Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is not a recommendation to buy or sell stocks.

Summary

- Malaysia is a small economy in Southeast Asia with a population of 36 million people.

- I think it’s underrated in many ways: it has a dynamic export sector, excellent disclosures, strong corporate governance practices, English disclosures and trading access to 1,000 stocks via Interactive Brokers

- I’ve gone through the entire list of publicly listed companies with more than US$50 million in market cap and picked out 25 companies that I consider to be hidden champions. These operate within the healthcare, finance, consumer, tech industries and more.

Last year, Interactive Brokers enabled access to Malaysian equities. So if you have a brokerage account with them, you can now buy and sell the ~1,000 stocks listed on the Bursa Malaysia.

That’s why I think it’s a good time to dig into the Malaysian market. Over the past two years, I’ve searched for Hidden Champions in each of Asia’s markets, including Taiwan, Indian ADRs/GDRs, Chinese ADRs, Hong Kong and Singapore.

Today, I’ll see whether I can do the same for Malaysia — to see whether I can find companies that fit the profile of being long-term compounders. In other words, companies that dominate their niches and are able to compound their capital at a high return on equity.

I’ll pay zero attention to share prices, so don't take the following discussion as investment advice — I’m simply trying to identify hidden champions and nothing more.

Table of contents:

1. A top-down view

2. Screening for candidates

3. Hidden champions of Malaysia

4. Conclusion1. A top-down view

Let me first give a brief introduction to Malaysia. If you’re already familiar, you can skip to section to.

The country is divided into two parts:

- Peninsular Malaysia, just south of Thailand and north of Singapore. Its capital city Kuala Lumpur in peninsular Malaysia, as are several major cities such as Georgetown, Malacca and Johor Bahru.

- East Malaysia, which consists of two states on the northern part of Borneo, is a popular tourist destination.

People have been living in Malaysia for at least 40,000 years. But current-day Malays came from southwestern China and the Mekong River Delta about 10,000 years ago. Indian and Chinese traders arrived around 2,000 years ago. In the 12th century, traders from the Middle East brought with them Islam, which is now the state religion.

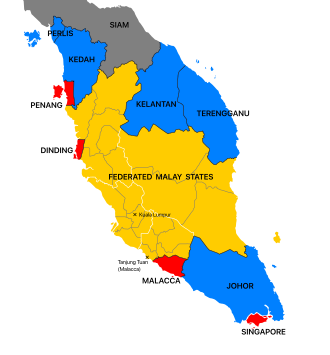

Some of Malaysia’s key territories were run by British from the 19th century until independence in 1957. The British brought the English language, and the Malaysian business community continues to speak English as a lingua franca. Financial disclosures are all in English. And the country has a common law legal system with decent protections for minority investors.

Four parts of Malaysia were direct British colonies: Penang, Dinding, Malacca and Singapore, known as the Straits Settlements. But the independent Federated Malay States were also under the protectorate of the British Empire, and heavily influenced by it.

