Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author holds positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. This is a disclosure - not a recommendation to buy or sell stocks.

Portfolio update

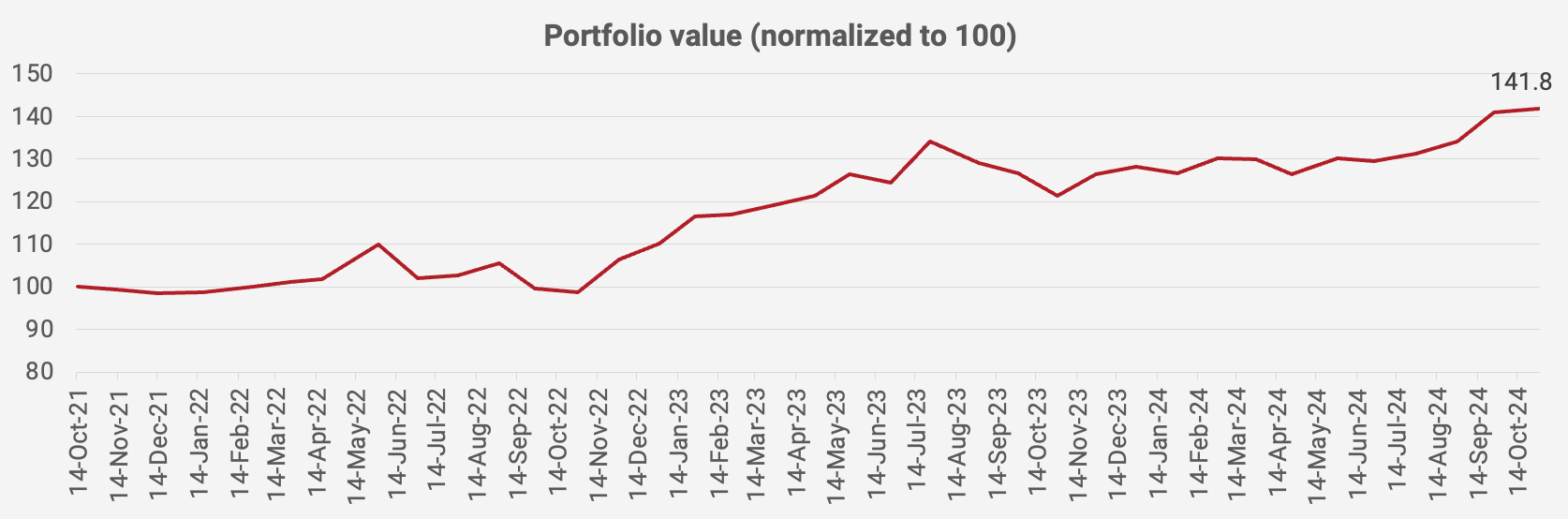

The portfolio continued rising in October, up another +0.6% month-on-month. The value of the portfolio is now up +41.8% since October 2021, equivalent to a +12.2% compound annual growth rate:

This month's major contributor was Japanese karaoke operator Koshidaka’s after it reported positive earnings. My original estimates proved far too conservative. Quarterly revenues grew +18% year-on-year and operating profit +27%. Koshidaka’s store expansion is likely to continue across the Kansai region with talks of “doubling the pace” of store expansions. The stock trades at 12.9x next year's earnings.

We also saw positive news from Indonesian beer producer and Heineken subsidiary Multi Bintang. Revenue growth in the latest quarter accelerated to +22% year-on-year and earnings per share growth to +36% year-on-year. The stock trades at 12.7x forward P/E.

Here is what the latest portfolio looks like as of 30 October 2024. I’ve added one new position: