Table of Contents

Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is not a recommendation to buy or sell stocks.

We are becoming infertile.

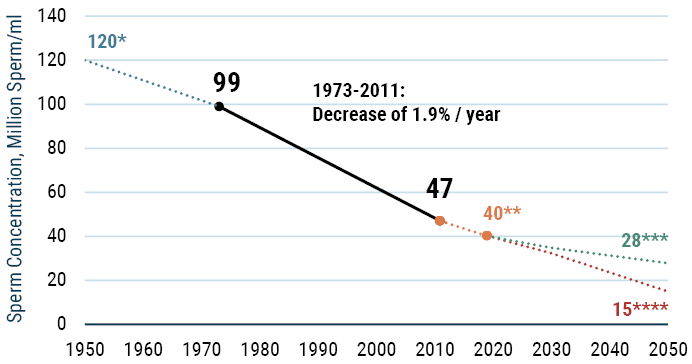

A study by Levine & Swan (2017) showed that the sperm count had decreased at a rate of 1.9% per year until 2011. Investor Jeremy Grantham believes if the current trends continue, the median couple will have trouble conceiving by the mid-2030s.

1. Solving the infertility problem

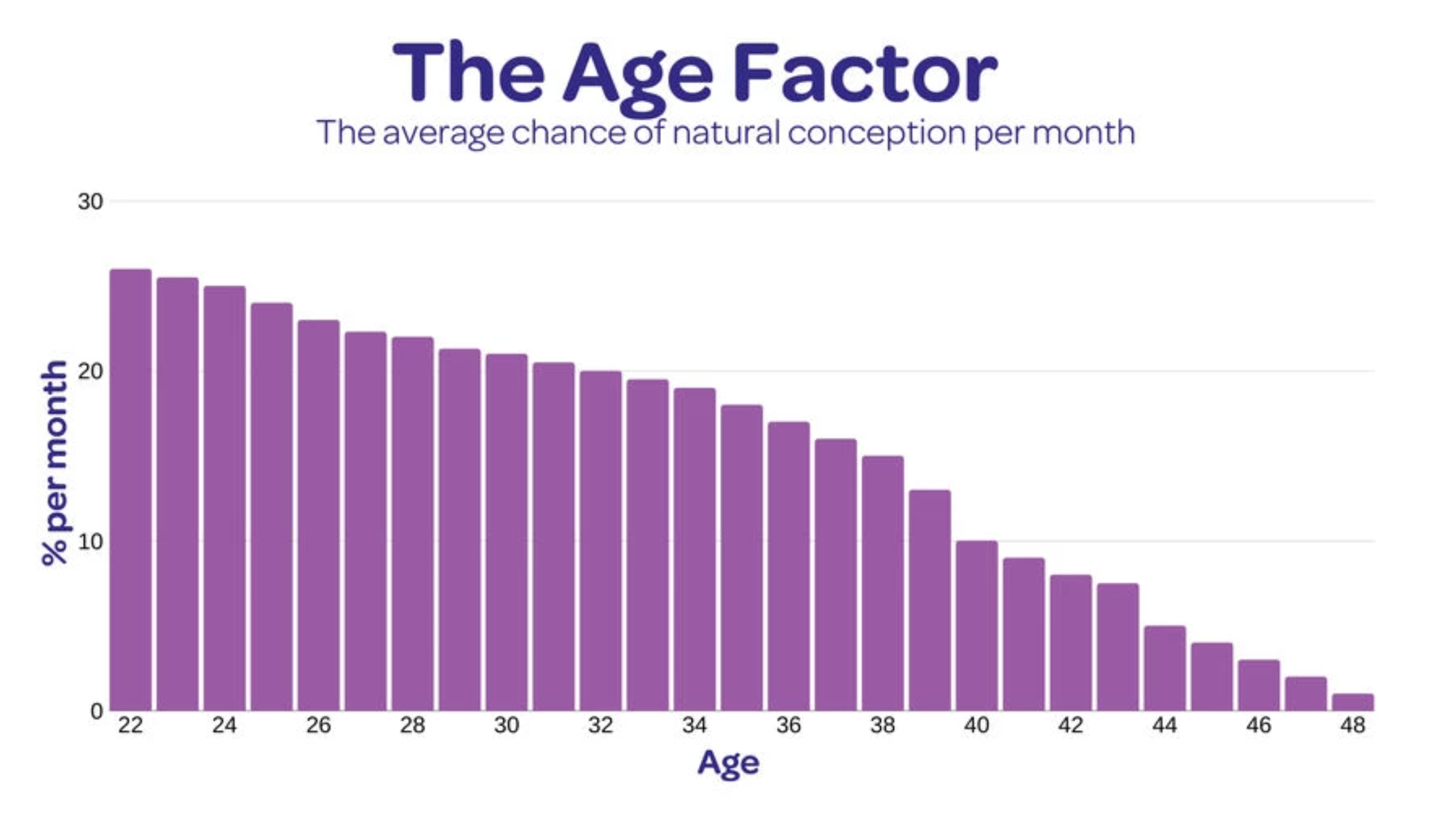

Part of the problem is that couples are choosing to have babies later in life. The likelihood of a natural conception each month goes from around 20% at age 30 to around 10% by age 40. The longer we wait, the more difficult it gets.

But it’s also becoming clear that certain substances are reducing our fertility. Over the past 50 years, the use of chemicals in our daily lives has exploded. Grantham believes that the key reasons for reduced fertility are pesticides on fruits and vegetables and active chemicals in plastics, shampoos, soaps, face creams, fragrances and other cosmetics.

A low sperm count isn’t the only factor behind infertility. Other common fertility problems include ovulation disorders, blockage in the fallopian tubes that transport eggs from the ovaries or inflammation causing damage to the lining of the uterus.

How can we solve the infertility problem?

- Better health: Eating whole foods rather than processed is said to improve fertility. Drugs such as caffeine, nicotine and alcohol are best avoided. Sleep and exercise can also help.

- Medications: Certain medications can be used to stimulate ovulation or increase sperm count in men.

- Surgery: In special cases, surgery can be used to remove and repair damage to the reproductive system.

- Artificial insemination: In these procedures, sperm is inserted directly into the woman’s reproductive tract during ovulation.

- In vitro fertilisation (IVF): Finally, women can get pregnant by fertilising eggs with sperm outside the body in a laboratory setting.

2. IVF: pregnancy in a test tube

In-vitro fertilisation (“IVF”) refers to a medical procedure where eggs are combined with sperm in a laboratory setting and then inserted into a woman’s uterus. The word “vitro” means glass in Latin, referring to the laboratory dish where fertilisation takes place.

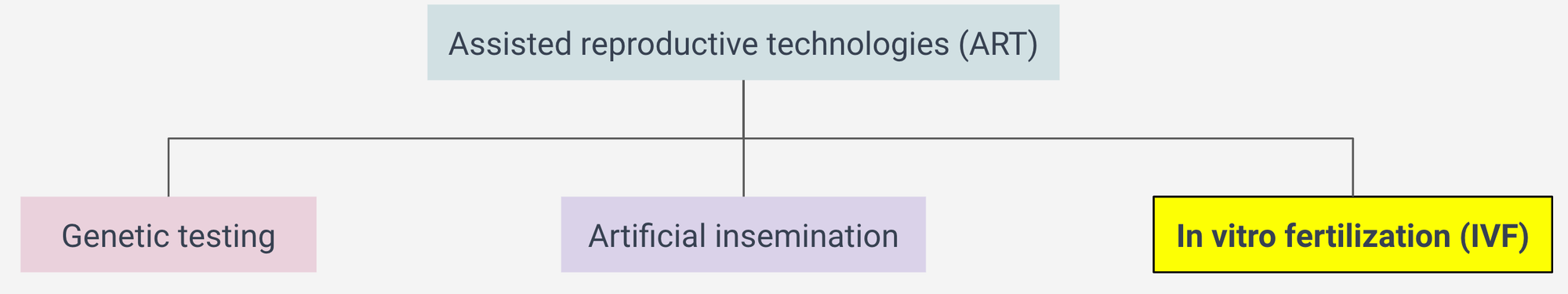

IVF is a sub-category of the broader universe of assisted reproductive technologies (“ART”): technologies meant to help couples achieve a successful pregnancy.

- Genetic testing is done to identify sperm or embryos that are most likely to lead to a healthy baby.

- Artificial insemination of sperm into a woman’s uterus is a simple procedure that’s suitable for couples with mild fertility issues.

- But for those with significant trouble conceiving, IVF will have a far higher success rate.

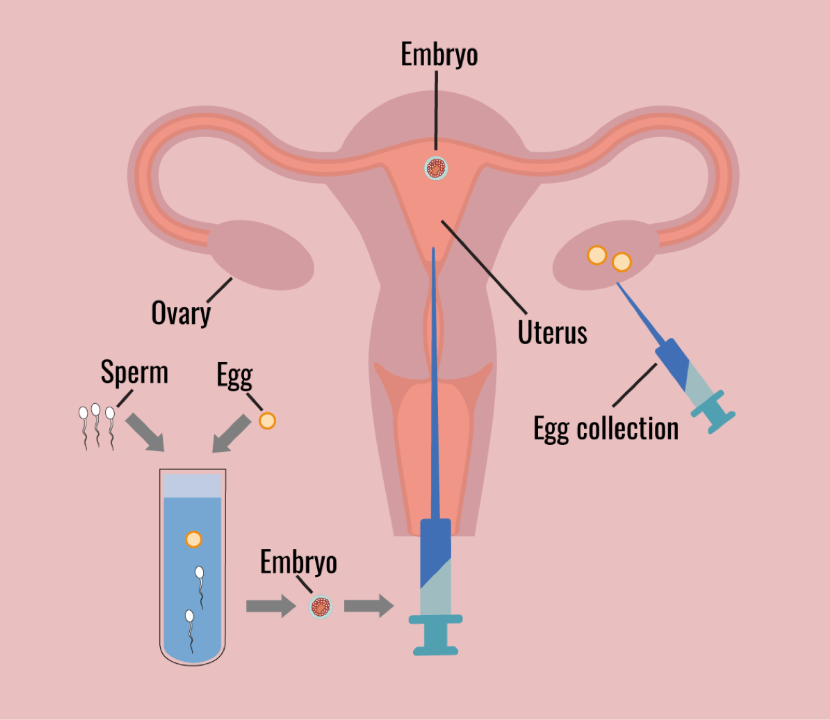

The first step of the IVF process is to inject hormones into a woman’s body to stimulate her ovaries to produce eggs.

A doctor then uses a thin needle to retrieve those eggs from the ovaries and then places them in a laboratory dish where they’re combined with sperm.

Once an embryo has been formed and grown for a few days, the embryo is then implanted into a woman’s uterus in the hope that it’ll lead to pregnancy.

Within two weeks, a pregnancy test will hopefully provide a positive result. If the procedure was not successful, then the patient has the option to go through yet another “cycle”, i.e. another attempt at IVF.

A woman wanting to prepare herself for a future IVF procedure has two options: she can either freeze her own eggs or freeze embryos:

- Freezing eggs enables the woman to decide who the father of the child is going to be at a later stage. It’s also cheaper.

- Freezing embryos leads to a higher success rate in achieving pregnancy, allows for genetic screening and also provides multiple opportunities for pregnancy within a single IVF cycle.

The probability of a successful IVF treatment for a single cycle is about 50% for women below 35. For women above the age of 42, that probability drops to about 4%. That may sound like a low number, but the probability of a successful pregnancy through IVF is still about 4-5x higher than for conception through natural means.

IVF procedures are expensive. The cost of IVF is about US$12,000 for a single cycle, plus another US$3-5,000 for genetic testing of implanted embryos. But one cycle is normally not enough. Typically, three cycles will be necessary to achieve a successful outcome, putting the total cost of pregnancy through IVF above US$50,000. And that’s not even counting the cost of childbirth.

To improve the chances of a successful outcome and save money, many choose to insert multiple embryos. Doing so increases the chances of pregnancy, but it also leads to a greater risk of twins, triplets or more children at the same time. While having one child typically costs around US$20,000, that cost skyrockets to US$100,000 for twins and more than US$400,000 for triplets or more. So inserting multiple embryos can be risky both in terms of health and finances.

On the positive side, children conceived via IVF - also known as test tube babies - have been shown to have equal school performance, social skills and behaviour. So while the procedures are costly, they are effective and valuable for those who are unable to conceive naturally.

3. The birth of a new industry

The first baby ever conceived through an IVF procedure was Louisa Brown in 1978. Dr Robert Edwards - one of the doctors that conducted the procedure - received a Nobel prize in medicine for his achievement.

Until 2018, over 8 million babies had been born through IVF procedures. And today, roughly 2% of babies born in the United States come from IVF. In some European countries like Denmark, that number is as high as 10%.

Because of our reduced fertility and the rising age of childbirth, the IVF market is growing quickly at almost 10% per year. And in the Asia Pacific region, growth is even higher, somewhere in the mid-teens.

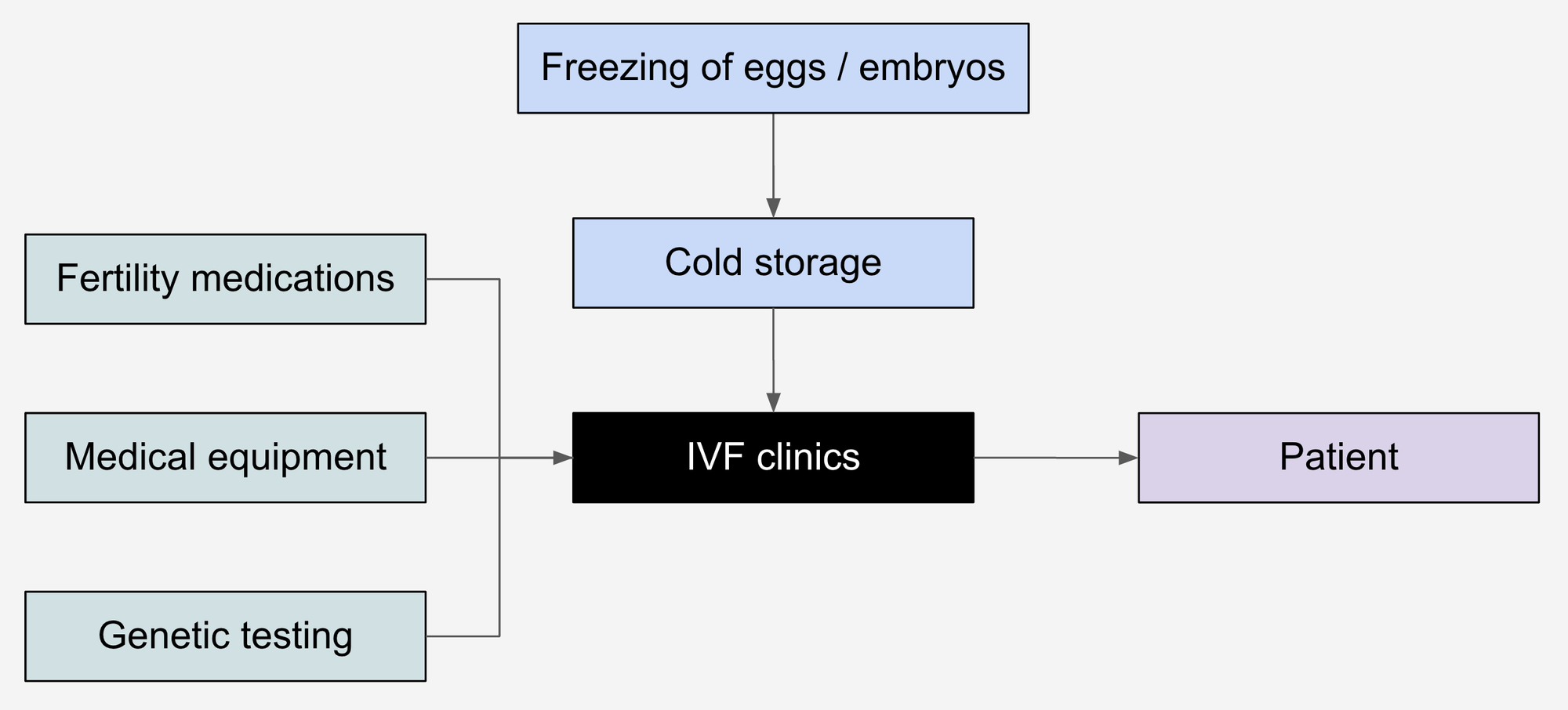

Here is a flowchart of the industry supply chain:

Patients are served by IVF clinics, which may be standalone or residing in larger hospitals. The freezing of eggs or embryos and the actual IVF procedure can occur in the same clinic, but that’s not always the case. Meanwhile, suppliers to the IVF clinics include drug manufacturers, producers of medical equipment and consumables and genetic testing companies.

Who captures the economics of the industry? The industry profit pool is well spread out and distributed across the supply chain. The owners of important patents - including drug manufacturers and genetic testing companies - enjoy strong bargaining power.

The IVF clinic industry is highly fragmented and not particularly regulated. Some have reported that IVF clinics exaggerate claims, perform unnecessary procedures and cross certain ethical boundaries. For example, a doctor in California famously inserted 12 embryos into a woman’s uterus, leading to the birth of eight babies.

4. The investable universe of IVF stocks

The IVF industry remains niche. Most drug- and equipment makers are based in Europe or the United States. There are also a few listed IVF clinic operators in Australia, Canada, the UK and China.

4.1. IVF clinics

In certain Asia Pacific countries such as Japan, South Korea, Singapore, Taiwan and Australia, governments cover a portion of the cost of IVF. In Singapore, for example, the government provides subsidies for up to three cycles.

In most Asia EM countries, including China, Indonesia, Thailand, etc., patients are forced to pay entirely out of pocket. That’s led to so-called fertility tourism, whereby Chinese travel to Thailand or the United States for their IVF. The cost of a single IVF cycle in Thailand is less than half the price of that in the United States or Singapore, making the industry cost-competitive. The single-cycle IVF success rate in Thailand of 40-50% is also said to be significantly higher than that in China’s 20%, according to research analysts at DBS, though I can’t guarantee the accuracy of those numbers.

Some of the Thai hospital operators have large exposure to fertility tourism, including Ekachai Medical Care, with almost 20% of its revenues from IVF prior to COVID-19. Bangkok Chain Hospital also has exposure to the IVF industry through its subsidiary World Medical Centre. Praram 9 Hospital had roughly 7% of its revenues from IVF services prior to COVID-19.

China’s National Health Authority vowed in 2022 to make IVF technologies more accessible to its citizens. The Chinese government has now said it wants IVF procedures to be gradually included in the government insurance fund’s reimbursement program. So while the reopening of China’s borders should help certain Southeast Asian hospital operators, greater subsidies could bring part of that IVF business back to China.

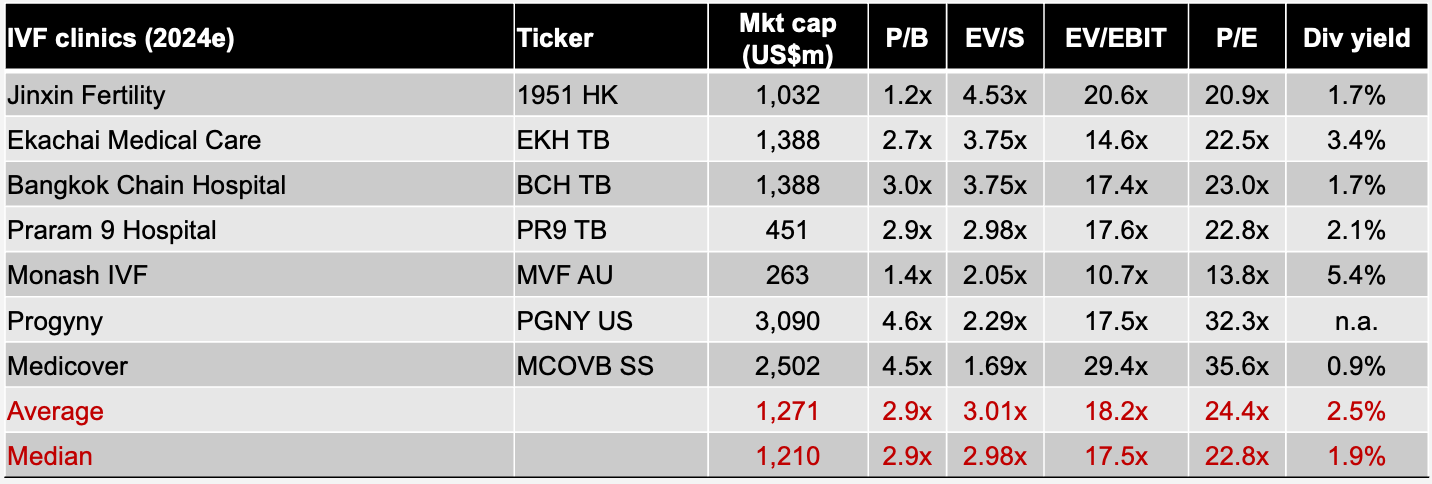

Within China, the only pure-play IVF clinic out there is Jinxin Fertility (1951 HK). It’s a Shenzhen-based IVF clinic operator with over 50 clinics across the Sichuan and Guangdong provinces. Jinxin Fertility’s services offered include genetic testing, artificial insemination and IVF.

Monash IVF (MVF AU) operates a network of 27 fertility clinics across Australia, where it has a 20% market share. It also operates in Malaysia. Monash’s parent company is Australian Clinical Labs (ACL AU), and it’s also engaged in other types of medical testing services, including fertility testing.

In other parts of the world, Medicover (MCOVB SS) operates healthcare clinics across, including IVF centres in Poland and Ukraine. The Fertility US-based Progyny (PGNY US) is a fertility benefits manager, acting as a patient advocate to ensure the best outcomes for the client.

Ekachai Medical Care trades at a low multiple and but its hospitals have most likely benefitted from COVID-19, a trend that is likely to reverse now that Thailand has reverted to a living-with-COVID strategy.

Monash IVF and Jinxin Fertility both trade at reasonable multiples. But the acquisitive nature of both of these companies has dragged down their returns on equity to single-digit levels. EPS growth has been practically non-existent.

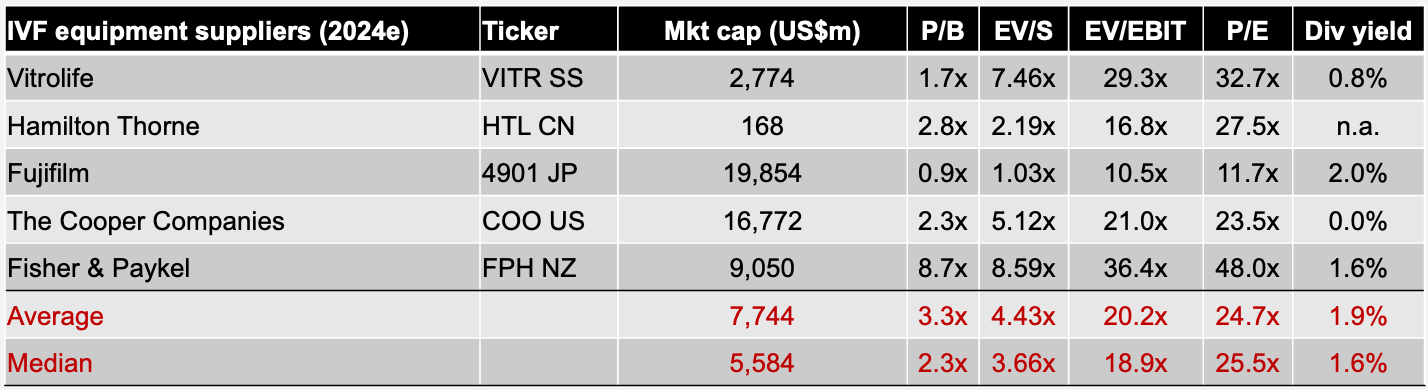

4.3. Suppliers of equipment & consumables

There is no pure-play IVF equipment or consumables supplier in the Asia Pacific region. But in Europe, you have Vitrolife (VITR SS), a Swedish company providing products and services for IVF procedures. The common denominator between all of its products is that they’re all designed to improve the chances of successful fertility treatments: for example, sperm handling products, embryo transfer catheters, culture media, etc. Analysts at Redeye estimate that the company has a 20% market share in the global market for disposable IVF products. Vitrolife’s well-regarded CEO, Thomas Axelsson, just announced his resignation.

Canada’s Hamilton Thorne (HTL CN) provides equipment, consumables, software, and services for IVF clinics. It has grown partly through acquisitions, including genetic testing company Embryotech and IVF consumables business Gynemed, which specialises in cell culture media products. There’s a decent 2018 write-up on the stock at Value Investors Club.

Other equipment suppliers such as The Cooper Companies (COO US), Fujifilm (4901 JP) and Fisher & Paykel (FPH NZ) have only limited exposure to the IVF industry and should, therefore, not be considered pure-play IVF stocks.

Most suppliers trade at relatively high multiples. While the industry tailwinds are obvious, note that expensive acquisitions have driven down the return on equity for all of these companies except New Zealand’s Fisher & Paykel. But it doesn’t have much exposure to the IVF industry, to begin with.

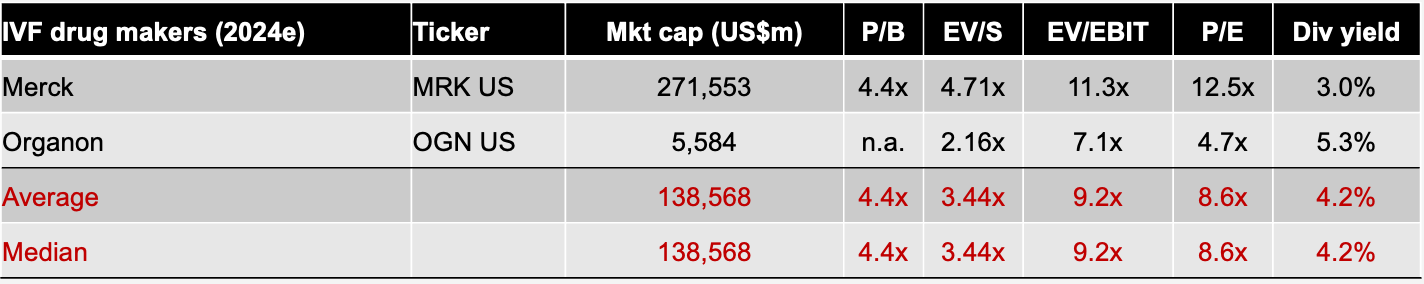

4.2. IVF drug makers

The largest producer of drugs used in IVF treatments is the drug company Merck (MRK GR). It produces so-called gonadotropins, which are used to stimulate the ovaries to produce multiple eggs. It also sells drugs used to control the timing of ovulation as well as branded progesterone used to prepare the uterus for embryo implantation. But Merck is a massive pharmaceutical company with only a fraction of its revenues from IVF drugs.

In 2021, Merck spun off Organon (ORG US), which owns medicines such as Ganirelix, Follistim and Pregnyl, which are used in IVF treatments. I estimate that Organon has a high-single-digit revenue contribution from IVF drugs. There was a short write-up on Organon on Value Investors Club here, with limited analysis, though pointing out that post-spin-off selling pressure might have pushed down the share price.

Organon does trade at an exceptionally low P/E multiple, though be aware that its drug Nexplanon is facing a loss of exclusivity in 2025.

Conclusion

The IVF industry is booming, driven by couples having children later in life as well as infertility problems.

There should be plenty of opportunities for IVF clinic operators, including for Jinxin Fertility which may benefit if the Chinese government introduces subsidies for IVF procedures. But the acquisitive nature of many IVF-related companies has caused their returns on equity and earnings per share growth to be weak.

One stock that trades at a low multiple with fat profit margins is Organon, though be aware of its ongoing patent cliffs, which may be the reason it was spun off in the first place.

Enjoying Asian Century Stocks? Consider a free trial, giving you instant access to deep-dive reports, thoughtful commentary and access to my Asia-focused portfolio: