Welcome back. As you may have noticed, I’ve settled on writing links round-up emails once per month. To access prior issues, go to the main page of my Substack and click “Links” at the top of the screen.

Since last month, I’ve had time to write a review of the book Spy the Lie, a 2Q2024 macro update, a post with Travel notes from Hong Kong ($), a deep-dive on Best Mart 360 ($) and updates on Koshidaka ($) and IMAX China ($), along with a portfolio update for April ($). Subscribe to get full access:

In any case, here are investment-related links for May 2024 that I think you’ll enjoy:

- Third Point Capital on Taiwanese foundry TSMC (🇹🇼 2330 TT - US$672 billion)

- Saltlight Capital on WeChat developer Tencent (🇨🇳 700 HK - US$470 billion)

- Investing in China on Kuaishou (🇨🇳 1024 HK - US$32 billion), Part 1 & Part 2

- Bos Invest discussing HK conglomerate CK Hutchison (🇭🇰 1 HK - US$21 billion)

- Global Stock Picking on the bid for L’Occitane (🇭🇰 973 HK - US$6.0 billion)

- Pyramids and Pagodas on GDS Holdings (🇨🇳 GDS US - US$1.8 billion)

- Sweet Stocks on Japanese IT distributor Daiwabo (🇯🇵 3107 JP - US$1.6 billion)

- Acid Investments on cinema stock IMAX China (🇨🇳 1970 HK - US$352 million)

- Value Zoomer on Centurion Corporation (🇸🇬 CENT SP - US$338 million)

- One Foot Hurdle on Taiwan PCB Techvest (🇹🇼 8213 TT - US$328 million)

- Made in Japan on software company Atled (🇯🇵 3969 JP - US$71 million)

- Value Investing Blog on Macau E&M Holding (🇭🇰 1408 HK - US$11 million)

(estimated reading time)

- Yours truly interviewed by Swen Lorenz at Undervalued Shares (21 mins)

- Seraya Investment: The case for Japan Part 1 & Part 2 (21 mins)

- Noah Smith speculates why China’s goods exports are going up fast (14 mins)

- Arjun Murti on supply & demand for crude oil (14 mins)

- Continuous Compounding: How to navigate Japanese filings (8 mins)

- Edelweiss on the 1820’s Poyais scam, a classic in financial history books (7 mins)

- Jam Invest on Singapore’s Haw Par, Credit Bureau Asia, SUTL, ThaiBev (6 mins)

- Richard Katz discussing the weakness in the Japanese yen (5 mins)

- Joe Studwell on the lessons from industrial policy in Asia (5 mins)

- Weighted Capital on AEM, Pentamaster and Left Field Printing (4 mins)

- Michael Dunne talks about a future where every car is made in China (4 mins)

- Variant Perception on the limits of fiscal deficits in developed markets (5 mins)

- Polen Emerging Markets Growth’s 1Q2024 letter on HKEX, Mandiri (5 pages)

- David Tepper’s Appaloosa’s latest 13F has made big bets on China tech (1 min)

(listening time)

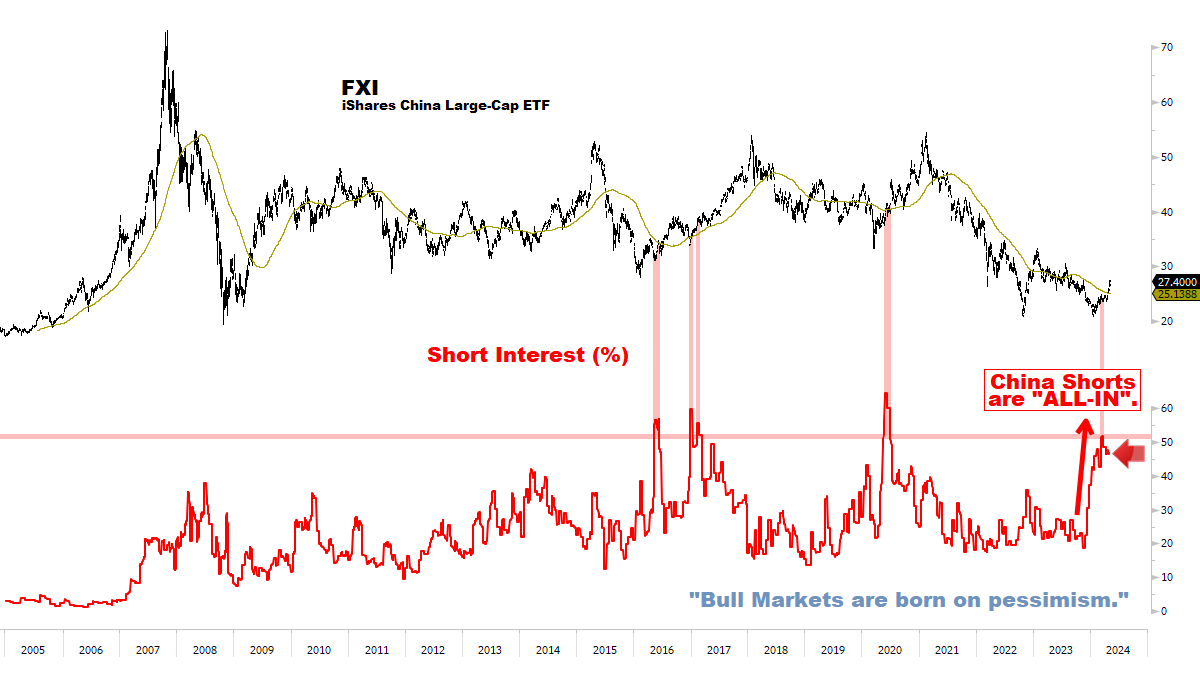

- Leonid Mironov provides a bullish view on Chinese equities (2:19 hours)

- Mark Hart on his research process and views on China in 2024 (1:19 hours)

- Rare interview with Angus Tulloch on his long career investing in EMs (1:09 hrs)

- Charles Gave & Anatole Kaletsky on similarities with the 1970s (1:05 hours)

- Ex-SAC Arvind Sanger on where we are in the energy cycle (59 mins)

- TRG’s Nick Rohatyn on emerging market bonds and more (51 mins)

- Pierre Andurand on the recent tightness in cocoa markets (49 mins)

- Brad Setser on the Japanese yen and the Chinese yuan (32 mins)

- Economist’s David Rennie: Why are Chinese running to Japan? (31 mins)

- Asianometry on Indonesia’s Salim Group, the owner of Indofoods, etc. (29 mins)

My favorites out of the above links are: