The 2023 box office looks promising

Expect another year of recovery. Estimated reading time: 14 minutes

Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is not a recommendation to buy or sell stocks.

Summary

The 2023 line-up of new Hollywood movies looks fantastic. Over the next year, we’ll see potential new blockbusters such as the latest Mission Impossible movie and Dune Part 2.

The cinema industry has been suffering from COVID-19 restrictions, in particular social distancing measures that have kept cinema operating rates low.

But the real issue, in my view, have been the delays in the releases of new Hollywood movies ever since Christopher Nolan’s Tenet flopped at the box office.

Now that the release pipeline looks strong again, cinemas will be on a path to recovery. I doubt that the global box office will reach the 2019 level this year, but it will get closer to that number.

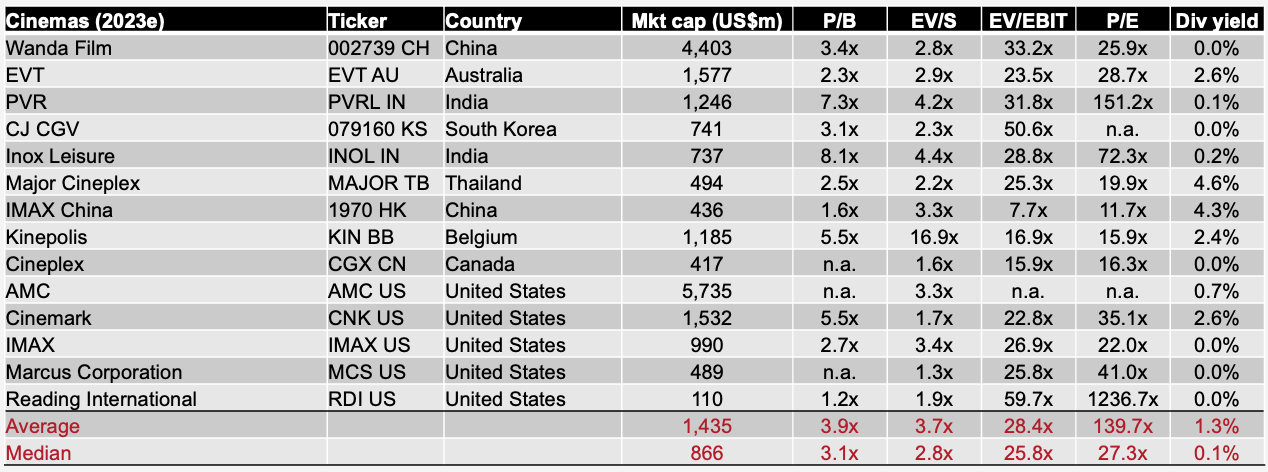

Cinema operators worth mentioning include North America’s Cinemark, Cineplex and Marcus Corporation, China’s IMAX China and Thailand’s Major Cineplex.

1. The cinema industry’s COVID slump

It’s been three years since the start of the COVID-19 pandemic. And the global box office still hasn’t recovered.

Back in 2019, total box office revenues reached US$42 billion globally. And in 2022, it reached US$26 billion, still down -38% since the beginning of the pandemic:

The big question is whether the weak performance at the global box office is due to COVID-19, or a secular shift away from cinemas to online streaming services.

In my view, the primary issue has been COVID-19. And specifically, the low number of blockbusters released in the past three years. There wasn’t any point returning to cinemas when movies were of such poor quality.

Let’s look at the numbers. The 2021 global box office revenues were US$21 billion - exactly half those in 2019. But the number of movies released that year was also half those in 2019. So on a per-movie basis, cinema attendance was actually flat during most of the pandemic.

In other words, it seems to me, that the issue hasn’t been customer willingness to go back to the cinemas. The issue has been the low number and the low quality of movies released over the past three years.

Hollywood studios became cautious after Disney’s Mulan and Christopher Nolan’s “Tenet” flopped at the box office in the summer of 2020. But there were social distancing restrictions imposed on cinemas across most of the world in 2020.

But today, cinemas are finally showing signs of life. The success of Top Gun: Maverick in the summer of 2022 and, more recently, Avatar 2 and Black Panther: Wakanda Forever, shows that you can achieve US$1 billion+ revenues even in a post-COVID world.

The weakest cinema market by far in 2022 has been China. Mostly due to the government’s zero-COVID policy, which cut revenues down by over half vs the 2019 baseline.

2. The misplaced fears of a cinema death

Investors have been fearing that streaming services will take over the market share once held by cinemas. I think that fear is mostly misplaced, though on the margin, a greater supply of content might compete for the same attention.

Here are the key reasons I believe that cinemas are here to stay:

2.1. Cinemas offer much more than just the movie

The “job-to-be-done” of a cinema is to offer an enjoyable night out. It’s not just about the movie itself. Families or young couples may want to get out of the house, for whatever reason.

And the substitutes of cinemas aren’t necessarily streaming services but rather other date night options such as casual dining restaurants, bowling, bars, etc. From that perspective, a $10 cinema ticket won’t necessarily be a deal-breaker.

The experience of watching a great movie on the big screen is also quite different. It’s much more immersive. Watching a movie together with dozens of other people might also attract some movie-goers, in that you’re experiencing the movie together. On a sub-conscious level, that may bring about more enjoyment as well.

While it is possible to recreate the cinema experience through high-end equipment at home, spending thousands of dollars makes for a very long pay-back period compared to, say, US$10 for a cinema ticket.

2.2. The theatrical window will stay

The big question in the industry has been whether cinemas will lose their exclusivity window, during which they have unique access to content before it’s released on streaming services or DVD.

Movie studios will still want theatrical windows to exist. Cinemas have the ability to create buzz around a new movie release. As explained by the CEO of US-based Marcus Corporation in the company’s recent earnings call:

“That’s just incremental revenue that you get in the theatrical plus being able to distinguish your product in the theatrical window as opposed to being a tile on a screen that disappears in 14 seconds… because we have a limited shelf space, you become part of the Zeitgeist, part of the discussion and part of the water cooler talk.”

In other words, to become part of the Zeitgeist, the water cooler talk, you need a theatrical release. And for a theatrical release, a window of exclusivity is needed.

A number of movies have been released straight to streaming since the pandemic started in 2020. But most of those launches have been failures. Even high-quality movies get lost in the thousands of other options available on those platforms.

Finally, movie studios like cinemas for another reason. Cinemas provide advertisements for upcoming movies through short 2-3 minute trailers before the screening starts. Those trailers represent free advertisement and would probably not be watched if it wasn’t for the cinema industry.

So I highly doubt theatrical windows will go away entirely. They will narrow somewhat, from 90 days before the pandemic to closer to 45 days. That won’t be a major issue, given that 80-90% of box office revenues tends to occur in the first three weeks of a movie’s release.

2.3. Movies don’t belong on streaming services

Netflix’s real strength lies in TV shows rather than movies. TV shows with multiple episodes keep viewers subscribing since they don’t want to miss out on the next episode or season. Movies are unlikely to help as much with retention and mitigating churn.

I find it plausible that streaming services will end up focusing on TV shows, stand-up comedy, talk shows rather than movies.

During COVID-19, content spending among the major streaming service has been exceptionally high. Now that venture capital funding is starting to dry up, and stock prices are falling, I believe that their content spending will decline as well. For that reason, studios might well shift their attention away from streaming services back to the box office.

2.4. Incredible resilience in the past

Judging from Google Ngram data, cinemas have become increasingly relevant since their birth around 1910 - despite inventions such as the TV, the VCR, the Internet and so on:

Why do we assume that online streaming services will somehow bring the final death blow to an industry that’s survived for over a decade?

While it is true that American cinema attendance has come down roughly 1% per year, that’s not the case for Europe and certainly not for the Asia-Pacific.

One reason for the weak number of visitors to American cinemas could be that ticket prices have increased rapidly, causing consumers to go for other options. In revenue terms, American cinemas have been doing well, with steadily rising revenues. I believe that resilience will continue into a post-COVID world.

3. The 2023 movie pipeline

The 2023 movie pipeline looks great to me. For example, some of the top box office contenders will be:

Ant-Man and the Wasp: Quantumania (17 February 2023): Paul Rudd plays Ant-Man, exploring Quantum Realm, where they interact with strange creatures. The two previous Ant-Man movies from Marvel Studios raked in US$500-600 million each.

Guardians of the Galaxy Volume 3 (5 May 2023): Peter Quill rallies his team to defend the universe yet another time. The two predecessors clocked in box office revenues of US$800-900 million each.

Fast X (19 May 2023): The tenth movie in the Fast & Furious series with Vin Diesel and Jason Statham will be the fifth most expensive movie ever made with a budget of US$340 million.

The Little Mermaid (26 May 2023): Walt Disney’s The Little Mermaid is based on the classic saga about a young mermaid trading her voice for human legs. This is an entirely new franchise for Disney.

Indian Jones and the Lost Dial of Destiny (30 June 2023): The fifth movie in one of the largest movie franchises in Hollywood, with Harrison Ford making a comeback after 15 years after the last Indiana Jones movie.

Mission Impossible - Dead Reckoning Part One (14 July 2023): The seventh movie in the Mission Impossible franchise will be the second to last. With Tom Cruise having more fans than ever, its success is almost guaranteed.

Barbie (21 July 2023): Ryan Gosling and Margot Robbie will bring the Barbie universe to life for the first time.

Oppenheimer (21 July 2023): Director Christopher Nolan of Interstellar fame will release a movie about American scientist J. Robert Oppenheimer, and his role in creating the atomic bomb.

Dune Part 2 (3 November 2023): A highly anticipated sequel to Denis Villeneuve’s first Dune movie, based on Frank Herbert’s books.

Aquaman and the Lost Kingdom (25 December 2023): The sequel to the 2018 DC Universe hit Aquaman with Ben Affleck.

It’s hard to tell whether these movies will outperform the 2022 box office, which included Avatar 2, Top Gun: Maverick and Jurassic World Dominion. But at least you can tell that great content will be back in cinemas in 2023.

A few estimates suggest that the 2023 box office will outperform that in 2022:

Bloomberg Intelligence estimates 100 wide releases in the United States vs 76 last year and 120 in 2019. That would suggest box office revenue growth of over 30%.

JP Morgan estimates that we will see at least 30 films with the potential for US$100 million+ in revenues in 2023 vs just 18 such films in 2022.

It’s also encouraging that Marvel movies will be imported to China in 2023 for the first time since before the pandemic. For example, Ant-Man and the Wasp: Quantumania is scheduled for a China release on 17 February. I also believe that Fast X, Transformers and the Mission Impossible: Dead Reckoning Part 1 will also be released in China later this year. That bodes well for the Chinese box office.

4. Evidence of recent box office strength

4.1. Search query analytics

The number of search queries for “cinema ticket” globally is now back to pre-pandemic levels.

I’m aware that Americans don’t use the word cinema and that the above search query chart largely reflects a recovery in the Indian market.

But even US search queries for “movie tickets” has come back nicely. Google search queries for “Rotten tomatoes” has also recovered completely.

Though interest in new movies remains high, the number of search queries for “Cinemark” or “AMC” remains in line with cinema attendance, in other words, roughly 40% below the 2019 baseline.

In Korea, the number of search queries for “movie ticket” remains slightly below pre-pandemic levels. But it’s certainly improved since the arrival of the Omicron variant in late 2021. In Japan, cinema-related search queries have remained high throughout the pandemic. In China, the number of search queries for cinema (电影院) has shot up recently.

I’m also intrigued by the high number of comments on the r/boxoffice subreddit. In the chart below, its ranking is now at a similar level as in December 2019 (a lower ranking is better). So interest in the latest box office releases has already returned to pre-pandemic levels.

4.2. Earnings call commentary

It looks like studios are now investing heavily into full feature-length movies again:

“We do see the different studios leaning back more heavily into theatrical… the limitation to how fast the volume overall recuperates is just the nature of how long it takes to make movies. So as we look at that, we see probably another couple of years to get fully back to where it is.” - Cinemark Holdings, 3Q2022 earnings call

And these higher investments are causing industry experts to be positive on the 2023 movie pipeline:

“Management has a similar view to ours on the company’s 2023 outlook. They are quite confident that 2023 should be the golden year for the company, based on the strong movie lineup.” - Brokerage firm Finansia, quoting Major Cineplex’s management team, November 2022

“The 2023 Hollywood blockbuster slate is very strong with multiple Marvel films, including Captain Marvel, Guardians of the Galaxy and Ant-Man, multiple DC films including Aquaman and the Flash, the highly anticipated new Mission Impossible, the latest Fast and Furious event, and of course, Christopher Nolan’s Oppenheimer.” - IMAX, 3Q2022 earnings call

“We also were ebullient about the movies coming out in the fourth quarter of 2022 and in calendar year 2023, and that is precisely our view again today… we’re seeing that the industry-wide box office is already on a rebound, both domestically and globally, clawing and climbing its way back.” - AMC Entertainment, 3Q2022 earnings call

“We expect 2023 will continue to be another year of recovery with regard to overall content volume, with early projections indicate it will be a further step forward from 2022, much like 2022 was from 2021.” - Cinemark Holdings, 3Q2022 earnings call

“We’re excited by the robust slate of blockbuster titles for the remainder of the year and into 2023. We feel this lineup, combined with strong consumer enthusiasm for moviegoing, confirms that our business is back in a film slate… we feel pretty confident with the release schedules that we’re looking at into 2023, that there are going to be some strong, meaningful releases all through the year.” - Cineplex, 3Q2022 earnings call.

5. Investable universe of stocks

In the United States, Cinemark (CNK US - US$1.5 billion) has seen its enterprise value drop significantly since the start of COVID-19. However, that’s partly due to the company’s LatAm exposure and weakening currencies in those countries. It’s hard to judge exactly what a normalised multiple will be, given significant currency movements. But in my view, it should end up somewhere around 6-7x EBITDA.

Marcus Corporation’s (MCS US - US$489 million) enterprise value is down roughly 30%. It owns most of the properties in which the company operates its cinemas. It has a suburban where the competition from Cineplex and AMC is low. And it also owns a number of high-quality hospitality assets. The stock trades at roughly 4x pre-pandemic EBITDA.

Canada’s Cineplex (CGX CN - US$417 million) also trades well below its pre-pandemic levels. It has a completely dominating 75% market share in its local market. However, be aware of the company’s relatively high 3x normalised net debt/EBITDA ex-operating leases. I get to a normalised EV/EBITDA multiple of around 5x for Cineplex.

In Asia, IMAX China (1970 HK - US$436 million) is another stock whose enterprise value remains well below the pre-pandemic level. It’s a subsidiary of IMAX Corporation and provides IMAX format theatre screenings in China, where it provides screen installation and takes a cut of IMAX box office revenues. It’s probably the most pure-play Chinese cinema stock out there. On my numbers, IMAX China trades around 5x pre-pandemic EBITDA. But note the critical commentary on the stock provided by J Capital back in 2017.

In Thailand, movie chain Major Cineplex (MAJOR TB - US$494 million) has a 70% market share in a market where ticket prices remain low and penetration rates a fraction of those in, say, South Korea. Major Cineplex’s enterprise value ex-operating leases remains down roughly 50% since 2017. With an EV ex-operating leases of THB 16 billion, I get to a normalised EV/EBITDA of around 6-7x. Also, note that Major Cineplex’s founder Vicha Poolvaraluk bought a few million shares a few months ago around the current share price. I wrote about Major Cineplex back in 2020 in the following report:

Overall, cinema stocks don’t necessarily look cheap on reported multiples. But if the box office continues to recover, then in some cases, you could get to EV/EBITDA well below 10x. Whether those multiples are worth the risk, is another matter.

6. Conclusion

2023 will be a great year for the global box office. I’m certainly seeing myself going back to the cinema a lot more than in the past three years. An improving pipeline of new movies will help. It will probably take another 1-3 years for a full recovery to take place, in my view.

There aren’t many cinema stocks listed in Asia, unfortunately. IMAX China and Major Cineplex remain the two companies that I pay the most attention to. Out of the two, in my personal opinion, Major Cineplex seems like a simpler story with fewer regulatory and corporate governance-related risks.

Thank you for reading 🙏

Click the button below to get access to the best Substack about Asia-Pacific value stocks. You’ll get 20 deep dive reports per year, portfolio updates and intelligent commentary.

Section 2.1 is great. Reminds me of the phrase: People don't want a drill, they want a hole in the wall but actually they want a picture hung up. 3M solved this by selling those hooks with removable sticky tape at the back.

영화 is movie, not movie ticket. Also, you should look at Naver and Daum, Google is not a good indicator of SERP or search trends in Korea.