Table of Contents

Disclaimer: This article constitutes the author’s personal views and is for entertainment and educational purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. From time to time, the author might hold positions in the below-mentioned stocks consistent with the views and opinions expressed in this article. This is a disclosure, not a recommendation to buy or sell stocks.

After a brutal 4-year bear market, high-profile alcohol stocks such as Diageo, Pernod Ricard, and Brown Forman are finally showing signs of life:

This has prompted some investors to ask whether value is finally emerging.

First, let's talk about the bear case. Nielsen IQ data shows that in Asia-Pacific, 30% are reporting drinking less, and only 15% more are reporting drinking more. The only exception is South Asia, where consumption levels remain low:

So why are consumers drinking less? Nielsen's data showed a mix of health concerns, more time spent alone, and financial challenges:

“I am trying to be healthier”

“I am going out less”

“I am trying to save money”

“I do not like feeling hungover”

“My lifestyle has changed”

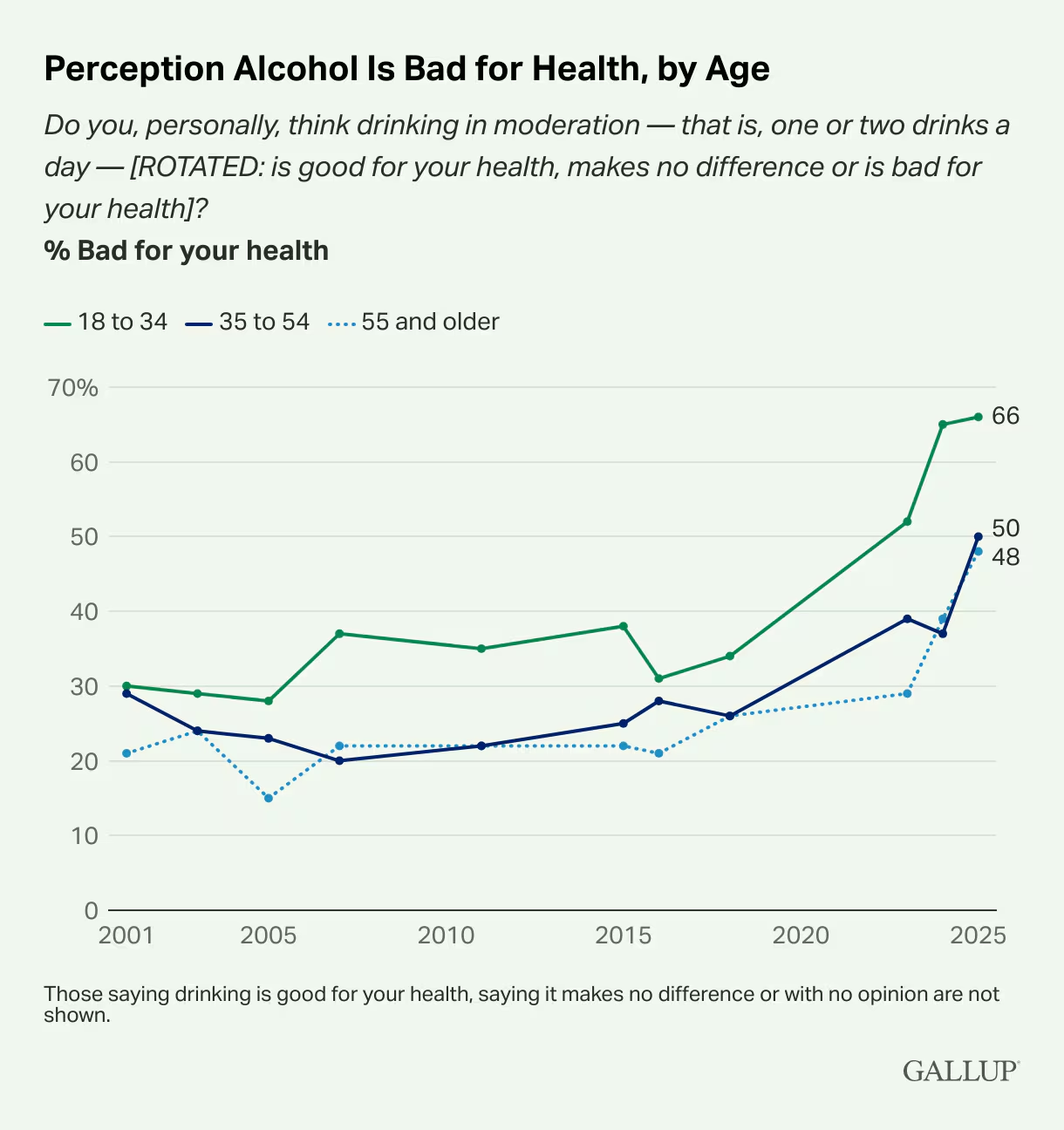

It's also possible that people are becoming better-informed now that they have instant access to generative AI tools in their pockets. Influencers such as Bryan Johnson have millions of YouTube subscribers and are inspiring others to take better care of their health. And indeed, a US Gallup survey shows that an increasing number of people see alcohol as being bad for their health, coinciding with the release of ChatGPT in 2022:

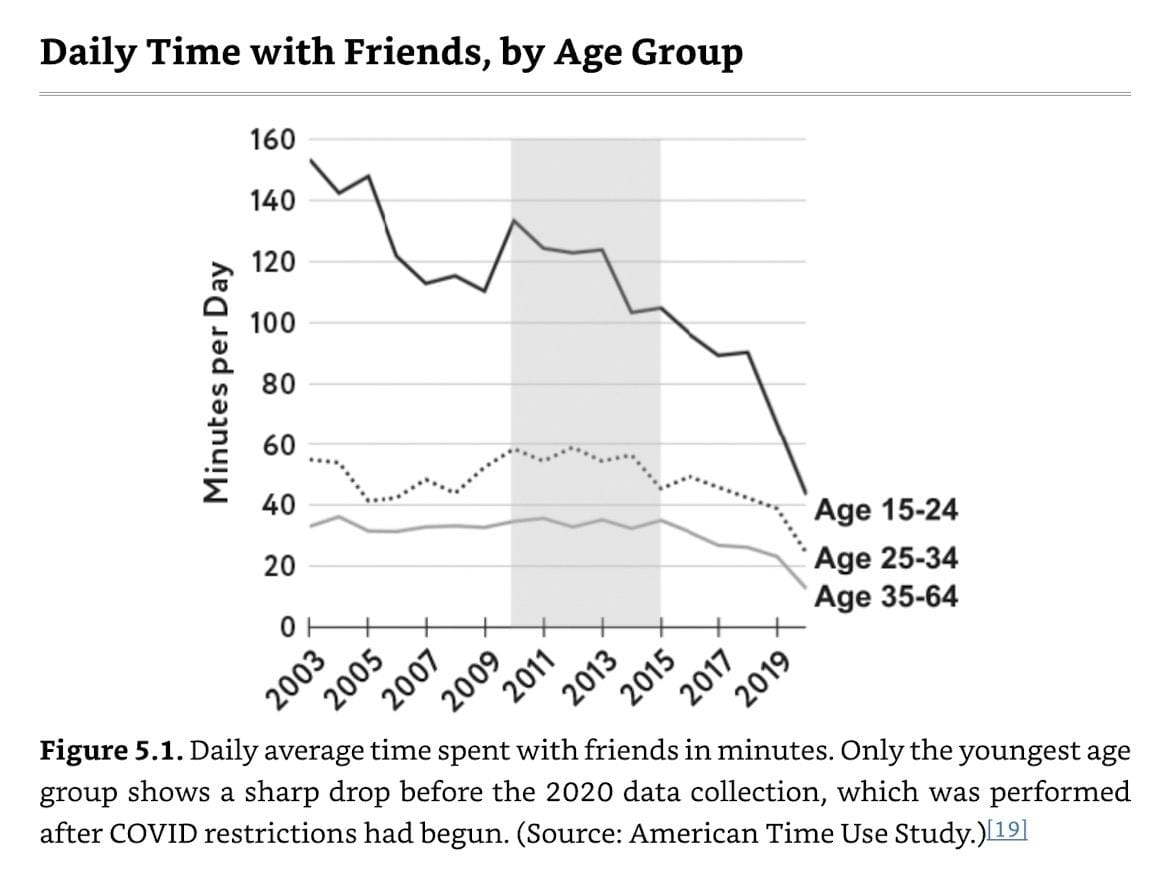

It's also plausible that the smartphone itself has caused us to drink less. Younger people spend more time alone than in the early 2010s:

That's having an impact on the sales of alcohol. Because it tends to be consumed in social settings, not when doomscrolling on your phone.

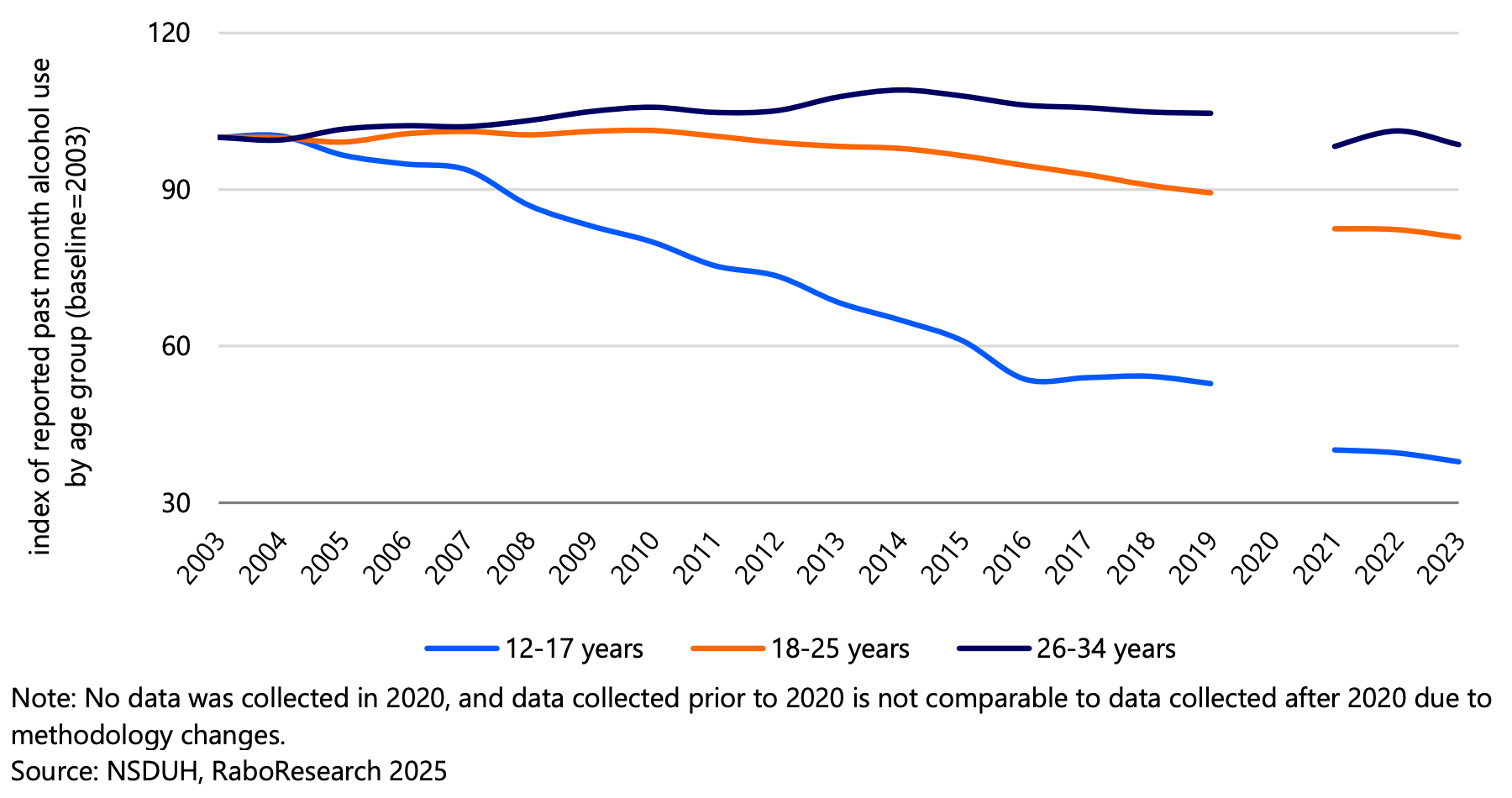

Surveys across the world, including from Hong Kong and the United States, show that underage drinking has declined. However, Rabobank analysts argue that smartphones are simply delaying the aging process. And that once they enter the workforce from around age 26, they'll end up drinking just as much:

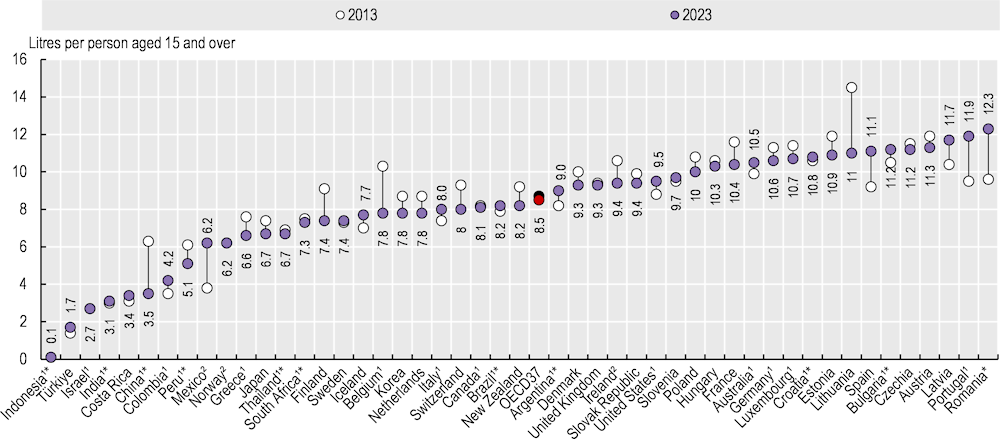

Recent OECD data show that individuals aged 15 or older in East Asian countries such as the People's Republic of China, South Korea, and Japan are consuming less than they did 10 years ago. Conversely, in India and Australia, consumption rates have actually increased. So there's nuance beyond the headline numbers.

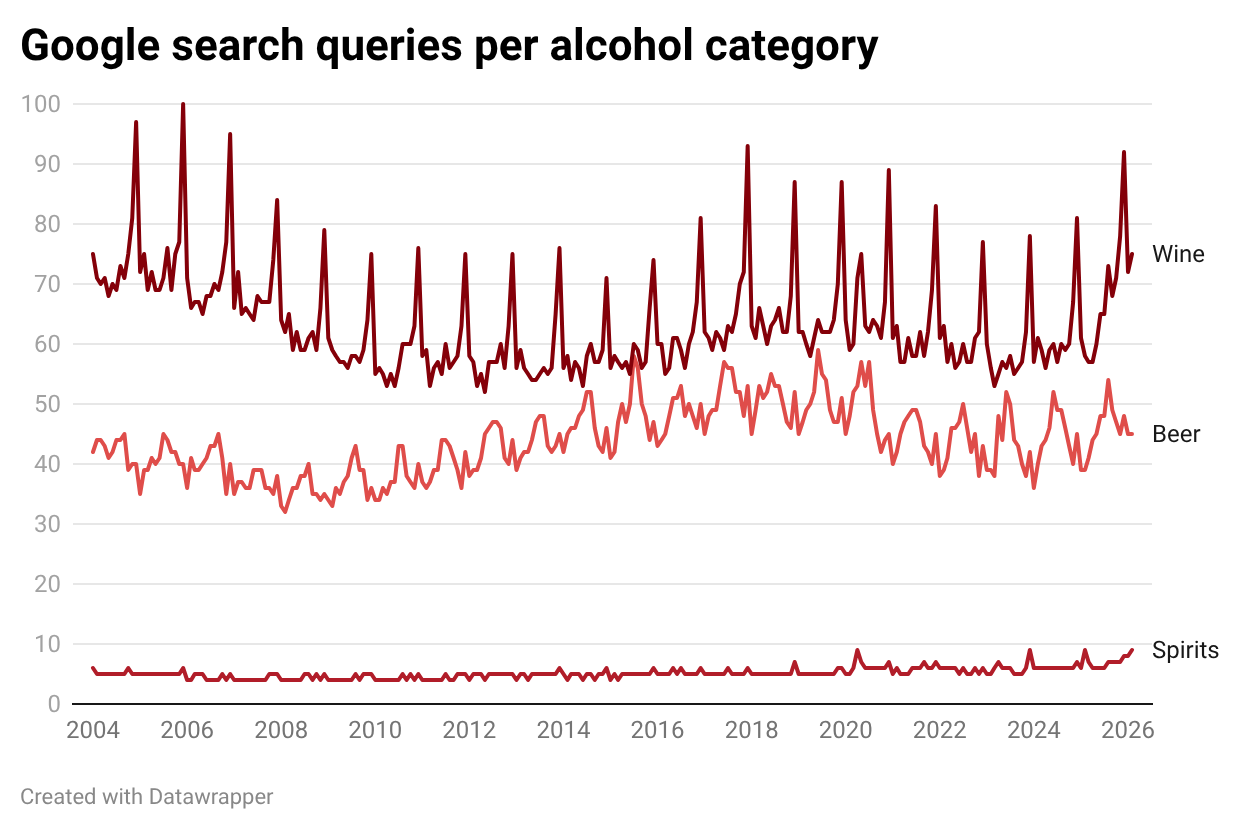

We've also seen a shift by category. Since the 1990s, wine has clearly taken market share from beer. Wine is seen as the healthier option:

The most health-conscious individuals are moving to alcohol-free beers and spirits. An index of Google search queries for "Mocktails" has tripled since 2020. The success of Heineken Zero and Guinness Zero is another sign of a strong demand for alcohol-free options.

It now looks like spirits are finally taking market share from both wine and beer. This is due to a widespread premiumization trend that might have accounted for part of Kweichou Moutai's success:

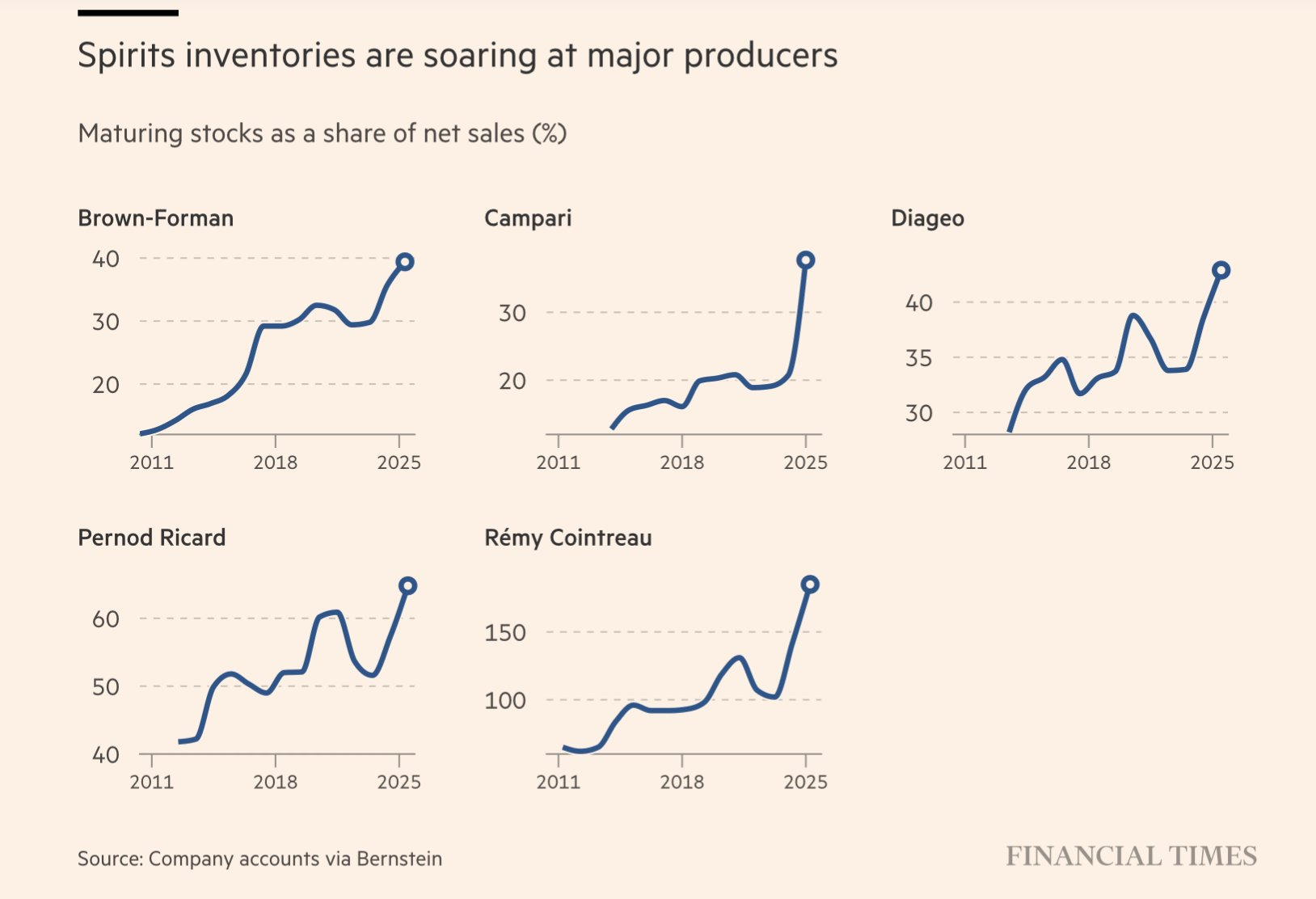

COVID-19 provided a short-term boost to alcohol consumption, as at-home drinking surged. Spirit companies ramped up production, anticipating that demand would remain high. But as demand dropped, inventories built up across the industry, leading to indigestion:

In 2026, supply is finally being curtailed. Suntory is halting production at its flagship Kentucky distillery through 2026. And Diageo is suspending operations at several US whisky facilities.

So to summarize, my tentative view is that smartphones and possibly generative AI have caused a shift towards healthier, but also more isolated lifestyles. But once the younger generation enters the workforce, they'll probably get into a habit of drinking with their colleagues. In any case, a particular bright spot within the global alcohol industry seems to be higher-priced wine and spirits. Consumers feel that these options are healthier, while still giving a buzz. Those categories are probably a safer place to be than beer.

The publicly listed universe of alcohol brands includes the following stocks:

Debt levels have risen among spirits and wine producers. But as I noted in my write-up on Treasury Wine Estates, part of the debt increase is due to the ramp-up in COVID-era inventories. And those will eventually be monetized.

Growth in India is by far the healthiest. And that's reflected in the much higher valuation multiples for Indian alcoholic beverage companies. Kweichou Moutai is still growing its top line at a steady pace, and now trades at 19.0x P/E. A personal holding of mine, Ginebra San Miguel, continues to grow at double-digit rates, yet trades at just 10.0x P/E. Other stocks with low valuation multiples include the Chinese and Vietnamese beer brands, as well as Lion Brewery in Sri Lanka.