Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers, including whether any investment suits your specific needs. From time to time, I may have positions in the securities covered in the articles on this website. Full disclosure: I do not hold a position in Koito Manufacturing at the time of publishing this article. To reiterate, this post and the below presentation are for informational and educational purposes only - not a recommendation to buy or sell shares.

Orbis Japan Equity Fund recently wrote about auto supplier Koito Manufacturing in their second-quarter 2024 letter.

So, who is Koito? It’s the world’s largest manufacturer of automotive lighting products, serving primarily Japanese customers such as Toyota, Nissan and Honda.

What stood out in Orbis’s second-quarter letter is that Koito plans to return JPY 350 billion to shareholders in the next five years, more than half the current market cap. Rational capital allocation is rare in Japan, so this number caught my attention.

Another thing that caught my attention is that Koito Manufacturing’s share price is getting close to its 2020 lows when the world seemed to be ending:

So I wanted to revisit the Koito Manufacturing story and see whether its recent headwinds are permanent or not. Here’s what I discovered:

Table of contents:

1. Quick recap

2. Update since my first write-up

2.1. Koito’s financials

2.2. Shifts in the customer base

2.3. Improved capital allocation

3. What will change for Koito?

3.1. Koito’s FY2025 outlook

3.2. The new medium-term plan

3.3. The latest product roadmap

4. Valuation

5. Risks

6. Conclusion1. Quick recap

Here’s my original write-up on Koito Manufacturing (7276 JP - US$3.7 billion) from back in 2022:

Here’s a quick summary of that presentation:

- Koito is the world’s largest manufacturer of automotive lighting products: headlamps, rear-combination lamps, fog lights, etc.

- It’s grown with its key customer, Toyota, which still represents more than 40% of Koito’s revenues.

- Between 2020 and 2022, the global auto industry suffered from a shortage of semiconductor chips, constraining production volumes. These lower production volumes caused second-hand car prices to skyrocket and OEMs to make windfall profits. However, auto suppliers such as Koito - whose earnings are a function of production volumes - did not benefit as much.

- Back when I did my write-up, I saw signs that the semiconductor chip shortage was going to ease. And I also saw the Japanese yen weakening, which I predicted would lead to a renaissance for Koito’s mostly-Japanese OEM customers.

- Finally, I thought that Koito would benefit from the ongoing shift from halogen and HID lamps to LED. And that it would benefit from the increased popularity of adaptive driving beams. Further, Koito was developing headlamps with integrated LiDARs that would enable level 2/3 advanced driver assistance systems.

- With a prediction of JPY 90 billion in net profit, I foresaw a forward P/E of 7.0x, while net cash represented 40% of its market cap.

2. Update since my first write-up

2.1. Koito’s financials

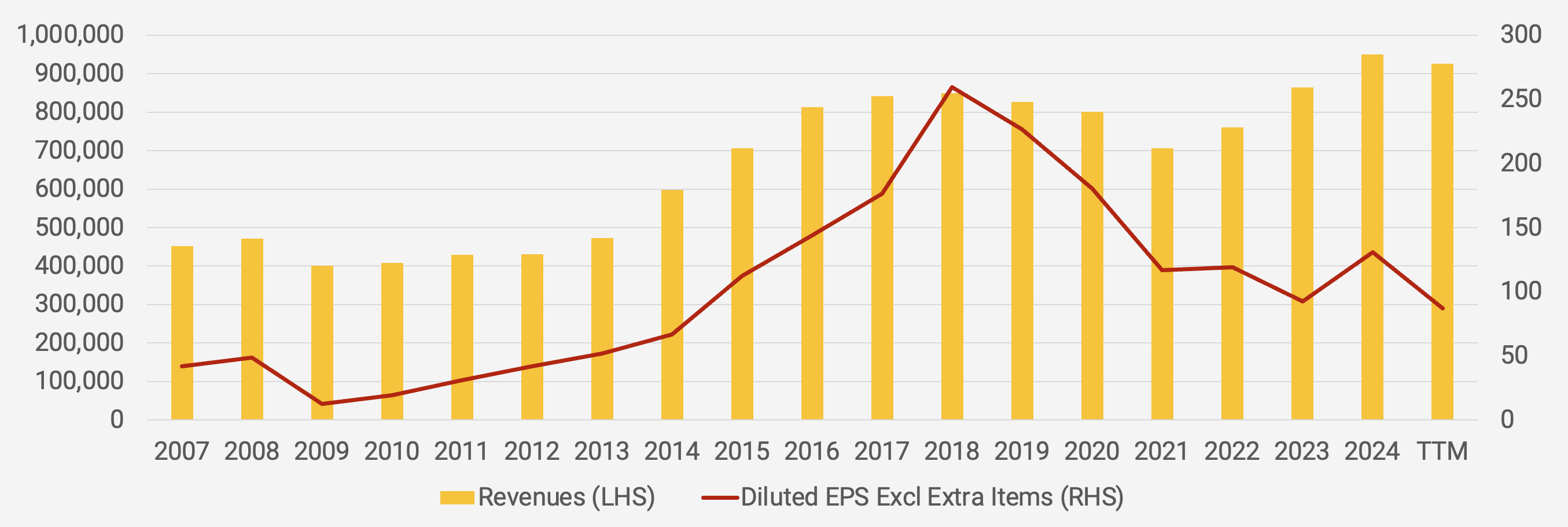

Koito’s revenues have already recovered nicely following the 2022 end of the semiconductor chip shortage. Yet its earnings per share has continued to lag:

Here’s another way to visualize its earnings development: