Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author may hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. I have positions in all of the below stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.

Portfolio update

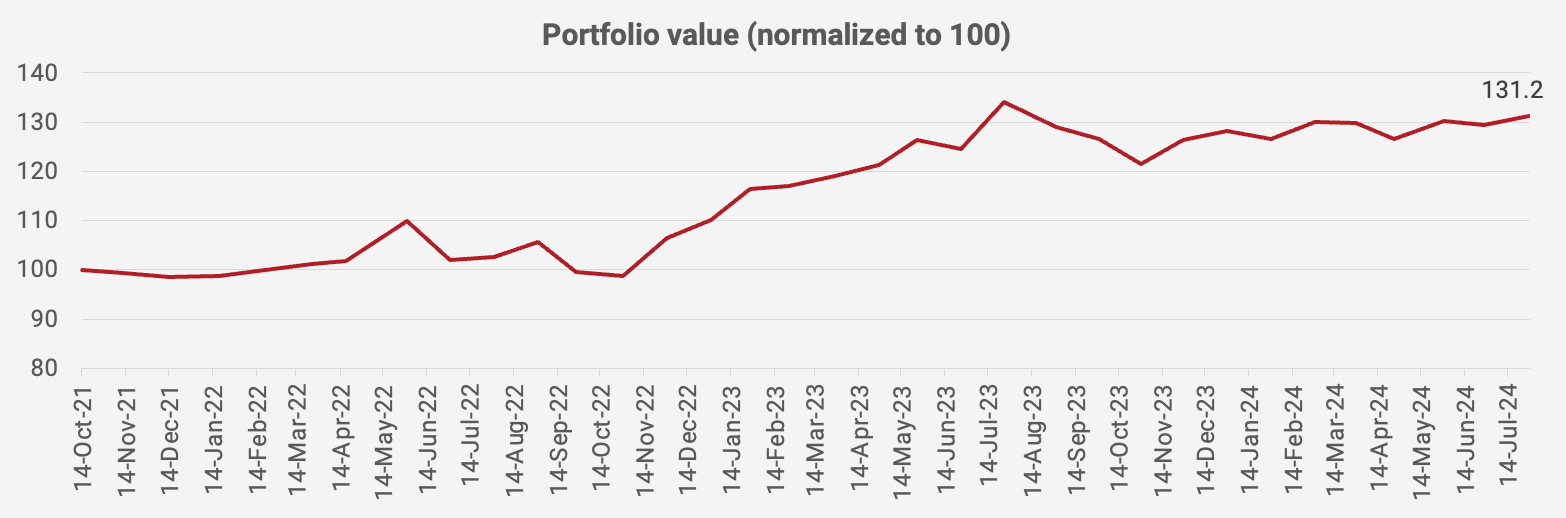

Welcome back! The value of my Asia-focused portfolio gained +1.4% last month and is now up +31.2% since inception in October 2021, equivalent to a compound annual growth rate of +10.2%:

Hong Kong equities continue to be weak, however. Chinese bond yields keep going lower, suggesting that the economy is suffering from negative momentum. That said, my stocks in Hong Kong have very little exposure to China, and they have held up okay.

The biggest outperformer in the last month was karaoke bar operator Koshidaka, which started a bull run just as the Japanese Yen began to strengthen. Ginebra San Miguel also continues to creep higher as its recent positive result is being digested by the market.

Here’s what the portfolio looks like as of 29 July 2024: