Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author may hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. I have positions in all of the below stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.

Portfolio update

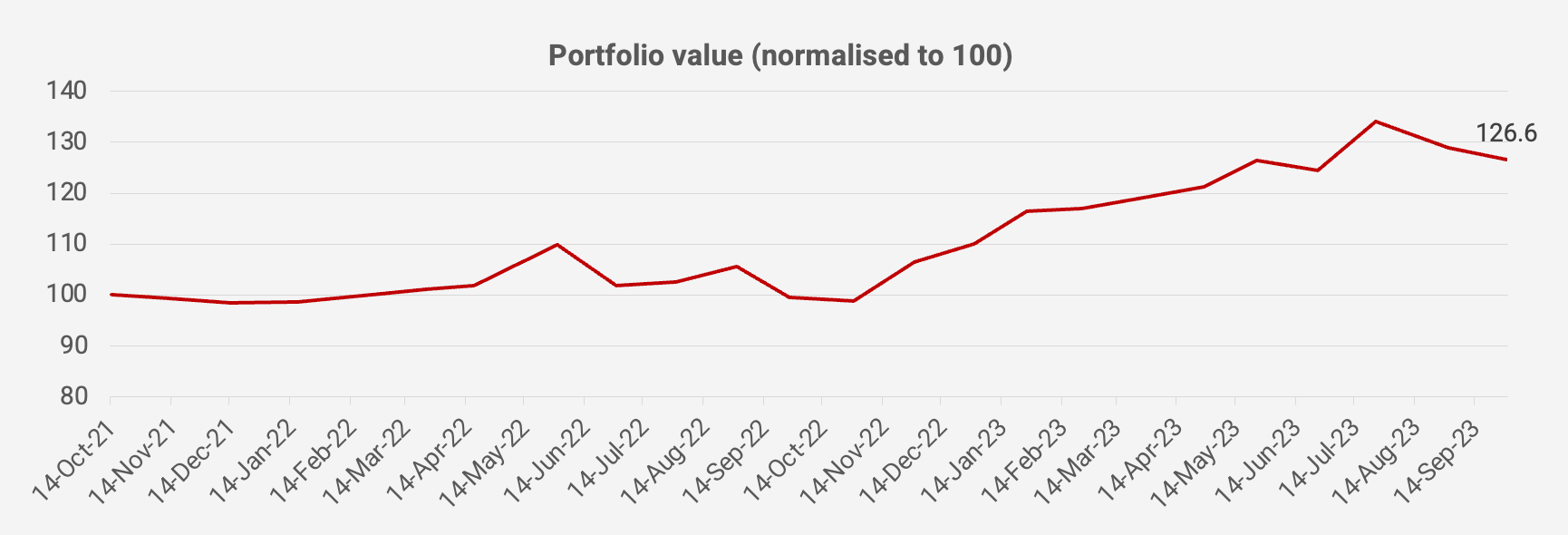

Another weak month. The portfolio's value fell by -1.9% month-on-month and is now +26.6% since inception in October 2021, equivalent to an IRR of +12.8%.

There’s been a confluence of factors holding the portfolio back. The US Dollar has been strong, with the DXY index at a one-year high. But Chinese equities have also been unusually weak, with Cafe de Coral and Fairwood continuing to languish. The failed bid for L’Occitane also contributed negatively to the portfolio.

On the positive side, trading volumes in the Philippines seem to have picked up since the launch of GCash’s single-stock trading feature, benefitting the Philippine Stock Exchange.

Here is the portfolio as of 30 September 2023: