Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is not a recommendation to buy or sell stocks.

Summary

- Taiwan is an independently governed island just off the coast of mainland China.

- Its economy is dynamic, with a large number of SMEs that compete successfully on a global scale.

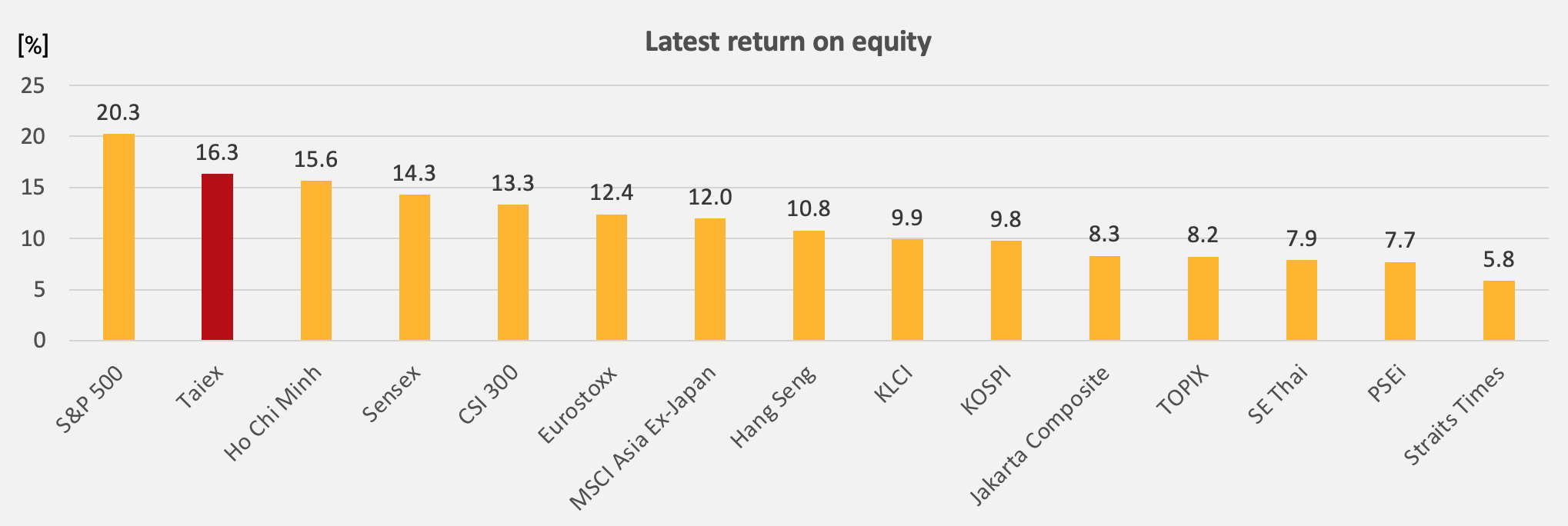

- The stock market has enjoyed strong performance over the past few decades and enjoys the highest return on equity of any market in Asia at 16%.

- There are currently 2,500 stocks listed in Taiwan. I’ve dug into this list and tried to identify so-called “hidden champions” of companies doing well.

- My list of 28 hidden champions includes semiconductor companies, display makers, Internet platforms, food & beverage companies, bicycle manufacturers and more.

Interactive Brokers has just enabled access to Taiwanese stocks for all its clients. So if you own an Interactive Brokers account, you can now trade Taiwanese stocks through Interactive Brokers’ partner firm, SinoPac Securities. It’s as easy as buying shares in the United States or Europe.

Since Interactive Brokers announced the news, I’ve seen a high interest among investors in Taiwanese equities. So I felt I should do my part and write a post about companies listed on the Taiwan Stock Exchange.

This post will follow the same format as my previous write-ups on “hidden champions” in Hong Kong, Singapore and China’s ADR market. The objective is to find companies that dominate their niches and compound capital at a high return on equity. More or less the type of companies that German management guru Hermann Simon called hidden champions.

I pay zero attention to price, so do not take the following discussion as investment advice. I’m simply trying to identify the most successful companies operating on the island of Taiwan.

Table of contents:

1. A top-down view of Taiwanese stocks

2. Screening for candidates

3. Hidden champions of Taiwan

4. Concluding remarks1. A top-down view of Taiwanese stocks

Taiwan is an island off the coast of mainland China with a population of 24 million people.

The island was originally inhabited by Austronesian tribes. During the Ming and Qing dynasties, the island came under Chinese control. It was then ceded to Japan after China’s defeat in the first Sino-Japanese War in 1895 and remained a Japanese colony until it was returned to the Republic of China (ROC) in 1945.

After a defeat by the Communists in 1949, the Republic of China’s leader Chiang Kai-Shek fled to Taiwan. It then became the only formerly Chinese province no longer controlled by the Chinese Communist Party. Under Chiang Kai-Shek’s authoritarian rule, the island enjoyed significant economic growth. And in the 1990s, it became a multi-party democracy and continues to thrive under the current system.

Whenever I mention Taiwanese equities, the first question I get is about the unresolved civil war between the Nationalists (Kuomintang or “KMT”) and the Communists (the CCP). Will Taiwan eventually come under the control of the CCP?

I personally think that’s likely. The CCP’s military arm is becoming more powerful each year, and it’s hell-bent on taking control of Taiwan.

But I’m sceptical that we’ll see an amphibious invasion with hundreds of thousands of casualties and destruction of property. There’s no need for a war. Much better to work the system from the inside by co-opting locals first. Perhaps a KMT win in the January 2024 election will help the CCP achieve its goal.

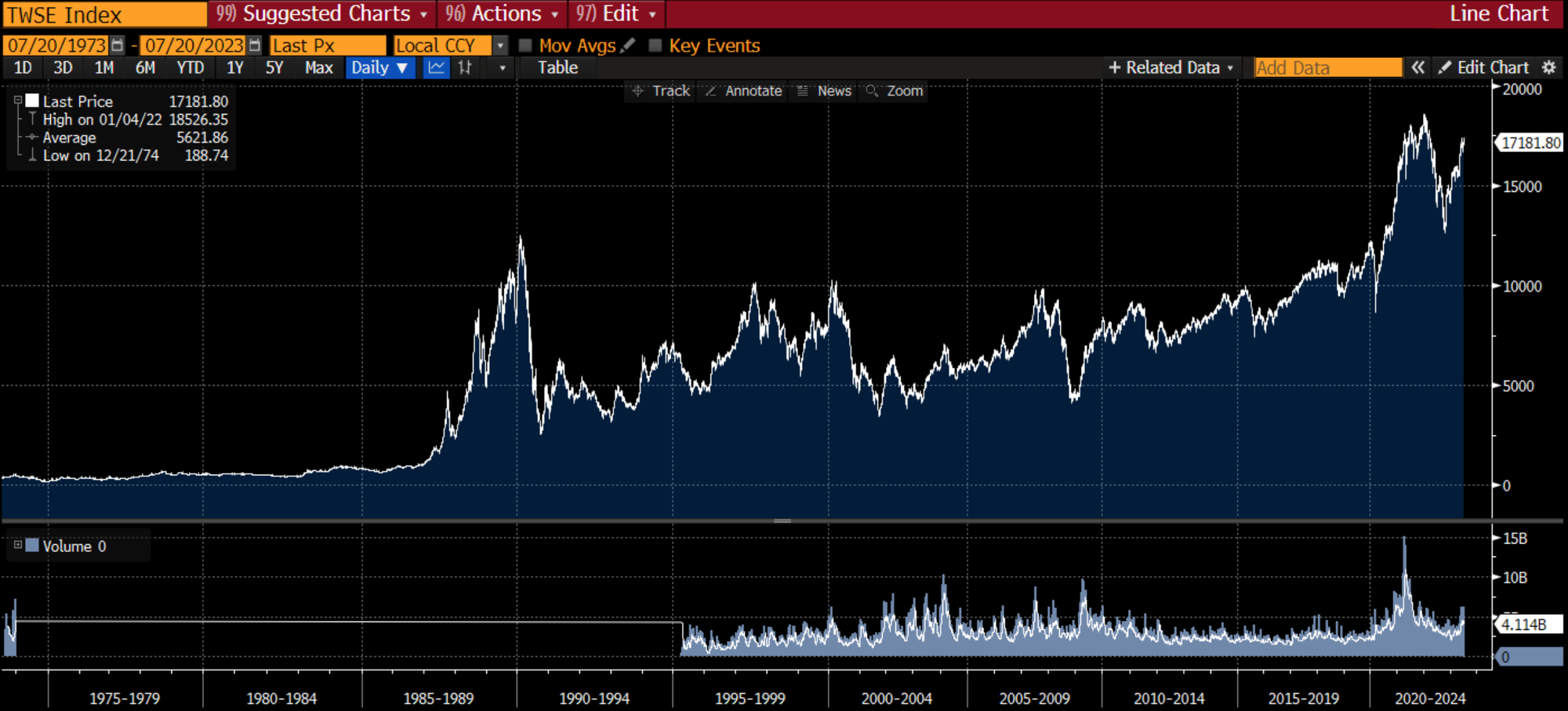

Let’s put that aside for now and dig deeper into the Taiwanese stock market. The market has existed since 1897 when Taiwan was a Japanese colony. In the 1980s, Taiwan enjoyed an incredible stock market bubble - a series of events I wrote about in this previous Substack post. In the 1990s, the Taipei Stock Exchange merged with the OTC Securities Exchange and was renamed the Taiwan Stock Exchange, with the new symbol TWSE.

Taiwan has a vibrant economy. The number of companies per capita is among the highest in the Asia-Pacific. Economic growth has been steady at around 3-4% per year. And Taiwanese businesses are doing very well, with Taiex earnings rising almost 15% per year in the past decade. Much of that increase is thanks to the rise of semiconductor juggernaut TSMC and its suppliers - but still.

But Taiwan is also the home of many smaller successful companies. For example, Taiwan hosts the largest wet suit manufacturer in the world, the largest snowboard maker in the world, and the largest producer of golf clubs. The list goes on.

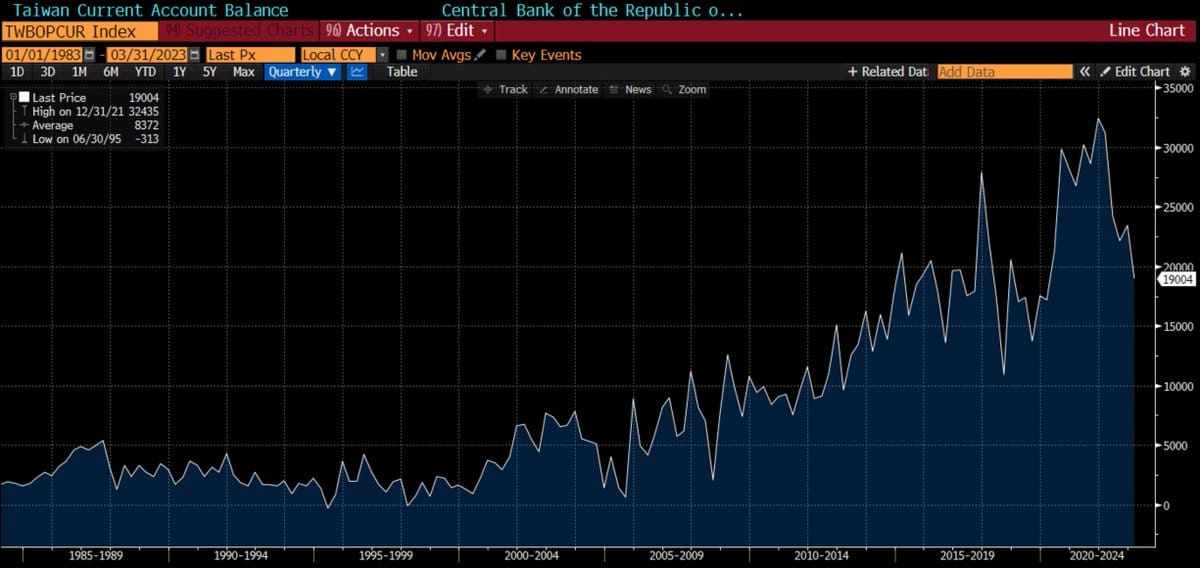

I think there’s also a case to be made that Taiwan’s currency is undervalued. Its real effective exchange rate remains far below its early 1990s highs. And Taiwan’s current account surplus keeps rising, putting upwards pressure on the exchange rate.

It’s also worth mentioning that former central bank governor Perng Fai-nan explicitly aimed to keep the currency cheap to promote exports. When he was replaced in 2018, the Taiwanese Dollar was finally allowed to appreciate.

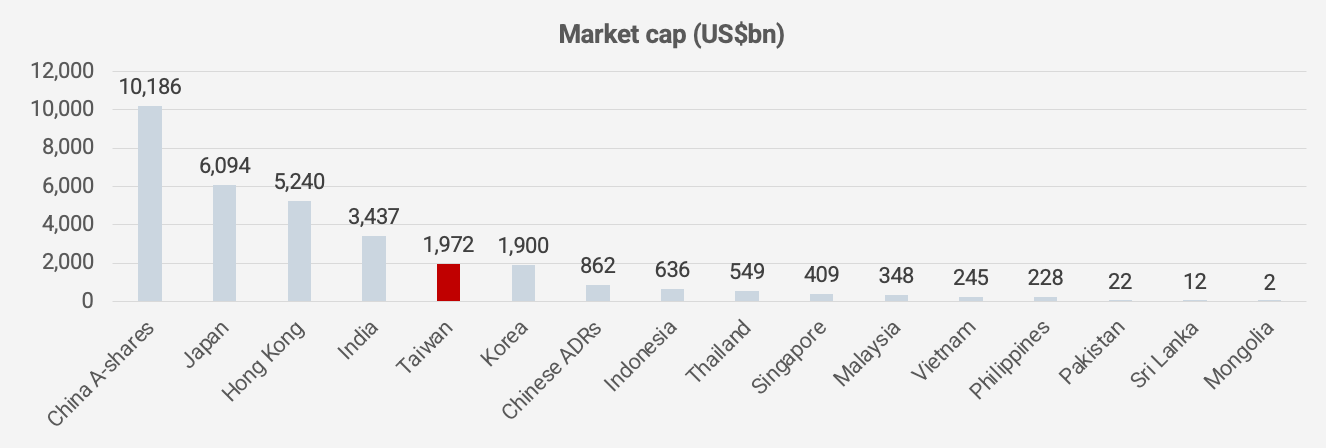

The Taiwanese stock market is highly liquid. The following chart from 2022 shows that stock market capitalisation was the fifth highest in Asia after markets in China, India and Japan. There are many stocks to choose from - even for funds with high requirements on daily trading volumes.

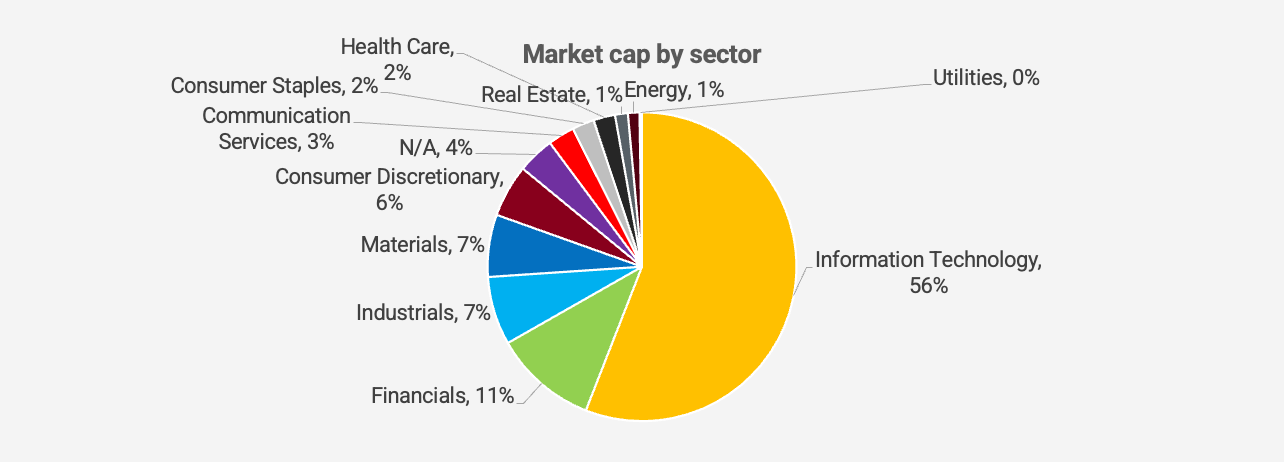

The most popular index is the Taiwan Taiex Index (TWSE Index). It’s a tech-heavy index weighted by market cap, with the largest constituents being TSMC (28%), Hon Hai, Mediatek, Delta Electronics And Chungwha Telecom.

The Taiex has performed well and is above its 1980s bubble highs. And it’s been driven by strong fundamentals (= higher earnings) rather than a multiple expansion.

Many of Taiwan’s hardware-centric tech companies benefitted from the COVID-19 tech boom, also known as the work-from-home bubble. Fundamentals have deteriorated more recently, with TSMC reporting negative revenue growth, DRAM prices slumping, and inventories building up in the PC supply chain. So I’m frankly surprised by the recent strength in the index.

Taiex now trades at a forward-looking P/E multiple of 14.6x, in line with the historical average of 14.7x. While that might seem high, remember that Taiex has the highest return on equity of any index in Asia. The market is the closest you can get to the S&P 500 in this part of the world - at least when it comes to return on equity.

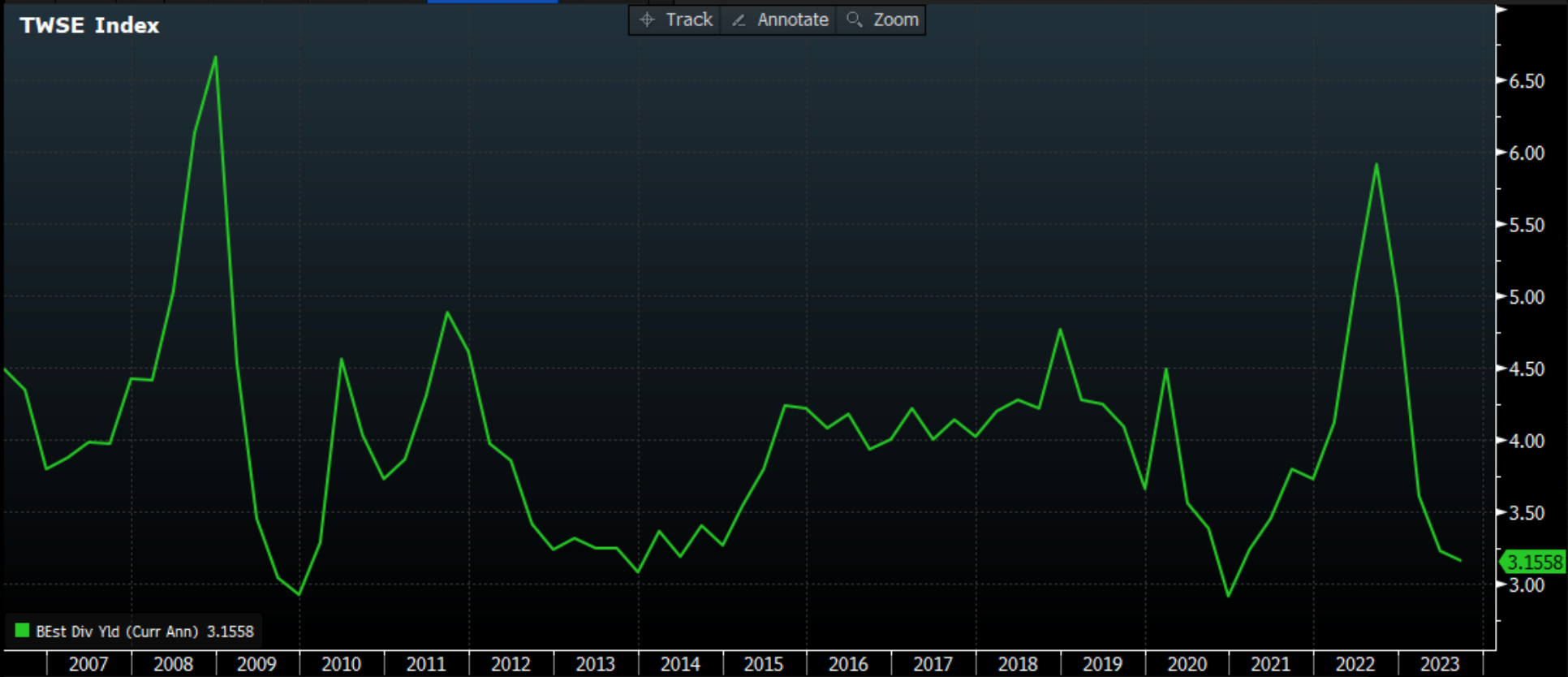

Taiwanese equities also offer surprisingly generous dividend yields. Historically, the dividend yield for Taiex has been around 4%. The primary reason for Taiwan’s high dividend payout ratio (~60%) is that retained earnings are subject to a 5% additional profit retention tax over and above the normal 20% corporate income tax rate. That means retained earnings are subject to an aggregate tax rate of 25% compared to just 20% for dividends. Individuals also enjoy dividend tax credits. Companies are incentivised to pay out high dividends.

Here is the sector split of all the 2,500 companies listed in Taiwan, weighted by market cap. As you can tell, it’s a tech-heavy market, with industrials, materials companies and consumer companies representing far smaller parts of the market capitalisation.

The largest companies in each of the above sector groups are the following:

That said, it is a difficult market for foreigners to understand. Most of the documentation is in traditional Chinese; analyst coverage is sparse outside the top names. But for those with access to management teams, English is usually sufficient. Companies are generally open to meeting investors, at least if you can get a local brokerage house to open the doors for you.

If you want to dig into individual companies, I recommend the following two reference books, best described as the Taiwanese version of America’s Moody’s manuals. They’re unfortunately only available in traditional Chinese. You can buy them on Shopee here.

2. Screening for candidates

Let’s now dig deeper into individual companies that exhibit “hidden champion” like characteristics, including:

- High historical average return on equity

- High growth in earnings per share

- Strong share price performance

The following ten companies score the highest in terms of historical return on equity: