Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author may hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. I have positions in all of the below stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.

Portfolio update

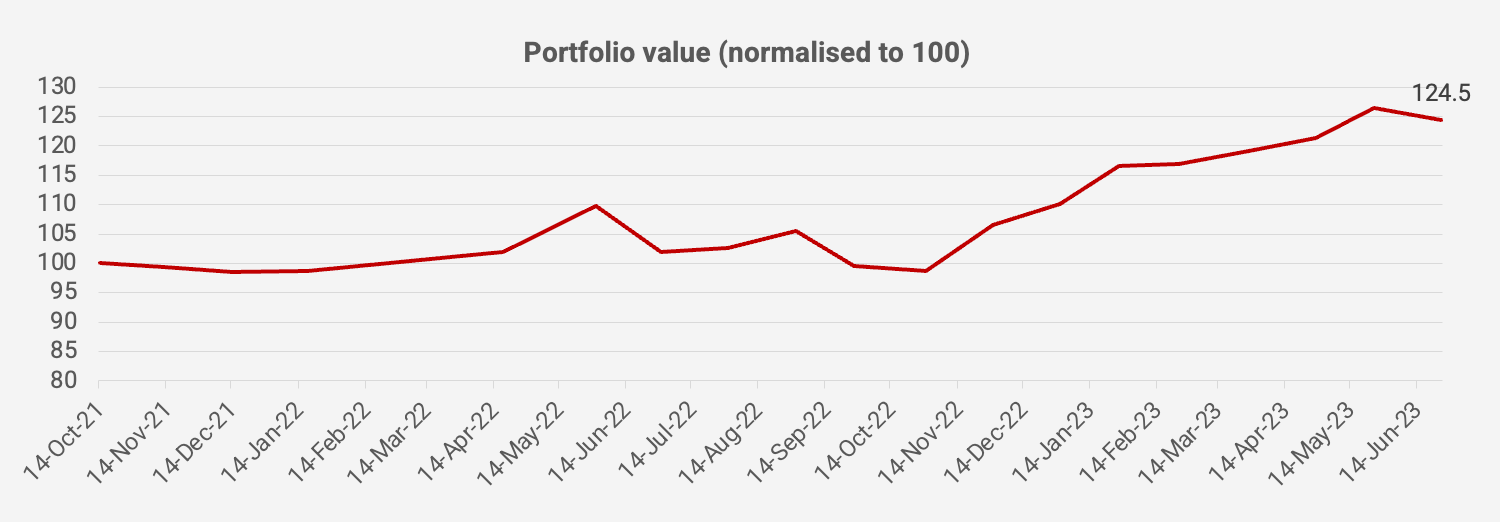

June was a weak month for the portfolio, down -1.5% month-on-month and now +24.5% since inception in October 2021, equivalent to an IRR of +13.8%.

The primary issue was pullbacks in the share prices of Chinese oil & gas company CNOOC and Indonesian chocolate producer Delfi. I suspect rising OECD crude oil inventories are to blame for the recent drop in energy equities. Higher cocoa prices might have caused some to sell Delfi. It’s unclear why Multi Bintang dropped, as I believe the outlook continues to improve.

On the positive side, the Indonesian dairy company Ultrajaya had a big rally. And the new holding Fuji Corp Miyagi rose after a surprise announcement that it would buy back another 1 million shares.

Here is the portfolio as of 25 June 2023: