Table of Contents

A few weeks ago, Olivier at Emerging Value wrote about Pentamaster International (1665 HK - US$246 million) and his write-up caught my attention.

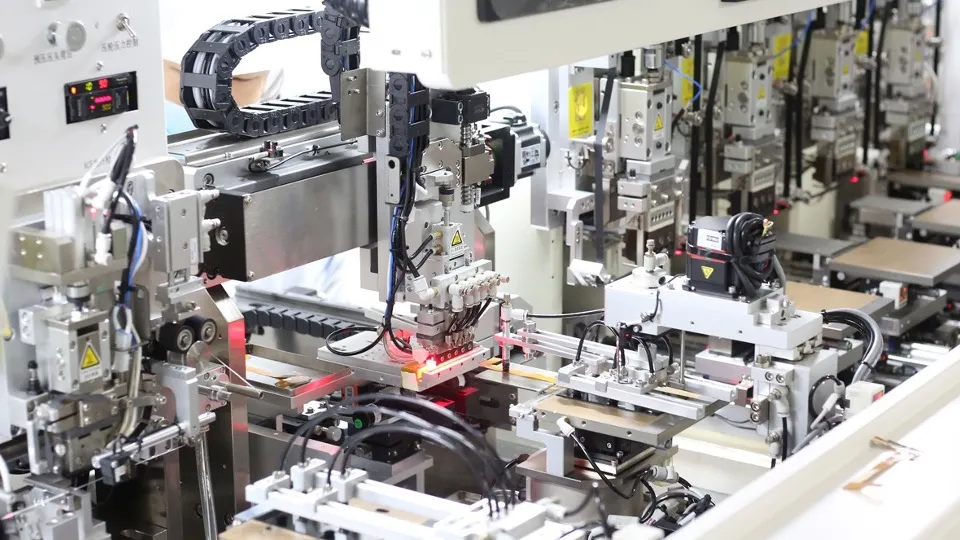

Pentamaster is one of the largest manufacturers of automated test equipment (ATE) for electronic devices. Such devices include non-memory products such as semiconductor chips, electro-optical sensors, power modules and LED lights. In the past, such work would have been done manually, but since the 1980s, machines from Pentamaster and others perform this task automatically at high speed.

The company is also involved in factory automation projects. It builds custom-made equipment to automate manufacturer processes such as material handling conveyor belts, high-speed sortation systems, warehouse storage systems, etc.

Pentamaster was founded by Malaysian engineer Chuah Choon Bin in 1991. He had worked for Intel and National Semiconductor and then decided to jump ship and become a supplier to them instead. The company grew slowly then benefitted significantly from the devaluation of the Malaysian Ringgit after the Asian Financial Crisis in 1997. And since then, it’s slowly moved up the value chain. Malaysia listed parent Pentamaster Corporation has risen roughly 20x since its IPO in 2003.

Now, Hong Kong-listed Pentamaster International is the operating company in the group. It was listed in 2018, supposedly to gain credibility in their attempt to gain Chinese customers. Kuala Lumpur-listed Pentamaster Corporation is better thought of as the family holding company.

Since 2018, Pentamaster International’s revenues have risen at a +11% compound annual growth rate. And growth seems to be accelerating.

The company’s contract liabilities - which reflect deposits on new sales orders - rose +37% in 2023. And Pentamaster is now building a third factory that will quadruple Pentamaster’s total factory floor area and expand its factory automation business. The company sees potential in the automation of medical device manufacturing plants, and in the testing of automotive chip components.

On my conservative estimates, Pentamaster International trades at a 2026e P/E ratio of 6.1x on top of a 3.1% dividend yield. And this is despite Pentamaster having a fortress balance sheet with plenty of cash and an 18% return on equity.

For some odd reason, its parent Pentamaster Corporation (PENT MK - US$638 million) trades at a much higher multiple, at 27.6x near-term earnings. Its market cap its materially higher, even though the two companies’ consolidated revenues and profits are virtually the same.

I don’t fully understand why this disparity has emerged. Some people point to a weak Hong Kong stock market. Others think it’s because Pentamaster International is not covered by many analysts, and that it doesn’t have many peers in the Hong Kong stock market. When asked about the valuation disparity, management says they don’t understand it either.

The risks are mostly related the cyclicality of earnings. For example, between 2005 and 2010, Pentamaster’s revenues dropped for five years straight. While Pentamaster has moved up the value chain since then, a similarly protracted downturn cannot be ruled out. Though, near-term leading indicators, including management’s own guidance, remains positive at this point.

Another risk relates to the currency. I believe that Pentamaster benefitted from the weaker Malaysian Ringgit from 2015 onwards. If the Ringgit were to strengthen compared to, say, the Renminbi, then Malaysia’s low labor costs would be less of an advantage to Pentamaster than they are currently. But that’s a question for the future, because right now Pentamaster seems to be taking market share, if anything.

Click the “Download” button below to access the full PowerPoint presentation: