Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author may hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. I have positions in all of the below stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.

Portfolio update

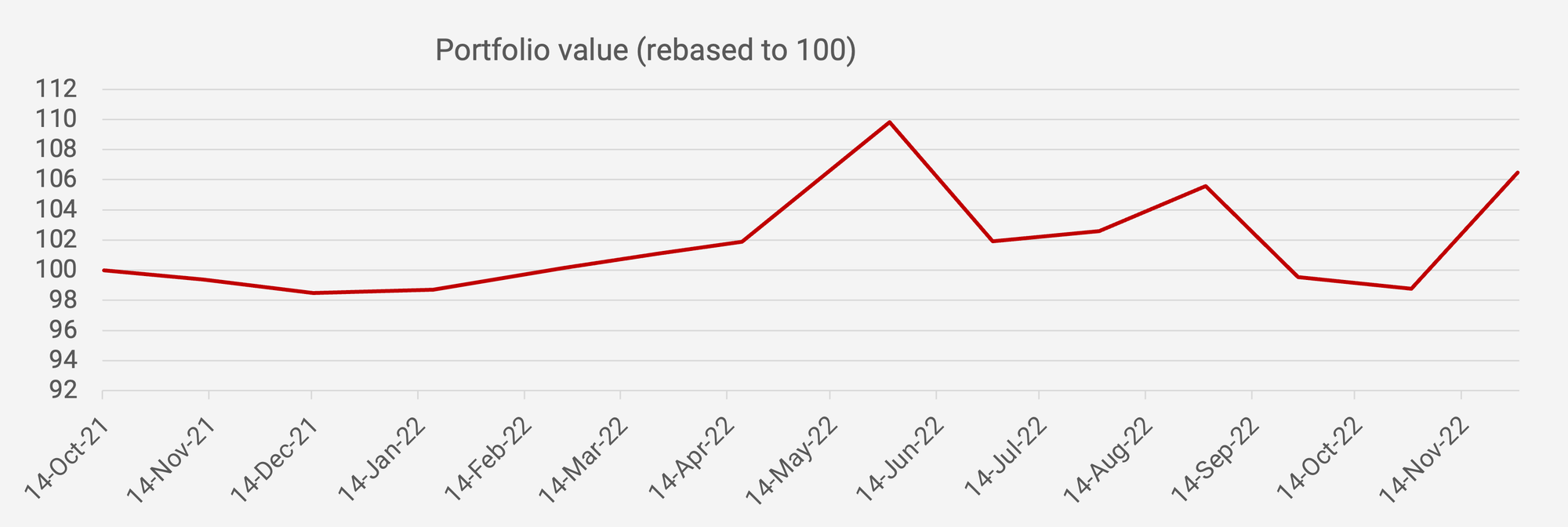

Finally, some sail in the wind. The portfolio rebounded sharply in November, up +7.8% month-on-month and up +6.5% since inception in October 2021 in US Dollar terms.

A primary contributor to last month’s performance was MAP Aktif (MAPA IJ - US$768 million), which reported solid 3Q2022 numbers and with analyst estimates trying to catch up with reality. Small position VTech (303 HK - US$1.6 billion) also rebounded after its late October 2022 crash. Sony’s (6758 JP - US$102 billion) stock price went up after reports of the PlayStation 5 finally becoming available to consumers.

The US Dollar has also come off with DXY topping out, causing currency gains for the portfolio. The market is pricing in an earlier end to Fed’s rate hike cycle than previously expected. That’s also the reason why bond yields have come down and why many Asian bond proxies rebounded in November.

Here is my Asian portfolio as of 30 November 2022: