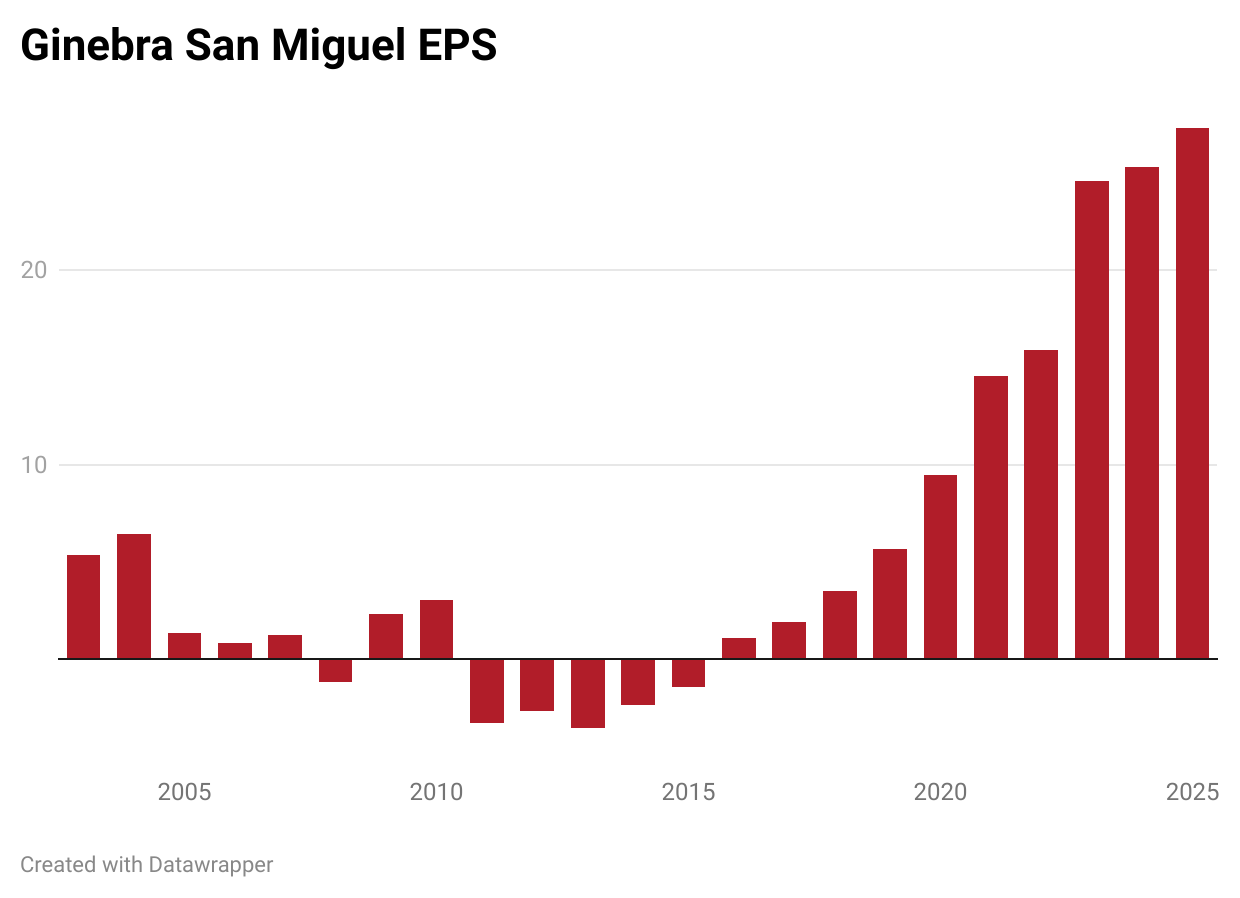

On 13 October 2025, Philippine gin maker Ginebra San Miguel (GSMI PM - US$1.4 billion) (3.9%) published a public ownership report, where it disclosed the ownership position of its directors and executives. Importantly, CEO Ramon Ang does not hold any material position in the stock. This provides a potential conflcit of interests.

On 26 September, the House of Representatives filed a bill (No. 5003) to raise excise taxes on alcoholic drinks. Philippine excise taxes are already rising 6% per year, and have been offset by higher prices that have boosted Ginebra's margins. But the new bill suggests double-digit increases in excise taxes. Eventually, they could start to hurt demand for the product, in my view.

Ginebra now trades at a trailing P/E of 10.2x. The company is performing well so far, but I think it's worth keeping track of House Bill No. 5003.

Not much news regarding warehouse management software developer Logizard (4391 JP - US$25 million) (3.8%). According to its news page, it held a seminar and exhibited at the Kyushu Next Generation Logistics Exhibition.

On the website, Logizard also highlighted a case study of when e-commerce customer Toranoana used Logizard Zero managed to cut its staff by 50%. Toranoana reported better inventory accuracy and faster shipping. In their own words:

In order to create a system that allows for immediate shipping work in the morning, we moved away from paper-based operations and moved towards a paperless system. As a result, work efficiency improved dramatically and shipping speed increased dramatically. Furthermore, by utilizing inventory data analysis, we were able to level out operations and reduce staffing during busy periods to about half of what it was before.

Logizard now trades at 15.9x trailing P/E. On the FY2026 consensus estimate, the stock now trades at a P/E of 12.7x. The long-term FY2028 target is JPY 3.1 billion in revenues and JPY 530 million in operating profit, putting the forward EV/Sales at 0.71x and EV/EBIT at 4.1x. Its net cash/market cap remains around 50%.

Not much news about Best Mart 360 (2360 HK — US$269 million) (3.7% position). Arena Man Capital (who is no longer a shareholder) tweeted that an M3 Chardonnay wine bottle costs only HK$200 at Best Mart's Foodville, compared to HK$700 in a restaurant. Best Mart is indeed very competitive.

The stores continue to add new products, including canned tuna, cookies, chocolate, drinks, etc. Some of the new products come from China, and others from Malaysia, Spain, South Korea, etc. Best Mart is also running a large number of promotions, including Chupa Chups (imported from Vietnam), EuroCake chocolate cake, Oolong tea, frozen food, etc.

But no news otherwise. Best Mart trades at an 8.5x trailing P/E with a 10.0% dividend yield. I'm not sure how much the company will be able to grow, as there's no indication of a material increase in the store count this year.

On Kawai Musical Instruments (7952 JP — US$143 million) (3.6 % position), I noticed that Halvio Capital recently sold their shares in the company. Halvio justified the decision by saying that they:

"Found better opportunities for the capital where there are actual catalysts or current shareholder return policies being implemented today."

On the positive side, I noticed that an index of Google search queries shot up between July and October 2025. The interest in Kawai pianos seems to be the highest in years. If you search on Google News for "Kawai Piano" between these dates, you'll find news about Kawai's new CX Series of digital pianos, and about the Shigeru Kawai International Piano Competition in Tokyo. In August, Kawai also launched its new marketing campaign Instrumental to Life, with marketing that's way better than anything Kawai has put out in the past few years.

In other news, the Kawai CX302 Digital Piano won the grand prize in the Musical Instrument Store Awards 2025. Kawai also moved its Tokyo office to the Sumitomo Fudosan Oimachi Ekimae Building. This move may or may not help revitalizing the company.

Kawai's 2QFY2026 earnings will be released on 12 November 2025. The stock now trades at 0.20x EV/Revenues and 0.52x book. It has a great amount of inventory on its balance sheet, and the question is whether the inventory will need to be written down. Pianos do age, especially in certain humid climates like Indonesia. I'm hoping for further clues on 12 November.

Malaysian auto distributor Bermaz Auto (BAUTO MK — US$178 million) (3.4% position) is another new position for me.

My reasoning is that the stock remains exceptionally cheap. It will probably benefit from the 1 January 2026 rise in import duties for Chinese electric vehicles, as they will rise from zero to 30%. I also think that Bermaz Auto will benefit from new Mazda product introductions in the next two years, including the new Mazda 3, the CX-60 and the 3rd generation CX-5. As I noted in my write-up, the insider buying has continued, with Chairman Choon San Yeoh buying shares throughout October.

At the 8 October annual general meeting, Bermaz Auto renewed its share buyback mandate. Between 22 and 24 October, it repurchased 700,000 shares and on 28 October, another 160,000 shares. The amounts are small in absolute terms but signal confidence about the future.

In late September, Bermaz's shareholder Pangolin Asia Fund put forward a special motion to pay its independent board directors 50% in shares rather than cash. I thought that was an excellent suggestion. But unfortunately, the board rejected the proposal.

The stock now trades at a headline P/E of 9.0x with a dividend yield of 7.6%. It's hard to predict earnings with any degree of accuracy. I'm not just nothing that even in bad years, the company has earned more than MYR 10 sen per share. So the current share price of MYR 0.66 doesn't seem particularly high.

