Table of Contents

Disclaimer: This article constitutes the author’s personal views only and is for entertainment purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author may hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. This is a disclosure - not recommendations to buy or sell stocks.

This week, I’ve decided to do something a little bit different. I asked Asian Century Stocks members on Twitter to suggest a stock for me to review.

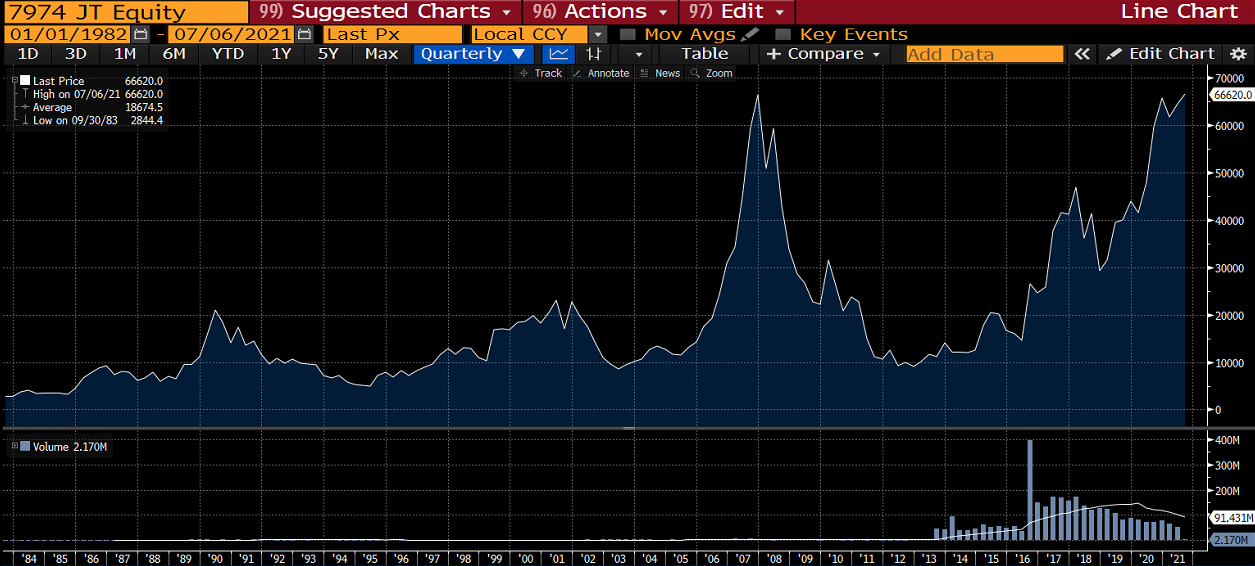

There was an overwhelming demand for me to review Nintendo (7974 JP / NTDOY US). So here we go:

I will go through the main bullish and main bearish arguments for Nintendo and then wrap up with an expected earnings trajectory and how the stock will be valued given this scenario.

1. Digitisation of sales

In 2019 and early 2020, US hedge fund ValueAct took a US$1.1 billion position in Nintendo around the $40/ADR level. ValueAct’s thesis is that Nintendo has potential for growth in its software business and a transition to a broader entertainment company. The ValueAct thesis is centred around Nintendo’s ongoing digitalisation efforts.

In the old days, Nintendo used to sell its games on physical discs and sold in stores, with the retailer capturing about 30% of the retail price (~US$60). The cost of the disc/cartridge represented another 8% of the retail price, cutting further into Nintendo’s margins.

With third-party games (15% of revenue), Nintendo captured an average US$10 royalty on each unit sold, which was directly margin-accretive with few variable costs.

As more of Nintendo’s sales move online, Nintendo will capture an extra US$24 on each sale (US$18 retail margin plus US$6 of cost savings from not having to produce a disc/cartridge).

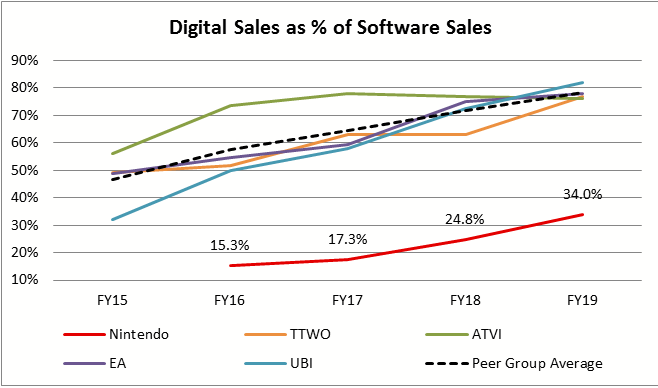

Today, digital sales represent 36% of all of Nintendo’s revenues, and this ratio is going up. Key American peers Electronic Arts, Take-Two Interactive and Ubisoft, enjoy close to 80% share of sales from digital.

Could Nintendo one day reach an 80% digitalisation rate?

There is one reason that makes me cautious about projecting 50%+ digital sales ratios. Nintendo Switch only has 32Gb of storage. For example, Legend of Zelda: Breath of the Wild requires 13.4Gb of storage. So a given user who does not buy expandable storage might only be able to buy 2 digital games - far below the typical 7-8x attach rate. The storage problem will be partly solved with the next generation of Switch, the Switch OLED, which will have 64Gb of built-in storage.

In addition, Nintendo started a subscription service called Nintendo Switch Online in late 2018, which allows you to play multiplayer games / classic Nintendo games or access cloud storage for US$4/month or US$20/month. Nintendo Switch Online had 26 million paying subscribers in September 2020, and that number must have increased since then. What’s the potential? At an ARPU of $2/installed base, you could see US$600 million of additional revenue of JPY 66 billion - close to 10% of operating profit.

2. Monetising intellectual property

Mario, Zelda, Donkey Kong, Kirby and Pokémon are brands with major franchise value.

Nintendo’s franchises have a cult following. When NES Classic Edition was launched in 2016, it was sold out practically everywhere. Pokemon Go was a worldwide hit. Pokemon, Mario are on the lists of the greatest media franchises of all time.

The monetisation of their brands are likely to happen with the following initiatives:

Flagship stores: A flagship store in Tokyo (Shibuya Parco) opened up in November 2019, being the second one after that in NYC. Customers go there to try out different consoles and see demonstrations of new video games and buy merchandise. Lines have been long, and the waiting time to get in can be as long as 1-2 hours. Unlikely to be a major driver of revenues. Nintendo is considering plans to expand to additional locations outside Japan. For reference, Disney has 200 stores globally.

Theme parks: The Super Nintendo World theme park opened in Osaka in 2020. More theme parks will then open up in Orlando (2023), Hollywood, Moscow, South Korea, Singapore (2025) and possibly Beijing. Though the deal terms are undisclosed, it’s possible that Nintendo could make over US$10 million (JPY 1.1 billion) on royalties for each. Although when asked about the profitability of future theme parks in April 2017, however, then-President Tatsumi Kimishima said that theme parks and movie deals are less for potential profits and more for synergy with the dedicated videogame business.

Movies: Nintendo is working on a new Mario movie together with Universal Studios subsidiary Illumination (Minions, Despicable Me) that will be launched in September 2022. This will be the new first Mario movie release since “Super Mario Bros” flopped in 1993.

Collaborations: Nintendo teamed up with Lego in early 2020 to create a Super Mario lego set.

3. Huge untapped potential in mobile games

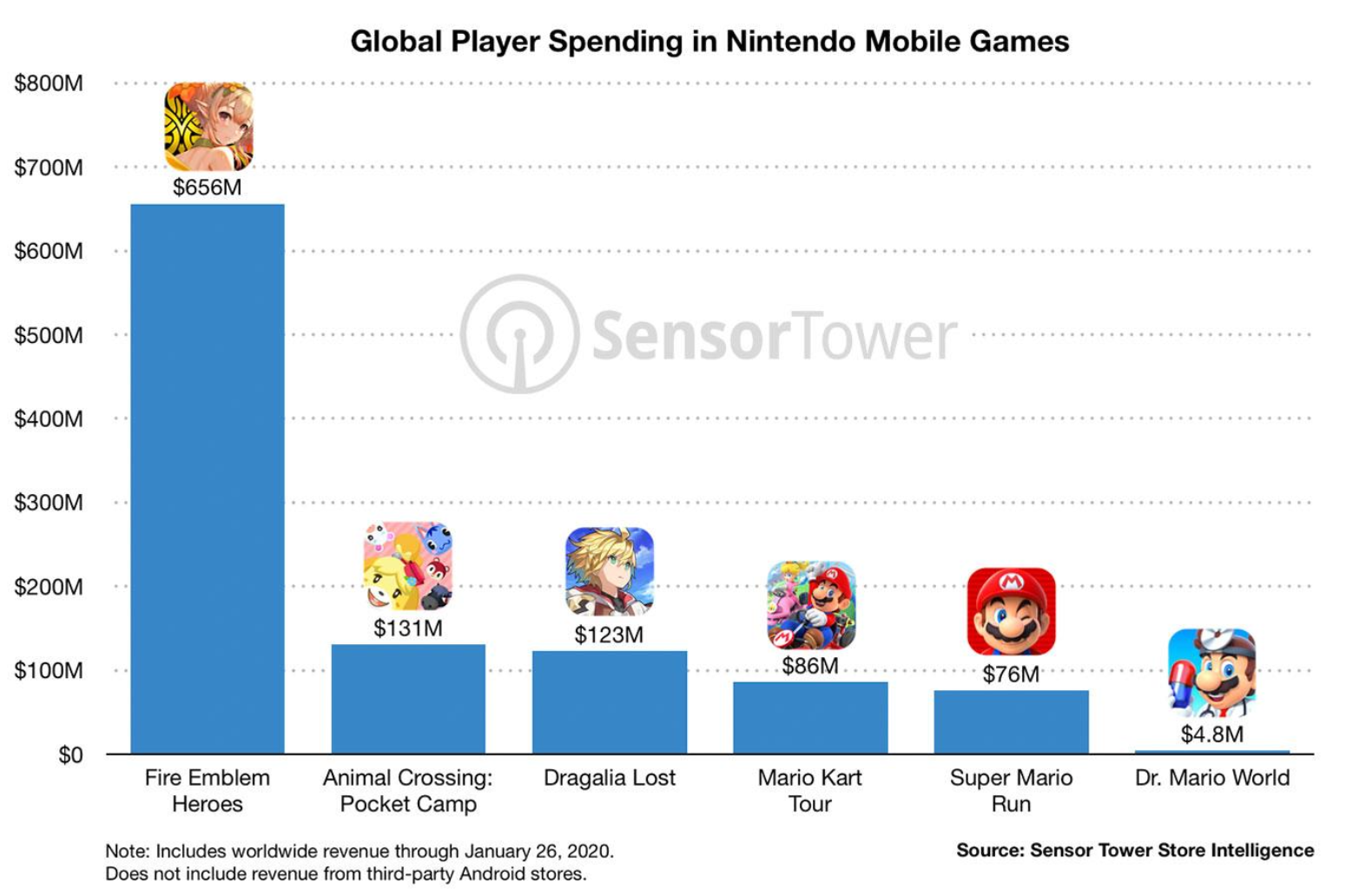

Nintendo’s track record in mobile games has been mixed so far:

- Nintendo enjoyed the blockbuster success of the augmented reality game Pokémon Go in 2016. That said, Pokémon Go was a free game, and Nintendo only owns a small stake in developer Niantic (probably around 20%).

- In late 2016, Super Mario Run was downloaded 300 million times. The monetisation model of Mario Run was less than ideal given the up-front cost and no in-game monetisation. The average spend per user was only eleven U$ cents.

- Fire Emblem Heroes’ monetisation model was far better given that it was free to play with many opportunities for in-app purchases. It has netted US$500 million since February 2017.

- 2017’s Animal Crossing: Pocket Camp also used a free-to-play mechanism.

- 2018’s Dragalia Lost, developed by Cygames, also became a success, with hundreds of millions of US$ in revenues.

- Mario Kart Tour was launched in September 2019 to great fanfare. That said, there was a missed opportunity in that only single-player gaming was available initially. By the time multi-player functionality was released, gamers had already moved on from Mario Kart.

So you can see that Nintendo’s success in mobile games has been mixed. There is a great deal of potential if they ever get it right. Given the popularity of Mario, one would have thought that Mario-branded games should do better. Especially after trying for over half a decade.

So Nintendo has not yet found a winning concept for mobile games. Disney’s Tsum-Tsum made US$2 billion, but no Nintendo property had made above US$100 million.

Nintendo’s mobile game revenues are allegedly around 10% of the total. Over the past year, mobile game revenue has grown around 10% per year. Mobile game margins are unlikely to be high, however.

A potential wild card is a new cooperation between Nintendo and Niantic on an AR game called Pikmin. Details here. The launch date of the Pikmin AR game has not yet been disclosed.

4. Entry into the Chinese market

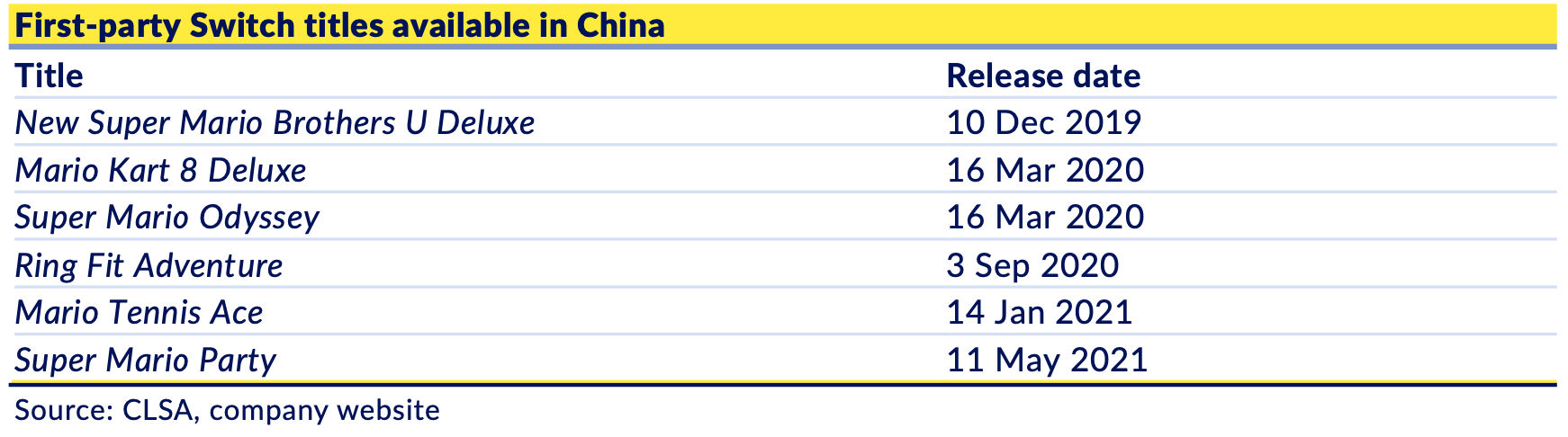

The Nintendo Switch has been available in China through a partnership with Tencent since December 2019. The Switch console costs US$321 in China as well, whereas Nintendo Switch games tend to be 20% cheaper there than in the rest of the world. The deals of the cooperation agreement with Tencent have not been disclosed, but presumably, a chunk of the economics will go to Tencent. Most of the major Nintendo Switch games have been released in mainland China, except Legend of Zelda: Breath of the Wild.

According to this report from Reuters, Nintendo shipped 1 million Switch consoles in China, most of which during 2020. Initial demand was weaker than expected. At a 14% hardware gross margin and 80% software gross margin (assuming 50% digital sales), a 7x attachment rate and a 50% cut of gross profits, Nintendo could make around US$160 million or JPY 34 billion in extra gross profit from China at this pace.

5. Nintendo Switch OLED

Nintendo just announced an upgrade to the original Nintendo Switch console called “Nintendo Switch (OLED model)”.

This is what we know about the new model:

- It will feature a 7 inch OLED screen

- Identical battery life

- A price of US$350

- Launch date of 8 October 2021

I expect the Switch OLED to lead to a bump in console sales of around 3 million units momentarily and then for sales volumes to decrease gradually.

Will I buy it?

Probably not. Most casual gamers such as myself are not overly concerned about graphics. We just want great games that are responsive and fun. As long as the Nintendo Switch games are backwards-compatible (as Nintendo has guided for), there is not much need to buy a new console.

6. Hidden assets

Nintendo has several “hidden” investments (historical cost accounting):

- 10% of DeNa (worth ~JPY 25 billion)

- 1.73% of Bandai Namco (worth ~JPY 20 billion)

- The Seattle Mariners (JPY 15 billion)

- 20% of Niantic (1/3 directly and 32% via 1/3-owned The Pokemon Company). Niantic developed Pokémon Go. Niantic earns royalties whenever a game uses its platform. There are rumours that Niantic could one day go public.

Though overall, these hidden assets are relatively small compared to Nintendo’s market cap of JPY 8.7 trillion.

1. Nintendo Switch is likely at the end of its console cycle

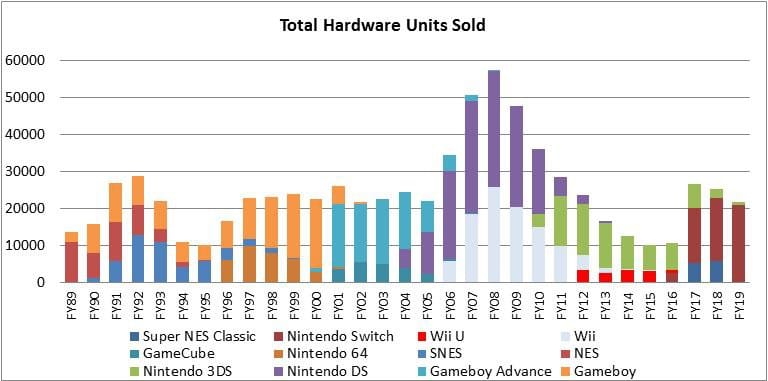

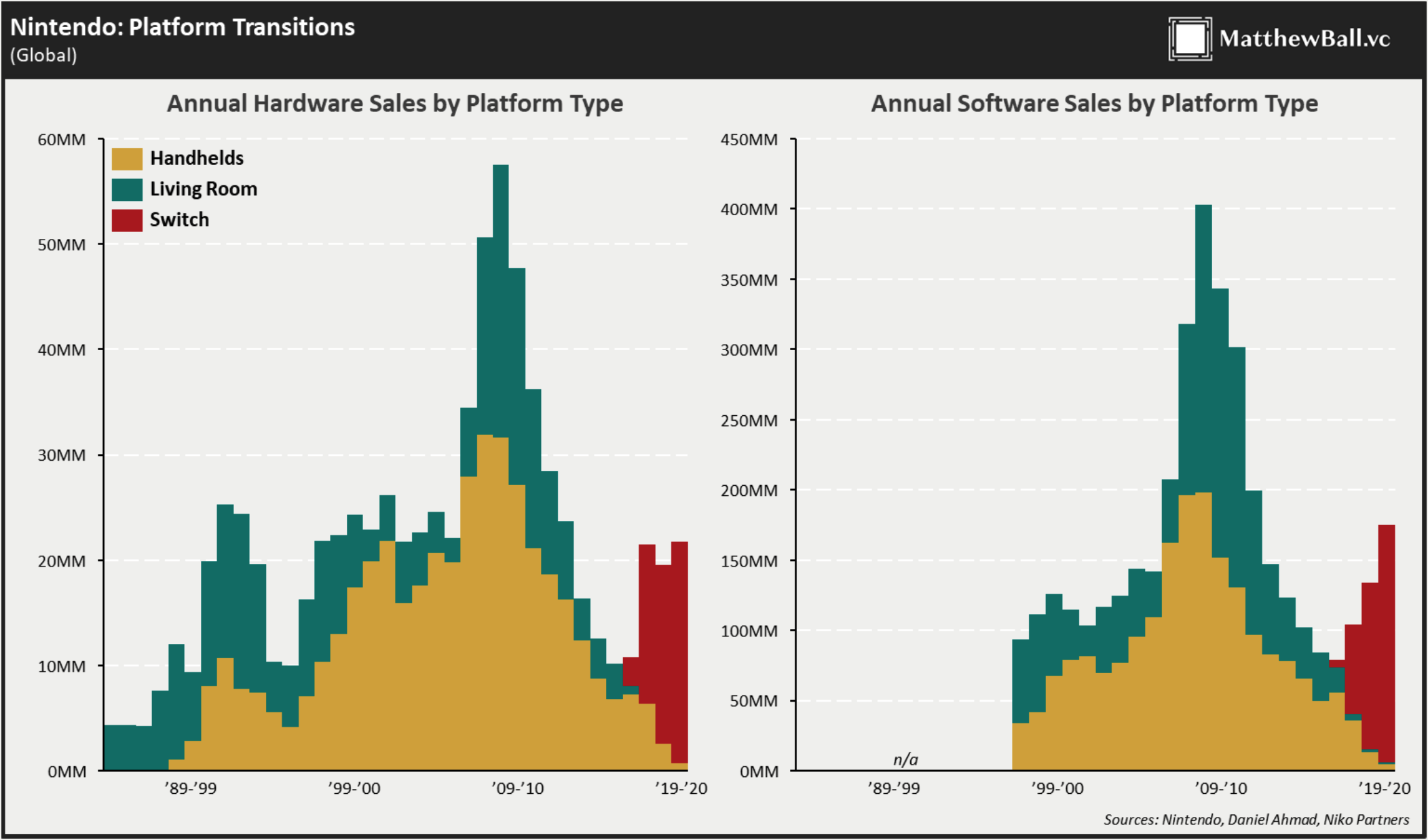

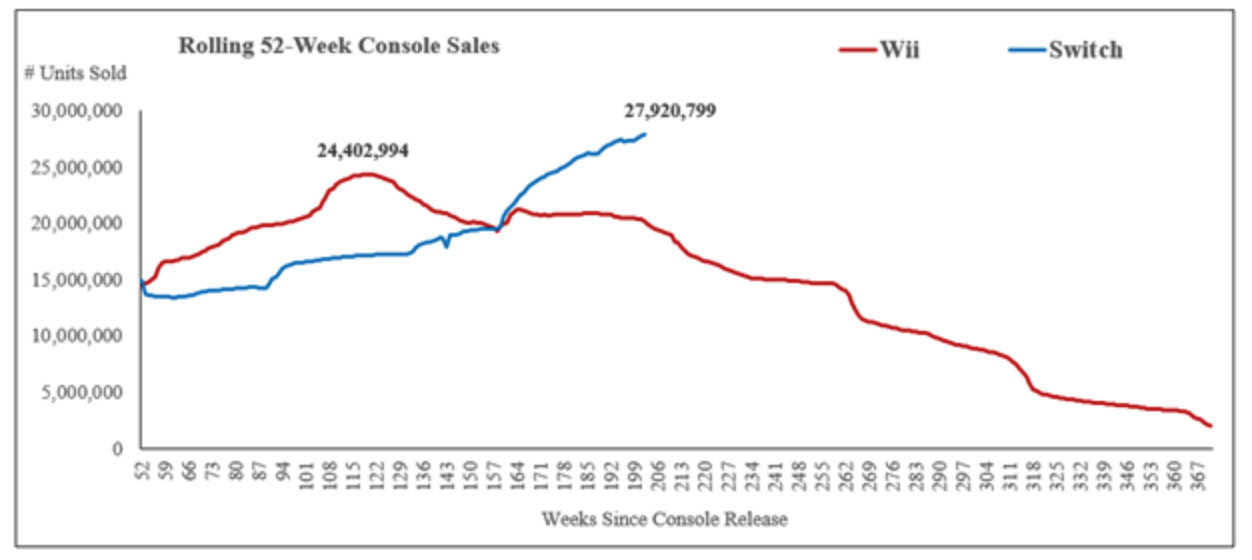

94% of Nintendo’s current revenues come from the Nintendo Switch console. Historically, Nintendo’s hardware unit sales were highly reliant on the console cycle. The number of units sold would ramp up and peak roughly 2 years following the launch of a new console. Software sales would peak a few years after sales of the console itself peaked.

This has been the behaviour of Nintendo’s past hardware cycles:

- SNES: Peaked in 1992 after launch in 1990 (2 years to peak)

- Nintendo 64: Peaked in 1997 after launch in 1995 (2 years)

- Gameboy Advance: Fairly steady for three years after launch in 2001 (3 years)

- Nintendo DS: Peak in 2008 after launch in 2004 (4 years)

- Wii: Peak in 2008 after launch in 2006 (2 years)

- Nintendo 3DS: Fairly steady for three years after launch in 2010 (3 years)

As you can tell, home consoles (SNES, N64, Wii) have seen their console sales peak 2 years after launch. Whereas handheld consoles (GBA, DS, 3DS) have tended to peak 3-4 years after launch.

Why do handheld consoles enjoy longer console cycles? Potentially because they are lower-priced. But also because the high visibility of hand-held consoles outside the home provides free marketing, spurring others to buy the same device.

After Shuntaro Furukawa became Chairman in April 2018, he committed to a strategy of reducing reliance on the console cycle. As he said at the time:

“It is a high-risk business… so there will be times when business is good and times when business is bad. But I want to manage the company in a way that keeps us from shifting between joy and despair.”

With the Switch, Nintendo has shifted its approach. It has committed itself to make sure that future games will be backwards-compatible with prior Switch consoles. That may reduce the cyclicality of overall sales. At the same time, users will find have less of an impetus to purchase new consoles.

I find it highly unlikely that people will upgrade their Nintendo Switch every 2 years like they do with their iPhones. Smartphones tend to be on 2-year contracts. They break easily. And we use them several hours per day.

Nintendo Switch has yet to peak even after 4 years since its launch. It could be related to the fact that Switch is both a home console and a handheld console at the same time.

The 2019 release of Nintendo Switch Lite made the console even easier to carry. It has thus replaced the need for a separate handheld console of the Nintendo DS / 3DS kind. That makes overall Switch sales numbers look better. At the same time, Switch is cannibalising Nintendo’s handheld console sales (Gameboy / Nintendo DS).

Either way, 4 years means that the platform has become very mature and that Switch hardware sales are likely to peak soon.

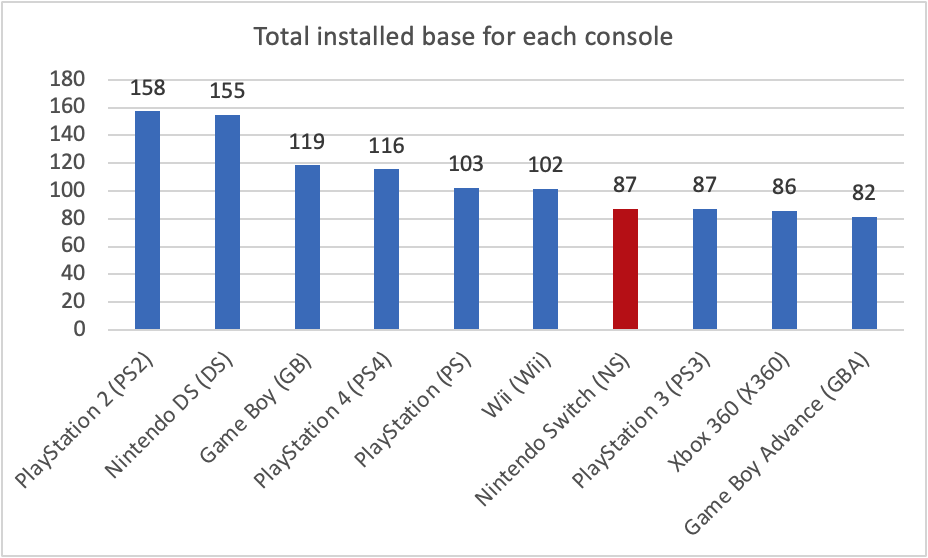

Another way to measure the potential for each console is to estimate the total installed base for each generation. Nintendo Switch is now at close to 90 million compared to 102 million for Nintendo Wii and 116 million for Playstation 4. That seems to suggest that Switch has now become a mature console and that we are nearing the end of the Nintendo Switch hardware cycle. I believe that the installed base will reach close to 150 million in the end - but only if you include Switch Lite, Switch OLED and future upgrades.

Note that even though unit sales has kept rising for four years, $ sales have not kept pace given that Nintendo Switch Lite ($200) is significantly cheaper than Nintendo Switch ($300). On the other hand, the weighted average price is likely to rise with the upcoming Switch OLED.

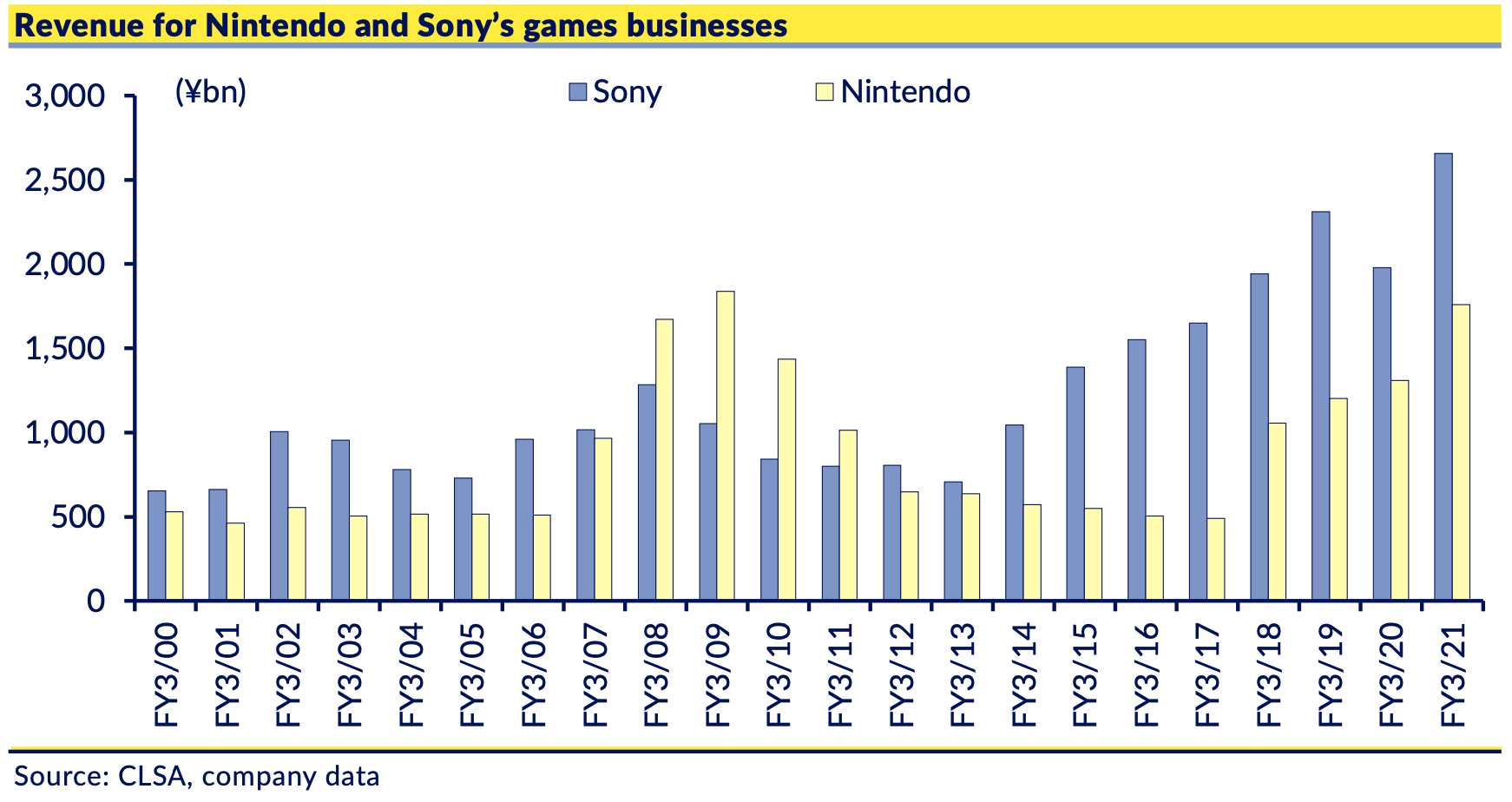

Does the overall industry grow? Not really. The console industry’s peak-to-peak revenue from 2008 to 2018 only grew in the single digits. Most of the growth in the video game industry has actually come from my mobile - not consoles. China is obviously an exception since video game consoles have previously been banned there.

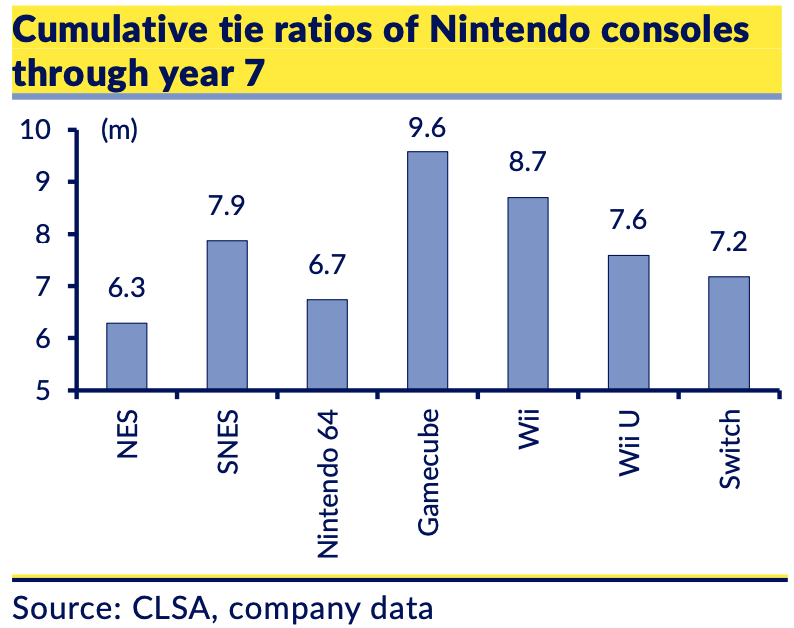

Another aspect is the console attach rate (also known as “tie ratio”), i.e. the software sales volumes divided by console unit sales. Nintendo Switch’s attach rate is among the lowest of any Nintendo console so far. That could provide some upside if new game releases prove popular. I think Nintendo Switch could eventually get to an 8.0x attach rate.

Once Nintendo Switch reaches its next hardware sales peak, I expect console sales to drop at a 20% yearly rate, in line with Wii, before stabilising at around ~50% of peak (assuming that we all buy fewer new consoles thanks to the aforementioned backwards-compatibility).

If we look ahead to the next-generation console, we need to be mindful of the risk that it won’t do as well as the Nintendo Switch. Nintendo has long had a blockbuster-bomb pattern in console releases, with the Nintendo 64 doing well but the subsequent GameCube bombing. The Wii did well, but the Wii U became a big flop. I don’t think the success of Nintendo’s next-generation console should be a foregone conclusion.

2. A recovery from COVID-19 will shift consumption away from video games

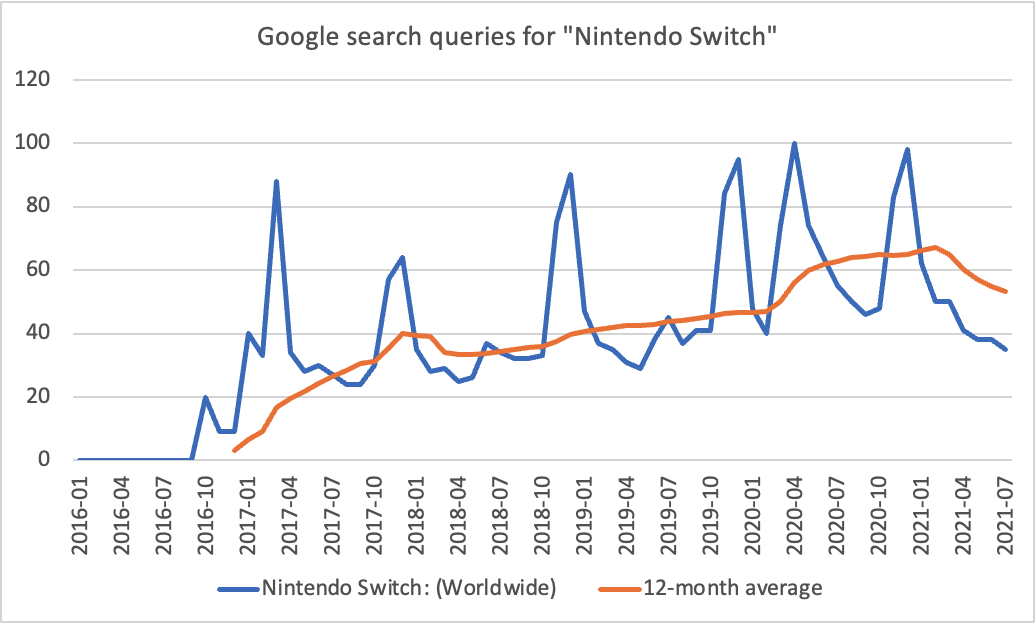

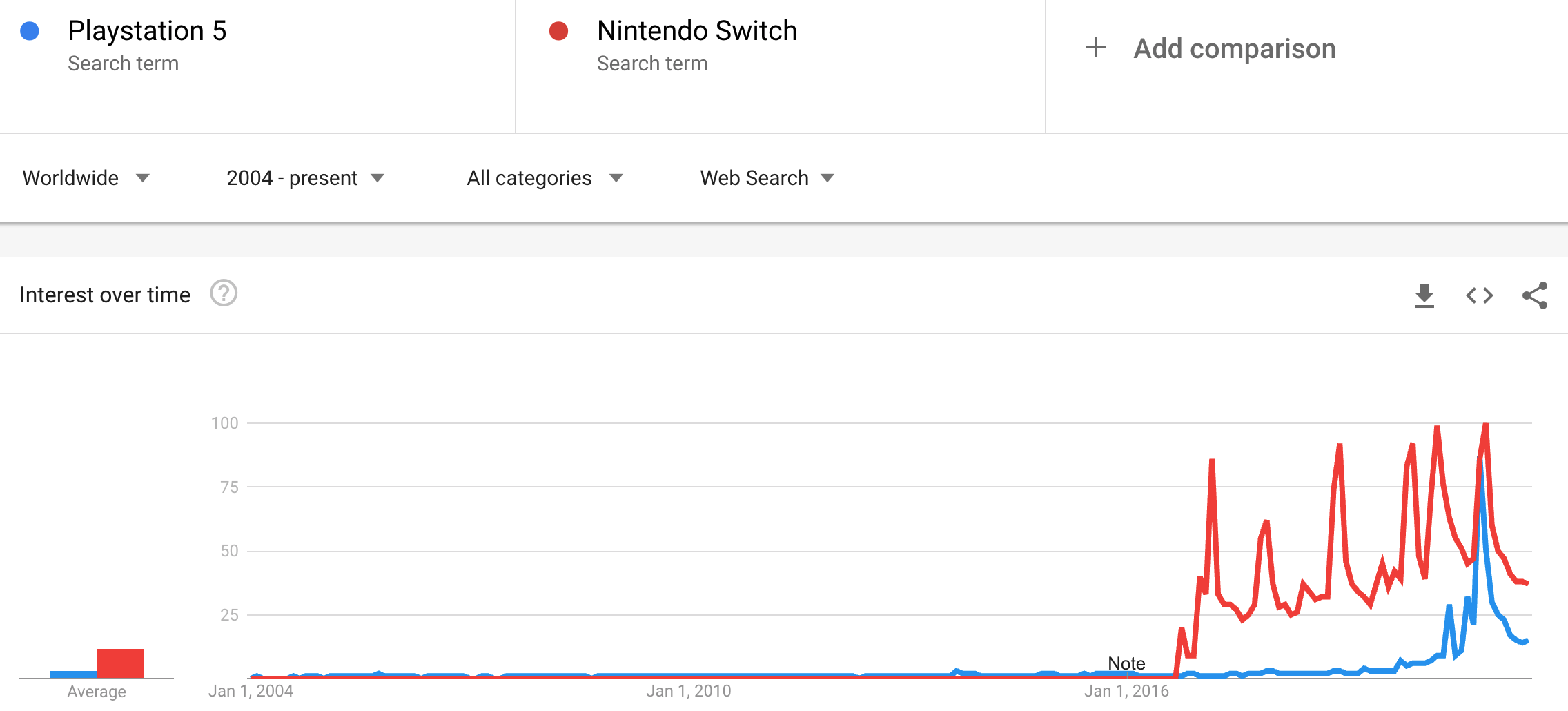

Google search queries for “Nintendo Switch” worldwide have now started to drop since March 2021. It could be related to recovery from COVID-19. But it could also be due to the Nintendo Switch console cycle turning.

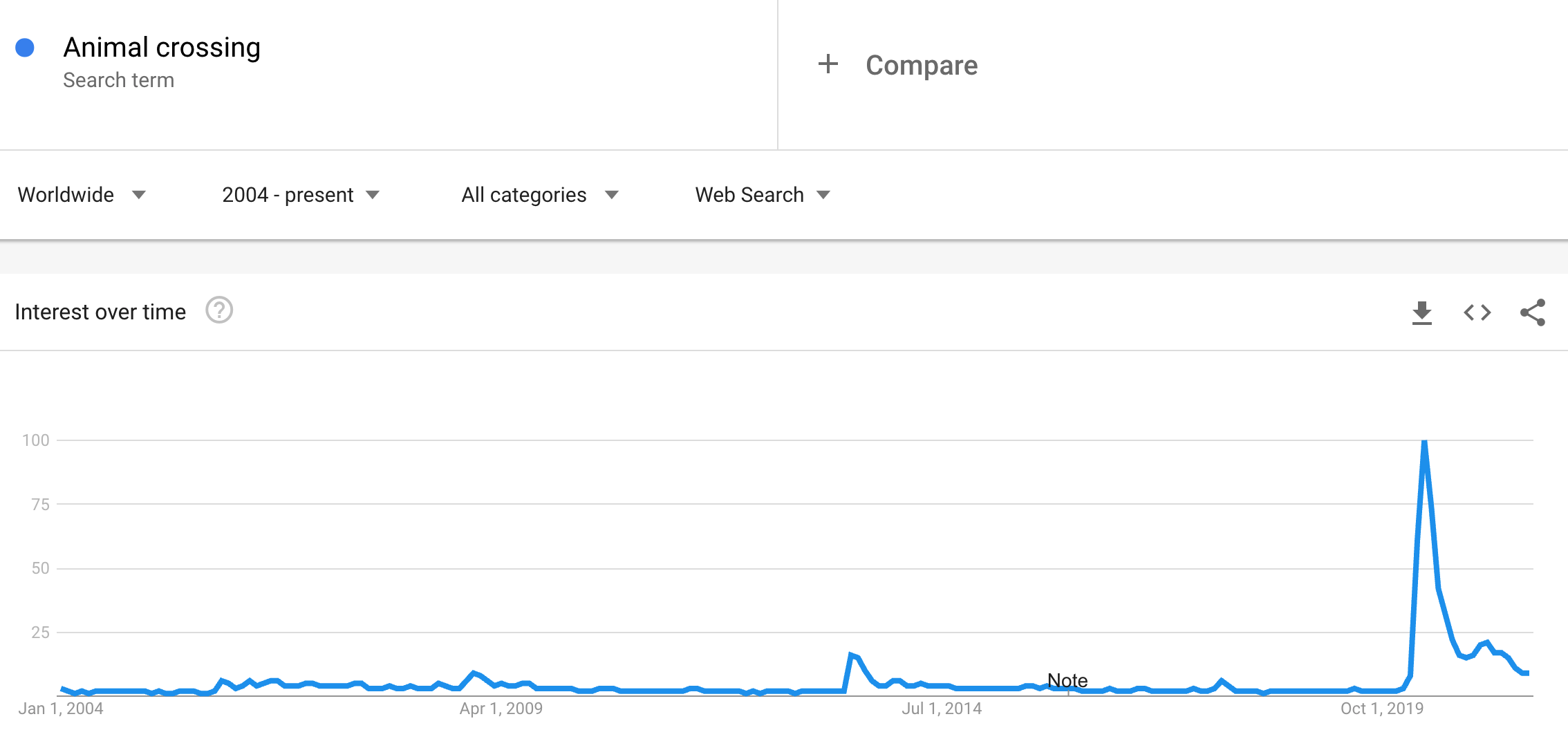

The “Animal Crossing” fad (sold on the Nintendo Switch) seems to have largely died down:

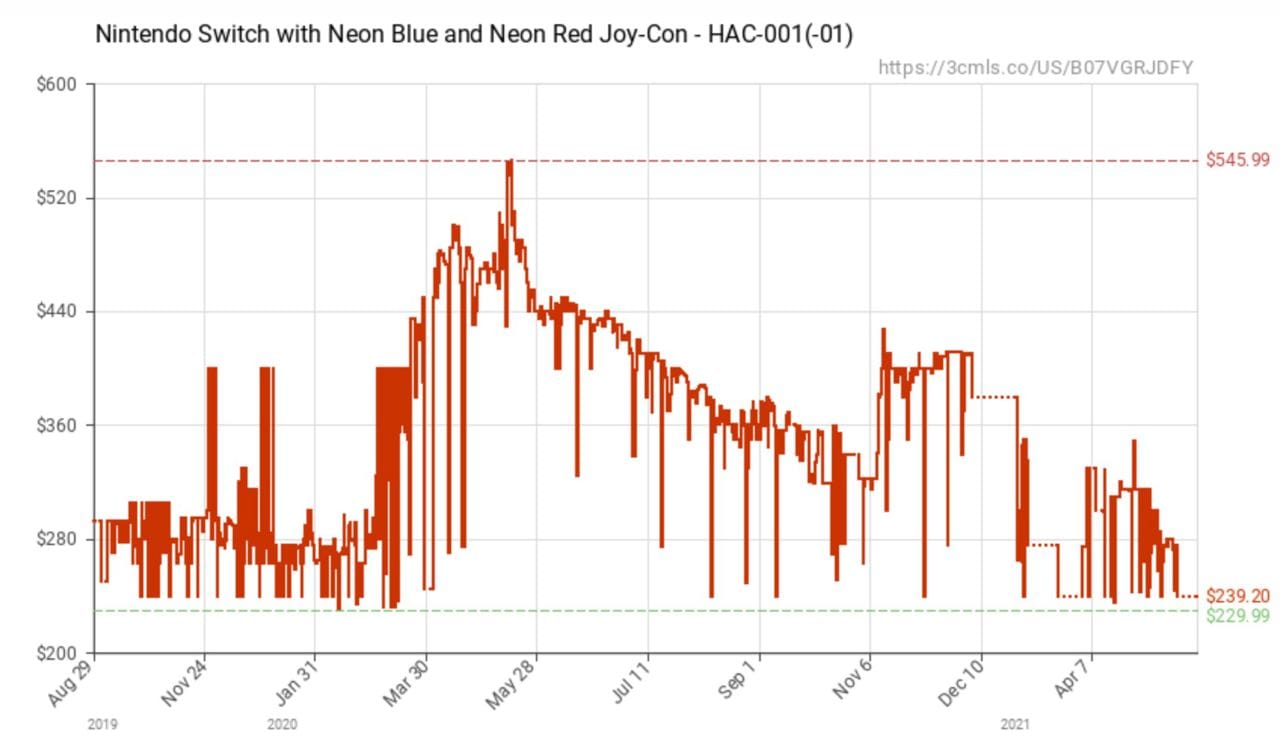

We can also observe that second-hand prices for Nintendo Switch consoles have dropped back to pre-pandemic levels.

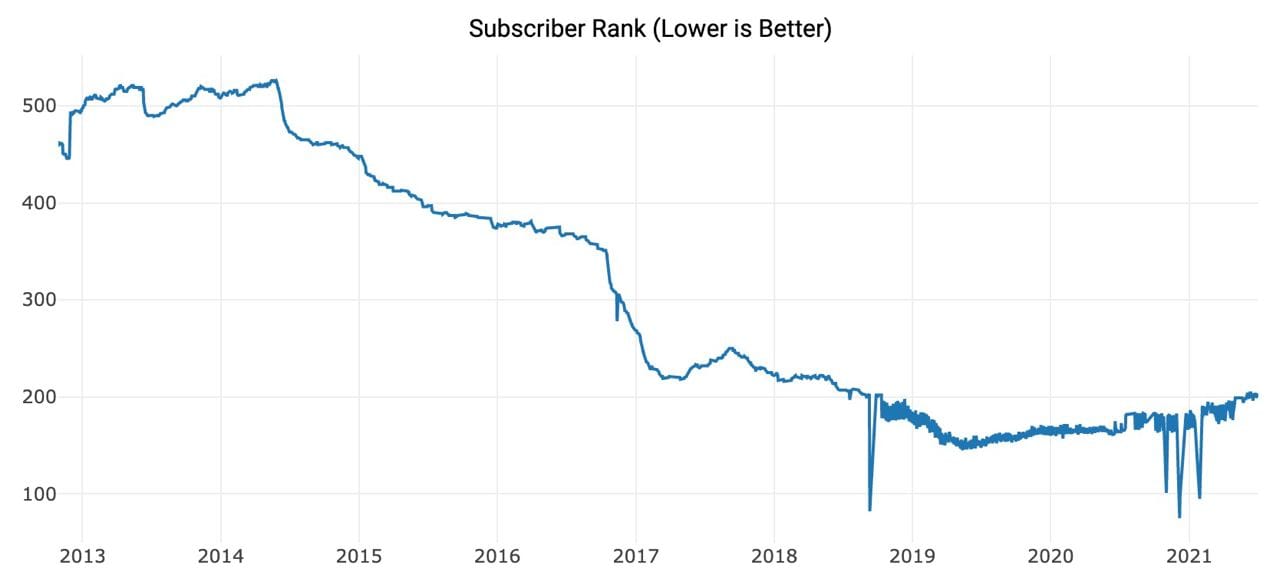

The subscriber rank on the r/Nintendo subreddit peaked in mid-2019 (2 years after launch) and is now falling gradually (the below chart is a subreddit ranking representation, i.e. lower line means that the subscriber count is higher). I believe that the pandemic prolonged the Switch console cycle but that it is now about to turn down.

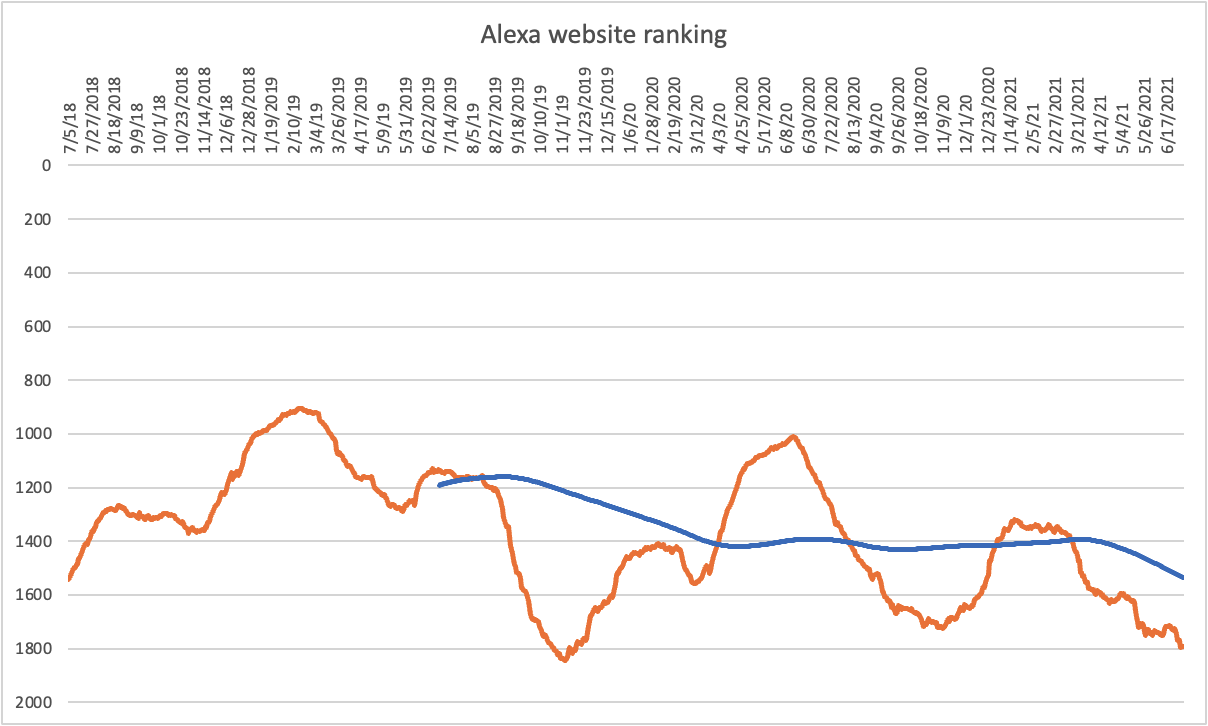

The 12-month average Alexa website ranking for Nintendo.com had also weakened since March 2021, which is incidentally when US restaurant traffic started to improve. I suspect that Americans - and maybe Europeans - are now starting to spend less time at home.

3. New competition from Sony Playstation 5

Sony’s Playstation 5 (PS5) is likely to take wallet share. Playstation and Xbox tend to focus on more serious gamers, whereas Nintendo focuses on casual / younger gamers. But there is still a certain overlap, and gamers only have so much money to spend.

Reviews for Playstation 5 have so far been excellent: Techradar, Cnet, The Verge.

Search queries for Nintendo Switch are still higher than for Playstation 5

Why are search queries so low for the Playstation 5? It could be related to the fact that Sony is unable to meet demand. Second-hand prices for PS5’s are currently US$920 - more than twice the price of the MSRP. That seems to suggest that the demand for PS5 has still not been satisfied.

Sony’s control of the dominant platform for third-party developers makes it a formidable competitor. It has been taking significant market share from Nintendo since the Nintendo Wii.

4. Reliance on hit games creates a vulnerability

83% of Nintendo’s games are developed in-house. Nintendo Switch is therefore not so much a platform as it is a mechanism to sell its own games. Nintendo’s consoles haven’t been true hardware platforms since 1995 when Sony PlayStation launched, and most of the major third-party developers flocked to Sony instead.

Given that the majority of Nintendo’s games are produced in-house, an important factor to assess will be Nintendo’s ability to create hit content.

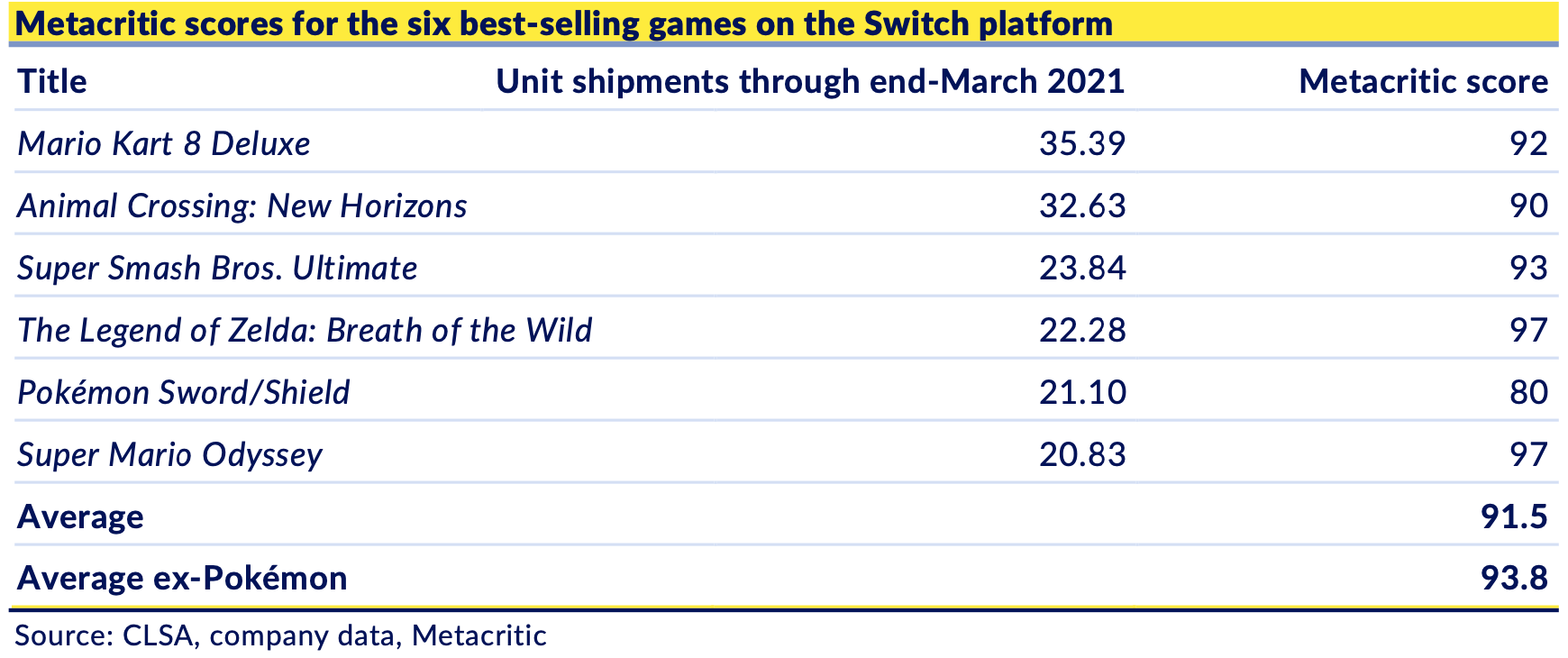

So far, Nintendo has been an excellent game developer. The Metacritic scores for the six-best selling games on the Switch platform are fantastic.

And five out of the top 10 best-reviewed games of all time comes from Nintendo, according to GameRankings/Metacritic.

The only problem is that it takes 4-7 years for Nintendo to create a hit product. And in between those years (typically coinciding with console cycles), Nintendo might get wind pockets of weaker earnings.

And as many other game developers have developed more recurring revenue through in-app purchases and social elements (MMORPG), Nintendo has not yet made this transition. They continue to rely on up-front purchases and single-player games where the consumer pays 1x and then moves on to something else.

5. Weak game release pipeline

These are the key games that are due for 2021/2022 releases:

- Pokemon Legends: Arceus (early 2022)

- Splatoon 3 (2022)

- Legend of Zelda: Breath of the Wild sequel (TBA)

- Mario + Rabbids: Sparks of Hope (TBA)

- Metroid Prime 4 (TBA)

Along with a few other titles such as WarioWare and a remake of Legend of Zelda: Skyward Sword HD.

I personally own a Nintendo Switch Lite. And given my age (37), I suppose I am not representative of the broader community of Nintendo Switch users. But apart from the Zelda sequel, there is nothing that really gets me excited in the Nintendo Switch game pipeline.

6. Poor capital allocation

Japanese companies are known to be excessively conservative. Partly because of weak shareholder orientation. But also because employees often enjoy lifetime employment and companies want to save for a rainy day in case revenues drop, and they are forced to endure years of losses.

That makes me wary of assuming that the cash belongs to minority shareholders. I see many foreigners using EV multiples to value Japanese companies, but I think you are probably better off ignoring the cash on their balance sheets. It’s never going to be paid out as a special dividend. You might have to wait decades for that to happen.

A balanced view of the future

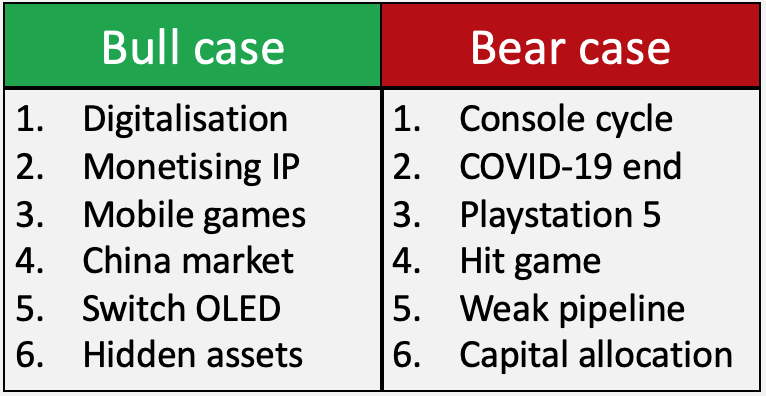

Here is a summary of each of the above arguments.

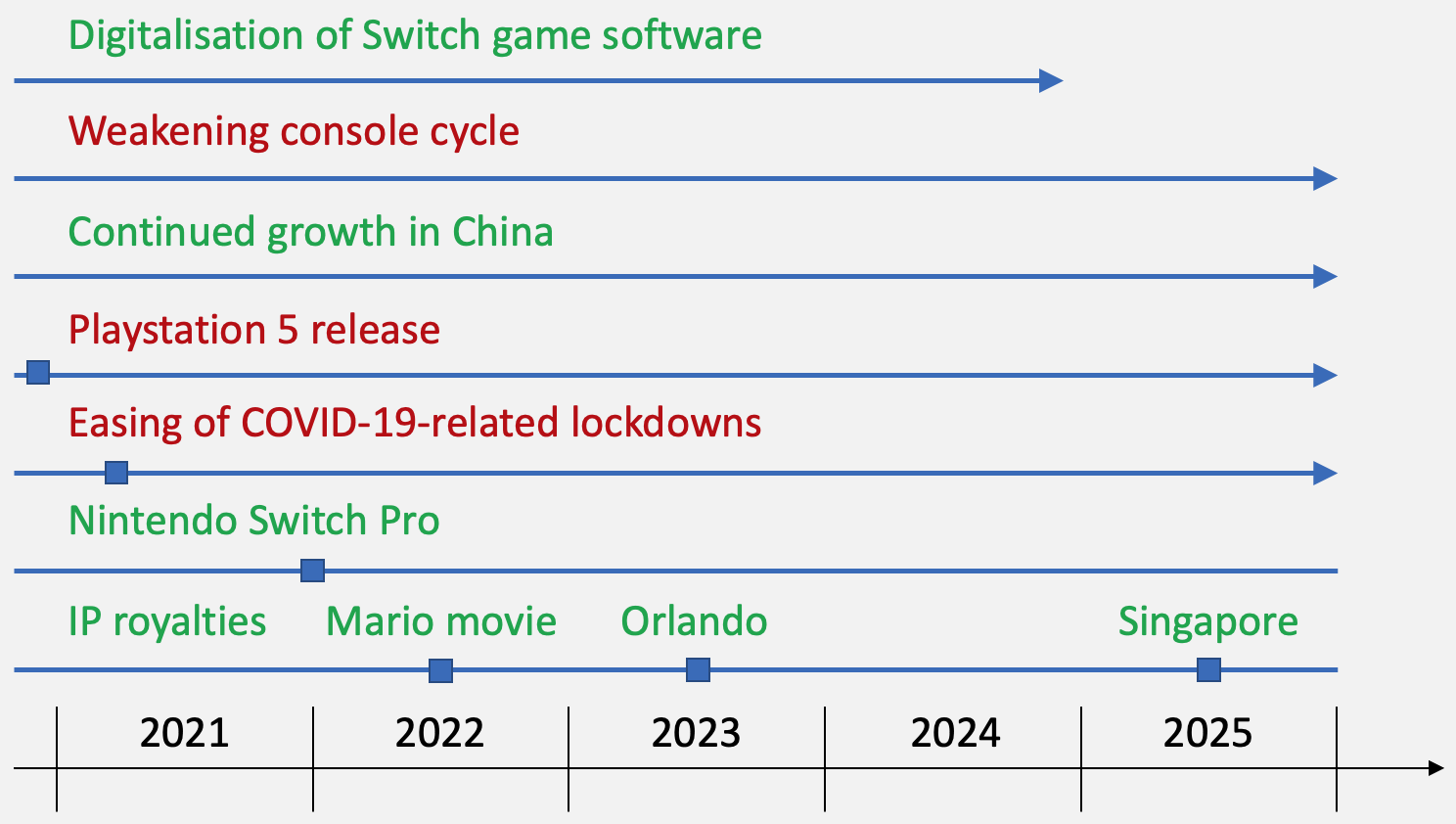

And here is a timeline of Nintendo’s future.

The ongoing digitalisation of Nintendo Switch sales, their entry into China and the Switch OLED are clearly positive growth drivers. On the other hand, the fact that Nintendo Switch is late in its console cycle, new competition from Playstation 5 and a potential end to COVID-19 are likely to weigh on earnings in the near term.

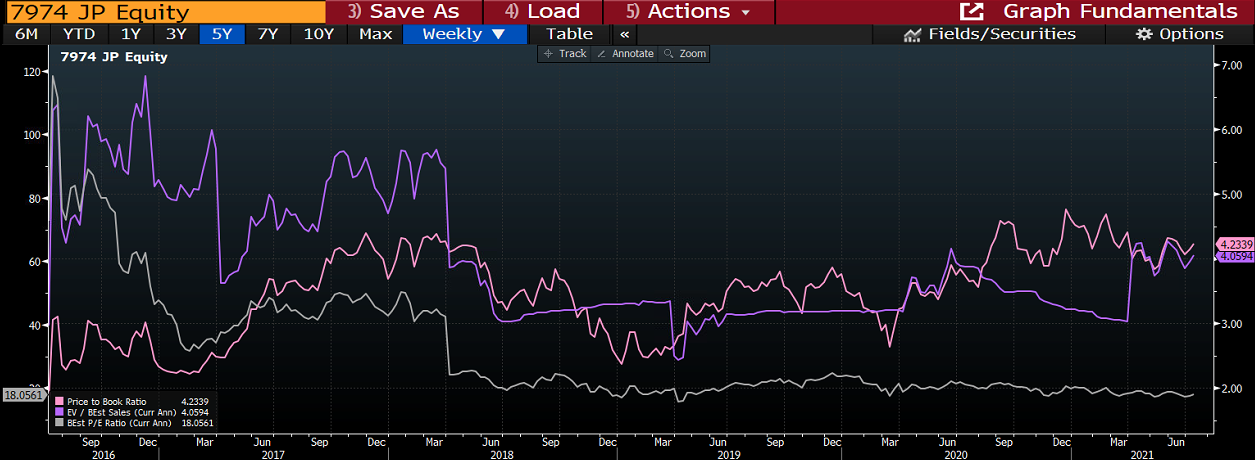

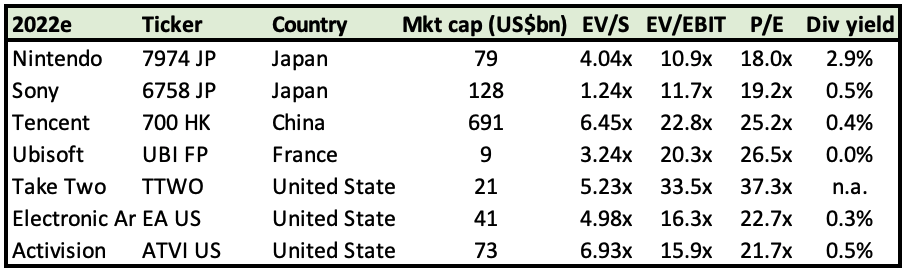

Nintendo has historically traded at a median forward P/E multiple of 22x. Today, the forward P/E multiple is 18x, putting it at a discount to historical levels.

Nintendo’s peer group trades at multiples of 20-30x P/E. From that perspective, Nintendo’s near-term multiple looks inexpensive.

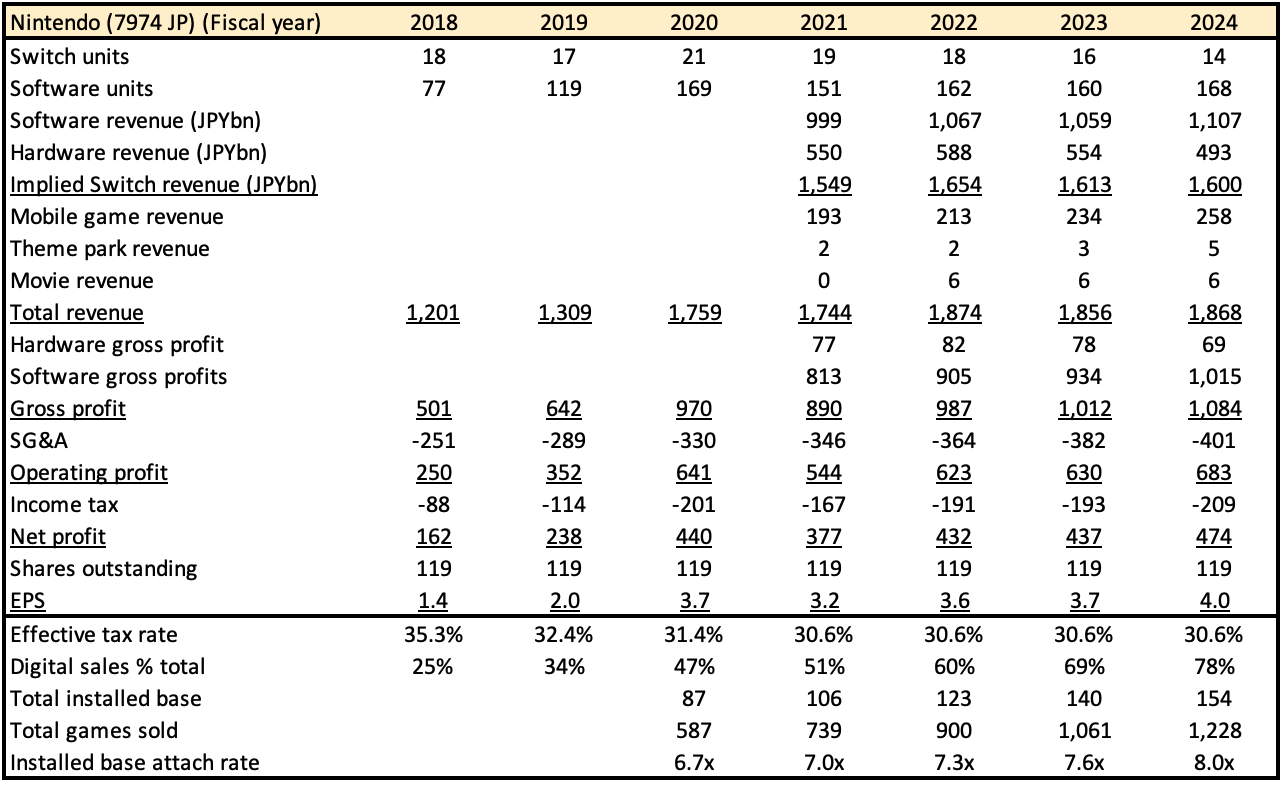

I’ll now make a few assumptions: Switch unit sales to peak in 2020 then drop 12% in 2021 and then 20% per year, additional Switch OLED sales of 3, 2, 1 million extra units from 2022 onwards, ARPUs rising to $320 as Switch OLED takes over, a digitalisation rate of 78% by 2024, mobile game revenue, SG&A rising at a 5% yearly rate and installed base attach rate/tie ratio of 8.0x at maturity.

Here is what those assumptions imply for Nintendo’s future:

As you can tell from the above table, I get to an EPS of JPY 4.0k in FY2024e.

There is significant uncertainty around the JPY 4.0k EPS number. The tie ratio could equally well end up at 7.0x, in which case earnings are likely to weaken over the next 2-3 years. It all depends on how Nintendo’s new games are received.

With my EPS estimate of JPY 4.0k and assuming a P/E multiple of 22x, I get to a target price of JPY 87k/share in 2024e, implying an upside of +32%.

Given near-term headwinds (a mature console cycle, a potential return to pre-pandemic consumption habits, weak coincident alt-data indicators, PS5 competition for wallet share), the multiple could well end up lower than 22x. If so, there is a risk that the stock price dips temporarily.

Conclusion

The digitalisation trend is real. But so is the console cycle. Ask yourself whether you are more likely to buy the Playstation 5 than the Switch OLED. For me, it’s a no-brainer - in favour of Playstation 5. At $350, I suspect the Switch OLED will flop. The Switch console cycle will remain negative.

In the near term, I’m wary of the post-COVID-19 cliff that we already see signs of in the alt-data. Second-hand prices of the Nintendo Switch have weakened. I think the risk-reward is poor in the near term, though as we move through 2021 and the post-COVID-19 cliff is increasingly priced in, it might be worth re-entering the stock.

I prefer to stay away from cases that are not clear-cut. And while I recognise that Nintendo is an incredible company with unique products, I personally don’t feel comfortable speculating on tech stocks with a close-to-20 P/E multiple at the horizon.

Further reading

- Find Me Value: The Future of Nintendo ($)

- Matthew Ball: Nintendo, Disney, and Cultural Determinism

- Asymmetric Skew: Nintendo - Switching the business model

Thanks for reading this free post on Nintendo!

Sign up for over 20 deep-dive reports on Asian stocks per year and full disclosure of my personal portfolio.