Table of Contents

Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may from time to time have positions in the securities covered in the articles on this website. This is disclosure and not a recommendation to buy or sell.

Casinos can be highly profitable businesses. After they reach maturity, many of them enjoy operating margins above 30% and return on equity above 20%.

But at the same time, there are many risks to take into account. Greenfield development is always unpredictable. And once a resort is up and running it will face concession renewal risks, competition from other new developments and regulatory risk. Minority shareholder abuse is also common in the sector. All these factors make casino investing a little bit more difficult than what first meets the eye.

What follows is an introduction to the Asian casino industry. I will go through the regulatory frameworks in each country, the key trends that I see in the sector and where I see opportunity.

A casino industry primer

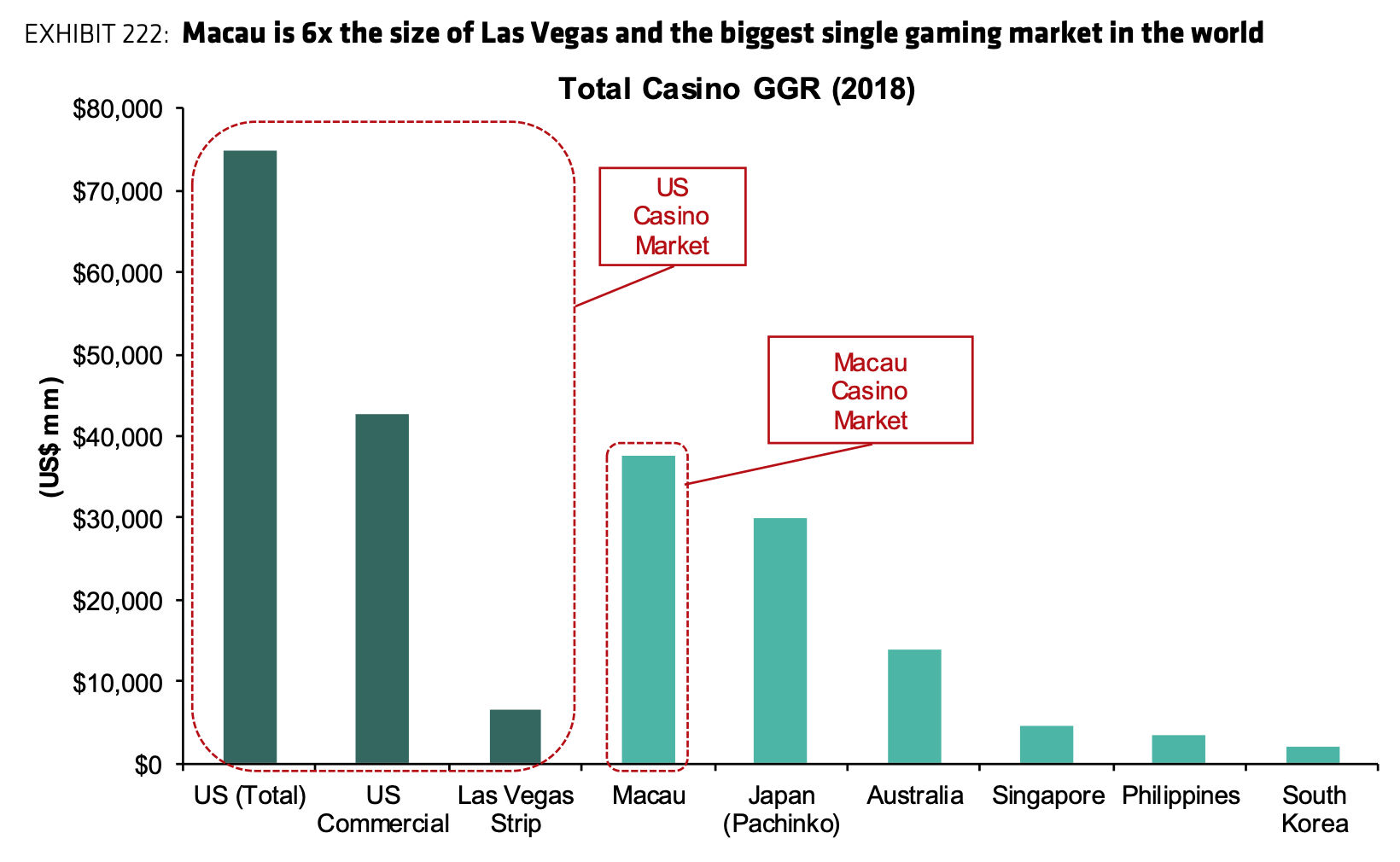

Today, the global casino market generates around US$200 billion in gross gaming revenues (GGR). Within Asia, Macau in China stands out with a US$38 billion GGR. Japan’s Pachinko market comes at a close second with US$30 billion in GGR. Singapore, Korea and the Philippines are much smaller than either Macau or Japan.

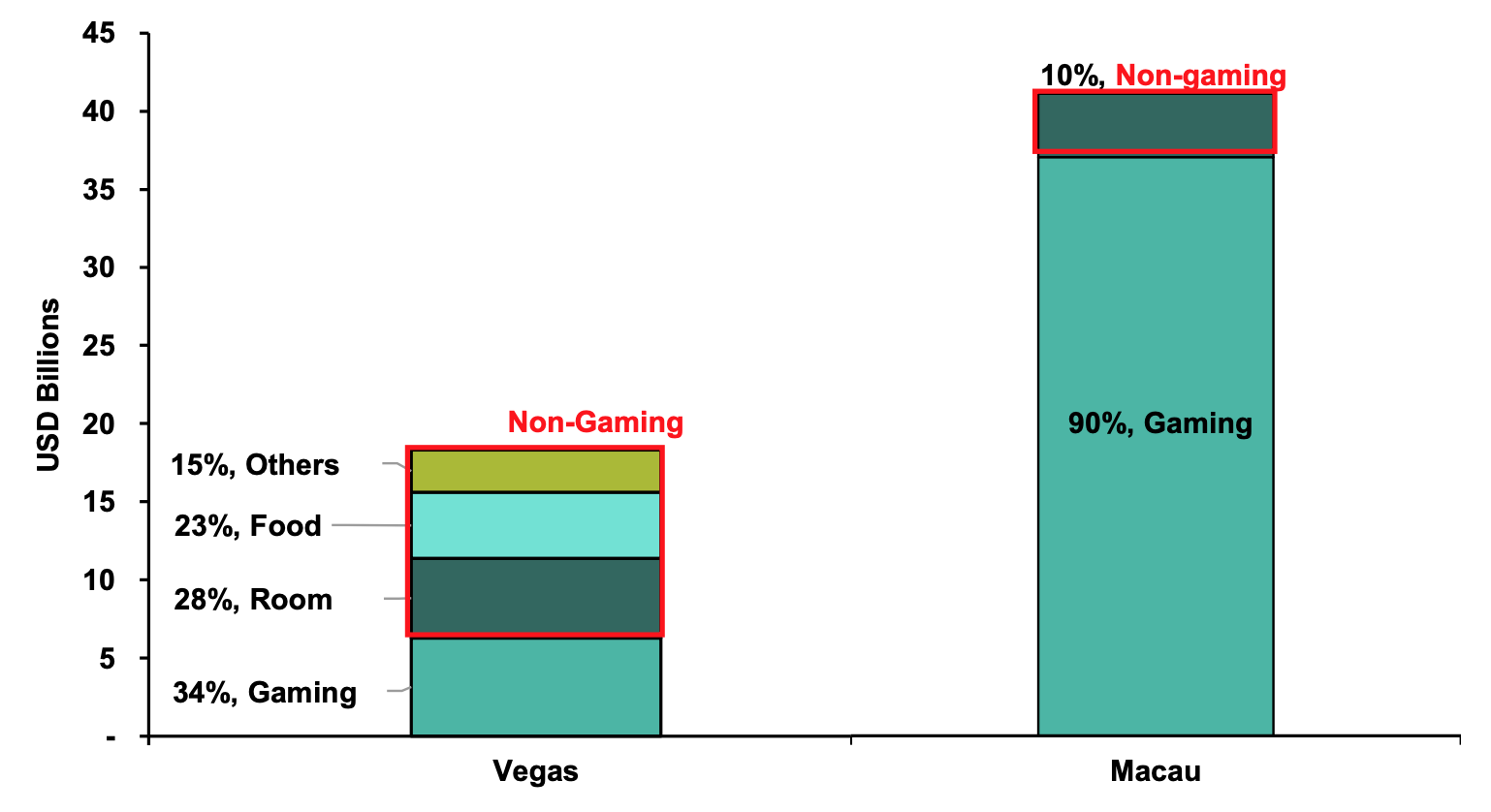

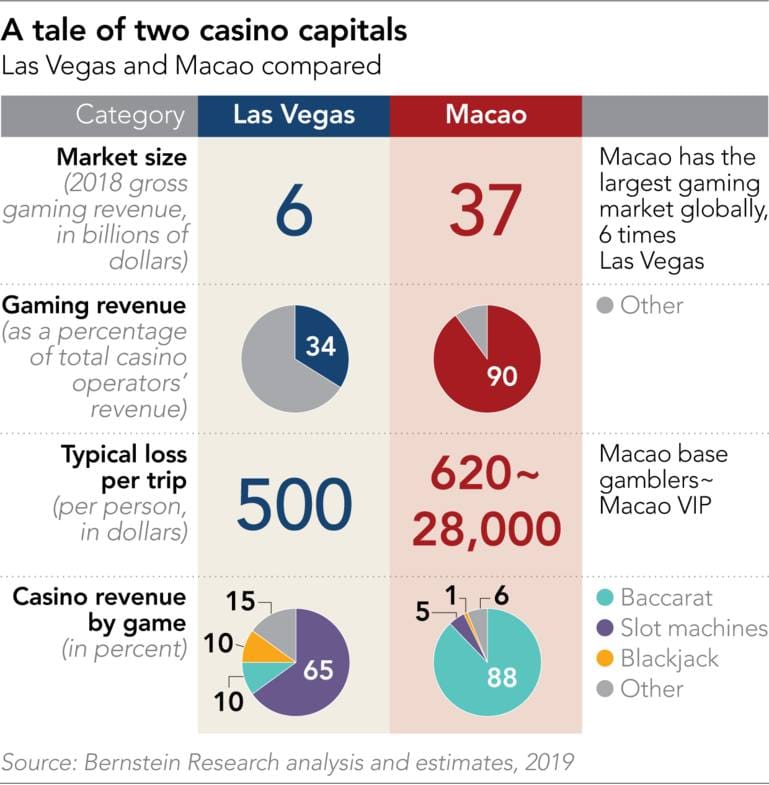

In Asia, casinos typically generate the vast majority of their revenues from gaming. Ancillary revenues such as hotel rooms and food & beverage are small in comparison. That’s true across both Macau and Southeast Asian casinos.

In contrast, Las Vegas only gets 34% of its revenues from gaming and the majority from hotel rooms, food & beverages, etc.

Casinos set up slot machines and tables on large floors. Before entering, customers purchase chips from the casino which they then use on the floors to gamble. They can also borrow money from loan sharks (“junket operators”) to purchase these chips.

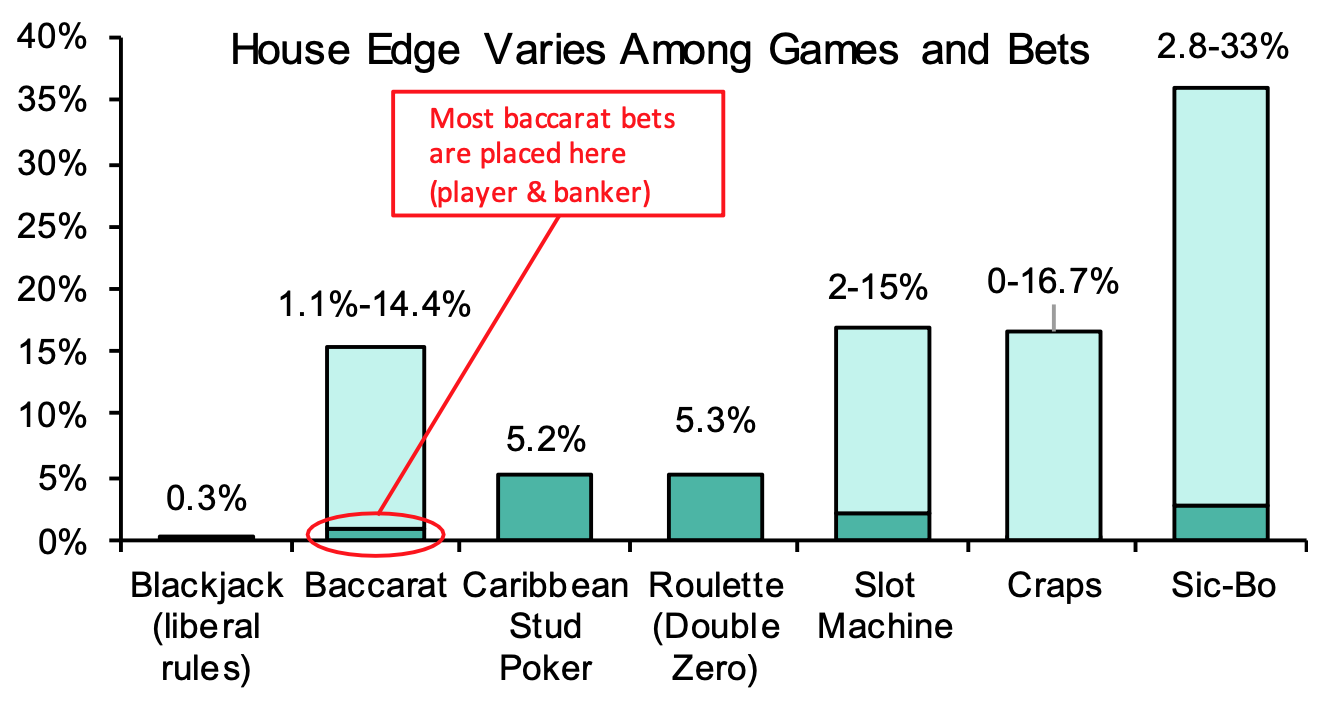

The house edge (how much the casino is likely to make on every dollar, on average) is lowest for Blackjack, followed by Baccarat. Slot machines vary in the degree of house edge. As an example, the house may win 46% of the time and the player 45% of the time (with a tie during the remaining 9% of the time). But the pay-out to the player may only be 0.95x of his or her chips, tilting the equation further towards the house. Of every $100 played, roughly $1.5 will then go to the house, on average.

So on a long enough timeline, the player will almost certainly lose against the house (the casino).

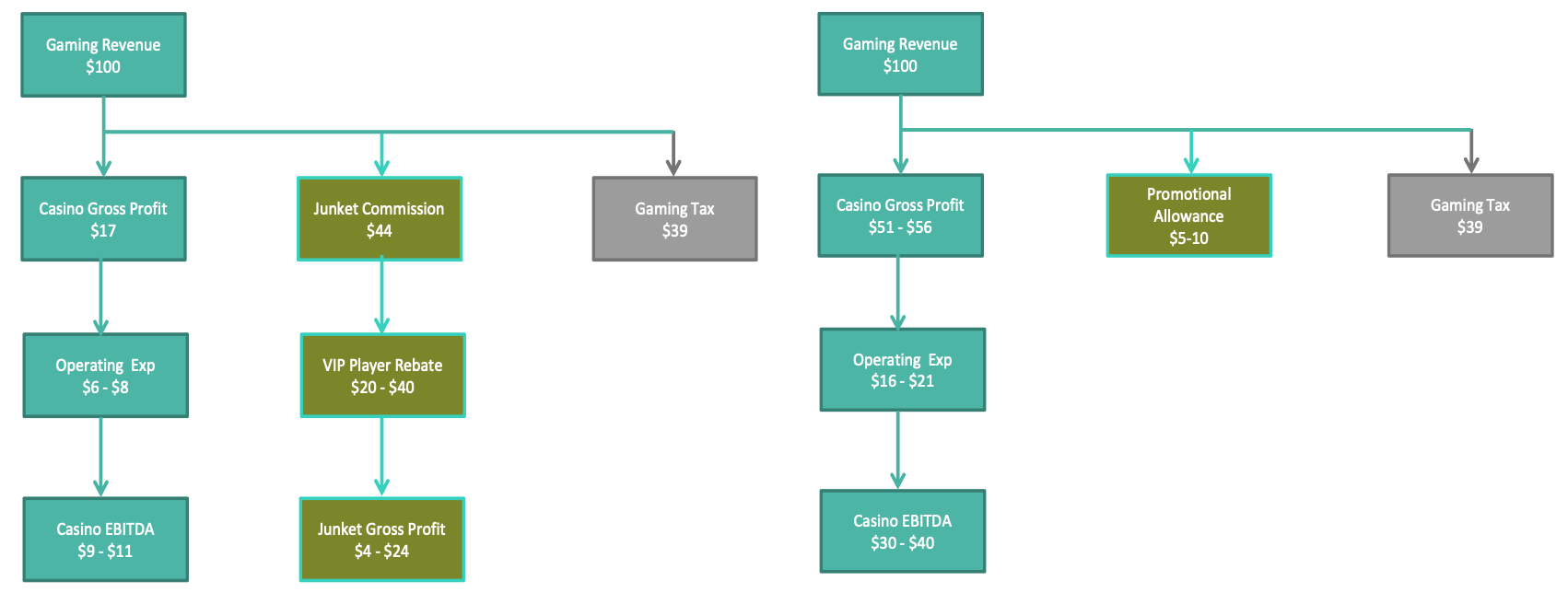

Casino profitability depends on the type of customer they are serving:

- For mass-market customers, the equation is simple: take in payment for the net number of chips sold (and lost), pay out the gaming tax, promotional allowances, operational expenses and you end up with EBITDA.

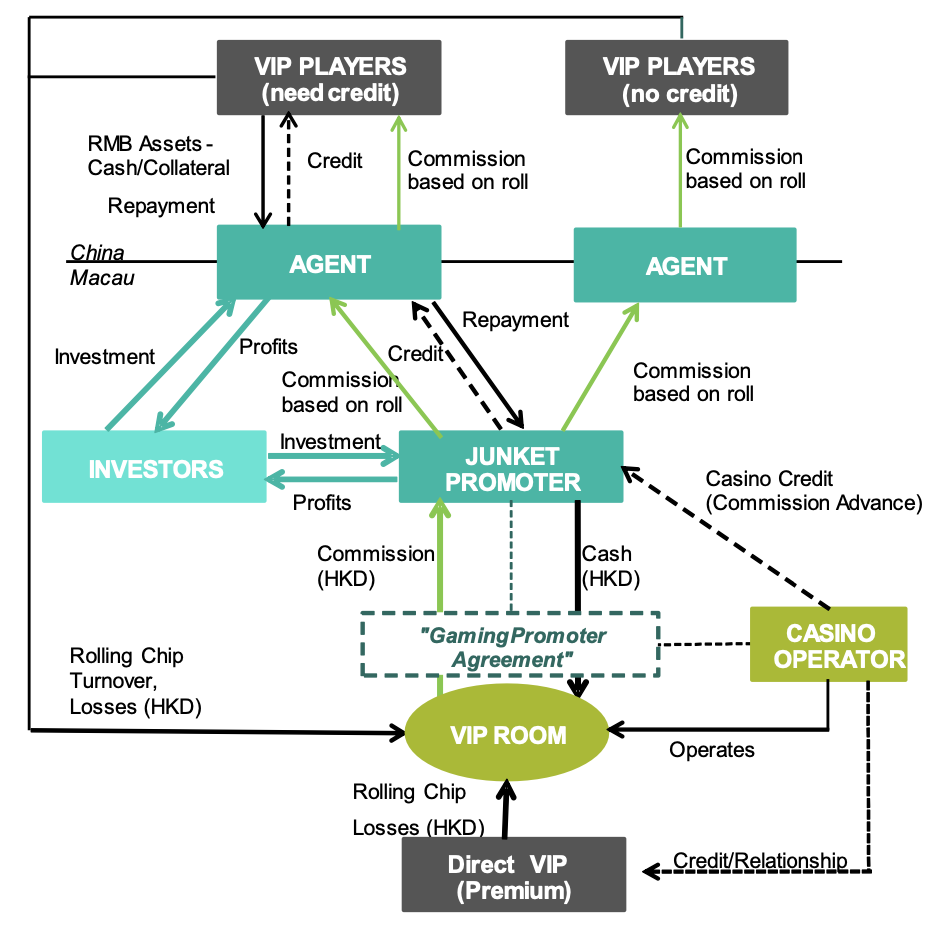

- For VIP customers, commission to junket operators also needs to be paid. And their cut can be substantial (>40%). Part of those economics is then paid out as rebates to the players that they help bring into the casino.

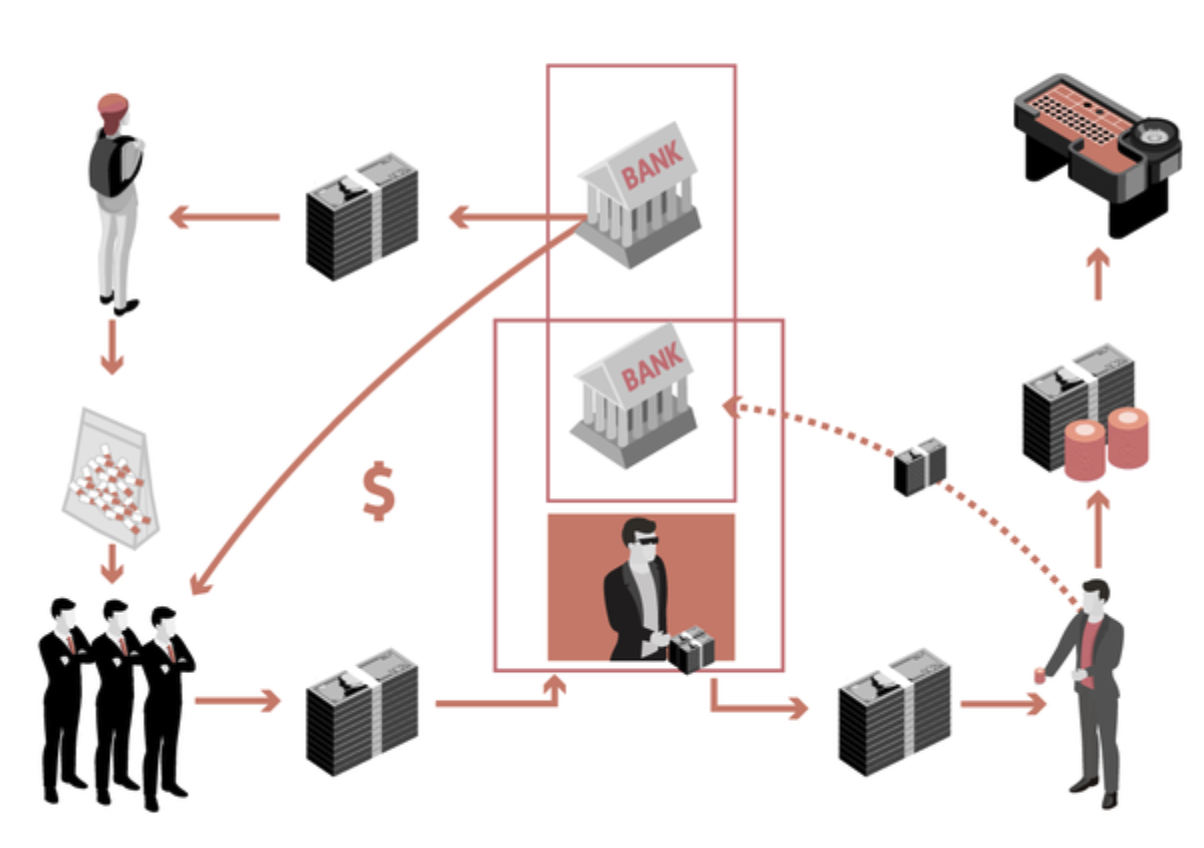

Why do junket operators exist? The business model came into existence during Macau’s casino monopoly days. Junket operator help bring VIP customers into the casino.

One reason is that junket operators help promote casinos in mainland China, where doing so is illegal. Another reason is that Asian junket operators help convert cash - whether from legitimate sources or not - from RMB into foreign currency.

From a broad perspective, there are several ways in which individuals are able to get cash out of China:

- In the past, Chinese individuals used their UnionPay credit cards in Macau to pay for casino customer deposits. But since 2015, the government has cracked down on this practice.

- Another way that individuals have been able to get money across the borders is to carry it in a suitcase and then convert them to foreign currency in Hong Kong or Macau. The obvious risk is that they might get caught by the border police. A variation of this theme is to buy jewellery, say Rolex watches or diamonds, and then wear them when crossing the border.

- A third alternative is to issue fake invoices or overpay for imports / letting customers underpay for exports and settling with them privately. This practice is almost impossible for the Chinese government to weed out entirely.

Junket operators can help individuals convert RMB into foreign currency. They lend individuals chips in the casino. And once their customers are back in the mainland, they pay back the loan through underground banks that have ties to the junket operators. So it’s clearly a very murky business.

Casinos can also help launder money from criminal activities or from individuals who evade taxes. Deposit the cash you have received from an illegitimate enterprise, gamble with it and then take out your winnings through a bank transfer and voilà - no one will be able to trace your money further back than to the casino.

In other words, the value proposition of VIP gambling is not just amusement but also money laundering. In that sense, casinos actually compete with other ways to launder money, including buying luxury goods, real estate or even cryptocurrencies.

Money laundering could explain the popularity of the game baccarat in Macau. As explained in a Quora post:

“I would think a logical launderer would either play simple, low house edge games like Baccarat. It’s possible they might choose craps, as you can get more money on the table with odds and that brings the house edge even lower. You might be able to play $500 pass line and $1500–5000 odds since 3–4–5x odds is common and some places do 10x odds. But, you have to fill out forms if you cash out or buy in for $10k+ in a day. Of course, you can save chips for the next day or have friends cash in chips.”

Other than provide loans to VIP customers, junket operators also acquire them as customers, organise transport and “entertainment” as well as set them up in special VIP hotel rooms. While promotion of casinos is prohibited on the mainland, they do promote casinos in less overt ways, including via person-to-person networks and referrals. Macau casinos offer them about 1.25% of rolling chip sales as a reward for bringing in VIP customers. Within Macau, they also offer “off-table betting” - matching bets on a casino table - though this is obviously illegal and discouraged by casino operators and Macau tax authorities as they lose revenue that they could otherwise take a cut from.

I will now go into the major casino markets throughout Asia: Macau being the most important, but also Japan, South Korea as well as Southeast Asian markets such as Singapore, Malaysia, Cambodia and the Philippines.

Macau

The Portuguese set foot in Macau in 1557 but it wasn’t until 1887 that China signed an official treaty confirming Macau’s status as a Portuguese colony. Gambling was initially illegal but prevalent across the colony. No restrictions were placed on gambling. A licensing system for gambling houses was finally introduced in the 1850s.

The triads controlling the Macau gambling houses. The city had a reputation for being lawless: brothels, drugs and gambling at almost every street corner. Kidnappings and murders were common occurrences

At the same time, Macau has always been a beautiful city. It’s now classified as a UNESCO World Heritage City and its unique history continues to capture the imagination of visitors.

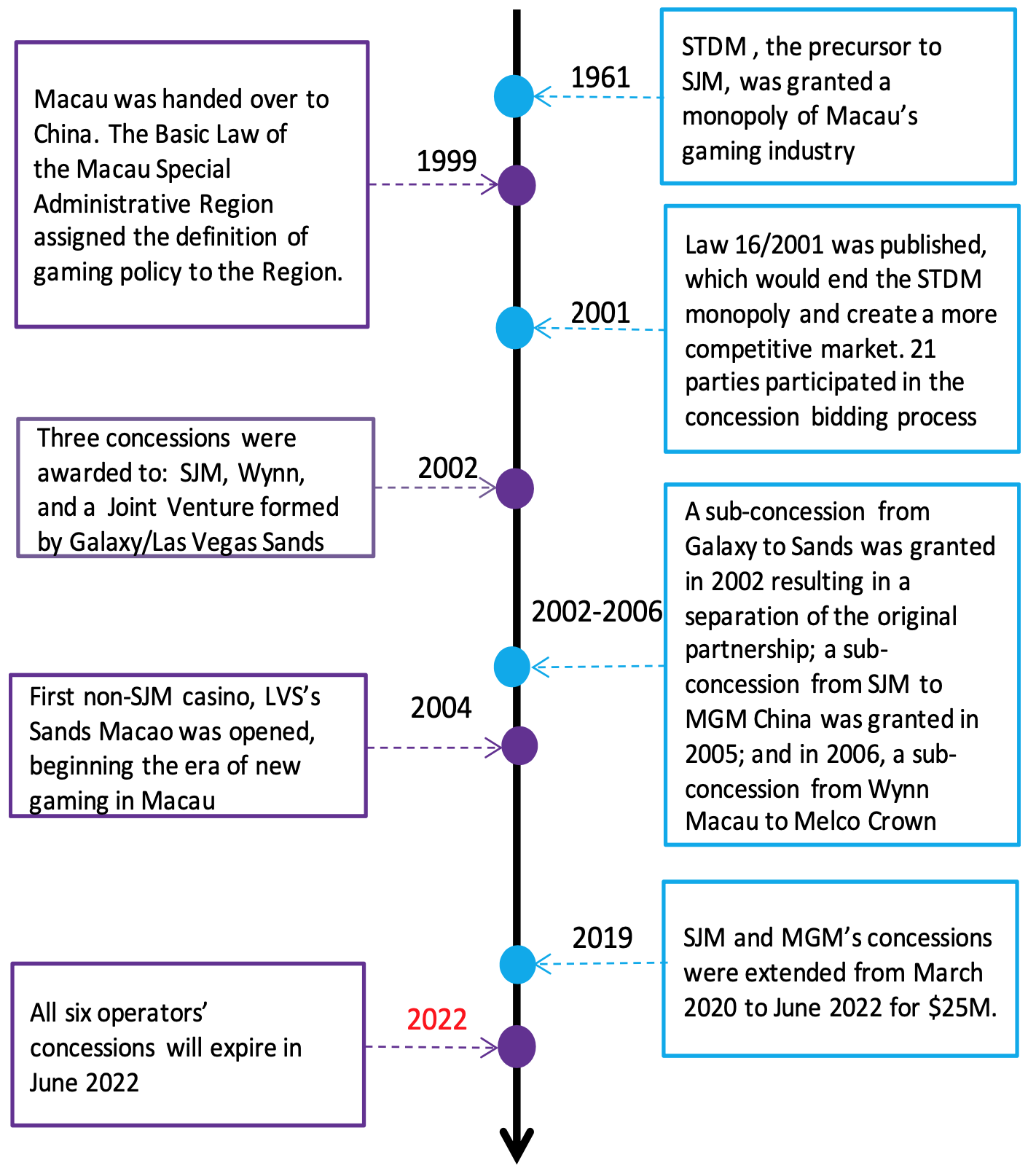

Macau’s legal casino market began with a monopoly granted to the Tai Xing Company in 1934 - then owned by local citizen Fu Tak Iam. Following Fu’s death in the 1960s, a young man called Stanley Ho teamed up with a consortium of influential stakeholders to lobby Portuguese authorities for the coveted monopoly casino license. The monopoly was granted to Stanley Ho’s company Sociedade de Turismo e Diversoes de Macau (STDM) in 1962. Stanley’s and STDM’s control of the gaming industry was considerable since it also controlled the Macau Jockey Club and greyhound races, a sports lottery called SLOT and the Pacapio Lottery. Via subsidiary Shun Tak, it also controlled 90%+ of high-speed jetfoils between Macau, Hong Kong and mainland cities, which accounted for the majority of traffic to Macau casinos. It was an incredible business and helped Stanley Ho create a large fortune for himself.

STDM’s monopoly ended in 2002. STDM retained its casino license and was renamed SJM (Sociedade de Jogos de Macau). But now SJM also had to grapple with two new competitors: Wynn Resorts and Galaxy Casino. These concessions allowed the two new operators to open as many casinos and gaming tables as market conditions allowed.

Today, Macau has three concessionaires: SJM, Wynn Macau and Galaxy. But since the state monopoly ended, three additional sub-concessions have also been provided to the following companies: MGM China, Melco and Sands China.

The first casino after the state monopoly was lifted was Sands Macau. It cost only US$265 million and the payback period was less than <1 year. But the number of casinos today in Macau has grown significantly and today, competition is fierce.

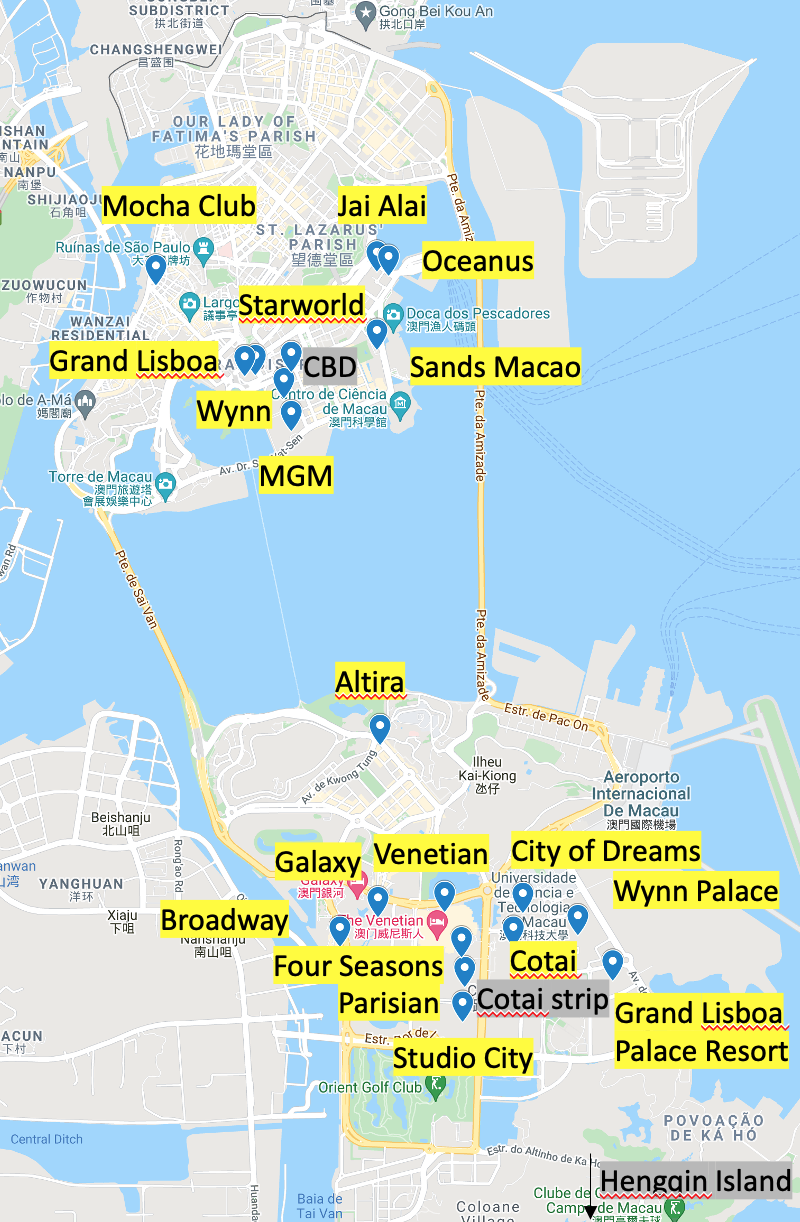

Here is a map of where the major casinos are situated.

- SJM: Grand Lisboa, Casino Lisboa, Jai Alai, Oceanus, Grand Lisboa Palace

- Wynn Macau: Wynn Macau, Wynn Palace

- Galaxy: Galaxy Macau, StarWorld, Broadway,

- MGM: MGM Grand Macau

- Melco: City of Dreams, Studio City, Mocha Clubs, Altira Macau

- Sands China: Sands Macao, Venetian, Parisian, Four Seasons, Cotai Central

Two clusters of casinos exist in Macau: around the central business district (“CBD”) in old town Macau and around the “Cotai strip”: on a piece of reclaimed land between the islands Coloane and Taipa in Southern Macau. 60% of gaming revenues are today on the Cotai Strip, making it the largest casino destination in the world.

South of Macau is Hengqin Island, a part of the mainland city of Zhuhai. New developments on Hengqin Island are meant to relieve Macau of its land constraints. Since gambling is illegal on the mainland, it is likely that accommodation would move to Hengqin Island whereas casino activity will still remain within Macau.

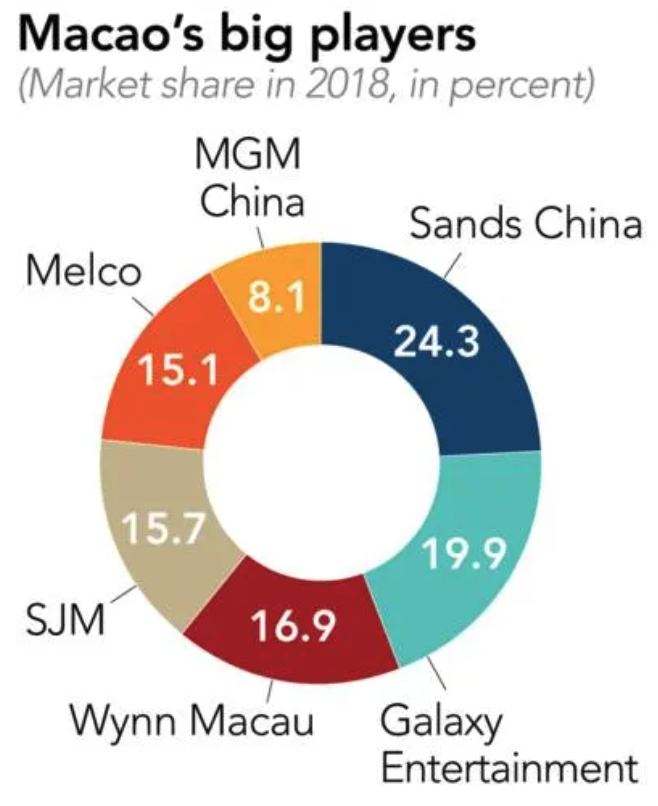

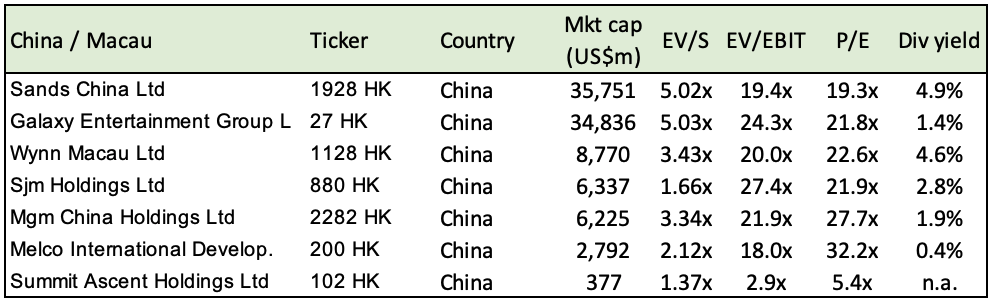

The largest casino operator is Sands China, followed by Galaxy Entertainment, Wynn Macau, SJM, Melco and MGM China.

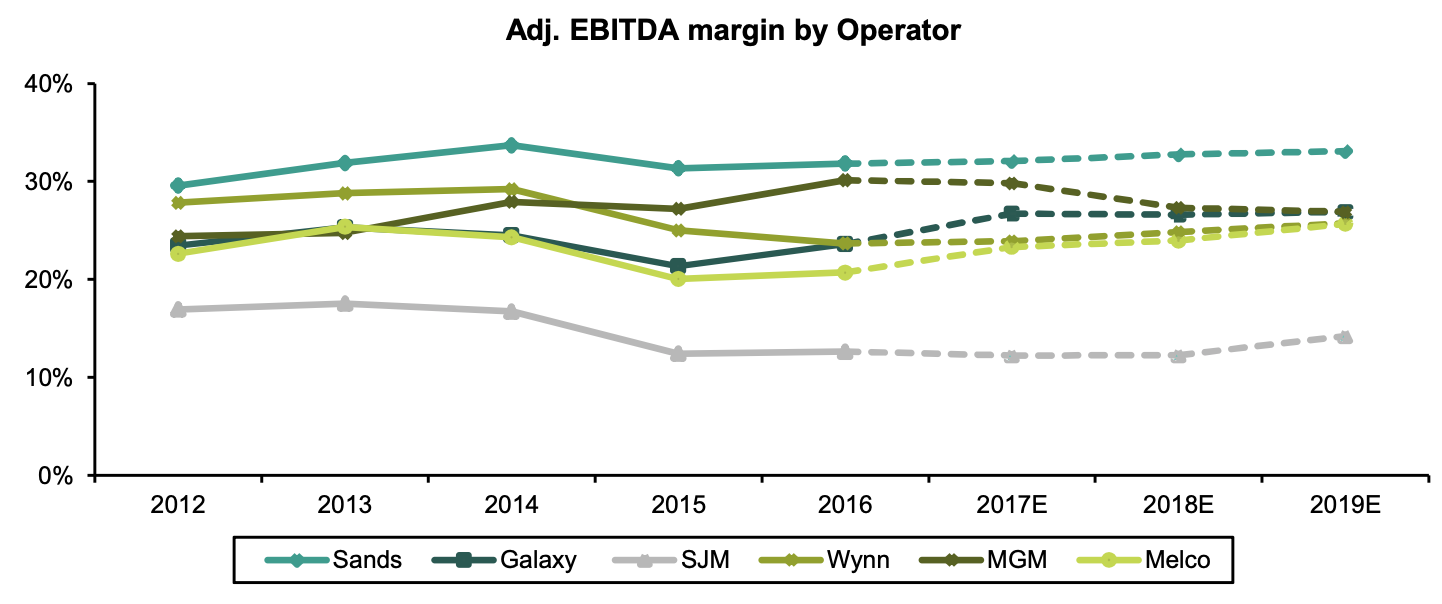

Sands has also had the highest EBITDA margin whereas former monopolist SJM is clearly underperforming. It appears that Cotai strip properties are more profitable, especially those owned by Las Vegas Sands.

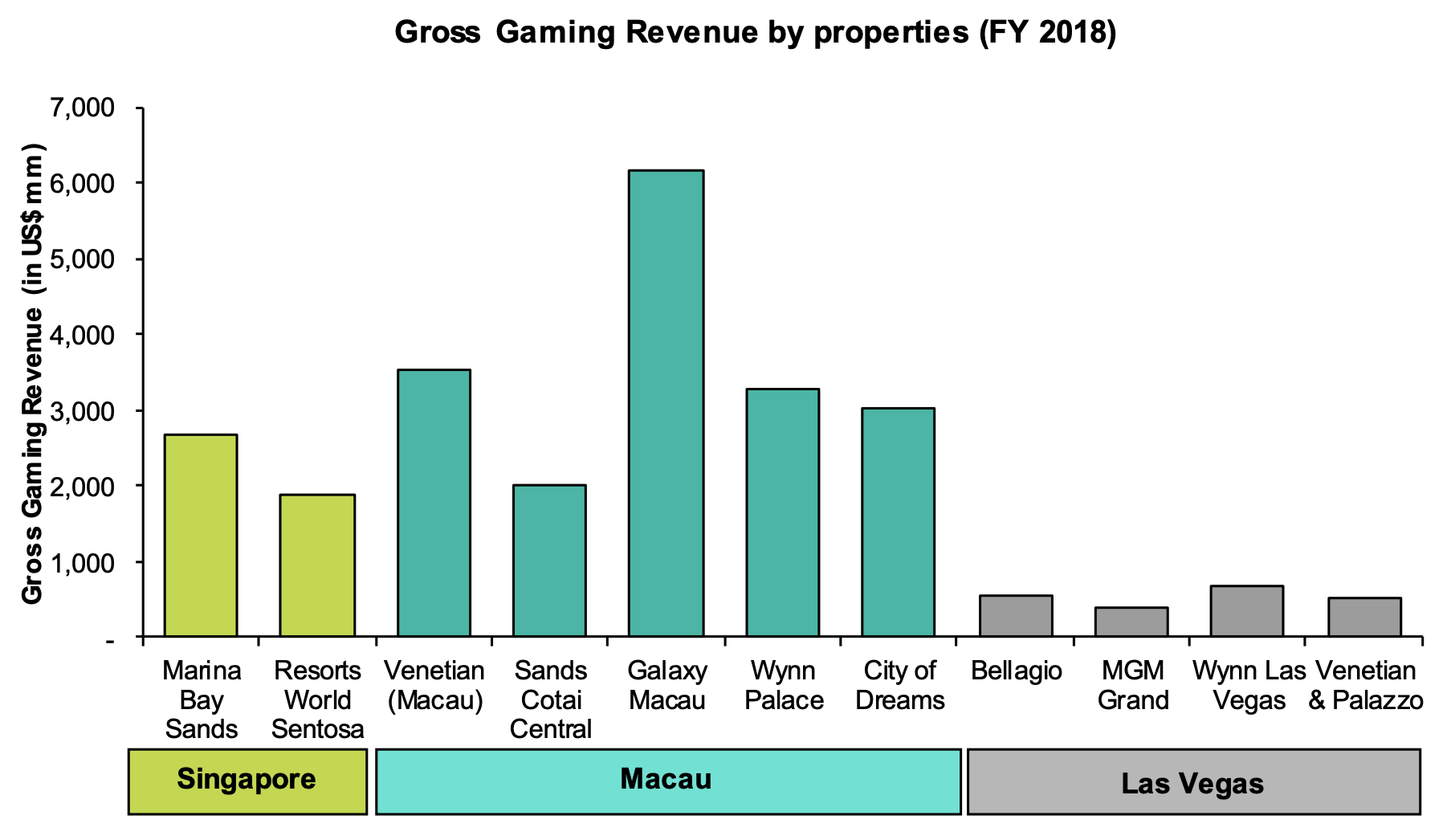

By property, Galaxy Macau is by far the largest, followed by Venetian, Wynn and Melco’s City of Dreams. They are far bigger than their Las Vegas counterparts. The two companies with the highest GGR are Sands and Galaxy.

The five major casino properties in Macau are as follows: Grand Lisboa, Venetian, Galaxy, Wynn Palace and City of Dreams.

Macau’s concessionaires pay 35% of gross gaming revenues in tax to the government, plus an additional 2% to a public foundation and an additional 3% to support urban development and construction. So Macau casinos are operating under a very onerous tax regime.

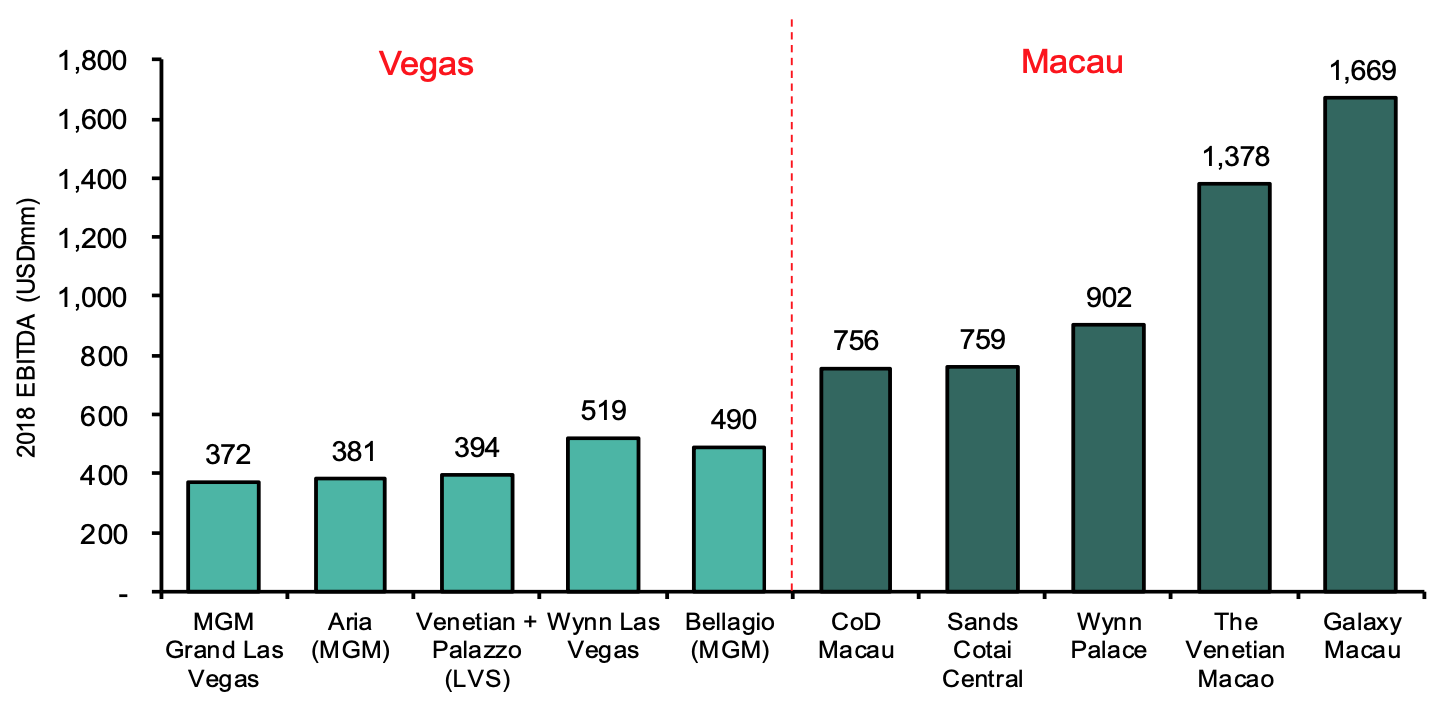

But despite the high tax rate and weak ancillary revenues, Macau casinos are still immensely profitable. EBITDA of respective Macau casinos is far higher than their Las Vegas counterparts:

Here is a quick comparison between Macau and Las Vegas that shows you the scale of Macau in a relative context. Macau GGR is far greater and the typical loss per person is multiples higher than that of Las Vegas. And as mentioned above, while Las Vegas gaming revenue is only ~35% of the total, that number is closer to 90% in Macau.

As you can tell from the above charts, the most popular game in Macau is the table game Baccarat. In Las Vegas, visitors typically stick to slot machines. Some attribute this disparity to the Chinese culture, which has a greater focus on social interaction. Another reason is that Baccarat offers a low house edge and is, therefore, better suited for money laundering or funnelling money out of China.

One peculiarity about Macau is that the average stay is only 1.2 days, meaning that the average visitors will only be able to visit one casino - and at most, two. Cotai strip casinos are not connected to each other, making it even more difficult to visit several casinos in one day. So brand names matter and will matter even more as mass-market customers start to dominate the revenue mix.

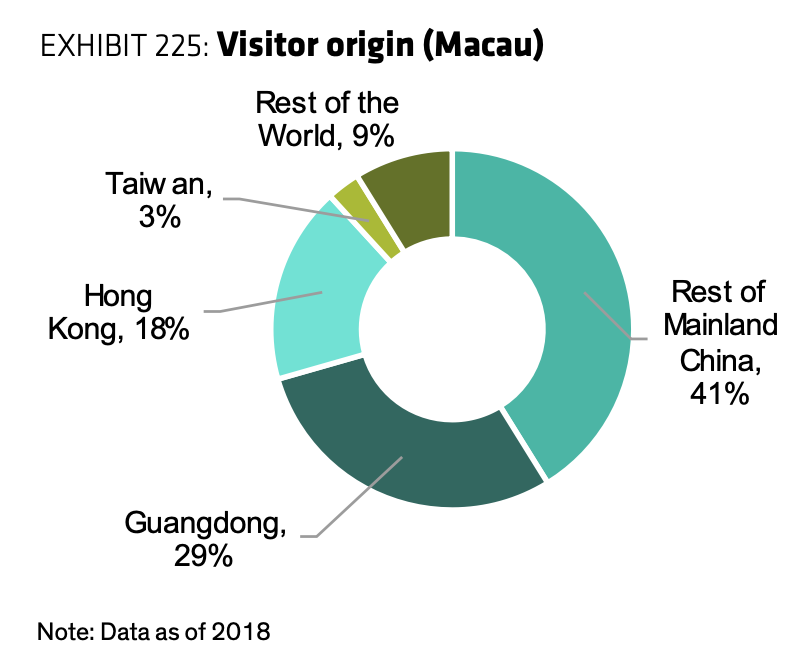

Mainland visitors represent 70% of total visitors to Macau casinos, and Hong Kong close to 20%.

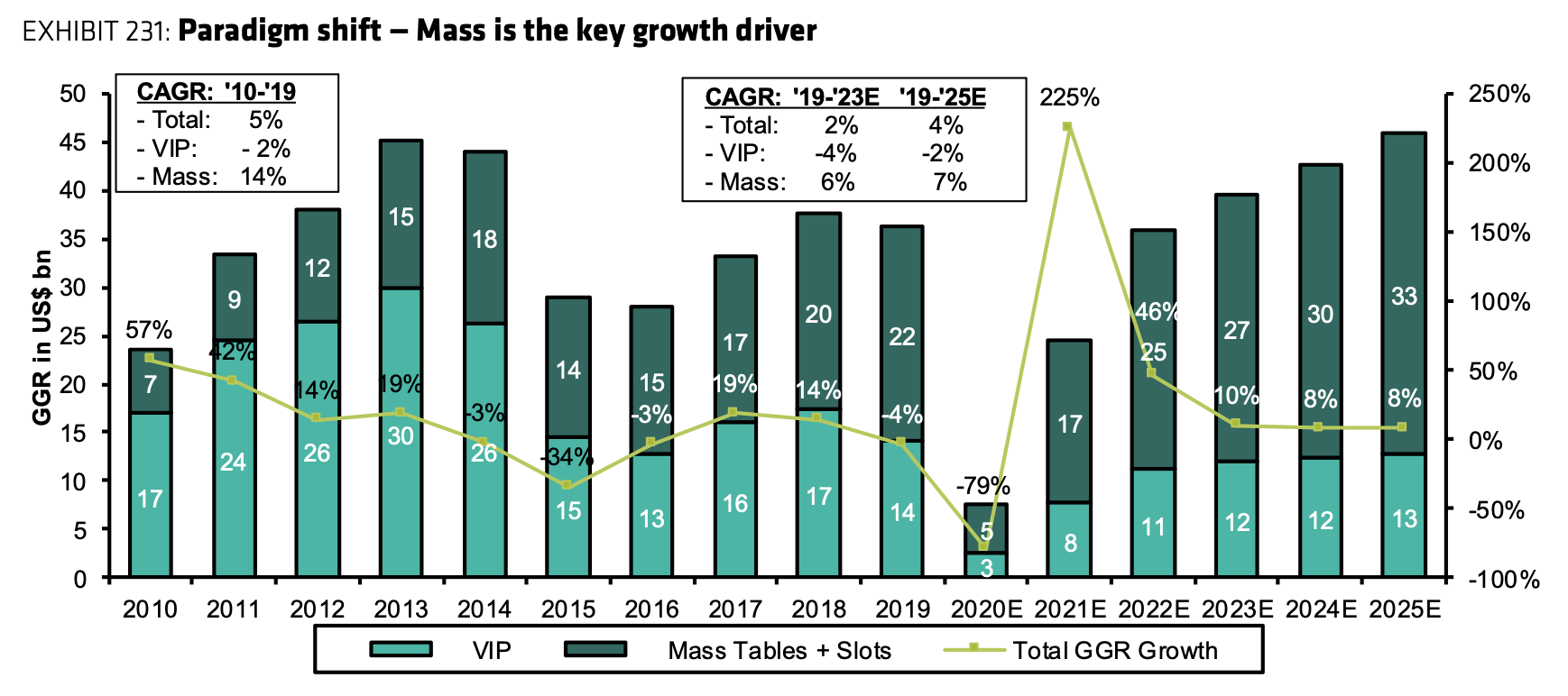

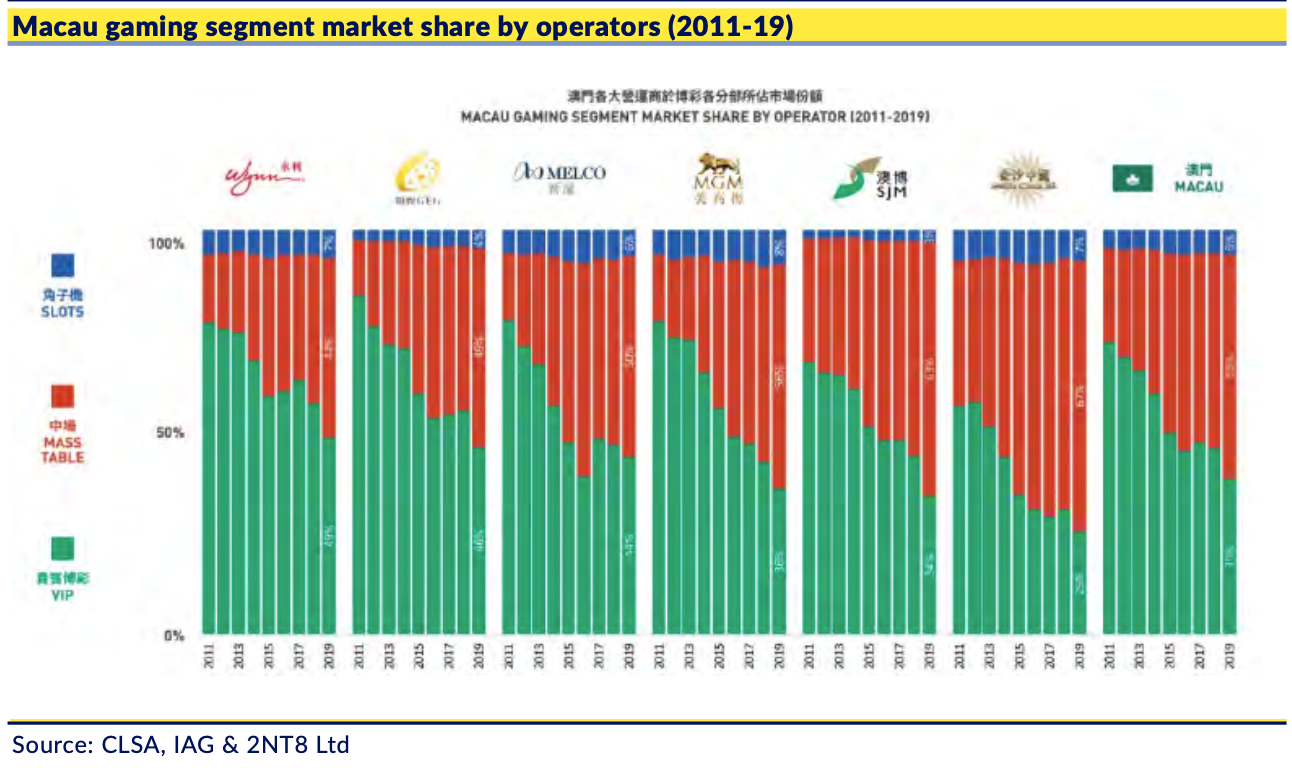

China’s anti-corruption drive in 2014-2016 led to a big downturn in Macau casinos. Since then, the business has shifted from VIP to mass-market customers. And given that VIP margins are lower than for mass market, VIP now accounts for a very small portion of overall Macau casino profitability.

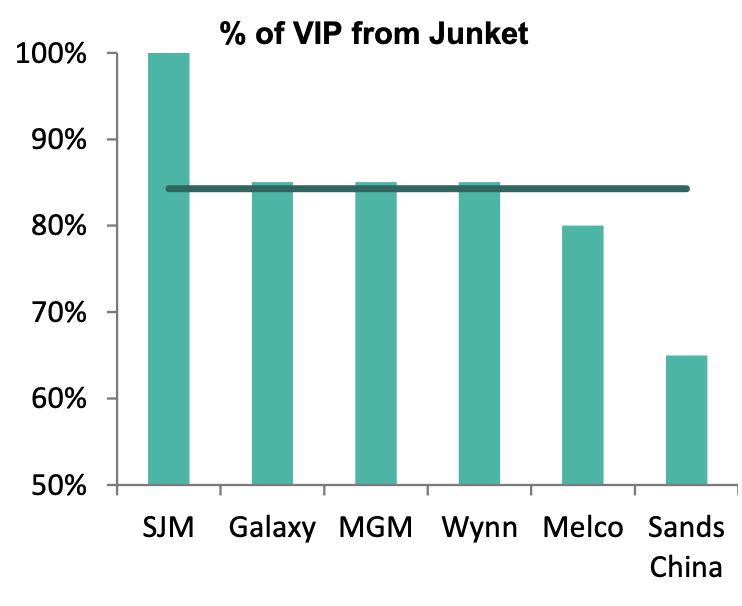

In terms of exposure to junket business, SJM ranks at the top whereas Sands China appears to be cleaner. But there is no doubt that junkets remain important to the major Macau casinos, and especially for SJM.

Overall, VIP revenue has been falling across all Macau casino operators since Xi Jinping’s anti-corruption campaign began in 2013.

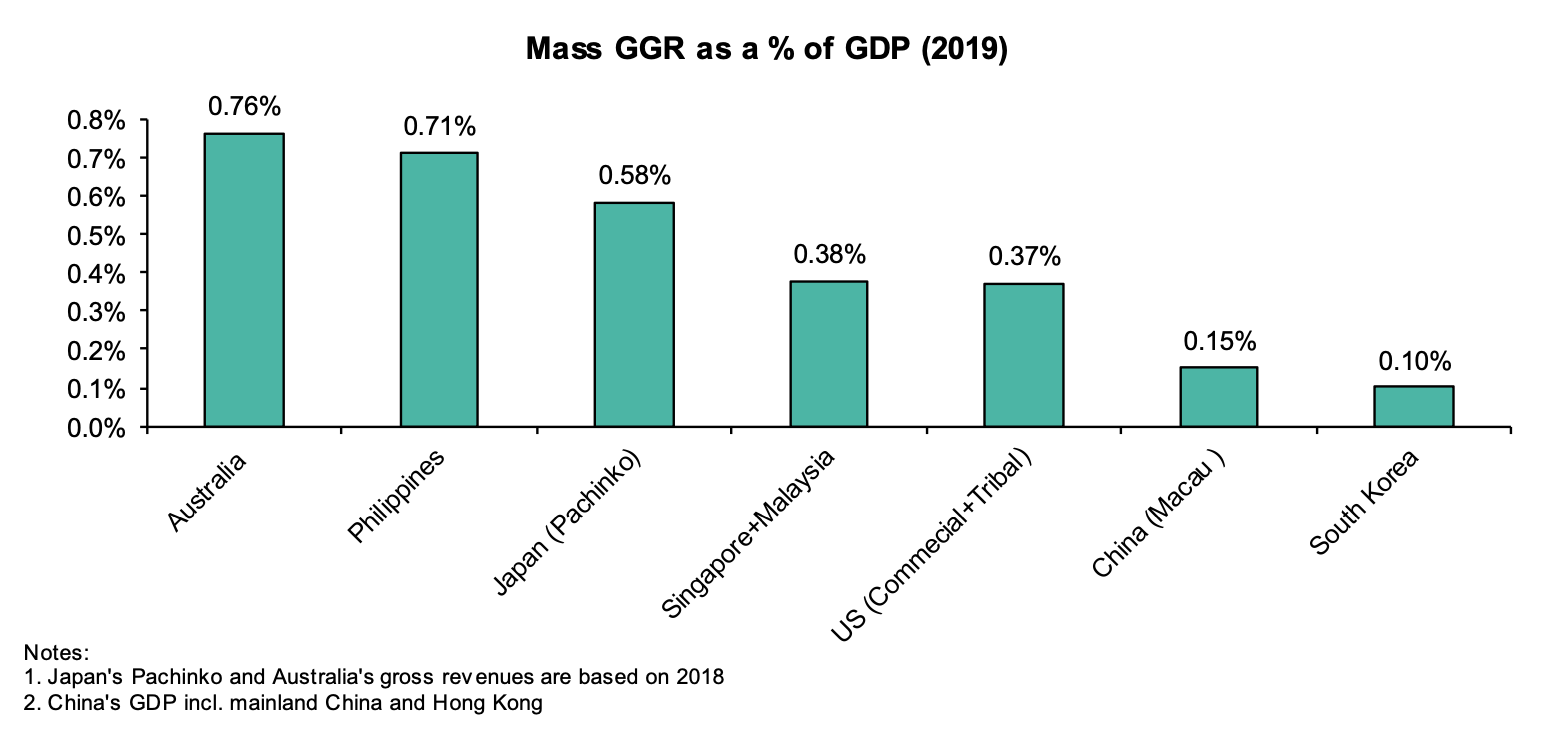

Sell-side analysts believe that the mass market business will become a major growth driver for Macau casinos. In the US, roughly 1/4 of adults go to the casino each year. In Hong Kong, roughly 1/3 of residents go to Macau each year. However, it is more difficult to judge the potential for mainland gamblers to come to visit Macau since there is obvious friction to doing so (distance from the Northern part of the country being a major concern). Therefore, I don’t think that mass GGR as % of China’s GDP is a particularly good measure to judge the growth potential of Macau casinos.

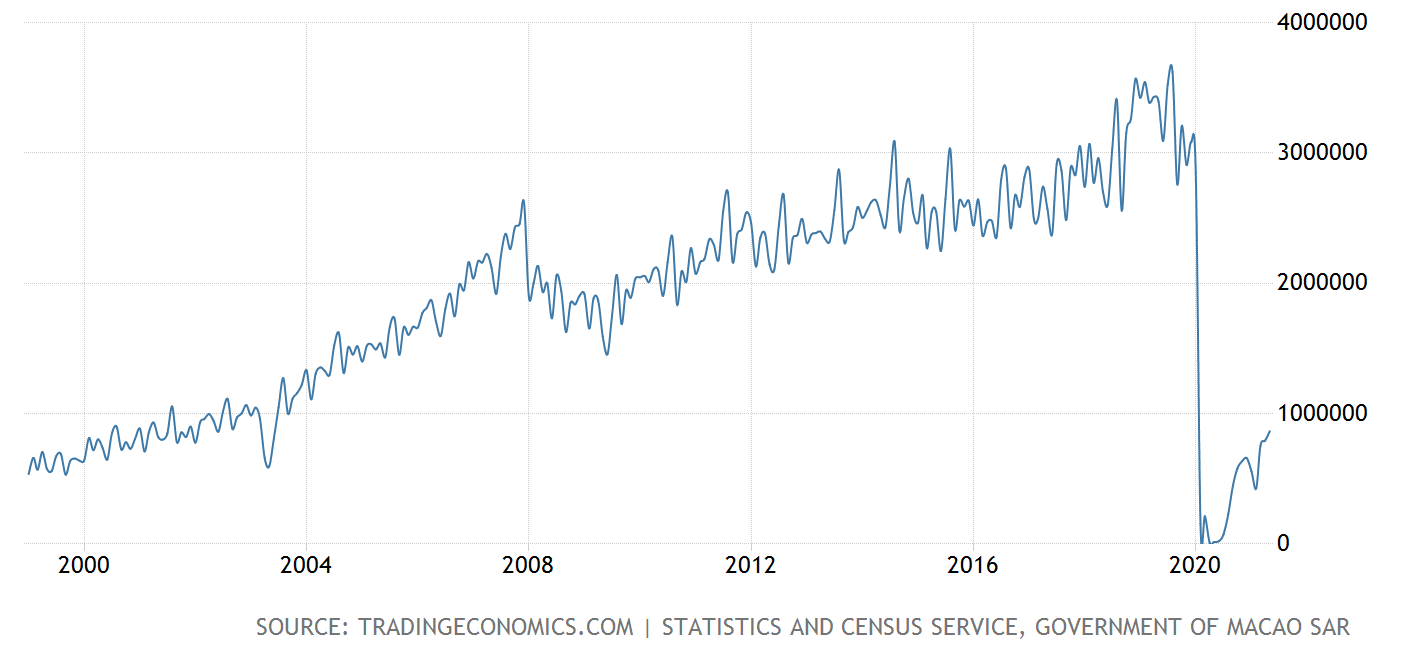

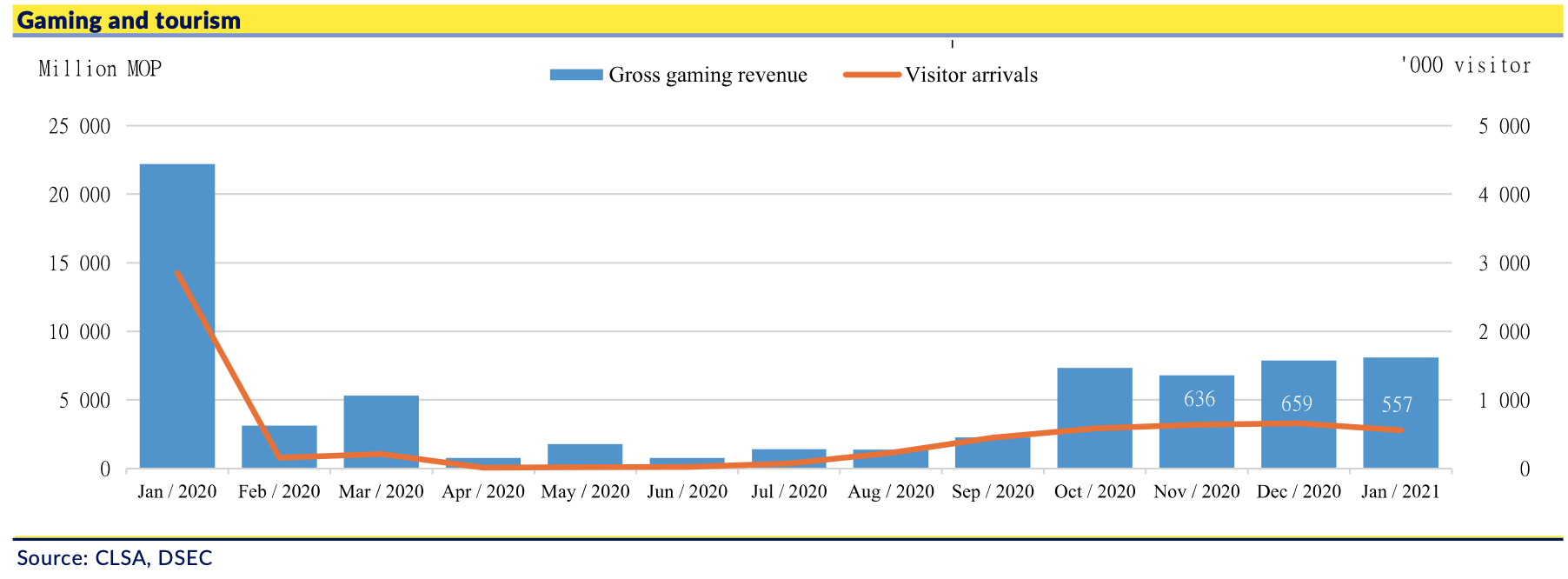

Recently, casinos suffered from anti-government protests in Hong Kong as well as COVID-19, with Macau visitor numbers down 90%+ at one point. A travel corridor was opened up between Macau and mainland China in September 2020. That has helped to some extent, but for a variety of reasons, Macau tourism remains weak.

As you can see from the below chart, Macau GGR is still a fraction of what it was prior to the pandemic.

Will Macau’s casino concessions be renewed in 2022?

The major question of investors’ minds when it comes to Macau casinos is the risk concessions won’t be renewed when they lapse in June 2022. They can be renewed once or more, with the number of times and length of each extension up to the Macau Chief Executive’s discretion.

Macau receives 86% of its tax revenues from casinos, so the government is probably keen to keep the status quo. Tax revenue could increase further if the government chooses to eliminate the waivers it has extended to operators on paying the city’s 12% corporate income tax. Eliminating corporate tax payment waivers seems like a larger risk to the casinos than any of the concessions lapsing.

Which casino is most at risk? According to “sources familiar with the Macao government’s deliberations”, as quoted by Nikkei:

“Operators investing heavily in Singapore and Japan will lose some goodwill with the authorities. Yet most expect the same six companies to remain in business after the official tender, given the government's intense aversion to risk.”

That makes me think that the risk of Las Vegas Sands is in a more precarious position than the MGM and Wynn. But Sheldon Adelson was always on good terms with the Chinese government. Melco is also considering investing in a Yokohama casino. But again, most investors believe that the risk of a concession non-renewal is small.

Macau’s largest junket agency Suncity Group recently became the top shareholder of a Hong Kong-listed company running a casino in Vladivostok. It is also pursuing a $4 billion casino project in Hoi An, Vietnam and another casino in Busan, South Korea. The company has built up significant goodwill by sponsoring key local events like the Macau Grand Prix race. It has also expressed interest in a casino license. As Nikkei described:

“If new operators were allowed, most bet that they would be controlled by local investors rather than another foreign company.”

So I suspect that another casino license could be granted mid-next year, perhaps to Suncity or another local company. If so, that would cause competition within Macau to heat up further.

I don’t have very strong views on any of the Macau casino names. Sands China would appear to have a stronger market position than say SJM. Valuations are high across the sector. While concession renewal risks may be low, I still prefer to wait and see what happens mid-next year.

Summit Ascent is an odd casino stock, operating a resort called Tigre de Cristal in Vladivostok, Russia close to the Chinese border. I don’t think the management team is focused on shareholder value.

South Korea

South Korea’s gambling legislation came into effect in 1961 and was quickly amended to legalise gambling. But gambling is only legal for foreigners, and most casinos are highly dependent on Chinese tourist spending. There is only one exception: Kangwon Land Casino, which has been allowed to take in local customers ever since it began operation in the year 2000.

Olympos Hotel and Casino in Incheon became the first Korean casino in 1967. Since then, many others have opened up their doors to foreign visitors: Paradise Walker-Hill Hotel and Casino opened a few years later in Seoul. Pusan Paradise Hotel and Casino opened in 1978, attracting many Japanese visitors. Several casinos have since opened on Jeju Island south of the mainland.

Casino operators in Korea pay the government (the Tourism Development Fund) about 10% of gross sales. There’s a good mix between table games and slot machines across the major casinos.

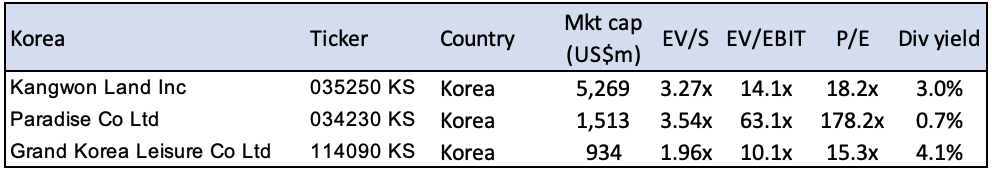

Today, the three major listed casino companies are:

- Grand Korea Leisure: Seven Luck Casino Seoul / -Busan

- Paradise Co: Paradise Casino / -Walker Hill / -Busan / -Jeju Grand

- Kangwon Land: Kangwon Land Resort Casino

The Kangwon Land Casino is a special business. The Korean government chose to legalise gaming in Kangwon, because of the negative impact that the declining coal industry had on the city. Kangwon is in the eastern part of the country - far away from the major cities of Seoul and Pusan. The part-state owned Kangwon Land Casino opened up in 2000 and expanded in 2003. Today, the casino is also associated with a theme park, golf courses and ski slopes. Unfortunately, growth has been tepid over the past decade.

The other Korean casinos have been reliant on Chinese tourist spending. Most of them were hurt badly by the THAAD crisis in 2017. Chinese state media encouraged its citizens to avoid consuming Korean products and services due to concern that Korea’s new THAAD missiles could pose a military threat to China. The casinos have yet to recover from the THAAD crisis and it’s unclear if they ever will.

I’m intrigued by Kangwon Land, given its unique position of being able to offer gambling services to Korea’s 52 million population. It’s essentially a monopoly. The casino is just starting to re-open up following COVID-19 related restrictions. Kangwon’s share price is already back to pre-pandemic levels, unfortunately.

Grand Korea Leisure looks inexpensive as well. So if you believe that China-Korea relations will eventually recover, it could be a good way to express that bet.

Japan

The Japanese gambling law (“Keiho”) has prohibited gambling since 1882.

”A person who gambles shall be punished by fine.”

But - there is an escape clause:

“This shall not apply when the bet of a thing is made only for momentary amusement”

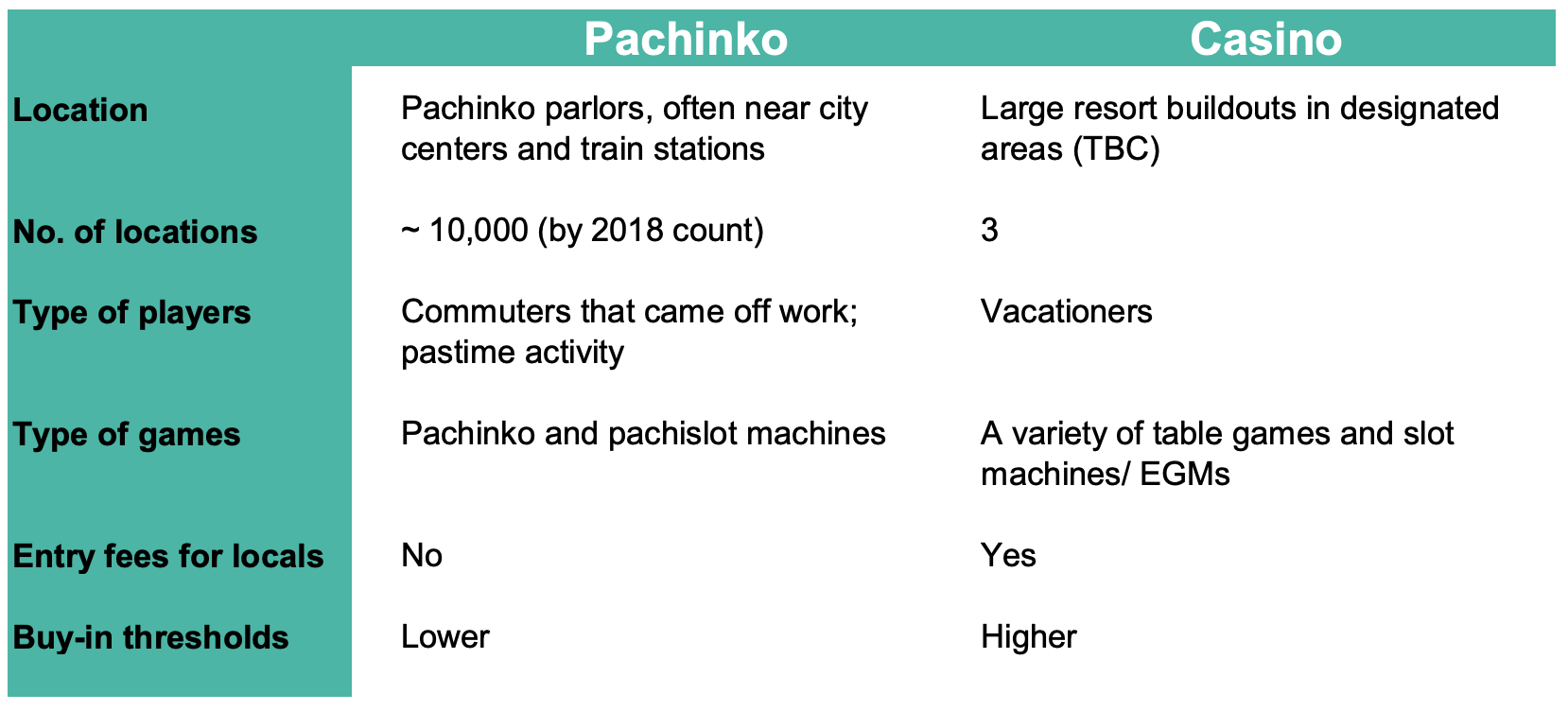

Since the 1950s, an entire industry catering to gambling “for momentary amusement” has sprung up through so-called “Pachinko” parlours. A Pachinko machine is a cross between a pinball machine and a slot machine. The name comes from the sound “pachin, pachin, pachin” of balls bouncing around the machine. Here is a good video that explains how Pachinko machines work.

There is an element of skill - but the machines mostly just give you an illusion of control. The vast majority of players lose money over time. While Pachinko might seem innocuous, Japanese lose twice as much money to gambling compared to US citizens. All because of Pachinko machines.

When you walk into a Pachinko parlour, you “rent” balls that you pay for using cash. The balls circulate through the machine. If you’re successful, you end up with more balls than you began with. You can then cash them out for prizes such as cigarettes, bottles of wines, toys, etc.

The parlour itself will not give back cash for your balls. But every Pachinko parlour will have a backdoor operation that offers to buy the rewards for a cash hand-out. These operations are unrelated to the Pachinko parlour but in practice operated by triads (e.g. Yakuza). A survey from the 1990s found that 96% of players actually converted their winnings to cash through such backdoor operations. The police are comfortable with the current set-up and tolerate Pachinko as a lesser evil.

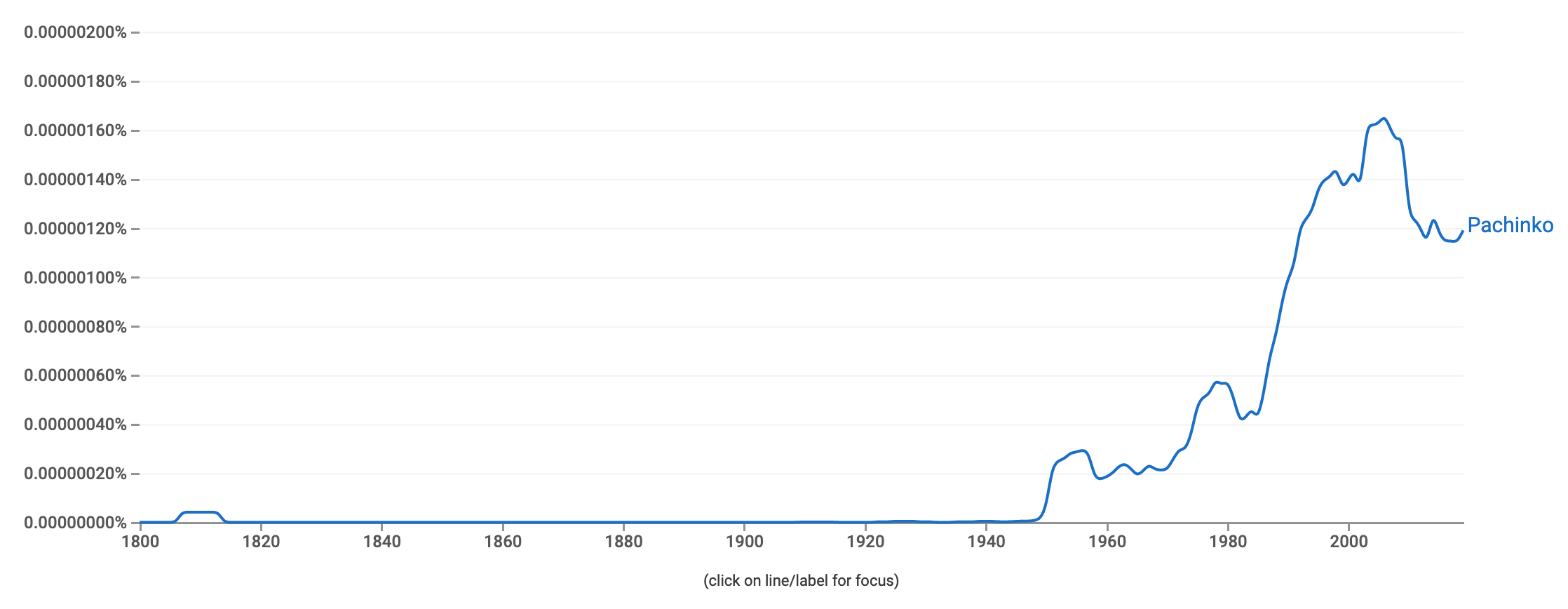

Today, Pachinko seems to be losing in popularity to online gambling. The number of mentions of Pachinko in English language books has dropped since the early 2000s, according to Google Ngram.

And it’s going to get worse. In 2016, new legislation was passed that would eventually legalise casinos in Japan. An implementation bill was finalised in 2018. The first casinos could open as early as 2025.

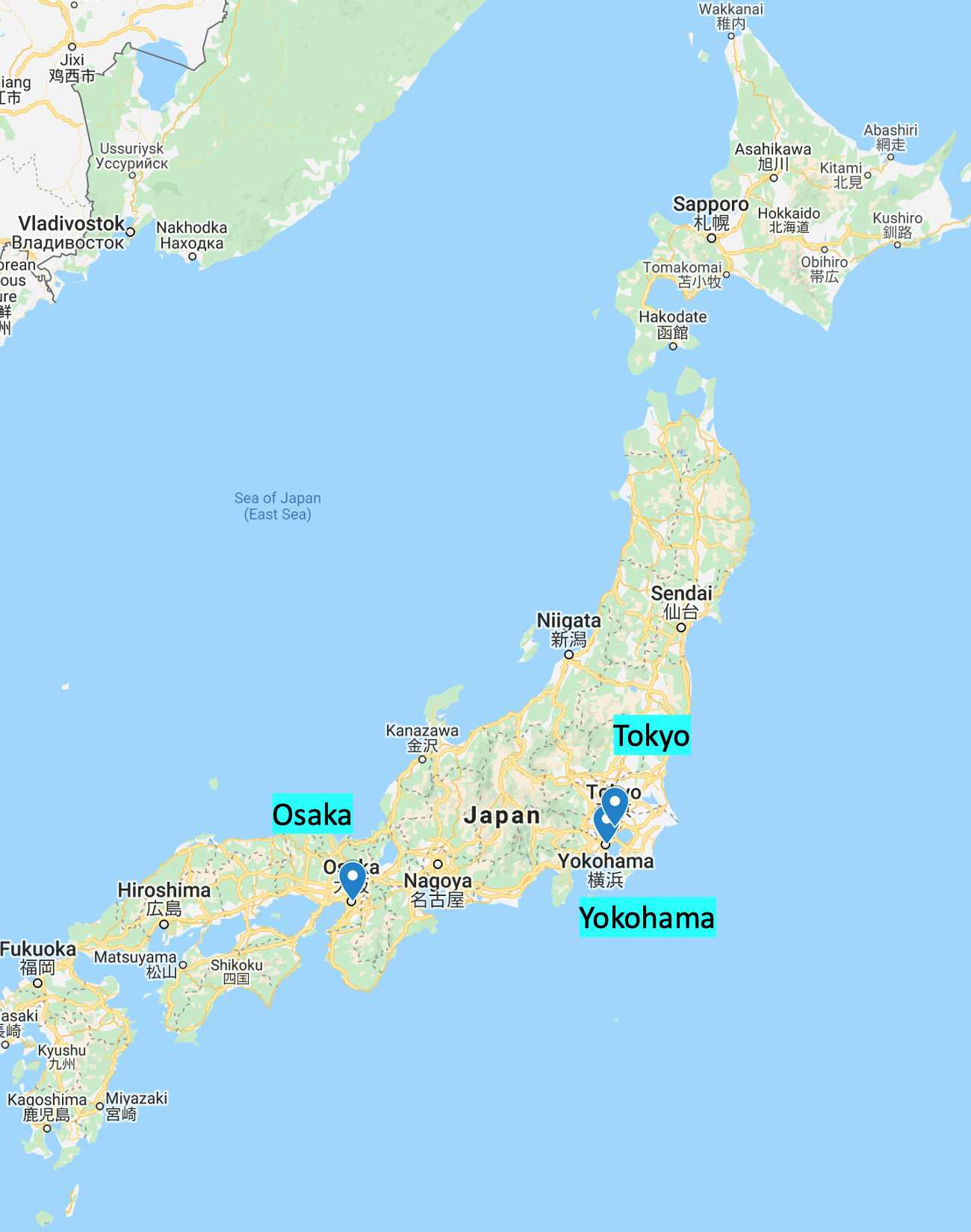

Three integrated resorts are likely to be built in Osaka, Tokyo and Yokohama. But these integrated resorts come with restrictions: Japanese residents will only be able to visit casinos a maximum of three times per week or ten times per month. And they will be charged a JPY 6,000 entrance fee to help discourage addiction, similar to the restrictions that Singapore has imposed on its citizens.

Osaka sent out RFPs to potential bidders in 2019 and MGM ended up winning the contract. Melco and Genting Singapore (partnering with Sega Sammy) are apparently bidding for an integrated resort license in Yokohama. Wynn might be bidding for a Tokyo license.

- MGM: Osaka casino

- Melco / Genting / Sega Sammy: Yokohama casino (potentially)

- Wynn: Tokyo casino (potentially)

How will the Pachinko market fare in competition with new casinos? Pachinko will certainly lose wallet share. At the same time, the vast majority of Pachinko players do so casually on their way back from work or as part of their daily routines. The stakes are much lower. So I doubt that the Pachinko market will go away entirely.

The big question in my mind when it comes to the new Japanese casino resorts is what types of games Japanese will want to play. Most casinos throughout Asia focus on table games such as baccarat. The nine games that will be permitted in Japan will be baccarat, blackjack, poker, roulette, Sic Bo, craps, Casino War, money wheel and pai gow. Electronic games will also be permitted.

But Japanese in other parts of the world have never been into baccarat. So how will the integrated Japanese casino resorts look like? Hundreds of pachinko machines on every floor? Or will Japanese gaming habits change? I believe these questions will have to be answered before investing in any of the companies that are currently bidding for licenses. Investing billions of dollars in a project with uncertain demand seems risky to me.

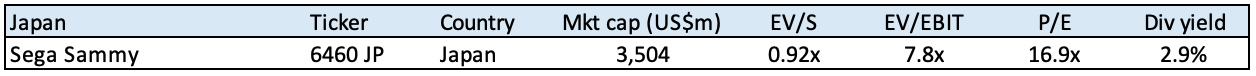

There are several Pachinko machine OEMs listed in Japan: Sega Sammy, Heiwa, Sankyo and Universal Entertainment. And a few Pachinko parlour stocks as well, including Dynam Japan, though listed in Hong Kong. But since the Japanese casino market is so young, there are no pure-play casino stocks available yet. The closest one you will find is Sega Sammy. I don’t like Sega Sammy’s Pachinko exposure. But your mileage may vary.

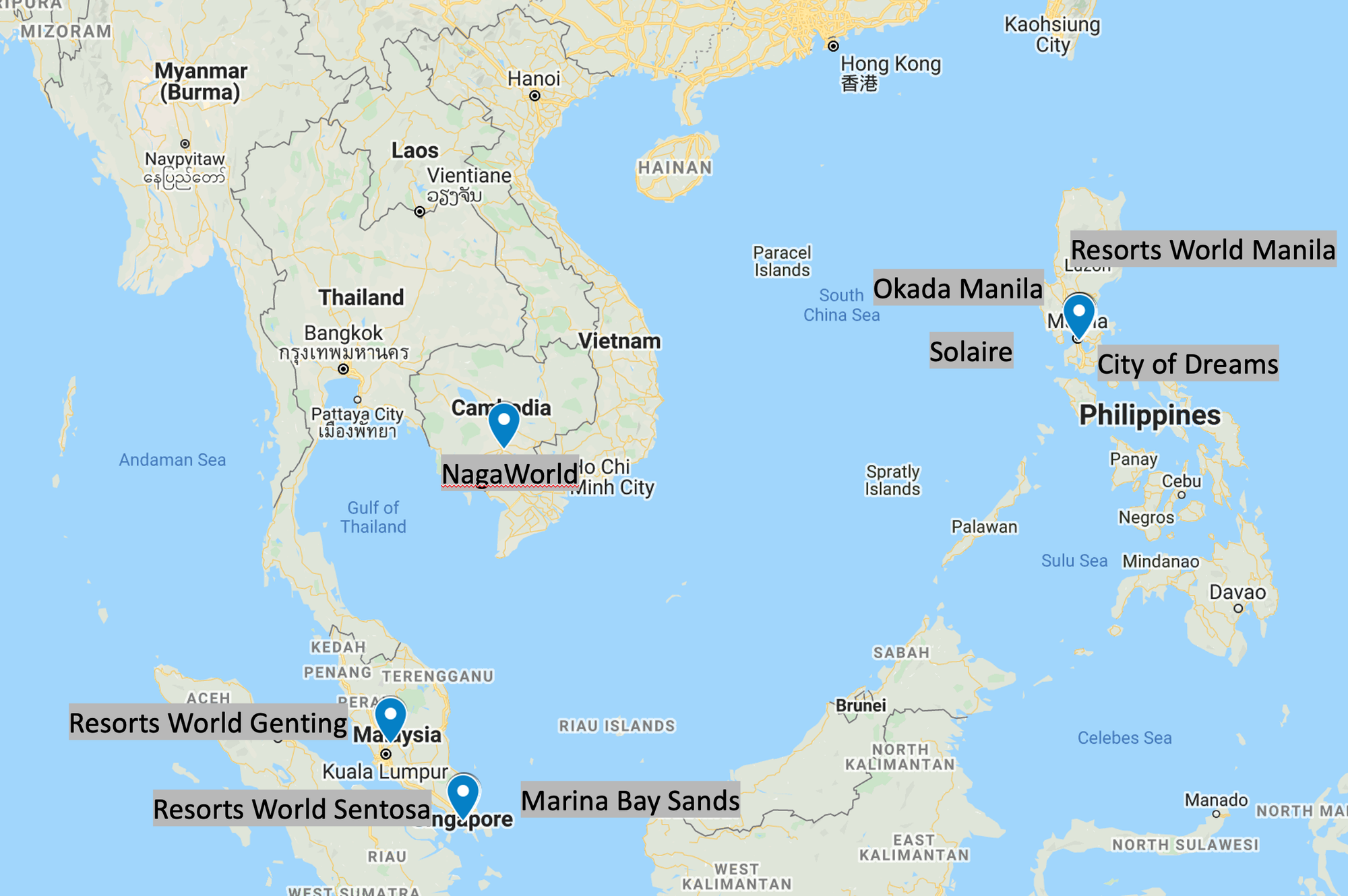

Southeast Asia

Both Singapore and the Philippines have major casino markets, whereas Malaysia and Cambodia (Phnom Penh) tend to be more niche with only one major operator in their immediate vicinity.

Here are the major integrated casino resorts in Southeast Asia:

- Genting: Resorts World Genting, Resorts World Manila, Resorts World Sentosa

- NagaCorp: NagaWorld

- Las Vegas Sands: Marina Bay Sands

- Bloomberry: Solaire Resort and Casino

- Melco: City of Dreams Manila

Singapore

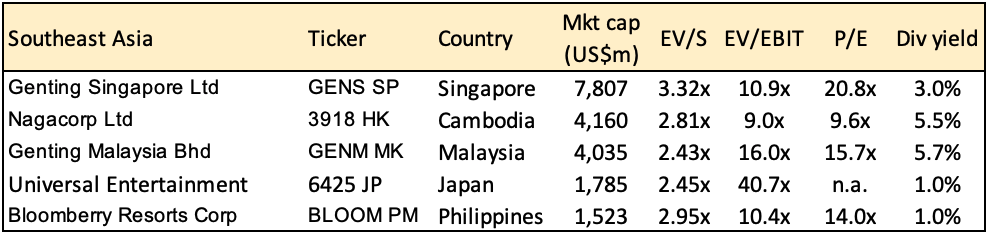

Singapore’s casino market is a duopoly between two operators: Genting Singapore (Resorts World Sentosa) and Las Vegas Sands (Marina Bay Sands). The two casinos were granted their 30-year licenses in 2006 and opened their doors in 2010.

The local casino market is highly regulated. An SG$100 entrance levy is imposed on all local residents to help protect them from gambling addiction. Promotions targeting local residents are banned and shuttle buses or loyalty programs are not allowed. And junket operators hardly operate in Singapore’s casinos: there are zero junket operators at Marina Bay Sands and only three at Resorts World Sentosa. Casino taxes are set at 12% of VIP GGR and 21% on mass-market GGR, plus additional corporate tax.

Despite onerous regulation, the two Singaporean casinos are highly profitable and enjoy mid-single-digit growth in inbound tourism, driven by tourists from mainland China.

Cambodia

Casinos in Cambodia operate in a grey zone. Since 1995, all gambling places were deemed illegal - unless specifically authorised by the government. Only the Prime Minister has the authority to hand out new casino licenses. In general, casinos are not allowed within 100 km of the capital Phnom Penh. But there is one major exception: NagaWorld Casino, owned by Nagacorp. Casinos in Cambodia are only open to foreigners and not to Cambodian citizens and that’s true for NagaWorld as well. Table gameplay dominates these Cambodian casinos, just like it does in Macau.

Philippines

The Filipino casino industry used to be run by state-monopoly PAGCOR (Philippine Amusement and Gaming Corporation). Under the Aquino administration, casino licenses were granted to a number of private companies that have now become highly successful. Most of them are centred around Entertainment City in Parañaque, Metro Manila. Gaming taxes are low, enabling junket operators to offer great deals to their Chinese customers. While competition has heated up over the past few years, the overall market grew fast prior to the pandemic and the government halted new casino licenses from 2018 onwards. That has helped create a highly favourable environment for the incumbents.

Malaysia

There is only one major integrated resort in Malaysia - Resorts World Genting in the Genting Highlands one hour drive from Kuala Lumpur. From my point of view, it’s a strange creation: massive slabs of concrete on a mountain peak at close to 2,000 metres of elevation. The casino is only open to non-Muslims and most of the patrons are local Chinese. Genting is in the process of refurbishing its Genting Highlands resort, its Resorts World Sentosa project in Singapore and launching a new $4.5 billion Las Vegas project as well as bidding for a casino license in Yokohama, Japan. With already high debt levels, it’s unclear how much further debt they’ll be able to take on in the process.

When it comes to stock picking among the Southeast Asian casinos, I’m leaning towards the countries that enjoy secular tailwinds: Cambodia and the Philippines.

That said, I’m wary of the recurring private placements that Nagacorp is directing to its controlling shareholder. I also think that the $3.5 billion investment in NagaWorld phase 3 is excessive given that Phnom Penh is a small city and given that casinos are not yet open to local residents.

The Philippines is an interesting gaming market. Taxes are low and crucially, casinos are open to local residents. They will also gain the ability to offer online betting services to residents in the near future. Unfortunately, Universal Entertainment has large Pachinko exposure and its Chairman has been accused of misappropriating company resources in the past. I’m bullish on Bloomberry Resorts - so much so that I wrote an entire deep-dive on the stock, available here.

The Genting group of companies have historically not delivered satisfactory returns on capital. So while I’m bullish on Resorts World Sentosa in Singapore and consider the stock to trade at a very attractive level, I’m not completely sold on becoming a long-term shareholder.

Recommendations

The reason why I wanted to dig into the Asian casino sector is that I believe it is primed for recovery from COVID-19. As global mRNA vaccine exports ramp up, even emerging markets will get access to high-quality vaccines from the second half of 2021.

Some of the stocks already price in a full recovery. There could be some upside in Sands China, Genting Singapore and Kangwon Land. But the stock with the greatest upside and that also has a very competent and minority friendly controlling shareholder is Bloomberry Resort, so I suggest you take a look at my deep-dive report, available here:

Tired of US tech compounder stocks?

Asian Century Stocks is a differentiated service focusing on Asian value stocks. I don’t believe in “growth at any price” - a strict value discipline is employed. While focusing on high-quality companies. Sign up for 20+ deep-dives per year, thematic industry reports—all for the price of a few cappuccinos per month.