Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author may hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. I have positions in all of the below stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.

Summary

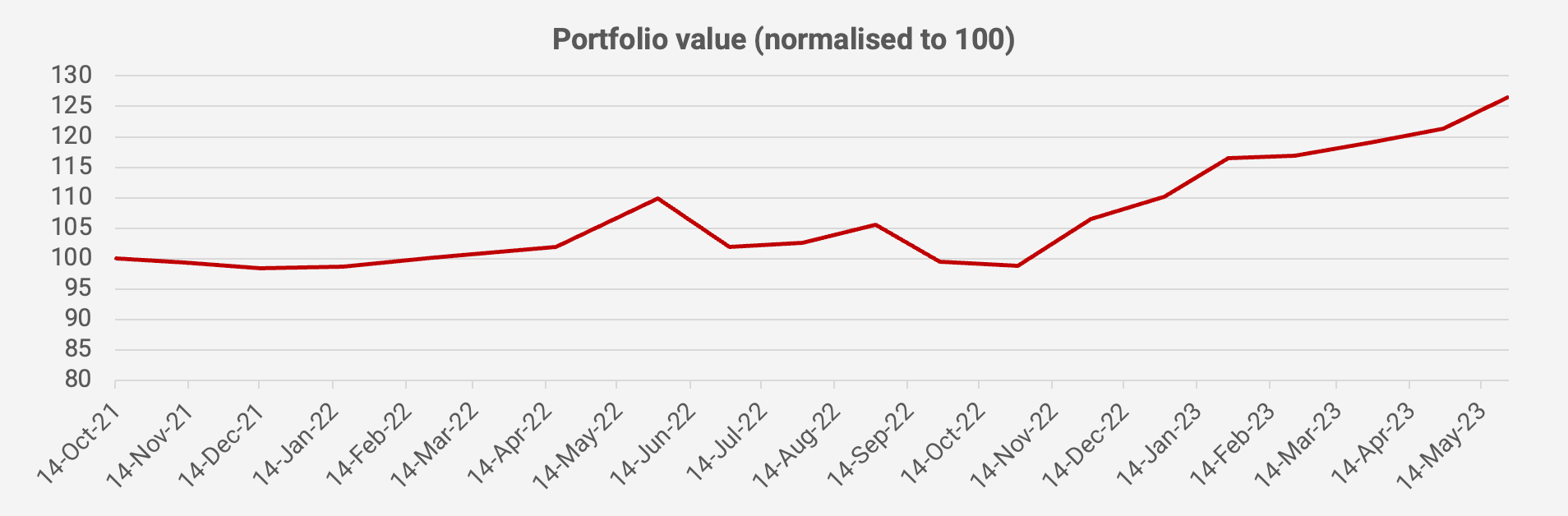

- May’s portfolio performance was strong, with the portfolio value rising another +4.2% month-on-month. The portfolio is now up +26.4% since inception in October 2021, equivalent to an IRR of +15.7%.

- The biggest outperformers were Delfi and MAP Aktif, perhaps partly related to the strength of the Indonesian consumer in early 2023.

- I’ve started selling shares in two Japanese names, using them as funding sources for Chinese consumer and Asia travel recovery bets. These are the themes I am most excited about.

- Meanwhile, with the weakening US and European economies, I’m considering hedging the portfolio by buying government bonds. I’m also considering reducing my exposure to commodities.

Portfolio update

The portfolio performance has been decent, rising another +4.2% month-on-month in May and is now +26.4% since inception in October 2021, equivalent to an IRR of +15.7%.