Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is not a recommendation to buy or sell stocks.

Summary

- So far, I’ve avoided discussing Indian equities for one simple reason: few international investors can invest in stocks listed on the Bombay Stock Exchange.

- But there are more than a dozen Indian companies listed overseas.

- I spent two days researching these companies, determining which has sustainable competitive advantages or not.

- Out of 16 companies, I highlight five: HDFC Bank, Larsen & Toubro, Dr Reddy’s Laboratories, Infosys and MakeMyTrip.

- In my view, they all have competitive products and are likely to grow for the foreseeable future.

The post will follow the same format as my previous write-ups on “hidden champions” in Hong Kong, Singapore, Taiwan and China’s ADR market: to find companies that dominate their niches and compound capital at a high return on equity.

The topic of discussion will be Indian companies listed overseas, specifically in the United States (ADRs) or London (GDRs). This discussion should not be taken as investment advice - simply a discussion of what companies are doing well among this sample of overseas Indian businesses.

Table of contents:

1. A top-down view of Indian stocks

2. Screening for candidates

3. Hidden champions among India's ADRs/GDRs

4. Concluding remarks1. A top-down view of Indian stocks

I first came to India in the mid-2000s and spent half a year there as an exchange student. But in my subsequent career, I never had the opportunity to invest in Indian equities, and my knowledge remains woefully inadequate.

I want to remedy that situation by first digging into Indian depositary receipts listed in the United States and London. The interest in these stocks is high, given that they’re easily accessible through most trading platforms.

Most of you are aware of the Indian growth story, so that I won’t rehash those old narratives. But I want to share two charts that I think illustrate key realities of the Indian economy.

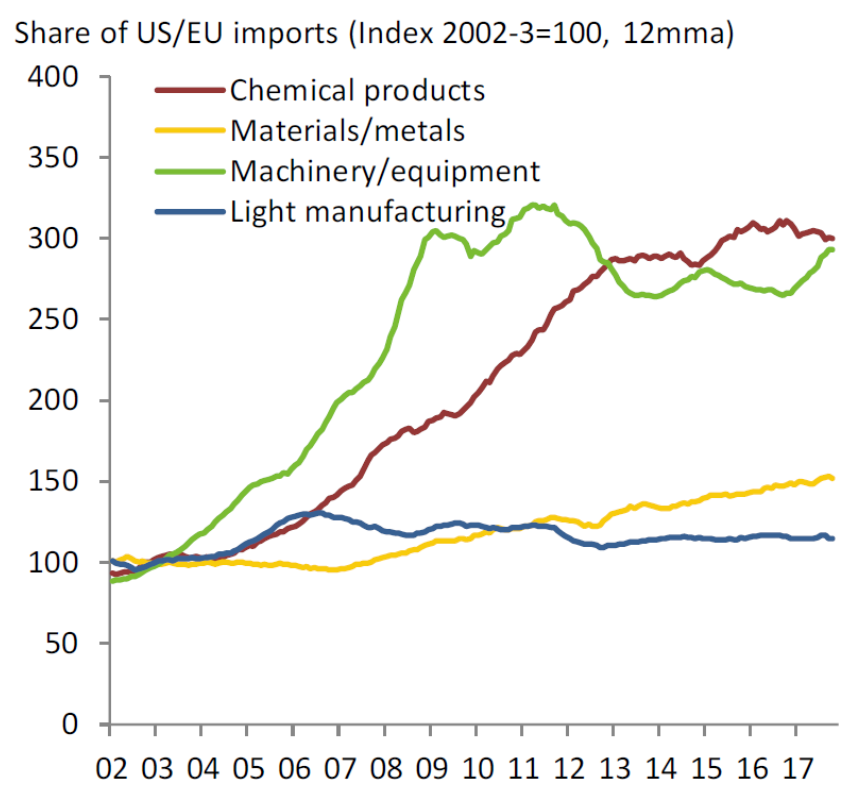

One chart is about India’s failed manufacturing sector. Rather than manufactured goods, the greatest success stories in the past two decades have been in service industries such as IT outsourcing, pharmaceuticals R&D, hospital tourism and so on. Meanwhile, India’s manufacturing sector has gone nowhere, as this chart from Emerging Advisors illustrates:

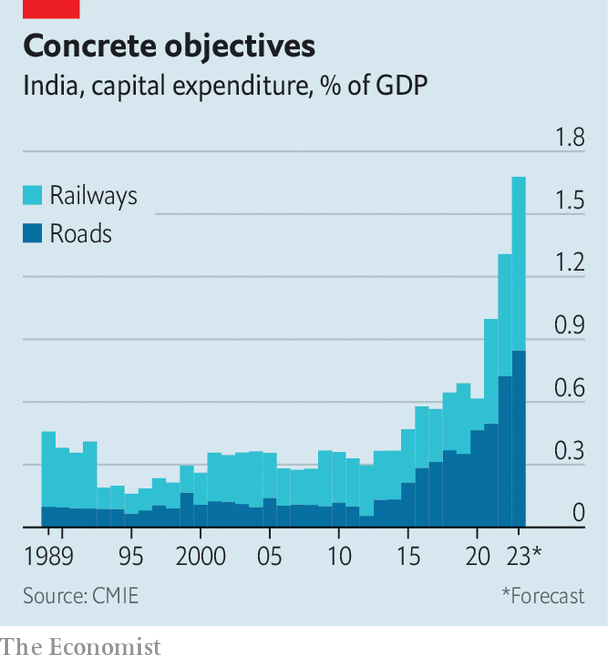

The second chart I want to draw attention to is this one on the explosion in investment in roads and railways over the past ten years.

This massive increase in infrastructure spending might be a game-changer for the export of manufactured goods, which remains the missing piece in India’s development puzzle. And there are now early signs of improvement, with Apple now making 5-7% of its products in India and targeting 25% soon. I would like to find companies that are benefitting from this trend.

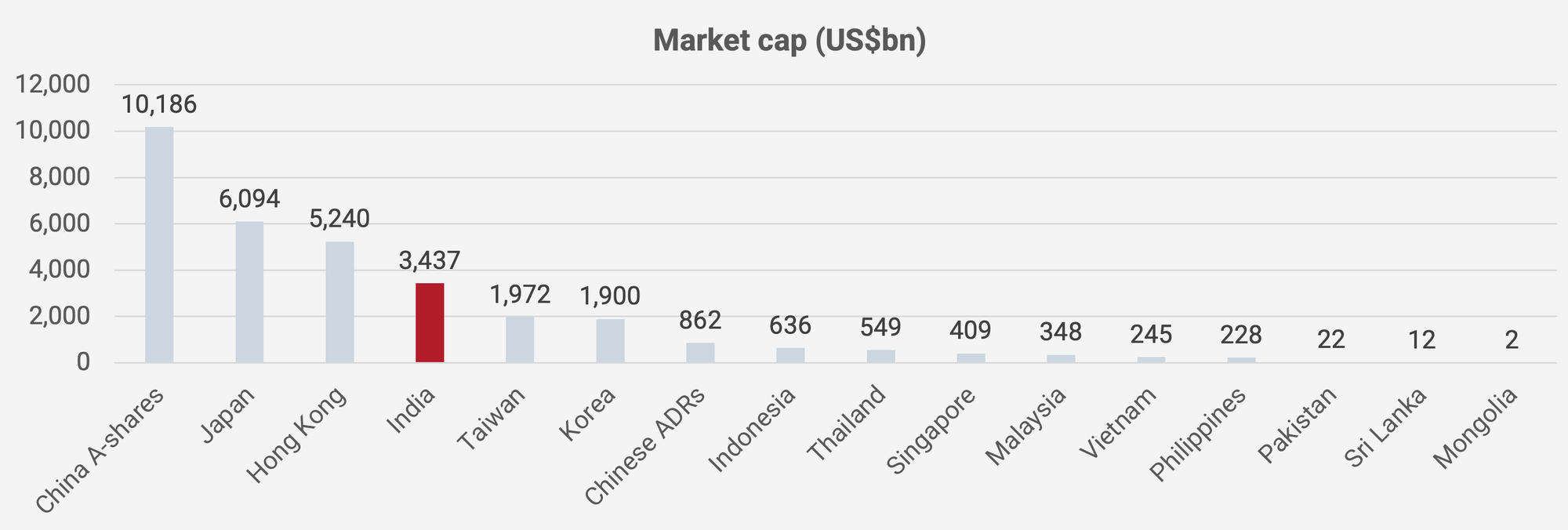

Regarding the stock market, there are over 5,000 stocks listed in India, though most of them with tiny market capitalisation. The domestic market ranks between Hong Kong and Taiwan.

In the past, it’s been illegal for Indian companies to list directly overseas. While that may change in the future, Indian companies continue to use depositary receipts to raise capital overseas, and the aggregate market cap of Indian American Depositary Receipts (ADRs) and Global Depositary Receipts (GDRs; typically listed in London) is now about US$660 billion.

A Dow Jones index with 15 Indian ADRs and GDRs has performed nicely over the past two decades, rising +11.6% per year in US Dollar terms.

Part of this increase is undoubtedly due to higher valuation multiples. The domestic stock index SENSEX now trades at a P/E ratio of 23.6x, making it one of the world’s most expensive markets other than the United States. India’s CAPE ratio is now 32x, much higher than the 20x level in the early 2010s.

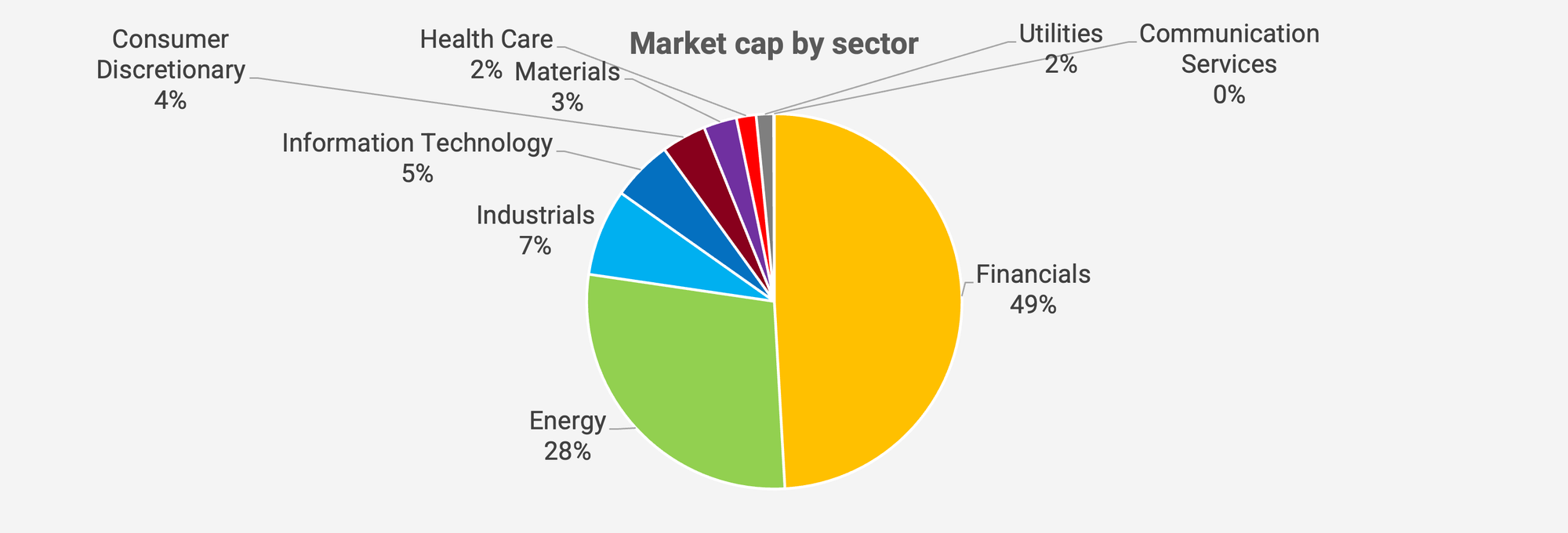

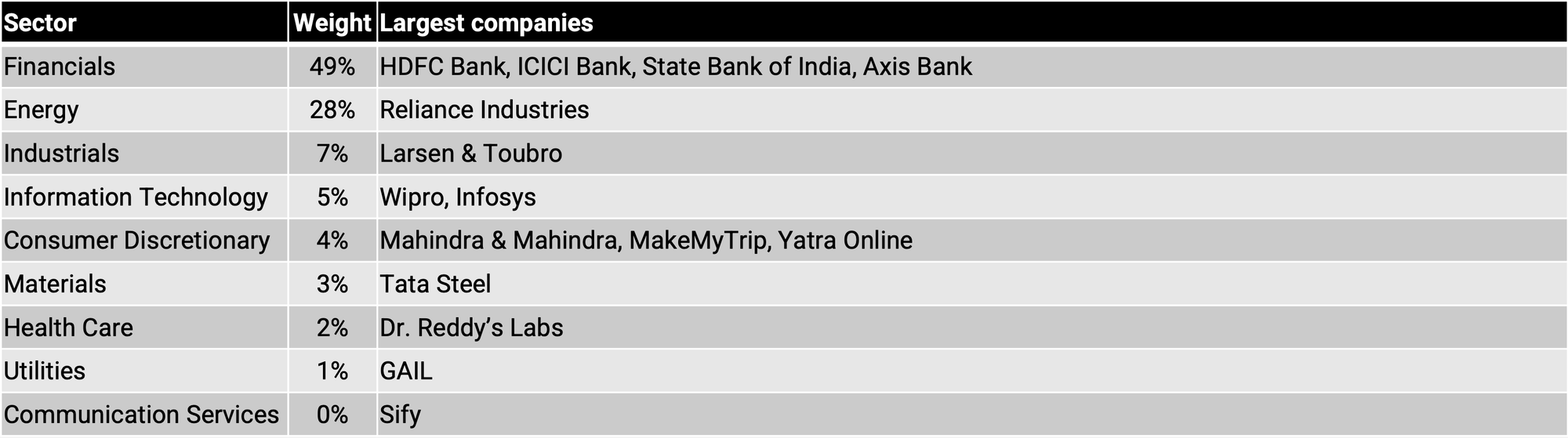

I found 16 depositary receipts of Indian companies traded actively in London and New York. Weighted by market cap, roughly half are financials such as HDFC Bank and ICICI Bank. Another 28% are in energy, specifically Reliance Industries. The rest include several tech businesses and industrials.

Some more details of what companies belong in each GICS sub-sector:

2. Screening for candidates

In any case, let’s now dig deeper into individual companies that exhibit “hidden champion” like characteristics, including:

- High historical average return on equity

- High growth in earnings per share

- Strong share price performance

The following ten companies score the highest in terms of historical return on equity: