Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers, including whether any investment suits your specific needs. From time to time, I may have positions in the securities covered in the articles on this website. Full disclosure: I do not hold a position in JD.com at the time of publishing this article. To reiterate, this post and the below presentation are for informational and educational purposes only - not a recommendation to buy or sell shares.

China-focused Twitter user “pandawatch” posted a tweet comparing the total shareholder return of Chinese tech companies.

At the top of the list was online retailer JD.com (JD US — US$57 billion) with a total dividend yield and buyback yield of 10% — even after deducting share-based compensation. That’s impressively high.

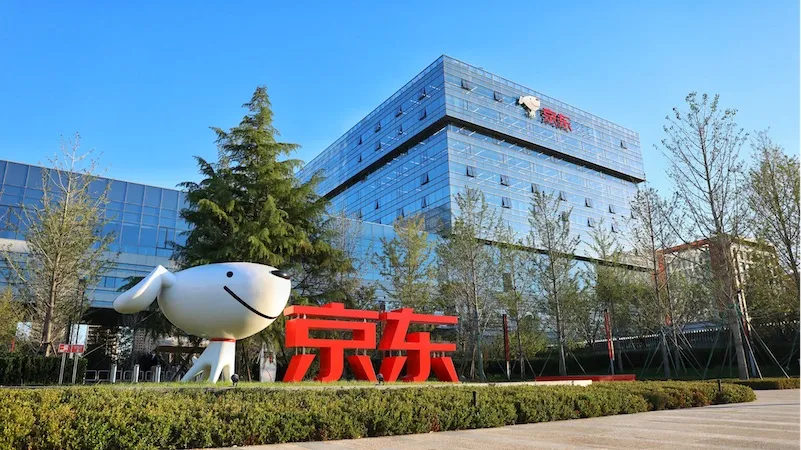

JD is one of China’s largest e-commerce companies. It dominates the niche of selling authentic, branded goods online with fast and reliable delivery. Unlike Alibaba, JD focuses on selling authentic products directly to consumers, taking on inventory risk and delivering packages straight to customers’ doors.

The company was founded by Richard Liu, the son of a peasant farmer in China’s Jiangsu province. He managed to get into the top Renmin University in Beijing and then ventured on a path of entrepreneurship.

Richard’s first business was a restaurant, which failed within months due to employee embezzlement. He then found gainful employment, saved money along the way and used that money to start an electronics shop in Beijing.

Within five years, his business had grown to a network of 12 shops with CNY 10 million in total turnover. But then came the SARS epidemic of 2003, causing foot traffic to grind to a halt. Richard then decided to close all stores and shift to an online model. That online business later became JD.com and became a smashing success.

Up until 2007, JD.com had a relatively small footprint. Yet somehow, he managed to raise US$1.0 billion to build out proprietary logistics infrastructure. It’s unclear where the money came from, but he must have had powerful backers.

Today, JD has built logistics infrastructure across most of China’s larger cities with 1,500 warehouses, seven fulfilment centers and 6,700 delivery stations. And the numbers speak for themselves: 93% of packages are delivered within the next day. In contrast, products from Alibaba’s marketplaces can take three or more days until delivery.