Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author holds positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. This is a disclosure, not a recommendation to buy or sell stocks.

Table of contents

1. Portfolio update

2. Update on my key holdings

3. My plans going forwardPortfolio update

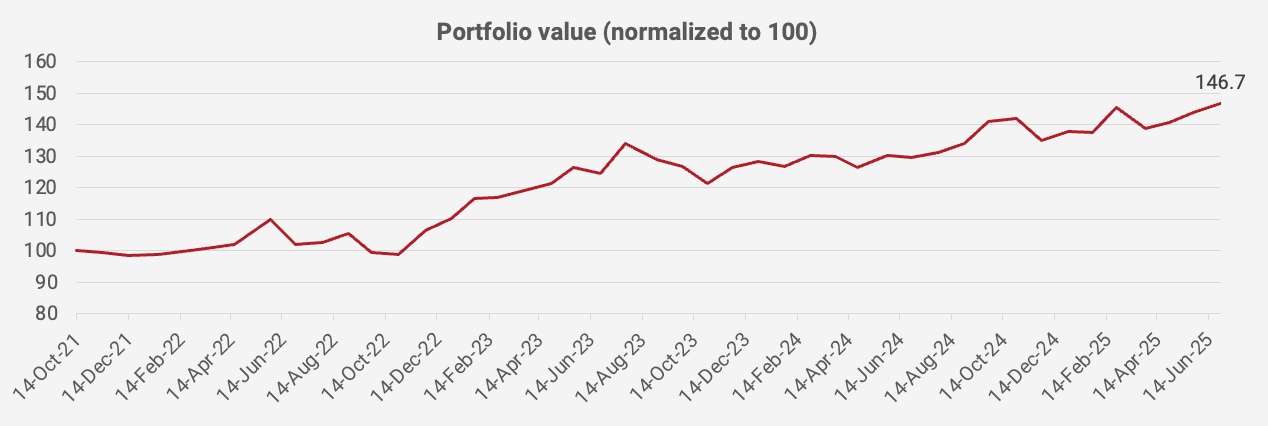

The portfolio’s value increased again in June 2025, up +2.1% month-on-month. Since the portfolio’s inception in October 2021, the value has now increased by +46.7%, equivalent to a +10.9% compound annual growth rate:

This year, Japanese SaaS company Poper’s share price has gone up in an almost parabolic curve. It finally broke in mid-June. Japanese retail investors on Twitter have started to write about the name more frequently. In a Q&A with CEO Shingo Kurihara, investors asked a whopping 79 questions. That makes me question whether the stock is still “undiscovered”. That said, Poper’s last result exceeded expectations with +45% revenue growth and strong operating margins.

I’m also seeing some life in the share price of Philippine Stock Exchange. Sell-side is warming up to the idea that trading volumes will ramp up once the new CMEPA law goes into effect on 1 July 2025. With CMEPA, stock transaction taxes in the Philippines will drop from 60 basis points to 10. Many investors now think that this will be positive for both volumes and prices of companies listed on the PSE.

Otherwise, the month was uneventful. We saw a decent result from Pacific Textiles as the new Nam Dinh factory continues to ramp up. Management’s latest guidance is positive, yet the share price remains in the doldrums. Part of the issue could be a fear that Trump’s tariffs on Vietnamese textile exports are going to hit them. But Vietnam is not the only country faced with tariffs, and textiles are cheap relative to the end-customer price for clothing. I don’t think we’re going to see much demand destruction, even at the tariff rates announced in April.

The main detractor from performance came from Thai cinema operator Major Cineplex. Thailand is currently in a bear market, and we’re seeing selling almost across the board. Foreign fund flows continue to be negative. Another reason for the decline is the decline in the company’s dividend payouts. Major has been buying back shares, but the share buyback has been put on hold. On the positive side, the Thai box office has surprised to the upside recently. Hollywood is finally emerging from its post-COVID slumber.

In any case, here’s the latest portfolio as of 27 June 2025: