Table of Contents

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author might hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. This is a disclosure, not a recommendation to buy or sell stocks.

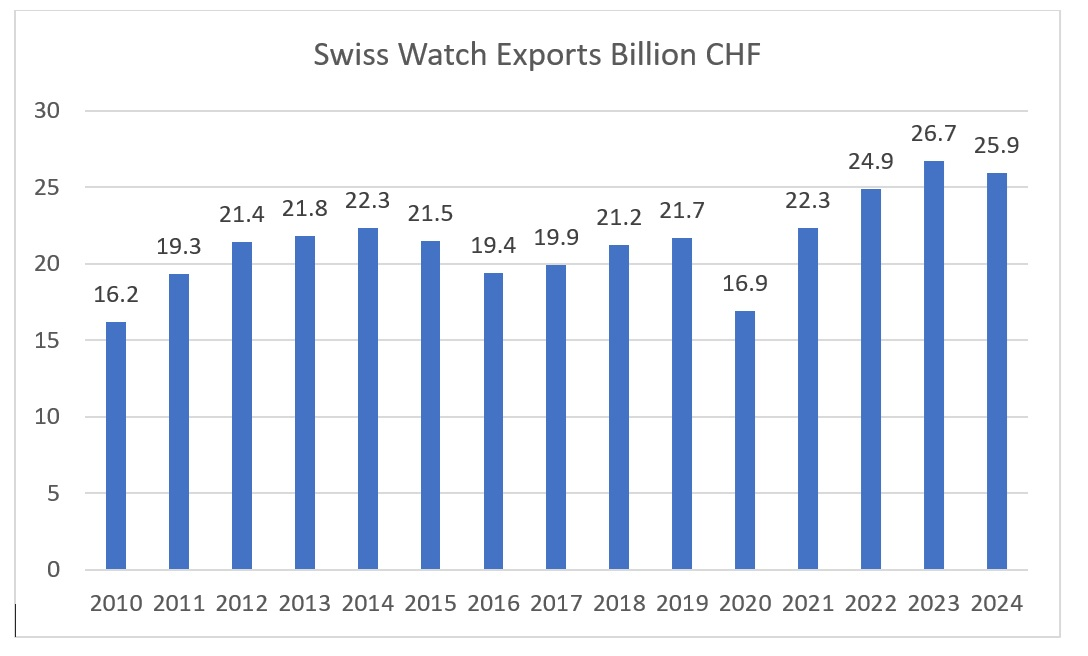

While the luxury market appears to be in decline, one bright spot has been the wristwatch subcategory.

A case in point: prices for second-hand Rolex watches are now on an upward trajectory. This should lead to higher profits for Rolex and its retail partners across the globe:

The watch market is clearly cyclical. For example, after Xi Jinping came to power in 2013, he initiated an anti-corruption program that led to a severe slump in global watch sales.

Then came the COVID-19 pandemic. Consumers received stimulus cheques and accumulated savings while being cooped up at home. They then used some of those savings to buy watches.

The popularity of mechanical wristwatches comes as a surprise to some. People have been predicting the death of Swiss watchmaking for well over 50 years. Quartz watches from Casio and other Japanese brands undercut them by a wide margin. And then in 2015, the Apple Watch started to take over, with its immersive screen, on-the-fly notifications and its rich feature set.

That begs the question: why are consumers still buying mechanical watches? It's certainly not because of their accuracy. Nor is it because of their features, or their low prices.

It's a difficult question to answer, but most likely it's simply about the romance of owning an expensive hand-crafted object on your wrist. You can hear the movement tick as hundreds of microscopic parts work in harmony. There are also signs that young people are fed up with smart watches that give them notifications they don't really need.

Another aspect is status. A luxury watch is perhaps the ultimate Veblen good: a product whose demand increases as its price rises.

Scarcity sells. If only the top 0.1% of the population can afford a US$50,000 watch, then wearing it will be the ultimate way to demonstrate your success.

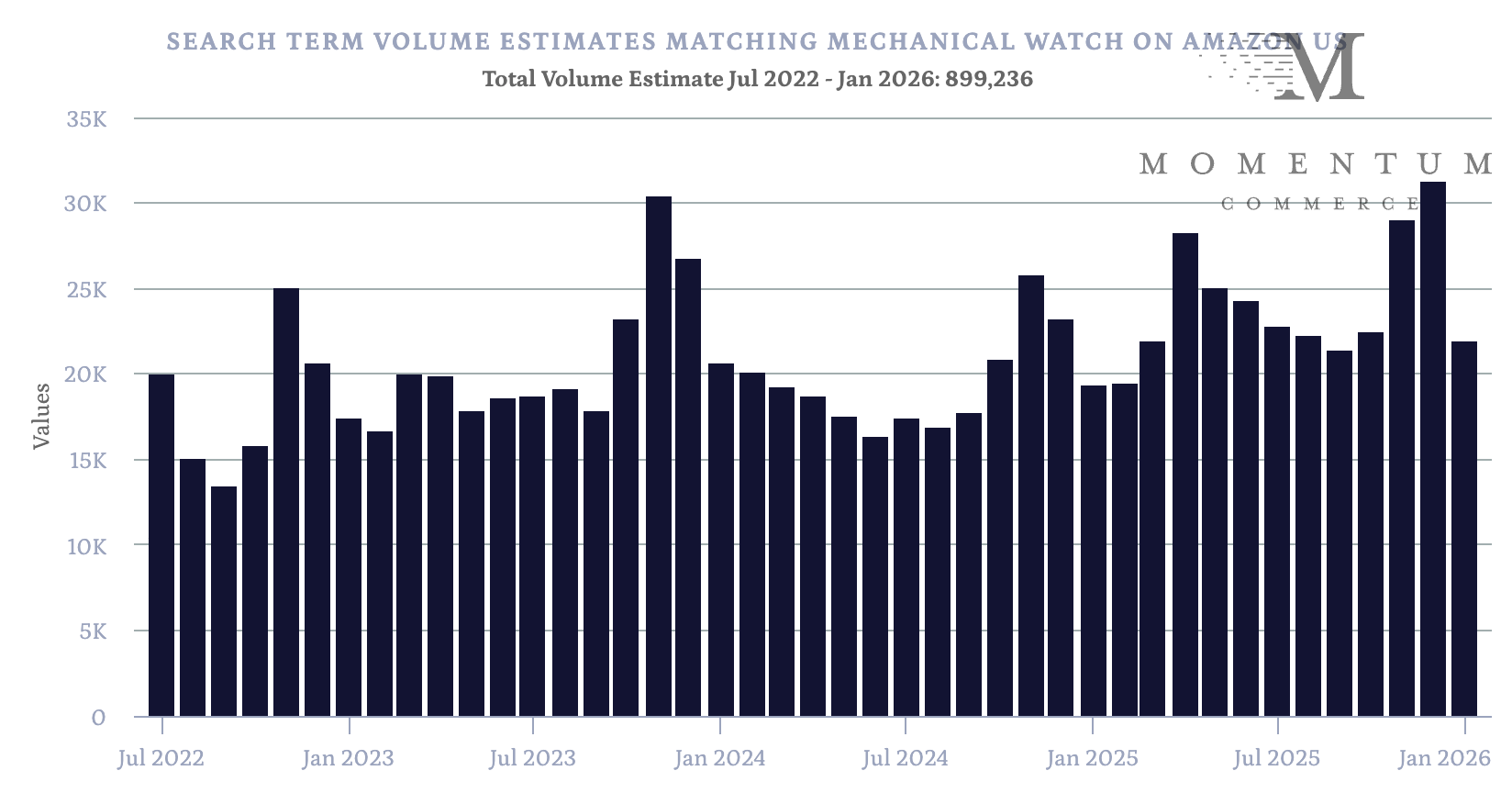

In any case, the luxury wristwatch market is clearly thriving. Volumes have declined, but prices more than make up for it. A 2025 US survey showed that 30% of Gen Z individuals already owned a mechanical watch or planned to buy one.

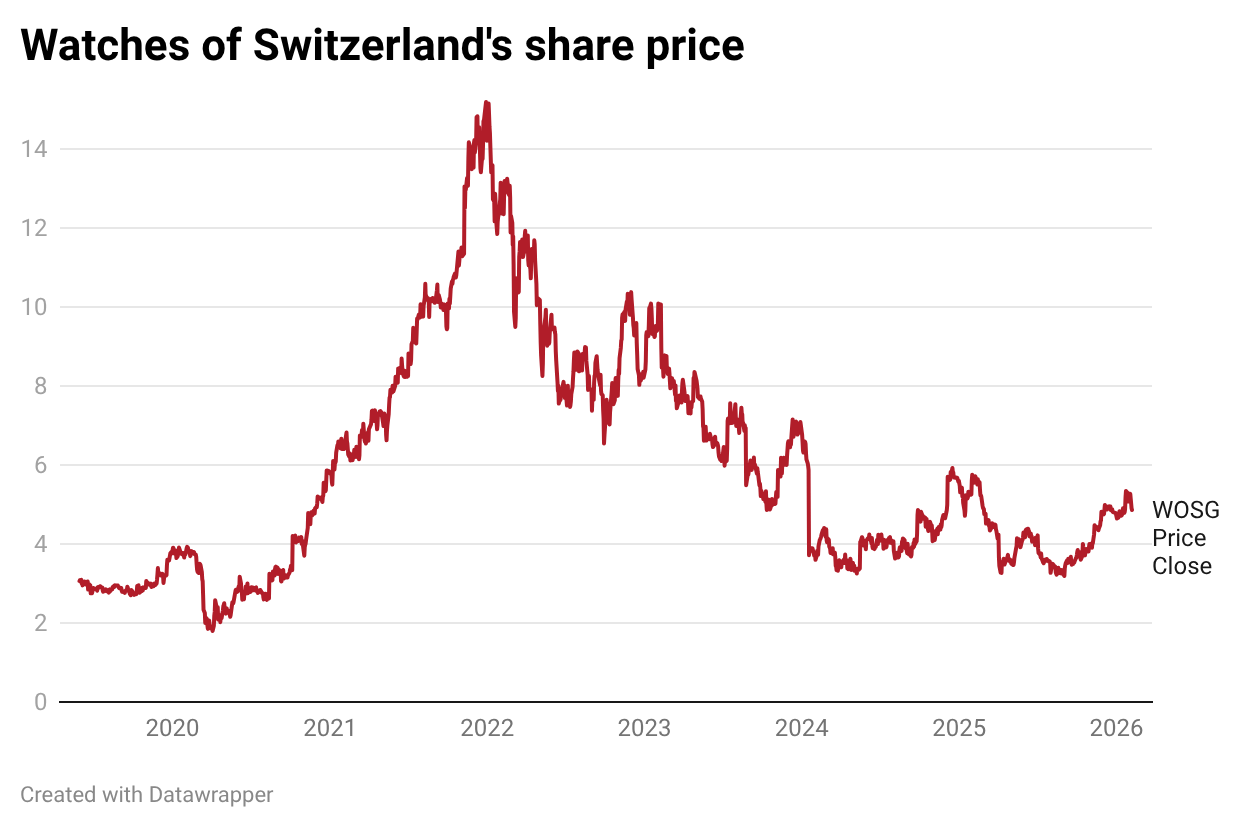

After the heights of the COVID-era watch bubble, the market suffered a multi-year downturn. The Chinese government's 2021 crackdown on its real estate bubble probably didn't help. And in the process, the share price of Rolex dealer "Watches of Switzerland" declined by almost 80% from peak to bottom:

But amid this volatility, we're starting to see watch collecting emerge as a major trend. Young buyers are influenced by Instagram, YouTube, and other social media platforms, where mechanical watches are showcased as lifestyleor investment objects.

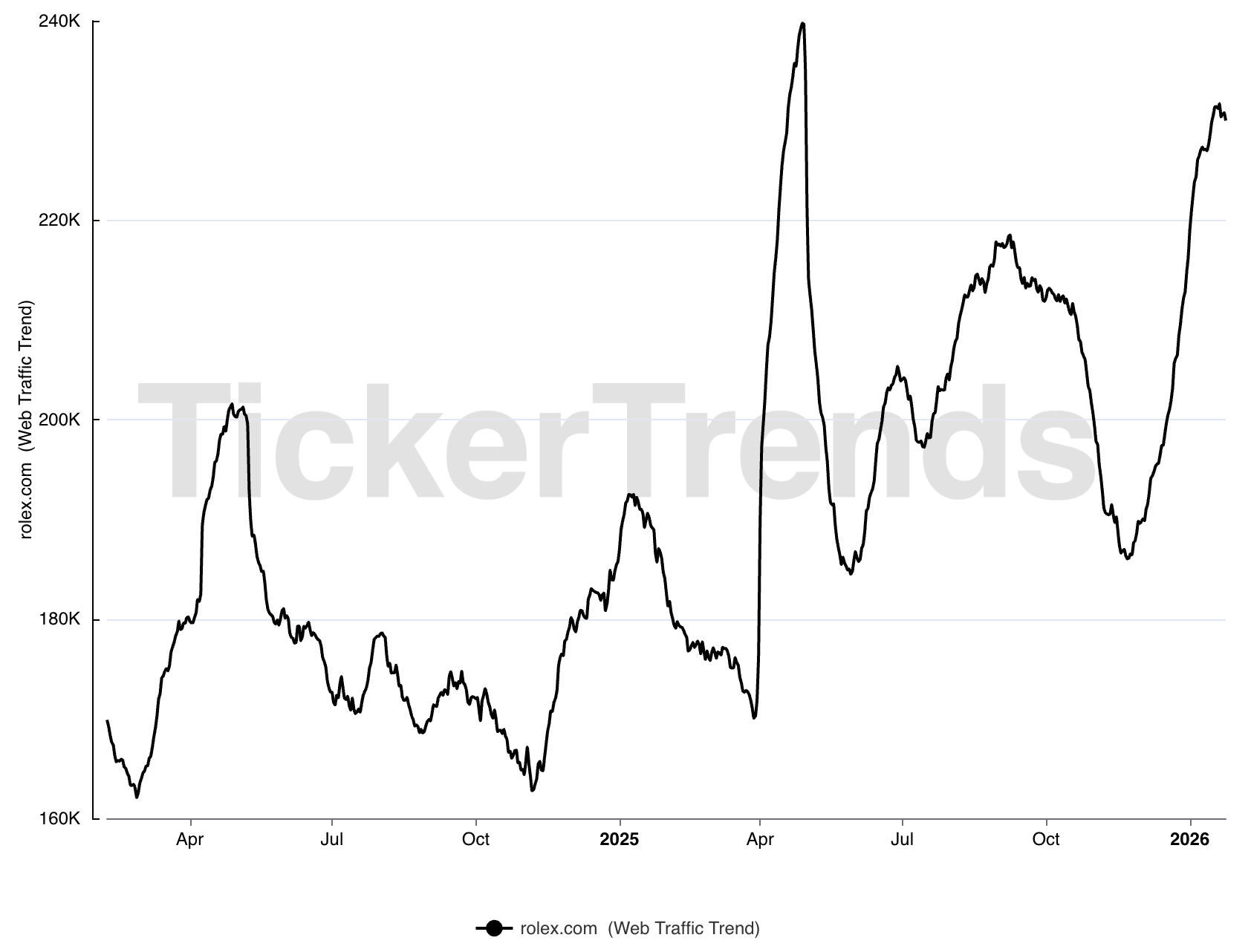

Just look at the number of visitors to the Rolex.com website: now 230,000 per day and rising:

There's interest in other brands as well. The number of search queries for "mechanical watch" on Amazon.com keeps rising, year after year:

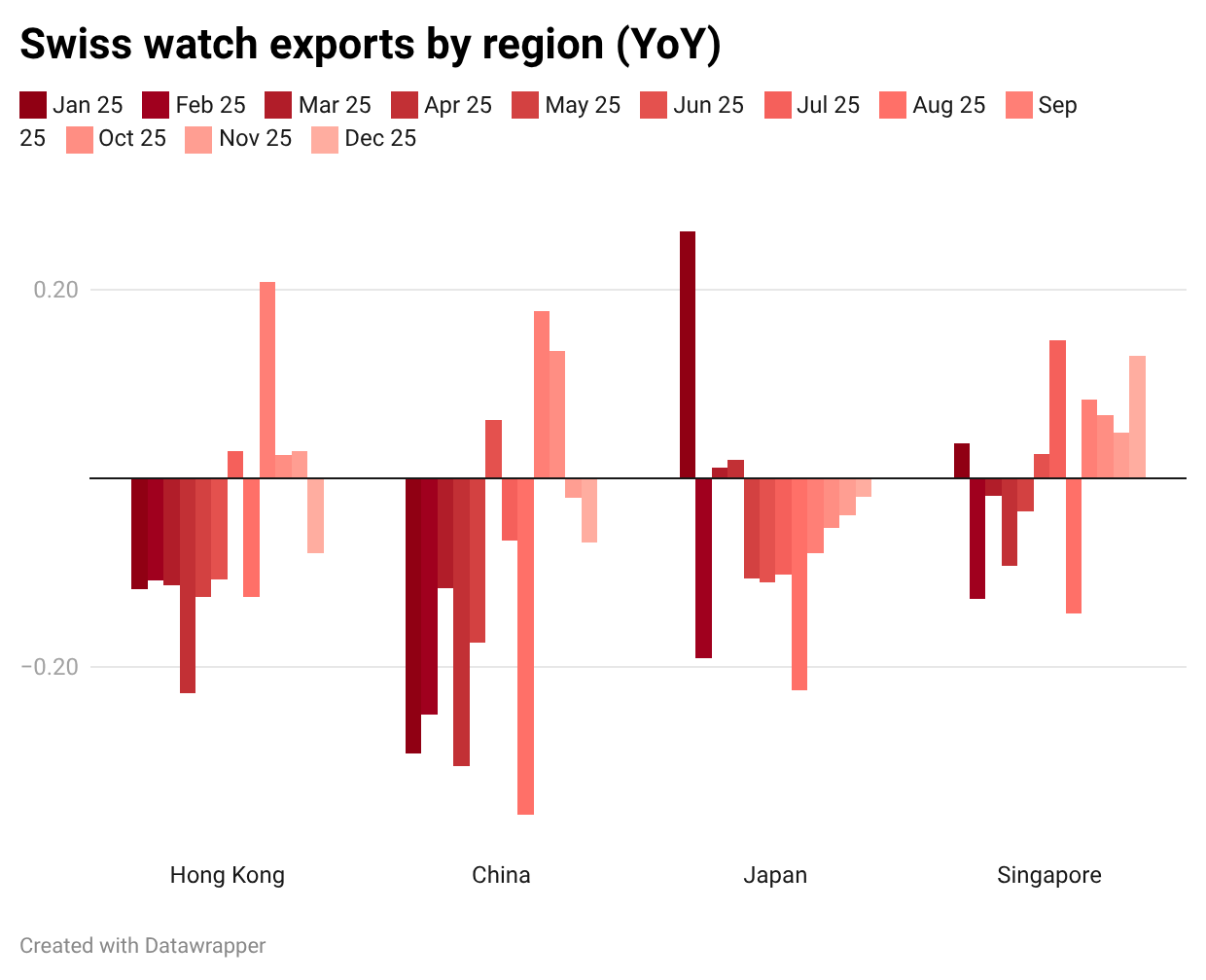

After a four-year decline, the industry looks set to turn. The year-on-year growth in Swiss watch exports to Hong Kong, China, Japan, and Singapore has finally turned positive:

Among these regions, Singapore is the clear outperformer. But we've also seen stabilization in watch sales in Japan, China, and Hong Kong.

When it comes to Rolex resellers, it's helpful that prices for second-hand watches have begun rising again. Since Rolex watches continue to trade at a premium to MSRP, authorized dealers enjoy strong bargaining power over their customers. And they'll be able to push their customers to spend more to qualify for the most coveted models, such as the Rolex Dayton.

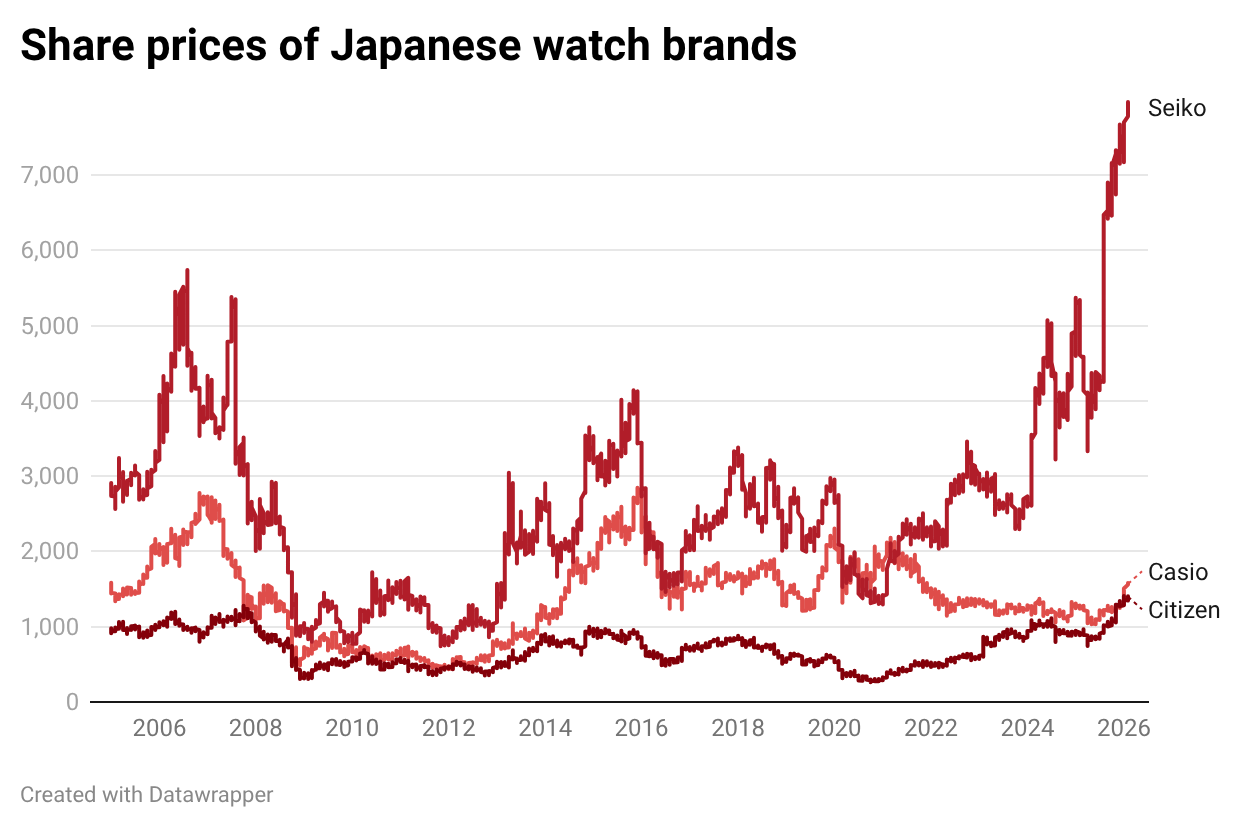

In Japan, the three watch brands Seiko, Casio, and Citizen are also doing well, with their share prices hitting multi-year highs recently:

