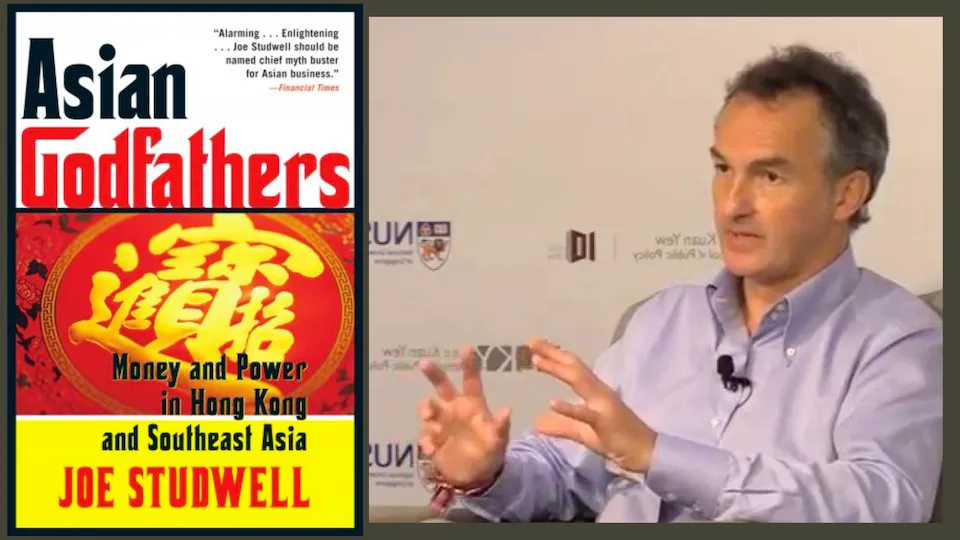

Book review: Asian Godfathers

A book by Joe Studwell on how to become an Asian tycoon. Estimated reading time: 22 minutes

Latest

Babies out with the SaaS-water

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time,