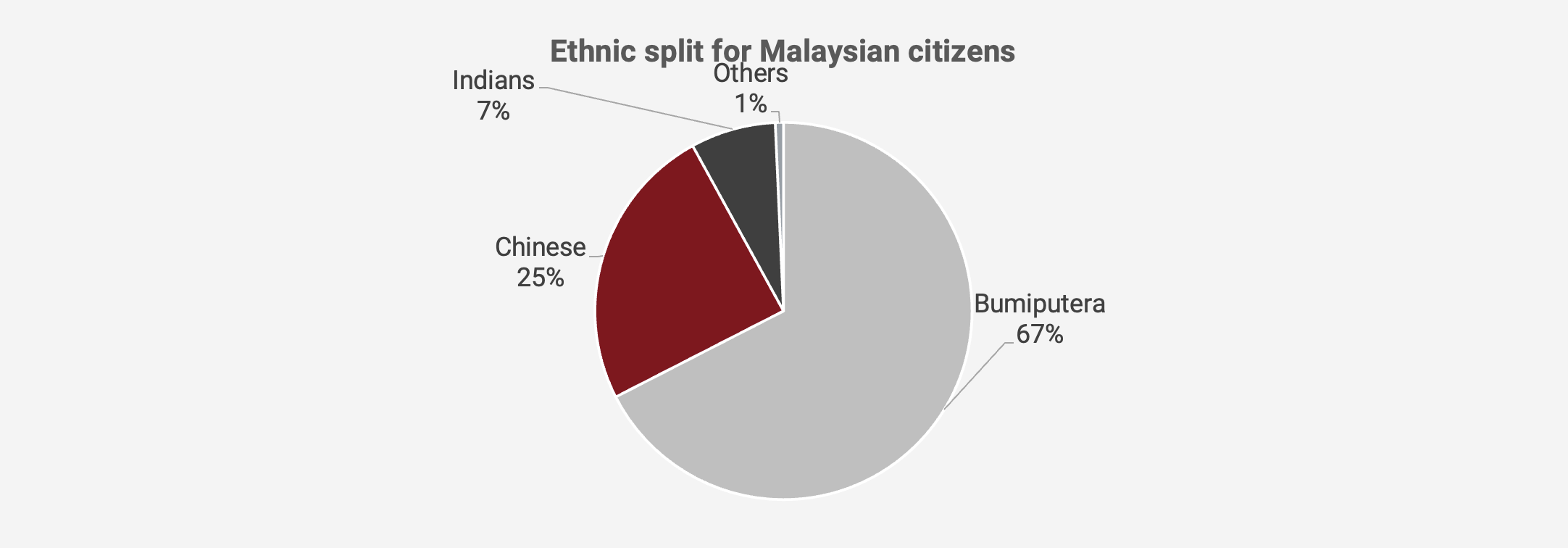

Malaysia is clearly multicultural. According to the 2020 census, 67% are Malays, 25% are Chinese and 7% Indians. The indigenous population, which includes Malays, are often referred to as “Bumiputera”, meaning native inhabitants.

It’s a divided society. The government has long considered the Bumiputera population to be lagging behind. To rectify the situation, a variety of affirmative action policies have been introduced, including preferential access to government contracts, preferential access to jobs in state-owned enterprises, reserved spots in universities, better access to loans, etc.

Malaysia has a dynamic economy, with a host of export companies in Penang and the Klang Valley. The GDP/capita is about US$11,000 per year, similar to China’s.

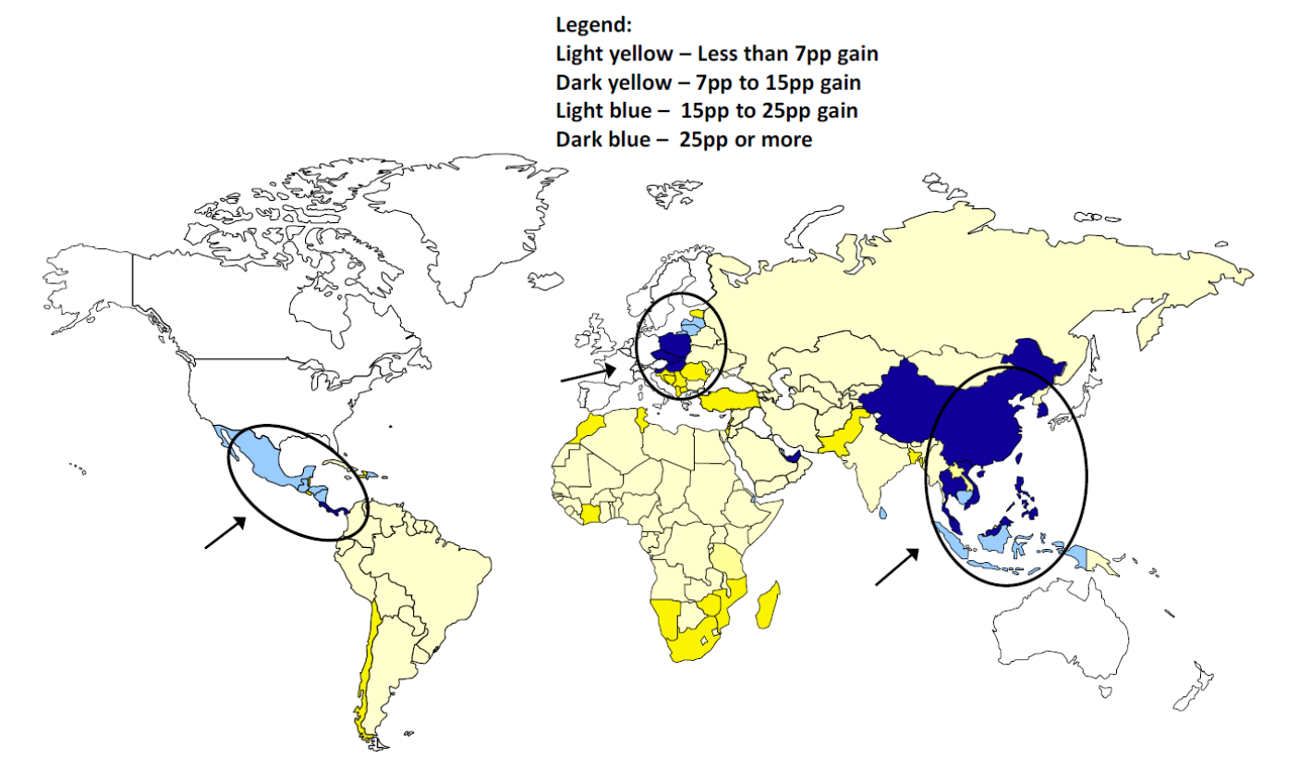

So what are Malaysia’s competitive advantages? In my view, one major advantage is proximity to manufacturing supply chains in East Asia. Ships carrying manufactured goods from Asia tend to pass through the Malacca Strait, right next to. Malaysia. For example, semiconductor chips will typically be shipped from Southern China or Taiwan to Malaysia for testing and packaging before transport to the rest of the world.

Another advantage is the climate, enabling highly productive oil palm plantations and rubber plantations. A medical glove industry has emerged, with workers imported from Bangladesh and India, thanks to permissive visa schemes.

There’s also a thriving oil & gas sector thanks to discoveries of resources in the Gulf of Thailand and offshore Borneo.

Finally, it’s an easy place to do business. Malaysia is an English speaking country with a relatively educated population. There’s a Chinese diaspora able to communicate with their counterparts in Mainland China or Taiwan. Taxes are low. The protection of intellectual property is stronger than many other emerging markets. The infrastructure is decent. And as a Muslim country, Kuala Lumpur is well placed to serve the Muslim world with Sharia-compliant banking services.

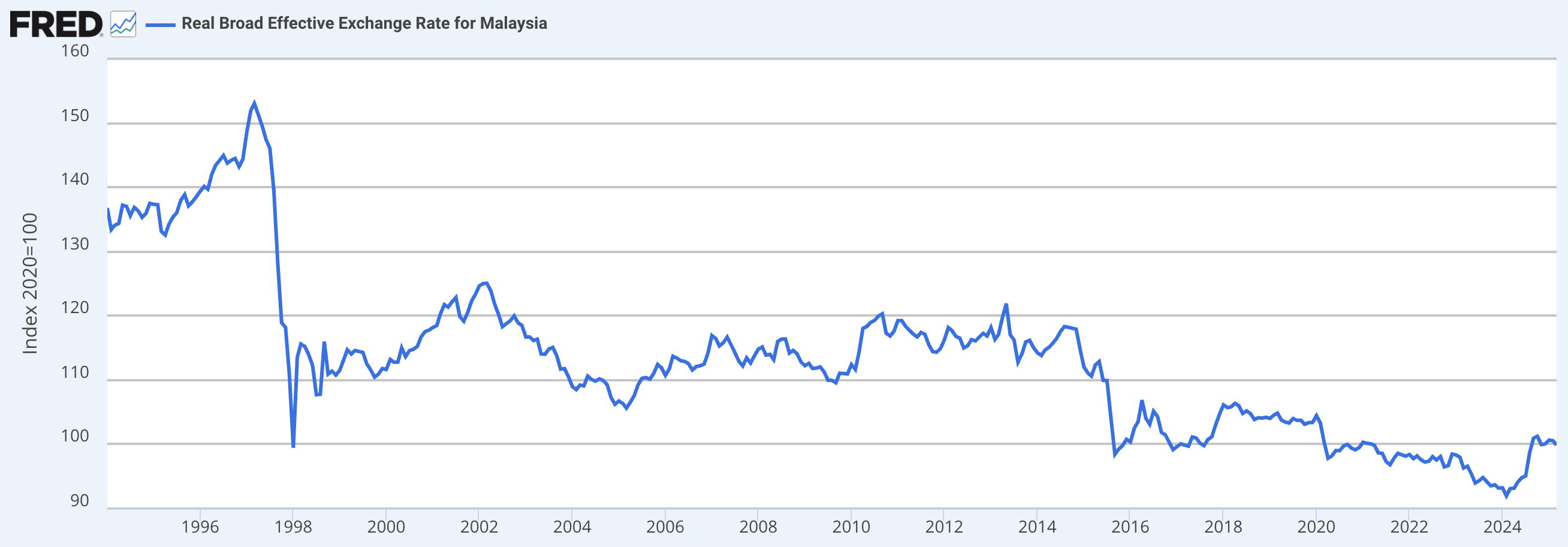

As I’ve argued in the past, the currency has been incredibly weak, with the Malaysian Ringgit trading at right about its post-Asian Financial Crisis lows in terms of the real effective exchange rate.

The implication is that Malaysian labor costs are competitive. When travelling from Singapore to Malaysia, you can feel how cheap the currency is. Many Singaporeans retire in Malaysia, given the lower costs and similar culture.

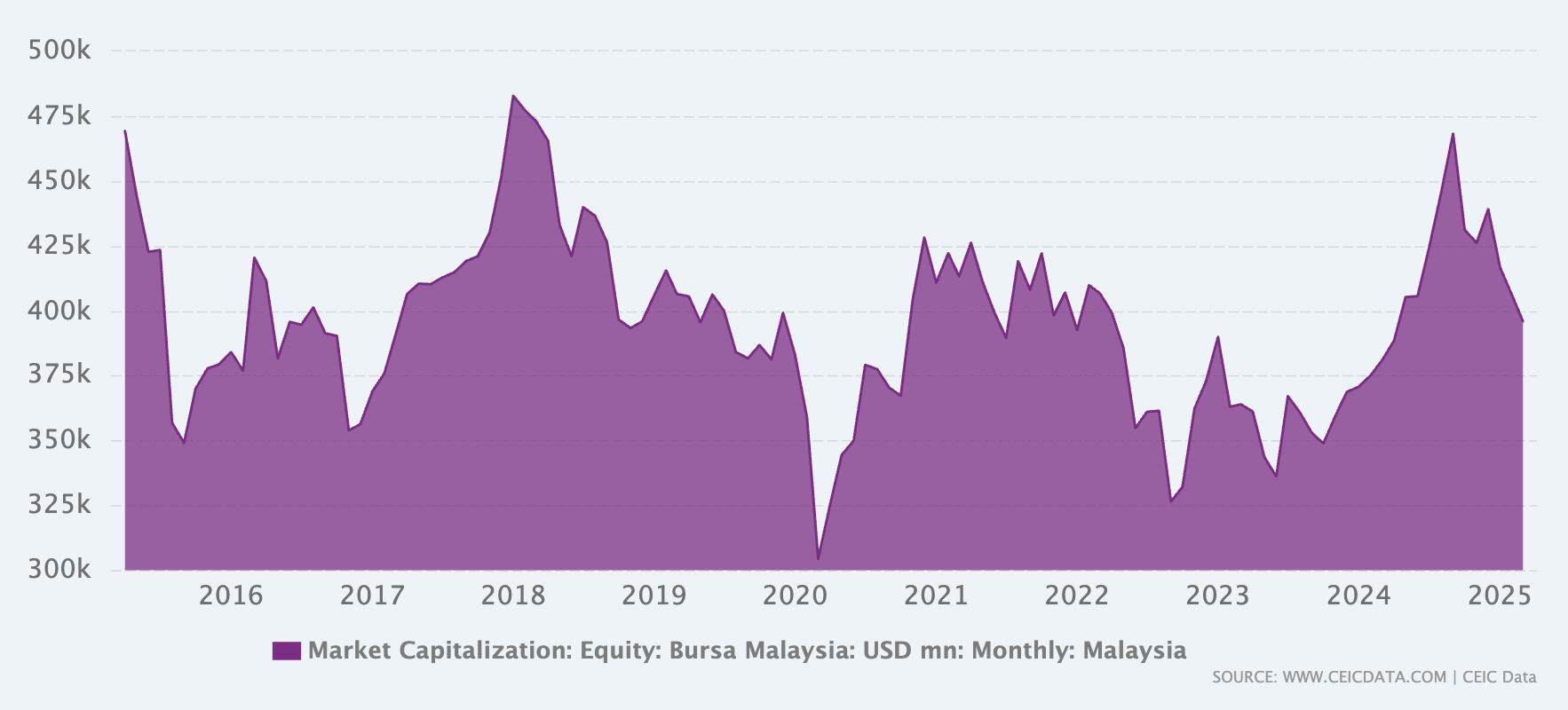

When it comes to the stock market, the Malaysian and Singapore stock exchanges used to be run as a single entity before being split off in 1973. The aggregate market cap for Bursa Malaysia is about US$400 billion, close to that of Singapore:

Out of roughly 1,000 stocks, only 80 or so are above US$1 billion in market cap. So it’s a small and relatively illiquid market. Perfect for retail investors, in my view.

The most popular index is the FTSE Bursa Malaysia Kuala Lumpur Composite Index. It has rebounded nicely since 2023 and is now trading at a current-year P/E multiple of 14.3x.

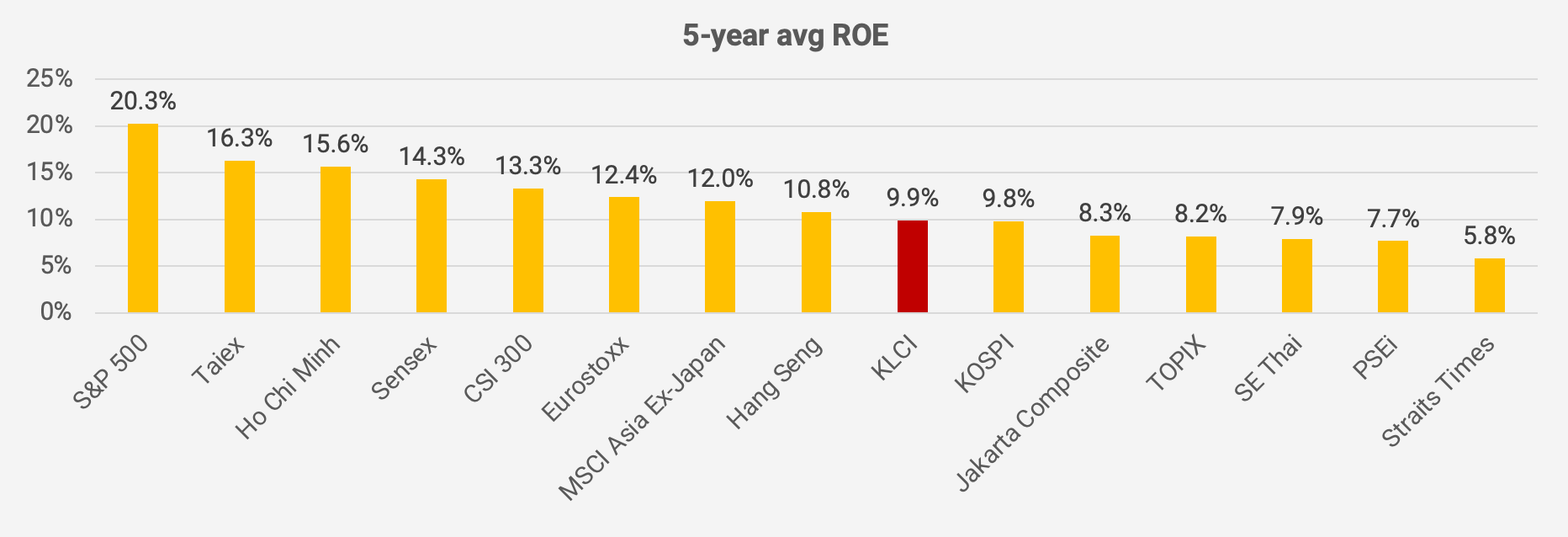

A P/E of 14.3x is not particularly compelling in relation to the index’s 5-year average return on equity of 9.9%. Several other Asian countries such as Taiwan, India and the Vietnam show much higher return on equity.

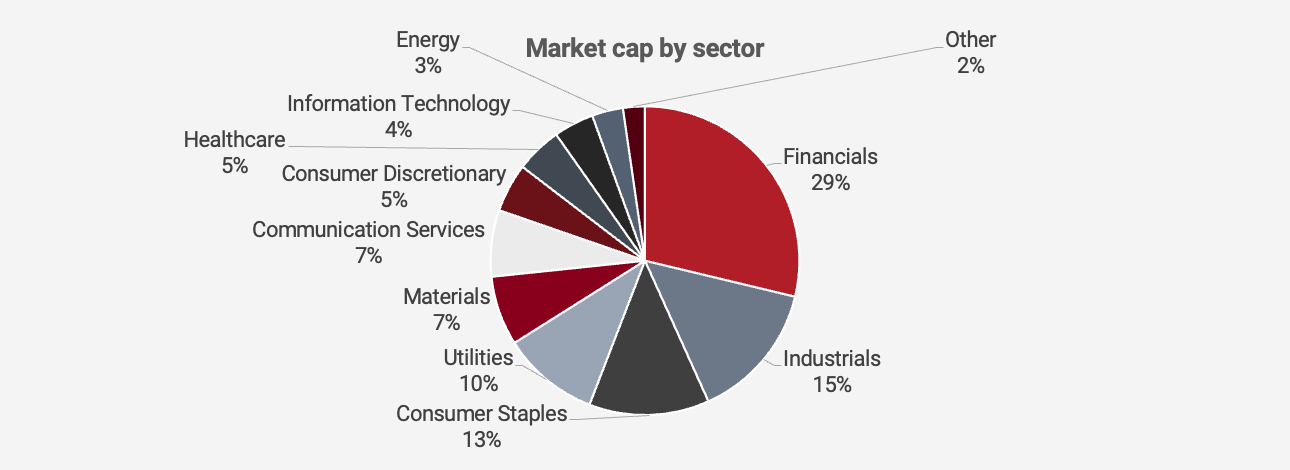

In terms of the sector split, it’s more diversified than many other emerging markets, with plenty of industrials, consumer stocks and even tech companies.

The largest companies in each sector are the following:

So to summarize, I think Malaysia is a straightforward market to invest in. The analyst coverage is excellent, even for smaller companies. All disclosures are in English. You can buy and sell stocks using Interactive Brokers. All disclosures are in English. And I also think that corporate governance practices are relatively strong, at least in relation to the broader emerging market universe. So, definitely pay attention to Malaysia if you want to invest in the region.

2. Screening for candidates

Let’s dig deeper into individual companies that exhibit “hidden champion” like characteristics, including:

- High historical average return on equity

- High growth in earnings per share

- Strong share price performance

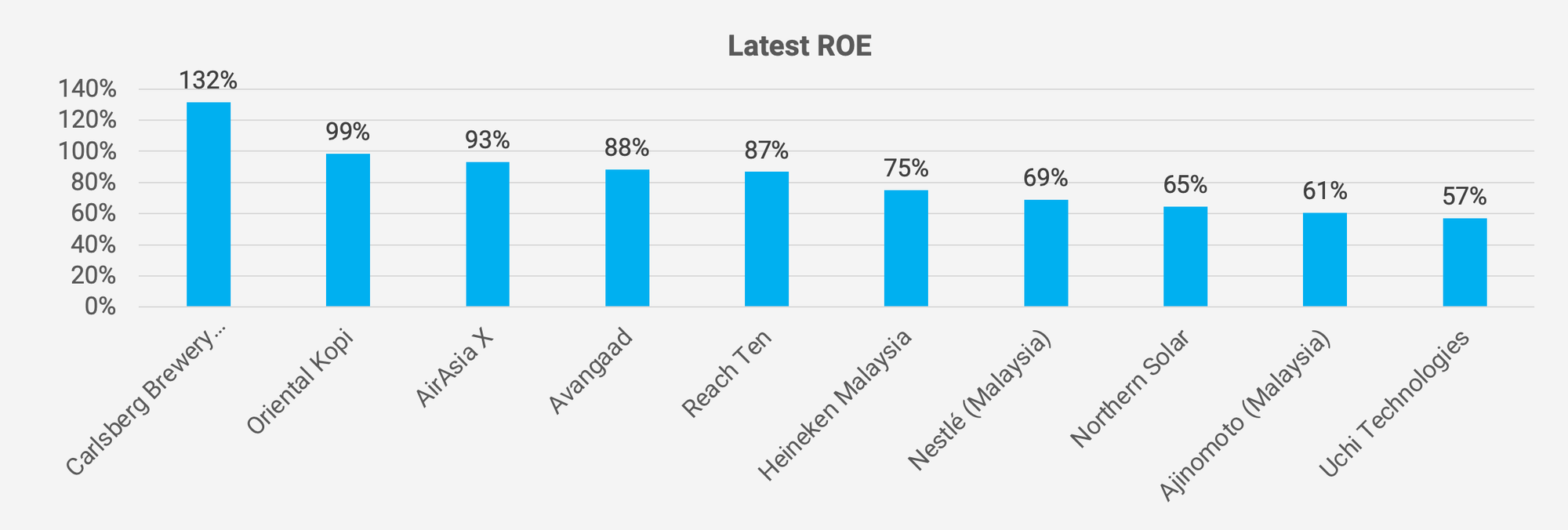

Here are the top ten companies in Malaysia in terms of a high return on equity:

Brewers Carlsberg Brewery Malaysia and Heineken Malaysia both stand out. While Muslims generally do not drink alcohol, roughly a third of the population is a potential target customer of the two brewers. Oriental Kopi is a Malaysian restaurant and coffee chain with great customer reviews. AirAsia X is the country’s leading low-cost airline that has debt, though it has been criticized for its consolidation accounting. Avangaad own oil tankers, floating storage units and support vessels. Reach Ten is a new IPO owning telecom towers, a fiber optical network and a satellite Internet service. Nestle Malaysia is the local subsidiary of Nestle that sells the chocolate beverage Milo, instant noodle product Maggi, Kitkat and several other food products. Northern Solar installs solar panels for businesses, factories and homes. Ajinomoto Malaysia is a subsidiary of Japan’s MSG giant Ajinomoto. Finally, Uchi Technologies builds ASIC chips for fully automated coffee machines like Jura, Thermoplan, etc.

Overall, I think most of these companies are exceptional. Though be aware that some cyclical companies will sometimes exhibit high return on equity at the peak of the cycle. And write-downs can have the effects of boosting return on equity.

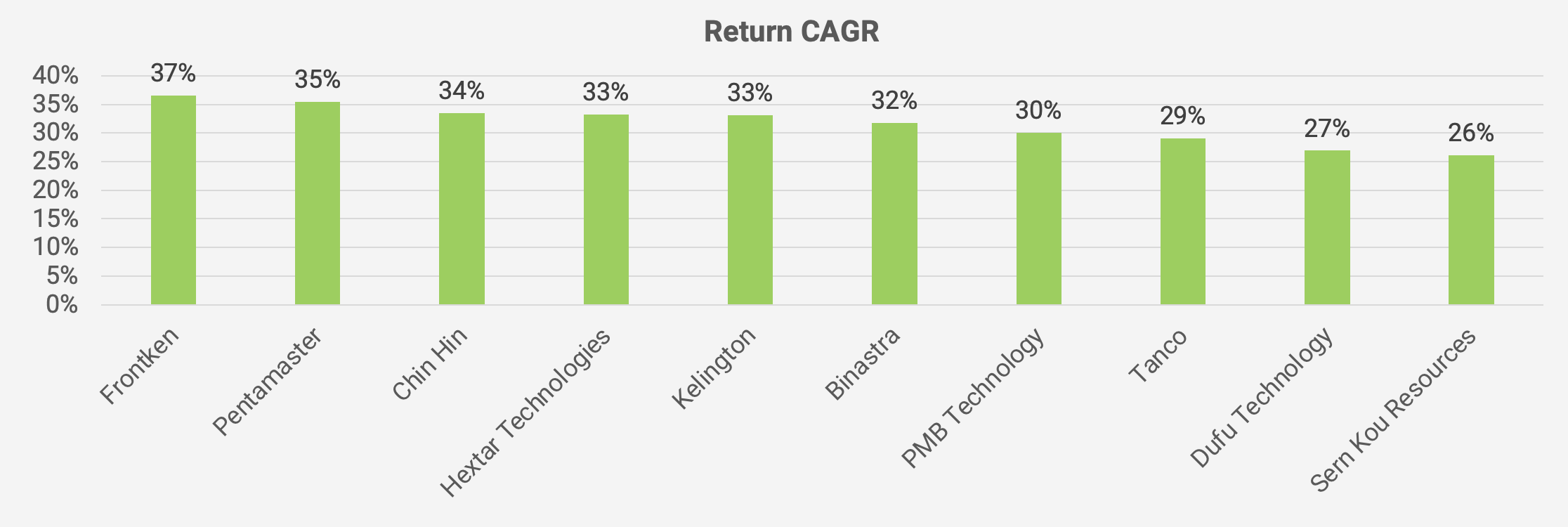

The Malaysian companies with the highest total returns include Frontken Corporation provides precision cleaning and coating for semiconductor parts, including for Taiwan’s TSMC. They also include Pentamaster Corporation, a sister company to the Pentamaster International I wrote about last year. Chin Hin Group is a cement company. Hextar Technologies is a trading company that now has a fintech app called MoneyX. Kelington Group makes gas and chemical delivery pipes for chip fabs. Binastra is a building contractor for condos, offices, retail lots and data centers. PMB Technology smelts silicon metal at a plant in Sarawak. Tanco is another construction companies, owning a large seafront landbank in Port Dickson. Finally, Sern Kou Resources owns owns sawmills and a furniture factory that exports to the United States.

I’m noting that several companies operating in the semiconductor industry have had great runs, though I believe this phenomenon is partly cyclical. I am not particularly impressed with either of these companies.

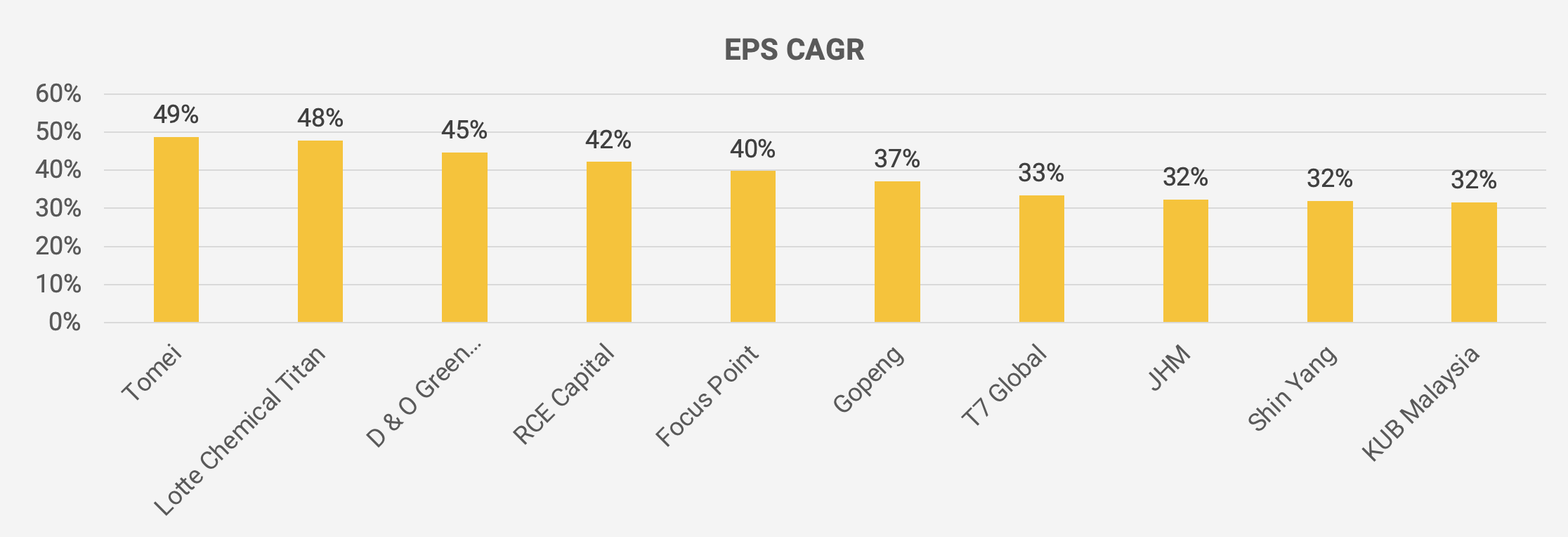

The fastest-growing companies in terms of EPS have been Tomei, the jewelry company, which I suspect has been benefiting from a strong demand for gold. Then Lotte Chemical Titan, the operator of a petrochemical plant in Johor. D&O Green Technologies designs LED chips used in car headlamps, etc. RCE Capital is a payroll lender. Focus Point runs Malaysia’s largest optical retail chain. Gopeng owns an oil palm estate and has property developments around Perak. T7 Global is an oil services contractor, helping with rig decommissioning, maintenance, etc. JHM makes LED modules and precision machinery for third parties. Shin Yang is a shipping company with four shipyards in Sarawak. And finally, KUB Malaysia is a distributor of LPG cylinders to households.

I believe that the EPS screen, while interesting, suffers from the same problem of industry cyclicality. I think we’ll have to dig deeper to find hidden champions.

And in the past week, I’ve done just that. I’ve gone through the list of 500 or so companies with market caps above US$50 million listed on Bursa Malaysia. I’ve then ranked them in terms of return on equity, historical price performance and earnings per share growth in the following spreadsheet. Companies with above 10% return on equity / yearly total return / EPS growth are marked with a green background colour.