Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author holds positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. This is a disclosure - not a recommendation to buy or sell stocks.

Portfolio update

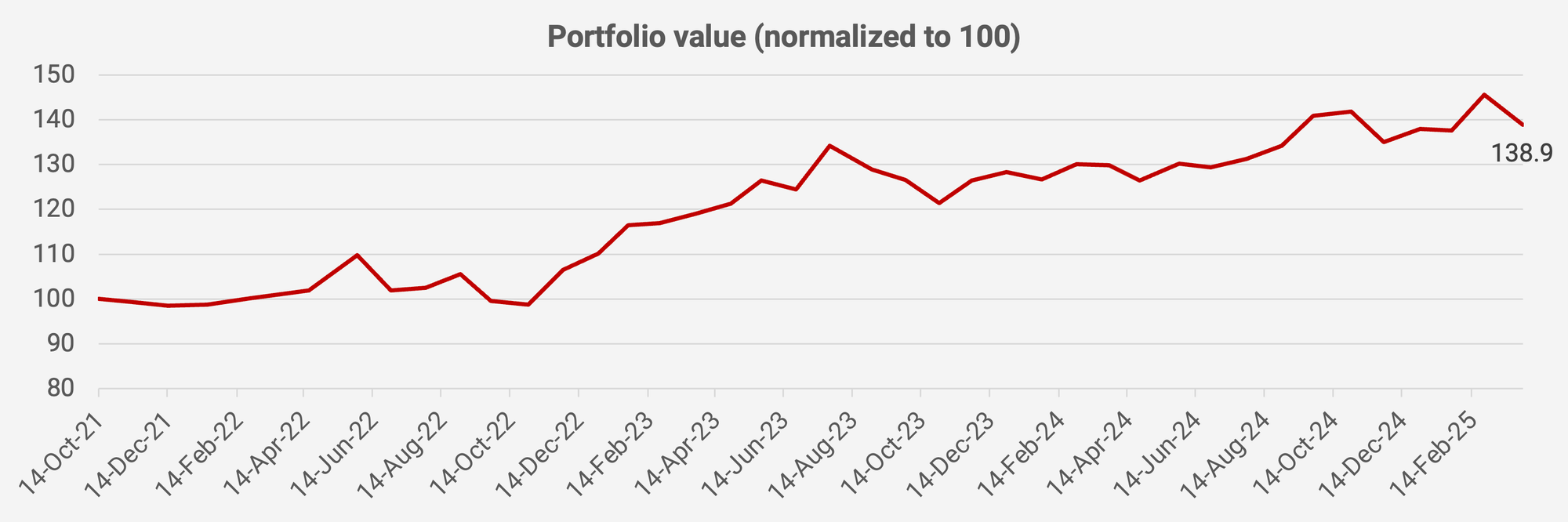

March was rough for the portfolio as US tariffs started to be priced in. The portfolio value dropped -4.6% month-on-month. Since inception in October 2021, the value of the portfolio has now increased +38.9%, equivalent to a +9.9% compound annual growth rate:

Best Mart 360 reported steady growth, as did Ginebra San Miguel and Poper. However, trade-dependent companies such as Hartalega and Samsonite declined considerably despite their already-low multiples. Pico Far East also sold off, presumably due to its exposure to auto trade shows in China and beyond. Thai cinema operator Major Cineplex dropped close to 30% after reporting weak fourth-quarter numbers. Even Fairfax India dropped despite largely positive developments in its core businesses.

All eyes are now on Trump’s tariff negotiations. The tariffs are so high that I can’t imagine the US economy surviving them without a recession.

Since the US administration is so hell-bent on eliminating trade deficits, Asian currencies will have to appreciate. I’m particularly bullish on the Japanese Yen.

But let’s see whether Trump follows through on his tariffs. Trump has a history of shocking his counterparts early in negotiations and eventually settling for less. Hopefully, Asian governments will step up to the plate and negotiate trade deals that are more fair than they’ve been in the past.

In any case, here is what the latest portfolio looks like as of 31 March 2025: