Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may from time to time have positions in the securities covered in the articles on this website. This is disclosure and not a recommendation to buy or sell.

The recovery in Asian cross-border travel has so far been weak. But a renewed pace in vaccinations provides some hope that the industry will one day get back its pre-COVID growth trajectory.

The long-term case for Asian tourism

While COVID-19 has disrupted the industry, there is a strong case to be made that Asian tourism will continue to grow for decades ahead.

China is by far the largest tourism spender. And it remains the key growth driver for the foreseeable future. India (1.4 billion population country) and Indonesia (280 million population) may at some point become significant factors as well, but not at their current income levels. European outbound tourism is also a major factor for certain Asian countries such as Thailand and to a lesser extent Malaysia, Indonesia (Bali) and Singapore.

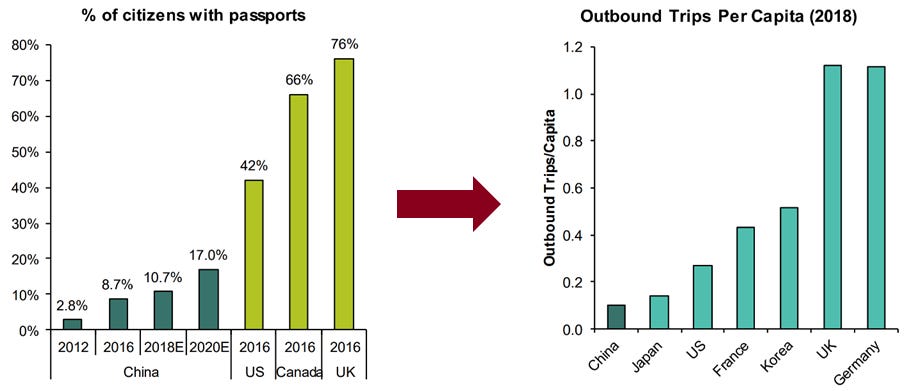

The bull case for Asian tourism is that only 11% of Chinese have passports. Roughly 42% of Americans hold a passport and 76% of Brits. And the number of outbound trips per capita are roughly 1/5x that in South Korea and less than 1/10th that in the UK. So there is undoubtedly still a lot of room for outbound Chinese tourism to grow.

Within China domestically, the number of air seats per capita are only around 2. This compares to 5 for North America and 6 for Europe. Based on these numbers, there could be 2-3x long-term upside in Chinese air traffic if the country continues to grow richer.

In 2019, China had about 155 million outbound travellers. The most popular destinations were Japan, South Korea, Thailand and Singapore.

Prior to the pandemic, outbound travel grew at a roughly 10% CAGR. I think we can expect this growth to resume sometime in 2022-2023. In volume terms - add a few percentage points to get nominal spending growth. Also worth mentioning is that this growth is secular in nature and could continue for many years if not decades.

The current state of the Asian travel recovery

The recovery from COVID-19 has been sluggish. CLSA’s COVID-19 alt-data re-opening indices are perhaps the best ways to track the recovery. As you can see from the charts below, Thailand, India, Philippines and to some extent Japan are currently experiencing new waves of infections. In almost all cases, CLSA’s re-opening indices are 50% below where they were prior to the pandemic, implying that consumption and travel patterns are far from normal. Asian emerging markets such as Indonesia and the Philippines have been badly hit.

What that means for air travel is another question. Domestic travel in mainland China has also recovered nicely as travellers have shifted from outbound tourism to domestic travel destinations. Domestic tourism numbers recovered by late last year but have slipped somewhat after the new outbreaks in the Northeast of China. Chinese outbound travel numbers remain close to zero.

In terms of hotel RevPAR, China was probably the only industry that had recovered by the fourth quarter of 2020. RevPAR in Europe, America and APAC ex-China were down 50%+. The Chinese RevPAR recovery was seen across the country, with leisure travel predictably outperforming business.

Another way to measure the recovery in travel demand is to look at Google, Naver and Toutiao search query statistics. Using search queries that signal intent such as “Flight ticket” or “Booking.com” (one of the most popular online travel agents globally).

You can see below that consumer interest in buying flight tickets is on a recovery path, though still 30% below 2019 (peak) levels.

But digging deeper into the data, it becomes clear to me that while demand for travel has recovered nicely in the United States and India, cross-border travel across Asia is pretty much dead. People won’t travel if they are forced to sit in quarantine for weeks on end. Domestic travel is likely to recover far faster domestically than internationally because of this very issue about quarantines.

The US precedent

One data point that brings hope to the industry is that US domestic air travel has started to recover from February 2021 onwards.

In mid-February, around 5% of the US population had received full vaccinations and somewhere around 12% had received their first shots. That’s an important data point that might tell us something about the future trajectory of the Asian cross-border travel recovery.

However, many in Asian emerging markets are given the less-effective Sinovac, Sinopharm, Covaxin or Covishield vaccines. So the US experience might not be completely transferable.

The pace of Asian vaccinations

I believe that the pace of vaccinations and the build-out of vaccine passport compatibility will be key to cross-Asian travel.

Vaccine skepticism is rare in this part of the world, with the vast majority of respondents in an Ipsos MORI survey in August 2020 saying that they would take a COVID-19 vaccine if available.

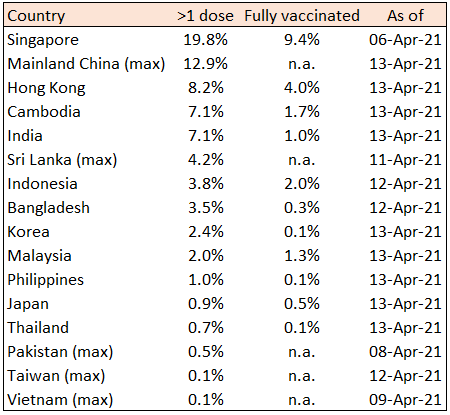

Singapore is far ahead in its vaccination drive while China (only discloses total number of vaccinations administered) is not far behind:

The following chart shows the vaccination progress over time, with just over 3% of the Asian population having received at least one vaccine shot.

At the current pace of 0.6 percentage points vaccinated every week, it will take over three years to fully vaccinate the overall Asian population. However, the key threshold of 10% receiving their first jabs will be reached by July this year. It is reasonable to believe that travel demand should start to increase from this point onwards. That will be the first hurdle. The next hurdle will be to open up borders and loosen quarantine restrictions.

Vaccine passports

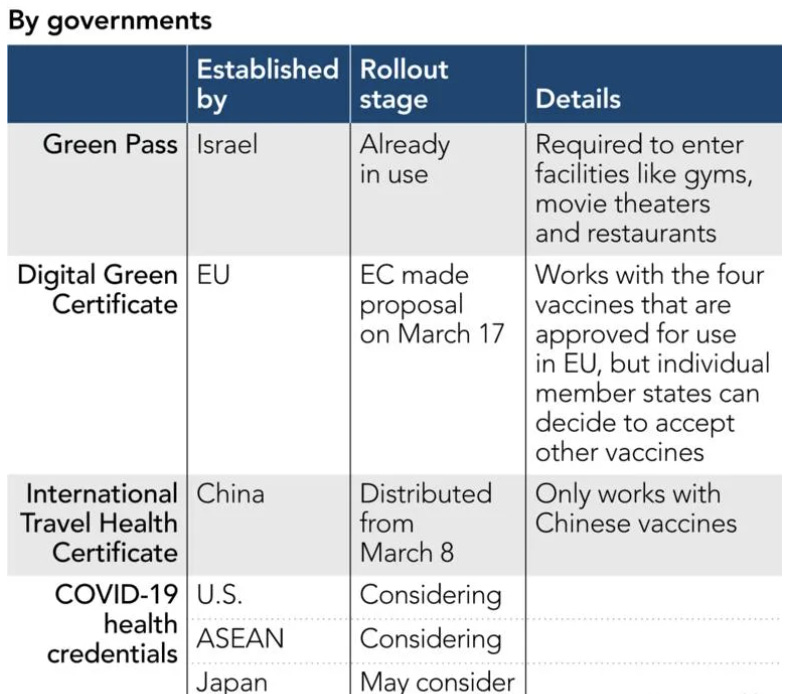

China is now pushing its International Travel Health Certificate, which is a mini program available on the WeChat social media application. However, foreigners travelling to China are still subject to two weeks of quarantine before being able to roam the country freely. And China’s vaccine passport only works with Chinese vaccines - not Pfizer’s or Moderna’s.

The European Union is preparing its own version of a vaccine passport: the called “digital green certificate” which will be useable throughout EU and EEZ countries. Individuals who have tested negatively for COVID-19 will also be allowed free movement throughout the EU. The digital green certificate will only work with the four vaccines that have been approved for use in the EU, although it is entirely possible that Russia’s Sputnik vaccine will eventually become approved as well. The vaccine certificates will be launched prior to the summer season.

The US CDC is working on the feasibility on its own vaccine passport called “COVID-19 health credentials (CHC)”.

Japan is also planning to issue a digital health certificate, that can be managed from a mobile app and will be in line with standards set in the EU and the US. The original launch date was set for April but it’s now unclear whether that deadline will be met.

Singapore is discussing mutual recognition of national vaccine certifications with other interested countries according to PM Lee Hsien Loong, starting with Malaysia. But it sounds like it could be a drawn-out process. The Singaporean government is very risk-averse.

There are opponents of government vaccine passports. For some individuals vaccination is inaccessible, unadvisable or simply impossible. That would deny a large proportion of the world population from free movement. So we should probably expect compromises to be made.

Airlines are working on their own health certificate apps, such as IATA’s Travel Pass app. Seventeen airlines including Emirates, Qantas and ANA have signed up for trials of the IATA app. American Airlines and British Airways are working on their own mobile health passport called VeriFly, developed by US identity assurance company Daon. Proponents of airline industry vaccine apps hope that they will become accepted standards by governments worldwide. But whether governments will accept them is a big question.

The intra-regional travel bubbles that have been discussed over the past six months have so far failed to materialise. The reason is that governments in Singapore, Hong Kong, Australia and New Zealand are afraid that infection rates will re-emerge.

ASEAN started exploring a potential introduction of a common digital coronavirus vaccine certificate for the region. But it’s taking longer than originally expected.

I am convinced that once EU’s digital green certificate and America’s CHC become accepted standards, governments of countries such as Japan, Singapore and Thailand will start to accept visitors who hold these certificates.

Visitors from emerging markets such as Russia or China may have a tougher time, despite having their own vaccine passports. That’s because Chinese vaccines have not been approved for use in any major developed market. Outbound tourism from US and the EU are therefore likely to recover first, and outbound tourism from emerging markets much later.

Quarantines opening up

Travelling across Asia is still very tricky. Compared to other parts of the world, Asia’s travel restrictions are among the toughest in the world. And travel restrictions have not eased materially from April 2020 when roughly 70% of Asian countries had complete closure of borders. Today, that number is still around 65%.

Almost all Asian countries still require foreign travellers to sit in quarantine for about two weeks:

Bangladesh: Quarantine for 14 days for some countries

Cambodia: Quarantine for 14 days depending on test results

Hong Kong: Mandatory quarantine for 14-21 days

India: Required quarantine for 14 days for all travellers

Indonesia: Required quarantine for 14 days for all travellers

Japan: Self-isolation for 14 days required for some travellers

Mainland China: Quarantine for 14 days for all travellers + 7 days at home

Malaysia: Quarantine for 7- to 10 days required for some travellers

Pakistan: Self-isolation for 14 days required for all travellers

Philippines: Required quarantine for 14 days for all travellers

Sri Lanka: Required quarantine for 14 days for all travellers

South Korea: Self-isolation for 14 days required for all travellers

Taiwan: Self-quarantine for 14 days required for some travellers

Thailand: Required quarantine for 10 days for all travellers, some exceptions

Vietnam: Quarantine in a government facility for 14 days

As long as these quarantines remain, I find it difficult to believe that Asian air travel has any chance of full recovery.

So far, the only major country that is even talking about opening up their quarantine requirements is Thailand. The quarantine period has just been cut from 14 days to 10 days and will be able to freely move around in hotels they are quarantined in. Those who have been vaccinated can now go to Phuket, Pang-nga, Samui, Chonburi and Chiangmai after just a 7-day quarantine. From 1 July 2021 if everything goes according to plan, Phuket will take away all quarantine requirements for vaccinated foreign travellers. Chiang Mai, Koh Samui, Krabi, Pattaya, Phang Na, and Phuket will adopt similar policies on 1 October 2021. Thailand plans to lift all quarantine requirement for foreign visitors sometime in 2022.

Other Asian countries are likely to take a wait-and-see approach as their populations are vaccinated and developed market health certificates are adopted.

Risks to the Asian travel thesis

Outbound tourism has been a significant drain on China’s current account, causing the trade balance to narrow over the past few years. COVID-19 caused China’s trade surplus to grow. But as the world moves back to experience-based consumption as opposed to work-from-home goods such as consumer electronics the trade surplus is likely to narrow yet again.

The question is how China’s policymakers is going to view renewed outbound tourism. The current account is in a sense the only major policy constraint that the government faces in fabricating GDP growth through stimulus programs. As long as China has ample foreign exchange reserves, they will be able to engage in further fiscal stimulus directed to infrastructure spending or property. Too much outbound tourism would take away some of that policy freedom.

Relevant investment opportunities

The Asian countries most sensitive to inbound tourism are Macau, Maldives, Cambodia, Hong Kong and Thailand.

I am particularly bullish on Thai tourism, given that Europe is far ahead in vaccinating its population and that Thailand is early in loosening its quarantine restrictions. Asian tourist destinations will be a bit more hesitant to welcome Chinese tourists, given the low efficacy rates of Sinovac and Sinopharm vaccines.

Another border that is likely to open up sooner rather than later is the one between Hong Kong and Mainland China. There is talk of quarantine requirements for mainland visitors to be dropped from mid-May 2021 onwards.

Eventually, I am convinced that travel across the region will recover. But it may be a 2023 event rather than 2022.

I recommend sticking with stocks with a very limited about of debt. New variants of COVID-19 could well pop up and prolong the recovery from the pandemic.

Here is a non-exhaustive list of Asian tourism-related investment ideas:

Airlines

I recommend staying away from airlines since neither of them have differentiated business models. The Asian airline industry is hyper-competitive. Most of them have bled cash during the pandemic, and enterprise values are in many cases higher than they were prior to the pandemic.

Many Asian airlines such as Garuda or Thai Airways are heavily indebted and could at any point seek bankruptcy protection if travel doesn’t pick up soon. There is underlying secular growth in some low-cost airlines such as Cebu Pacific, VietJet, Juneyao and Spring Airlines. But corporate governance is often a big question mark. I personally believe it is better to stick with companies whose business models are demonstrably profitable. Airlines don’t fit that profile.

Airports & related services

Airports tend to compound capital much better over the long-run. Airports of Thailand and Shanghai Airport are the two airports that investors have favoured over the past few years and they continue to trade at high multiples. There might be some upside left in Shanghai Airport. Beijing Capital International Airport and Xiamen Airport are suffering from near-term same-city competition but trade at what you might consider to be long-term attractive multiples.

I’ve covered Malaysia Airports (MAHB MK) in the past here and I continue to think there is upside if and when cross-border travel picks up again. The amount of debt is modest and the government has explicitly said it will support the company if necessary. The expected P/E multiple is now in the mid-teens, but could go down if ongoing RAB reform ends up being favourable to the company.

Singaporean gateway services and catering provider SATS (SATS SP) has recovered quite a bit despite Changi Airport traffic staying at rock-bottom levels. That said, SATS has a strong balance sheet fully capable of weathering the storm, together with a largely variable cost structure that can be adjusted to ongoing conditions. I covered SATS in a separate write-up here.

China’s third largest airport Guangzhou Baiyun Airport is interesting from the perspective of the new terminal that opened in April 2018 and has direct access to the high-speed railway line to and from Hong Kong. With the new terminal, total capacity rose from 66 million to 111 million passengers per year, significantly increasing the overall earnings potential of the airport. On the negative side, Guangzhou Baiyun stopped receiving airport fee refunds from regulator CAAC in 2018 onwards. In my model, I foresee PE 15x on 2025 earnings.

Beijing Capital International Airport (BCIA; 694 HK) is an inexpensive stock, trading at less than 10x 2019 earnings. However, note that Beijing’s second airport Daxing opened up in 2019 onwards and it will take many years for BCIA to return to its peak 2018 utilisation rate and a positive catalyst remains many years into the future.

Software suppliers

I’m a big fan of the business models of Expedia and Booking.com given the network effects that these travel booking platforms enjoy. Superficially, Trip.com enjoys similar advantages, and the stock has been beaten down since the anti-government protests started in Hong Kong in mid-2019 and COVID-19 in 2020. I am not fully comfortable with the persistent share count dilution from Trip.com’s employee stock option programs that has caused the share count to more than double over the past decade. Assuming a 30% operating margin and a full recovery from COVID-19, together with an assumed 20x EBIT multiple, the stock could easily end up being a US$55 stock, implying a more than 50% upside from today’s level. A 30% operating margin would be a bull case, and you might want to be a bit more conservative given the company’s less-than-favourable treatment of minority investors.

Indian online travel agent MakeMyTrip (MMYT US) is similar to Trip.com in that it has a clear dominance in its home market. Indian domestic travel seems to have recovered nicely, at least up until the latest wave of COVID-19 infections. It bleeds money however and there seems to be no end to it, despite a business model that in theory should be very profitable. At 6x pre-pandemic EV/Sales and strong underlying growth there certainly is upside if MMYT reaches global peer-type operating margins of ~30%. Growth stock speculator Jonah Lupton wrote a free Substack post on MakeMyTrip back in January, link here.

TravelSky (696 HK) provides the ordering backbone system for China’s airlines and other tourism-related companies. It’s essentially a government monopoly with a 98% share of domestic airlines. The closest global peer in the global distribution system (GDS) industry is Spain’s Amadeus, a stock that has been very rewarding to its shareholders and traded at a high 20s P/E just prior to the pandemic. It’s the type of stock that fits into a “picks and shovel” strategy of benefitting from the growth of an industry, but without having to pay for the capex needed to buy aircraft. TravelSky trades at just 18x 2019 earnings, so there could be some upside left in the stock.

Hotels & hospitality REITs

The Asian hospitality industry is generally not very attractive. Unlike US hotel operators, few Asian hotel operators have got into the franchising game. Without franchising and with the full ownership of property, it is difficult to compound capital at a high rate. Industry 5-year average ROEs tend to be in the low single digits.

Hongkong & Shanghai Hotels owns a high quality hotels across the region under the Peninsula brand name. But it also owns a few other assets such as Hong Kong’s Victoria Peak tram. It remains a key holding company of the Kadoorie family. Leverage is on the high side, but if you’re comfortable with their debt levels, I can see a further upside of about +40% or so - assuming a historical median P/E of 25x.

I covered Ichigo Hotel REIT in a prior write-up here. Japan is in the process of vaccinating its elderly in anticipation of Tokyo Olympics in July. While its sponsor Ichigo Inc is likely to compound capital better over the long-run, Ichigo Hotel REIT is beaten down and lenders remain very supportive. With some assumptions about occupancy rates and room rates returning to normal following the pandemic, the stock should be worth somewhere around JPY 130,000/share.

Banyan Tree and Shangri-La both have corporate governance issues. Mandarin Oriental and Minor International look expensive to me. I don’t like the persistent share count dilution at Japan Hotel REIT or Invincible Investment Corp. There is some upside in Singapore’s hospitality REIT, but not enough to get me interested.

Retailers

I suggest being careful about offline retailers given the threat of e-commerce taking wallet share.

One company that I think owns high-quality assets is Hysan Development. Its flagship asset is Hysan Place in Causeway Bay in Hong Kong. It also owns a number of other irreplaceable buildings around Times Square. While these shopping malls also face the threat of e-commerce, the buildings adjacent to Times Square serve a different purpose: they enable global luxury brands to market themselves to mainland visitors. Hong Kong will open up its border to the mainland later this year, and with the new national security law, anti-government protests are unlikely to re-erupt.

Other ideas

Among the other stocks in my table above, I am interested in casino operators Nagacorp and Bloomberry Resorts, both of which trade at very attractive multiples. Be careful about their corporate governance, however. Among Chinese A-shares listed in the above table, Emei Shan Tourism also seems like a high quality asset.

Conclusion

Domestic travel in India, China, Malaysia etc. will recover a lot faster than international travel. Once the EU, the US and Japan agree on vaccine passport standards, we can probably expect tourism from these sources to recover quickly. Thailand will be a key beneficiary. Mainland tourism to Hong Kong should also recover faster than overall cross-border Asian tourism.

I haven’t found a Thai tourism-related stock that I find appealing. But in Malaysia, airport monopoly Malaysia Airports still trades at a relatively attractive multiple. SATS in Singapore still has some upside left. Trip.com and TravelSky both offer some additional upside into an Asian travel recovery. Hysan Development is a high quality retail asset in Hong Kong that is likely to benefit if and when tourism from the mainland recovers. Ichigo Hotel REIT should also recover if Japanese tourism recovers following Japan’s current vaccination drive.

Thanks for reading!

I love any feedback: just let me know what you think here.

If you have any questions, feel free to ask anything in the comment section below.

Thoughts on Luk Fook (590 HK)? High insider ownership, 45% payout ratio, ample cash, has traded below book value. Benefitted from HK opening up to Chinese tourism in the 2000's with ROE's of 20-30% during 2007-2015. It's has somewhat of a moat, having the lowest SGA expenses as a percent of revenues of all the Cantonese jewellers. Furniture, jewellery, food & gifts appear to be more difficult for e-commerce to disrupt. It looks interesting under $20.