Table of Contents

Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may from time to time have positions in the securities covered in the articles on this website. This is disclosure and not a recommendation to buy or sell.

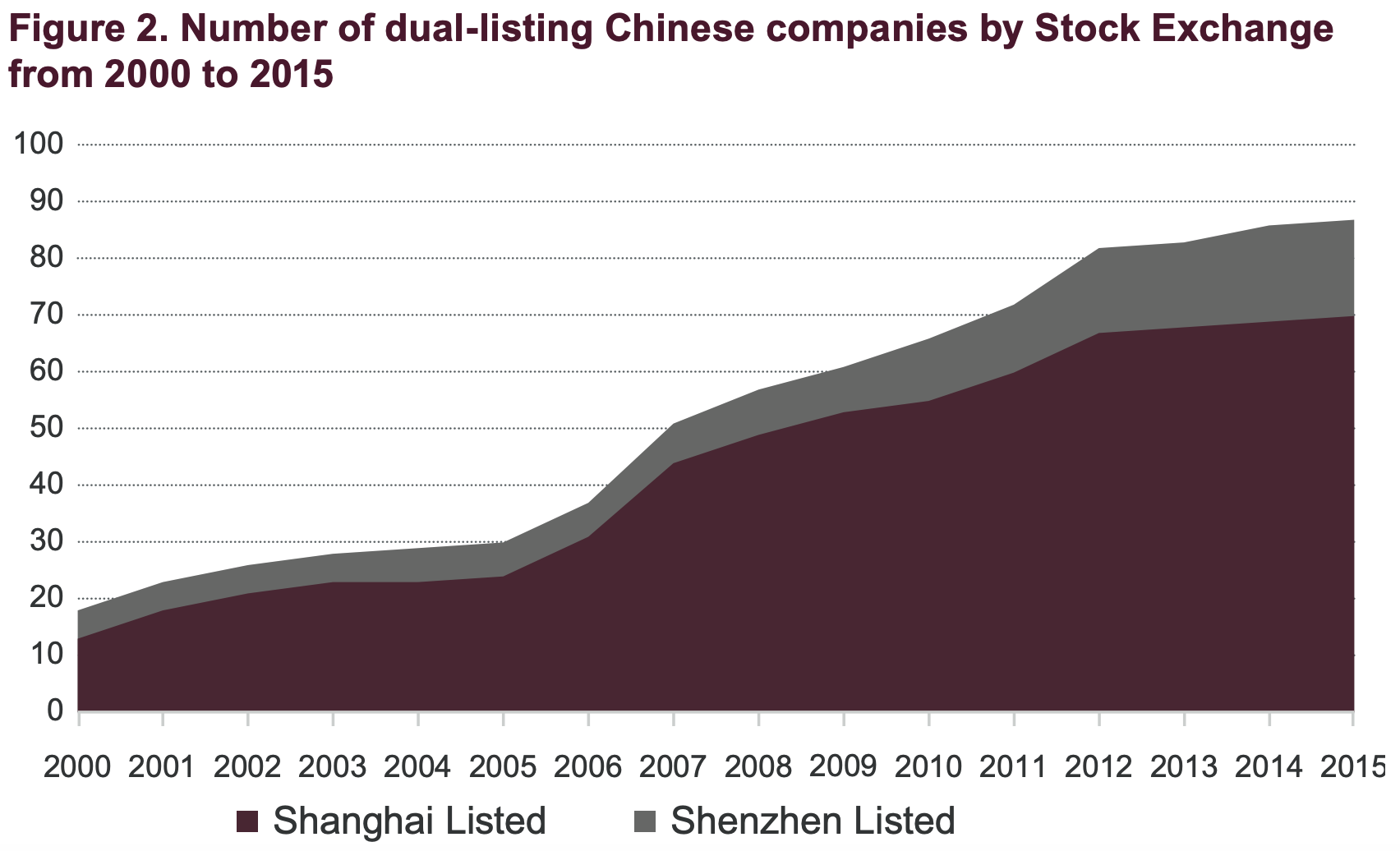

There are 130 or so shares that are simultaneously listed in Hong Kong and mainland China (Shanghai or Shenzhen).

The vast majority of those dual-listed stocks trade at a discount. The Hang Seng Stock Connect China AH Premium Index (89 constituents) traded close to par between 2010 and 2014. Since 2015, the H-share discount in that index has widened to over 20%.

In my own sample of dual-listed stocks, the median discount for all dual-listed stocks is currently 46%. You can find the full list of dual-listed stocks here.

So with such a large discount, should you buy the H-shares of dual-listed companies and hope for them to revalue upwards?

The characteristics of dual-listed shares

Chinese stocks listed on the Shanghai or Shenzhen stock exchanges are known as “A-shares”.

In the 1990s, then-Vice Premier Zhu Rongji gave Chinese state-owned enterprises (SOEs) the go-ahead to list in Hong Kong. These listings were part of broader SOE reforms. Other than raising capital, the purpose of these Hong Kong listings was to upgrade the corporate governance standards and management practices to international levels. These Hong Kong-listed shares became known as “H-shares” or “red chips”.

The majority of dual-listed H-shares have their secondary listings in Shanghai rather than Shenzhen. Shanghai Stock Exchange tends to skew towards SOEs and old-economy companies, whereas Shenzhen Stock Exchange has a greater focus on technology stocks.

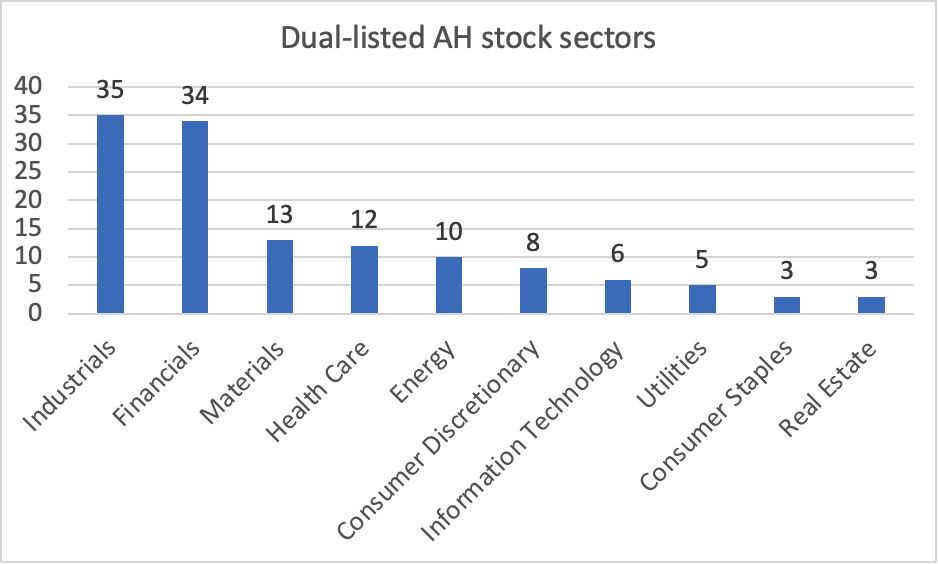

The most common sector among these dual-listed equities is industrials, followed by financials, materials, healthcare and energy.

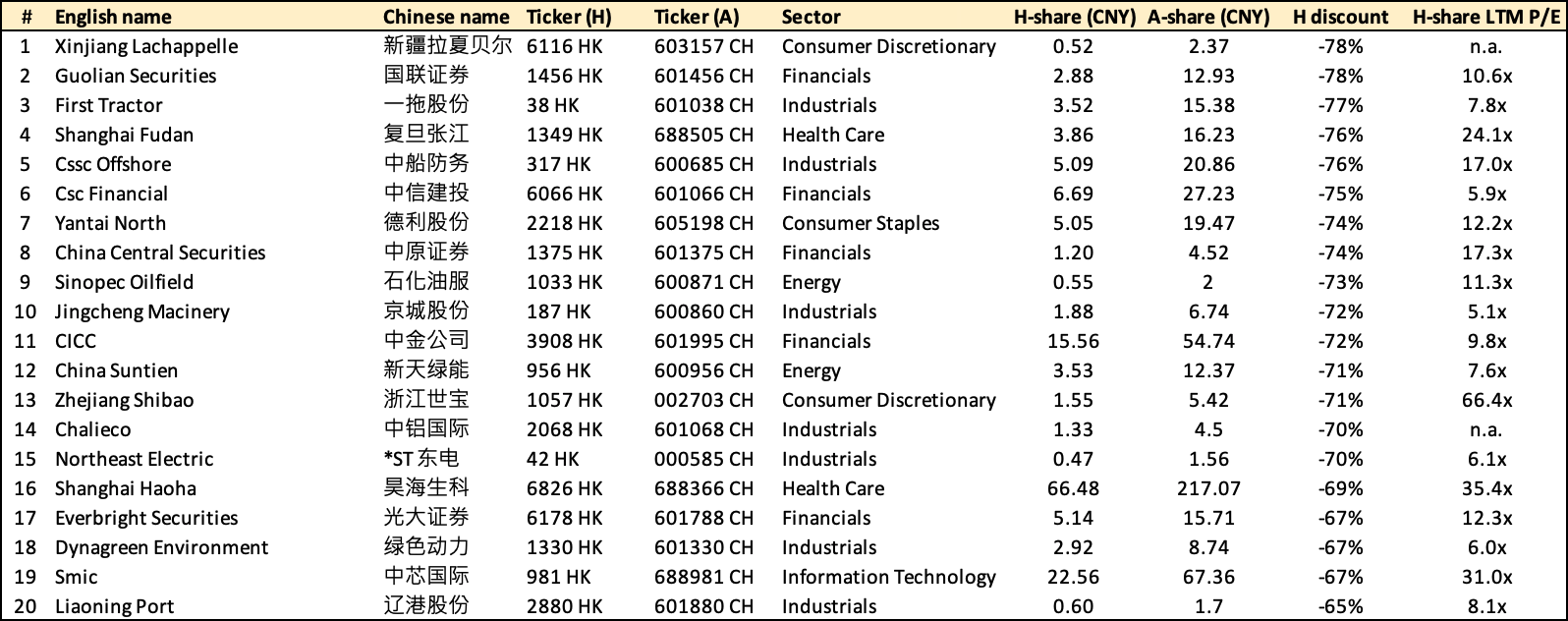

The 20 stocks with the largest H-share discounts include securities companies such as CICC, CSC Financial and Everbright Securities, and industrial stocks such as First Tractor and Dynagreen Environment.

Again, you can find my full list of A/H dual-listed equities here.

The discount is because of China’s capital controls

Here are a few theories why H-shares trade at such a large discount:

- Arbitrage conditions don’t exist: There is no way to arbitrage away the disparity between H- and A-shares prices. China has capital account restrictions, making it difficult to move money across the border. Even if an institution has a presence in both markets, it cannot engage in pure arbitrage as short-selling of individual stocks is illegal on the mainland.

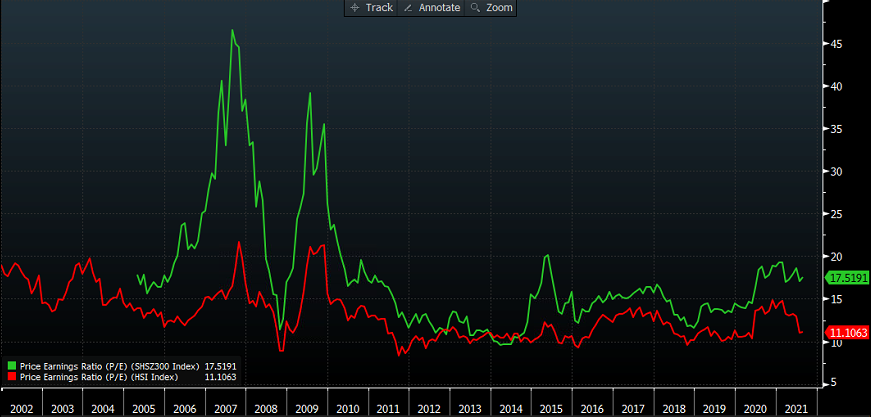

- A-shares could be overvalued: The change in the H-share discount is usually related to the degree of overvaluation of the A-share market. The discount tends to go up whenever the A-share market is rallying. That was the case during the 2015 A-share bubble. So perhaps the discount doesn’t necessarily mean that H-shares are undervalued but rather that A-shares are overvalued. Today, the mainland CSI 300 Index’s P/E ratio is 17.6x vs 11.1x for Hong Kong’s Hang Seng Index. In fact, the Hang Seng Index does not seem materially cheaper than it has been historically.

- A-shares traded by retail investors: Trading onshore in the A-share market has historically been dominated by retail investors. They tend to be less sophisticated and less focused on value. However, that is not the case anymore. Most A-shares are now held by institutional investors:

- Sector preference: Since most dual-listed shares are SOEs, it’s plausible that foreign investor preference for private companies could explain the A/H price differential. As Paul Sandhu, head of multiasset quant solutions for Asia-Pacific at BNP Paribas Asset Management, said:

“It would be nice if the two markets valued these stocks similarly, but given the drastically different investor profile, this anomaly is not surprising,”

- Expected devaluation of the RMB: A more philosophical reason could be that the H-share discount implies an expected devaluation of the Renminbi if capital controls were to ease. The H-shares trade in Hong Kong Dollar and the A-shares in Renminbi.

- Lack of access to Stock Connect programs: Since 2014, mainland investors have purchased H-shares through the HK-Shanghai Connect and later HK-Shenzhen Connect. Almost all dual-listed H-shares are eligible for purchase. That could help narrow the H-share discount. However, mainland investors need to have at least CNY 500,000 in their accounts before buying H-shares through the Stock Connect programs. There are also daily southbound trading quotas.

Potential catalysts

Unfortunately, there are very few reasons that suggest the discount will ever narrow.

It seems highly unlikely that the Chinese government will open up its capital account. Doing so would tie its hands, as outflows would draw down the country’s FX reserves, making it more difficult to boost GDP growth via new stimulus measures.

What is more likely to happen is a gradual shift to a more sophisticated market structure, whereby value- and dividend-focused institutional investors dominate instead of investors focused on momentum. Therefore, there is a chance that it will help push up the prices for some of the dual-listed stocks currently listed on both markets.

So to summarise, there is a chance that the H-share discount will narrow over time. But it could well happen through a weaker A-share market rather than an upwards revaluation of stocks in Hong Kong.

Instead of anchoring on the A/H discount, I would instead advise focusing on value. If the stock is worth buying in its own right, a large discount would be a cherry on the top.

A few ideas from the sample of dual-listed stocks

Here are the dual-listed shares that I think stand out the most, in terms of having:

- A defensible business model

- Growth tailwinds

- A low valuation multiple

1. China International Capital Corporation (CICC)

CICC (3908 HK) is the largest “international” investment bank in China. It was founded in 1995 as a joint venture between Morgan Stanley and China Construction Bank.

Today, it remains the investment bank in Chinese with perhaps the strongest brand name, helping it attract high net worth individuals to its private banking franchise. The company has particular strengths on the institutional side and in cross-border services.

But it also has great access to IPO flows. CICC was chosen as one of the lead underwriters for Alibaba’s Hong Kong IPO. CICC will benefit from Chinese tech companies’ shift from NASDAQ and NYSE to HKEX, both via capital raisings and ongoing trading volumes.

The P/E multiple of 9.8x seems modest to me in an international context. And it trades at a 72% discount to its equivalent in the A-share market. The stock price has come up during the pandemic thanks to higher trading volumes and market caps, but for good reasons.

2. CGN Power

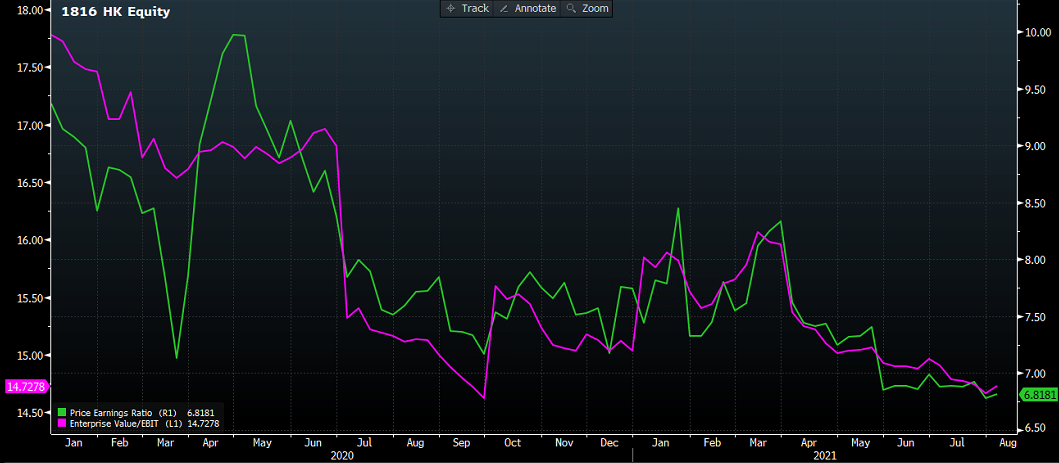

Nuclear power plant operator CGN Power (1816 HK) was listed in 2014 to much fanfare but has since then heavily underperformed as new plant construction has been delayed. It’s one of China’s two major nuclear power producers, with 27GW of currently operating nuclear power plants. The roll-out of new power plants has been slower than expected as technology transitioned from Gen II to Gen III. The threat to CGN is that power sales rates are being driven down by market reform. Nuclear is also not cost-competitive against coal-fired power plants, though more environmentally friendly. The company also has a certain amount of debt.

COVID-19 hit power demand in early 2020, but the market has already seen a full recovery. More recently, CGN Power has been in the news for having problems with its Taishan reactor and blocked by UK authorities from operating in the country. But neither of these are likely to hurt CGN Power’s long-term earnings potential.

The H-share trades at P/E 6.8x and a dividend yield of 5.8% - very low in an international context. And it also trades at a 45% discount to its equivalent A-share.

3. Qingdao Port

Qingdao Port (6198 HK) is the main seaport serving the city of Qingdao in the Shandong Province of China. It was the 7th busiest seaport in the world in 2019. The cargo mix comprises liquid bulk (oil), containers and, to a lesser extent, coal and metal ores. It’s a deepwater port, so it is able to accommodate very large vessels.

Qingdao itself is a fast-growing region, with city household registrations growing over 1% per year. Shandong province has become a favourite region for Korean manufacturers thanks to its proximity to Korea. The province’s major exports include apparel, autos, agriculture, mobile phones, etc. The port is also used for the transhipment of goods on their way to Shanghai.

While growth is likely to be slow but steady, I think that at 5.5x earnings, the stock looks very inexpensive, whichever way you look at it. It also offers a 7.8% dividend yield. And it trades at a 42% discount to its equivalent A-share.

4. Guangzhou Baiyunshan Pharma

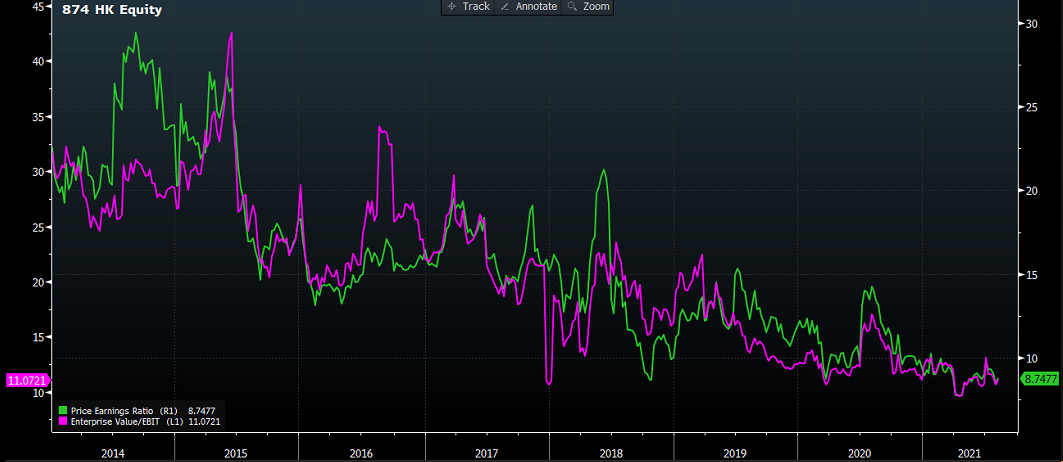

Baiyunshan (874 HK) is a manufacturer of traditional Chinese medicine (TCM) drugs and herbal beverages and a distributor of pharmaceuticals. It also owns the Baiyunshan Hospital in the city of Guangzhou.

The jewel among the company’s assets is the Wanglaoji (王老吉) tea drink. It enjoys incredible brand recognition across China, almost on par with Coca-Cola. However, it is facing competition from copy-cat Jiaduobao. TCM drugs are trusted by some, scorned by others, but many of the brands names are well-known across China. Revenues and profits are likely to remain steady. Pharma distribution is a growth industry, though recently battling with poor receivables collection from government-run hospitals.

Either way, at a P/E multiple of 8.8x and 3.0% dividend yield, I think the stock is a bargain. You could almost justify the stock on the Wanglaoji beverage segment alone. And it trades at a 42% discount to its equivalent in the A-share market.

5. CRRC Corp

CRRC (1766 HK) is China’s monopoly rolling-stock equipment producer, with a close to 90% market share. IT was formed through the merger of CSR and CNR in mid-2015. Completely dominating in railway locomotives, bullet trains, passenger trains and metro vehicles, and a 70% market share in freight wagons. Being an SOE, the company enjoys strong support from the government, both in terms of bank loans and customer orders.

A big driver of CRRC’s growth over the past two decades is the build-out of China’s high-speed rail network. They are now trying to export the trains and have a 2% share internationally. Within China, its major customer Ministry of Railways, is heavily indebted, so the future build-out of high-speed rail lines is in question. That said, a part of CRRC’s revenue comes from replacement demand which will continue regardless of whether the high-speed rail build-out continues at the current pace.

The stock trades at a PE ratio of 6.8x and a dividend yield of 6.3%. The H-share trades at a 53% discount to its equivalent in the A-share market.

Conclusion

Don’t buy an H-share just because the discount to its equivalent A-share is high. Buy it because the stock is attractive in its own right.

But screening for high discounts for dual-listed H-shares can help save time in the search process. Out of my sample of 129 dual-listed stocks, the median discount is 46%, and the median P/E multiple is 7.5x.

I do believe that the list is a very good source of new investment ideas. Some of the stocks that I believe offer good value include CICC, CGN Power, Qingdao Port, Baiyunshan Pharma and CRRC. Chinese SOEs are never exciting, and they do answer to the government. But they are unlikely to be frauds, and the valuation multiples are far lower than they have been historically. They offer attractive dividend yields. And it also doesn’t hurt that they trade at 40%+ discounts to their equivalents in the A-share market.