Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers and to understand whether any investment is suitable for your specific needs. From time to time, I may have positions in the securities covered in the articles on this website. Full disclosure: I hold a position in Koshidaka when publishing this article. Note that this is a disclosure and not a recommendation to buy or sell.

Summary

- I first wrote about Koshidaka three years ago, when it was experiencing its first-ever loss as a public company due to Japan’s COVID-19 lockdowns.

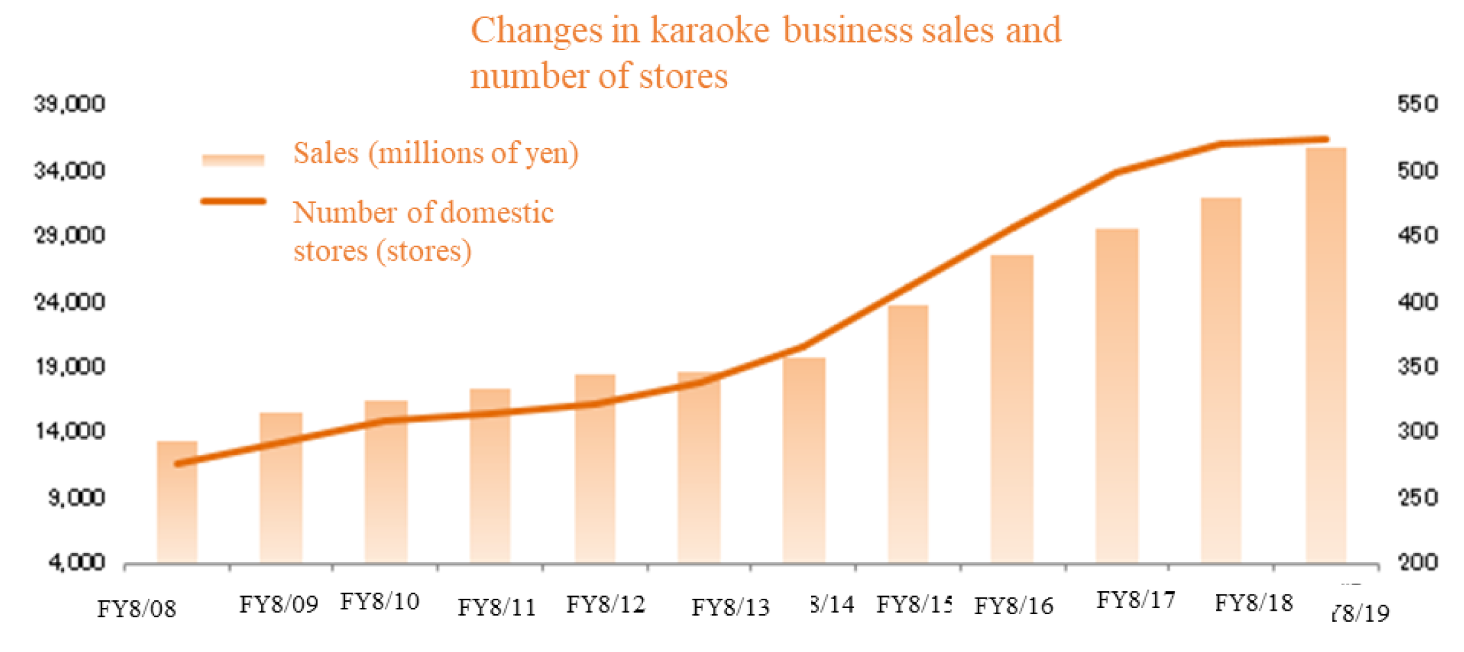

- Koshidaka operates low-cost karaoke bars throughout Japan under the brand name “Manekineko”. It’s unique in that it allows customers to bring in food and drinks from outside, and its membership fees are low. This strategy helped it grow its market share from 5% to 10% in the decade before COVID-19.

- The company has recovered from the COVID-19 pandemic, with revenues far above pre-COVID. Koshidaka is firing on all cylinders, and superstar CEO Horishi Koshidaka is optimistic about the future.

Table of contents:

1. Quick recap

2. Update since my first write-up

2.1. Koshidaka’s financials

2.2. Shift in the store count

2.3. Bath houses and other revenues

2.4. Business alliance with Advantage Advisors

3. What will change for Koshidaka?

3.1. Stabilization after a bout of revenge spending

3.2. Store expansion

3.3. The Entertainment Infrastructure Plan

3.4. Private Entertainment Rooms

3.5. Koshidaka Digital

3.6. Koshidaka’s new “welltainment” business

3.7. Alt-data check

4. Valuation multiples

5. Conclusion1. Quick recap

I first wrote about Koshidaka (2157 JP - US$457 million) about three years ago - long enough that many people have probably forgotten the story at this point:

But here’s a summary of how I viewed the company back then:

- Koshidaka is one of Japan’s largest operators of karaoke bars, focusing specifically on the lower-end segment. Most of its karaoke bars carry the “Manekineko” brand name, which is a type of porcelain cat “まねきねこ” with a waving hand that’s supposed to bring good luck.

- What makes Manekineko unique compared to its larger competitor, Big Echo, is that Koshidaka allows customers to bring outside food and drinks. Each customer just needs to buy 1 item from the menu. Koshidaka’s karaoke equipment is easy to use, its facilities are clean, and the membership fees are low at only JPY 200/year. Many of its outlets are close to railway stations. Finally, many of the outlets are larger, allowing for economies of scale in selling, general, and administrative expenses.

- These benefits have helped Koshidaka gain market share from 5% to 10% in less than a decade before COVID-19 despite flattish growth for the overall industry. Koshidaka’s book value compounded fast, with a 20% return on equity. Koshidaka had also engaged in bolt-on acquisitions at reasonable multiples. The plans were to open 30 stores annually, representing store growth of about 5-6%. Before COVID-19, Koshidaka’s top-line growth used to be +13%.

- Another kicker is that smaller competitor Shidax had exited the karaoke industry in 2018, leaving room for Koshidaka to fill the void. In addition, on 1 September 2019, Koshidaka banned cigarette smoking across all its outlets as it believed cleanliness would benefit its brand and attract more customers to its outlets.

- Karaoke is a steady, almost recession-proof business. But Japan’s karaoke industry was hit hard by Japan’s COVID-19 lockdowns. However, I speculated that the restrictions would one day ease, perhaps after the governments planned vaccination drive.

- Other than karaoke bars, Koshidaka also runs “onsen” bath houses representing roughly 5% of total pre-COVID revenues. Koshidaka’s bath house business is a no-growth business but cash flow generative.

- Koshidaka also had a small property management business, owning the three buildings Sport Nagoya, AQERU Maebashi Commerce & Business Complex and Fleuret Hanasaki building in Yokohama.

- Founder Hiroshi Koshidaka built the company from scratch and continued to manage it as CEO. At the time, he owned 14% of the business and had a great reputation within Japan as a super-star CEO.

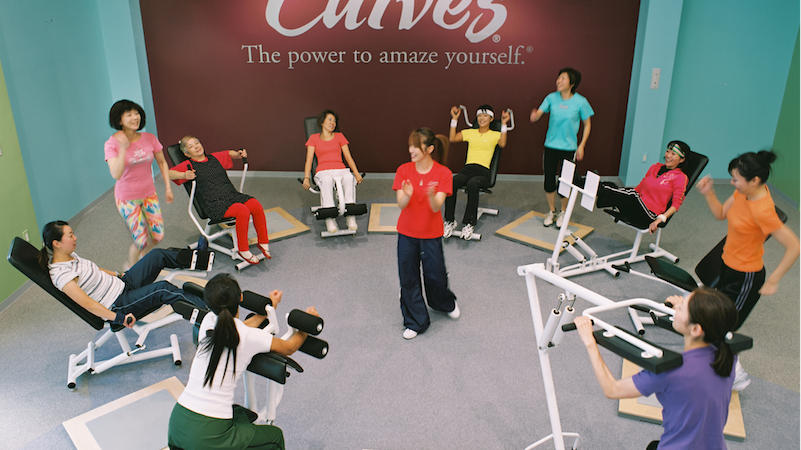

- In 2020, Koshidaka spun off its gym operation Curves (7085 JP - US$447 million) into a separately listed company. Curves was, in fact, Japan’s first-ever spin-off and a sign that Koshidaka cares about its minority shareholders. I wrote about Curves in the following post:

- Right after the spin-off, given that 90% of the tax basis was attributed to Koshidaka, I speculated that many investors would sell their Koshidaka shares rather than Curves. And indeed, Koshidaka’s share price dropped to low levels.

- I foresaw a 2024e P/E of 6.8x, lower than the industry average of about 15x.

- Koshidaka’s balance sheet is clean, with a modest net debt position, though convertibles and warrants will likely lead to a net cash position soon.

2. Update since my first write-up

Koshidaka’s stock price has rallied nicely over the past three years, roughly doubling in price, though coming off by roughly 40% since the peak in 2023:

The rest of this post is for premium subscribers only. To access it, click the button below to join a community of 435 subscribers and get over 20 deep dives yearly. See you on the other side!