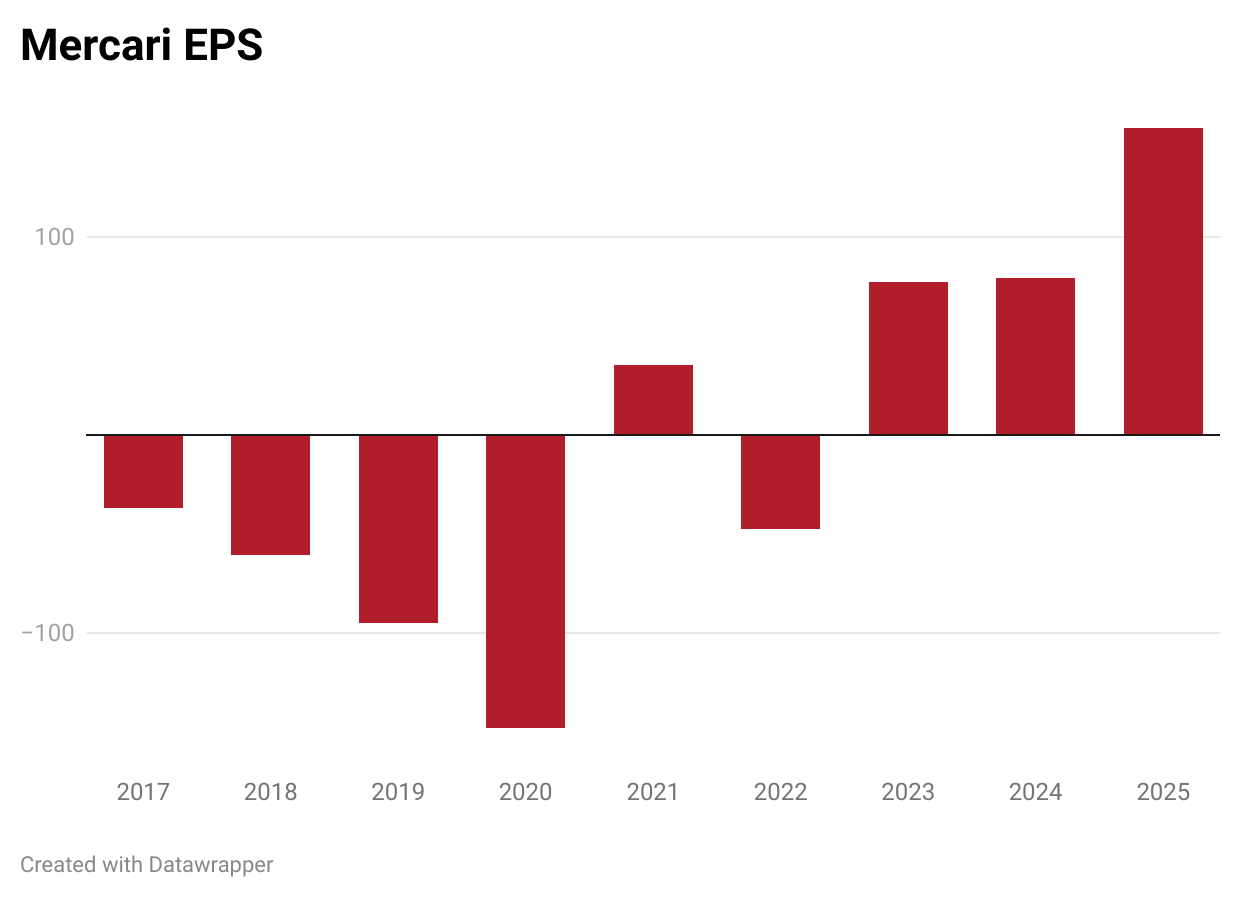

Mercari (4385 JP — US$2.4 billion) (3.2% position) finally shut down its Mercari Hallo app, a competitor to popular gig sourcing network Timee. I felt the shutdown was a positive event, given that Mercari Hallo's losses weighed Mercari's profit margin by almost four percentage points. It was clear that Timee led in terms of user engagement, so I trust that it was the right decision for Mercari. The shutdown will take place on 18 December 2025.

In other news, Mercari was chosen as a partner company for the Official Tokyo Metropolitan Government app. Customers who hold Tokyo Points will be able to convert their points to Mercari points and then use them within the app or Merpay-affiliated stores.

The stock now trades at a trailing P/E of 14.6x and a forward EV/Sales of 2.0x. But I think margins are likely to go up with the shutdown of Mercari Hallo and the ongoing turnaround at Mercari US. It's encouraging to see Shintaro Yamada finally take decisive action to improve the profitability of the company. I suspect that these moves have been a result of the influence of Hong Kong-based activist investor Oasis Management.

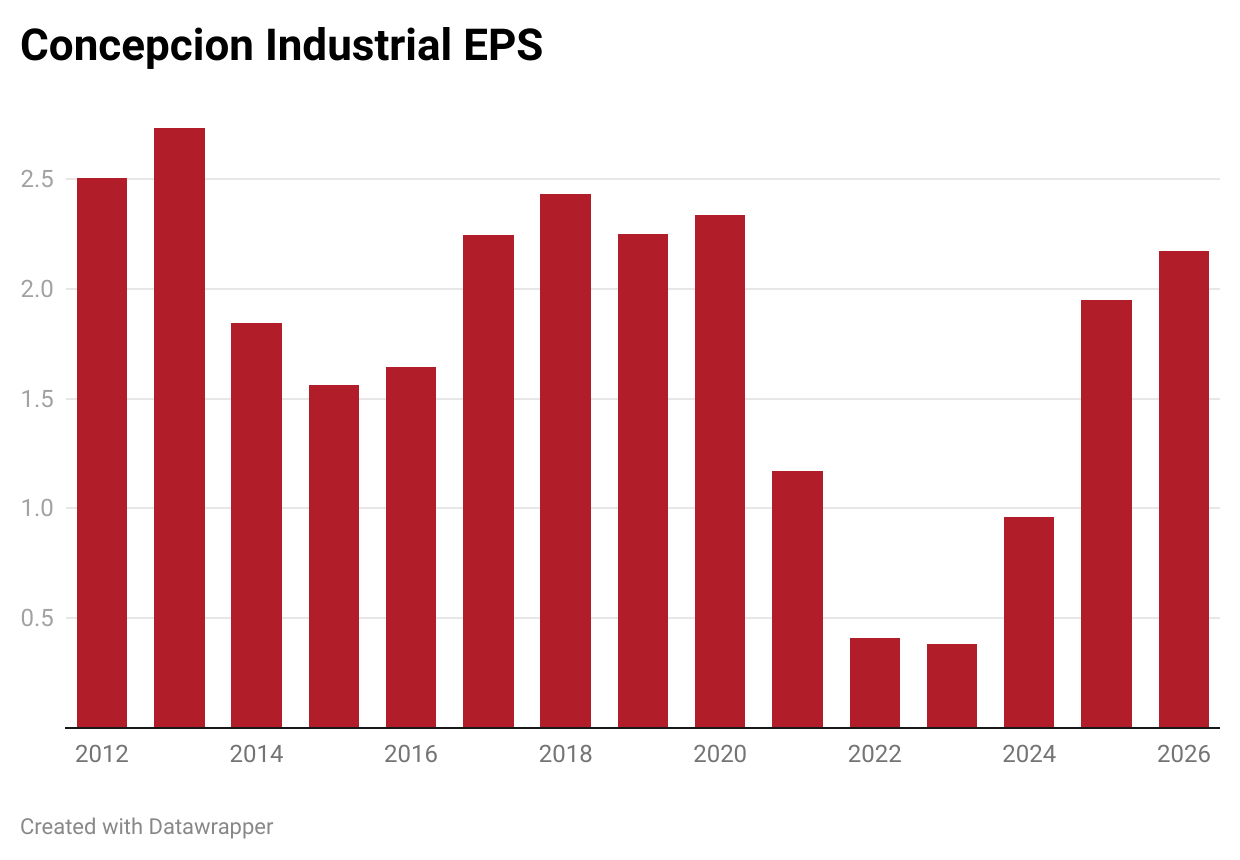

Concepcion Industrial (CIC PM — US$93 million) (3.1% position) reported its 3Q2025 result, and it wasn't great:

- Consolidated 3Q2025 revenues increased by +2% year-on-year, a decline from +11% year-on-year in the first nine months of 2025. Group-wide revenues, including contributions from associates like Midea and Concepcion-Otis, rose by +11% year-on-year.

- Consumer segment sales declined -3% year-on-year due to lower air conditioning category sales. Meanwhile, the commercial segment did very well, with revenues rising by +18% year-on-year thanks to a number of large commercial projects and momentum in the contractor network. Contributions from elevator equipment sales and aftermarket services apparently bolstered the overall profitability.

- Gross profit dropped by -3% year-on-year due to competitive pricing, along with higher input costs and lower utilization of its factories

- 3Q2025 attributable net income declined by -25% on margin pressures and external headwinds

CEO Ariel Fermin commented that the weak result was mostly due to market forces, perhaps due to cooler weather in 2025 and competition from Chinese appliance brands:

“Our third quarter performance reflect our commitment to serving our customers in a soft market... We continued to enhance brand relevance and deliver superior value across our product portfolio, demonstrating the resilience of our diversified business model."

I have full faith in Ariel Fermin and his ability to revitalize the Carrier and Condura brand names. And while there's competitive pressure in the consumer segment, I think Concepcion has a strong competitive advantage in the commercial projects, thanks to local relationships and access to the Carrier and Otis brand names.

Concepcion now trades at a forward P/E of 6.3x with a 6.8% dividend yield. There's been no new insider buying since January 2025, when a board member bought shares at an average price of PHP 13.50.

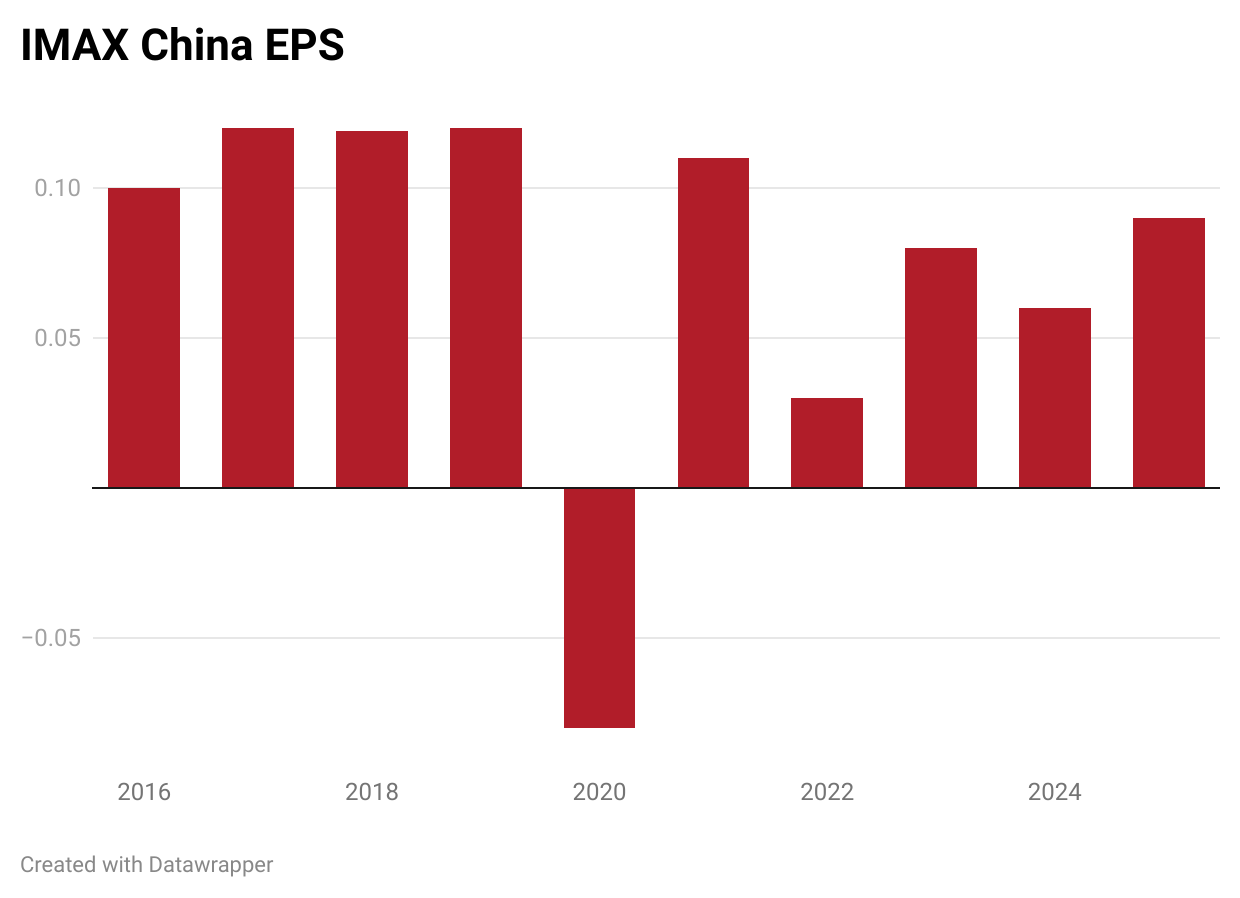

IMAX China's (1970 HK — US$348 million) (3.2% position) parent company IMAX Corporation recently reported 3Q2025 earnings. Here are the key China-related takeaways from the report:

- IMAX's Greater China 3Q2025 revenues declined by -4.9% year-on-year. Not a terrible result, but not great either.

- There were 12 local language film releases in 3Q2025 compared to 10 in the same period in 2024. However, the problem was that only 7 Hollywood movies were released compared to 11 in the same period in 2024. IMAX Corporation now says that it's expanding the number of local language films is a core strategy for its international (non-US) segment. But no mention of whether the number of Hollywood movies screened in China is going to increase.

- The number of screens declined from 808 last year to 800 today, suggesting poor growth momentum overall. However, there was a backlog of 227 IMAX systems as of 30 September 2025, and these will contribute to revenues at some point in the future.

- IMAX China repurchased US$1.5 million worth of shares year-to-date, but zero share buybacks in the third quarter of 2025. It looks like most of the shares were bought during the Q2 slump when a Xinhua journalist speculated that Hollywood movies would be shut out of the Chinese market. I think IMAX China could do so much more to add value to minorities, including reinstating its regular dividend.

IMAX China now trades at 8.4x forward P/E. There's still no indication that a privatization will take place anytime soon. Vice Chairman Jiande Chen sold 10,886 shares at an average price of HK$8.6 per share in July, and there's been no significant insider buying recently.

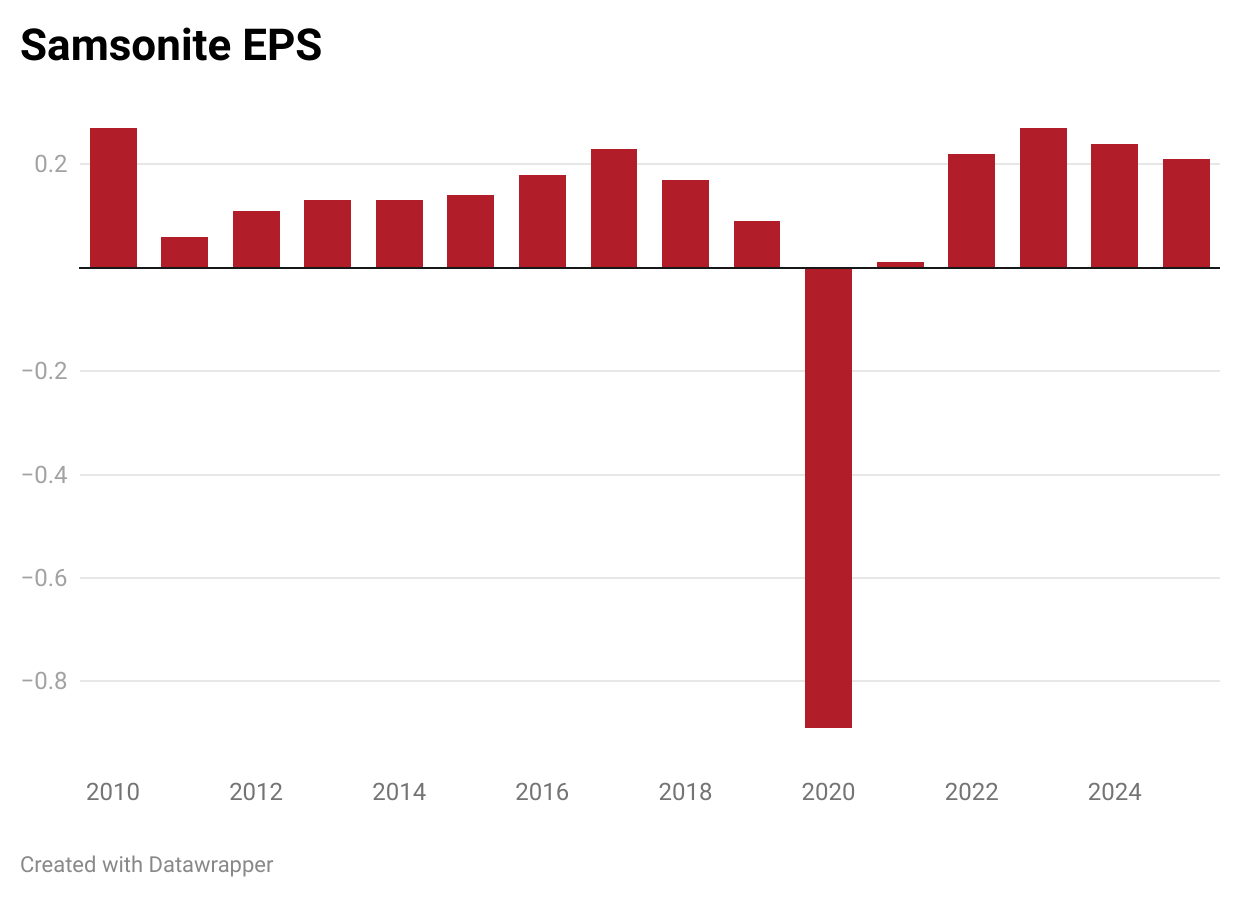

Preparations for Samsonite's (1910 HK — US$3.0 billion) (2.2% position) US listing are still underway, but the timing remains unclear. Samsonite spent US$5 million in costs related to a US IPO in the first half of 2025, but it's still monitoring the "economic backdrop and market uncertainty". It's presumably referring to US tariffs on luggage imports.

In other news, Fitch updated its view on Samsonite's proposed US$850 million senior secured facilities maturing in June 2028. Fitch rated the new loans BBB- and noted:

"Fitch expects Samsonite and its discretionary retail peers to experience near-term operational challenges due to softening consumer sentiment and the evolving U.S. tariff policy."

Meanwhile, Fitch expects long-term EBITDA of US$650-700 million:

"Longer term, Samsonite's ratings assume the company can generate annual EBITDA of around $650 million-$700 million, with EBITDAR leverage sustained below 2.75x."

These long-term estimates would put the stock on an EV/EBITDA of 7.0-7.5x and an EV/EBIT of 7.6-8.2x. I've been hoping that Samsonite would be awarded a higher valuation in the US market, but we'll see whether the US listing will eventually take place. In the meantime, the global luggage market has been softening. A board meeting is scheduled for 12 November 2025 to approve the 3Q2025 result.

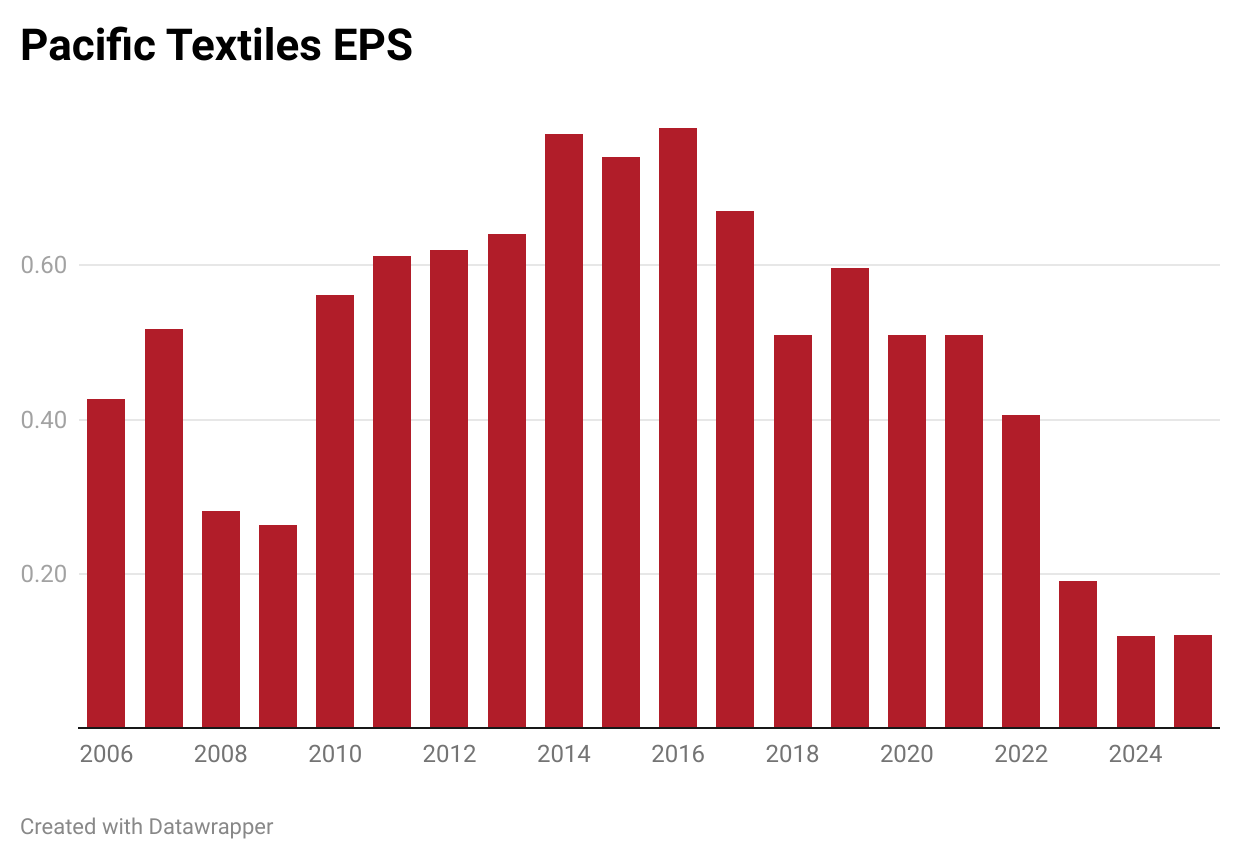

There's barely been any news on Pacific Textiles (1382 HK — US$258 million) (2.1% position) this month either.

Smartkarma analyst Sameer Taneja visited Hong Kong in October and wrote an excellent piece summarizing his views. He made the point that high US tariffs on US and Chinese imports are causing textile manufacturing to move to Vietnam. That should benefit Hong Kong-listed textile names like Nameson, and presumably also Pacific Textiles, whose new Nam Dinh plant remains underutilized.

Pacific Textile's forward P/E is now 5.7x and the dividend yield is 9.0%. But I expect earnings to rise now that the Nam Dinh plant in Vietnam is finally ramping up.

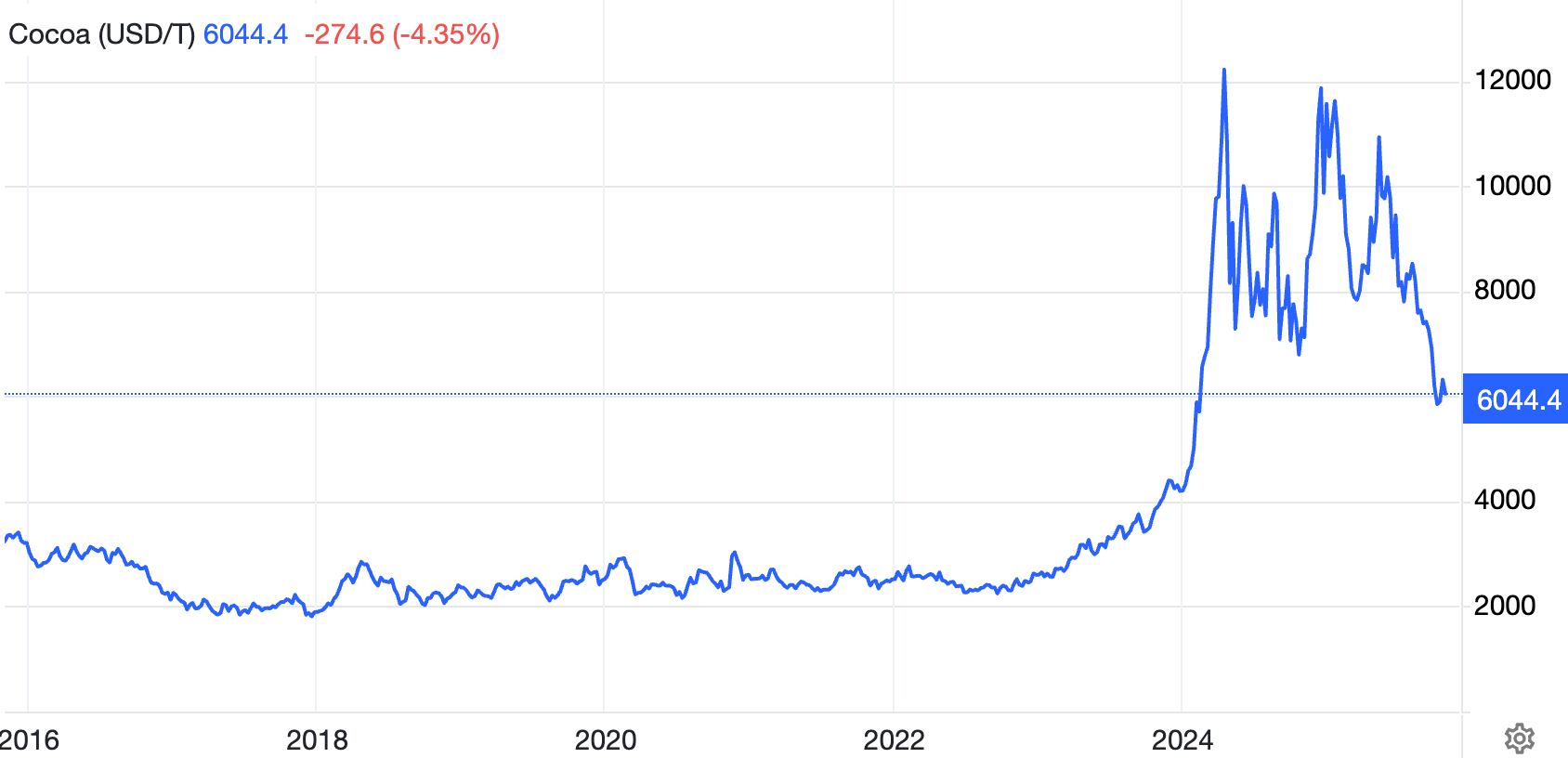

Not much news around Indonesian chocolate manufacturer Delfi (DELFI SP — US$382 million) (1.3% position). Temperatures keep getting colder this year, and cocoa prices are down another 10% month-on-month. That should be bullish for Delfi, whose sales and profit margins have been weighed down by weak consumer sentiment and high input costs (especially cocoa).

Janeo on Twitter mentioned the Singapore website InvestingNote, where there's recurring commentary about Singapore small-caps. As you can tell, when it comes to Delfi investors have been concerned about high cocoa prices.

Otherwise, no news as far as I can tell. The stock now trades at a forward P/E of 13.2x. But the normalized P/E should be closer to 8x, if and when cocoa prices ever come down to earth.

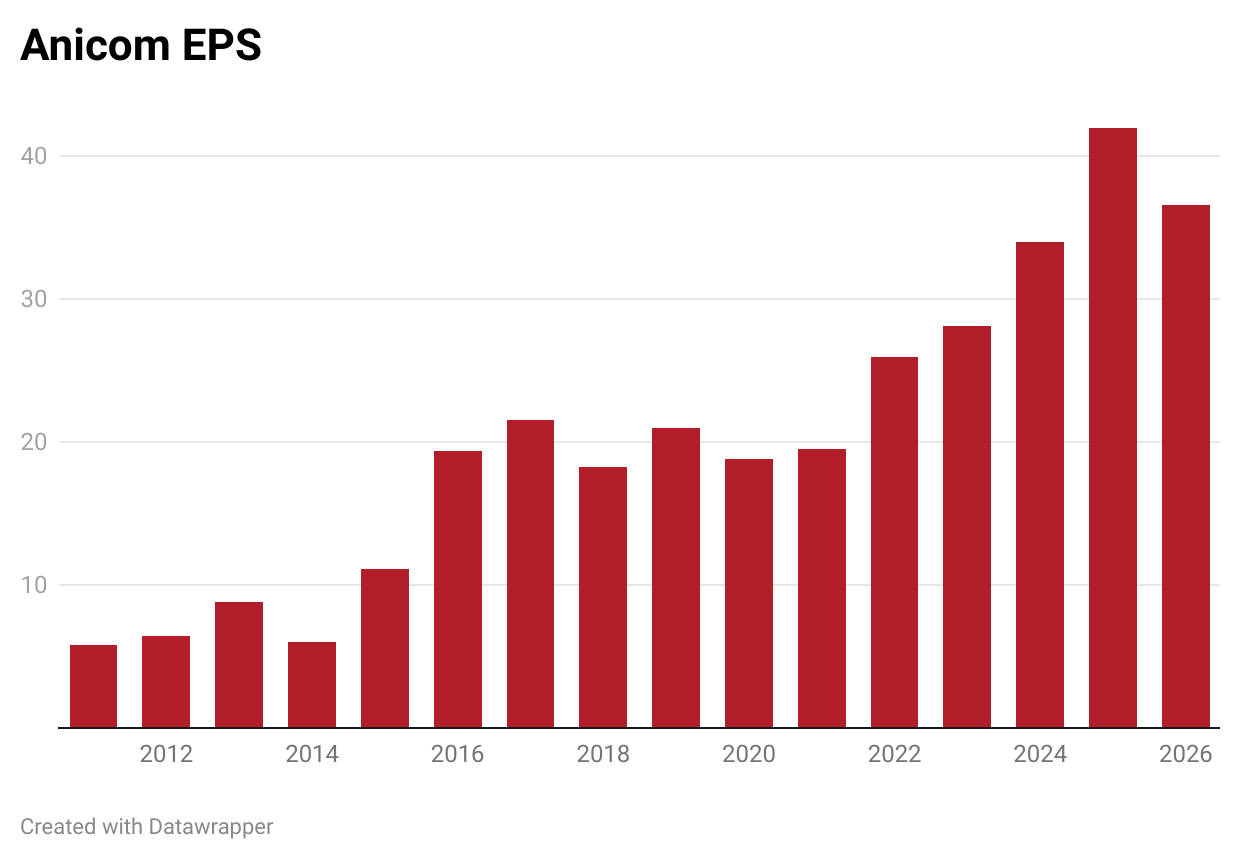

Japanese pet insurance company Anicom (8715 JP — US$370 million) (0.9% position) launched a media outreach campaign to promote its new JARVIS Medical Center in Tokyo.

Surprisingly, Anicom's operational statistics for September 2025 have still not been disclosed. I expect continued steady growth around the 10% mark.

Hikari Tsushin has continued buying, raising its stake in Anicom from 11.5% to 12.6% by late September. Activist Dalton Investments has remained at 6.3% since July, and there's been no public information about its intentions.

The stock has come up quite a bit, now trading at a P/E of 21.0x with a dividend yield of 1.3%. For the record, I no longer think the stock is undervalued.

My plans going forward

It feels like Japan is in the later stage of a bull market. But the best value can be found in Hong Kong small caps or Southeast Asia. That's what drew me to Bermaz Auto, Hartalega and Concepcion. And I'll continue to move the portfolio in that direction.

Within the portfolio, the stocks exhibiting positive momentum in fundamentals include AeroEdge, Anicom, Bermaz Auto, Mercari, Fairfax India, Concepcion, Ginebra San Miguel, Koshidaka and maybe PSE.

In contrast, I'm not as convinced that earnings will increase as quickly for Major Cineplex, IMAX China, Lion Rock, Best Mart 360, Hartalega, Multi Bintang and Samsonite. But they do remain undervalued, in my view.

Thank you for reading all the way to the end.

If you have any questions, feel free to ask them in the comment section below!

Best regards,

Michael