Table of Contents

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author might hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. This is a disclosure, not a recommendation to buy or sell stocks.

My eight-year old son was recently diagnosed with myopia — nearsightedness.

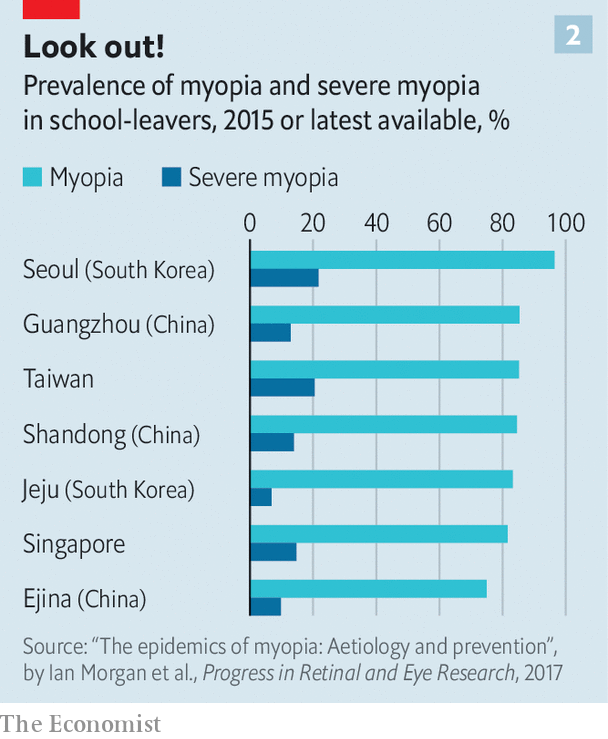

It's a consequence of the eyes becoming too long, making distant objects appear blurry. And for some reason, it's become extremely common across Asia.

Before 1950, the myopia rate in China was only about 5%. Fast-forward to today, more than 80% of Chinese high school children have myopia. And the numbers are even higher in Taiwan, South Korea, and Japan:

That begs the question, what's causing this phenomenon?

According to the YouTube channel Asianometry, the main culprit seems to be children spending time indoors. Their retinas are not getting enough sunlight. And the children spend too much time looking at objects close to themselves, including iPads and school books.

In response to rising myopia rates, in 2010, the Taiwanese government launched a government program called "Tian Tian 120", encouraging children to spend 120 minutes outdoors each day.

And that initiative seems to have worked. Following the launch of this program, the prevalence of myopia in Taiwanese primary school children declined, suggesting that spending time outdoors helps combat the trend:

At the same time, the increasing prevalence of myopia is unlikely to reverse. Especially when children are glued to their smartphones for several hours per day.

I dug into the research on myopia and found that there are three main treatment options for those affected by it:

- Atropine eye drops. These are eye drops administered daily before sleep, and supposedly slow the onset of myopia.

- Ortho-k contact lenses: These specially shaped contact lenses are worn overnight, reshaping the eye to help prevent worsening myopia.

- Refractive surgery: Finally, after the eyes stop growing at age 21, patients can also use laser procedures like LASIK to reshape the front of the eye and thus correct their vision.

So, from an investment perspective, it seems that manufacturers of contact lenses, spectacles, and eye drops should benefit. As well as operators of eye surgery clinics.

The "Big Four" heavyweights in the contact lens industry are Johnson & Johnson (Acuvue), Alcon, Cooper Vision, and Bausch + Lomb. These companies also make LASIK surgery equipment. Germany's Carl Zeiss Meditec has exclusive patents on another type of surgery called SMILE, which is a newer procedure that's less invasive.

In Asia, I've found that the following companies have exposure to the increasing prevalence of myopia:

In the above table, I've divided the investable universe into three buckets:

- Contact lens manufacturers: These include Taiwanese contact lens OEMs such as St Shine and Pegavision. Meanwhile, Japan's Menicon and SEED primarily sell contact lenses under their own brand names. Interojo in South Korea is one of the most popular cosmetic/color lens brands in the region. Finally, Autek China is known for its ortho-k contact lenses, which help prevent the onset of myopia.

- Eye surgery clinics: Aier Eye Hospital is a well-known blue-chip eye surgery group. Dr Agarwal Eye Hospital in India has also achieved a reasonable return on equity. ISEC Healthcare in Singapore and Optimax in Malaysia own eye surgery clinics and also offer other healthcare services.

- Spectacle makers: These include retailers such as Lenskart, Japan Eyewear, JINS, Doctorglass, and the recently privatized Paris Miki. Then you have suppliers of eyeglasses such as Shanghai Conant Optical, Thai Optical, and Samyung Trading, which owns a joint venture with EssilorLuxottica.

There are many stocks to dig into here. But the three that excite me the most are Pegavision, Japan Eyewear, and Samyung Trading. They all trade at low valuation multiples while growing steadily. So stay tuned for a deep dive on at least one of these stocks in the next few months.