These three companies operate at lower price points than Rolex. So their success has more to do with the weak yen and a seemingly unstoppable interest in watch collecting. The alternative data remains positive, especially for Casio and Seiko. The former company just released its 3QFY2026 results, with sales rising +28% year-on-year.

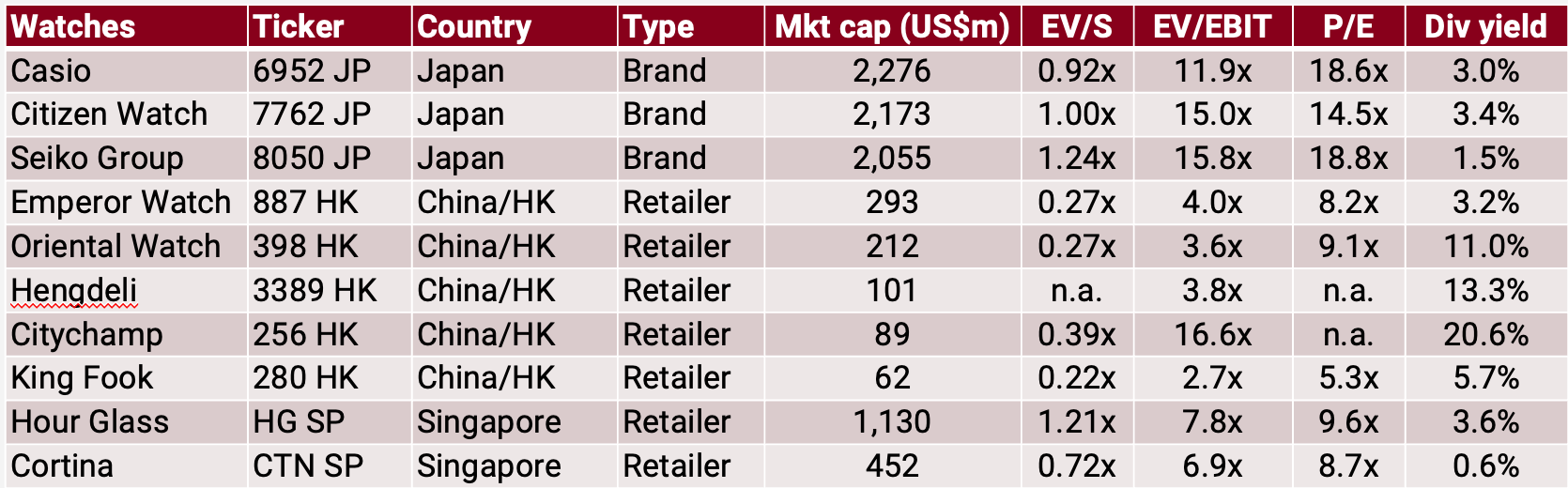

The investable universe of luxury wristwatch stocks includes the three Japanese brands as well as smaller watch retailers, which tend to serve the industry heavyweight Rolex:

If you check the table above, you'll find that the Rolex-affiliated watch retailers all trade at single-digit P/E multiples. The biggest risk for them is that the premium over MSRP might one day disappear. Another risk is that Rolex takes distribution in-house, perhaps through its fully owned retail arm, Bucherer.

But at the moment, both volumes and prices are currently heading in the right direction. And that should be positive for authorized Rolex dealers, especially those with exposure to the better-performing markets such as Singapore and Taiwan.