Table of Contents

Disclaimer: Asian Century Stocks uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is a disclosure and not a recommendation to buy or sell.

1. What the literature says

The seminal work on insider transactions is Nejat Seyhun's 1996 book Investment Intelligence from Insider Trading.

"Insider trading" refers to stock transactions of a company's officers, directors or controlling shareholders.

Whenever insiders buy or sell shares, they are typically required to disclose those transactions to local regulators.

So why should we care about insiders? Well, they tend to be better-informed than we are. Academic studies show that insider buying tends to outperform the overall market by 6-10% per year over several decades.

In Nejat Seyhun's book, he analyzed over one million insider transactions in the United States between 1975 and 1996. He had six main conclusions:

- When insiders open new positions, stock prices tend to perform significantly better than when they engage in routine transactions, such as exercising options.

- Top executives, such as CEOs, tend to be the best informed and therefore make more money on their purchases. Conversely, when controlling shareholders buy, they don't tend to outperform much at all.

- Trading activity in smaller firms tends to have greater predictive power than in large firms. Insider trades tend to be particularly profitable when the market capitalizations are lower than US$25 million (equivalent to US$50 million in today's money).

- Greater trading volume generally signals more valuable information and a higher prospective return.

- Profitability increases when there is strong agreement among insiders, i.e., a cluster of buying activity occurs across multiple directors or officers.

- When insiders of a firm buy and sell within a given month, then the signal disappears. So you'll want transactions that are not preceded by conflicting signals. In other words, you'll want to require that the buying has not been preceded by recent selling.

Another great book discussing insider transactions is Wesley Grey's Quantitative Value, which was published back in 2012:

Grey came to similar conclusions as Seyhun, but he also points out that the signal of an insider purchase is amplified when:

- The insider is buying a value stock, i.e. a company trading well below its intrinsic value. Conversely, insider trades in growth stocks tend to be much less profitable.

- Companies that announce buybacks when insiders are simultaneously buying shares tend to outperform even more.

Furthermore, Grey argues that stock sales tend to contain less information because they can be motivated by liquidity needs or a desire for diversification. Selling doesn't necessarily mean that the stock is overvalued. So he recommends focusing on insider buying only.

Finally, in Asif Suria's 2024 book The Event-Driven Edge in Investing, there's also a chapter on insider transactions.

Suria argues that:

- We should pay attention to what insiders of multiple companies in the same industry are doing. Because broad-based buying could be related to a turn in industry fundamentals. Especially in cyclical industries.

- He also pays attention to buying by independent directors, especially those with a background in investment management and who have served on the board for an extended period of time.

Conversely, Suria argues that we should ignore the purchases of newly appointed directors and executives. They're often legally required to hold a minimum number of shares and may simply be fulfilling their contractual obligations. He also cautions that some insiders purchase stock to send a signal to the market, perhaps even issuing a press release to pump the stock price.

In the academic realm, Wang, Shin & Francis (2011) demonstrated that CFO purchases actually contain more information than those of CEOs. This might be because CEOs often come from sales backgrounds rather than from analytical backgrounds. CFOs know that companies are worth.

So to summarize, recent insider purchases are often followed by significant outperformance - especially when they're new and large positions, in small firms, with high trading volumes, by people with CFO or investment management backgrounds, coincide with share buybacks and in large clusters where every person is buying rather than selling.

2. The Smart Insider platform

I mentioned in my Ghost launch post that I've now become a subscriber to an institutional insider transaction platform called Smart Insider. It's the best one I've found, and I've found it very helpful in sorting out the noise.

Smart Insider has two key modules covering 14 markets in Asia:

- Insider transactions: You can search across the insider's role in the company, trading volumes, market cap, whether a cluster or not, by sector, by minimum change in ownership, filter out non-discretionary purchases and more.

- Share buybacks: Another database covering tens of thousands of companies. You can search for announcements and executions over time with nice charts.

If you purchase the global dataset, you'll also gain access to markets in the Americas, Europe, and other regions.

Smart Insider also has a Company Signals service, where their analysts pick out insider transactions and share buybacks that they think contain the most predictive power when it comes to future returns.

They also send out monthly emails with summaries of broad trends in insider trading activity across regions and sectors. For example, earlier this year, they noted broad insider buying in China and broad insider selling in India. That was a prescient call, because since then, the Chinese market has greatly outperformed.

3. Insider transactions in Asia

In the past few days, I've spent some time reviewing the insider transaction data for September 2025. I've attempted to identify situations where there's meaningful buying across five categories: CFO buying (because they tend to be more savvy than CEOs), cluster buying, buying in microcaps, returning buyers, and buying during corporate restructurings.

I'll now discuss one situation from each of these five categories - all discretionary trades that I hope will contain some signal among all the noise.

3.1. Top CFO situation

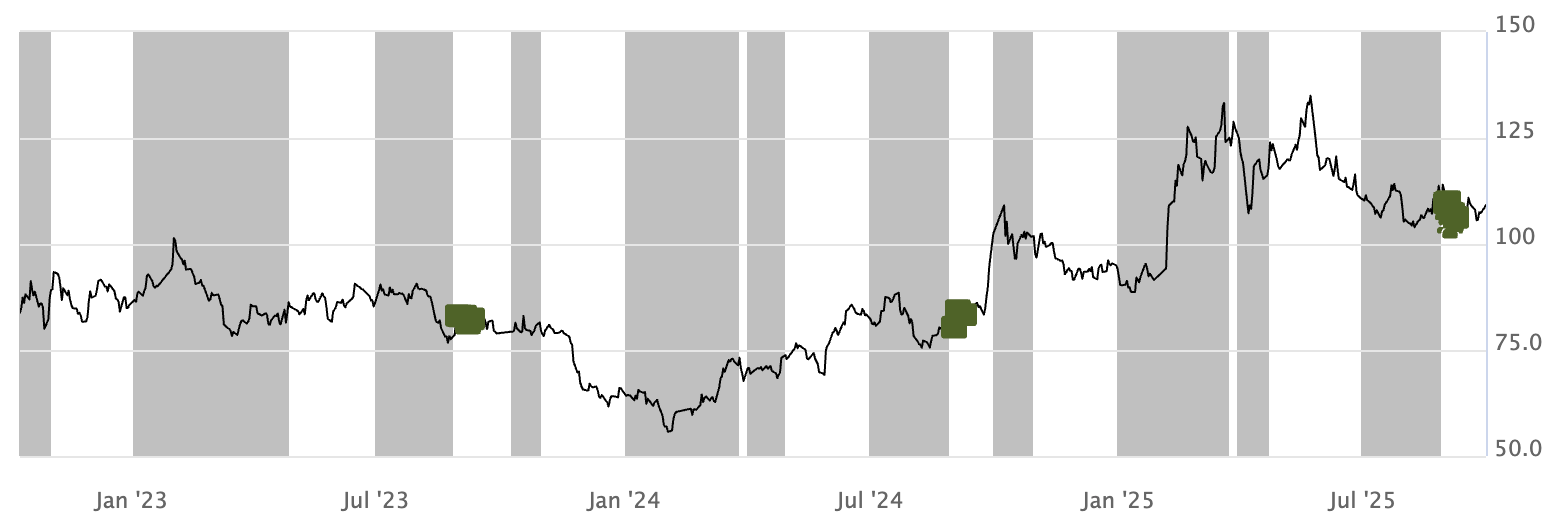

Converge ICT (CNVRG PM - US$1.5 billion) sells fiber broadband services to households in the Philippines. They have monthly postpaid plans called FiberX and BIDA Fiber, as well as a prepaid option called Surf2Sawa. 85% of revenues come from households, and the rest from companies.

The company has done well over time, increasing its earnings per share 6x since 2017. The return on equity remains high at 21% and the operating margin 38%. It now has 2.8 million subscribers, out of a population of 116 million. The prepaid option Surf2Sawa now has over half a million subscribers, two years after its launch, which has helped increase its penetration in lower-income areas.

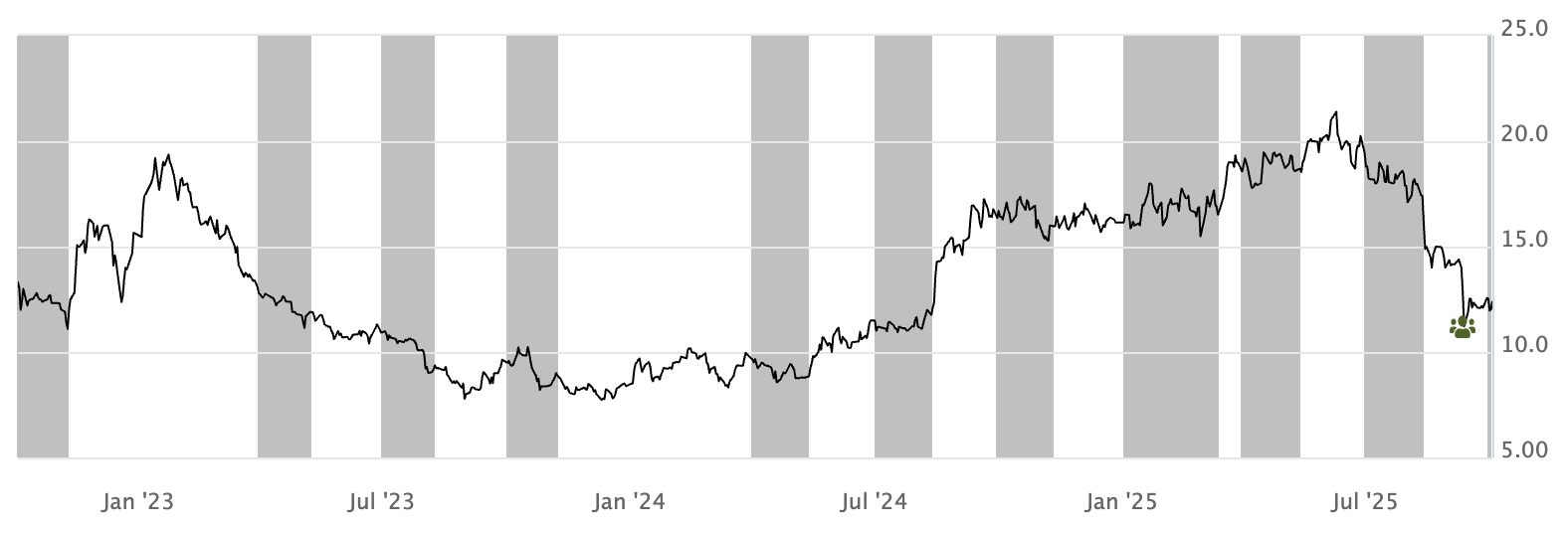

However, the stock price has dropped significantly since the summer of 2025. Converge cut its FY2025 revenue guidance from 14-16% to 10-12% due to manpower constraints. It hasn't been able to find enough new employees to install and repair household connections.

On 13 September 2025, the Senate approved a new law called the Konektadong Pinoy Act that will remove hurdles for smaller Internet service providers to enter the data transmission market. Competition is likely to increase, and Converge's average selling prices might drop after the law is passed.

On the same day the law took effect, we observed significant insider buying by Maria Grace Uy, the founder and head of R&D. She purchased 2 million shares at PHP 11.10 each. There was also an additional, smaller purchase by Chief Financial Officer Robert Leo Yu and Chief Risk Officer Christine Renee Blabagno, all at a price below PHP 12 per share.

It's unclear why insiders have been buying. But the stock now trades at a forward P/E of 7.0x with a relatively clean balance sheet. Converge may be able to monetize some of its excess capacity by selling it to others. So it might actually benefit from industry liberalization, at least in the short run. I also note that Converge now has an active share buyback program and pays a steady dividend representing 25-30% of earnings. So it looks like insiders consider the stock to be undervalued.

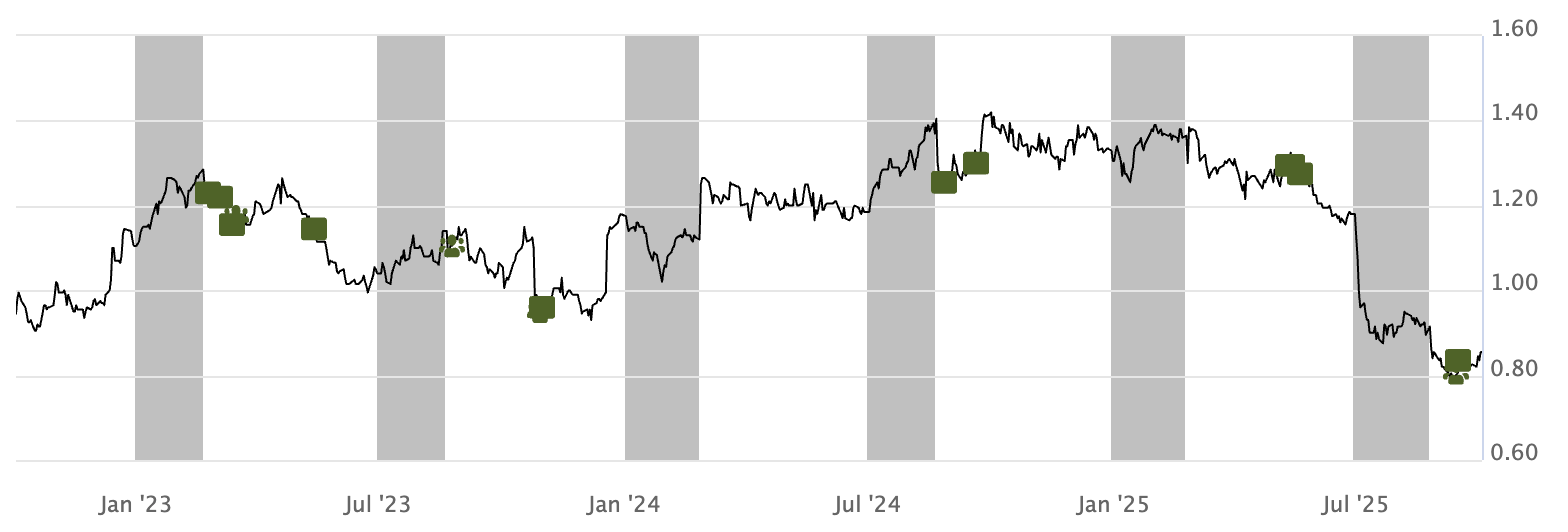

3.2. Top cluster situation

BYD (1211 HK - US$54 billion) - formerly known as "Build Your Dreams" - is the global leader in electric vehicles, based in Shenzhen, China. They're known for their electric vehicles, but they also produce plug-in hybrids. It's a vertically integrated operation, making everything from LFP batteries, motors, gearboxes, chips, and more.

There's plenty of competition in BYD's home market of China, with 300 electric vehicle brands competing on price. But BYD's DM-i hybrids and affordable EVs are selling well. Its domestic sales volumes now exceed 4 million vehicles per year. And BYD is increasingly setting its sights on overseas markets, where prices tend to be much higher than in Mainland China.

In September 2025, we've seen significant cluster buying in BYD. CFO Yalin Zhou bought over 140,000 shares between CNY 82 and CNY 104. Vice President Dongsheng Yang bought almost 200,000 shares. Vice President Hongbin Luo bought over 50,000 shares. And senior employee Wei Li bought over 30,000 shares too. Finally, Vice President Zhongliang Luo bought more than 50,000 shares, too. BYD issued a press release providing details of this insider buying, saying it "reflected confidence in the company's future", but it reads like a regulatory notice.

This cluster buy came immediately after a weak 2025 interim report, which showed slowing sales growth and lower margins resulting from domestic price cuts. The market also reacted negatively to Berkshire Hathaway's selling of its shares in BYD and BYD's March 2025 capital raise. So it's possible that the company coordinated the cluster buy to increase demand for the stock.

BYD now trades at 20.2x forward P/E. Their vehicles are selling well. At the same time, BYD is dependent on government subsidies in many of the countries where it's active. BYD is also facing new EU anti-subsidy duties. But in any case, it's encouraging to see insider buying activity - certainly better than the alternative.

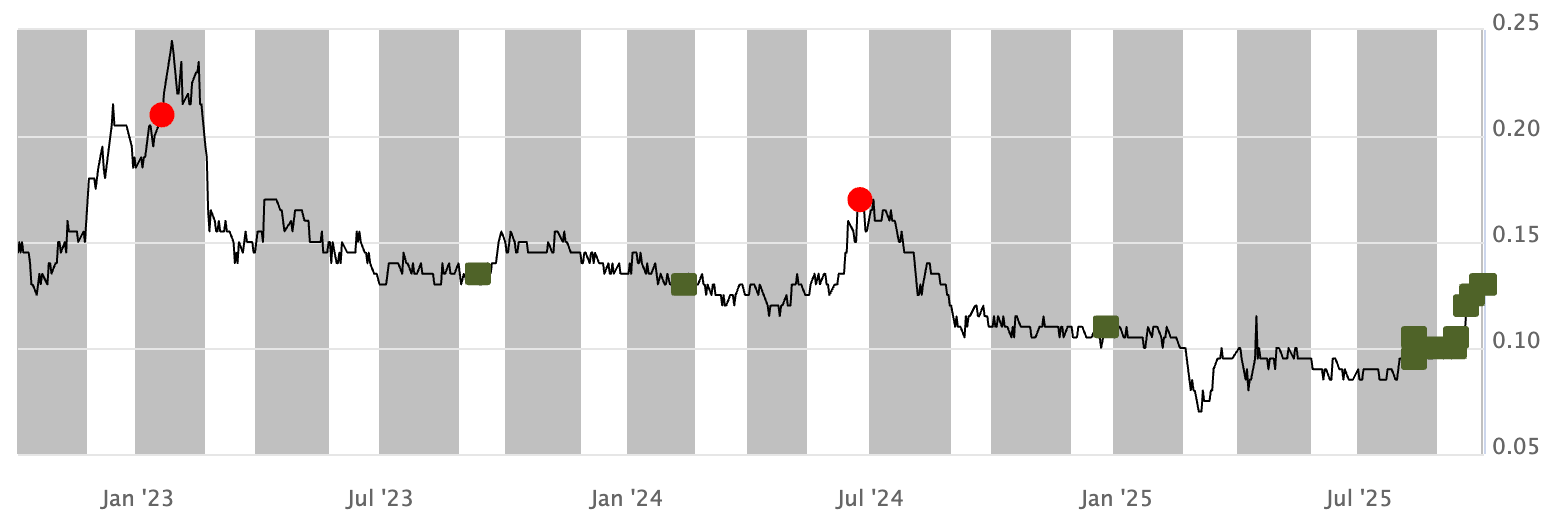

4.4. Top returning buyer situation

G8 Education (GEM AU - US$436 million) is an operator of daycare centers across Australia. It has 406 early-learning centers across 21 brand names, including Community Kids, Great Beginnings, First Grammar, etc. The government's Child Care Subsidy is a significant contributor to revenues, but there's also a portion that needs to be supplemented by parents.

The business has been growing slowly since the mid-2010s, and earnings per share has declined due to overpriced acquisitions through 2019 and an ill-timed capital raise in 2020. G8 was hurt significantly during COVID-19 as daycare centers had to close. But since then, capital allocation seems to have improved.

G8 is now earning an operating cash flow of AU$185 million per year and capex of AU$33 million, for a total free cash flow of about AU$150 million per year. With a market cap of AU$656 million and an enterprise value of AU$1.4 billion, you could argue that there's value at the current share price.

In mid-2025, there was media coverage of a G8 Education employee who had sexually abused children at a Victoria daycare center. Sell-side analysts downgraded the stock on the basis of an expected decline in enrolment. And it's true that the recent occupancy numbers have declined compared to last year's levels.

On the positive side, there's been significant insider buying this year. Chairman Debra Singh bought 30,000 shares in May 2025 at AU$1.29 per share. And after the share price crashed, she returned to the market, purchasing another 30,000 shares.

G8 Education now trades at a forward P/E of 8.6x with a dividend yield of 6.7%. The EBIT interest coverage ratio is 3x and is probably manageable, given that this is a recurring revenue business.

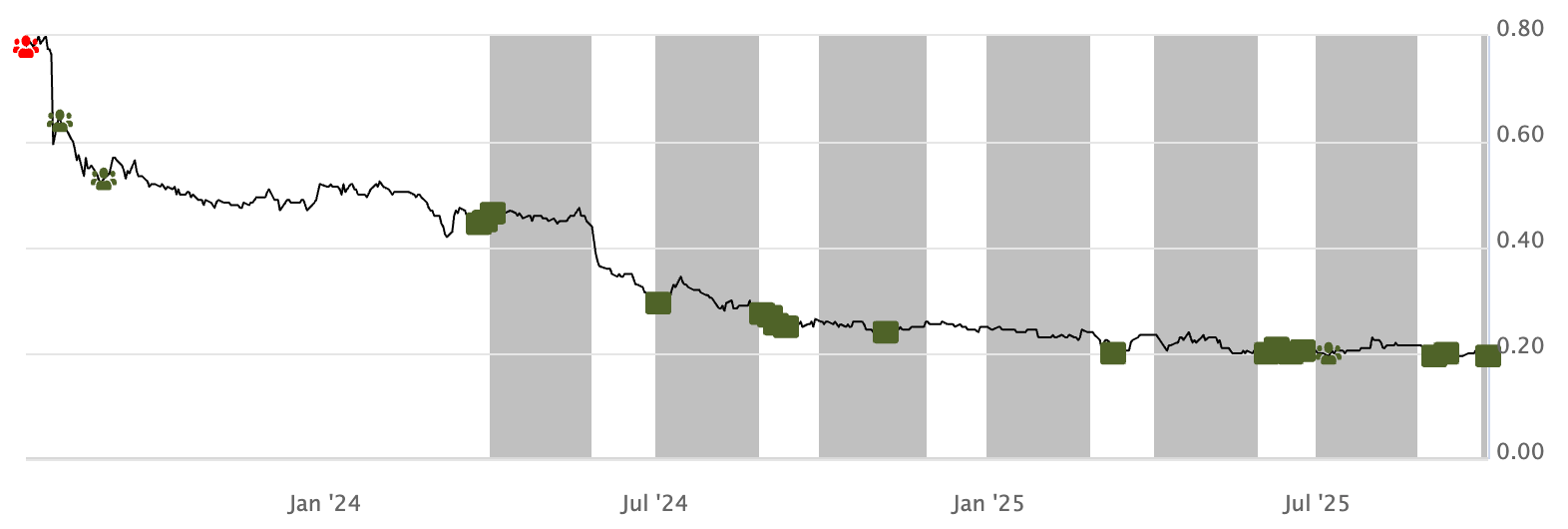

4.3. Top micro-cap situation

MST Golf (MSTGOLF MK - US$38 million) is Malaysia's largest retailer of golf clubs, golf balls, golf apparel, shoes and accessories. It distributes golf gear to other retailers. MST also offers golf coaching services and lessons in Singapore and Malaysia. In 2022, it launched a new indoor golf simulator concept called MST Golf Arena, where customers can eat food and drink while playing indoor golf. The Johor MST Golf Arena location has a Google review score of a whopping 4.8/5.

The company was listed on Bursa Malaysia in 2023 at 81 sen per share, but the stock has since declined to below 20. Revenues have also declined from the COVID-era golf boom. And margins have compressed due to the discounting of hard-to-move items. MST Golf's Indonesian expansion has also added costs. However, indoor golf is a growing industry, so growth may well resume at some point. An index of Google search queries for MST Golf continues to grow nicely.

The insider buying has been continuous since 2024, but accelerated in June 2025 and more recently, in September 2025. It's primarily Chairman Kok Poh Low who's buying. He bought over 7 million shares in September, worth more than US$300,000. In addition, the controlling shareholder, All Sportz, recently lifted its stake to 54%. So insiders are clearly accumulating shares in the company.

It's unclear why Kok Poh Low is buying. The stock now trades at a discount to its net asset value per share of 28 sen. It also trades at a relatively low 0.67x EV/Sales, with historical margins of about 10% on average. Unfortunately, there's no indication that margins have turned just yet.

4.5. Top restructuring situation

Scope Industries (SCP MK - US$36 million) is a mini-conglomerate based in Penang, Malaysia. It has a large electronics manufacturing business, assembling circuit boards and gadgets for larger brands. It also has an oil-palm plantation business, an electronics parts business and a smaller trading business.

In June 2025, Scope announced that it would sell its electronics manufacturing business to China's Luxshare for MYR 97 million. The company has an enterprise value of MYR 118 million, so it's a significant portion of the business. From my understanding, Scope will end up with a net asset value of MYR 186 million, so it's still trading at a discount to its book value.

Scope has already earmarked MYR 23 million for a special dividend after completion. Management has committed to investing another MYR 50 million in expanding the company's oil-palm estate.

In September 2025, Executive Chairman Min Huat Lee has purchased shares aggressively, scooping up close to 60 million shares worth US$1.5 million. It's unclear why he's buying, but presumably he sees value in the company now that it's offloading its troubled electronics business.

5. Conclusion

I believe that insider transactions are worth tracking - especially when they involve new and large positions in small firms, when they're done by CFOs or directors with investment management backgrounds, in clusters of individuals, and when they coincide with share buybacks.

However, investing requires considering all aspects of a business, as well as your personal situation and risk tolerance. So do not consider the above information as investment advice. It's only meant as a starting point for discussion.

What caught my eye in September 2025 was the insider buying in Converge ICT. I wonder if investors are overestimating the negative impact of the Konektadong Pinoy Act. There was cluster buying at the high-profile company BYD, although the press release raises concerns that the buying may not have occurred organically. The returning buyer in G8 Education signals confidence in the future. Then again, the fundamentals have deteriorated, and the debt burden is substantial. The broad-based insider buying in MST Golf fascinates me, especially since I am interested in the indoor golf market. Finally, Scope Industries' Executive Chairman, Min Huat Lee, must be seeing value in the stock. Though I'm questioning how fast capital can compound when it's reinvested in oil-palm plantations.

Thanks for reading!

Michael