Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers, including whether any investment suits your specific needs. From time to time, I may have positions in the securities covered in the articles on this website. Full disclosure: I do not hold a position in Nippon Parking Development at the time of publishing this article. To reiterate, this post and the below presentation are for informational and educational purposes only - not a recommendation to buy or sell shares.

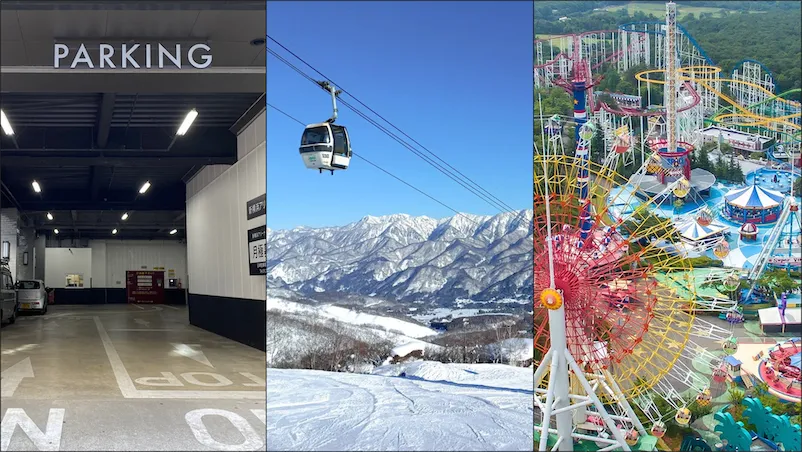

Nippon Parking Development (2353 JP — US$477 million) — also known as “NPD” — is a Japanese lessor of parking spaces and an operator of ski resorts and theme parks.

It’s the brainchild of lifelong entrepreneur Kazuhisa Tatsumi, who literally built the company in his garage in the early 1990s.

In Japan, developers are generally required to build 1/3 parking space per 100 square meters of floor area for any large building. This is known as “legally mandated parking space”.

The purpose of legally mandated parking spaces is to keep parked vehicles off roads. The government wants to minimize congestion and reduce the risk of traffic accidents. However, legally mandated parking has led to an oversupply of parking space in many urban areas across Japan.

Kazuhisa Tatsumi saw an opportunity to make money from the excess supply of parking spaces. He would enter into long-term contracts with property owners to take them over and then sublease individual parking spaces on a monthly basis.

It turns out that Tatsumi’s sales-focused organization was adept at taking at finding underutilized assets and then turning them around. He eventually formulated the strategy as NPD’s “Happy Triangle” — finding solutions to underutilized assets that benefit owners, users, and society alike.

The same type of thinking led Nippon Parking Development to the ski resort industry in the mid-2000s. From that point onwards, it acquired a collection of eight ski resorts in central Japan, half of which are in the Hakuba Valley. These resorts now belong to the separately listed subsidiary Nippon Ski Resort Development (6040 JP — US$129 million).

NPD acquired snow machines to increase utilization, built terraces overlooking beautiful mountain valleys, and introduced a kids' loyalty program. These efforts helped increase the attractiveness of the company’s ski resorts.