Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is disclosure and not a recommendation to buy or sell.

Here’s another edition of my reviews of the key holdings of Asia-focused funds.

I will release new editions as I find more high-quality funds to track.

Summary

Given the recent strength in gold prices, it’s odd to see jewellery company Chow Sang Sang trade at just 6.4x P/E. Most likely related to China’s current COVID-19 restrictions and lack of tourism to Hong Kong.

Leading Korean online recruitment platform SaraminHR has fat profit margins and continues to grow, yet trades at just 10.1x P/E.

Uni-President Enterprises subsidiary Uni-President China, which sells ready-to-drink beverages and instant noodles, trades at only 14.4x P/E and 9.7x EV/EBIT on 2023e consensus numbers with a 7.3% dividend yield.

Thailand’s Bangkok Bank seems inexpensive at 8.3x P/E and 0.5x and may benefit from Thailand’s reopening.

Malaysian offshore oil & gas support vessel operator Coastal Contracts should benefit from rising oil & gas capex budgets.

I suspect that Japanese TiO2 producer Tayca Corp will benefit from the weaker Japanese Yen.

Fidelity Asian Values Fund

Fidelity Asian Values is a permanent capital vehicle trading on the London Stock Exchange. It’s run by Nitin Bajaj, a long-term Fidelity employee and previously with the famed Fidelity Global Special Situations Fund since 2013.

The fund is up 383% since its inception in 1996 in US Dollar terms or 6.3% per year. Since Bajaj took over the fund, it has risen 11.8% per year. Today, it has net assets of around GBP 360 million.

This interview here describes what Nitin Bajaj is looking for: small- and mid-sized, undervalued firms in Asia. In his own words:

“I never buy any stocks. I buy the business models that convince me of their potential”

The current portfolio is a good mix of Indian, Chinese and Southeast Asian companies. Bajaj doesn’t take great bets but instead diversifies broadly. As of November 2021, there were 178 positions in the fund, the top 10 being the following:

Arwana Citramulia is an Indonesian producer of ceramic construction material for flooring. It has an 18% market share in the Indonesian ceramic tile industry with an excellent distribution system. The company is well-managed and benefitting from the currently-improving property market. A new factory is being built in Mojokerto. The stock has doubled in the past two years and now trades at 12.8x current-year earnings.

Chow Sang Sang is the Hong Kong-based competitor to Chow Tai Fook that’s received a lot less attention in the investor community. Roughly 2/3 of its revenues come from mainland China and 1/3 from Hong Kong and Macau. Jewellery sales have been strong globally since the pandemic. But Chow Sang Sang has suffered from China’s and Hong Kong’s battle against COVID-19 with lockdowns in Hong Kong, Shanghai and elsewhere. The stock trades at P/E 6.4x current-year earnings, though be aware of near-term headwinds in Hong Kong’s lockdowns.

The fund’s position in Texwinca has gone up dramatically since 2020. The company is a Chinese textile producer exposed to spinning, knitting, dyeing and treatment (yarn to fabric). The industry has suffered from rising labour costs compared to Vietnam. Margins have dropped since 2017, and I’m not sure what could help Texwinca engineer a turnaround. The stock trades at 7.4x P/E.

Powertech Technology is semiconductor packaging and assembly of semiconductor chips. It’s focused on memory chips with facilities throughout China. The company will launch its next-generation advanced packaging products in 2023. The stock trades at P/E 7.9x and EV/EBIT 6.3x current-year earnings.

Taiwan Union Technology provides lamination services to PCB customers. The company has exposure to RF chips, which may or may not benefit from the move towards 5G phones or even autonomous vehicles. The stock trades at 8.1x P/E with a strong balance sheet.

I’ll skip commenting on the Indian stocks since few subscribers have access to the Indian market. Also, I have met Yongda a few times, but I could never get comfortable with the management team and the accounting.

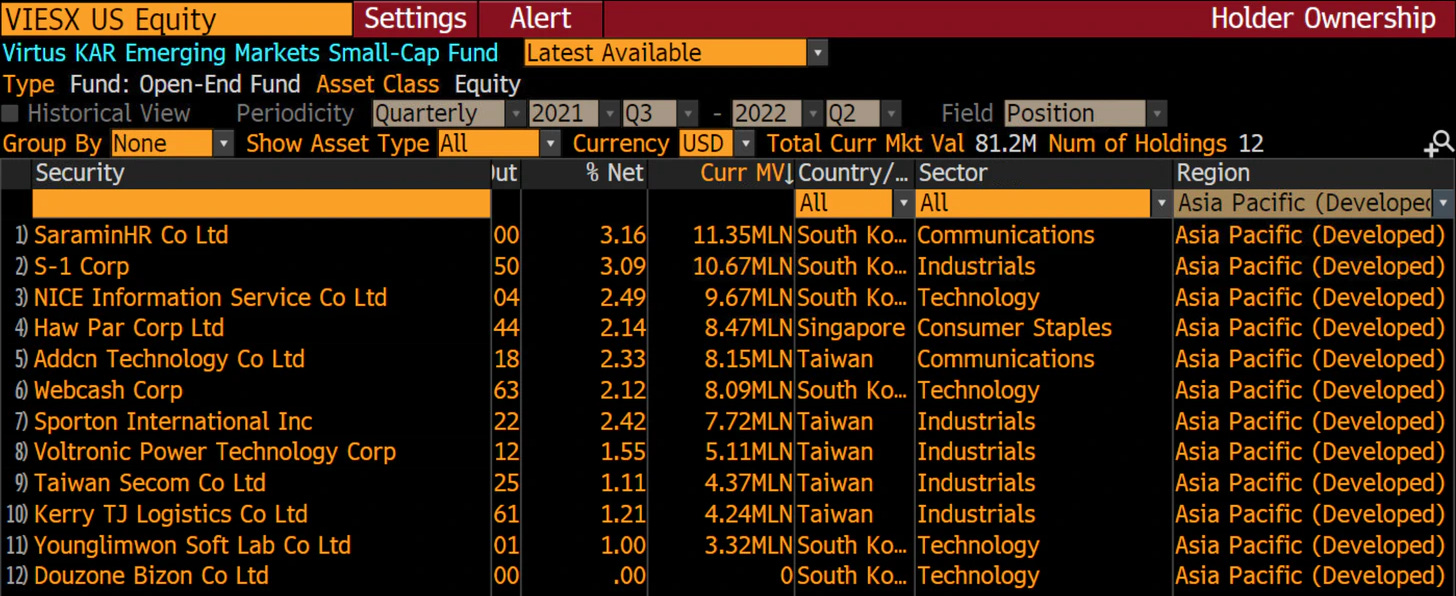

Virtus KAR Emerging Markets Small-Cap Fund

The Virtus KAR Emerging Markets Small-Cap Fund is run by Kayne Anderson Rudnick Investment Management, an affiliate of Virtus Investment Partners. The two portfolio managers for the fund are Craig Thrasher and Korean Hyung Kim.

The fund is up roughly 72% since its inception in 2013, or 6.7% per year. From my understanding, the fund’s AUM is about US$360 million.

What attracts me about the fund is its heavy exposure to Korean equities - unusual among emerging market value funds.

The fund’s developed Asia holdings are as follows:

And the fund’s emerging Asia holdings are as follows:

Kaspi is an institutional favourite, a Kazakhstan fintech business connected to a local commercial bank. It was written up on Value Investors Club in early 2021 here. The stock has become collateral damage after the war in Ukraine, causing some to believe that Putin does not recognise Kazakhstan’s independence.

Anhui Gujing is an unusual stock among active managers in Asia. It’s a B-share denominated in Hong Kong Dollars that trades at a 44% discount to its equivalent A-share. The company produces baijiu, a market that’s become hot for reasons I don’t fully understand. The stock trades at a P/E ratio of 14.8x and EV/EBIT 18.3x.

SaraminHR runs Korea’s largest online recruitment platform. It also has a headhunting arm, helping companies find suitable employees. It has close to 30% operating margins and continues to grow. The stock trades at 10.1x P/E and 8.9x EV/EBIT on current-year earnings.

S-1 Corp is a security system company affiliated with the Samsung Group, with a business model to Japan’s Secom and America’s ADT. It installs alarms for customers and dispatches its personnel if an alarm goes off. They have 5-6 year contracts with very low churn. The downside is that it has customer concentration, with 37% of revenues from companies within the Samsung group. The stock trades at a 15.4x P/E and 9.4x EV/EBIT on current-year earnings.

NICE Information Services is South Korea’s leader in credit scoring services, similar to FICO in the United States. They also have a debt collection arm and provide advanced credit analytics to clients and a new subsidiary in Vietnam. The stock trades at a P/E ratio of 17.9x and EV/EBIT of 11.9x on current-year earnings. I’m surprised the fund didn’t invest in parent Nice Holdings instead, which trades at a discount to its sum-of-the-parts valuation.

Heineken Malaysia and Carlsberg Malaysia are Malaysian subsidiaries of their namesakes. Strong companies with pricing power but hard to see how they would be undervalued at mid-20s P/E.

I’ve discussed the Singaporean family holding company Haw Par Corporation before in this prior write-up here. The company owns the valuable Tiger Balm franchise and almost half a billion of cash and stakes in UOB and UOL. A sum of the parts valuation gives you a value per share close to SG$17 per share. It remains unclear whether the family will ever realise the values on the balance sheet.

Sarana Menara is an Indonesian tower company with a Western-educated management team. It’s been previously written up on Value Investors Club here. Supply in the industry has historically been restricted due to difficulties in acquiring land. The shift to 5G might plausibly increase tower density in Indonesia. The stock trades at a P/E of 13.6x and an EV/EBIT of 10.0x.

AddCN has also been discussed on Value Investors Club here. It’s a Taiwanese online classifieds platform. It operates online platforms for jobs, used cars and property, and a C2C marketplace for virtual items in games. The company has recently sold off its loss-making e-commerce business. The stock trades at 15.9x P/E and 12.8x EV/EBIT on current-year earnings.

Webcash is a Korean enterprise management software company with solid margins and low-teens top-line growth. Its products include cash management software for financial institutions. The stock trades at 14.3x current-year P/E.

Scottish Oriental Smaller Companies Trust

The Scottish Oriental Smaller Companies Trust is also structured as a permanent capital vehicle, enabling it to hold illiquid assets without the fear of redemptions. It has a total AUM of GBP 346 million and is listed on the London Stock Exchange.

The fund has a lot of history, with the team being formed by Angus Tulloch in 1988, then at Stewart Ivory. I wrote a profile of Angus Tulloch here. The fund was launched in 1995 and is up +1,279% since inception in 1995 in US Dollar terms, or +10.2% per year.

The Commonwealth Bank of Australia acquired Stewart Ivory in 2000. The team eventually split up, with the Edinburgh team returning to Stewart Ivory and the Hong Kong team rebranding to FSSA Investment Managers.

Today, the fund is co-managed by FSSA portfolio managers Martin Lau and Vinay Agarwal out of Hong Kong and Singapore. The mandate is to invest in Asian equities with market caps below US$1 billion at the time of investment. The fund can invest in India but not Japan or Australia.

Here are the fund’s largest positions at the moment. Information about the fund’s largest positions can be found in their annual 2021 update here.

I will skip discussing their Indian holdings since I know that few Asian Century Stocks subscribers have broker access to the Indian market.

Mitra Adiperkasa is the parent company of sportswear retailer MAP Aktif, which I’ve discussed here. Other than sportswear, MAPI also owns department stores under the SOGO and Marks & Spencer brands. It’s also the Indonesian partner of the American coffee chain Starbucks. Like its sportswear retailer subsidiary MAP Aktif, it’s suffered from Indonesia’s COVID-19 restrictions, but there seems to be light at the end of the tunnel. 2023e consensus P/E is 14.0x and EV/EBIT 8.9x.

Selamat Sempurna is an Indonesian auto supplier selling filters under the “Sakura” brand name. It also sells radiators under the “ADR” brand name. Its key partnerships are with US company Donaldson and Japan’s Tokyo Radiator. It has significant exposure to the heavy equipment market and sells its products overseas, with only 1/3 of its revenues domestic. The current-year P/E ratio is 13.3x.

Uni-President China is a mainland Chinese subsidiary of Taiwanese food conglomerate Uni-President Enterprises. The company sells ready-to-drink teas, ready-to-drink milk coffees, juice drinks and instant noodles. The current-year P/E ratio is 16.2x and EV/EBIT 11.0x. It also provides a decent dividend yield of 7.2%.

Philippine Seven is the operator of 7-Eleven convenience stores in the Philippines. It acquired the license to operate 7-Eleven stores in the country in 1984 and retains that privilege. Today, the company operates almost 3,000 stores, half of which are franchise stores and the remaining company-owned. The stock is highly valued at 38.7x full-recovery (2019) profit.

Jardine Matheson's subsidiary Hero Supermarket runs supermarkets in Indonesia under the Giant brand name. However, its hypermarkets have been loss-making, and it’s now decided to shut them down instead of focusing on its smaller supermarkets, its pharmacies, and its IKEA stores. The company is still loss-making, and the P/B is 8.0x and EV/Revenue 3.1x.

Century Pacific Food is a Philippine packaged foods producer. The company is a leader in canned foods, including canned tuna, where it has an 81% market share. But it’s also entering into new markets such as pet foods and dairy products. The stock trades at a current-year P/E multiple of 15.7x and an EV/EBIT of 13.2x.

Redwheel Next Generation EM Equity Fund

Redwheel is a UK-based diversified asset manager. They run several funds, many of which have an EM, Japan or China focus.

The Next Generation EM Equity Fund is run by former Everest Capital PM James Johnstone and co-PM / analyst Victor Erch. It remains small at below US$70 million.

The fund is up roughly +110% since inception in September 2020, or 64% annualised.

The portfolio is unusual, with a heavy tilt toward ASEAN markets and a clear focus on value.

Indonesian shopping mall operator Pakuwon has been discussed previously here. It focuses on mixed developments: shopping malls with integrated condo properties, offices and hotels. Rental income makes up roughly 50% of the total revenues. Their malls are among the best I’ve seen in Indonesia. They also develop residential properties in Surabaya, a city where coal mining wealth tends to end up. The company has been hurt by COVID-19 but is now on a clear recovery path. The 2023e full-recovery P/E multiple is 13.0x and EV/EBIT 10.7x - high for a developer but low for a shopping mall owner.

Kazatomprom is the world’s largest uranium miner, representing roughly 20% of the global supply. It’s a low-cost producer, owning 9/11 lowest-cost mines in the world. The corporate structure is complex, with significant minority interests. Uranium prices tend to move in long-term cycles since the lead time for new supply is measured in years, and demand is not price sensitive. The uranium price is now at a 10-year high. Kazatomprom’s share price has fallen year-to-date due to the war in Ukraine and Putin’s comments questioning Kazakhstan’s independence. There’s also the risk of US sanctions against Russian uranium exports, making it difficult for Kazatomprom to export uranium via St Petersburg. There is a 2019 VIC write-up on the stock here. The stock trades at a current-year P/E of 13.1x.

Ayala Corp is the largest conglomerate in the Philippines. It’s most known for developing the Makati CBD area. The main subsidiaries include developer Ayala Land, Bank of the Philippine Islands, Globe Telecom, Manila Water, power company AC Energy and automotive supplier AC Industrials. Ayala was recently in the news after President Duterte threatened to jail its chairman Jaime Augusto Zobel de Ayala. The stock trades at current-year P/E 16.1x and EV/EBIT 17.3x.

Bangkok Bank is Thailand’s third-largest bank, founded by famed entrepreneur Chin Sophonpanich. Today, the bank has 1,150 branches throughout Thailand and 25,000 employees. It has a strong deposit franchise among corporate customers but lags in online banking. The stock has been down significantly since 2019, presumably due to the risk of higher credit losses. There is a case to be made that Thai banks will recover from the reopening of the economy, as argued here by bank analyst Daniel Tabbush. Bangkok Bank trades at a current-year P/E of 8.3x.

Sri Trang Agro-Industry (“STA”) produces rubber for car tires and medical rubber gloves. The medical glove business has done well during the pandemic, but the supply & demand situation has deteriorated with ASPs and utilisation rates dropping. The company has benefitted from the weak baht, which could be a curse if a rebound in tourism causes the baht to strengthen. The stock trades at 2023e consensus P/E of 6.0x and EV/EBIT of 7.0x. The enterprise value remains almost twice as high as in 2019.

BDO Unibank is the Philippines biggest bank, with an extensive branch network. Provisioning for credit losses has risen during the pandemic but may eventually normalise. The CET-1 ratio is somewhat weaker than other Philippine banks, and the ROE has historically only reached 11-14%. The stock trades at a current-year P/E of 11.9x and P/B of 1.2x.

Halyk Savings Bank is Kazakhstan’s largest commercial and previously a local affiliate of Russia’s Sberbank. The stock is down over 40% since the war in Ukraine, and Halyk now trades at P/E 3.4x and P/B 0.74x on current-year numbers. The Kazakhstan Tenge continues to trade at a low real effective exchange rate. But the political risks are high. There is a recent VIC write-up on the stock here.

Robinson Land is a Philippine real estate developer focusing on shopping malls, hotels and residential developments. It currently has 52 malls in the country and 22 office properties. The residential properties are sold under the Communities and Robinson Homes brands. It’s similar to Pakuwon in its significant exposure to recurring revenue. The Philippines is far ahead of other Asian nations in its recovery from COVID-19. The current-year P/E is 12.9x and EV/EBIT 11.6x.

Bank Rakyat Indonesia is a state-controlled commercial bank in Indonesia. It has a massive presence throughout the country with over 10,000 branches. It also has exposure to microfinance, which partly explains its fat net interest margins that have enabled the stock to compound capital rapidly. The current-year P/E is 16.0x.

Vincom Retail is a Hanoi-based shopping mall operator that’s part of the Vin group. It has a 60% market share in modern retail in Vietnam under the Vincom Center, Vincom Mega Mall, Vincom Plaza and Vincom+ brand names. The country has recently relaxed its COVID-19 restrictions. The stock does not appear cheap at first glance at 25x 2019 (full-recovery) earnings, but the stock has always traded at high levels.

Samarang - Asian Prosperity Fund

Samarang Asset Management’s Asian Prosperity Fund is another value fund that’s not particularly well known. Samarang is run out of London and manages around US$212 million. The Asian Prosperity Fund is structured as a Luxembourg UCITS fund.

The fund’s portfolio manager is Greg Fisher, who started the fund in 2012 with the stated mandate to invest in the rise of the Asian middle class. Fisher was previously at Morgan Greenfell / Deutsche Bank. Since its inception in 2012, the Samarang Asian Prosperity Fund is up 112% in US Dollar terms, or 8.4% per year.

The portfolio is unusual, with significant exposure to Vietnam and Japan. No index hugging whatsoever.

Vinh Son - Song Hinh Hydropower is a Vietnamese hydropower plant operator. It was formed as a merger between the Vinh Son plant and the Song Hinh plant in 2000 in two southern coastal provinces of Vietnam. The new Thuong Kon Tum power plant started operating in 2021, increasing capacity significantly from 133 MW to 353 MW. Broker BIDV has a 2022e forward P/E of 11.5x for the stock.

Pha Lai Thermal Power is a Vietnamese operator of coal-fired power plants. Electricity demand is growing, especially in the Northern industrial parks where many of Pha Lai’s power plants are located. It has historically paid out 100% of net profit as dividends. Near-term headwinds include a rising coal price and technical issues at the Pha Lai 2 power plant. Consensus 2023 P/E is 9.0x with an 11.1% dividend yield.

Coastal Contracts is a Malaysian offshore oil & gas service company. It owns various support vessels for offshore oil rigs, including platform support vessels. Coastal is a contractor of Malaysia’s national oil company Petronas. Insider buying in March, even though the share price has rebounded strongly. The current-year P/E is 9.7x and EV/EBIT 5.2x.

Tayca Corp is a Japanese producer of titanium oxide, which provides colours for autos, household products, cosmetics and ink. TiO2 prices in foreign currency terms have stayed more or less flat. But the Japanese Yen has depreciated, and margins should, in theory, benefit. The stock trades at a trailing P/E of 9.3x and EV/EBIT of 6.7x.

Nippon Pillar Packing produces industrial-type mechanical seals (preventing leakage) and fluororesin fittings for semiconductor chips. Demand seems to be driven by semiconductor chip volumes. The current-year P/E is 8.6x and EV/EBIT 5.0x.

PetroVietnam Nhon Trach 2 Power (NT2) is a thermal power plant in the Dong Nai province, close to Ho Chi Minh City. The plant is run on gas and has a total output of 750MW. The electricity is sold to EVN at high fixed prices and the rest to the market. Power shortages are severe in Vietnam’s South, and NT2 doesn’t have much competition in the Dong Nai province, though that could change. The near-term P/E is 13.3x and EV/EBIT 12.1x.

Sun Frontier Fudousan operates a Japanese property business. It specialises in buying small to mid-sized office buildings with low occupancy rates and doing renovation work to improve the property value. The average period from investment to exit is seven months with close to 20% ROE historically. The company also operates as a real estate brokerage business. There have been dilutive equity offerings in the past. The current-year P/E is 6.7x and EV/EBIT 5.5x.

Tosei is a mid-sized developer of residential and commercial property. Like Sun Frontier Fudousan, it also buys older office buildings and renovates them. Tosei Corporation manages REITs, including the Argo Fund, listed on the Tokyo Stock Exchange. The stock trades at a current-year P/E of 6.4x and EV/EBIT of 10.1x.

Dong Phu Rubber sells latex from the company’s rubber plantation in Vietnam. It also sells rubber trees. Since the pandemic, rubber and latex prices have gone up significantly, and Dong Phu is a prime beneficiary. The current-year P/E is 12.3x and EV/EBIT 8.3x against elevated earnings.

Chin Well Holdings is a Malaysian company producing screws, nuts, bolts and other fastening products. Earnings were temporarily weak during COVID-19, but the stock is already pricing in a full recovery. The stock trades at P/E 7.2x and EV/EBIT 5.5x.

You can expect at least 1-2 future Asian Century Stocks write-ups from the above sample of stocks.

I guess Sri Trang Agro-Industry could benefit from the current ESG trend.

Interisting to look closer.

Not sure if it is a thing for them, but there are many chemical companies looking for petrochemical substitutes, and natural rubber may qualify. I also dont know if this works on the glove industry.