Table of Contents

Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is a disclosure and not a recommendation to buy or sell.

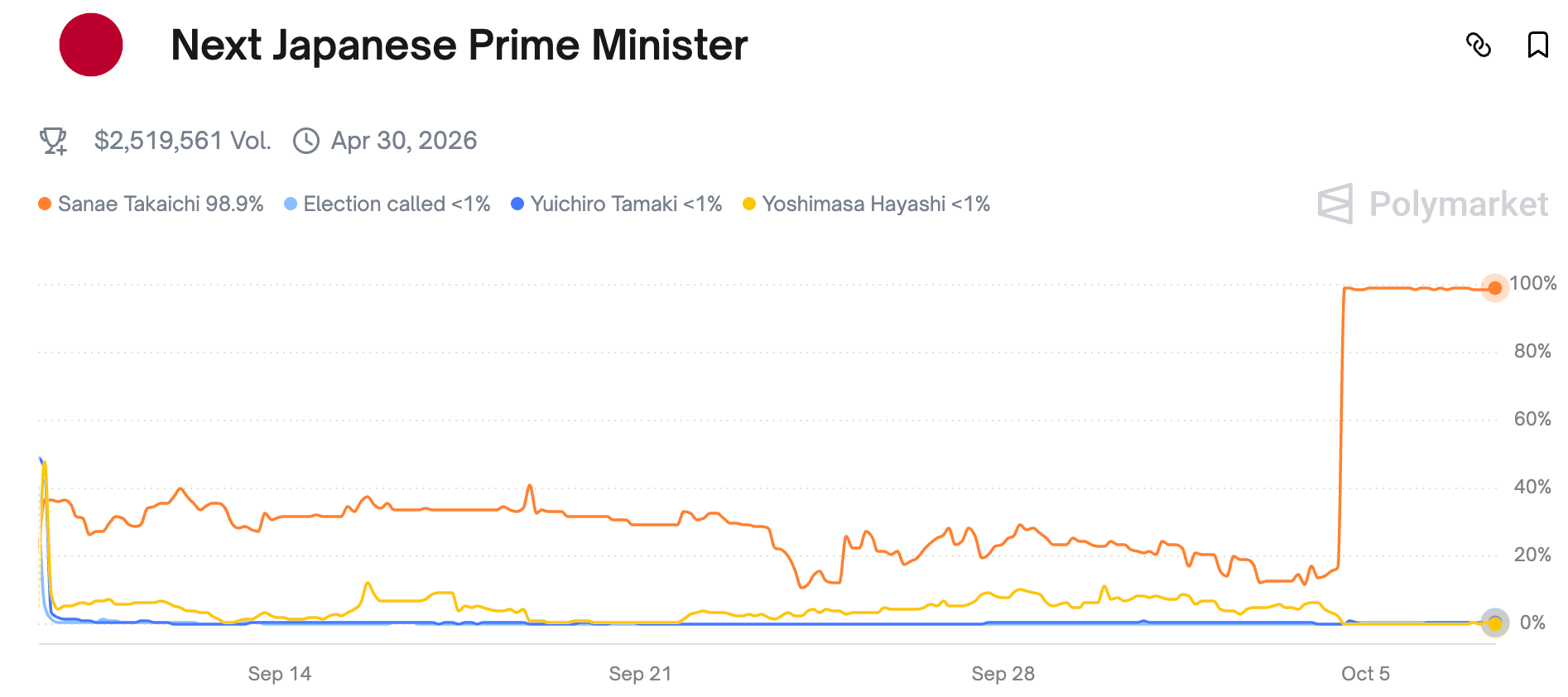

Japan's ruling Liberal Democratic Party (LDP) has just elected Sanae Takaichi to become its next leader. From the end of October 2025, she is expected to succeed Shigeru Ishiba as the new Prime Minister of Japan.

In one way, she'll be a break from the past. She'll become the first-ever female prime minister of Japan. But on the other hand, she represents continuity. She was close to former prime minister Shinzo Abe and is expected to revive and continue his reform agenda.

Following the news of her election win, the Nikkei jumped +4.0%, with investors pricing in a weaker yen and a stronger economy:

In this post, I'll discuss who Sanae Takaichi really is and what changes she's likely to bring to Japan. Let's dig in.

Table of contents:

1. What happened?

2. Who is Sanae Takaichi?

3. "Sanaenomics"

4. Implications for Japanese equities

4.1. Japanese exporters

4.2. Construction

4.3. Defense

4.4. Energy sector

4.5. Tourism

5. Conclusion1. What happened?

On 7 September 2025, current Prime Minister Shigeru Ishiba announced that he would resign.

This forced the ruling Liberal Democratic Party (LDP) to organize a vote for the top leadership. Five candidates joined this time around, and two of them were seen to be front-runners:

- The current minister of agriculture Shinjiro Koizumi. He is the son of a former prime minister who was seen as a great reformer.

- The former Minister of Economic Security Sanae Takaichi. She belongs to the conservative faction of the LDP and is closely connected to former prime minister Shinzo Abe.

It was a tight race. In the first round, neither of them cleared the 50% bar. But thanks to the support of veteran politician Aso Taro and broad support from rank-and-file members, the advantage swung towards Takaichi giving her 185 votes vs Koizumi's 156. And she finished first or second in 36 of the 47 prefectural chapters.

While the LDP doesn't have a majority in parliament, she's still expected to win enough support from lawmakers to become prime minister.

Upon winning, she said that she will:

"Work, work, work, work, work... for the sake of Japan and to rebuild the LDP."

Her new administration will likely be staffed with the remnants of the Abe faction, including Hagiuda Kōichi or Nishimura Yasutoshi. They are both affiliated with the ultranationalist organization Nippon Kaigi which supports a stronger national defense.

Since LDP doesn't have a majority in parliament, she will need to seek a coalition with other like-minded parties. Most likely, LDP will now team up with the Democratic Party For the People (DPFP), whose views on fiscal spending are broadly aligned. DPFP are pro-nuclear, want to cut the consumption tax to 5% and are also hawkish when it comes to geopolitics.

Since Takaichi is a conservative, she'll find it difficult to work with the LDP's longtime junior coalition partner Komeito. The Komeito party has been pushing for stronger healthcare, education and higher minimum wages. So it seems like such policies will now be put on the back-burner.

2. Who is Sanae Takaichi?

Here's a brief bio of Sanae Takaichi. She was born in Nara, a former capital of Japan, famous for its wild deer and beautiful temples.

From an early age, she's been brilliant in school. Her excellent grades got her into both Waseda and Keio University. But since she couldn't finance the degrees on her own - her parents wouldn't support her - she had to stay at home and commute six hours daily to Kobe University.

She was then trained at the public policy programv at Matsushita Institute and spent a few years at Capitol Hill in the 1980s working for Democratic US Representative Pat Schroeder.

Back in Japan, she won her first Diet seat in 1993 - the same year as Shinzo Abe. And she soon became one of his allies. That friendship helped her become Minister of Internal Affairs & Communication under Abe from 2014 to 2017 and from 2019 to 2020. She later also served as Minister for Economic Security in from 2022 to 2024.

As a person, Takaichi is known to be a voracious reader with great attention to detail. She's not natural at socializing, but has recently tried to become more active in creating a dialogue with her voters.

Her favorite car? A 1991 Toyota Supra sports car. She has been a motorhead since she was young, perhaps thanks to her father, who used to work for a company associated with Toyota.

Another fun fact: during her university days, she played the drums in a heavy metal band. Takaichi gained notoriety for her energetic performances, often breaking drumsticks during gigs. Favorite song? 2004 hit Burn by Deep Purple.

My point with all this is that she's not your typical Japanese politician. She's an original and will not be afraid of taking the road less travelled.

3. "Sanaenomics"

In terms of her politics, Takaichi is a conservative.

For example, she's long opposed legislation allowing women to keep their maiden names after marriage. She's also against same-sex marriage as she thinks it will break traditional family structures.

Her favorite book is Margaret Thatcher's memoirs. This admiration for Thatcher has led to some supporters calling her "Japan's Iron Lady", since there are obvious similarities between the two.

In terms of her ideological beliefs, however, she's closer to former Prime Minister Shinzo Abe.

Now that Abe has passed away, Takaichi has publicly stated that she will "carry on his will". In other words, she will carry on the "Abenomics" program that began in 2012 and included:

- Aggressive monetary easing

- Substantial fiscal stimulus through increased government spending

- Structural reforms to improve Japan's competitiveness

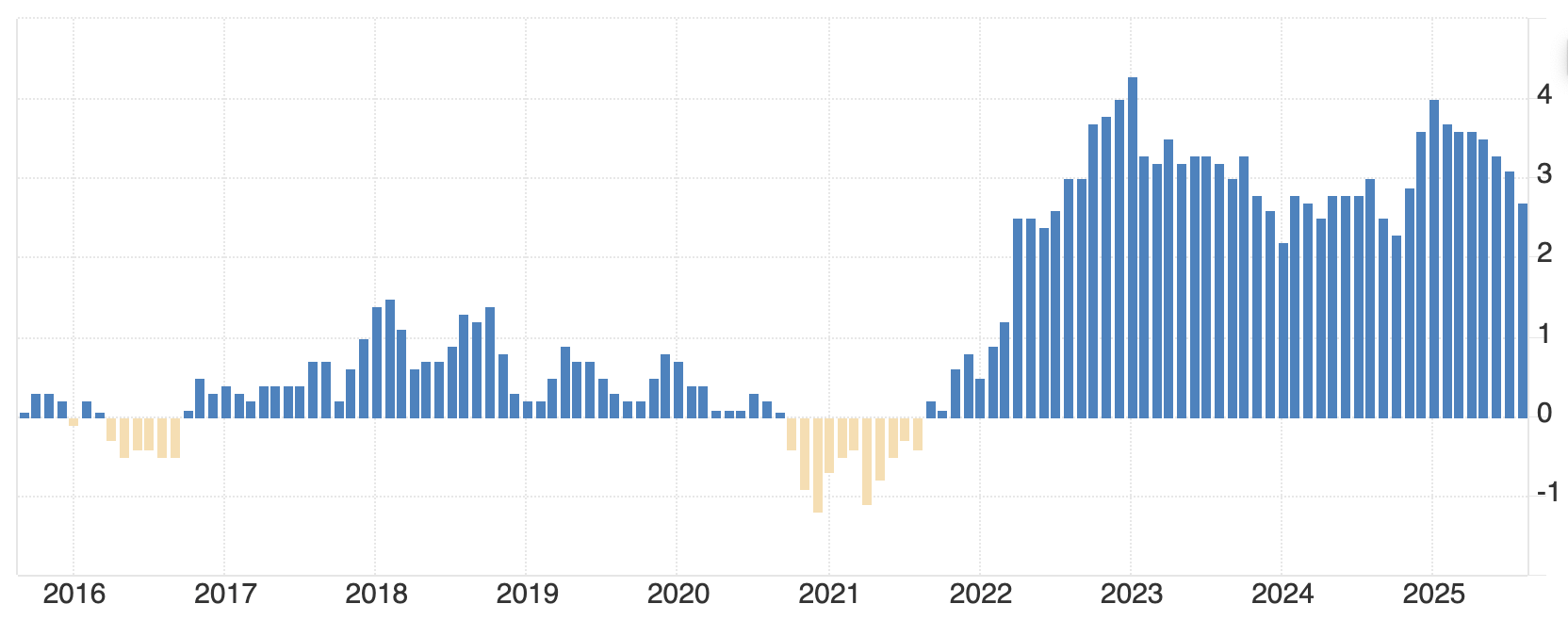

So it seems clear to me that Takaichi will push for continued monetary easing. Last year, Takaichi complained that it was "stupid [for BOJ] to raise interest rates now". She argued at the time that rate hikes would hurt household finances.

When it comes to fiscal stimulus, Takaichi has said that she's willing to do whatever it takes to stimulate economic growth.

"If elected I will turn on ALL switches available, ALL at once, to drive growth of Japan"

Not only does she want to raise spending, she also wants to lower income taxes, consumption taxes and gasoline taxes.

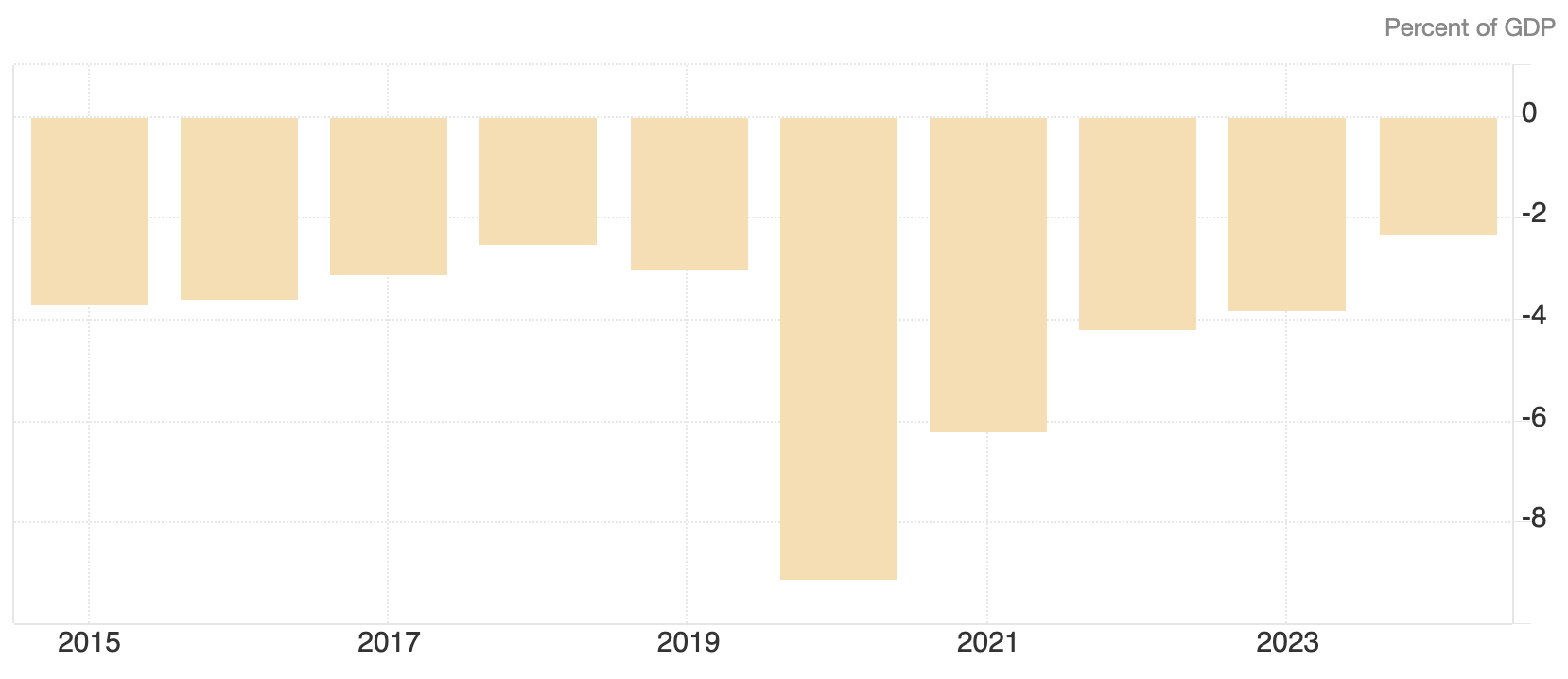

So many investors now expect budget deficits to rise from the current 2.3% level:

That said, during Abe's second term - between 2012 and 2020 - fiscal deficits actually declined. On Twitter, Paul Cavey of East Asia Econ recently argued that the impact of Abenomics was mostly on the monetary policy side, i.e. through quantitative easing and a weaker currency:

Is it really necessary to talk about “Sanae-nomics”? “Abenomics” was already a stretch, both linguistically, and content-wise, given it was as really all about monetary easing. pic.twitter.com/A0J9r6Bb9w

— East Asia Econ (@eastasiaecon) October 7, 2025

When it comes to Abe's third arrow - the corporate reform agenda - she's likely to push it even further. In her 2021 book, she proposed a "cash deposit tax", pushing companies to either pay out or reinvest cash on their balance sheets. She's also argued for revising the Corporate Governance Code to require companies to clarify the use of retained earnings.

In terms of geopolitics, she's most definitely a hardliner. She's hawkish towards China and has voiced support for reducing Japan's economic dependence on China. Once the prime minister, it seems likely that she will build alliances with other democratic countries.

This clearly means greater defense spending in the years ahead, way beyond the current 2.0% of GDP target. She even wants to revise Japan's pacifist constitution, enabling it to declare war if needed and be able to export arms to other nations.

There's been a great degree of criticism of her from the left, including about worsening press freedoms under her reign as Minister of Internal Affairs & Communication and promoting a book about Hitler's election strategy. However, the worsening press freedom ranking preceded her ascent, and she didn't explicitly promote the book about Hitler; she just allowed herself to have her photo taken with the author.

That said, she's raised eyebrows for visiting the Yasukuni Shrine, where war criminals from the Second World War are buried. These moves may hinder her ability to work together with South Korea in building a geopolitical alliance.

When it comes to the US, Takaichi apparently has a strong relationship with Donald Trump. And there's been some noise about her wanting to renegotiate the recent trade agreement with the United States, though we'll see whether that's at all possible.

4. Implications for Japanese equities

So what does this all mean for stocks then?

Following the news of Takaichi's win, the Nikkei jumped 4%. The Japanese Yen to US Dollar exchange rate rose from 147 to 150. And the 30-year government bond yield moved from 3.15% to 3.30%. It looks like the market is now pricing in greater fiscal stimulus and a more dovish Bank of Japan.

In the words of Saxo's Chief Investment Strategist, Charu Chanana:

"With policy unlikely to shift soon, the yen stays under pressure - not collapsing, but also not finding safe-haven demand unless there's a shock. It remains the go-to funding currency in global markets."

Takaichi will be facing a dilemma. If she pushes through with her tax cuts and pressures the Bank of Japan not to hike rates, then the Japanese Yen could weaken further. And that would cause inflation to stay higher for longer.

So it's unclear how much she can allow the Japanese Yen to weaken.

When it comes to corporate reforms, I think they'll prove bullish for stocks. If we ever see a tax on corporate cash deposits, then that would ultimately lead to greater pressure on companies to pay out the cash to shareholders. Or, they'll simply reinvest the cash into non-productive assets like real estate. We'll see.

4.1. Japanese exporters

If the Yen does weaken further, then that would be fundamentally bullish for Japanese exports. The biggest exporters include the the passenger vehicle industry. Japan is also a massive exporter of machinery parts and manufacturing equipment. You already know the names: Toyota, Honda, Nissan, Hitachi, Panasonic, etc.

I've covered a large number of exporters in the past, including US-focused auto maker Subaru:

I've also covered auto supplier Koito Manufacturing, a producer of LED lights, LiDARs and adaptive driving beams who gets 70% of its revenues from overseas:

Aircraft component supplier AeroEdge gets 100% of its revenues from overseas:

Paint manufacturer Kansai Paint gets 70% of its revenues from overseas, which includes its fast-growing subsidiary serving Maruti Suzuki in India:

Finally, electronics giant Sony gets around 70% of its revenues from overseas:

However, note that Takaichi's stance towards China could well impact Japanese companies with exposure to the Chinese market. Such companies include both Okamoto and Ryohin Keikaku:

4.2. Construction

A key part of Takaichi's vision is to strengthen infrastructure. She wants "wise spending" on projects that will increase tax revenues, though she hasn't mentioned exactly what such projects might entail.

She also wants to build up national champions in certain strategic industries, including in semiconductor chips, batteries, AI hardware and advanced materials. So companies within these sectors could plausibly benefit from subsidies or other forms of government support.

From what I recall, the only company I've written about that could plausibly benefit from greater factory construction is industrial robot maker FANUC:

4.3. Defense

As mentioned above, Takaichi is pushing for a change to Japan's constitution that would allow for greater defense spending. Most of Japan's defense stocks popped on the day of her election win.

We should expect greater spending on missiles, cybersecurity, as well as the building of new naval ships and fighter jets. Mitsubishi Heavy Industries has the largest exposure to missiles, and Kawasaki Heavy Industries has the greatest exposure to shipbuilding.

Revising Japan's pacific constitution through Article 9 will be difficult, since supermajority votes will be needed in both houses of the Diet, followed by a national referendum. However, greater defense spending and arms exports do not require a revision to the Constitution.

I have not written about individual stocks in Japan's defense sector, but in 2021, I did publish a primer on Asia's defense industry:

4.4. Energy sector

Takaichi is a big fan of nuclear power. She wants faster reactor restarts. As you may recall, some reactors still remain idle after the post-Fukushima shutdowns. She also wants to support next-generation reactors and fusion technology through state support schemes.

In contrast, she's skeptical of the solar industry and doesn't like imported (mainly Chinese) solar panels used in domestic solar farms. She's also skeptical about offshore wind, since it offers worse value-for-money compared to nuclear.

So under Takaichi, it seems like security will matter more than the climate. She's said publicly that she wants to implement measures to supply high voltage electricity, and in the process improve the competitiveness of Japanese manufacturing.

It's also worth noting that she wants to scrap the "temporary" gasoline tax, which has been in place since 1974. I think it's another way to combat the inflation pressures facing many households.

The only company within Japan's energy sector I've written about is Kansai Electric Power, the owner of nuclear power plants in Japan's Kansai region:

4.5. Tourism

Takaichi's impact on tourism will be mixed. A weaker Yen will certainly pull in tourists from overseas and lift per capita-spend.

On the other hand, her hawkish stance towards China may cause a backlash from Chinese tourists. They currently represent 23% of Japan's inbound tourist arrivals.

Her security-focused agenda may also make it more difficult for foreigners to immigrate to Japan. Many of the service workers in Japan's hotels and food establishments are foreigners. So it's plausible that the current staff shortages will be exacerbated by Takaichi's skeptical views on immigration.

One of the Japanese tourism-related companies I've written about is Kyushu Railway, which now trades at 13x P/E:

Another tourist-related name is Ichigo Hotel REIT, managed by Scott Callon's Ichigo Inc. and now trading at a 6.2% dividend yield:

5. Conclusion

I think Sanae Takaichi is brilliant in many ways. She's serious, detail-oriented and willing to go against the grain. As a woman in a male-oriented LDP, she got to where she is on her own merit - not due to nepotism or being a safe choice for the leadership.

Of course, some of her past actions and behaviours are controversial and in some cases, even distasteful. I also question her strategy of battling inflation with lower interest rates and fiscal stimulus.

So what does her ascent mean for Japanese stocks? Sell-side seems convinced that we'll see a weaker Japanese Yen. I'm not so sure. All I know is that defense spending is likely to rise further, and that nuclear power plants will have full government support for restarting idle reactors.

And I think it's clear that Abe's corporate reform agenda is back on track. That's fundamentally bullish for the Japanese stock market. And if we see a tax on cash deposits, then perhaps we'll see the balance sheets of corporate Japan finally being right-sized. It's been a long time in the making.