Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author holds positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. This is a disclosure - not a recommendation to buy or sell stocks.

Portfolio update

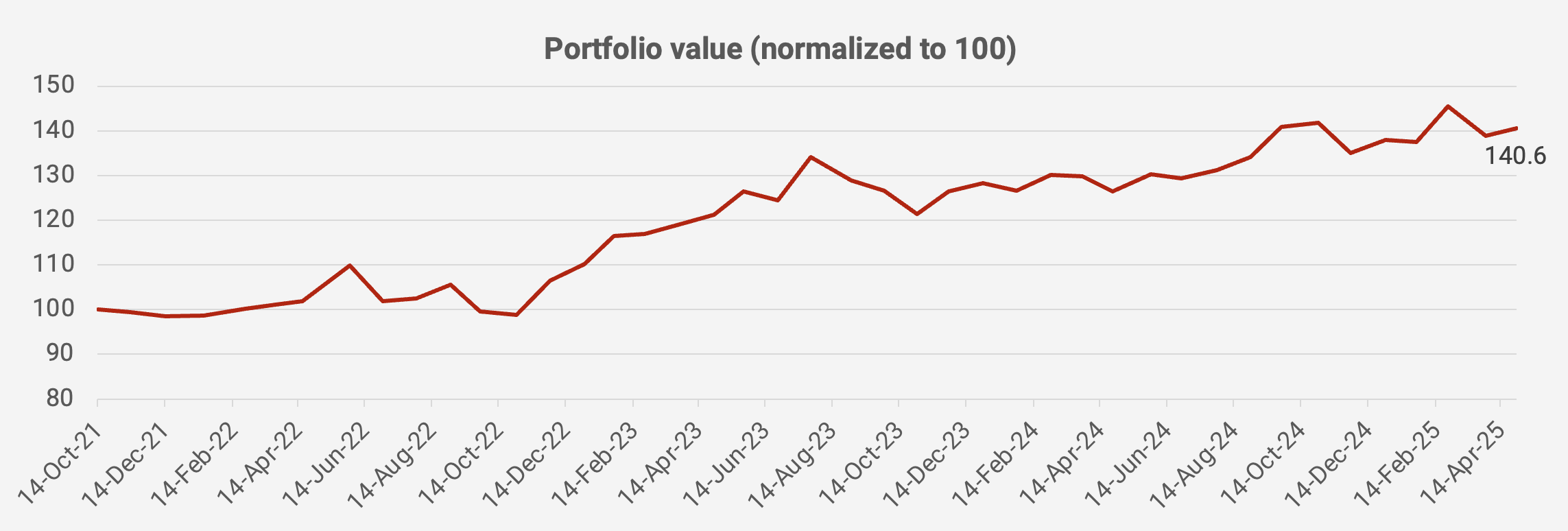

The portfolio rebounded last month despite significant intra-month volatility. Since its inception in October 2021, the value of the portfolio has now increased by +40.6%, equivalent to a +10.1% compound annual growth rate:

It was a stressful month. After “Liberation Day” on 2 April 2025, Asian equities went into freefall, with many stocks limit-down. The tariffs announced were shockingly high, and in the case of China, eventually ramped up to a whopping 145%. And what’s worse, the United States will also remove exemptions on tariffs for low-value goods, known as the “de minimis rule.” That means goods from overseas e-commerce websites will now carry much higher tariffs than before.

With this backdrop, I cannot imagine much positive news coming out of the Chinese export industry in the next few quarters. The declines in the share prices of companies such as Pico Far East and Sony were probably warranted, in my view. Pacific Textiles and Samsonite will also face pressure, as they export products out of Mainland China, partly to the United States.

Some of these companies will be able to deal with the problem by moving production overseas. But it can, in some cases, take years. As I outlined in my post' Tariff Chaos,' I believe that high US tariffs on Chinese goods are here to stay, whereas America’s historical allies, Japan, South Korea, Taiwan, and the Philippines, will probably be able to negotiate a lower rate before the 90-day exemption window passes.

As Donald Trump has made clear, it’s not just about fair trade, it’s also about implicit US security guarantees to its allies. So these countries will have to raise their defense spending, let their currencies appreciate and show progress at allowing US companies to enjoy market access on equal terms.

For Asian equities, the news isn’t necessarily all bad. Materially higher defense spending could lead to an acceleration of credit growth in some countries, including Japan and Taiwan. Some of that liquidity might eventually spill over to their local stock markets. And if their currencies start to appreciate, flows might pick up, with foreign investors thinking that the market is a one-way bet.

I’m personally wary of Chinese exposure. There could be retaliations, as we saw with the rumor that the Chinese government is going to ban US movies from being played within Mainland China. I also think the Chinese consumer is going to suffer in the near term. To use an old cliche, it’s only when the tide goes out that you realize who has been swimming naked.

I feel that Southeast Asian stock markets offer decent value today. Thai equities have come down significantly, as have Indonesian equities. Some countries, such as the Philippines, don’t export much in the first place, so where is the hit from US tariffs going to come from? And where else can you buy the most blue-chip of blue-chip stocks below 10x P/E?

When it comes to East Asia, I see a path towards stronger currencies for both Japan and Taiwan. And that would spell trouble for the earnings of their export industries. So, I’m leaning towards companies that serve local consumers, including Koshidaka and Poper. These companies will continue to do well, regardless of what happens to the USD-JPY exchange rate.

In any case, here is what the latest portfolio looks like as of 28 April 2025: