Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is not a recommendation to buy or sell stocks.

Trump’s tariff war has caused Asian equities to decline considerably.

In this post, I’ll try to understand Trump’s intentions. I’ll discuss how Asia is going to be impacted by the tariffs. And I’ll also mention a few companies that will do fine regardless of whether Trump’s tariffs stay or not.

I don’t claim to be an expert. But as an investor, I have to adjust to this new reality and respond accordingly. So this is simply my attempt at making sense of the recent chaos.

Table of contents

1. Trump's tariff war

2. The impact on the United States

3. The impact on Asia

4. Ten highlighted companies

5. Conclusion1. Trump's tariff war

In 2021, I wrote a post about how East Asia became wealthy. It was heavily inspired by Joe Studwell’s books and Jonathan Anderson’s research at Emerging Advisors Group.

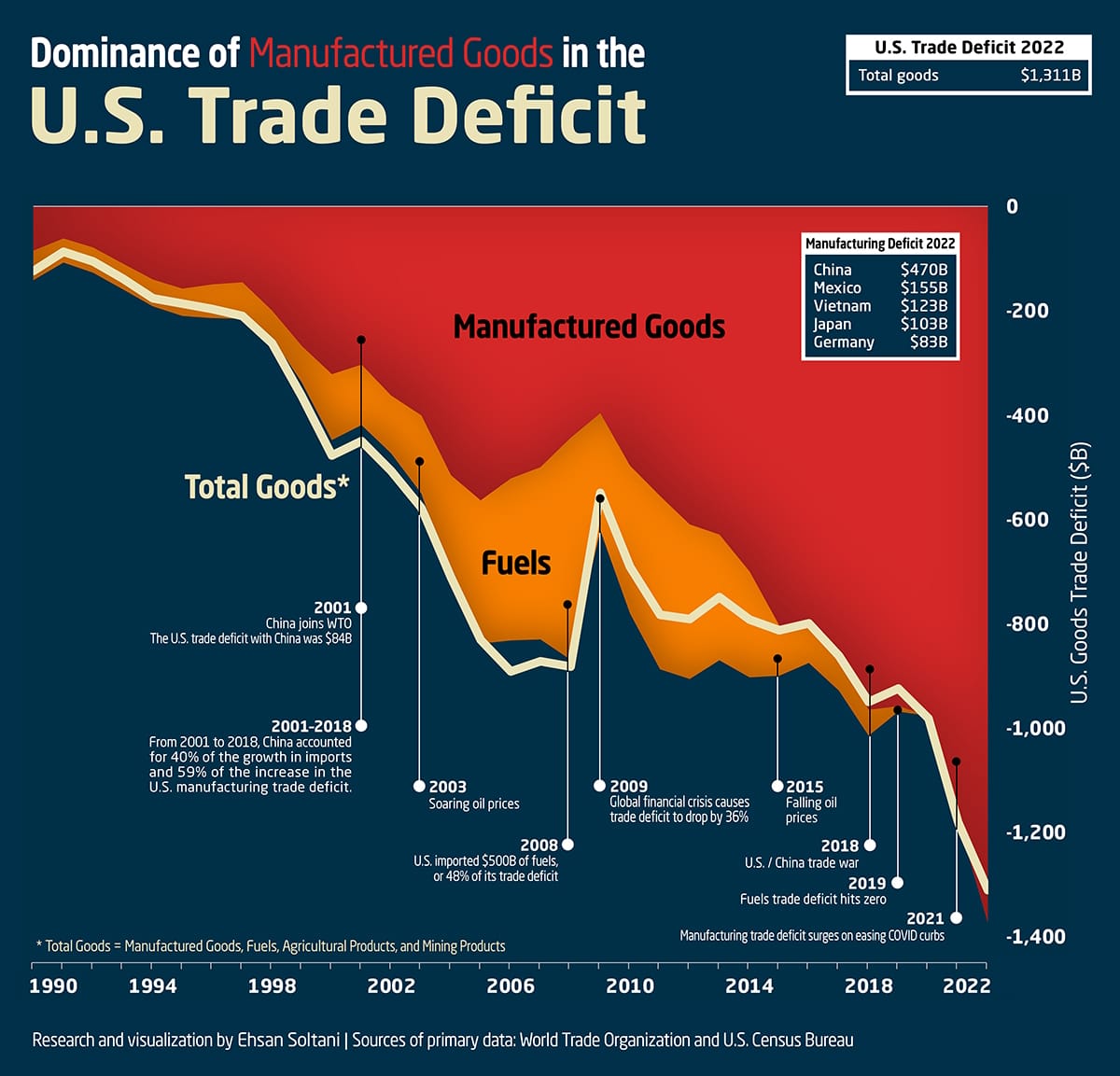

The gist of the post was that East Asia developed thanks to the export of manufactured goods. The invention of the container in 1956 brought down the cost of transporting goods across the world. Western companies outsourced manufacturing to factories in Japan and later South Korea, Singapore and Taiwan. Over time, technological know-how spilt over to local companies, who then started competing in world markets on their own terms. I’m thinking of brands such as Sony, Samsung and TSMC.

But the process didn’t happen organically. All of these countries adopted industrial policies to boost exports and accelerate this transfer of technological know-how. Some of the methods used included:

- Financial repression to channel savings into investments that facilitate trade

- Sterilizing capital inflows so as to maintain exchange rates weaker for longer

- Infant industry protection to allow local companies to survive

- Direct subsidies, including lower taxes, cheap land and access to loans

Later on, communist nations such as China and Vietnam copied the same industrial policy, taking it to the next level. A lack of EU-style environmental laws made it more profitable to outsource manufacturing to these countries. A lack of intellectual property protection meant that the transfer of technological know-how could happen faster, with fewer hurdles. And they’ve also limited access to foreign brands through a variety of methods and thus maintained high budget surpluses.

So I can certainly see where Trump is coming from when he says that he’s seeking to rebalance the American economy in favor of domestic manufacturing. He wants manufacturing to move back to America, not just to create middle class jobs but also for geopolitical stability.

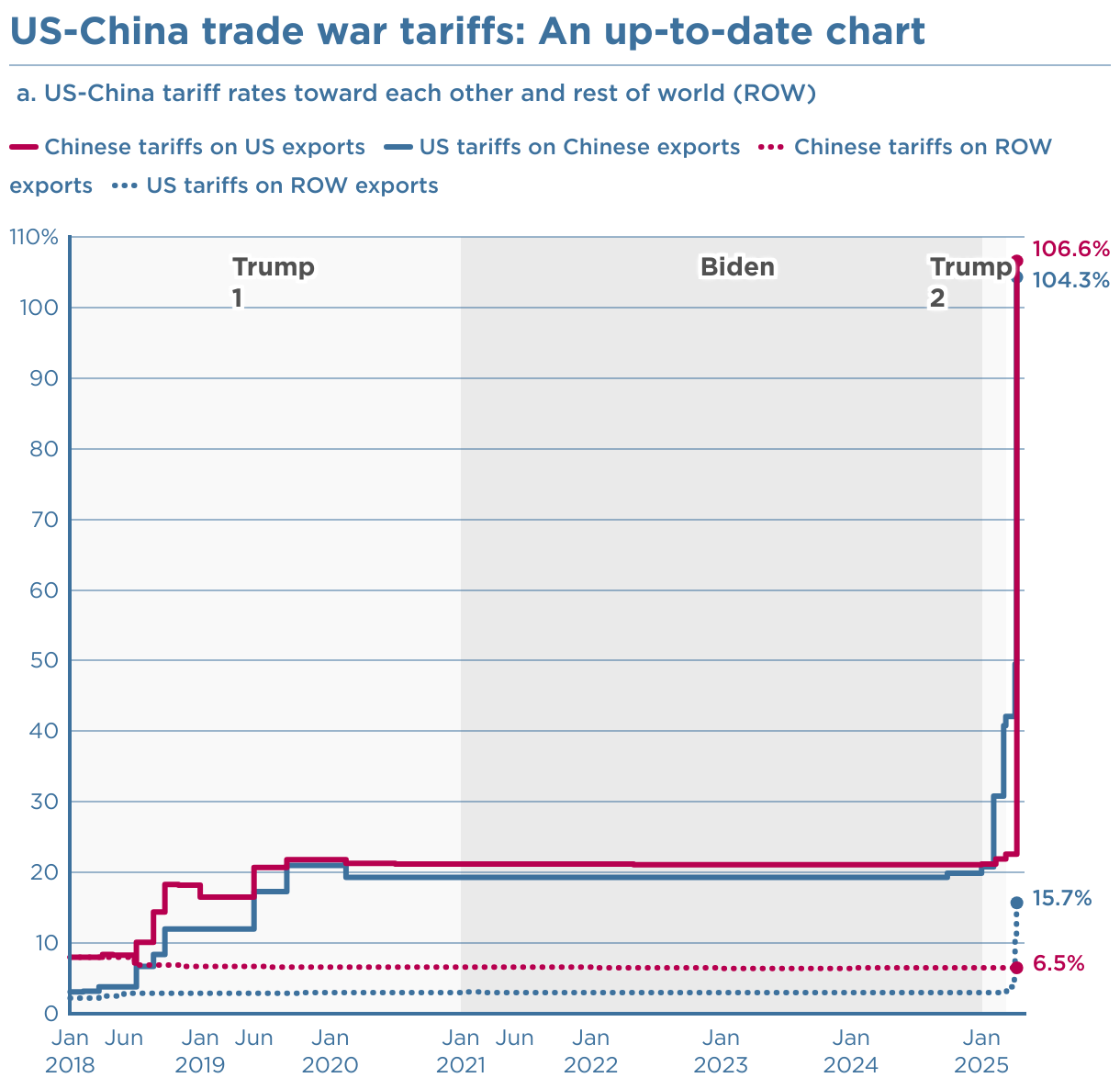

Trump’s realignment push began during his first term in office from 2016 to 2020. Back then, he raised US tariffs on Chinese goods to match theirs. This led to tit-for-tat retaliation and eventually 20% tariffs in both directions between the US and China, not counting non-tariff trade distortions.

This year, he’s upped the ante significantly. Trump introduced another 10% tariff on Chinese goods on 4 February 2025 to punish the Chinese Communist Party for its alleged complicity in the US fentanyl crisis. Then came yet another 10% tariff on Chinese goods on 4 March 2025. Additional tariffs were imposed on steel, aluminium, semiconductors, pharmaceuticals and autos.

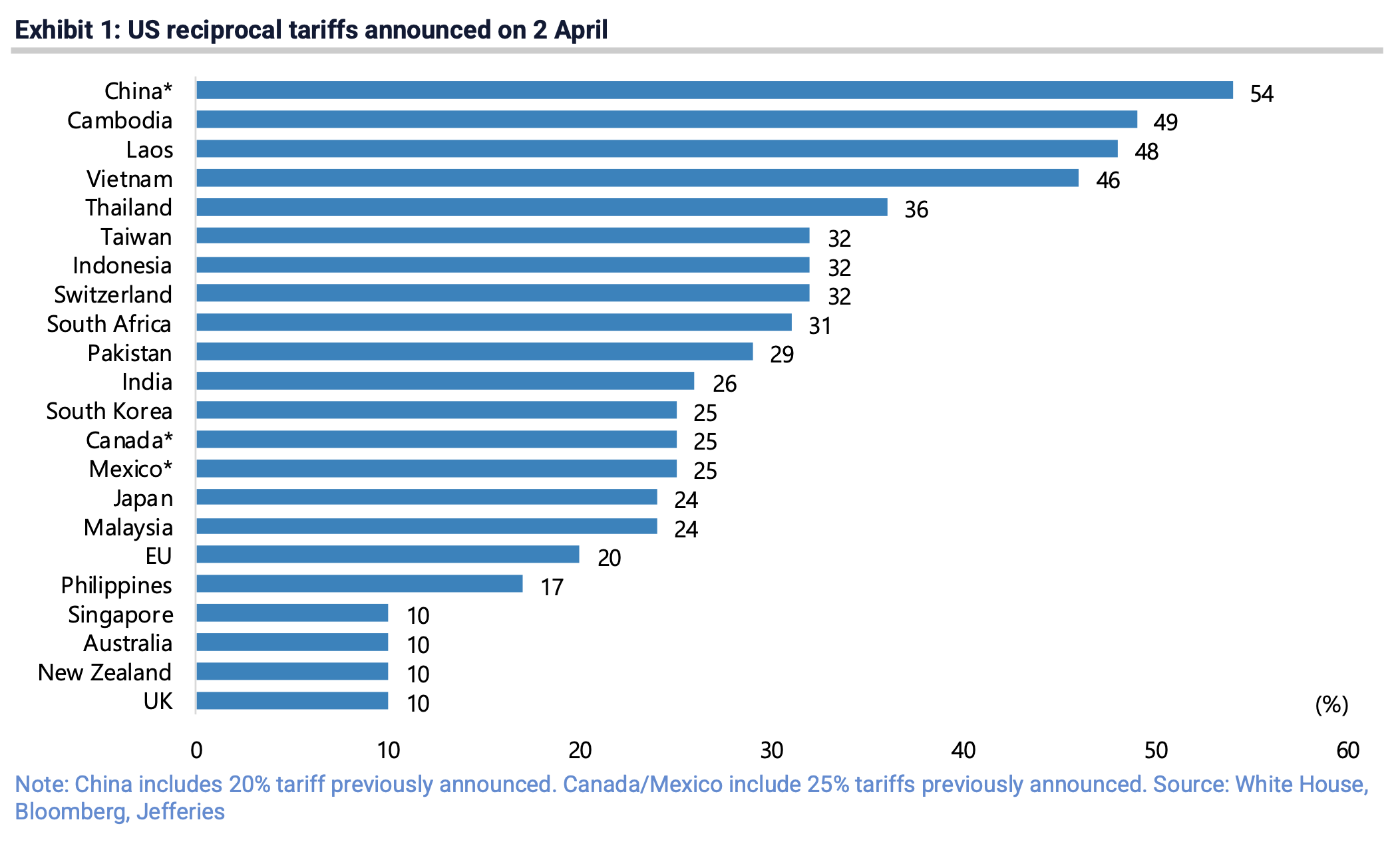

However, Trump was just getting started. On 2 April 2025 — the day Trump calls “Liberation Day” — he imposed a universal 10% tariff on all imports to the United States. Countries seen as having mercantilist trade policies were hit with tariffs of 11-50%, with most of Asia hit with 24%+ rates.

In the past week, we’ve seen the Chinese government retaliating with an equal 34% tariff on US goods. Trump retaliated yet again with another 50% tariff, putting the total at 104%. Such tariffs would put Chinese manufacturing at an enormous disadvantage and cause an immediate negative impact on the Chinese export industry.

So what is Trump’s longer-term vision? From my understanding, he’s been heavily inspired by economic advisors Peter Navarro and Stephen Miran. To understand their worldview, I read through Miran’s November 2024 paper “A User’s Guide to Restructuring the Global Trading System” and found it a reasonable take on the predicament the US finds itself.

Miran makes the point that the accumulation of US$12 trillion of foreign exchange reserves has caused distortions in the US economy, most importantly by pushing up the US Dollar exchange rate. If true, then trade policy has been positive for US consumers and negative for US producers.

He thinks that if trade distortions are allowed to continue, they could plausibly lead to a hollowing out of the US manufacturing base, a loss of middle class jobs and a reliance on foreign adversaries. He views the current trajectory as being unsustainable.

What Miran wants is for the US Dollar to weaken, for manufacturing to move back to the United States and for trade deficits to narrow.

His suggestion is, therefore, to introduce reciprocal tariffs to offset the distortionary policies already in place in the rest of the world. As a starter, Miran suggests a 10% flat tariff on the rest of the world. And then additional tariffs on countries that have:

- Tariffs on the import of US goods

- A history of suppressing exchange rates

- Limited market access to US firms

- No respect for intellectual property rights

- Enabling the transhipment of goods to hide the country of origin

- Not living up to their NATO obligations

- Siding with the Russia-Iran-China axis geopolitically

Since China performs poorly in most of these respects, it’s understandable that China has been hit by the highest tariff rates so far. But other countries in Asia have also been hit by tariffs, including Vietnam Taiwan, South Korea and Japan. More on that later.

2. The impact on the United States

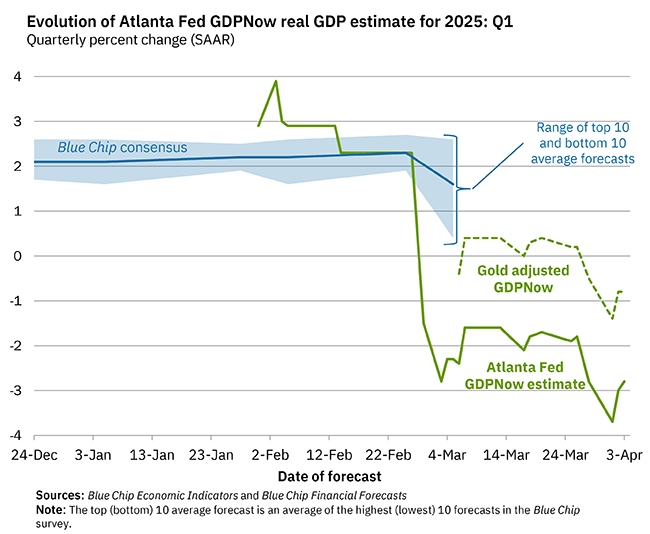

In his paper, Miran recommended a gradual implementation of tariffs, to allow economic actors to adjust their behaviors gradually. He suggested increasing tariffs by 2% per month until the ultimate targets had been reached.

However, Trump has taken a far more aggressive approach by imposing tariffs immediately, effective today 9 April 2025. This shock treatment is likely to lead to significant mark-ups on US imports from the early summer 2025 onwards, and reduced discretionary spending by US consumers.

Given that Atlanta Fed’s GDPNow model had already estimated a near-term recession back in February, it seems likely that the additional tariffs imposed this month is going to cause even more pain for the US consumer. The US economy might already be in a recession.

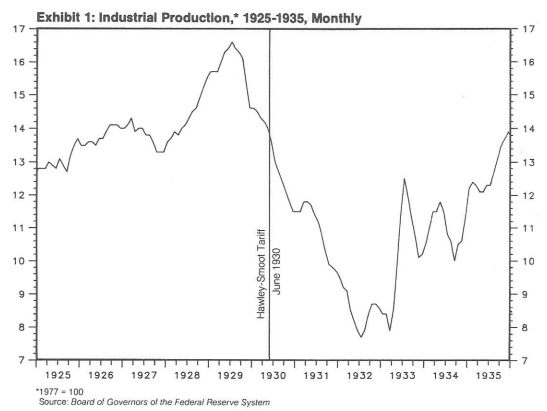

There are several precedents to what Trump is trying to achieve. When the Smoot-Hawley Tariff Act of 1930 was passed by the US Congress in June 1930, other countries retaliated with their own tariffs. Industrial production fell almost immediately and by 1933, US exports had dropped by over 60%. In economist Ed Yardeni’s view, Smoot-Hawley was the primary catalyst for the Great Depression.

I think that one would have to assume that with reduced discretionary household spending, a lower budget deficit, reduced immigration and delayed investments, economic growth will have to turn negative. Torsten Slok of Apollo said US layoffs could approach 1 million from the current tariffs alone. Since the Federal Reserve has a dual mandate to not only keep inflation low but also unemployment, it may become forced to act.

Another question mark is the fact that 40% of Chinese exports to the US are not actually sold to end customers. Instead, they’re intermediate goods sold to US manufacturers. As such, I believe that companies like Boeing will lose in competitiveness vs Airbus until it’s been able to rearrange its supply chain away from Asia to the United States. But that’s a process that could take years.

I also suspect that the consumer backlash will be massive. Consumers will see the cost of their iPhones going up 30% in one fell swoop. Meanwhile, the benefit of a longer-term reduction in payroll taxes will not be obvious to voters, so I suspect a Trump will eventually have to step back from his initial tariff rates. His tariffs might also be rolled by Congress, or by a new administration in 2029. But the near-term picture looks challenging.

3. The impact on Asia

The outlook does not look rosy for China, or its closest allies, either. US tariffs for most of Emerging Asia have ended up at 24-54%. The Philippines will be hit the least and China, Cambodia and Vietnam the most.

A confusing part of Miran’s paper is that he expects the US Dollar to strengthen initially thanks to reduced imports. But that sounds counterintuitive when he also wants to improve US competitiveness through a weaker currency.

I’m not sure I buy into his argument about a stronger US Dollar. When consumers purchase a product from China, money flows out. But thanks to FX sterilization, it then flows back into the US, enabling greater borrowing and bidding up prices for financial assets.

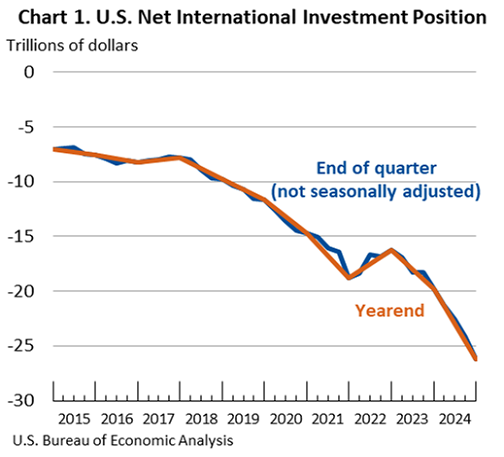

It’s also a fact that the net international investment position of the United States reached a record low in early 2024. In other words, foreigners have been buying US assets en masse, pushing up US equities and perhaps real estate prices, too.

If that money flows out, it will surely end up being negative for the US Dollar. Reduced economic growth, earnings downgrades could well hit equities, leading to a cycle of lower asset prices.

The US Dollar looks expensive on a real effective exchange rate basis. It’s probably been propped up by the recent enthusiasm for fast-growing US technology companies. If the US Dollar weakening cycle ever begins in earnest, then I would expect foreign equities to start outperforming, though not necessarily in Asia as a whole.

With the Trump administration intent on putting greater tariffs on the Russia-Iran-China league of nations, I think it would be foolish to bet on the resilience of their economies. I would personally much rather allocate capital to historical US allies such as Japan, the Philippines and Singapore, as they will be less likely to impose capital controls and more likely to support private sector entrepreneurship.

Donald Trump does not appear to be stable nor a genius, but if Trump’s thinking reflects the vision that Miran outlines in his paper, I think the rational approach would be to avoid the Russia-Iran-China axis of countries. Countries such as Japan and Taiwan are more likely to be able to negotiate down their tariff rates and have strong incentives to continue trading with the United States. I also think their countries have the potential to appreciate their current low levels. Currency appreciation would not be positive for exporters but certainly for companies selling services to the local population.

4. Five highlighted companies

The last few days have been complete carnage. East Asian markets such as Japan, South Korea and Taiwan are down about 10-14% year-to-date. Hang Seng and MSCI China are up year-to-date but have fallen off a cliff more recently.