Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author may hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. I have positions in all of the below stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.

Portfolio update

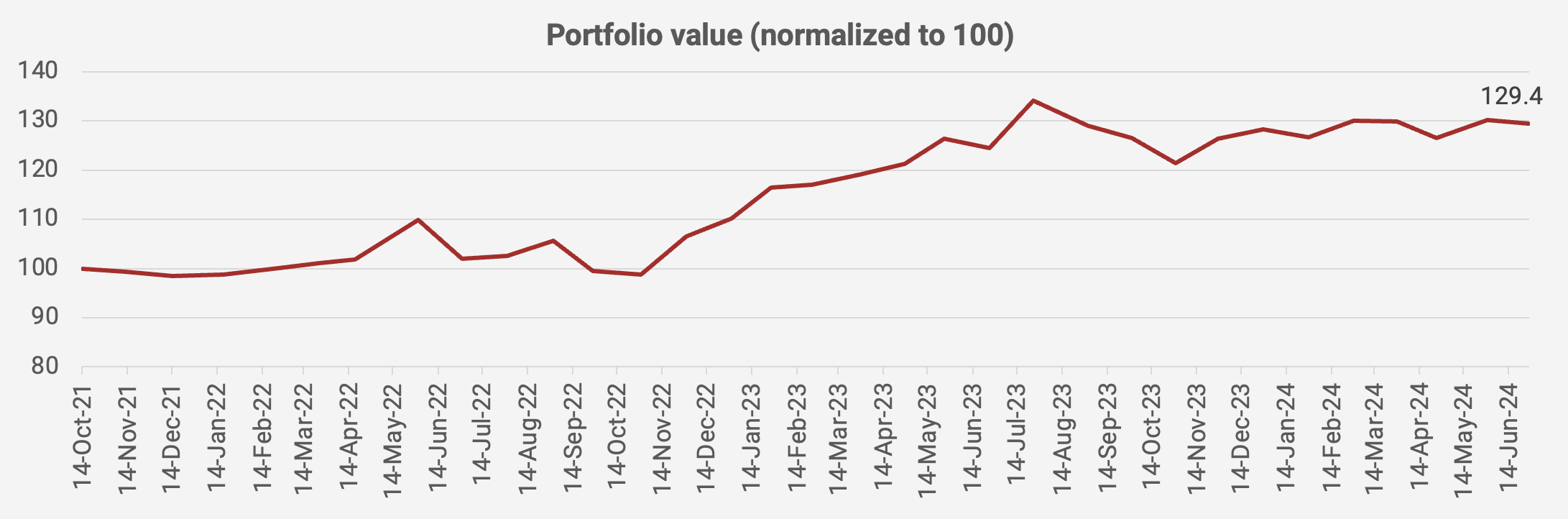

Welcome back. The value of my Asia-focused portfolio dropped a bit in June, down -0.6% and now +29.4% since inception in October 2021, equivalent to a compound annual growth rate of +10.0%:

We saw a rise in Hong Kong equities until mid-May and then a subsequent decline. My Hong Kong restaurant stocks Cafe de Coral and Fairwood both declined together with the index. On the plus side, Hong Kong equities remain incredibly cheap. Ginebra San Miguel continued to outperform and Fuji Corp Miyagi has rallied back to its all-time high.

In any case, here’s what the portfolio looks like as of 27 June 2024: