Table of Contents

Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is not a recommendation to buy or sell stocks.

Summary

- Investor sentiment in Hong Kong is worse than it’s been for over a decade. There’s a perception that the city is changing - or perhaps even dying.

- I think that view is probably misplaced. Hong Kong of tomorrow will certainly look more like a typical Chinese city than it used to be. But it retains several advantages, including low tax rates, a currency with an open capital account, and infrastructure more efficient than any other major city.

- While the Chinese economy is suffering from the pains of an implosion in construction activity, Hong Kong’s economy is actually fine. Tourists have returned, and retail sales are on a path to recovery. Hong Kong is now enjoying positive net migration. High interest rates weigh on the economy, but those rates could drop from mid-2024 if you believe in the latest Fed Dot Plot.

- I reviewed the list of Hong Kong-listed companies with market caps above US$50 million and identified ten stocks that trade at low valuation multiples.

If you’ve followed market prices, you will have noticed that Hong Kong’s Hang Seng index is now back to its October 2022 lows:

What investors are asking themselves right now is whether there might be any diamonds in the rough in Hong Kong. Whether there are any stocks with solid fundamentals that just happen to have been sold down in this ongoing bear market.

In this post, I’ll discuss the case for Hong Kong's equities: why the market has crashed, what investors are concerned about, what could potentially cause them to change their views, and the risks I’m seeing ahead of us. Towards the end, I’ll also discuss ten stocks that trade at low valuation multiples despite solid fundamentals.

Table of contents

1. The opportunity set

2. Timeline of the current bear market

3. Hong Kong remains the centre of Asia

4. Hong Kong’s economy is recovering

5. Potential risks for Hong Kong

6. Hong Kong domestic small caps remain cheap

7. Ten highlighted stocks

8. Conclusion1. The opportunity set

China has the deepest, most liquid capital markets in the Asia-Pacific. You can broadly divide the market into so-called “A- or B-shares” listed on mainland Chinese exchanges such as Shanghai and Shenzhen, American Depositary Receipts (ADRs) of Chinese companies listed in the United States and Chinese companies listed in Hong Kong. For a broad overview of these markets, check out the introduction to Asia-Pacific markets I wrote back in 2022.

Foreigners have the following options when it comes to Chinese equities:

- You can buy mainland-listed A-shares through the HK Connect program. These shares can be purchased through platforms such as Interactive Brokers, but are limited to the stocks listed here.

- You can also buy so-called B-shares, traded on the Shanghai or Shenzhen stock exchanges but denominated in foreign currencies. Only a few B-shares are listed. Those tend to be sleepy companies with little analyst coverage.

- You can buy American Depositary Receipts (ADR), the corporate structure used by most Chinese companies listed in the United States. I wrote about that market here.

- Finally, you can buy equities in Hong Kong. The majority of the companies listed here are from mainland China, and those are referred to as Red Chips or H-shares. It’s a massively large market, with an aggregate market cap of almost US$7 trillion.

Mainland-listed Chinese equities (A-shares) have typically traded at a premium to their Hong Kong counterparts (H-shares). But this so-called “A-share premium” has reached its highest level ever at 57%. In other words, Chinese-listed equities in Hong Kong are far cheaper than on the mainland.

This disparity between mainland-listed shares and Hong Kong-listed shares has remained for decades. I don’t think it will change. The most likely culprit is excess liquidity within mainland China, which has a closed capital account. Due to the scarcity of assets, Chinese capital has no option but to invest in overpriced equities. Investors in Hong Kong stocks have more options available to them. It’s also possible that if the Renminbi were measured at market exchange rates, A-shares would actually be valued similarly to their Hong Kong counterparts. I wrote about this theme here in 2021.

Foreigners can also buy Chinese equities listed in the United States. Most of the listings are of depositary receipts representing underlying shares in the Cayman Islands or elsewhere. The problem with these stocks is twofold.

- One is that a US SEC agency called the PCAOB has required full access to Chinese audit papers or else, Chinese ADRs might face delistings. If a company is large enough, it can relist in Hong Kong and change its primary listing to there. But investors also face the risk of take-private transactions below intrinsic value. I wrote about that theme here.

- Variable-interest entities have never been fully tested in Chinese courts. They operate in a legal grey zone and don’t provide as much protection as owning actual shares.

For these reasons, I think you could well argue that Hong Kong equities offer the best opportunities for savvy stock pickers. They’re cheaper than A-shares and usually represent direct ownership of underlying companies.

So, in this post, I’ll discuss the current opportunity set in Hong Kong as I see it.

2. Timeline of the current bear market

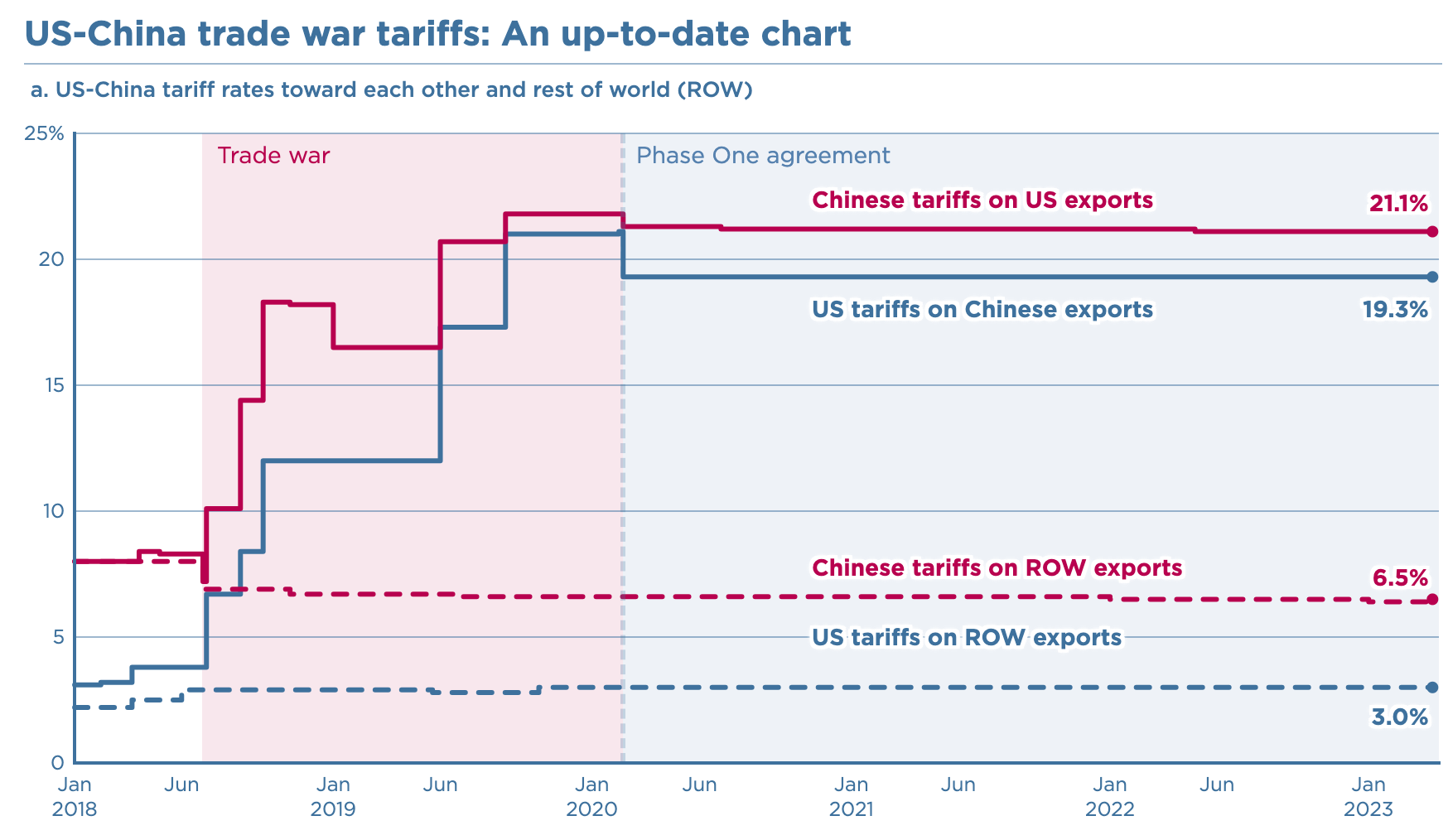

The current bear market for Hong Kong stocks began in 2018. The Hang Seng index peaked on 26 January 2018 around the 33,000 level. Around that time, the Trump administration in the United States reacted against perceived unfair trading practices of the People’s Republic of China, including property theft and forced technology transfers.

For those reasons, the Trump administration raised tariffs on US$50 billion worth of Chinese goods in June 2018. This marked the start of a series of escalations which ended in October 2018 with weighted average trade tariffs on both sides of about 20%:

In the initial stage, Chinese manufacturing companies were hardest hit. Meanwhile, tech companies such as Alibaba and Tencent continued to be favored by overseas investors.

In mid-2019, anti-government protests broke out in Hong Kong. Citizens protested against a proposed National Security Law that would take away the independence of Hong Kong’s judiciary. From this point onwards through COVID-19, tourism in Hong Kong ground to a halt.

The next stage in the current bear market for Hong Kong stocks was Trump’s Executive Order 13959, which I wrote about here. This executive order prohibited US investors from investing in listed Chinese military-linked companies. Stock prices of state-owned enterprises, such as China’s telecom operators, fell precipitously.

COVID-19 led to a shift in investor sentiment. Old-world companies were discarded, while tech companies benefitted from a trend towards people working from home. A speculative frenzy erupted in Chinese tech companies such as Meituan and Tencent.

This speculative frenzy happened just as General Secretary Xi Jinping began a crackdown on China’s largest tech platforms. I wrote about that theme here. While initially seen as a response to Alibaba’s Jack Ma criticizing the government in a famous speech, it soon became clear that the crackdown was not limited to Alibaba. No major tech platform was safe. In the subsequent years, around a dozen major tech CEOs resigned, willingly or not. Companies like Tencent and Alibaba contributed CNY 50 billion each to help further the government’s cause of “common prosperity”. Bytedance and others donated so-called “golden shares” to government entities, and those entities gained board representation. Chinese tech stocks began a three-year bear market.

In July 2021, the Chinese government banned for-profit tuition companies, which were officially aimed at reducing academic pressure on students. The stock prices of companies such as New Oriental and TAL Education dropped like stones.

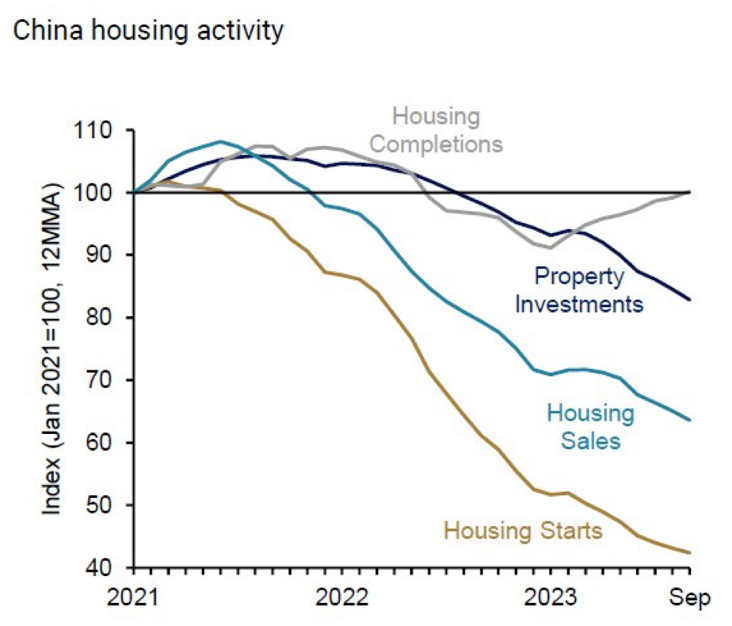

Around the same time, the government implemented a new policy in the property market called the “Three Red Lines”, which forced China’s overleveraged private property developers to deleverage. They were essentially cut off from all funding sources, and their offshore bond prices now signal bankruptcy across the board. The destruction of wealth was massive: private developers Evergrande and Country Garden alone had debts of over US$500 billion. I wrote about that theme here.

Since then, China’s construction problem has essentially been dealt with. At the peak, residential new starts reached almost 25 million apartments per year, compared to aggregate contract sales of no more than 11 million. This meant a gradual build-up of inventory that the government found difficult to deal with. Now that China’s private property developers have been cut off from credit, construction has been curbed. Residential new starts are down 60%. And contract sales have also dropped as new homebuyers are hesitant to put in deposits on buildings that may or may not be completed.

After Xi Jinping gained a third term at the Party Congress in October 2022, it seems Chinese citizens have lost faith in the economy. There is anecdotal evidence of a shortage of money in local governments, which previously relied on land sales for revenues. Many young people have resorted to simpler lifestyles, a trend known as lying flat. This despondency was beautifully captured in analyst Dan Wang’s 2023 letter, available here.

I’ve lived through a few cycles in the Chinese economy. In 2013, investor sentiment in the A-share was similarly weak. What saved the market then was retail speculation and an acceleration in credit growth from late 2014 onwards.

The problem today is that property construction used to represent 29% of GDP, according to Professor Kenneth Rogoff. That’s no longer the case. The implosion in residential new starts has naturally hurt employment and consumer confidence. The state could theoretically make up for this shortfall in spending, but credit growth remains weak, with the November 2023 print in the single digits.

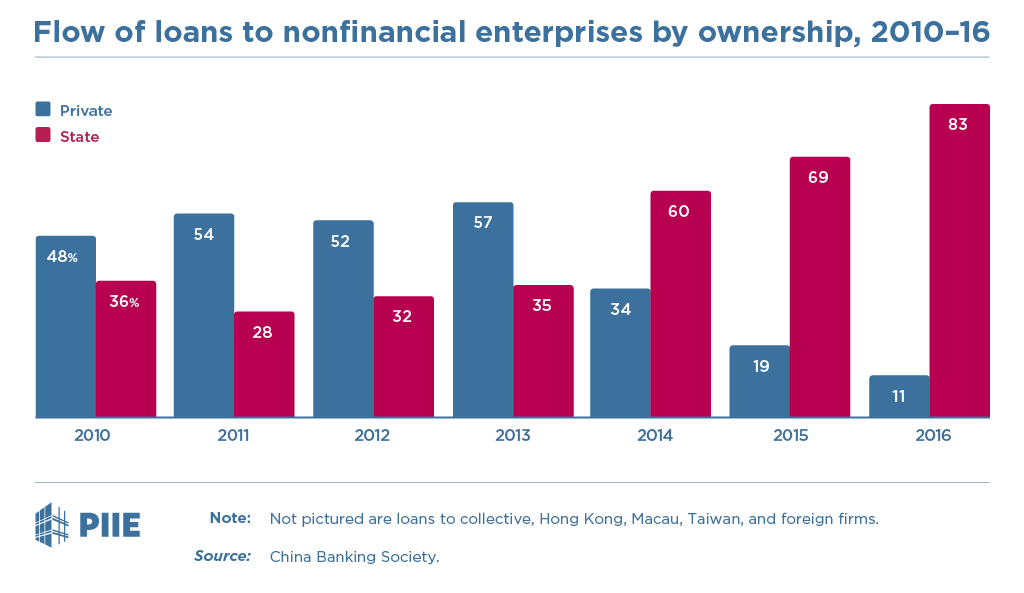

Part of the problem is that the link between credit and spending might have been broken. Before Xi Jinping became General Secretary of the Communist Party, most lending was to private borrowers, according to Nicholas Lardy.

While the data series was discontinued in 2016, there’s every reason to think that most lending is now to China’s state-owned enterprises. In other words, there’s a lack of credit in the private sector.

I’m not sure what’s going to change the calculus. But the tools are at Xi’s disposal. And I remember how gloomy the outlook was during the Great Financial Crisis in 2008 and the Eurozone crisis in 2012. The solution will only seem obvious with the benefit of hindsight.

3. Hong Kong remains the centre of Asia

The National Security Law in June 2020 was indeed a watershed moment for Hong Kong’s judiciary. Now that individuals seen to be endangering national security can be extradited to mainland China, there’s a fear that they will no longer receive fair trials.

But let’s look at the positive side of things. In reality, the National Security Law has really just had two major effects. One is emigration, and the other is stopping public demonstrations.

Since 2020, roughly 400,000 people have left Hong Kong, according to this data from the Hong Kong Immigration Department. But, if you calculate the cumulative number, net migration has actually started to decrease:

In other words, people are now moving back to Hong Kong. These could be individuals who avoided Hong Kong during COVID-19 and are now willing to return. They could also be people who changed their minds about living overseas, knowing that Hong Kong is a great place to make money. In the early 1990s emigration wave, many of those who left for Vancouver or elsewhere ultimately came back to Hong Kong.

While it’s certainly negative that hundreds of thousands of people have left Hong Kong, it’s not implausible that mainland Chinese immigration could make up for the shortfall. In fact, Hong Kong’s residential rents rose 8.1% in 2023 due to immigration from the mainland.

For now, the Hong Kong legal system remains reliable. The conviction rate for Magistrate’s courts in Hong Kong was 54% last year, far higher than mainland China’s 99.95%. This seems to suggest that Hong Kong judges are still independent. Hong Kong still ranks #23 in WJP’s Rule of Law Index, ahead of the United States.

Between Hong Kong and Singapore, the former remains a far larger financial hub. The aggregate market cap of Hong Kong-listed companies is 10x that of Singapore. Its assets under management are US$2.2 trillion - far higher than Singapore’s US$1.5 trillion. There are 2,000 licensed asset managers in Hong Kong vs just 1,200 in Singapore.

A key competitive advantage for Hong Kong is that its currency is freely convertible and pegged to the US Dollar. This enables the Chinese government and its companies to raise overseas capital while maintaining capital controls within mainland China.

It’s also the case that Hong Kong’s taxes are uniquely low:

- The highest marginal income tax is 17%.

- There is no capital gains tax.

- There is no withholding tax on dividends or interest income.

- There is no GST.

- There is no estate duty.

- There is no wealth tax.

- There is a 15% tax rate on rental income but with a standard deduction of 20%.

- Most import duties to Hong Kong are zero, making imported goods cheap.

- The stamp duty for purchasing residential property is 15% for foreigners and 7.5% for locals, but this stamp duty could soon be removed.

For these reasons, the PwC and the World Bank recently ranked Hong Kong as the region with the most friendly tax system in the world.

The Hong Kong government remains committed to its low-tax policy. Hong Kong has agreed to implement a minimum corporate tax rate of 15% from 2025, but so has many other major economies. The budget deficit is projected to continue at over HK$100 billion in FY2025, but 3% of GDP remains modest.

While I don’t want to minimize the political shift that has taken place, for Hong Kong companies, it will be mostly business as usual. Hong Kong will continue to attract the ultra-wealthy through its low taxes, and it will continue to be used to raise capital for companies in China and beyond.

4. Hong Kong’s economy is recovering

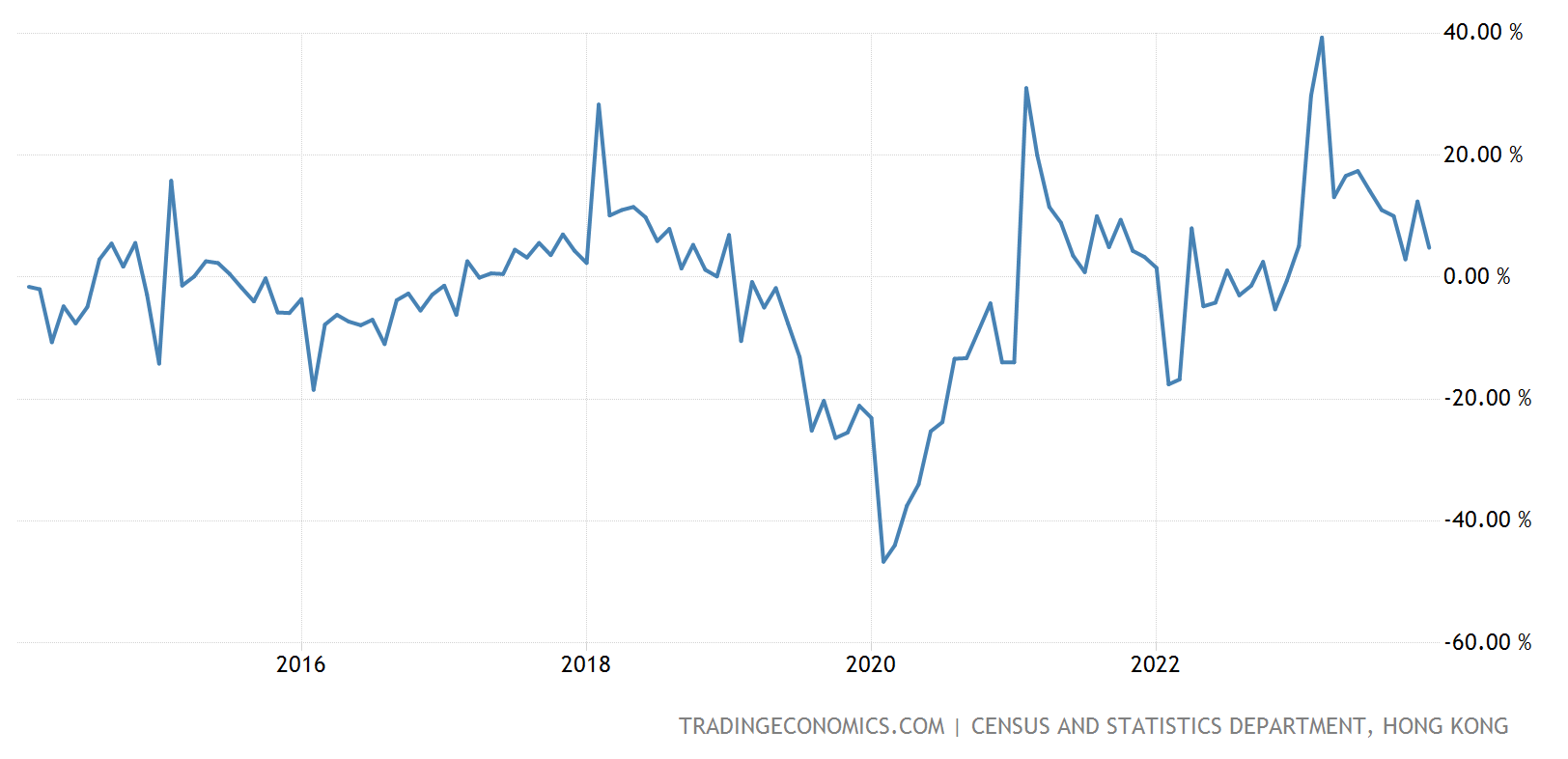

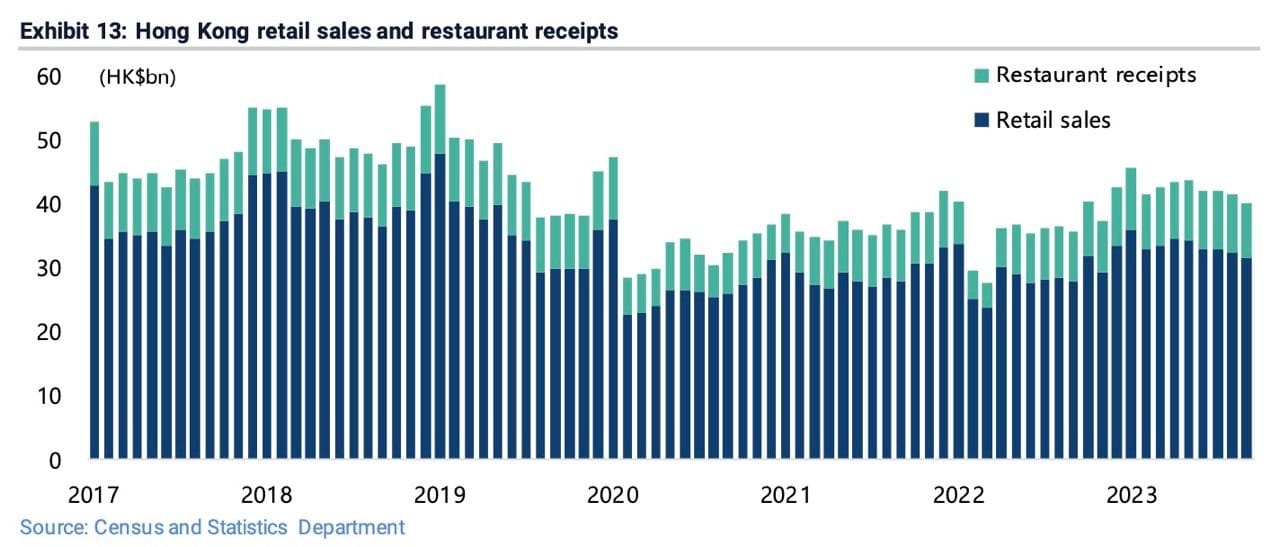

After Hong Kong’s zero-COVID policy was lifted at the end of 2022, the economy has actually been on a solid footing. Hong Kong’s retail sales grew +16% year-on-year in 2023, though remaining almost 20% below the peak in early 2019:

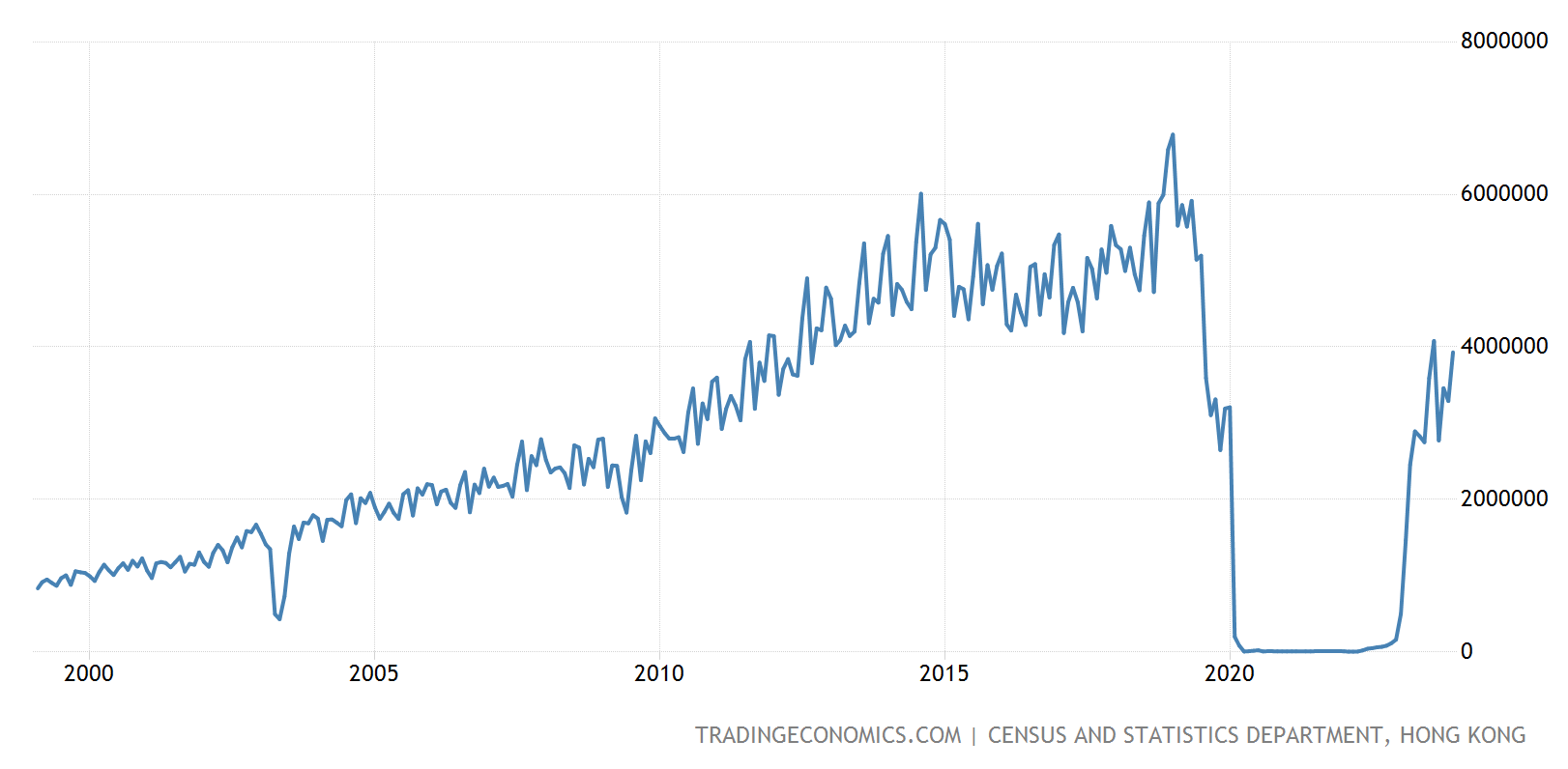

A major component in Hong Kong retail sales comes from tourism to Hong Kong, which is now back to around 70% of the pre-COVID level:

But don’t expect a full recovery in tourism spending. Before 2019, a large portion of Hong Kong retail sales to tourists comprised goods smuggled into mainland China. In 2021, China’s border controls tightened up significantly, and most of such business now occurs through legitimate channels. I wrote about such smuggling here.

One business that is booming is Hong Kong life insurance products sold to mainland Chinese visitors. Related premiums already exceed the pre-COVID-19 level, suggesting strong demand for USD-linked policies.

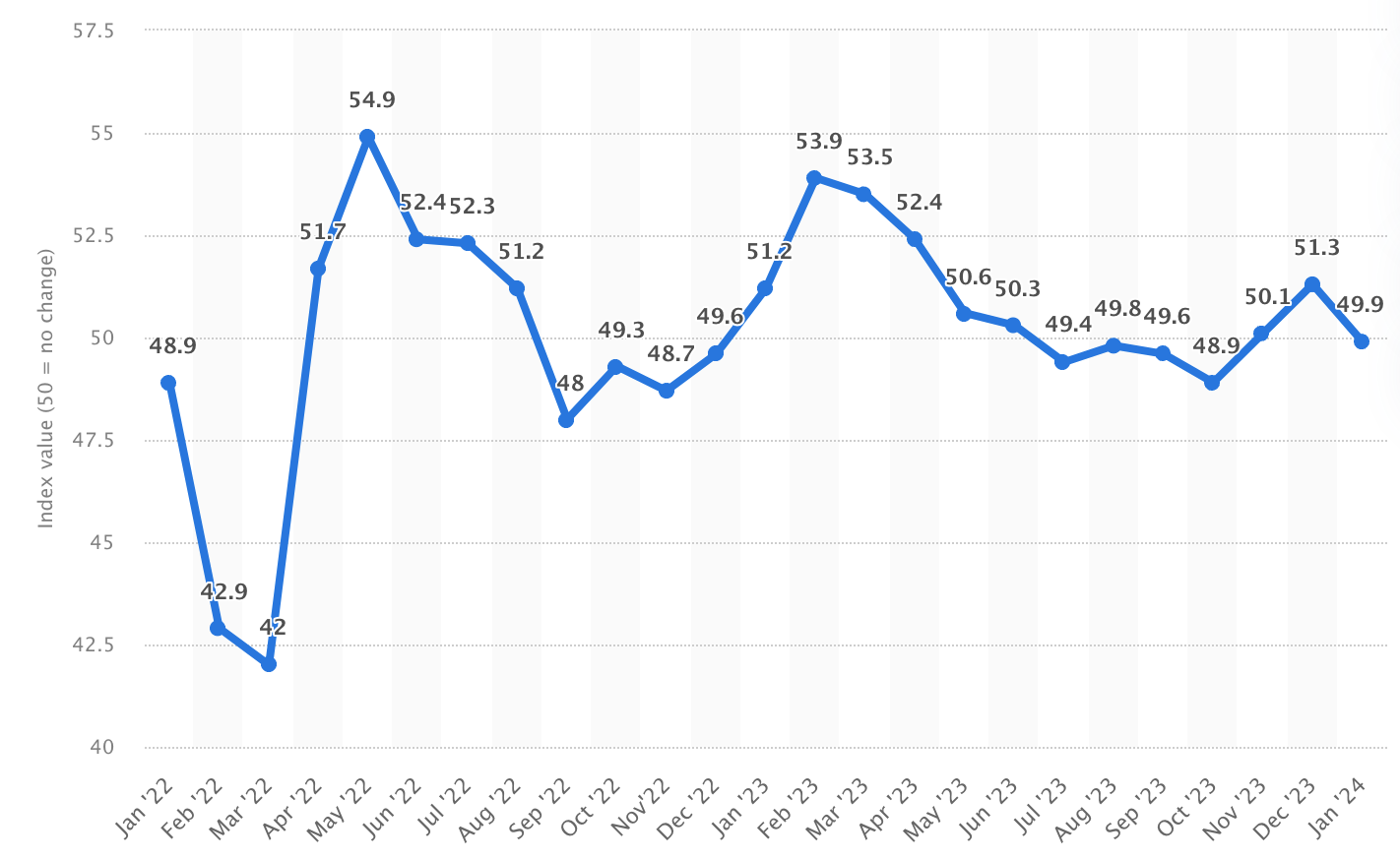

The Hong Kong private sector PMI has been around the 50 mark over the past few months and 51 in December, suggesting an expansion in private sector economic activity.

Hong Kong’s real GDP grew +4.3% in the fourth quarter of 2023. Hong Kong’s export growth has now turned positive at +11% year-on-year. The unemployment rate remains just 2.9%, suggesting that jobs are plentiful. Commentary from the Hong Kong government:

“The Hong Kong economy continued to revive in the fourth quarter of 2023, with inbound tourism and private consumption remaining the key drivers. According to the advance estimates, real GDP grew by 4.3% in the fourth quarter of 2023 over a year earlier…”

“Looking ahead, the difficult external environment will continue to pose pressures on Hong Kong’s exports of goods in 2024. The situation may stabilise later in the year if advanced economies cut interest rates as expected. Meanwhile, visitor arrivals should increase further as handling capacity continues to recover, with additional boost from the Government’s efforts to promote mega events.”

This wording suggests a positive outlook for the future, especially if US interest rates drop as expected and visitor arrivals continue to increase.

5. Potential risks for Hong Kong

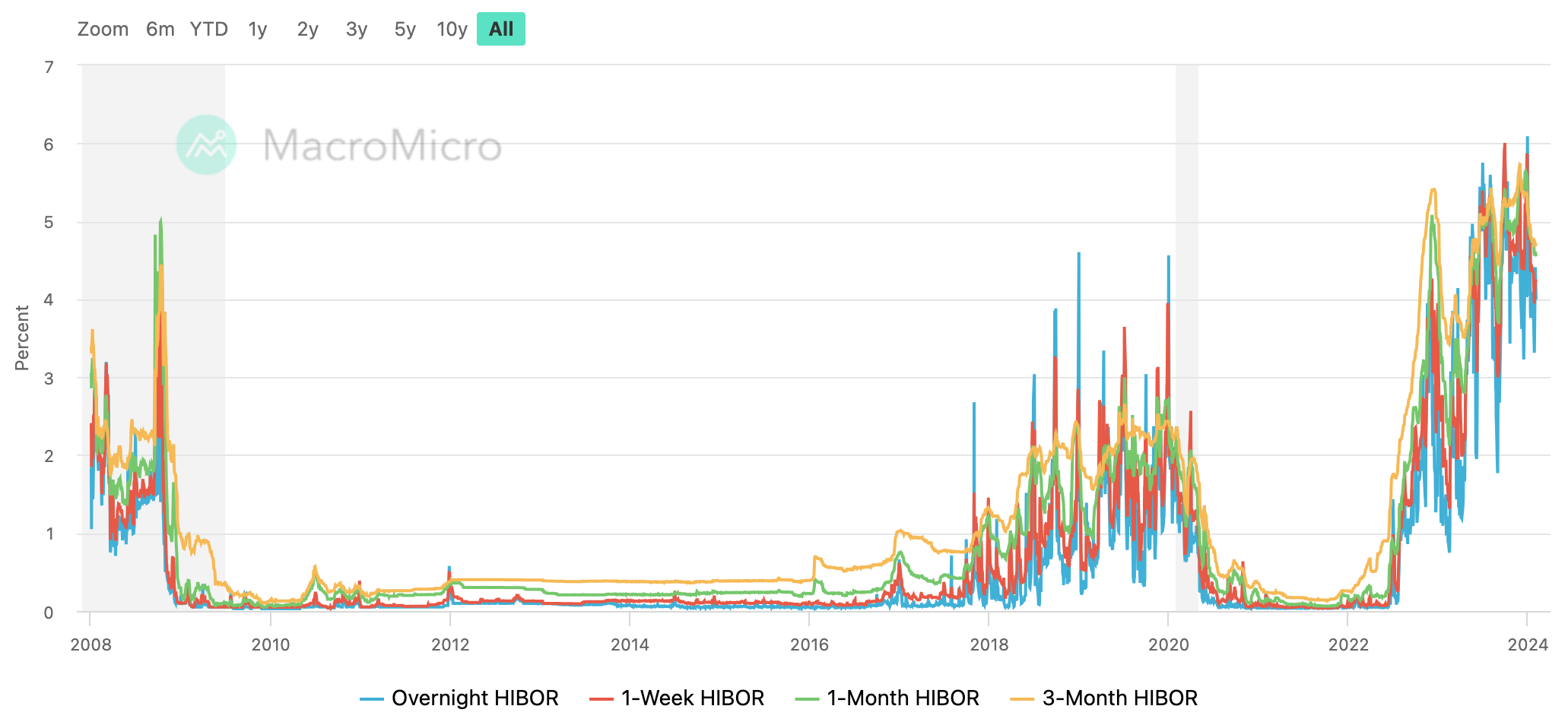

What’s weighing on the Hong Kong economy is the interest rate environment. Since the Hong Kong currency is pegged to the US Dollar through a currency board arrangement, it effectively imports its monetary policy and interest rates from the United States. Here is a chart of the interbank rates currently prevailing in Hong Kong, also known as HIBOR:

Now that HIBOR has reached over 4% borrow rates for households and companies remain above the nominal income growth in the economy. In my view, that means that monetary policy remains restrictive.

We’ll see what happens to interest rates, but I personally believe that US interest rates will be coming down. Starwood Capital’s Barry Sternlicht recently pointed out that CPI is a lagging measure because it calculates rents with a 14-month lag. US inflation rates are coming down fast, and the Federal Reserve will likely react once CPI goes below 2.0% later this year. The Fed Dot plot is already pricing in rate cuts, and such rate cuts will directly lead to lower mortgage rates.

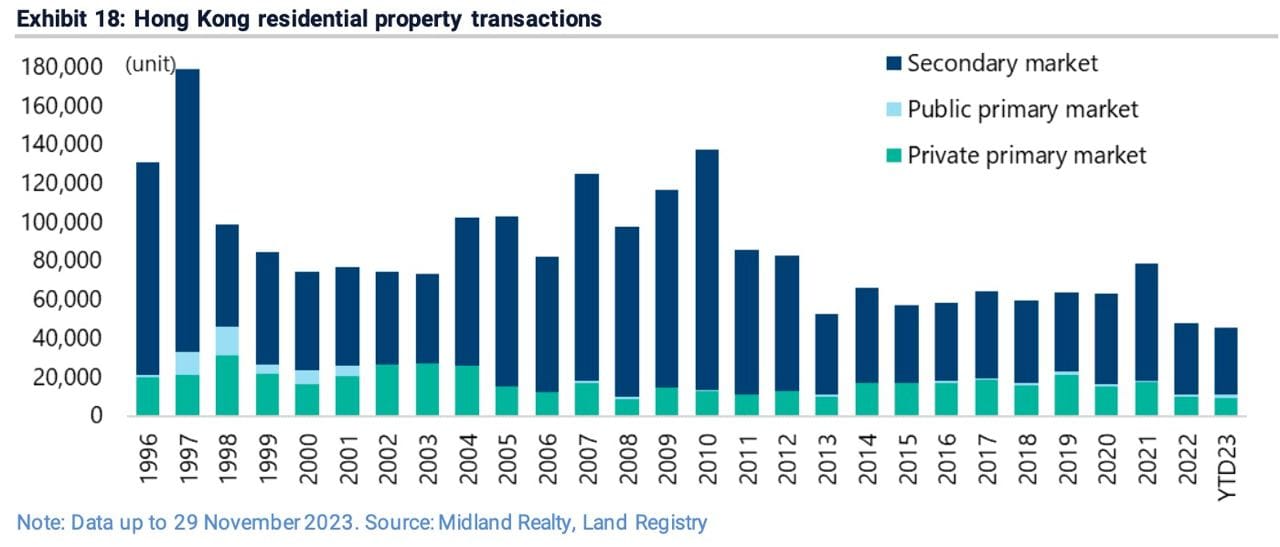

On that note, Hong Kong Chief Executive John Lee cut the stamp duty for purchasing residential property by half in October last year. This stamp duty was first introduced in 2010 and has been a primary reason why Hong Kong’s residential property transactions have been weak since that point in time:

However, given how dependent the Hong Kong government is on land sales, it’s possible that the stamp duty will be reduced to zero when the new budget is announced later this month. This would be a perfect time to do so, given the recent build-up in unsold residential in already-completed projects.

Lower interest rates and lower stamp duties should support the Hong Kong housing market. Which, admittedly, is still expensive at the current 3.5% cap rate.

Another challenge for Hong Kong has been the strong Hong Kong Dollar. China’s Renminbi has declined roughly 10% decline against the Hong Kong Dollar, causing as many as 200-300,000 Hong Kong people to cross the border each weekend, spending their money on Shenzhen restaurants and nightlife instead of in Hong Kong.

But if US interest rates drop in the future, it’s not implausible that the Hong Kong Dollar will yet again weaken against the Renminbi. I certainly would not assume that the current situation will persist forever.

Regarding the judiciary, a major risk is an update to Hong Kong’s National Security Law. The updated law could expand the government’s ability to prosecute residents for vaguely worded offenses like “colluding with foreign forces”, “publishing misleading statements” and close down civil society organizations. Chief Executive John Lee promises that people can still criticize the Hong Kong government and express their opinions as long as they do not endanger national security.

Reading between the lines, it sounds like you’ll still be able to say what you wish as long as you don’t challenge party supremacy.

Another longer-term worry is geopolitics. If a war were to break out in Taiwan or elsewhere, US sanctions could be imposed on Hong Kong. It could lose its special trade status. Import tariffs would be imposed, and it would be subject to the same export controls as China. If the Hong Kong Dollar were to be de-pegged to another currency. But as long as the currency remains freely convertible, Hong Kong will continue to retain its competitive advantage as a hub for raising overseas capital.

6. Hong Kong domestic small caps remain cheap

When I look at Hong Kong equities, I like to divide them into:

- Companies with exposure to mainland China

- Companies with exposure to other countries

- Domestic Hong Kong companies earnings their revenues in Hong Kong Dollar

Above, I’ve tried to argue that China’s economy remains weak. The construction industry has imploded, and I’m unsure whether residential new starts will ever recover. Consumer confidence is weak.

But the Hong Kong economy is doing just fine. And if you believe that the Federal Reserve will cut interest rates - as I do - Hong Kong will be one of the prime beneficiaries in Asia. Domestic Hong Kong companies should do well in that scenario.

If you want to go the ETF route, there are several indices to choose from. But MSCI China has a large exposure to mainland Chinese companies. Hang Seng China Enterprises Index is similarly focused on mainland Chinese companies. Comparatively speaking, the Hang Seng Index is the one index that has slightly more exposure towards domestic Hong Kong equities.

Today, the Hang Seng trades at a P/E of 8.4x - close to its October 2022 lows and at a similar level as in the Great Financial Crisis of 2008. This number is extreme.

The top 10 holdings of the Hang Seng include HSBC, Alibaba, Tencent, AIA and a few other companies. And the P/E multiples for these companies are low as well:

If you want to track this index, two of the options are the iShares Core Hang Seng Index ETF (3115 HK) or The Tracker Fund of Hong Kong (2800 HK).

If you want to dig deeper though, you can find companies with almost no exposure to the mainland Chinese economy. Not only will you gain exposure to an economy that’s performing better, I also believe that Hong Kong offers greater safeguards for investors when it comes to corporate governance. I trust the numbers more.

In the past few days, I’ve gone through the list of the 1,500 or so Hong Kong-listed equities with market caps above US$50 million. I then tried to identify those those that little to no exposure to mainland China and put them in a separate tab called “HK-Overseas stocks” in the following spreadsheet.

7. Ten highlighted stocks

I’ll now focus on the ten stocks within this list of Hong Kong-listed companies with large exposure to the Hong Kong economy. All of these stocks are well-run businesses trading at remarkably low valuation multiples.

7. 1. AIA Group

AIA Group (1299 HK - US$91 billion) is a Hong Kong-based insurance company with presence all over Asia.

It was founded by American entrepreneur Cornelius Vander Starr in 1919 and was based in Hong Kong after China became communist in 1949. After AIG ownership, it was spun off as a separate entity in 2010.

While AIA has a mainland presence, what makes AIA unique is that it offers USD-linked policies to visitors to Hong Kong. They are, therefore, benefitting from Chinese capital flight.

From 2019, it’s been allowed to operate in mainland China without a local partner, enabling it to grow much faster on the mainland than in the past. China’s life and non-life insurance market penetration rates remain low at just 4% vs South Korea’s 11%. The fact that AIA controls its distribution network provides it with an edge.

Finally, AIA should benefit from the currently high interest rate environment given that its assets are mostly plain vanilla developed market corporate and government bonds.

AIA’s forward P/E ratio right now is a modest 13.3x. The near-term picture looks positive as Chinese tourists return to Hong Kong. The only worries, perhaps, are more intense competition in mainland China from the likes of separately listed Prudential (2378 HK - US$29 billion). There are also ongoing concerns about a tightening of Chinese capital flows to Hong Kong.

7.2. Bank of China Hong Kong

Bank of China Hong Kong (2388 HK - US$25 billion) is the international arm of the Chinese state bank “Bank of China”.

It’s separate from its parent in that it focuses on overseas markets. It’s now the second-largest commercial bank in Hong Kong and is fully backed by its parent bank, the Bank of China. It’s one of the three note-issuing banks in Hong Kong and enjoys a unique competitive advantage in being the PBOC-appointed clearing bank for Renminbi transactions in Hong Kong. It’s also the preferred lender of Chinese state-owned enterprises in Hong Kong.

What’s more, it doesn’t face the same kind of pressure as mainland Chinese banks in falling Chinese interest rates. And it probably doesn’t face the same pressure in doing “national service” either - a common concern among investors in Chinese financials.

It also benefitted from the rise in Hong Kong's interest rates. Its Hong Kong exposure will probably work to its advantage as the economy is now recovering from COVID-19. So far, the bank’s asset quality has been better than those of its peers.

The P/E ratio is currently 6.3x, and with a payout ratio of about 40%, you’re looking at a dividend yield of 6-7%.

7.3. CK Hutchison

CK Hutchison (1 HK - US$20 billion) is one of Hong Kong’s largest conglomerates, owned by the city’s richest man Li Ka-Shing and run by his son Victor Li.

I first wrote about the company in 2022 here and a 2023 update here. The company has five main businesses: infrastructure assets like electric utilities, ports, telecom operators, retail, as well as oil & gas exploration and production. Its China exposure is only 8%, Hong Kong 5%, and the rest is mostly in Europe and the rest of Asia.

The stock has dropped significantly since its peak in 2018. Initially, during the COVID-19 pandemic, the issues were weak foot traffic in the company’s retail stores and low energy prices. But those problems have now been mostly resolved, while CK Hutchison was instead hit by high US interest rates and a strong US Dollar. The company mostly borrows in US Dollar-linked currencies and has a large exposure to Eurozone assets. CK Hutchison has been and remains a levered entity.

The stock is now trading at low multiples: 0.29x book and 5.9x forward P/E, with a forward dividend yield of 5-7%, even if interest rates remain at this level. I personally think that US interest rates will start to drop by the second quarter of this year, in which case fundamentals would then start to improve.

7.4. Swire Pacific

Swire Pacific (87 HK - US$10 billion) is the main operating company of the Swire Group, a trading company turned property conglomerate. I wrote about the company in late 2022 here.

Swire Pacific is the parent of Swire Properties, which owns the commercial properties Pacific Place in Admiralty and Taikoo Place in Quarry Bay. It also owns a number of high-quality retail properties in tier 1 cities in mainland China. In my view, these assets are top-notch, second to perhaps only Hong Kong Land or Wharf.

Other than properties, Swire Pacific also owns a stake in Hong Kong’s leading airline Cathay Pacific, aircraft maintenance business HAECO, and a Coca-Cola bottling business in Greater China.

The past few years have been tough for Swire Pacific as office rents have come down and vacancy rates hit a multi-decade high in 2023. Retail rents are down as well. Meanwhile, Cathay Pacific was hurt by Hong Kong’s closed borders but has recovered nicely since early 2023.

Back in 2022, I valued the B-share at HK$27/share. While the share price has increased slightly, it still trades well below HK$10/share. The dividend yield is now 6.5%. With the B-share, you’re investing alongside the family, given that it owns a disproportionate amount of B-shares. And Swire Pacific has also been buying back B-shares over the past year and a half.

The only question marks have been the high-interest rate environment and the weak office market, with high vacancy rates. I was also surprised by the related party transaction whereby Swire Pacific sold its US Coca-Cola business to parent John Swire & Sons. It was sold at a decent price, but it would have been better if the assets had been sold in a competitive bidding process.

7.5. L’Occitane

L’Occitane (973 HK - US$5.3 billion) is a Hong Kong-listed cosmetics firm with roots in France and sales across the United States, Europe And Asia. I first wrote about the company in 2023 here.

The flagship brand L’Occitane en Provence has a great following among the older female demographic. In the past decade, it’s also acquired several other brands, including Elemis and Sol de Janeiro, which has become a smash hit in its home market of the United States, where it’s become one of Sephora’s most popular brands. Sol de Janeiro’s “Bum Bum Cream” and “Brazilian Crush Fragrance Mist” are selling like hotcakes, pushing the brand’s revenue to grow over 200% year-on-year.

On my numbers, the stock trades at a 2025e P/E ratio of 13x. That’s well below the peer group’s 22x level and where the stock used to trade.

In August 2023, parent company L’Occitane International, controlled by Austrian businessman Reinold Geiger, entered negotiations to acquire the shares it did not own. But it eventually gave up on those ambitions, allegedly due to Geiger not wanting to pay more than HK$26 per share. But the latest rumor is that Blackstone is considering a bid on L’Occitane. How much they’re willing to pay remains to be seen. But a P/E of 13x does not seem like a particularly high number. A shareholder called Butler Hall Capital argues that the right price is closer to HK$45/share.

7.6. Cafe de Coral

Cafe de Coral (341 HK - US$605 million) is Hong Kong’s largest fast-food operator after McDonald’s, serving a mix of Hong Kong and Western fare at affordable prices.

What initially attracted me to Cafe de Coral is its strong brand name. I think the Cafe de Coral's brand recognition among Hong Kong people is better than perhaps any restaurant in the city. I also think it’s managed professionally with decent treatment of minority shareholders.

The problem with Cafe de Coral is Hong Kong’s zero-COVID policy and closed borders. But those were removed in late 2022, and tourism has now recovered roughly 70% of its pre-COVID highs. Meanwhile, the stock has languished, continuing to a ten-year low of around HK$8.0/share.

While margins are still low, I believe they will eventually return to the 8% operating margin level. That implies a P/E ratio of about 8x, much lower than the historical level of 20x. With an 80% typical payout ratio, Cafe de Coral would pay a dividend yield of around 10%.

7.7. Tai Cheung

Tai Cheung (88 HK - US$268 million) is a Hong Kong-based property developer and manager.

It owns 35% of the Sheraton Hotel in Tsim Sha Tsui, which overlooks Victoria Harbour. As well as several residential developments on Hong Kong Island. The Sheraton building was recently renovated, and the residential plots are in fantastic locations on The Peak and close to Repulse Bay. Further, Executive Chairman David Pun Chan has historically treated minority shareholders well, even though the company is decidedly sleepy in the turnover of its investments.

The problem for Tai Cheung has been weak tourism to Hong Kong, causing revenue per room at Sheraton to drop. Then, high interest rates in Hong Kong caused the demand for property to weaken, causing residential property prices to drop over 20%. But those two issues might eventually be resolved.

The stock trades at almost 80% discount to a conservative estimate of its net asset value. The Price/Book is about 0.3x, lower than its longer-term historical level of 0.3-0.5x. The dividend yield is currently 7.3%, but there’s a good chance the dividend per share will go up now that tourists are returning to Hong Kong.

That said, I will admit that the prices for Tai Cheung’s luxury developments are high by international standards. But Tai Cheung has no debt, so the downside risks seem limited. And Hong Kong remains a compelling destination for the ultra-rich, given its low tax rates.

7.8. Plover Bay Technologies

Plover Bay Technologies (1523 HK - US$283 million) is a Hong Kong-based developer of SD-WAN routers, selling them under the “Peplink” brand name.

These routers are used to create private and secure computer networks. The benefit of using SD-WAN routers rather than leased lines is that the former uses software to direct traffic through the most efficient routes. It can use DSL, 5G, Starlink and many other connecting technologies.

From what I can tell, Plover Bay seems to be competing successfully. The SD-WAN industry is growing fast, above 20% per year, and Peplink seems to be matching industry growth rates with a historical revenue CAGR of 23%. It’s comforting to know that Gartner sees Peplink as one of the stronger brands in the SD-WAN industry, characterizing it as having “strong viability”. It’s also worth noting that a large share of Plover Bay’s revenue now comes from recurring warranty & support services revenues.

The stock trades around 10x P/E with a dividend yield of 8.5%. The balance sheet is also clean, with a decent net cash position. These numbers are almost unheard of for a well-run company in an exciting, fast-growing industry benefitting from the popularization of 5G services and Starlink.

I will say that I don’t feel comfortable investing in technology companies, as I find it difficult to judge whether a company has competitive advantages. But I do think most investors will agree that a company of Plover Bay’s calibre typically trades at far higher multiples than 10x.

If you’re interested in Plover Bay, check out Pyramids and Pagodas’ recent interview with the company’s CEO Alex Chan here.

7.9. Pentamaster International

Pentamaster International (1665 HK - US$255 million) is the Chinese subsidiary of Malaysia’s Pentamaster Corporation. Aaron Pek at Value Investing Substack wrote about the company here, and there’s also a VIC write-up on the stock available here. While the main business is focused on China, Pentamaster International’s customers seem more international, which is why I included it in this list.

Pentamaster provides automated testing solutions for the semiconductor, telecom, automotive and electronics industries. Some of its products include warehouse automation systems, factory automation solutions, inspection and testing equipment for the medical device industry, automated testing equipment for semiconductor wafers and contract manufacturing of complex machinery. Its growth has been impressive, though with significant cyclicality. Revenues have gone up sevenfold over the past ten years.

The Hong Kong share Pentamaster International now trades at a P/E of 7.9x, a huge discount to its Malaysian parent Pentamaster Corporation’s 31.2x. The multiple is also low compared to most of its OSAT or semicap peers.

7.10. IH Retail

IH Retail (1373 HK - US$138 million) is a Hong Kong-based discount retailer. I first wrote about the company in mid-2023, with the report available here.

It has 380 shops operating under the "Japan Home Centre” brand name, mostly in Hong Kong. The products are mostly home-related, sourced from mainland China and sold at cutthroat prices. Roughly 40% of the products are private label goods, and that helps them maintain low prices. In my experience, the products are often shockingly cheap. Same-store sales growth has historically been around 5% per year.

In mid-2023, I predicted that profits would drop somewhat now that Hong Kong is healing from the COVID-19 pandemic. The reason was my view that COVID had been a period of excess consumption of home-related goods. Japan Home Centre had also sold face masks in its stores, and this profit stream would disappear.

The profit decline was even worse than expected and the share price corrected almost 50% from mid-2023.

If my long-term forecast is correct, IH Retail trades at a 2025e P/E of 5.8x. Given a typical payout ratio of 80%, a forward dividend yield will probably end at around 14%. The real question is when EPS will bottom out after the company’s post-COVID malaise. For what it’s worth, major shareholder David Webb just tweeted a picture implying his continued support for the company.

8. Conclusion

In my view, the public perception of Hong Kong as a dying city is probably misplaced. The fact that Hong Kong equities have reached multi-decade lows should open up opportunities for savvy stock pickers.

I’ve argued that Hong Kong’s economy is actually on a solid footing. Companies focused on the local Hong Kong market should do fine in the current environment, especially if US interest rates drop from mid-2024 onwards.

After reviewing the list of Hong Kong-listed companies with market caps above US$50 million, I narrowed it down to ten companies that trade at low multiples. These are, in the order of the highest market cap to the lowest, AIA, Bank of China Hong Kong, CK Hutchison, Swire Pacific, L’Occitane, Cafe de Coral, Tai Cheung, Plover Bay Technologies, Pentamaster International and IH Retail. Those stocks are the ones I’m paying the most attention to right now.