Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is not a recommendation to buy or sell stocks.

In large parts of Asia, people are still wearing face masks.

In this post, I will argue that using face masks has had a negative effect on the consumption of colour cosmetics such as facial makeup and lipstick. And now that face mask requirements are being relaxed across much of Asia, it’s possible that the demand for such cosmetics will finally recover.

1. Link between face masks & cosmetics

The broader cosmetics market can be divided into:

- Skin-care: cosmetics used to take care of your skin, including moisturisers, facial cleansers, hand care, etc. In Asia, skincare represents roughly 75% of the total spend on cosmetics.

- Colour cosmetics: cosmetics used to improve your appearance, such as facial make-up, lipstick, nail polish, eye make-up, etc. Colour cosmetics represent roughly 25% of the market.

The global cosmetics market tugged along nicely during COVID-19. For example, Estée Lauder saw its profits rise during the pandemic, as did L’Oréal.

But at the same time, there’s been a clear mix shift from colour cosmetics towards skincare. I attribute this shift to three main reasons:

- Many have been wearing face masks to protect themselves against the spread of COVID-19. And cosmetics worn on the lower half of your face, such as lipstick and foundation creams, have a tendency to smudge up masks worn on top. Also, wearing a face mask leads to a higher incidence of acne, which is then treated through skincare products.

- The so-called “Zoom effect”: The work-from-home trend caused consumers to become more concerned about their skin. Blemishes are accentuated by the typically poor lighting at home and the low resolution of most webcams. Some consumers have therefore tried to improve their skin through skincare products.

- And since we haven’t socialised as much in, say, restaurants and bars, there’s been less need to put on make-up.

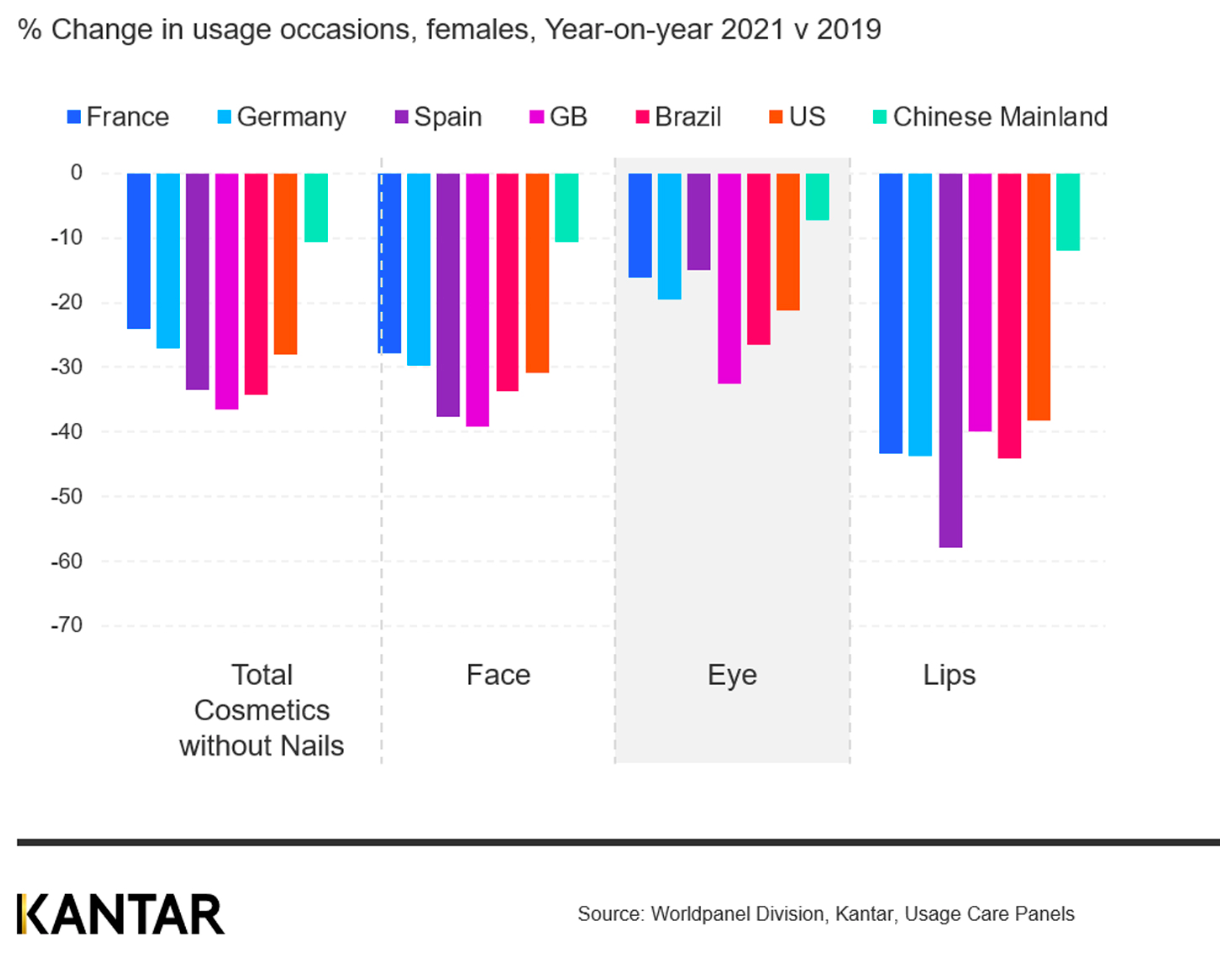

There’s plenty of evidence of this mix shift. For example, in South Korea, the market for make-up dropped 21% in 2020 and still hasn’t recovered. In Japan, the market for lip colour products shrank 65% from 2019 to 2021.

And early on in the pandemic, Alibaba reported that eye cosmetics sales had increased by +150% in a single month. Amazon reported that the demand for hair colouring and bath-and-body products had increased significantly.

A 2020 survey showed that 26% had stopped wearing makeup entirely. 21% only wore make-up for their video calls. Less than half of respondents said that they were wearing lipstick during COVID-19, a much lower number than in the past.

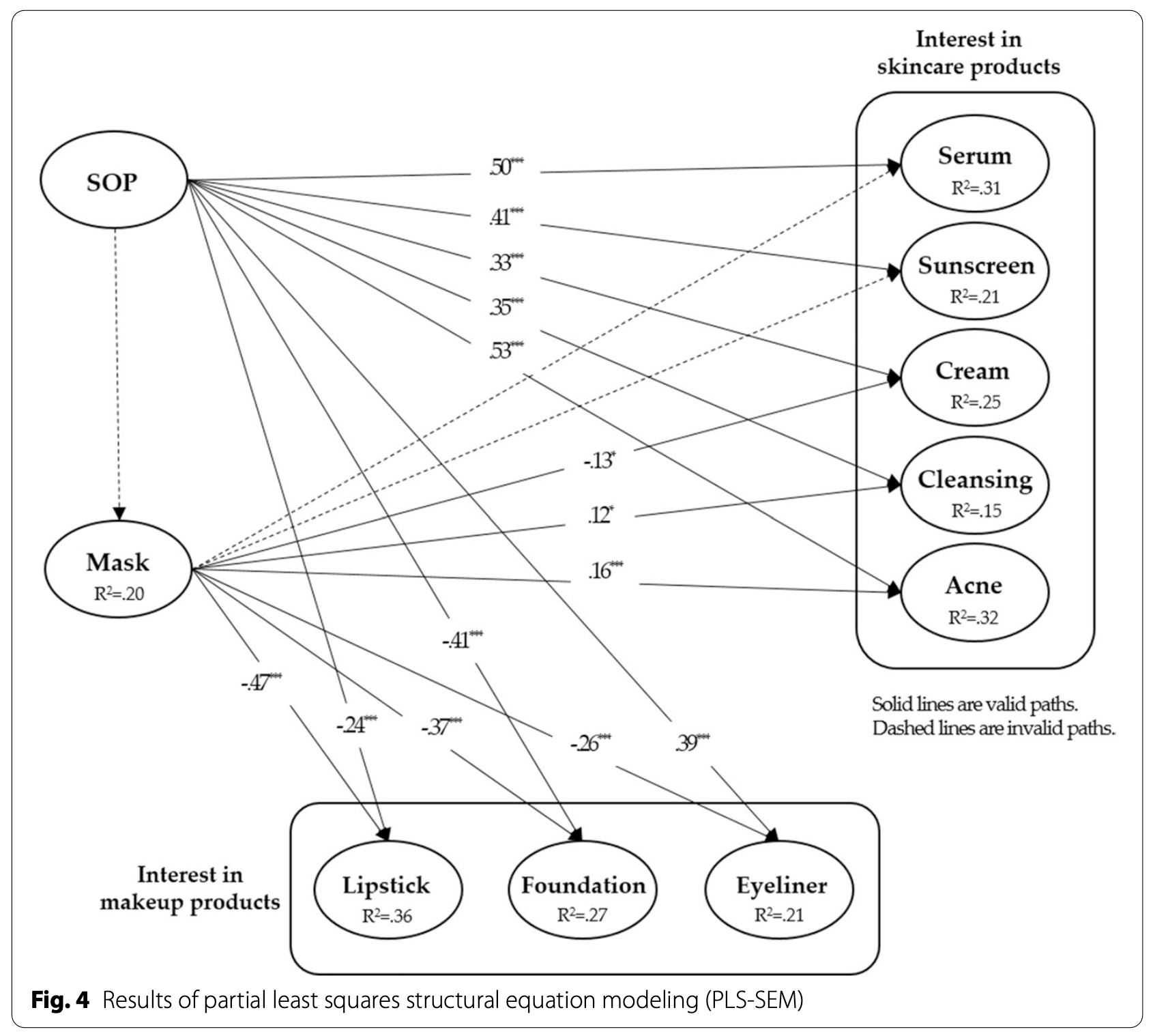

A study by Choi, Kim & Lee (2022) found that the more consumers wore face masks, the greater their interest in skincare products such as moisturisers, cleansers and acne products. And the lower their interest in make-up products such as lipstick and foundation cream.

A 2021 Kantar survey showed that lip product usage (lipstick and lipgloss) had dropped significantly between 2019 and 2021 - much more than for eye-related makeup.

This mix shift is of special interest to me, given that we’re now seeing face mask requirements being eased across Asia. I believe that this easing will have a significant impact on the cosmetics market.

2. Face mask requirements are easing

Earlier this week, South Korea dropped its face mask mandate for indoor public places such as shopping malls, schools and the airport. The mask mandate had been in place since 2020.

Don’t expect mask usage to change overnight. Koreans are still required to wear face masks in public transport settings and in hospitals. And the government continues to recommend indoor masking.

Meanwhile, in Japan, the face mask requirement could be dropped by March 2023. Several government officials have suggested that a broader abolition of face masks for indoor public places could follow.

It remains to be seen whether Japanese will cling on to their face masks, though. They’re already allowed to wear face masks outside, but many avoid doing so due to social pressure.

In Hong Kong, the government has now signalled that it is planning to lift its face mask mandate by March or April 2023. Today, people in Hong Kong are still required to wear face masks both indoors and outdoors.

China’s face mask requirements were introduced quickly after the initial outbreak in Wuhan in 2020. They were then eased and reintroduced after the Delta wave started in August 2021. For what it’s worth, that’s exactly when the Chinese cosmetics market started deteriorating.

Since November 2022, many of China’s COVID-19 restrictions have actually eased, but the indoor face mask requirement remains. And now that the spread of COVID-19 in China has now started to decelerate, I think that we might be nearing the end of the most intense phase of the pandemic.

In most Southeast Asian countries, such as the Philippines and Malaysia, wearing face masks indoors has been optional since late 2022. There are a few exceptions, but policy is certainly moving in the right direction.

So overall, face mask requirements are certainly being eased. And in the countries that have taken away their mask mandates, people are slowly becoming accustomed to a life without masks.

3. Evidence of a COVID mix shift

3.1. Earnings calls

We can tell from earnings calls that 2022 was an exceptionally tough year for the Chinese cosmetics market. And especially for colour cosmetics:

“Cosmetics was affected by the lockdown in Shanghai and is down year-on-year” - Kao Corporation, 2Q2022 earnings call

“With regards to the China market, tough environment persists in the market as with the first half of the year. There are still uncertainties for the recovery of the overall cosmetics market because of lockdowns in multiple cities...” - Shiseido, 3Q2022 earnings call

“The performance of L'Oréal Luxe was temporarily impacted by a number of factors in the third quarter (repeated lockdowns in China and Hainan…)” - L’Oréal, 3Q2022 earnings presentation

“Net revenues from skincare brands increased by 33% year-over-year… our colour cosmetics brands, on the other hand, saw 49% decline year-over-year, reflecting continued softness in the demand for colour cosmetics.” - Yatsen, 3Q2022 earnings call

In other regions, such as the United States and India, a recovery for the demand for colour cosmetics took place from 2021 onwards:

“Cosmetics has been doing well ever since the pandemic restrictions lifted basically and people started to socialize and return to the office or go out.” - Canadian food retailer Metro Inc, 2Q2022 earnings call

“Colour cosmetics had a very strong growth on a soft base and is marginally below pre-COVID levels… we are very optimistic about our colour cosmetics business, and it has bounced back very strongly.” - Hindustan Unilever, 1QFY2023 earnings call

“From a trend standpoint, foundation concealers, eyeliners and lipstick continue to deliver strong comp growth” - Ulta Beauty, 1QFY2023 earnings call

“On top of the strong categories that were booming during the lockdowns and post pandemic… anything to do with eye products like mascara,… eyeshadows, etc., we are [now] seeing the rest of the categories back to growth including lip color” - Coty, 4Q2022 earnings call

Could we see a similar recovery in China and other markets in East Asia? Shiseido and Estée Lauder seem optimistic:

“In China, -- we are assuming recovery and steady growth of the cosmetic market, if not the high growth recorded in the past. By overcoming key challenges, both in Japan and China, we aim for V-shaped recovery in 2023.” - Shiseido 2Q2022 earnings call

“In August, our outlook anticipated that first quarter sales would be negatively impacted by continued COVID restrictions in China and Hainan, with gradual improvement throughout the first half of the fiscal year as the restrictions lifted.” - Estée Lauder, 3Q2022 earnings call

3.2. Search query analytics

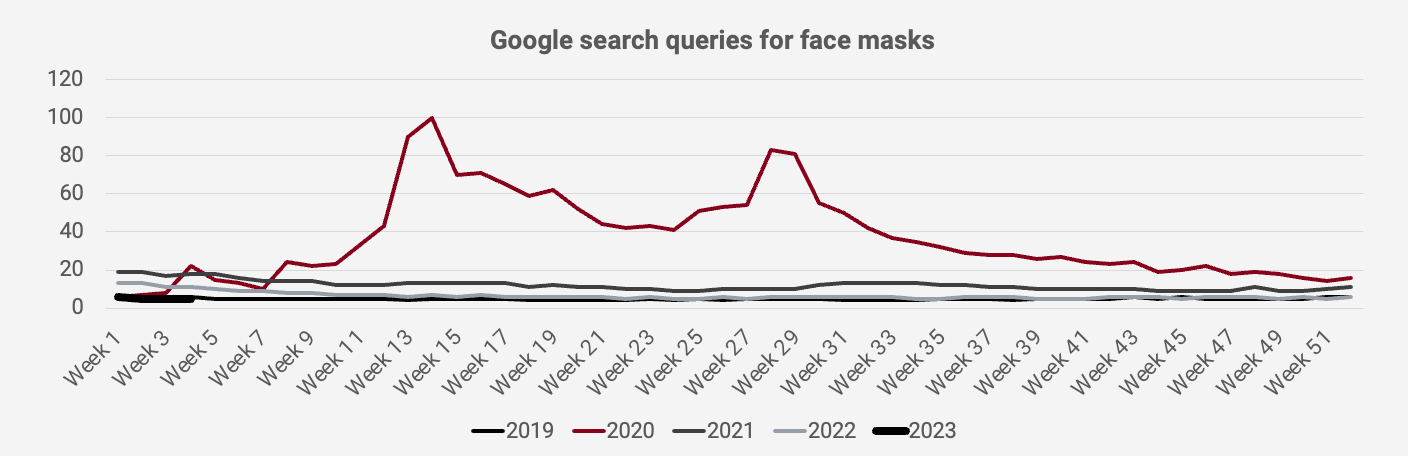

Globally, the number of Google search queries for “face masks” are now back to the 2019 level after a significant spike in 2020. So it looks like the English-speaking part of the world has moved on from mask-wearing at this point. Asian consumers are simply the last holdouts.

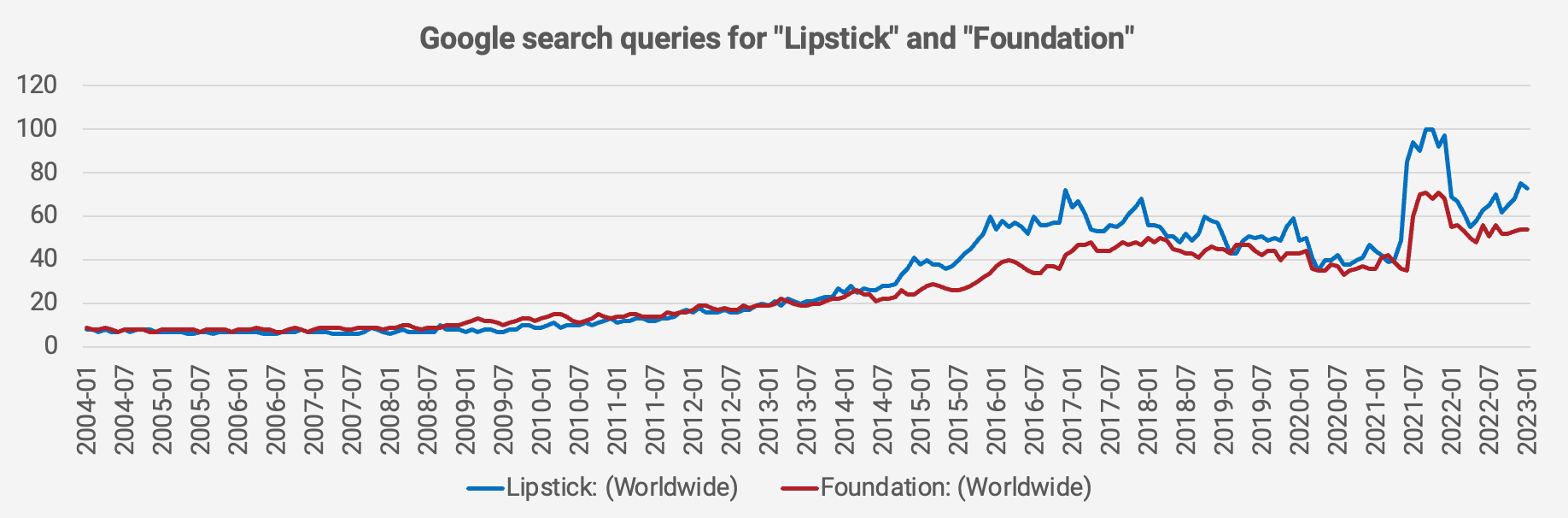

Meanwhile, since late 2021, the number of English language Google search queries for make-up products such as lipstick and foundation has gone ballistic:

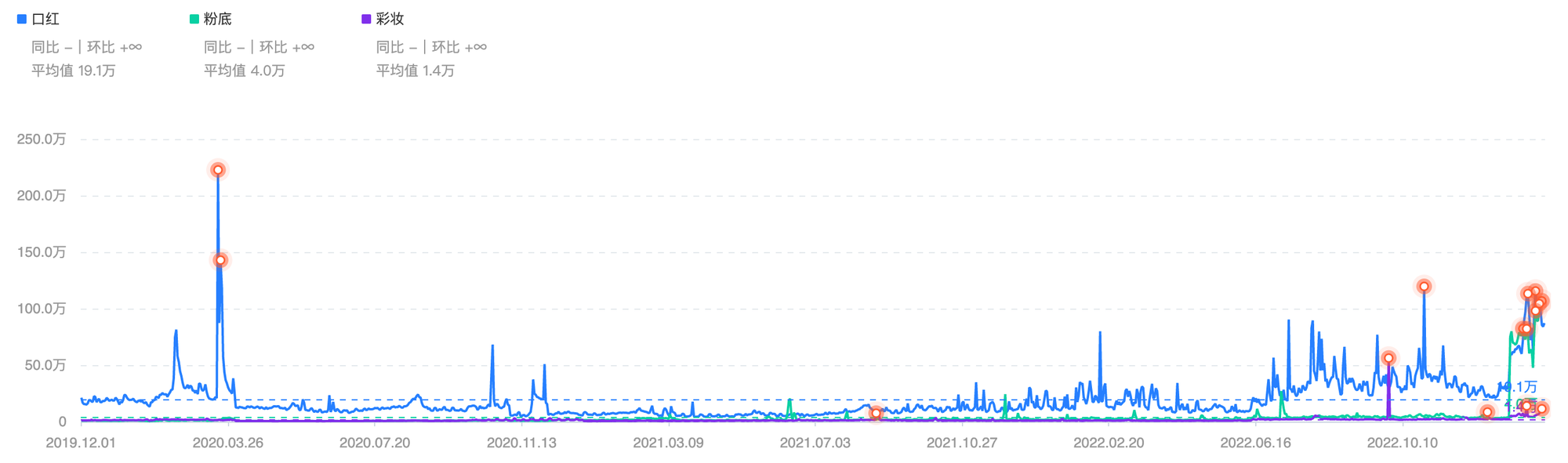

On Chinese news aggregator Toutiao, I’ve now started to observe an uptick in search queries for lipstick (口红), foundation cream (粉底) and colour cosmetics (彩妆). From what I can tell, this last spike that we’ve seen from January 2023 is driven by real end-user demand. This bodes well for the future.

4. Investable universe of stocks

The next section will be exclusively available to paid subscribers to Asian Century Stocks. Thanks for understanding.