Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers and to understand whether any investment is suitable for your specific needs. From time to time, I may have positions in the securities covered in the articles on this website. Full disclosure: I do not hold a position in Thai Beverage when publishing this article. Note that this is a disclosure and not a recommendation to buy or sell.

Summary

- Thai Beverage (“ThaiBev”) is a monopoly in Thailand’s spirits market with an almost 90% market share and ownership of important brands such as Ruang Khao. It also owns the Thai beer brand Chang and the Vietnamese beer brand Saigon.

- ThaiBev’s recovery from COVID-19 is now almost complete. The beer segment has benefitted from the reopening of entertainment venues. And its food segment has enjoyed a strong rebound as consumers have returned to its restaurants.

- While the Progressive Liquor Act has not passed parliament, the barriers to entry in Thailand’s beer sector have been lowered. ThaiBev will probably see greater competition in the Thai beer segment.

- The stock trades at a consensus 2024e P/E of 12x, far lower than the global peer group’s 20x. Do note that ThaiBev has a significant amount of debt, so enterprise value multiples do not show as much discount.

Table of contents:

1. Quick recap

2. Update since my first write-up

3. What will change for ThaiBev?

4. Valuation multiples

5. Conclusion1. Quick recap

My initial report on Singapore-listed Thai Beverage (THBEV SP - US$11 billion) was published in early 2022.

You can find that (free) report here:

My reasoning in that report was that:

- Thai Beverage (“ThaiBev”) completely dominates Thailand’s spirits market with an almost 90% market share. Its rum and whisky products are ubiquitous in Thailand and especially popular among the working-class population.

- ThaiBev’s foray into beer hasn’t been profitable. It sells beer under the Chang brand name, which means “elephant” in Thai. The Thai beer segment’s margins remain far lower than of Thai Beverage’s spirits division. And I don’t see that changing anytime soon.

- The company also owns a 54% stake in SABECO, the largest beer producer in Vietnam with a market share of 41% and brands such as Saigon and 333.

- One of ThaiBev’s competitive advantages is its ownership of several important brands such as Ruang Khao, SangSom rum, Mekhong and Chang. But the company also benefits from regulatory restrictions, including heavy import duties, foreign ownership restrictions, and environmental regulations preventing new plant construction. I also think that Thai Beverage has benefitted from its incredible distribution network with access to 400,000 points of sale across Thailand.

- Capital allocation hasn’t been perfect. Thai Beverage has made several high-priced acquisitions, including Vietnam’s SABECO at 35x EBITDA, a minority stake in Fraser & Neaves and Burmese spirits producer Grand Royal. It also reinvested capital into ThaiBev’s beer business, which has a high market share but isn’t particularly profitable. I believe the company would have been better off paying out that cash as dividends or buying back its shares.

- When I wrote the report, ThaiBev’s shares traded at 16x P/E, much lower than the global peer group’s 24x. However, I also noted that the company had significant net debt at 5x EBITDA.

- Catalysts that I identified in my write-up included a post-COVID Thailand tourism recovery, a Singapore BeerCo spin-off and a potential disposal of ThaiBev’s stakes in Fraser & Neaves and Frasers Property Limited.

2. Update since my first write-up

2.1. Operational update

Since my report in April last year, ThaiBev’s share price performance has been lacklustre. The share price is down 18% since that point in time.

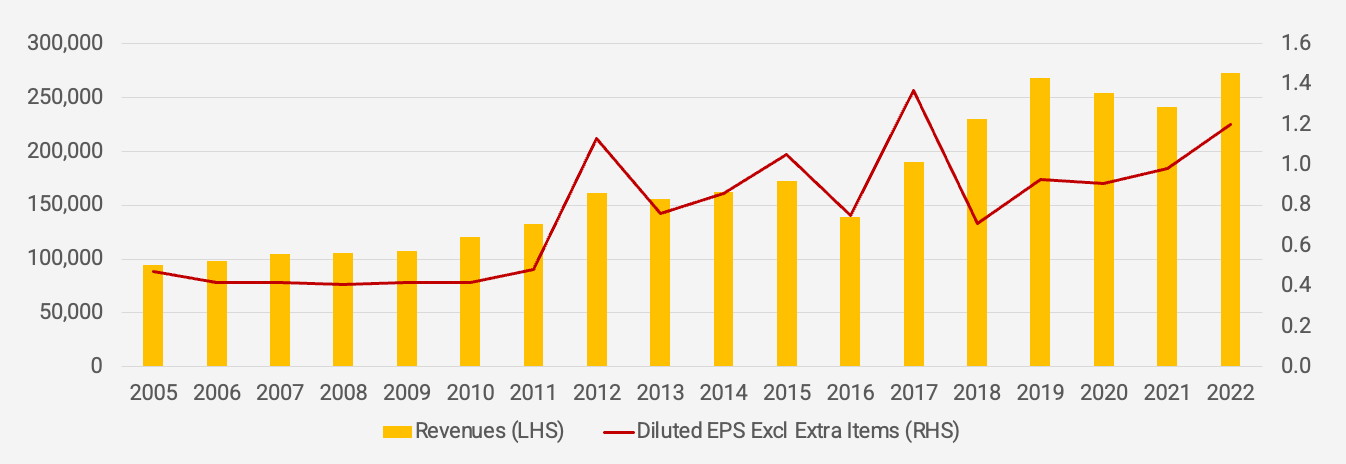

And this share price weakness came in the face of strong a strong earnings result in 2022 when revenues rose +13% year-on-year and earnings per share +22%:

The primary reason for this rebound is that Thailand’s COVID-19 lockdowns ended on 1 June 2022. After this date, Thailand’s entertainment venues and bars opened again, leading to greater on-premise sales, especially beer. The gradual recovery in tourist arrivals from late 2021 onwards also helped support ThaiBev’s beer volumes.