Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers, including whether any investment suits your specific needs. From time to time, I may have positions in the securities covered in the articles on this website. Full disclosure: I do not hold a position in Haier Smart Home at the time of publishing this article. To reiterate, this post and the presentation below are for informational and educational purposes only - not a recommendation to buy or sell shares.

Summary

- Haier is the world’s largest home appliances company, with particular strength in refrigerators and washing machines. It’s got multiple world-renowned brands, including Haier, GE Appliance, Fisher & Paykel, Candy and more.

- The company was largely built by visionary entrepreneur Zhang Ruimin, who created a corporate culture unique in China and beyond. He spearheaded Haier’s international expansion, acquiring companies such as America’s GE Appliances and Italy’s Candy, giving it local distribution networks for its lower-priced Haier offering.

- In late 2020, Haier Smart Home merged with its separately-listed distribution subsidiary Haier Electronics. Following this complex transaction, Haier was left with three separate share classes: A-shares listed in Shanghai, H-shares listed in Hong Kong and D-shares listed in Frankfurt.

- The D-share ended up trading at a massive 60%+ discount to the H-share, even though their cash flow rights and voting rights were identical.

- In this post, I discuss what’s happened to Haier since my first write-up, and what I think might happen in the future. I then discuss current valuation multiples in light of said earnings forecast and discuss the potential impact of US tariffs on Chinese goods as well as China’s recent trade-in program.

Table of contents:

1. A quick background

2. An update to my original post

3. The 2025 valuation model

4. Conclusion1. A quick background

My PowerPoint deck on Haier Smart Home (690D GR — US$39 billion) was one of the first I made on the Asian Century Stocks:

Back then, Haier had become the first Chinese company to list on Germany’s China Europe International Exchange, also known as “Ceinex”. So it had two separate listings: one A-share listed in Mainland China and one D-share listed in Germany, with the D standing for Deutschland (=Germany).

While the Ceinex IPO was successful, the D-share quickly sold off and started trading at a massive discount to the A-share. And given China’s capital controls, there was no way for arbitrage to take place, and no way for the two share prices to converge.

But let’s start with a quick overview of the company itself. Haier was started in 1984 as Qingdao Refrigerator Co., a collective enterprise owned by the local government. It took over a struggling state-owned refrigerator company and then tasked a young city manager, Zhang Ruimin, to turn it around.

It became a massive success. Zhang Ruimin quickly realized the need to improve the quality of the company’s products. So he orchestrated a joint venture with Germany’s Liebherr to produce refrigerators in China’s Shandong province. Liebherr contributed with cutting-edge technology, and Haier contributed with low-cost and highly productive labor. The joint venture took on the name “Haier”, a Chinese transliteration of the word “Liebherr”, or at least part of the word.

In the following decade, the Qingdao government supported Zhang Ruimin’s company by allowing it to take over other struggling appliances businesses in the region, helping it to expand its product portfolio beyond refrigerators. These products included air conditioners, microwave ovens, washing machines and more.

In 1993, the company’s key operating subsidiary, Qingdao Haier, was listed on the Shanghai Stock Exchange. While this led to a somewhat complex corporate structure, assets were gradually injected from the parent company into the ListCo. Meanwhile, Liebherr soon exited from its JV, with the Chinese side eventually taking over the entire business.

US private equity firm KKR became a 10% shareholder in the early 2010s through a transaction valued at US$550 million. And KKR might have helped it grow internationally through the acquisition of GE Appliances. In the 2010s, Haier acquired the following four companies:

- 2011: Sanyo’s Southeast Asian unit

- 2012: High-end appliances brand Fisher & Paykel

- 2016: GE Appliances for US$5.6 billion (8x EBITDA)

- 2018: Italian appliances firm Candy

And then came the listing of Haier’s D-share. The reason for seeking an international listing might have been political in nature. Or to gain an acquisition currency, should it want to expand further into Europe. But the share price quickly traded down and remained, trading just a few hundred thousand shares per day.

By the time I wrote my post on Haier, it had accumulated five brand names:

- Mass-market brand Haier, associated with refrigerators & washing machines

- Leader, another domestic mass-market brand with stylish, minimalist designs

- The company’s domestic high-end brand, Casarte, which it launched in 2006

- US-based GE Appliances, formerly part of General Electric

- New Zealand’s Fisher & Paykel, a luxury appliances brand

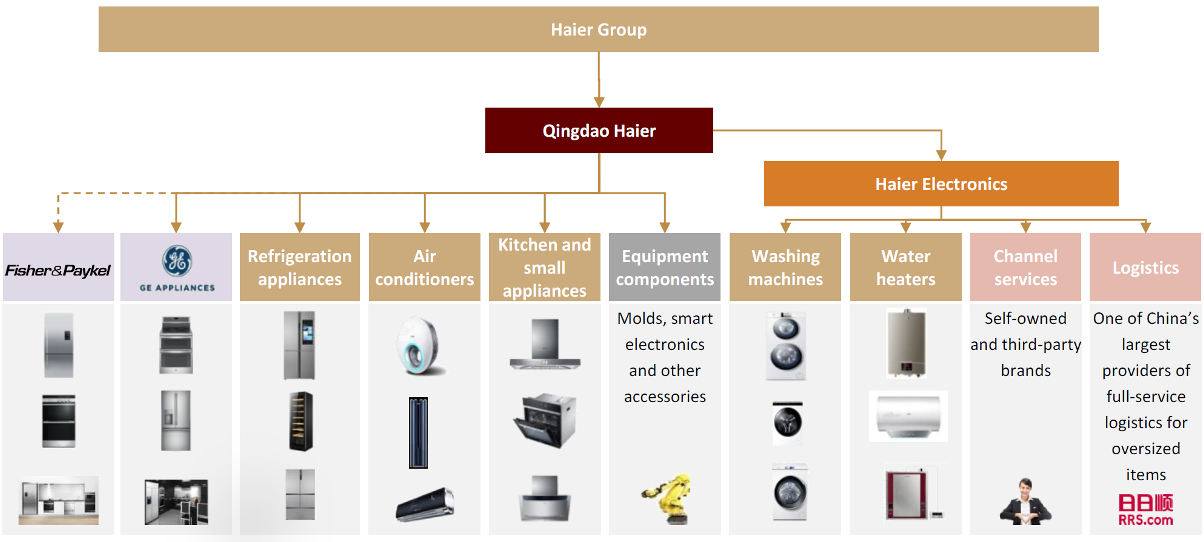

These five brands produced refrigerators, washing machines, air conditioners, water heaters and a variety of kitchen appliances:

Part of the business was run through Hong Kong-listed subsidiary Haier Electronics, whose primary business was acting as a distributor of the broader Haier Group. A messy corporate structure, to say the least.

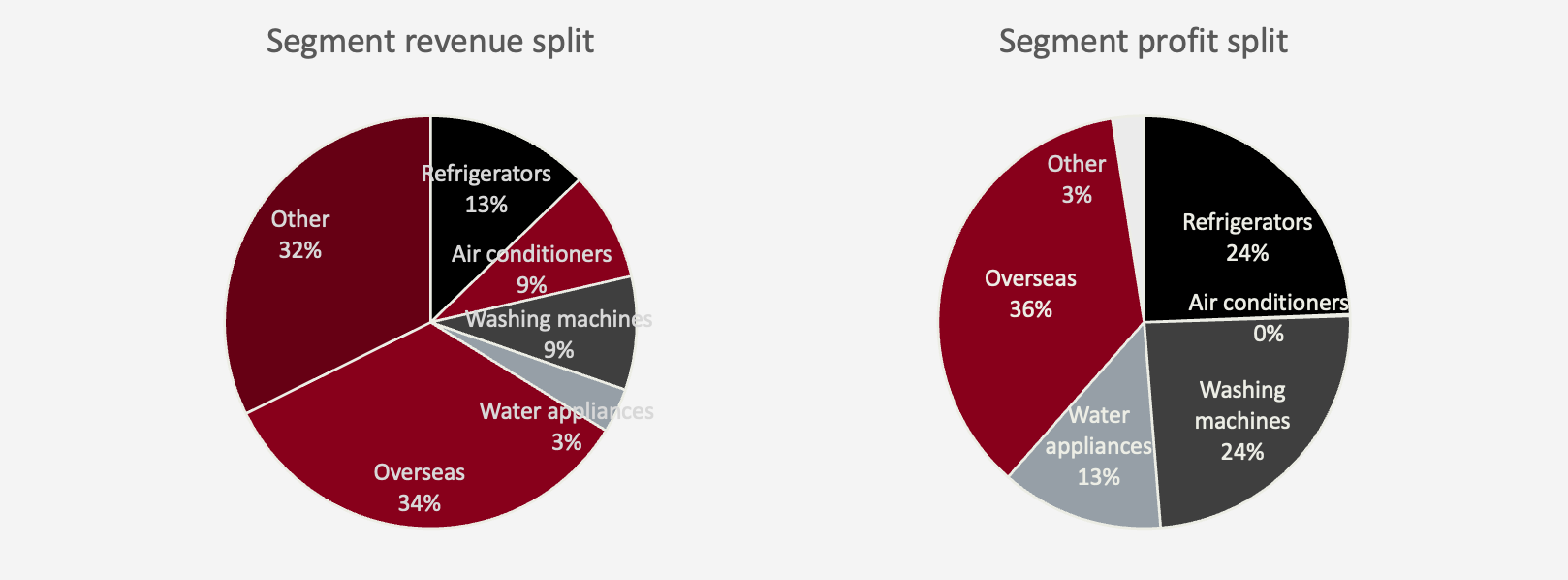

By the 2020s, Haier had already become successful globally. It was ranked #1 in home appliances with a global market share of 16%. And within China, it held a 30% market share.

Its most important products included refrigerators, washing machines, water appliances, and air conditioners. However, when it comes to Haier’s profitability, refrigerators and washing machines made up half of its profits from its Mainland China segment.

Over the past twenty years, China’s home appliances market has been dominated by three companies: Gree, Midea and Haier. Gree’s focus is on air conditioners. Midea is strong in air conditioners, too, as well as kitchen appliances. Meanwhile, Haier is primarily known for its refrigerators and washing machines, two segments where it holds 40-50% domestic market shares.

So what was Haier’s edge? Primarily cost control, with Chinese wages significantly below those of Europe and the United States. The prices for Haier’s appliances were typically 30% lower than those of most of its foreign competitors. And today, Haier’s scale remains hard to beat.

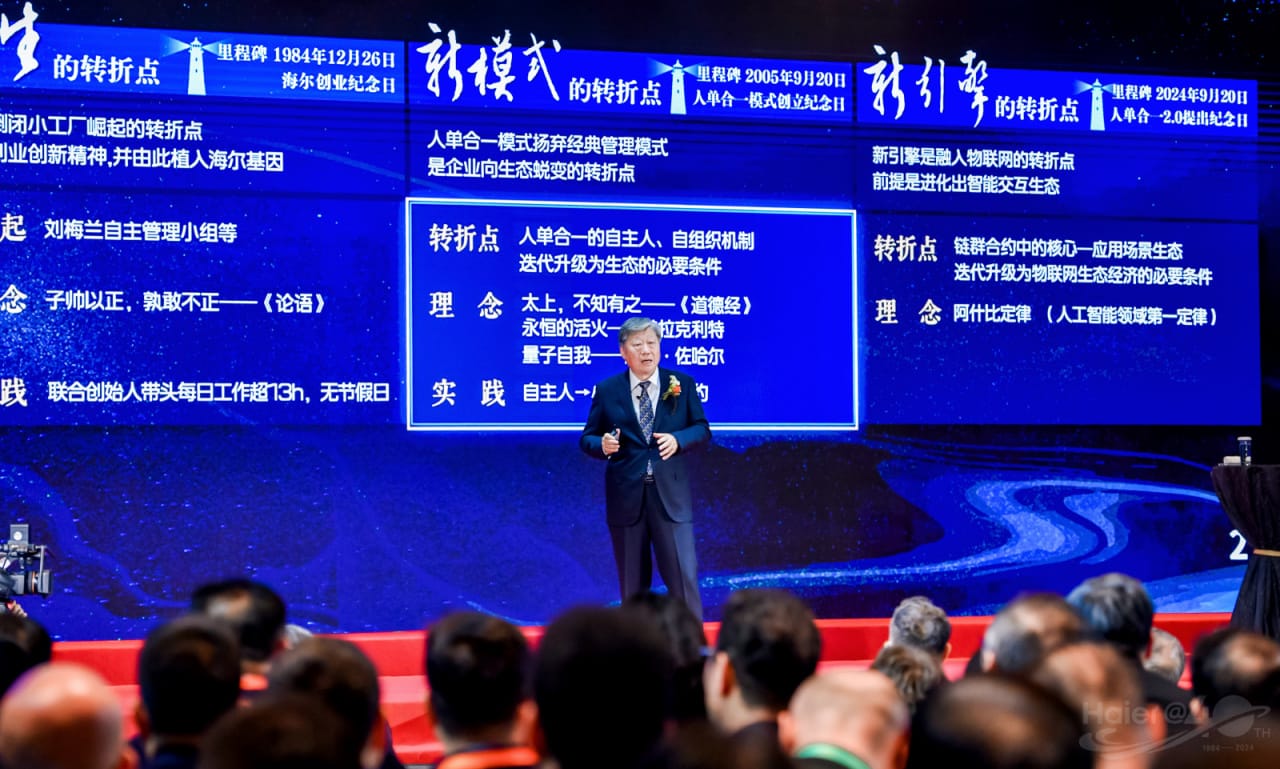

I also think that Zhang Ruimin was a visionary leader, helping introduce strict quality controls and helping to build up a global distribution network. One of his great contributions was the company’s management philosophy “Rendanyihe” (人单合一), which translates to an “alignment between employees and customers”. Zhang recognized that employees in large organizations typically ended up serving their bosses rather than customers. So within Haier, he ensured that teams would enjoy significant autonomy and be rewarded based on how well they added value to customers.

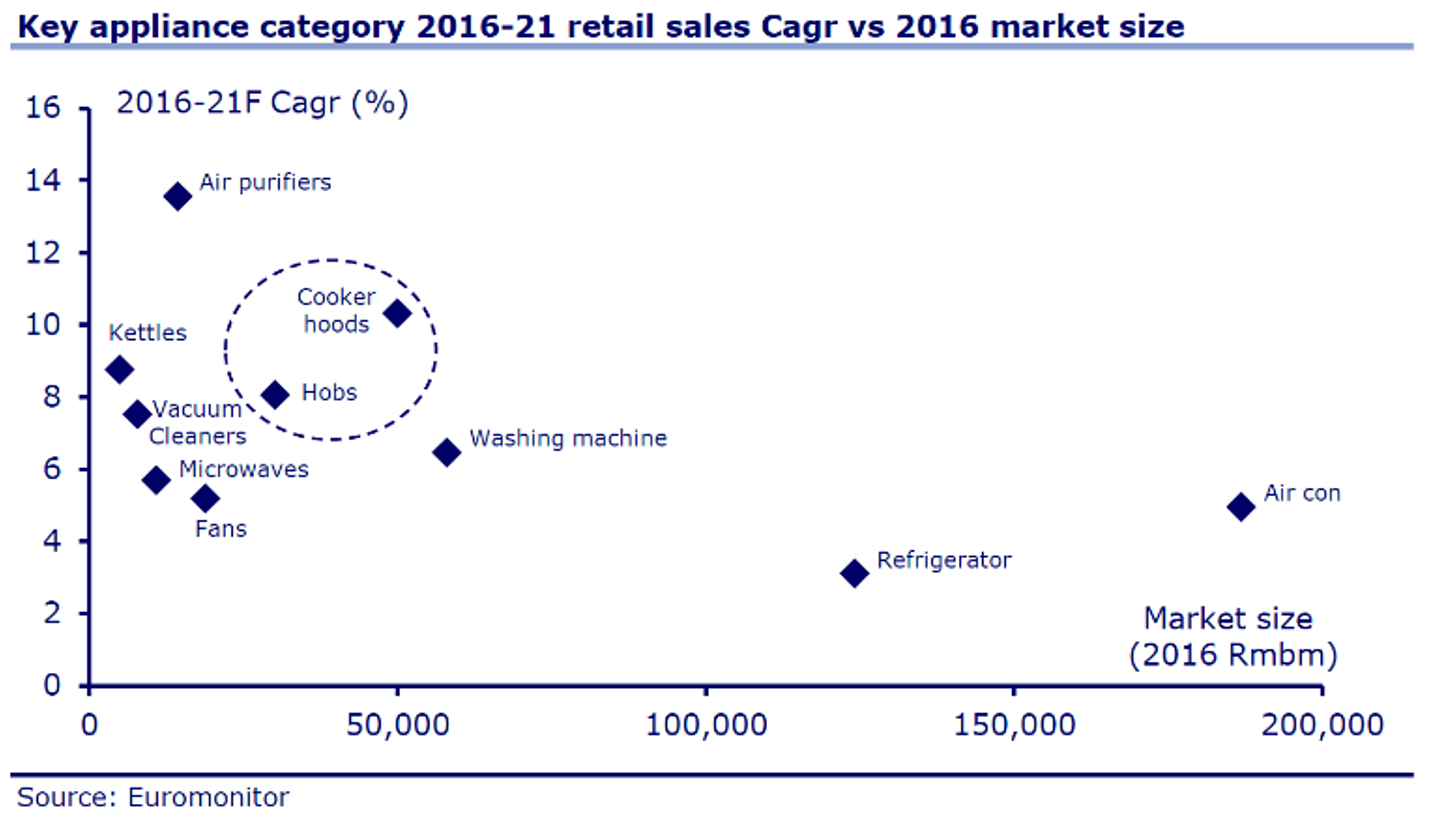

In the 2010s, growth had been slow but steady. But with an international focus, Haier had grown faster than, for example, Gree. By the early 2020s, the global appliances market grew roughly 6% per year, and high single digits in Asia.

I didn’t see much upside in the penetration rate of washing machines and refrigerators in China. But other segments such as air purifiers, vacuum cleaners, kettles, cooking hoods and hobs grew much faster. And internationally, Haier seemed adept at taking market share from slower-moving Western brands such as Whirlpool and Electrolux.

In my first post on Haier Smart Home, I noted that the company was planning to merge with its Hong Kong-listed distributor subsidiary, Haier Electronics. This meant that the complex corporate structure would be partially resolved. In addition, Haier Smart Home would also gain a Hong Kong listing, gaining greater visibility among institutional investors and hopefully be awarded a higher valuation.

The discount at which the D-share was trading was befuddling. The D-share and the H-share had identical cash flow and voting rights. The only major differences were reporting requirements and the regulator (CSRC for the D- and A-share and SFC for the H-share). So while I wasn’t sure that the D-share would trade up to the price of its Hong Kong shares, I considered it a possibility.

And the valuation of the D-share was astounding. I projected a forward P/E of 4.4x, a massive 72% discount to the A-share, even though the shares were virtually identical. Would the discount ever narrow?

2. An update to my original post

Since I first wrote about Haier’s D-share, the stock price has performed nicely:

Why?