Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is not a recommendation to buy or sell stocks.

Summary

- In developed Asia, a large part of the population is about to retire, causing massive shifts in consumption patterns. Specifically, they’ll shift their spending from transport and eating out to healthcare.

- Healthcare, nursing homes, insurance companies, gyms, golf, special interest travel and deathcare are some of the beneficiaries of Asia’s aging populations.

- I also discuss a few listed companies likely to be affected by this trend.

Over the weekend, I read an article in the Wall Street Journal about how golf is booming thanks to baby boomers reaching retirement age.

The US baby boomer generation was born from 1946 to 1964 and remains the largest demographic cohort due to post-war baby-making. These baby boomers are now retiring, causing a big shift in consumption patterns as they stop working and focus on leisure activities instead.

This begs the question of whether Asian countries will see a similar effect as their population become older. Several countries in this part of the world have population pyramids that resemble that of the United States. As people retire in these countries, companies selling into the Silver Economy - catering to those with gray hair - will probably thrive.

In this post, I’ll discuss exactly what those companies might be.

Table of contents

1. Asia's demographics

2. Spending patterns

3. Beneficiaries of senior spending

3.1. Healthcare

3.2. Nursing homes

3.3. Financial services

3.4. Hobbies & fitness

3.5. Travel

3.6. Deathcare

4. Conclusion1. Asia’s demographics

Asia has a population of 4.8 billion people, with China and India representing more than half of this number.

Overall population growth is 0.6% per year. But this number masks significant differences between developed and developing Asia, East Asia vs South- and Southeast Asia and urban and rural Asia. It’s hard to generalize across such a diverse region.

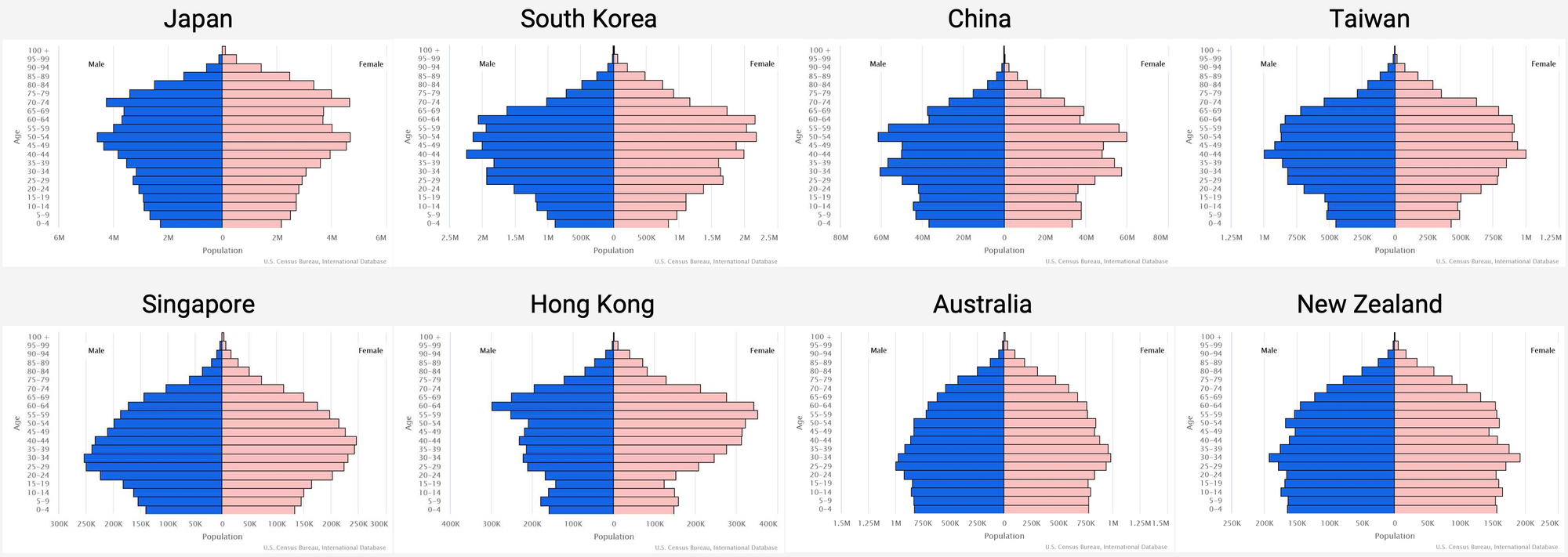

Developed Asia - which includes countries and regions like Japan, South Korea, Taiwan, Hong Kong and Singapore - is rapidly aging.

For example, in Japan, the number of elderly people aged 65 and older is expected to increase until 2044, growing about 2% per year and then falling gradually.

Look at the following population pyramids:

In Japan, the biggest bump in age brackets is between 70 and 74. In other words, peak retirement has already happened. However, in South Korea, Taiwan, and Hong Kong, the biggest bump in their population pyramids is in the 60-64-year-old bracket, which means that a large proportion of their populations are currently retiring. That has important ramifications for their economies.

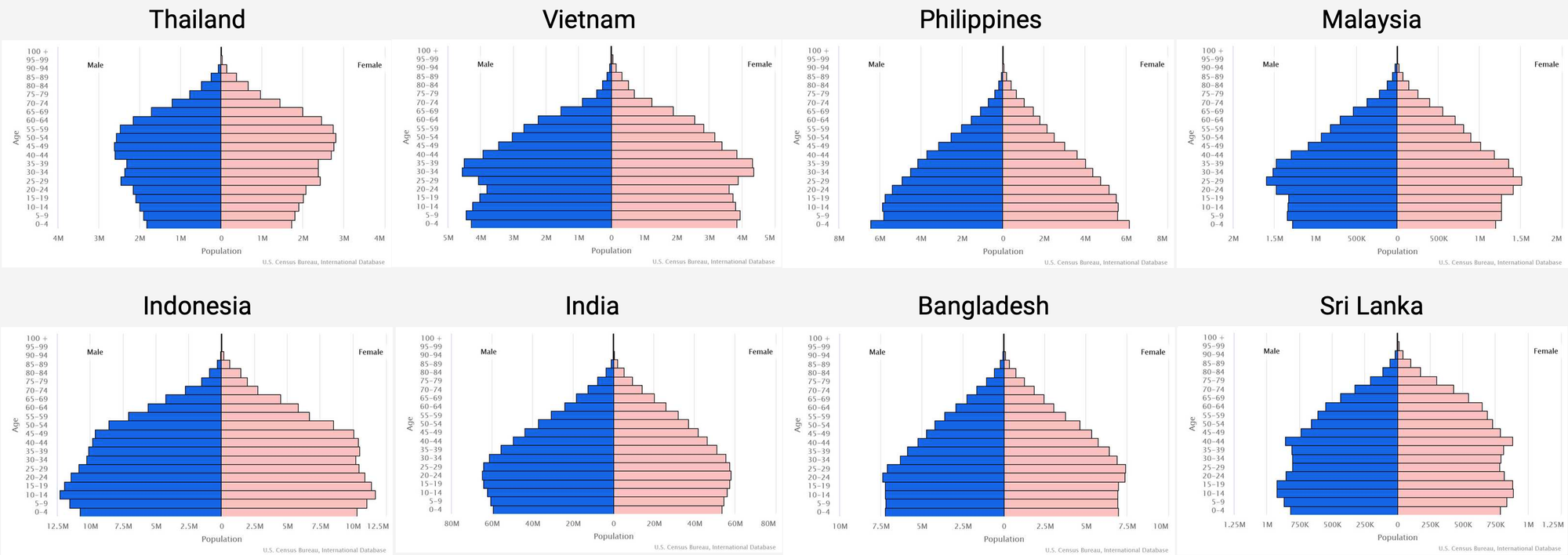

In Developing Asia, population pyramids are far more favorable:

These actually look like the “pyramids” they were named after, with many more young people than the elderly. The only real exception is Thailand, whose population is ageing with a bump around the 50-54-year-old bracket.

So, to summarize, the above demographic profiles suggest that the Silver Economy will likely grow the fastest in East Asia, specifically in Japan, South Korea, Taiwan and Hong Kong.

And given that the retirement age in the region is typically anywhere from 58 years old (Indonesia) to 65 years old (Japan), there’s a huge number of people in these countries retiring right now. And many of the companies serving them are thriving.

2. Spending patterns

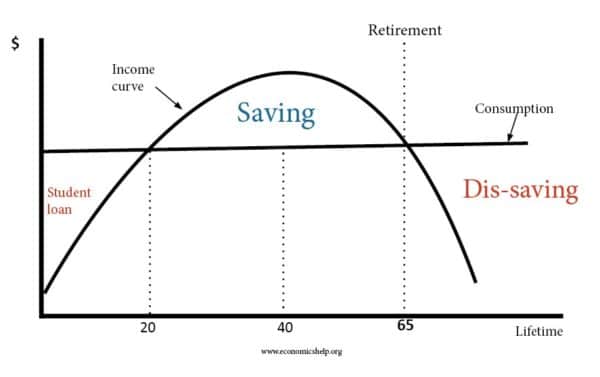

According to Franco Modigliani’s 1957 life cycle hypothesis, consumption throughout your life tends to be relatively constant. However, incomes vary with age, peaking around 40 and then falling into retirement. In this model, any short-fall has to be dealt with by either borrowing or drawing down savings:

Modigliani made the case that finance would help smooth spending over a lifetime through student loans, mortgages, and pension solutions. The ability to smooth spending is, therefore, dependent on the maturity of the financial systems in each country.

I’ve looked into the data, and it seems like the life cycle hypothesis is not entirely accurate. Actual dollar spending tends to go down into retirement. Numbers that I’ve seen suggest a drop of about 20% from pre-retirement to people 75 and older.

There are a few reasons for this. After people stop working, they’ll no longer incur work-related expenses such as transport and eating out. Their mortgages will often have been paid off. And with the children moving out, they’ll no longer need to pay for their education.

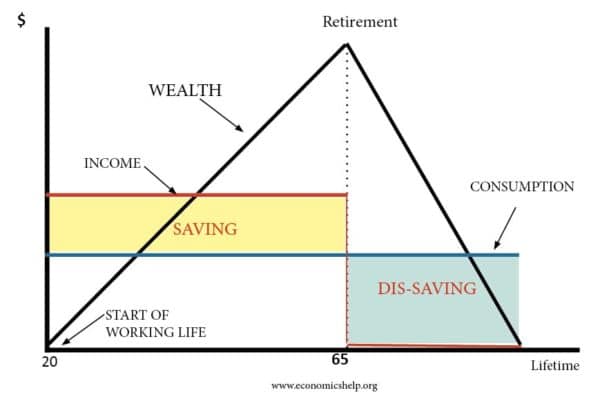

Another discrepancy concerns savings. According to Modigliani’s model, wealth peaks around the age of retirement, and people then dis-save until wealth reaches zero around the end of their lives:

However, data shows that the elderly tend to hoard wealth in retirement rather than running it down quickly. That’s understandable: we no longer know how long we’ll live, and many elderly wish to donate their remaining wealth to their children. This is another reason spending decreases into retirement in actual dollar terms.

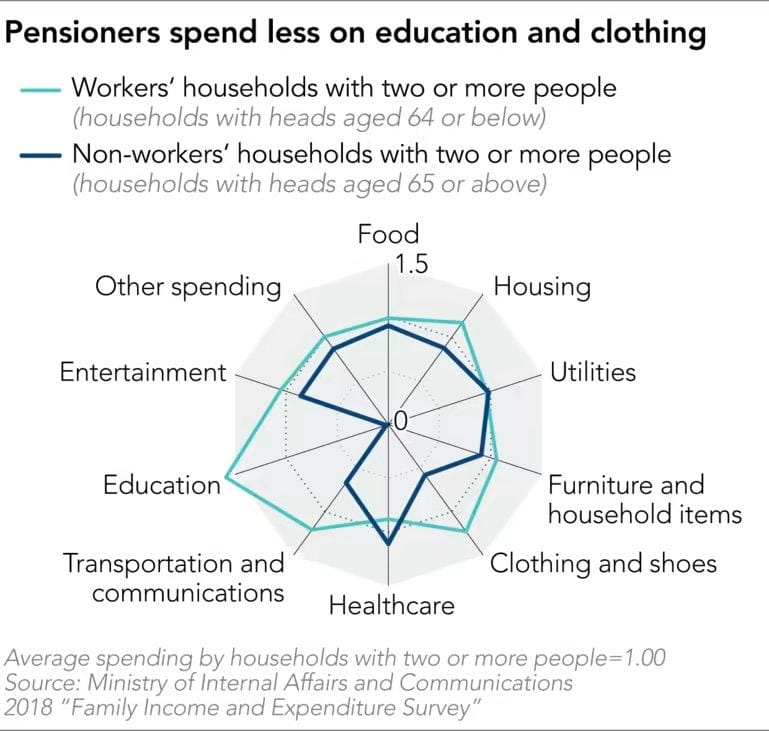

However, there are spending categories that tend to go up after people start working. According to survey data from the Japan Ministry of Internal Affairs and Communications study, for example, retirees tend to spend far less on transport and education but more on healthcare.

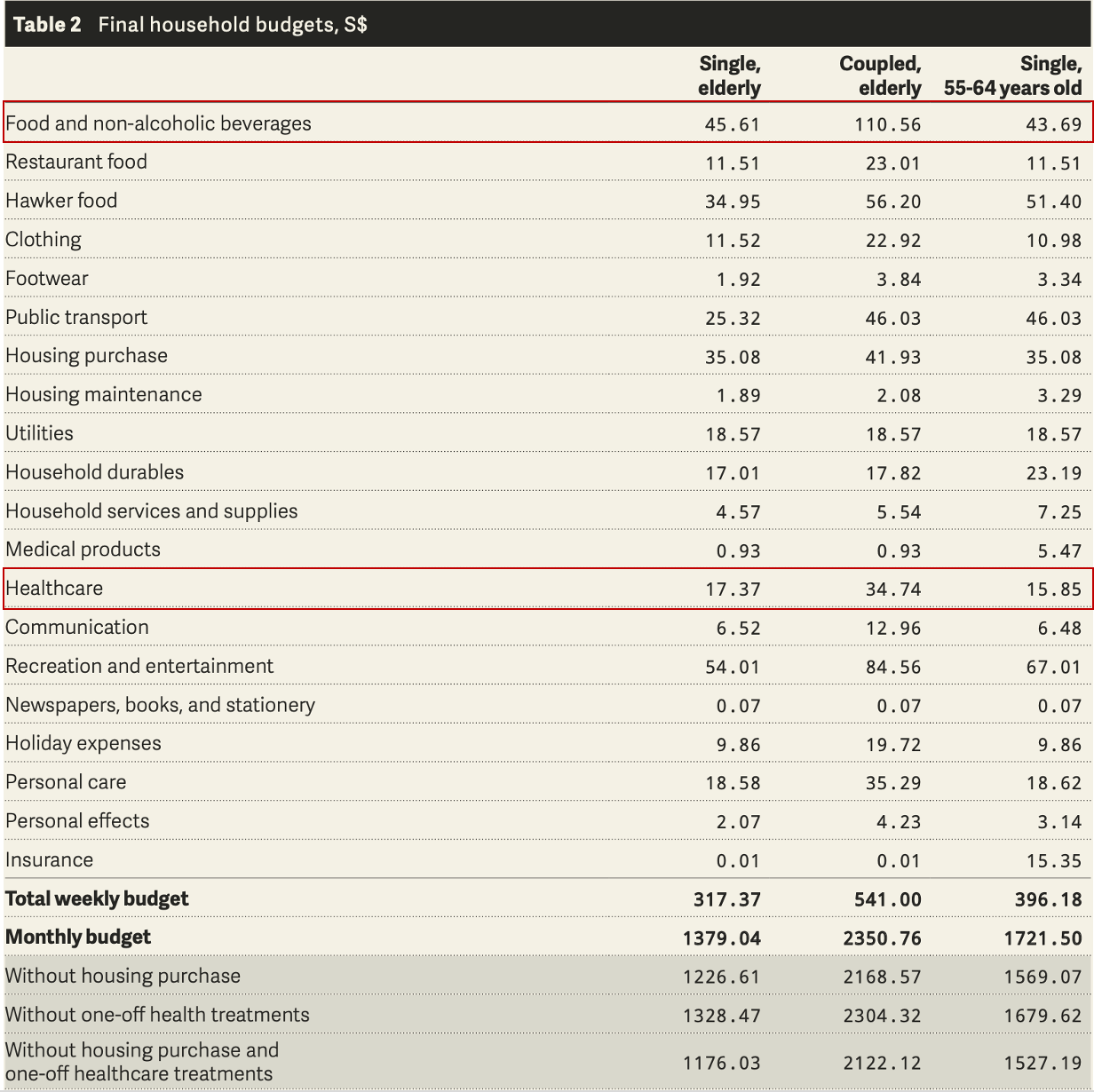

According to a 2019 study from Singapore, the elderly tend to spend more in absolute dollars on healthcare and food & and non-alcoholic beverages. Conversely, they spend far less on public transport.

3. Beneficiaries of senior spending

But let’s look deeper into the specific categories that I think the elderly will spend more money on as they age. I’ll also discuss the listed companies that I believe will benefit.

3.1. Healthcare