Table of Contents

Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is not a recommendation to buy or sell stocks.

Today, we’ll be talking to financial Afiq Isa. I know Afiq from Twitter, where he writes about Malaysian equities as well as broader trends in the Asia-Pacific.

Interest in Malaysia has picked up after Interactive Brokers announced they would offer full trading access to all of its clients.

I therefore reached out to Afiq to hear his view on Malaysian equities. Where does he see opportunities? And what are the key themes on his mind currently?

1. Hi Afiq! Thanks for participating. Can you tell us about yourself and your background? And what do you focus on today?

I’m a private investor and trader with more than a decade’s professional experience covering markets in Malaysia, Hong Kong, and Southeast Asia in various capacities. I mainly trade equities and derivatives with a short-to-medium term timeline.

I had a brief stint in stockbroking before becoming a financial journalist at The Edge, Malaysia’s leading business weekly, and then at The Star, the country’s largest newspaper. I then spent some time in Hong Kong writing on bank risk management and Basel regulatory frameworks that were impacting global financial institutions with a large presence in Asia. I returned to Malaysia to work for the regional investment banking arm of Malayan Banking Bhd, the country’s largest bank, before setting off to develop and trade my own ideas.

My current focus is on identifying tradeable and investable trends in industries that are undergoing structural shifts. For most of Southeast Asia, it’s manufacturing and services – with a special focus on aviation, utilities, healthcare and tourism in a post pandemic context.

2. For readers unfamiliar with the Malaysian market, how would you characterize it in terms of the market cap composition, sector focus, growth potential, etc?

Malaysia is an export oriented economy with a diverse manufacturing base. It’s the only net oil exporter in Southeast Asia, and the second biggest crude palm oil exporter in the world. You may also have heard about how the ‘Big 4’ glove makers had a once-in-a-generation thousand percent rally at the onset of Covid, though in recent years Chinese upstarts are eroding their once dominant market positioning.

The Malaysian stock market reflects this diversity, with most of the major players in these sectors being listed entities. The majority have market capitalizations of US$1 billion or less, at least until recently, which made them a favourite for retail investors and small/mid cap oriented growth funds. Newly emergent catalysts and greater confidence in the country’s economic prospects have triggered a broad based rally in the stock market in 2024. The benchmark FBMKLCI index is up +14% this year and has heavy weightage on financials.

As proxies to the economy, it is no surprise that the banks are catching the attention of fund managers who are previously underweight on EMs.

Property, construction, and utility stocks have been especially strong too, with some of them recording double to triple-digit percentage rallies over the past year. The prominence of new data center projects in Malaysia are relevant to all three sectors, whose valuations have re-rated in recognition of their earnings growth potential.

Aside from data centers, the promise of greater connectivity between Singapore and Johor via the upcoming RTS Link have driven up property and land prices in the southern state.

In other parts of Malaysia, particularly the northern industrial hubs, mainland China companies are reportedly setting up joint ventures to manufacture and export products made in Malaysia, as the threat of harsher US sanctions on mainland made goods loom large.

At the same time, the country benefits from the ‘China plus one’ concept with foreign companies diversifying away from China to set up base in friendly Southeast Asia geographies.

3. What do you think are the biggest issues facing Malaysia today? And to what extent do you think Prime Minister Anwar Ibrahim is well-placed to deal with them?

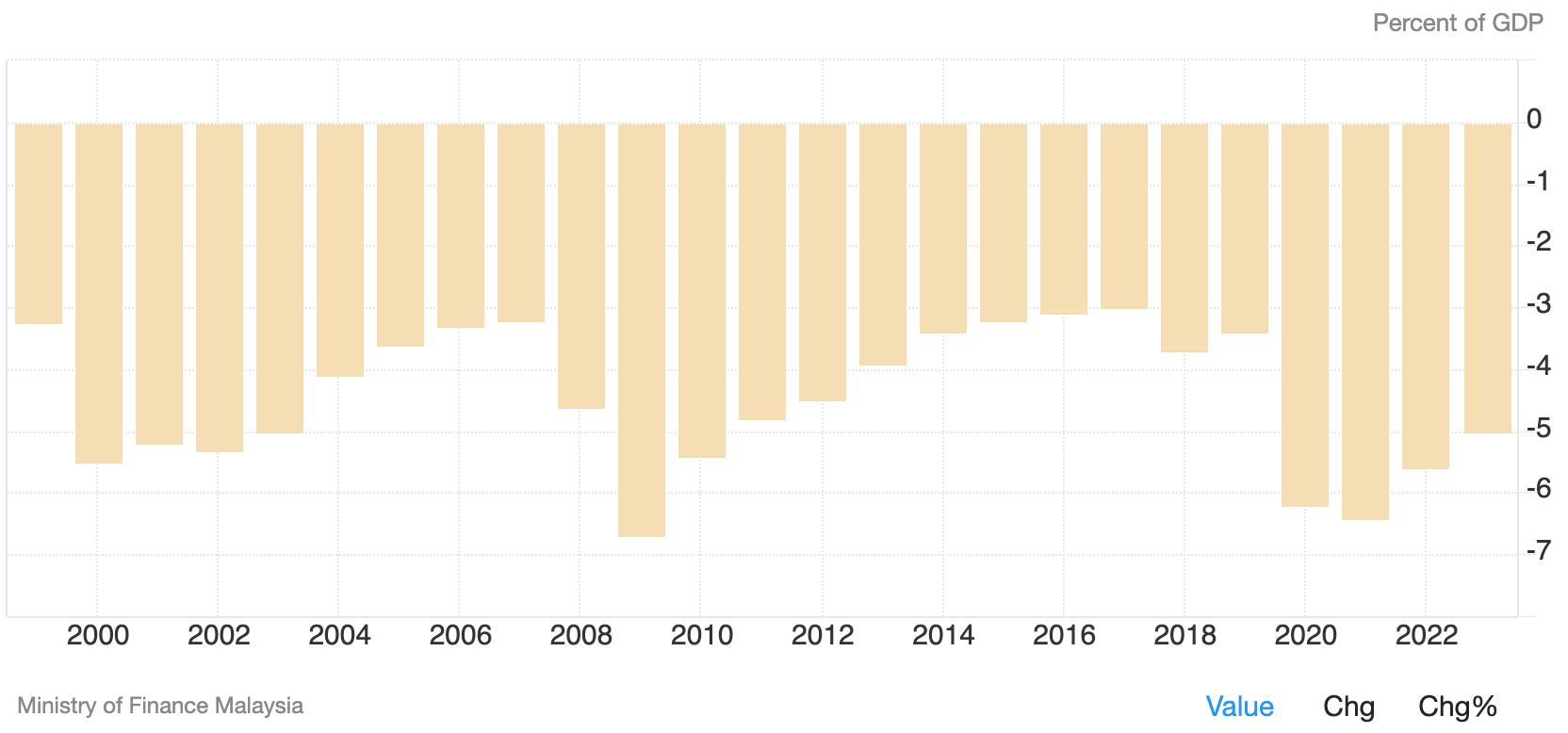

Narrowing the fiscal deficit is a must as the country has been grappling with a subsidy burden for fuel, electricity, and food that costs it nearly US$18 billion annually. It all comes down to decreasing government expenditure and increasing revenues, as well as possessing the commitment to stay the course.

Malaysia still has a low tax base of only 11% of GDP, hence there have been rumours of the return of a broad based goods and services tax (GST) to boost the nation’s coffers.

The recent liberalization of diesel prices this year was a good start, but a lifting of blanket subsidies on petrol stokes fears of inflation, aside from it being a politically sensitive matter for the ruling government.

Ultimately, the intended shift from broad based to targeted subsidies towards lower income groups will save the country tens of billions of dollars in the long run.

The Prime Minister has been making bold moves to rectify the government’s finances as well as undertaking an uncompromising push to tackle systemic corruption.

After two years in power, he remains popular among Malaysians who are keen to see real change after the disappointments of the Najib Razak era (which culminated in the 1MDB scandal), and the successive government collapses that occurred during the Covid years.

4. The Malaysian currency, the Ringgit, has been incredibly strong recently. Do you know why, and do you expect the trend to continue?

The central bank had been encouraging companies with overseas cash holdings to repatriate their income back to Malaysia for conversion into the ringgit.

Beyond this, the expectation of the Fed rate cuts has driven emerging market currencies higher, and the ringgit is no exception. Its outperformance may be due to greater foreign capital inflows – but this time with the intent of staying onshore for longer.

August 2024 saw the highest monthly inflows into equities by foreign investors in more than two years. A strong ringgit may also attract more flows into local sovereign notes, which is already a regional outperformer.

Confidence in both public and private sector initiatives is key. Microsoft, Alphabet, Amazon, ByteDance, and Japan’s NTT Data Group have announced major infrastructure spending in Malaysia this year totalling billions of dollars.

Favourable policies and tax breaks are bound to attract greater FDIs here. Stable politics and lack of geopolitical minefields also put Malaysia in a more favourable position to Thailand or the Philippines right now, inflows wise.

I expect to see the ringgit strengthen over the long term should these tailwinds persist.

5. What’s your strategy when it comes to your own portfolio? Where do you see value currently within the Malaysian equity markets and what are your favorite themes?

Like many Malaysians, I have significant investments in local equity funds that basically track the performance of the FBMKLCI as domestic institutional investors are major shareholders in the big cap names.

Separately, I currently focus on volatility trading strategies in Malaysian equities, crude palm oil and other vegetable oil futures. From time to time I’d also build countertrend positions in Hong Kong or Japanese equity index exposures if these markets make significant price moves.

For the most part I track assets that are exhibiting extreme volatility, either due to macro factors or corporate announcements. Mean reversion and multi year breakouts are my main hunting grounds, and the relationship between news and prices has been my professional focus since my journalism days.

In past years I used to be a very active momentum trader with high turnover, but nowadays I find more attractive opportunities in buying into extreme weakness, or selling into extreme strength.

These types of opportunities do not come by very often, so I’m learning to sit tight and wait for a good setup.

6. Malaysian crude palm oil prices have been rising recently. What do you think is the reason for this? Do you have a view on the supply & demand outlook for palm oil, and which companies are better-placed than others?

The major positive trend is India. It has taken up the slack from China and has become the world’s biggest importer of palm oil. Local Indian refining capacity is underutilized due to uncompetitive pricing, leading to larger imports of refined palm oil products as well.

Indonesia’s recent commitment on a higher biodiesel blend – which will prioritise domestic consumption over exports – is a big deal as it will put Malaysian planters at an advantage as importers seek supply security from other major producers.

However, upside for crude palm oil is capped by the abundant availability of alternates such as soybeans, whose prices are at multi year lows. The crude palm oil price trend is largely flat since the commodities price shock of the 2022 Ukraine invasion.

I expect prices to remain rangebound at the MYR 3,500-4,000 range until a truly significant catalyst emerges, such as a long term price recovery in soybeans, or a significant growth in China import demand for crude palm oil.

Personally I admire two planters in particular: United Plantations (UPL MK - US$2.5 billion) and Kuala Lumpur Kepong (KLK MK - US$5.4 billion), storied names with decades of experience, capably managed, and adequate capital reserves to undertake expensive replanting exercises to improve overall fresh fruit bunch yields.

Kuala Lumpur Kepong in particular had been adept in M&A with its 2021 takeover of IJM Plantations; another bid for Boustead Plantations last year were rebuffed.

Securing land bank for the long term is essential as Malaysia no longer allows deforestation of land for plantation activities. This may yet lead to more consolidation in the industry, as cash-starved planters consider selling their land bank to cash rich names in order to finance their own replanting.

7. You recently discussed the boom in data center construction in Johor Bahru. Are there any obvious beneficiaries of this trend?

The data center angle is a multi-sector thematic. In the short term, major landowners in Johor state such as UEM Sunrise (UEMS MK - US$1.0 billion), SP Setia (SPSB MK - US$1.3 billion) and Tropicana Corp (TRCB MK - US$759 million) have already recognised proceeds from land sales for data center construction.

Gamuda (GAM MK - US$1.0 billion), IJM Group (IJM MK - US$2.3 billion), and Sunway Construction (SCGB MK - US$1.2 billion), who are among the country’s largest listed construction companies, have recently announced major contracts to build data centers. These names had long been in property and infrastructure developments, so the data center ventures are a new growth avenue for them.

Another major trend is in utilities. Data centers are set to drive electricity demand nationwide, just like what happened in Singapore over the past few years. Keep in mind that industrial electricity tariffs in Malaysia are among the cheapest in the region, which is another reason for the rush in data center newbuilds here.

There is currently interest in further variations of the data center thematic. This includes not only the power plant operators, but companies that supply power cables and wires, ones that undertake substation works, and those with expertise in facilities management.

Additionally, more pipelines need to be constructed to connect industrial users to the water source, and data centers are notorious for their consumption requirements. Water operators throughout Malaysia had recently increased tariffs partly to finance upgrading works, so in theory suppliers of pipes and water infrastructure companies stand to benefit.

Notably, YTL Power International (YTLP MK - US$6.7 billion), the utility giant which had announced a data center collaboration with Nvidia utilizing the next gen Blackwell chips, had recently bought a majority stake in Ranhill Utilities (RAHH MK - US$401 million), the listed Johor state water operator, ostensibly to ensure adequate infrastructure to accommodate DCs over the long term.

8. Do you have any favorite books that you’d recommend to help us learn more about Malaysia and its stock market?

I recommend Malaysian “Bail Outs”? Capital Controls, Restructuring and Recovery by Wong Sook Ching, KS Jomo & Chin Kok Fay (published by NUS Press Singapore). The book covers the Malaysian response to the 1997-1998 financial crisis and the much-criticized capital controls.

Malaysia’s undertaking of government led corporate rescues and recapitalization of banks predated the US experience during the global financial crisis, and it’s interesting to note that whether because of or despite the interventionist policies, both economies have prospered in the decades since.

For those wanting to learn about Malaysia’s stock market, I recommend subscribing to The Edge Malaysia:

An annual subscription costs less than US$50, and the write-ups are insightful, with a mix of scoops and in-depth company profiles as well as CEO interviews you can’t find anywhere else.

9. Where can readers follow your work and commentary?

You can find me on X @pelabursaham, usually sharing esoteric data points on market trends, Southeast Asia tourism, and HK/China retail in search of investable angles.

Respondent’s disclaimer: The comments above constitute my personal views only, and all names mentioned here are not to be construed as recommendations to buy or sell any of the aforementioned securities.