Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is not a recommendation to buy or sell stocks.

Summary

- Johor is Malaysia's southernmost state. Its new chief minister, Onn Hafiz Ghazi, recently announced plans to launch a Johor-Singapore Special Economic Zone to recreate Shenzhen's success in China.

- The plan is still sparse on details. But marrying Singapore's capital and expertise with the low labor costs and abundance of land in Malaysia makes perfect sense.

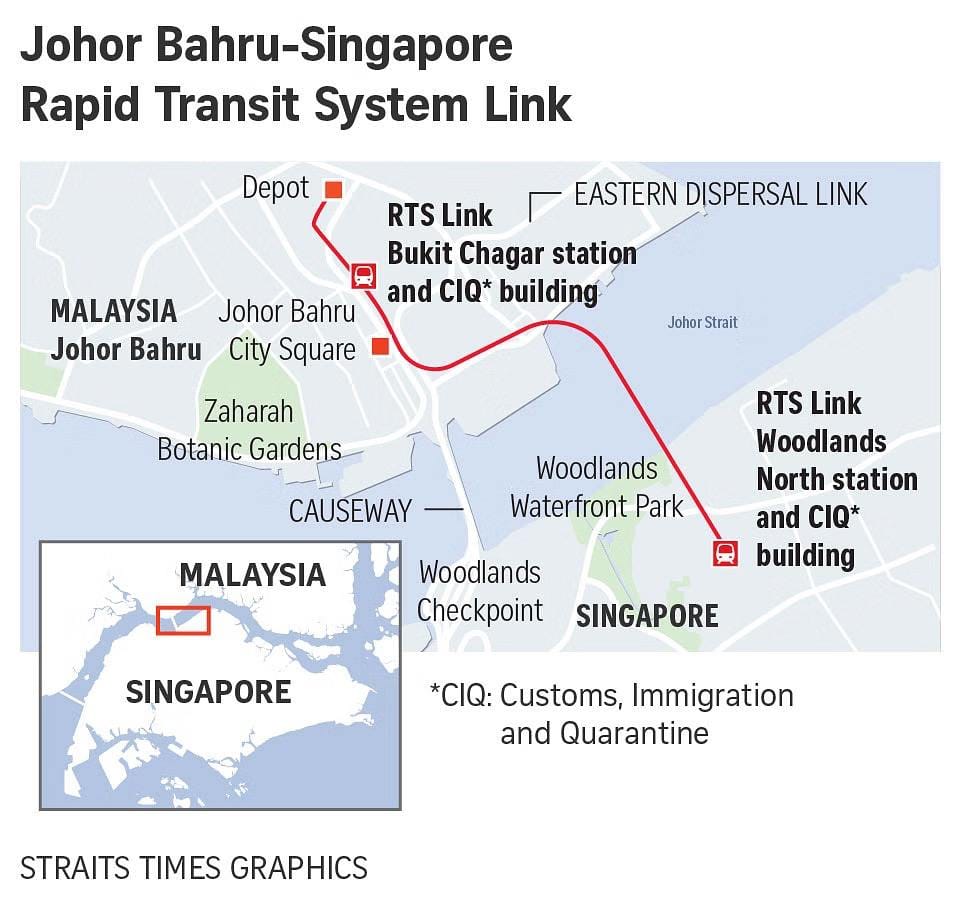

- In the near term, linkages between Singapore and Johor will also improve thanks to a new railway line from Singapore’s Woodlands MRT to Bukit Chagar in Johor. This will make it easier for Malaysians to live in Johor and commute to work in Singapore. The total travel time across the border is expected to be around 15 minutes.

- Towards the end of the post, I’ll discuss some companies that will benefit from these increased linkages between Singapore and Johor.

One of China’s first Special Economic Zones was the city of Shenzhen - just across the border from Hong Kong.

Shenzhen has been an immense success story. From 1980, when it became a Special Economic Zone, until today, its population has grown from 300,000 to over 17 million. It’s now one of the wealthiest and most developed cities in China.

In 2022, a new chief minister in the southernmost Malaysian state of Johor said he wanted to create a new Shenzhen in Southeast Asia and would introduce a special economic zone just across the border from Singapore.

It’s a brilliant idea: a marriage between the capital and expertise of Singaporean businesses and Malaysia's low land and labor costs. It’s still in the early days, but Singapore and Johor are becoming more integrated for every year that passes. And the 2026 completion of a new rail link between Singapore and Johor is going to increase the linkages further. That’s going to be positive for Johor’s property market.

Table of contents

1. The state of Johor

2. Brief history of SG-Johor co-operation

3. The KL-Singapore high-speed railway

4. The new RTS Link

5. The Johor-Singapore SEZ

6. Early signs of progress

7. The investable universe of stocks

7.1. Property

7.2. Transport

7.3. Utilities

8. Conclusion1. The state of Johor

“Johor” is the southernmost state of Malaysia - just across the border from Singapore. It’s largely agricultural but has something that Singapore does not: cheap labor and plenty of lands.

People have lived on the Malay Peninsula and Johor for at least 2,000 years. The predecessor of the state of Johor was formed in 1511, just southeast of the new Portuguese colony of Malacca. At that time, a royal residence was set up in Johor Lama in the deep south.

The state of Singapore was created when British colonialists agreed to recognize Abdul Rahman Muazzam Shah as the legitimate heir to the Johor throne in 1818. In return, they asked for permission to set up a trading post on the island. Eventually, Singapore became a British colony.

Johor’s economy was and continues to be largely agricultural. Around the turn of the 19th century, cultivation of rubber and oil palm took off. Tin mining also became a major industry around the same time.

More recently, a manufacturing economy has also emerged. Key industries include metal fabrication and machinery, furniture, petroleum, and food and beverages.

That said, Johor remains a middle-income state. The GDP per capita is only about MYR 33,000 annually, equivalent to US$7,000 and slightly below the Malaysian average.

But that’s also the opportunity. In the past few decades, Johor’s economy has increasingly become intertwined with that of neighbouring Singapore. A large part of the foreign direct investment into Johor now comes from Singapore companies.

Meanwhile, hundreds of thousands of Malaysians live in Johor and commute to Singapore daily for work. In other words, Johor is the hinterland that Singapore never had.

2. Brief history of SG-Johor co-operation

The dream of Johor becoming a Shenzhen of Southeast Asia is hardly new.

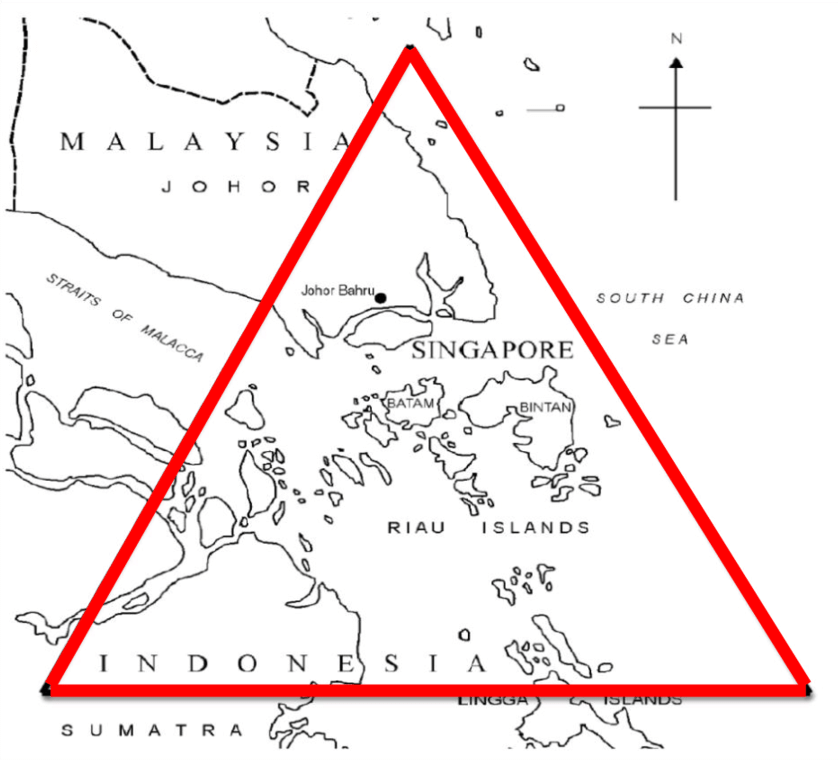

In 1989, Singapore’s former prime minister, Goh Tok Chong, announced a new initiative called the Indonesia-Malaysia-Singapore Growth Triangle (SiJoRi). This was a new partnership between Singapore, Johor, and the Riau Islands in Indonesia, which included the tourist destinations Batam and Bintan.

The idea was that government policies would enable labor-intensive industries to move from Singapore to Johor to take some pressure off the rising wages in Singapore.

In the following years, Singapore invested heavily in Batam's infrastructure, including the Batam Industrial Park and industrial estates in Johor. Ferry services between Singapore and the Riau Islands were also launched. Free Trade Zones were set up in Batam and Bintan, with tax incentives for companies there. Customs clearance procedures were simplified. Singapore also made it easier for Malaysians and Indonesians to work there.

But overall, the triangle turned out to be a disappointment. Tourism from Singapore to Batam and Bintan did indeed pick up. Johor’s manufacturing industry has continued to grow, but perhaps not as much as initially hoped for.

The next attempt to link Johor’s economy to that of Singapore was the Iskandar Malaysia program in 2006. The name “Iskandar Malaysia” refers to the southernmost part of Johor, just on the border of Singapore.

The 2006 initiative introduced 100% tax exemption for promoted activities in education, creative industries, financial services and business process outsourcing. For example, multimedia equipment manufacturers enjoyed zero import duty and zero sales tax. The initiative also introduced a 200% tax deduction on investment activities.

In practice, Iskandar Malaysia may have had some success in attracting investment, especially in manufacturing. However, as a percentage of GDP, the 2006 impact on foreign direct investment was not noticeable.

However, we did see a significant pick-up in residential real estate investment during this era. Part of the reason is that the region introduced flexible foreign ownership rules, allowing foreigners to own 60% of their properties.

The most famous example of a residential real estate project from this era is artificial island “Forest City”. It’s a 60:40 joint venture between Chinese property developer Country Garden and the Johor state. It’s a massive project, initially meant to house 700,000 people across 700 residential towers.

The island is entirely man-made, using sand imported from other parts of Malaysia or overseas. International schools announced plans to set up affiliates on the islands. Prices for flats were surprisingly cheap at just US$2,700 per square meter. Importantly, Chinese buyers could get free 10-year visas through Malaysia’s My Second Home (MM2H) program, providing a path for emigration.

However, in 2016, the Chinese government tightened its restrictions on capital outflows. And when former President Mohamad Mahathir returned to power in 2018, immigration also became more difficult.

Today, Forest City is a virtual ghost city. Only 8-9,000 people live there today, and the shops are practically all closed. Country Garden itself has defaulted on its offshore debt, and it looks like the Chinese state will take over its assets. Forest City’s property management company has ceased to look after the beaches, and crocodiles apparently roam freely.

That said, Forest City remains a duty-free zone, meaning alcohol is cheaper than in other parts of Malaysia. It, therefore, attracts young people wanting to purchase beer and cigarettes.

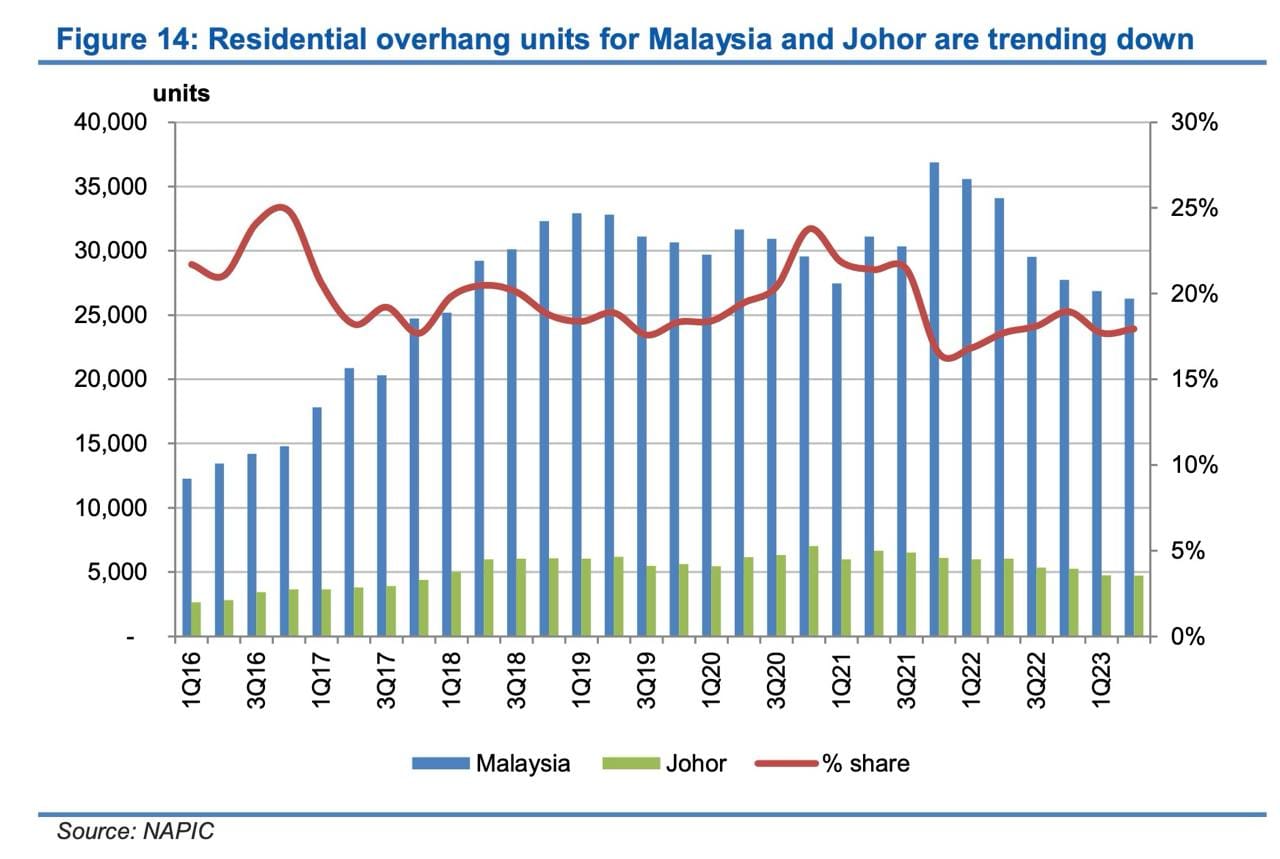

The post-2006 property boom also touched other parts of Johor. The inventory of unsold residential property rose throughout the 2010s until a peak in 2022. Only now are we seeing the property market become more balanced again.

3. The KL-Singapore high-speed railway

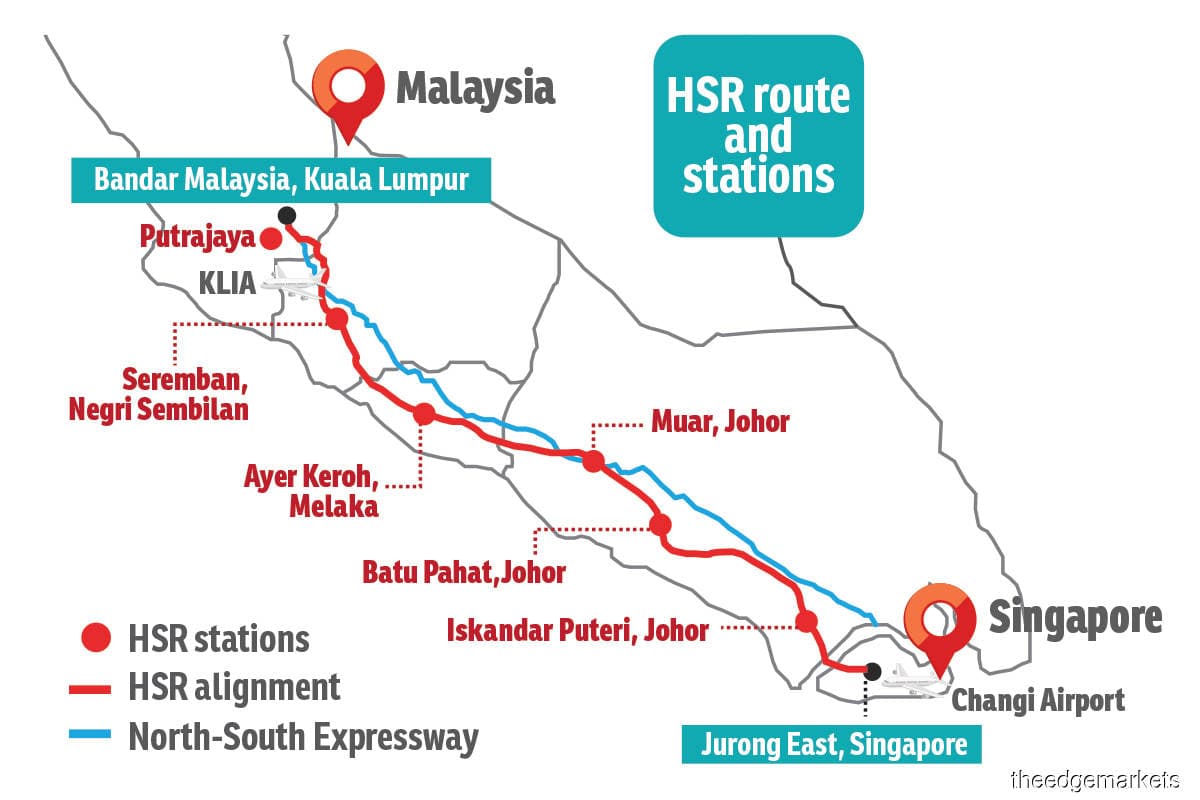

In 2010, former Malaysian Prime Minister Najib Razak proposed a high-speed railway connecting Kuala Lumpur with Singapore. It had been a dream project for many years, and it was expected to cut travel time from 7 hours to just 1.5 hours.

Representatives from Singapore and Malaysia signed a memorandum at a ceremony in 2016, promising to bring the high-speed railway to fruition by 2026. The project's estimated cost was US$11 billion, with funds coming from both Singapore and Malaysia.

When Mohamad Mahathir came to power in 2018, he shelved the project, citing the high cost and few benefits. Some people believe the project was shelved for political reasons due to the 1MDB scandal that had brought down Najib. Mahathir claimed that the project was delayed until Malaysia’s state finances were in a better position.

Last year, the Malaysian government met with several private companies to understand whether they might be interested in co-financing the high-speed railway. A government official said that:

“The prime minister gave me a very clear instruction ... we have no problem implementing that [HSR] project, but it must be a private sector project”

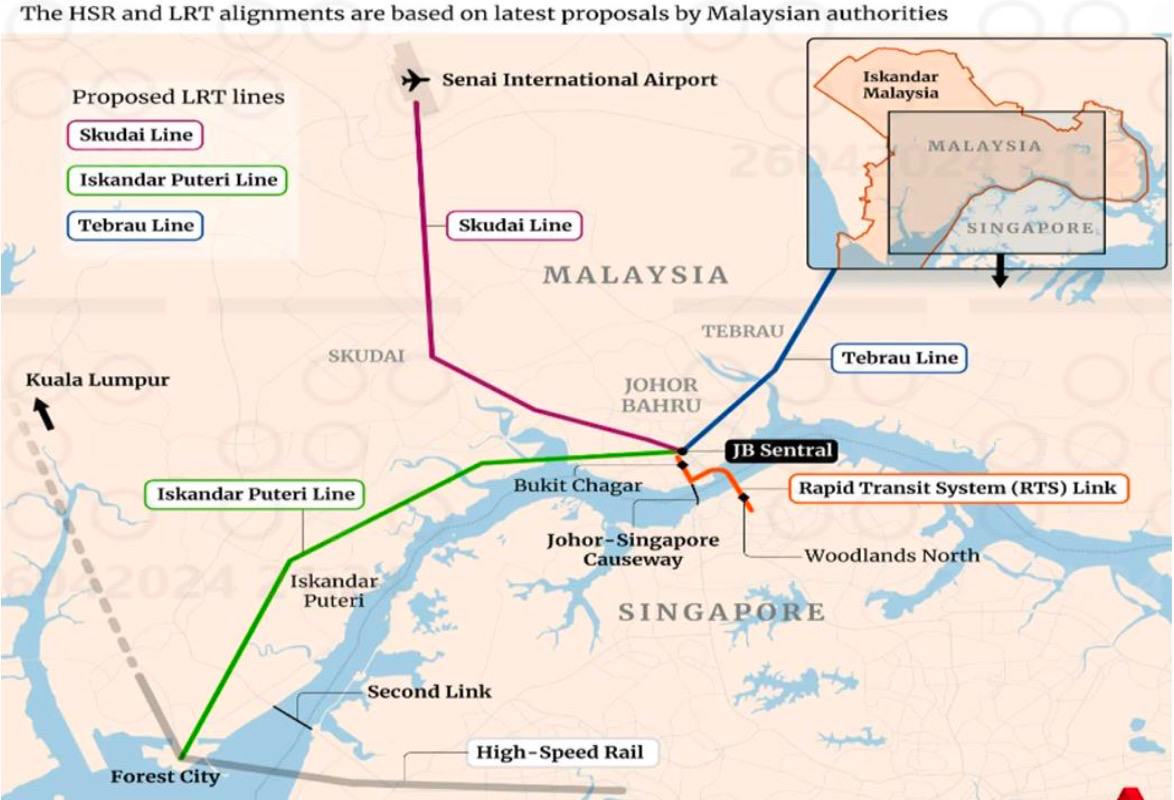

If the project is revived, the railway would link Singapore’s Jurong East with Johor’s Iskandar Puteri - where Legoland Malaysia is - with Malacca and Kuala Lumpur in the north. It might even pass by the Kuala Lumpur International Airport. Travelling across the Malaysian Peninsula would become far smoother than it is today.

The total travel time from Singapore to Iskandar Puteri in Johor would be about 15 minutes, making it a viable - though expensive - option for commuters.

It’s still unclear whether the Kuala Lumpur-Singapore high-speed rail project will proceed. If it does, expect a completion date well into the 2030s.

4. The new RTS Link

A project that will almost certainly go ahead is the new Rapid Train System (“RTS”) from Singapore’s Woodlands MRT station to Bukit Chagar in Johor Bahru - the city center just north of the border from Singapore.

This RTS rail connection project began in 2020 as a joint venture between Singapore transport operator SMRT and Malaysia’s Prasarana. It will cost about MYR 10 billion, equivalent to US$2.1 billion, and be completed by December 2026.

In the past, the only way to get to Johor was by motorcycle, car or bus across the Johor Causeway. But now, you’ll be able to walk from the Woodlands MRT station into the RTS Link and 15 minutes later arrive in Johor Bahru.

While this new railway might seem like a minor improvement, the devil is in the details. Notably, the customs, immigration and quarantine facilities on both the Singapore and Malaysian sides will be co-located in the same buildings. So passengers will only have to clear immigration at their points of departure, saving a significant amount of time. QR codes will be implemented to speed up immigration clearance.

In the past, commutes from Johor Bahru to Singapore could take 1 to 2 hours, depending on the traffic. But now, with the RTS Link, you’ll be in Woodlands in 15 minutes, including only 5 minutes in transfer.

The railway will serve roughly 10,000 passengers per hour in each direction. This is a small number compared to the 350,000 people crossing the border each day. However, from the RTS Link alone, authorities expect congestion on the Johor causeway to drop by 35%.

Further into the future, there’s also talk of an Autonomous Rapid Transit (ART) system in Johor. This system will be a train-bus hybrid running on normal roads using rubber wheels that follow a route through sensors along a virtual track. The carriages would be purchased from China’s CRRC.

A light rail transit with similar routes has previously been discussed, connecting several key areas in Johor to the RTS Link at Bukit Chagar station. If implemented, this public transport network would further improve connectivity to Singapore.

This Autonomous Rapid Transit system is still in the proposal stage. It would cost MYR 20 billion, or over US$4 billion, and would be finished in the 2030s, so that’s still far in the future.

5. The Johor-Singapore SEZ

The latest chapter in the increased linkages between Singapore and Johor is the promise of new chief minister Onn Hafiz Ghazi to create a Special Economic Zone. He announced this plan on 11 January 2024, with representatives from both Singapore and Malaysia present during his speech.

The idea is to combine Singapore’s capital and advanced manufacturing capabilities with Johor’s access to low-cost labor, abundant energy and excess land resources.

The Johor-Singapore Special Economic Zone will encompass an area of 3,505 square kilometers and six local councils. From my understanding, it’s going to include the entire area north of Singapore known as Iskandar Malaysia together with Pengerang, where a large-scale petrochemical plant was recently built. Iskandar Malaysia includes the key areas of Iskandar Puteri, Johor Bahru, Kulai, and Pasir Gudang.

Earlier this year, Onn Hafiz went with a delegation to Shenzhen to meet with 40 potential Chinese investors and the local Communist Party secretary. Johor is trying to learn from Shenzhen’s experience to recreate its success.

In Onn Hafiz’s own words:

“I am confident that with the help of the JS-SEZ, Johor can become the Shenzhen of South-East Asia. In terms of geographical makeup, Shenzhen-Hong Kong is quite similar to Johor-Singapore.”

The focus sector for this new special economic zone will include:

- Machinery & equipment

- Food processing

- Electrical and electronics

- Chemical & petrochemical

To get foreign companies to invest, Onn Hafiz plans to set up a one-stop business/investment service center to streamline the application processes for companies seeking licenses. However, details are still lacking.

The Johor government is currently seeking feedback from the public, and the next step will be to provide more details at the 11th Malaysia-Singapore Leaders Retreat in September 2024. The agreement will be signed at the end of 2024.

Meanwhile, Malaysia’s current prime minister, Anwar Ibrahim, is also talking about designating Forest City as a special financial zone to spur Johor’s economy. Incentives for workers will include multiple entry visas, fast-track entry for those working in Singapore and a flat income tax rate of 15% for knowledge workers.

6. Early signs of progress

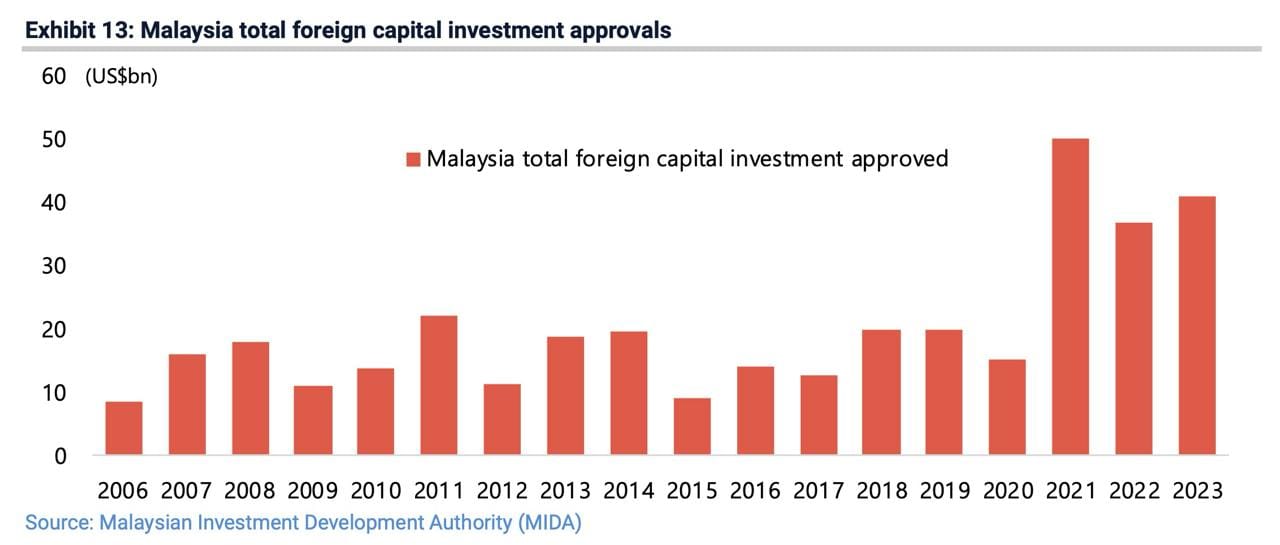

The plans for a Johor-Singapore Special Economic Zone have yet turned into reality. But foreign direct investment into Malaysia has already shot up.

Apparently, the main sources of this foreign direct investment are Singapore, China and South Korea. Much of these investments have occurred in the service sector, including data centers - a growth industry for Malaysia. Within the manufacturing sub-segment, investments have primarily occurred in electronics, machinery, equipment, and chemicals.

Malaysia is one of the beneficiaries of the new “China Plus One” trend of multinational companies diversifying their operations beyond China to other countries such as Vietnam, Thailand or Malaysia. The supply chain disruptions during the COVID-19 pandemic were a wake-up call.

It also helps that Malaysia’s currency - the “Ringgit” - remains cheap, with its real effective exchange rate recently hitting multi-decade lows:

Another important development is that rental costs for condominiums in Singapore have shot up, in many cases over 50% since 2022. Buying a property in Singapore has also become more expensive, with higher prices and foreigner’s additional buyer’s stamp duty rising from 30% to 60%.

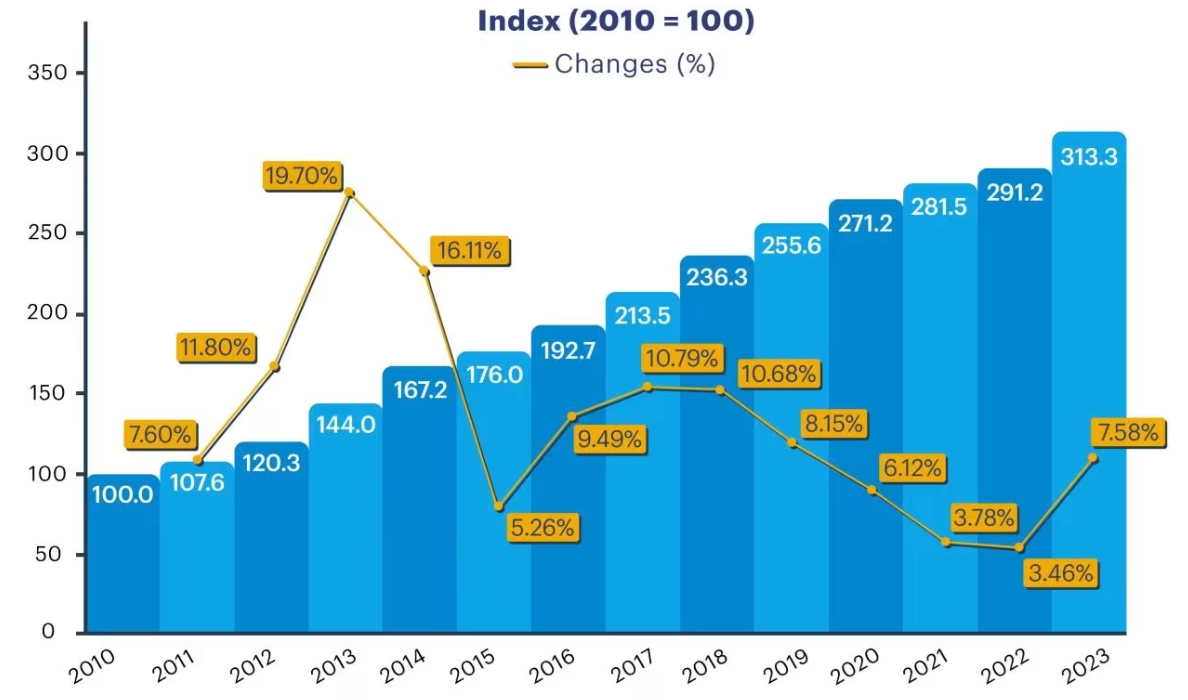

So, it would be natural for Malaysians in Singapore to look for alternatives to their living arrangements. Back in 2019, nearly 1 million Malaysians were living in Singapore. I think that many of them will be attracted to the more comfortable lifestyle of Johor, where even landed houses remain cheap, comparatively speaking. While Johor property prices have tripled, they remain low.

For example, renting one room in Singapore costs at least SG$700-800 per month. But if you pay a similar amount in Johor, you can get an entire 3-4 bedroom apartment for that price.

Buying a property is reasonably cheap, too. A two-bedroom unit at the conveniently located R&F Princess Cove costs about MYR 800,000, or roughly US$170,000. A similar unit in Singapore would cost around three times that amount.

7. The investable universe of stocks

So, who will benefit from the increased linkages between Singapore and Johor?