Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author may hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. I have positions in all of the below stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.

Portfolio update

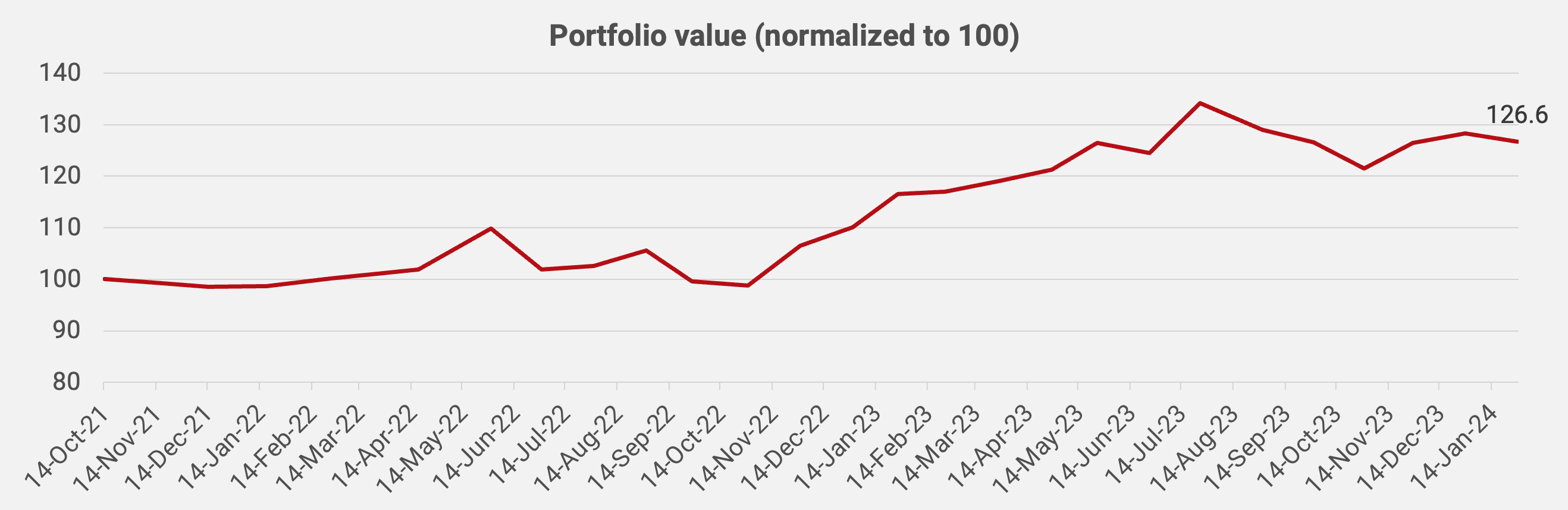

In January 2024, the portfolio dropped -1.3% month-on-month and +26.6% since inception in October 2021, equivalent to an IRR of 10.9%.

We had a bit of a “puke” in Hong Kong equities in January, causing the share prices of Fairwood and Cafe de Coral to drop further. Chinese ADRs such as Niu Technologies also dropped. Hong Kong has become a deep value market.

Election jitters also caused Indonesian beer giant Multi Bintang to weaken.

On the positive side, Chinese oil exploration and production company CNOOC rose during the month after the government said it would incorporate share prices in the performance evaluation of China’s listed state-owned enterprises.

In any case, a few weeks ago I sat down and thought about how a perfect portfolio might look like if I were to redesign it from scratch as of January 2024. Through this exercise, I came up with the following model portfolio: