Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author may hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. I have positions in all of the below stocks when publishing this article. This is a disclosure - not a recommendation to buy or sell stocks.

Portfolio update

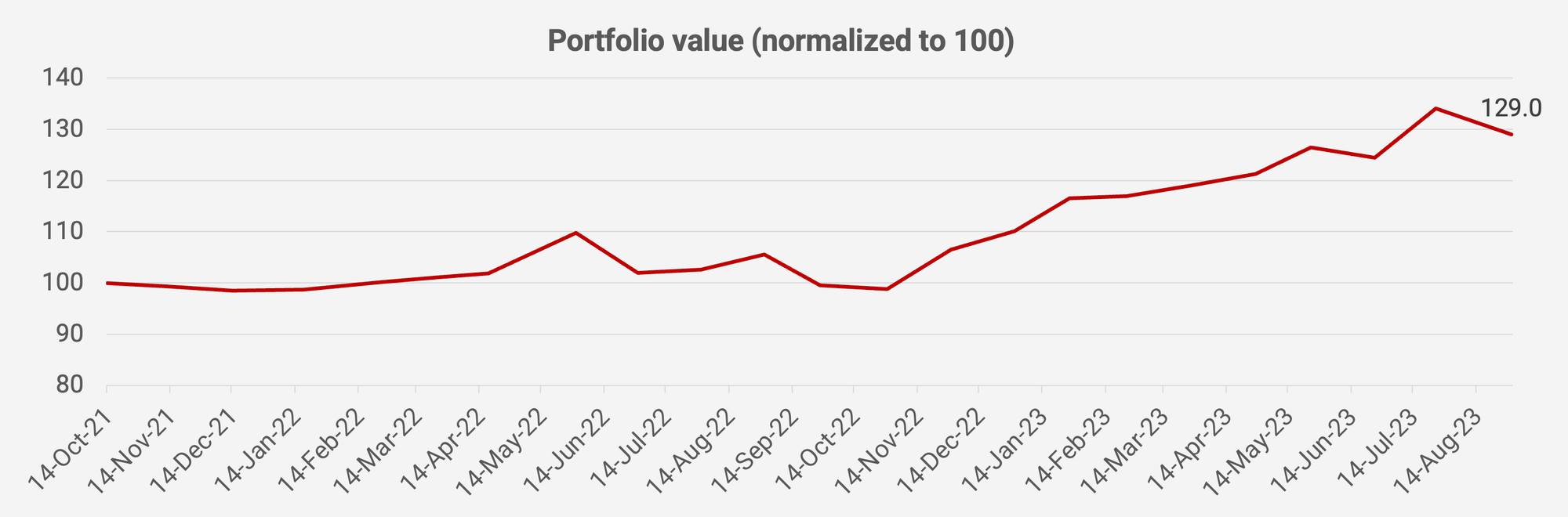

The portfolio experienced a pullback in August. Almost all stocks in the portfolio lost value, especially those listed in Hong Kong. The portfolio's value fell by -3.8% month-on-month and is now +29.0% since inception in October 2021, equivalent to an IRR of +14.5%.

I’m seeing a disparity between falling commodity prices and increasingly expensive Indonesian equities. There’s anecdotal evidence of an overall weakening Indonesian economy, but it’s not showing up in the numbers yet.

Pessimism around Chinese equities has reached a crescendo. Technical analyst Jason Goepfert at Sentimentrader recently published a chart showing that the number of negative headlines regarding China has become the greatest since 2015.

The prevailing narrative seems to be that China is experiencing a 2008-style housing crash. I disagree with that view. The slowdown is due to lower construction activity after government banks cut off private developers from credit. Growth will be weak for the foreseeable future. But I do not expect a housing-led financial crisis.

Here is the portfolio as of 31 August 2023: