Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author may hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. I have positions in all of the below stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.

Portfolio update

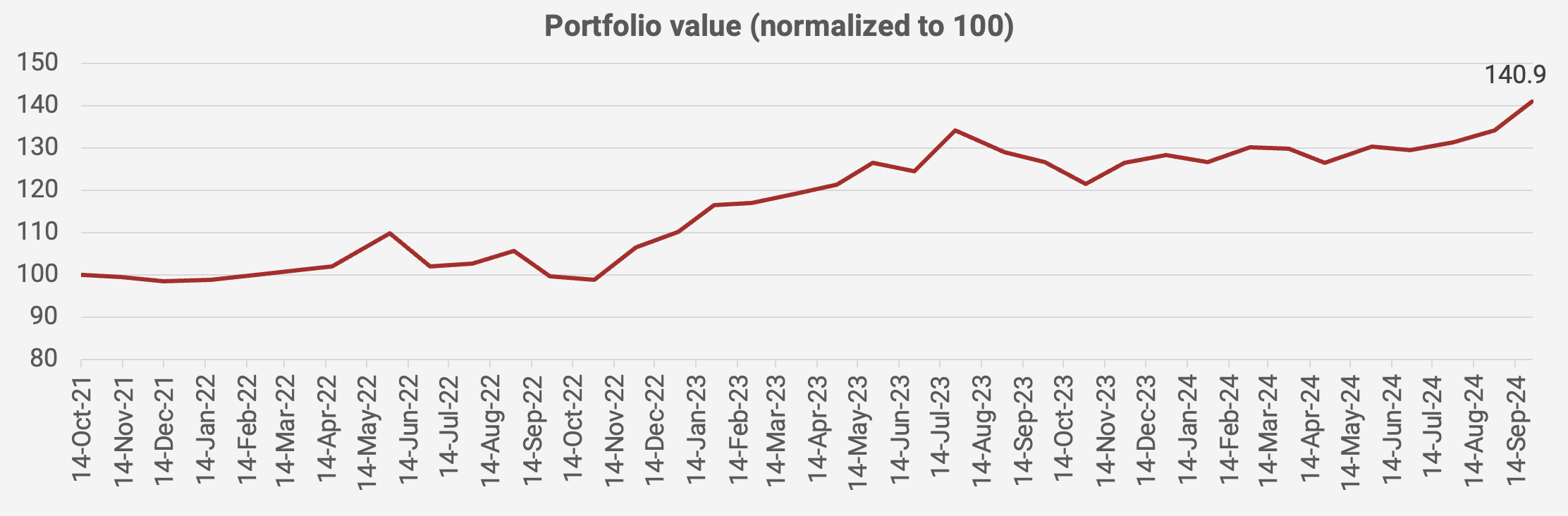

The portfolio continued rising in September, up another +5.0% month-on-month. The value of the portfolio is now up +40.2% since October 2021, equivalent to a +12.3% compound annual growth rate:

Two factors caused the value of the portfolio to go up:

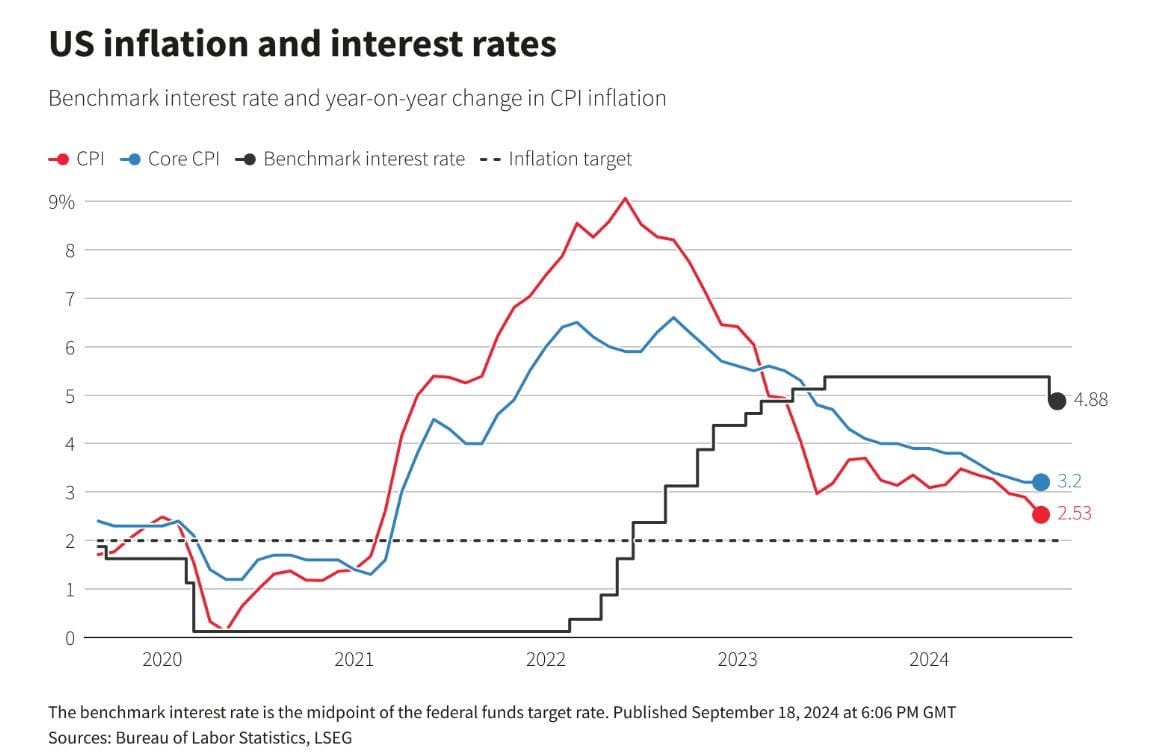

- US interest rates declined by 0.5%, causing the US dollar to weaken and several Asian currencies, such as the Japanese yen and the Malaysian ringgit, to strengthen.

- I ramped up my position in glove maker Hartalega aggressively just before news came out that US tariffs on Chinese medical gloves will rise to 50% in 2025 and 100% in 2026. Hartalega is the key beneficiary from these new tariffs. Though I knew that tariffs were forthcoming, I didn’t expect them to end up this high. I got lucky.

In any case, the following chart from The Transcript shows the potential for further US rate cuts:

So, like many others, I predict that the Federal Reserve will continue to lower interest rates. That bodes well for Asia’s currencies, and for further flows into the region.

Chinese stocks have also started to come alive. Especially the larger tech companies listed in the United States, with the KraneShares CSI China Internet ETF (KWEB US) up over 30% in the past month.

Investors are getting excited about a set of policies released by the Chinese government to revive the market. The Wall Street Journal called it “the most aggressive attempts at stimulus since the pandemic”. And indeed, it was the first off-schedule meeting to discuss the economic agenda since March 2020.

China’s new stimulus measures include:

- Much greater fiscal stimulus, with the Ministry of Finance planning to issue CNY 2 trillion worth of special sovereign bonds to help local governments and stimulate consumption. In the past, the government has always been wary of handing out cash to consumers. But now, leading policy advisors are advocating a CNY 10 trillion stimulus package over the next two years.

- Greater support for banks with a CNY 1 trillion capital injection, lower reserve requirement ratio and lower interest rates.

- Reducing the down payment on second homes from 25% to 15%

- Central bank loan guarantees to state-owned enterprises that buy vacant homes for conversion to social housing

- Central bank lending program to insurance companies and pension funds for the buying of equities

- A re-lending facility for companies that repurchase shares from the market

Felix Zulauf had previously predicted that a Chinese stimulus would only come after the Fed paved the way, as the Chinese government does not want to jeopardize its currency. That prediction turned out to be correct.

I don’t have a strong view of where the market is heading. But what I do know for sure is that Hong Kong equities trade at a massive discount to most other markets globally. And investors are finally starting to pay attention.

In any case, here is what the latest portfolio looks like as of 26 September 2024: