Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author holds positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. This is a disclosure - not a recommendation to buy or sell stocks.

Portfolio update

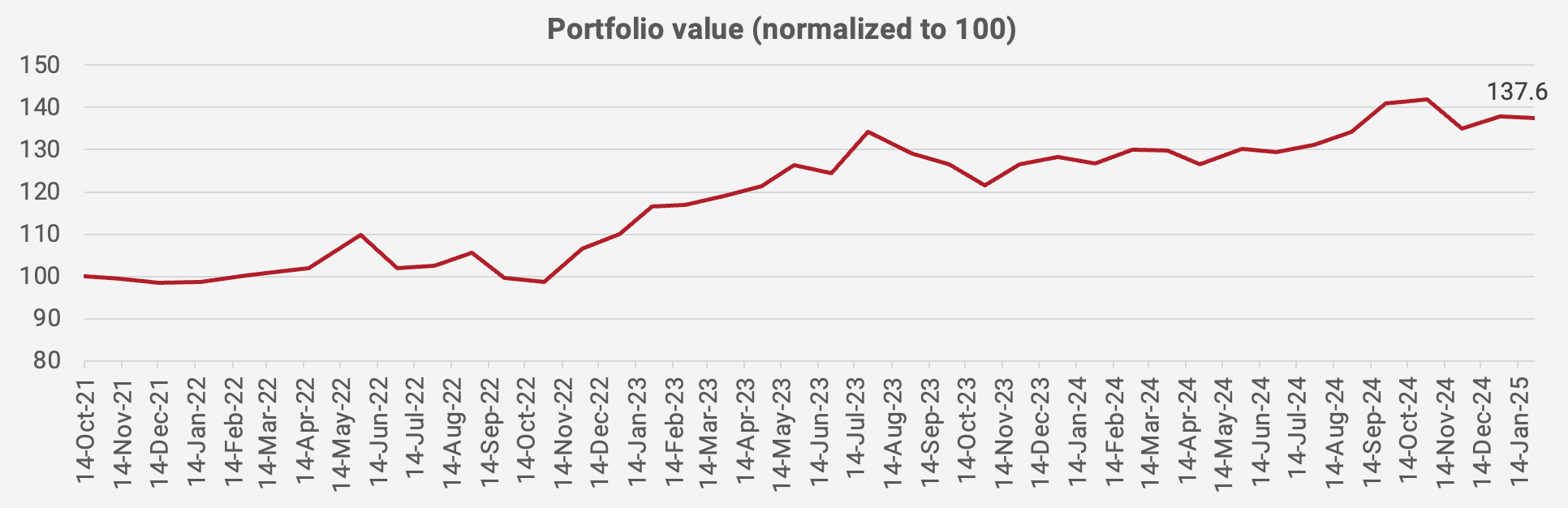

There was a slight decline in the value of the portfolio in January 2025, -0.3%, due to a decline in Bloomberry Resorts and generally weak market sentiment. The value of the portfolio is now up +37.6% since October 2021, equivalent to a +10.2% compound annual growth rate:

The majority of stocks that I either own or track have weakened somewhat, presumably due to outflows. There’s some enthusiasm about Chinese equities in the wake of the success of DeepSeek AI. It also feels like Japanese SaaS companies are finally waking up from their slumber.

Here is what the latest portfolio looks like, all share prices from 27 January 2025: