Asian markets have been digesting Donald Trump’s win in last Tuesday’s presidential election. Japanese equities responded positively, and Chinese equities negatively. There’s talk of 60% across-the-board tariffs on Chinese goods, though I think the tariffs will be watered down before implementation in 2025. In any case, they’ll be a headwind for the Chinese manufacturing sector.

Post of the week

Last Wednesday, I published a post about Hong Kong restaurant operator Fairwood (52 HK - US$113 million). It serves a mix of Western and Chinese food at affordable fares of about HK$50 per meal (~US$6). Before COVID-19, Fairwood earned a 20-30% return on equity. However, COVID-19 hurt the Hong Kong restaurant industry badly, with foot traffic declining and takeaway orders failing to offset the decline. Fairwood’s top-line revenues have now fully recovered from the pandemic, but its margins remain weak, causing many investors to lose hope. The stock price has declined about 75%. I make the case that Fairwood remains relevant and that its net margins will eventually return to 5%. If so, Fairwood would end up with a P/E ratio of 6x. And with Fairwood’s net cash now representing 72% of its market cap, there should be a cushion on the downside.

Tweet of the week

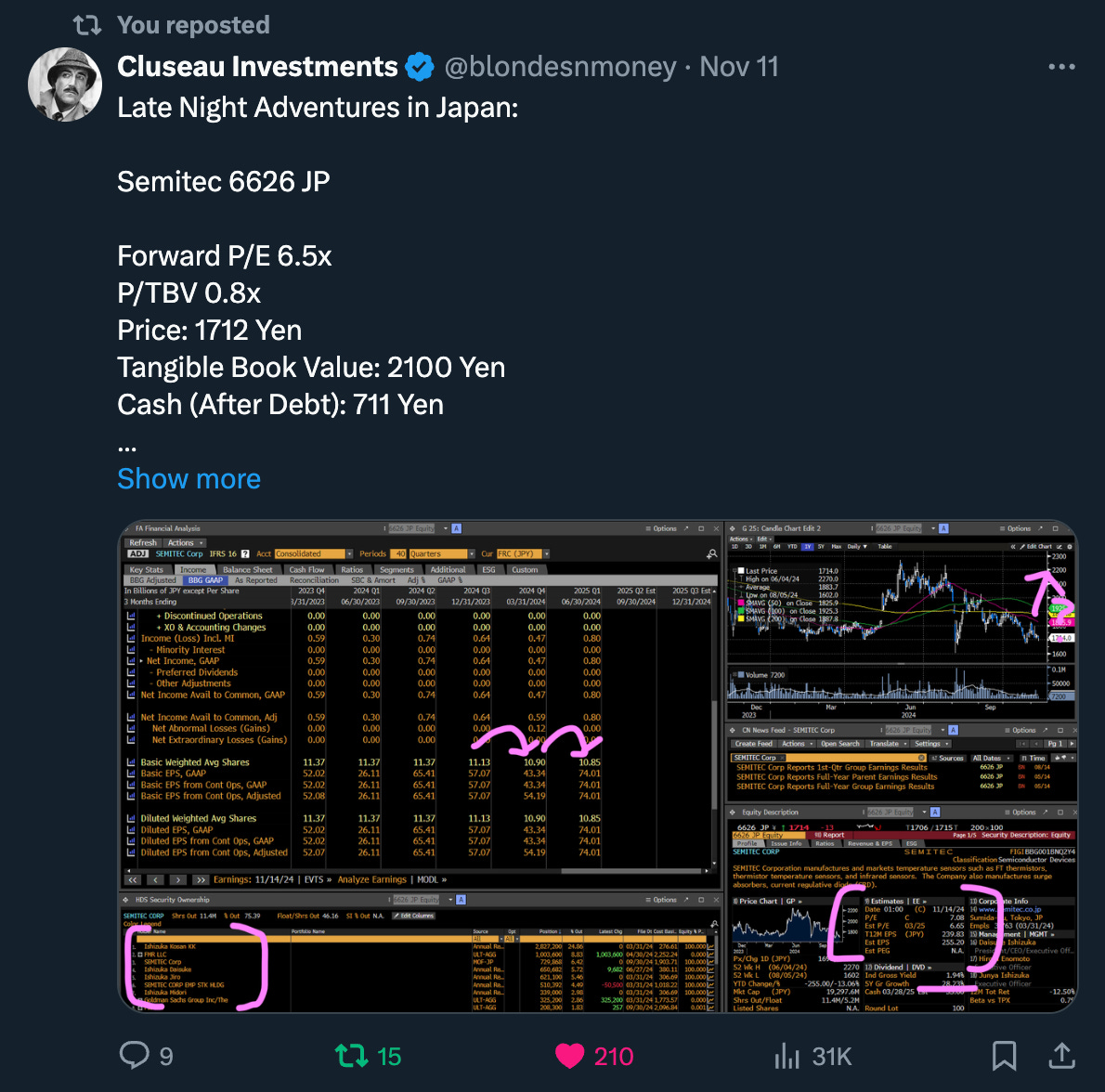

Cluseau Investments tweeted about Japanese electronic component maker SEMITEC (6626 JP - US$121 million). It’s a family-owned company producing temperature and infrared sensors used in security systems, thermometers, battery health monitors etc. Cluseau thinks that revenue growth will accelerate thanks to the weak yen and an expansion into Taiwan and the United States. What’s unique about SEMITEC is that it’s sitting on JPY 10 billion in net cash. And it’s now started to buy back shares in size: 5-6% of the free float this year alone. The stock trades at a forward P/E of 6.5x and at a 20% discount to book.

Podcast episode of the week

Yesterday, I sat down with economist Priyanka Kishore to discuss the impact of Trump’s tariff plan on Asia. She also provided a 2025 outlook for the region, how US monetary and fiscal policy is likely to affect interest policy and exchange rate, the weakening Chinese economy and the likelihood that China’s new stimulus measures will turn the tide.

Trump's tariff plan

I invited economist Priyanka Kishore to discuss the impact of Donald Trump’s election on Asia.

Discover value stocks in Asia-Pacific

Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is not a recommendation to buy or sell stocks.