Discover value stocks in Asia

There are 10,000 stocks listed in the Asia-Pacific region.

But if you read mainstream media outlets such as CNBC and Bloomberg, most of the discussion will revolve around companies such as Alibaba and TSMC.

Nothing wrong with that. But I think most readers can benefit from learning more about the broader universe of stocks here in Asia. In my view, Asia represents a fantastic opportunity set. All you need is someone to guide you through the noise.

My name is Michael Fritzell. I’m originally from Sweden but have spent the last 15 years in Asia. Most of that time was spent on the buy-side, helping funds and a family office find ideas in Hong Kong, China, Singapore, Indonesia, etc.

I became a CFA charterholder in 2012. I have a Master’s Degree in Finance from the Stockholm School of Economics. I’m also a long-time member of Joel Greenblatt’s Value Investors Club, a membership site for top investors around the world.

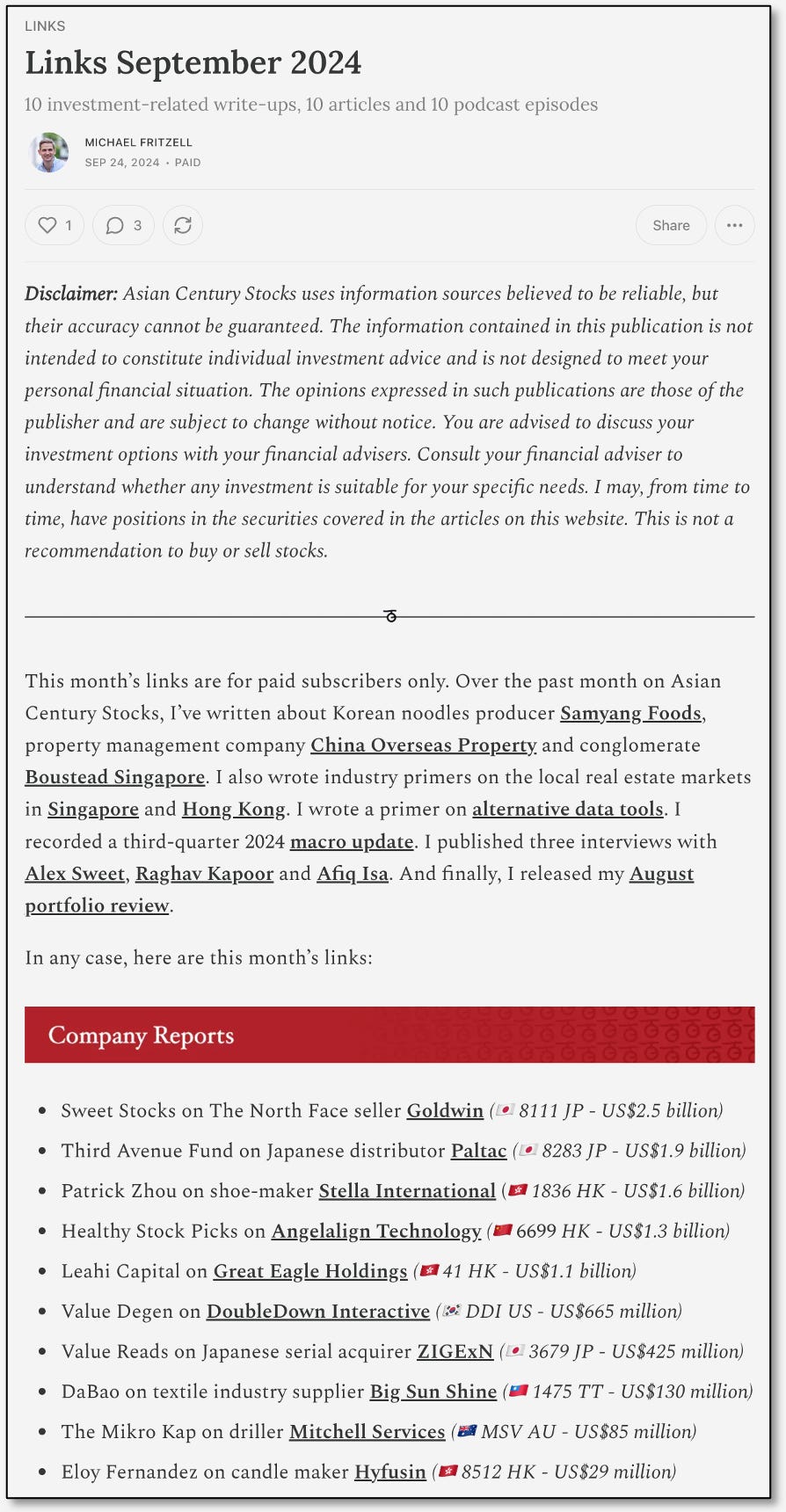

Disclaimer: I am NOT a financial advisor. Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers, whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website.

You can start by signing up to our free mailing list. You’ll get occasional free posts and weekly highlight emails where I recommend content related to Asian equities.

In addition, premium subscribers will also get 20 deep-dive reports each year, industry thematics to help you understand entire sectors and monthly updates on my personal, Asia-focused portfolio.

Deep-dives

My deep dives are typically 40-60-slide PowerPoint decks that enable you to get to know the company deeply. That’s why I call them “deep dives.” My information gathering is extensive, going through past annual reports, investor presentations, earnings transcripts, sell-side research, independent research, social media commentary, newspapers and more. You’ll understand all aspects of each business and not just the surface-level information you might find elsewhere.

You can check out a few of my previous write-ups on Hello Kitty licensor Sanrio Corporation, Indonesian chocolate producer Delfi, Hong Kong restaurant operator Café de Coral, and investment fund Fairfax India.

For each of these deep dives, I also record videos in which I introduce the company in a 10-15-minute conversation that gets to the gist of the story. You can also just read the summary that comes with each report.

Thematic reports

You will also receive thematic reports. These are meant to spark ideas related to a particular sector or product. You’ll get to know the companies benefitting from a trend and understand what distinguishes them from each other.

Here is an example of such a report:

Portfolio updates

Finally, I provide a full disclosure of my Asia-focused portfolio. Each month, I also give you updates on what’s happened with each of these companies. I follow these companies closely and tell you month-to-month if anything has changed. I’ve been incredibly transparent with regard to my portfolio. And so far, so good.

Finally, I send out monthly emails with the favorite content that I’ve come across during that month. These include stock write-ups, long-form articles, podcasts and charts.

Through these deep-dives, thematics and link emails, you’ll get a steady stream of new ideas. You’ll get a sense of the opportunity set in this part of the world. So consider a premium subscription to get the most out of the publication:

I typically send out 1-2 emails per week. My deep dives are typically published on Sunday mornings so that you can read them with your Sunday morning coffee.

I’ve been writing the newsletter since 2021, and have written hundreds of deep-dives and thematics. You can find the full list of them in my Table of Contents. I spend all my time serving premium subscribers with no other commitments. I am here to serve you.

Asian Century Stocks is focused entirely on stocks in the Asia-Pacific region. For stocks in the rest of the world, I recommend the following newsletters:

For Latin American stocks, I recommend Ian Insider Corner

For US stocks, I recommend Clark Square Capital's Ultimate Value

For European stocks, I recommend The Mikro Kap

With these four, you’ll get a steady stream of ideas with a high signal/noise ratio.

Twenty years ago, you’d have to pay at least $10,000 per year to get access to broker research. I only charge $350 per year. If you have a $100,000 portfolio, that equals 0.35% of the portfolio value each year. I think that’s a fair price for what you get.

Testimonials

Premium subscribers of Asian Century Stocks have been positive:

"Great idea generation, well written."

"Thank you for all the high-quality, detailed reports.”

"Love the work you do! Thanks for all the amazing business deep-dives."

"Good to see someone covering the interesting opportunities available in HK!"

"Excellent analysis on less well covered stocks & sectors"

"Thanks for the quick reply and helpful trial! I look forward to reading the articles you put so much work into!"

"To be introduced to Asian companies with exciting business models and attractive fundamentals from the perspective of a Western European with 15 years of "local knowledge" is simply unique in this form."

Substack chose Asian Century Stocks to become one of its Featured Publications in 2022. They argued that Asian Century Stocks exemplified best practices, including posting regularly and engaging with readers.

I was also one of the 11 writers who won a Substack Fellowship in 2021, chosen based on the quality of the publication:

“From a talented, competitive pool, a panel of judges selected 11 writers based on the clarity and insight of their publications, their ability to inspire new writers, and their appetite for community engagement.”

Try the newsletter and see if you like it. I offer all new readers a one-month free trial. If you don’t like the service, cancel before the 30-day period is up, and I promise your card will not be charged.

What if you regret your purchase after those 30 days? Just reply to any of my emails, and I’ll refund you pro rata, no questions asked.

Can you invest in the stocks I write about in the newsletter? Sure. I am not a financial advisor, so I won’t recommend particular stocks to you. But in terms of trading access, at least 20x of the stocks I cover each year can be bought and sold on regular brokerage accounts such as those provided by Interactive Brokers - in other words, stocks in Japan, Hong Kong, Singapore, Taiwan, Australia, and New Zealand. Soon, Interactive Brokers will also offer access to stocks in Malaysia and South Korea. As long as you’re on Interactive Brokers, you’ll get plenty of value from the service.

Will I cover names that are liquid enough to buy? Yes, I try. Trading liquidity is decent in Hong Kong, Japan, Singapore, Australia and New Zealand. These markets are my primary focus. A large proportion of the companies covered are in the US$1 billion+ category, with trading volumes above US$1 million per day.

To summarize

Reading CNBC or Bloomberg will not help you find undiscovered gems. You need someone to dig for you and present any conclusions through a steady stream of emails to your inbox.

I promise you that with a premium subscription, you’ll become much smarter about equities here in Asia. I’ll also help connect you to other investors in the region.

Once you’ve signed up, you’ll unlock the entire library and future posts from Asian Century Stocks. Right now, I offer a free 30-day trial. I look forward to hearing from you!

The Asian Century Stocks Substack is an investment education website managed by Delante Media. The company is not licensed or regulated to carry on business in providing any financial advisory service. Any information provided on this site is meant purely for informational and investor educational purposes and should not be relied upon as financial advice.