Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may from time to time have positions in the securities covered in the articles on this website. This is disclosure and not a recommendation to buy or sell.

Jefferies strategist Chris Wood made an interesting comment in his 4Q21 Asia Maxima report. He expressed a bullish view on Singaporean residential property developers, quoting a 40% discount to book and rapidly improving fundamentals. Here is a short report on the sector to figure out whether his bullishness is warranted or not.

Executive summary

- Supply & demand for residential property is not necessarily out of sync. The 2009-2013 period was a bubble and should not be seen as a baseline.

- The retail, office and hospitality segments have suffered over the past two years due to cross-border travel restrictions, working from home during the pandemic and the threat from e-commerce. But several of these factors are one-off in nature.

- I see value in City Developments, given high-quality assets, excellent execution and an upside of almost +60% using reasonable assumptions.

- I’m also bullish on small-cap Bukit Sembawang, which sit on a valuable land bank and has won awards as one of the best property developers in Singapore.

Introduction to Singapore’s housing market

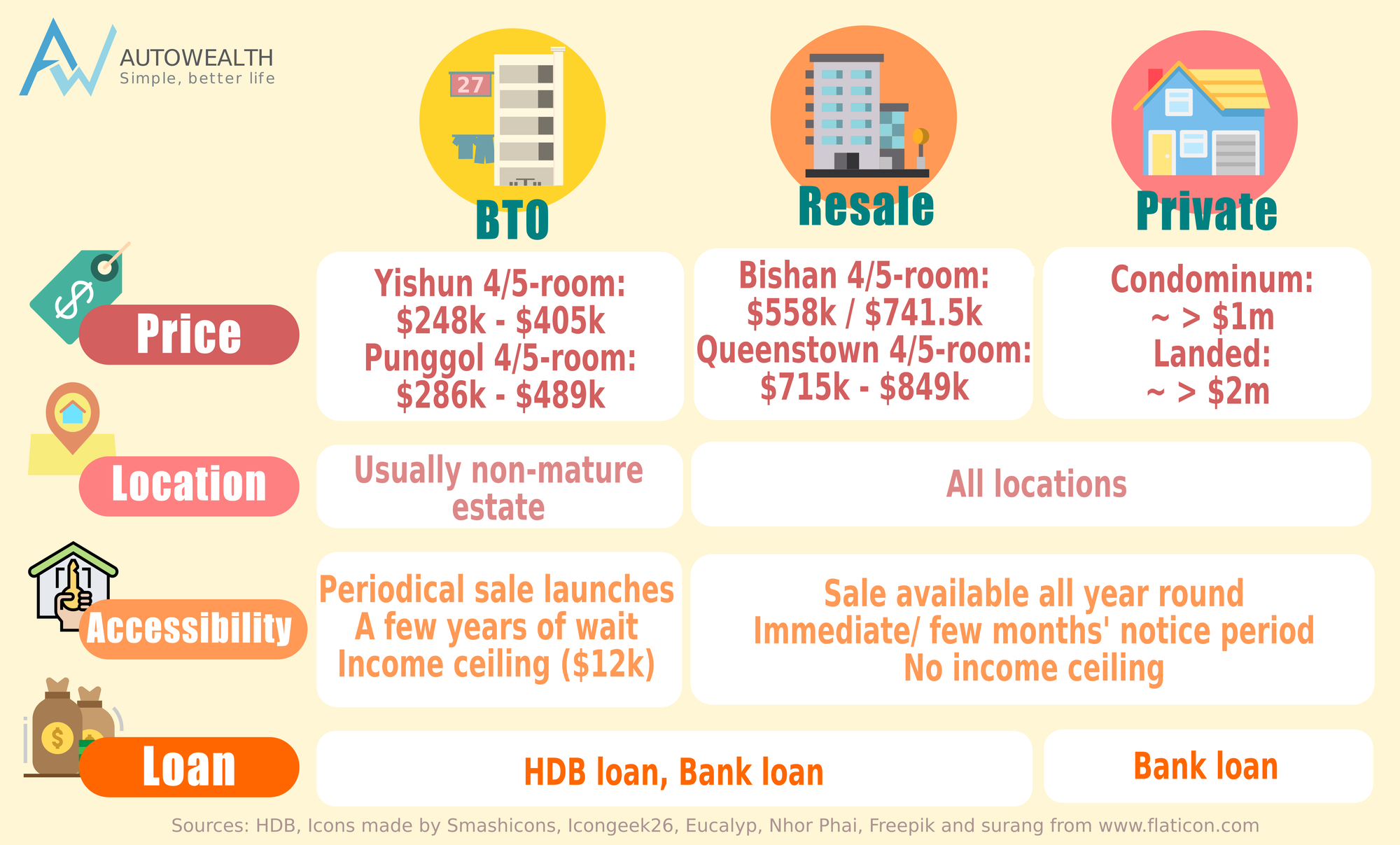

Housing in Singapore can be divided into three separate categories:

- Built to order (BTO) public housing, a.k.a. HDB flats (Housing & Development Board). Typical prices of SG$300-400,000 for 99-year leases.

- Resold HDB flats. Typical prices of SG$400-600,000 for 99-year leases.

- Private housing. Typically condos landed housing. Prices in excess of SG$1 million, depending on location and type (whether leasehold or freehold).

The Housing Development Board (HDB) system

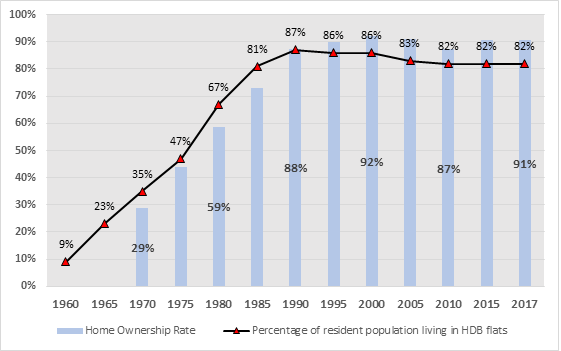

Singapore has a 91% homeownership rate, much thanks to the government’s public housing scheme under the Housing & Development Board (HDB). The HDB system was created to solve the nation’s housing shortage right after the People’s Action Party came to power in 1960.

While public housing existed even before the Housing Development Board, construction of such buildings accelerated after it was set up in 1960. It hoped that HDB flats would provide the population with high-quality housing. The government also reasoned that if the population owned their flat, they would be more committed to defending the nation in case of a conflict.

A 1967 law allowed the government to compulsorily acquire private land for public housing (“HDBs”). That sped up the construction of HDBs. By 1965 roughly 23% of Singapore’s population lived in public housing. By 1984, that number had reached 62% and by 2017 roughly 82%.

In 1989, a new quota policy was introduced to ensure racial harmony: each housing block from then on needed to ensure that it had residents from each of Singapore’s three key ethnicities: Chinese, Indians and Malays.

All HDB flats are 99-year leases, after which you will have to return the flat to the government. Since the HDB system was set up in 1960 and few 99-year leases existed before then, lease expires have only started occurring. In theory, the value of the leasehold will go to zero after the 99 years have passed.