Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author may hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. I have positions in all of the below stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.

Portfolio update

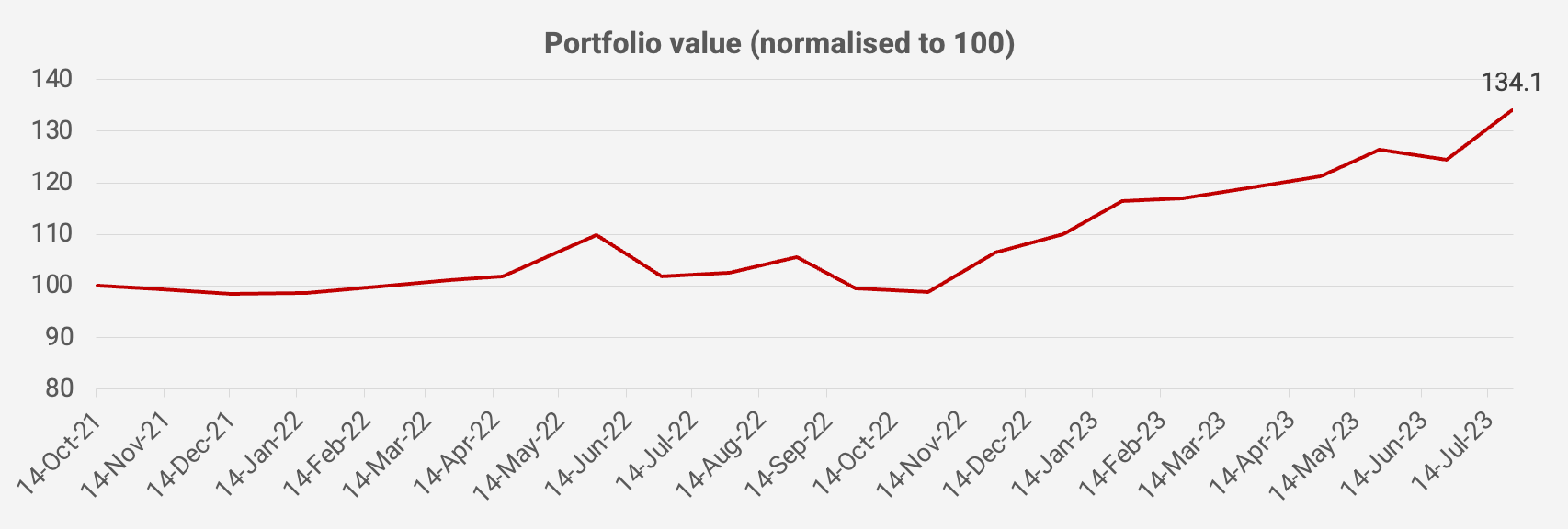

A great month for the portfolio. The value rose +7.8% month-on-month and is now +34.1% since inception in October 2021, equivalent to an IRR of +18.0%. US Dollar weakness explains part of the gain, as the portfolio value is measured in USD.

I recently joined Meta’s new social networking app, Threads. On there, I’ve noticed enthusiasm for Indonesian equities. And while my Indonesian stocks like Delfi, MAP Aktif and Ultrajaya have done well - they are not the exception. Almost every Indonesian consumer stock is rising. We are in a full-on bull market, and many stocks are getting closer to what I think they’re worth.

I see similar bull market tendencies in the Taiwanese market after Interactive Brokers opened up access to that market. Japanese stocks have become hot, too.

And at the other end of the spectrum, Chinese stocks remain hated. Every spike in the HSI seems to get sold. The contrarian in me is tempted to add exposure to Hong Kong equities. I’ve done so over the past seven months and I’ll probably continue.

Here is the portfolio as of 25 July 2023: