Hi! Welcome to a subscriber-only edition of Asian Century Stocks — a newsletter about value stocks in the Asia-Pacific. For more information, check out my Table of Contents and About pages.

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author may hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. I have positions in all of the below stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.

Portfolio update

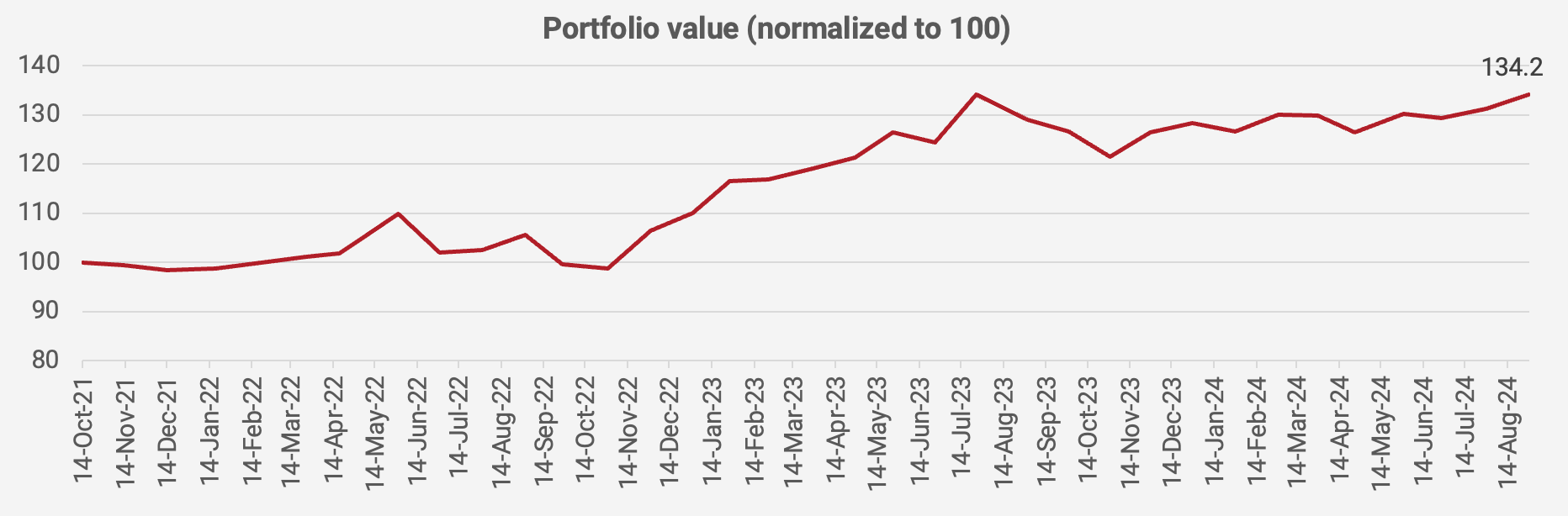

The portfolio did well in August, rising another +2.3% to an all-time high. The value of the portfolio is now up +34.2% since October 2021, equivalent to a +10.8% compound annual growth rate:

Most of the recent performance has come from the weakening US Dollar, with the DXY Index having broken down due to Powell’s recent dovish commentary. On the other hand, the strong US Dollar has been a headwind for the past three years. Perhaps that headwind is finally starting to go away.

In early August, the Japanese market crashed in an epic down-move. It was sparked by a small rate hike and guidance of reduced quantitative easing, causing carry trades to unwind and the yen to appreciate almost 10%. Since Japan is an export economy, earnings estimates took a hit, and share prices slumped. Luckily, I had no exposure to Japanese exporters, and my portfolio wasn’t impacted much. While the Nikkei has rebounded, I fear that investors are underestimating the negative effect of the stronger yen on Japanese earnings estimates.

Ginebra San Miguel seems almost unstoppable, with its 10x P/E and almost 20% earnings growth. And that’s after rising over 50% in the past year. Thai cinema operator Major Cineplex rebounded nicely in August thanks to the recent share buyback programs and hope for a better 2025 Hollywood movie slate.

In terms of negatives, I saw disappointments at Delfi, Bloomberry Resorts and SBS Transit. In the former two cases, the issues seem cyclical. For SBS Transit, it was simply a case of earnings growth turning out to be less impressive than I had originally anticipated.

In any case, here is what the latest portfolio looks like, dated 29 August 2024: